What Does Medicare Cover For Diabetics?

What Does Medicare Cover For Diabetics?

Diabetes is one of the fastest-growing medical conditions in America and can be one of the most costly conditions to treat. Diabetes costs for Medicare are important for Medicare beneficiaries to know.

According to the Center for Disease Control, there are currently 21.0 million Americans who have been diagnosed with at least one type of diabetes and millions more who have yet to be diagnosed. An additional 79 million people over age 20 living in the United States have blood sugar levels higher than usual but not high enough to be classified as pre-diabetic. With such dramatic numbers, it is no wonder that direct medical costs for diabetes treatment total over $176 billion each year. Nebraska and Iowa have their statistics. What Medicare covers for diabetics is critical for their sustained health and improvement.

What Does Diabetes Cost For Medicare?

Prevention and screening are high priorities for Medicare diabetes coverage. Medicare covers prevention programs and screening to detect pre-diabetic persons and high-risk individuals. Medicare can then more proactively treat and advise Medicare beneficiaries on how to avoid developing diabetes.

pre-diabetic persons and high-risk individuals. Medicare can then more proactively treat and advise Medicare beneficiaries on how to avoid developing diabetes.

For those with diabetes, Medicare covers insulin, anti-diabetic drugs, diabetes supplies, diabetes self-management training, nutritional therapy services, foot exams, blood testing mentors, and glaucoma exams.

Diabetes-related expenses can be a significant burden, especially for older Americans who rely on Medicare and government-funded healthcare systems. Unfortunately, Original Medicare (Medicare Part A and Part B only) will not cover diabetes costs 100% unless you have a Medicare supplement that may cover the remaining costs.

Not all Medicare Advantage Plans will completely cover testing or medications that help patients manage their diabetes, and even when coverage is extended, patients still face out-of-pocket expenses. Therefore, it is essential to read the Evidence of Coverage for your particular Medicare Advantage plan so that you understand Medicare diabetes prevention program billing and other services.

It is typical for Medicare Part B to cover blood glucose tests for diabetes screening, and two diabetes screenings each year for beneficiaries at high risk for diabetes, but drugs are not covered. As a result, patients are still often responsible for co-payments, office visit fees, and other expenses.

Part D Is the Achilles Heel of Medicare

On the other hand, Medicare Part D will generally help some patients cover the supplies needed to control diabetes by helping patients pay for insulin and blood sugar monitoring equipment. However, in nearly all situations, diabetes costs for Medicare do not cover the full cost of these expenses unless the individual has a supplement or is on Medicaid. Insulin and anti-diabetic prescriptions are costly and can quickly drive patients into the Part D gap (donut hole).

On the other hand, Medicare Part D will generally help some patients cover the supplies needed to control diabetes by helping patients pay for insulin and blood sugar monitoring equipment. However, in nearly all situations, diabetes costs for Medicare do not cover the full cost of these expenses unless the individual has a supplement or is on Medicaid. Insulin and anti-diabetic prescriptions are costly and can quickly drive patients into the Part D gap (donut hole).

When prospective clients come to my office, my heart drops slightly when they say they are on insulin or the well-known expensive anti-diabetic prescriptions. I know how expensive these medications can be, especially on a limited and fixed income.

What Kind of Diabetic Costs for Medicare Are Included?

Diabetes wears the body down, and there are lots of side effects. Diabetes may cause nerve damage to your feet. Part B covers a foot exam every six months by a podiatrist. Medicare might cover even more visits if you had a non-traumatic amputation of all or part of your foot.

Your doctor may order Hemoglobin A1c tests to determine your blood sugar levels over the past three months. Medicare will cover diabetic services such as that when prescribed by your doctor.

Glaucoma is another adverse side effect of diabetes. Medicare Part B pays for eye exams for glaucoma once a year, especially if you have retinopathy or a family history of glaucoma.

These are all efforts to curb the negative effects of diabetes and maintain the highest possible quality of life.

What Are the Medicare Diabetes Prevention Programs?

“An ounce of prevention is worth a pound of cure,” we’ve always heard.

The Medicare diabetes prevention programs begin with screenings. Diabetes screenings help detect early-stage or pre-diabetes in patients. Doctors can help their patients attack the causes when they can identify at-risk individuals. Medicare Part B covers diabetes screening tests when your physician prescribes a screening. Medicare may pay for as many as two diabetes screening tests in a 12-month period.

Symptoms like high blood pressure, a history of abnormal cholesterol and triglyceride levels, obesity, and impaired glucose tolerance, may indicate a higher likelihood of developing diabetes. Once identified, medical professionals can address the issue directly.

For those at risk, Medicare diabetes prevention programs may be in order. A once-per-lifetime behavior change program to help you prevent type 2 diabetes is covered by Part B. Medicare Advantage, which is Medicare delivered by a private insurance company, is highly motivated to keep its patients’ healthy. Diabetes is a costly disease, so Medicare Advantage plans are very generous with prevention services, especially diabetes. Read the Evidence of Coverage for your particular Medicare Advantage plan so that you understand Medicare diabetes prevention program billing and other services.

Prevention Program Criteria

Medicare establishes specific criteria your doctor must follow before prescribing a Medicare diabetes prevention program. You must have:

Medicare establishes specific criteria your doctor must follow before prescribing a Medicare diabetes prevention program. You must have:

- Part B (or a Medicare Advantage Plan).

- A fasting plasma glucose of 110-125mg/dL, 2-hour plasma glucose of 140-199

mg/dL (oral glucose tolerance test), or a hemoglobin A1c test result between

5.7 and 6.4% within 12 months before attending the first core session. - A body mass index (BMI) of 25 or more (BMI of 23 or more if you’re Asian). No history of type 1 or type 2 diabetes.

- No End-Stage Renal Disease (ESRD).

- Never participated in the Medicare Diabetes Prevention Program.

To be eligible for the program. You may pay nothing if you are eligible.

The program consists of a weekly core session over a 6-month period with a peer group. The topics covered are changing behavior around diet and exercise, weight control, motivation, group support.

After completing the initial core session, you will have a six-month follow-up program with monthly sessions to help you maintain the healthy habits you established in the core program. After the 6 month follow-up, you may qualify for an additional 12 month ongoing maintenance program if you have met personal weight loss outcomes.

How Does Medicare Help You Self-Manage Your Diabetes?

Once someone has diabetes, their situation can be managed and even improved. Medicare offers self-management training to help you learn how to control your diabetes successfully. Diabetes self-management training requires a doctor’s prescription. Diabetes self-management training falls under Part B, which is Original Medicare.

Like any program, you need to meet the prerequisites.

- You were diagnosed with diabetes.

- You changed from taking no diabetes medication to taking diabetes

medication, or from oral diabetes medication to insulin. - You have been diagnosed with diabetes and are at risk for complications.

Further, your primary care physician considers you at increased risk because of one or more of these conditions:

- Problems controlling blood sugar, have been treated in an

emergency room, or have stayed overnight in a hospital because of your

diabetes. - Diagnosed with eye disease related to diabetes.

- Lack of feeling in your feet or some other foot problems, like ulcers,

deformities, or have had an amputation. - Diagnosed with kidney disease related to diabetes.

Like most Medicare-covered services, the training program must be Medicare-certified and accredited by the American Diabetes Association or the American Association of Diabetes Educators.

Special Individual Training

The program is taught by specially trained healthcare professionals with a thorough knowledge of diabetes. Medicare covers up to 10 hours of initial training and 2 hours of follow-up training if necessary. They must complete the program within 12 months once it has begun.

The diabetes self-management training will cover:

- General information about diabetes, the benefits of blood sugar control, and poor blood sugar control risks.

- Nutrition and how to manage your diet.

- Options to manage and improve blood sugar control.

- Exercise and why it’s vital to your health

- Taking medications properly

- Blood sugar testing

- Foot, skin, and dental care.

Does Medicare pay for Diabetic Supplies?

Medicare Part B covers “durable medical equipment.” This category covers everything from CPAP machines to electric scooters. Diabetic supplies, like monitors, test strips, and lancets, fall under durable medicare equipment. Durable medical equipment even includes disposable items. Medicare covers diabetic supplies.

supplies, like monitors, test strips, and lancets, fall under durable medicare equipment. Durable medical equipment even includes disposable items. Medicare covers diabetic supplies.

With advances in diabetic technology, Medicare coverage of diabetes supplies includes new devices, like therapeutic continuous glucose monitors. The doctor, however, needs to make a case for you that a newer, more expensive device is medically necessary. In many cases, approval hinges on the doctor’s office making a case for the prescription. The prescription notes need to explain to Medicare or the insurer why the treatment would be beneficial to the health of the patient. In diabetes, especially, the insurance company and Medicare are trying to avoid more costly treatments that may result from further deterioration due to the illness. Even applying after a denial would be good. Sometimes it just takes a little more effort to get the best result.

So what diabetic testing supplies are over by Medicare?

Diabetes Test Strips Are Expensive!

I have learned a lot about diabetes over the years from my clients. They tell me in unambiguous and sometimes loud terms the cost of things like test strips. Syringes, insulin pens, needles, alcohol swabs, gauze, inhaled insulin devices, test strips are all covered. The issue is not usually coverage but cost. Depending on your supplement or Medicare Advantage plan, your supplies may be nothing to very little. That is why it is critical to know how your Medicare plan affects those particular areas and costs for your health.

I have learned a lot about diabetes over the years from my clients. They tell me in unambiguous and sometimes loud terms the cost of things like test strips. Syringes, insulin pens, needles, alcohol swabs, gauze, inhaled insulin devices, test strips are all covered. The issue is not usually coverage but cost. Depending on your supplement or Medicare Advantage plan, your supplies may be nothing to very little. That is why it is critical to know how your Medicare plan affects those particular areas and costs for your health.

Does Medicare Cover An Insulin Pump?

I am always delighted when someone tells me they use an insulin pump. I am happy for them because the insulin that goes with the insulin pump does not come under Medicare Part D. The insulin for the pump comes under Part B. Those clients with Original Medicare and a Medicare Supplement (Medigap) policy will pay little or nothing for their insulin. Insulin can be incredibly expensive.

Part B covers insulin pumps worn outside the body (external), including the insulin used with the pump. Insulin pumps are considered durable medical equipment. With a Medigap plan, the patient will pay little or nothing for the pump and insulin. Medicare covers insulin pumps and supplies. The insulin that goes with the pump is considered supplies. This is all contained in the Medicare insulin pump guidelines.

Medicare Covered Therapeutic Shoes Or Inserts for Diabetics

Medicare Covered Therapeutic Shoes Or Inserts for Diabetics

If you have Part B, have diabetes, and meet certain conditions, Medicare will cover therapeutic shoes if you need them.

The types of shoes Part B covers each year include one of these:

• One pair of depth-inlay shoes and 3 pairs of inserts

• One pair of custom-molded shoes (including inserts) if you can’t wear depth-inlay shoes because of a foot deformity, and 2 additional pairs of inserts

Doctor Certification for Therapeutic Shoes

For Medicare to pay for your therapeutic shoes, the doctor treating your diabetes

must certify that you meet these 3 conditions:

1. You have diabetes.

2. You have at least one of these conditions in one or both feet:

• Partial or complete foot amputation

• Past foot ulcers

• Calluses that could lead to foot ulcers

• Nerve damage because of diabetes with signs of problems with calluses

• Poor circulation

• A deformed foot

3. You’re being treated under a comprehensive diabetes care plan and need

therapeutic shoes and/or inserts because of diabetes.

Medicare also requires:

• A podiatrist or other qualified health care provider prescribes the shoes.

• A doctor or other qualified individuals like a podiatrist, orthopedist, or prosthetist fit and provide the shoes.

Are Medicare Diabetes Mail Order Suppliers Covered?

You can receive your diabetic supplies and medications through the mail. It is essential that the Medicare diabetes mail-order supplier be Medicare-certified and/or contracted with the Medicare Advantage plan. Insulin and anti-diabetic medications will usually come under Part D. The prescription drugs can be delivered by a stand-alone Part D plan or a Part C Medicare Advantage plan that includes prescription drug coverage. Prescription drug costs will be substantially different than those costs that fall under Part B. Check and confirm that company’s status before ordering, but mail-order is definitely an option.

Do Medicare Supplements Cover Diabetes?

The above discussion of Medicare coverage for diabetes has been reserved mostly to just Original Medicare (Part A and Part B). Medicare Supplements and Medicare Advantage add additional coverage but also another wrinkle to what is covered.

Medicare Supplements (Medigap) policies are simple because they are universal–the same everywhere. Plan G and Plan N are the most popular Medigap policies. Medigap covers whatever Medicare covers. They fill in the gaps in Original Medicare coverage. Under Part B, they take care of the insulin pump, and insulin for the pump, and durable medical equipment. Minus the Part B deductible, the Medigap policy almost completely covers any cost.

What Does Medicare Part C – Medicare Advantage Do For Diabetes?

Medicare Advantage plans all differ. Coverage varies from plan to plan and region to region. Reading the Evidence of Coverage that each plan has for the details of the plan is essential to find out how much is covered or not covered for things like orthopedic shoes, insulin pumps, diabetic supplies. I could describe the plans in the Omaha Metro area, but that may not apply to other areas.

What Does Medicare Drug Coverage Pay for Diabetic Prescriptions?

What Does Medicare Drug Coverage Pay for Diabetic Prescriptions?

Medicare drug coverage is very similar between stand-alone Part D and Medicare Part C plans that include drug coverage. Insulin and anti-diabetic medications are mostly very expensive unless you have EXTRA HELP. Depending on the amount and type of medication, the patient can easily be driven into the coverage gap (donut hole) and even to the catastrophic stage because of the cost. It hurts my heart when I am adding up all the medications knowing that the picture is not going to be pretty when meeting with a diabetic client. I’ve witnessed a lot of tears and fear because of the sometimes staggering drug costs.

You Need To Know Your Prices

Medicare coverage of diabetes and diabetics is comprehensive. The real question is the shared costs that beneficiaries pay out of pocket. Medicare supplies are limited. Prevention costs are very small if non-existent. The real challenge, even now after the Trump administration initiatives, is the cost of insulin and anti-diabetic medications.

For my clients who are on any expensive medications, I highly, highly encourage them to be in contact with me during the Annual Election Period (AEP) October 15th–December 7th when they can change their Part D prescription drug plan or Medicare Part C plan. Even if your medications do not change, the plan can change. You could go from paying very little for a medication to not being covered at all. An annual review is critical for those with high-end medications.

Talking with a licensed, knowledgeable, experienced insurance professional you trust is critical to get the correction information and prices to make informed decisions about your Medicare health coverage.

Enroll in Medicare Online Without Breaking a Sweat

Enroll in Medicare Online Without Breaking a Sweat

Don’t expect a letter from Medicare. Don’t wait for a phone call. No one will show up at your door from Social Security with a red, white, and blue Medicare card in hand. You are on your own enrolling for Medicare. So, how do you do it?

I will walk you step-by-step through how to enroll for Medicare online in Omaha, Nebraska. I will provide some explanations and insights as well as variations depending upon your situation.

First, if you are getting Social Security, you don’t need to do anything. Congratulations! Social Security will automatically enroll you in Medicare Part A and Part B. They will then give you the option to opt-out of Part B.

Why would you want to opt out of Part B, you ask? You may already have health insurance through an employer or spouse’s employer. Yes, you can opt-out without penalty. More on that in another blog.

Enroll in Medicare Step-By-Step

Step 1:

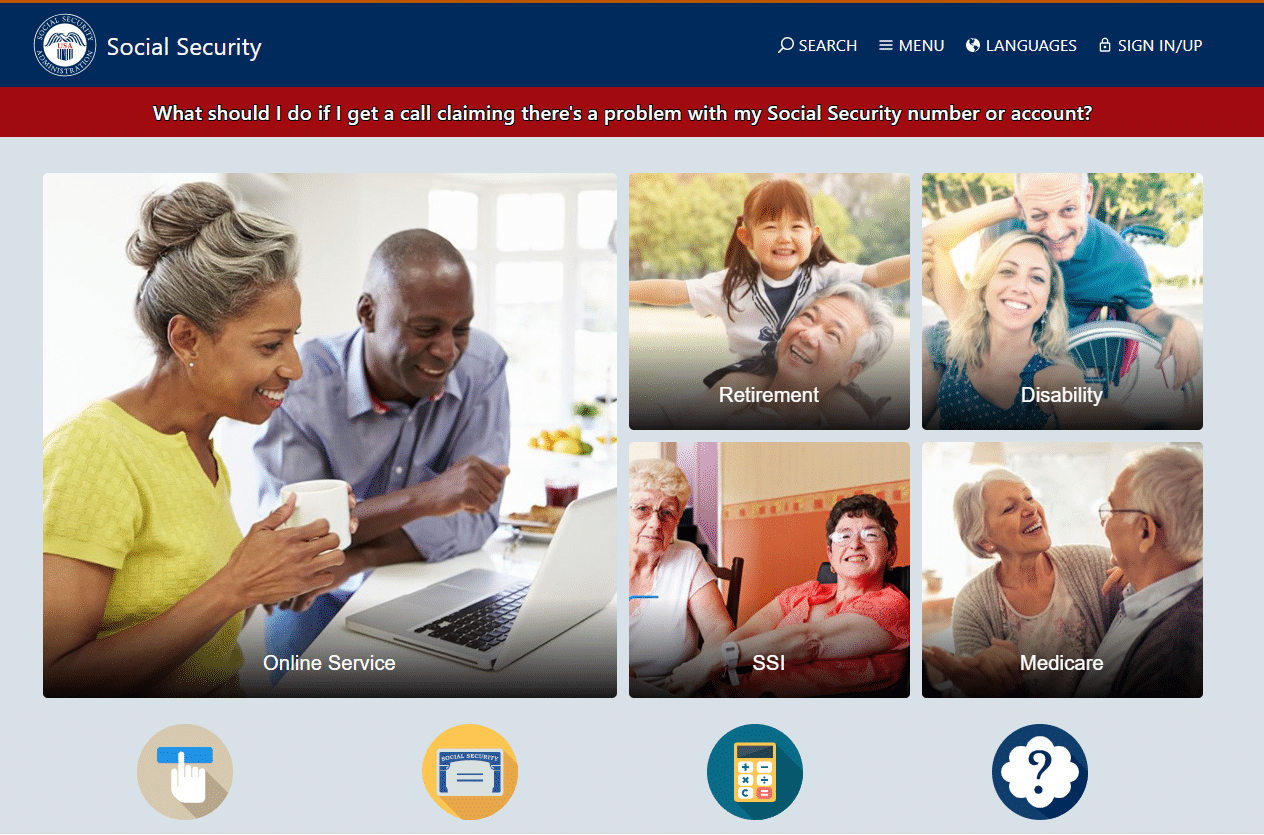

Go to ssa.gov. You can type the IP address into your address bar at the top of the browser screen. That is the best, fastest, and straightest way to the Social Security Administration website. If you “Google” ssa.gov or Social Security, you will get many Social Security imposters and insurance agents directing you to their websites. They will probably try to sell you something rather than help you apply for Medicare. You don’t need them.

Go directly to ssa.gov. Do not go to the Medicare website. Medicare does not handle enrollment into Medicare. I know; it makes no sense. It is an understandable mistake. Social Security, however, is the administrator that takes care of enrollment, collecting money, and other Medicare-related administration.

This is the ssa.gov website.

The Social Security homepage will look like this. The pictures may change on occasion, but this is how the Social Security homepage will be laid out. Go to the menu bar at the top right.

Step 2:

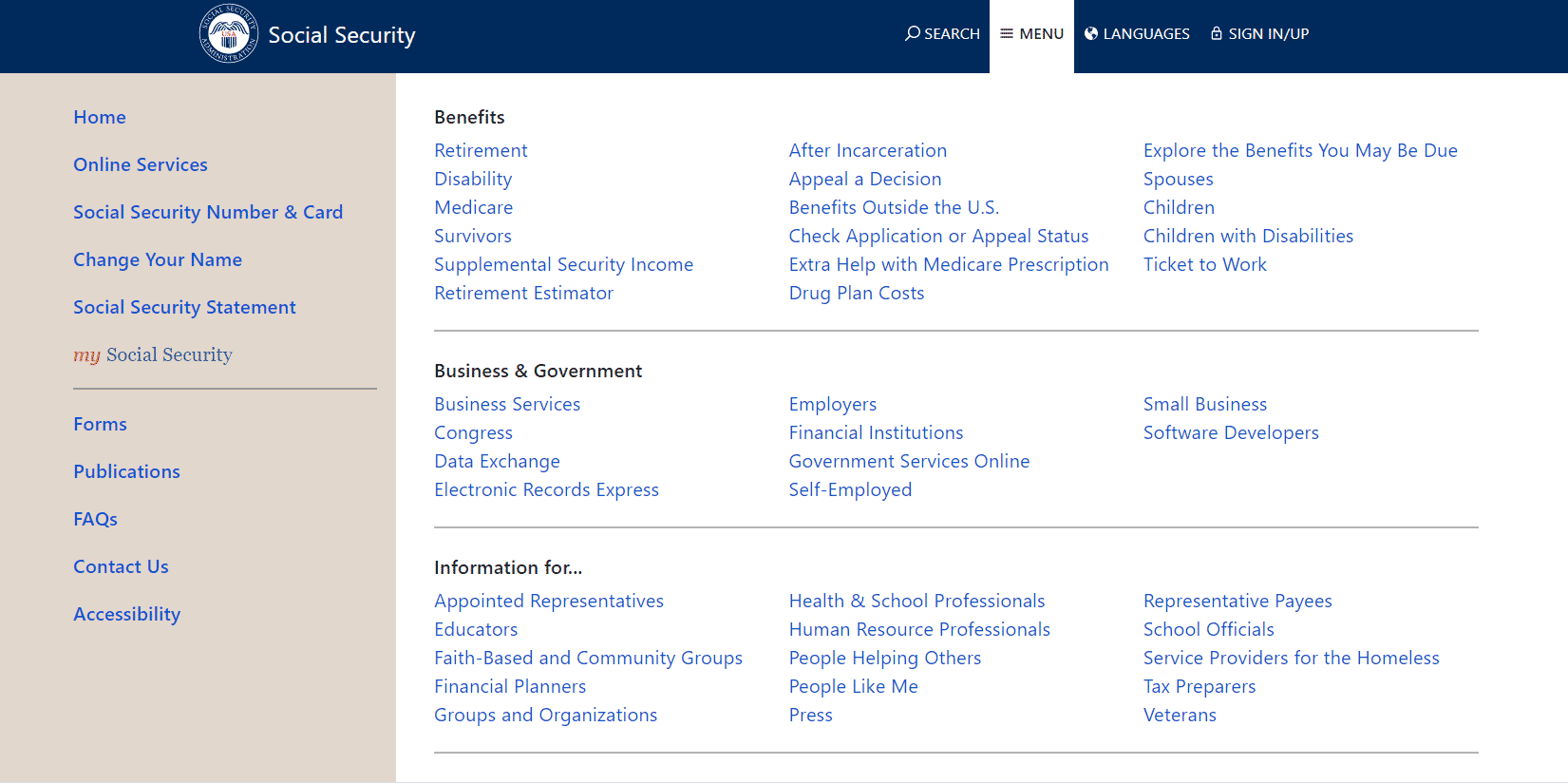

Click on the drop-down menu to begin enrolling in Medicare. You will see a number of different benefits.

Above is the drop-down menu. Go to the Benefits section. The 3rd title down is Medicare.

Step 3:

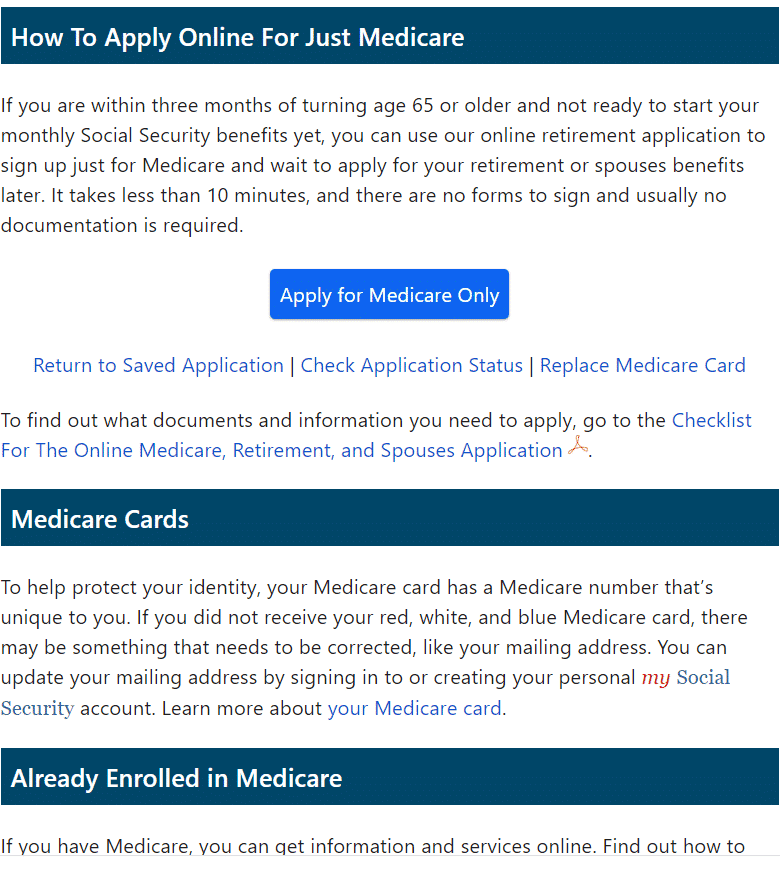

Click on the blue Medicare link. A very long page will appear that says “Medicare Benefits.” The next title bar will say, “Parts of Medicare.” Scroll down. The Medicare enrollment button says, “Apply for Medicare Only” in bright blue.

You may have to scroll for quite a while. Look for an Easter egg blue button that says “Apply for Medicare Only.”

Step 4:

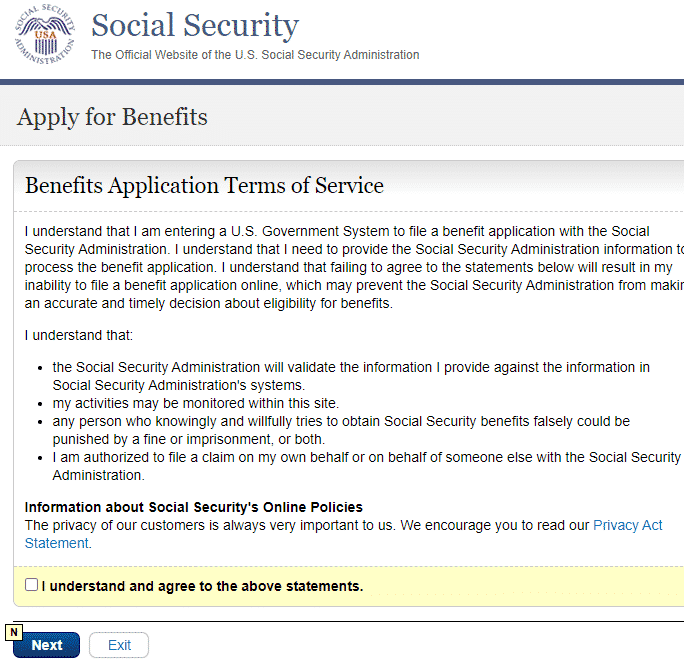

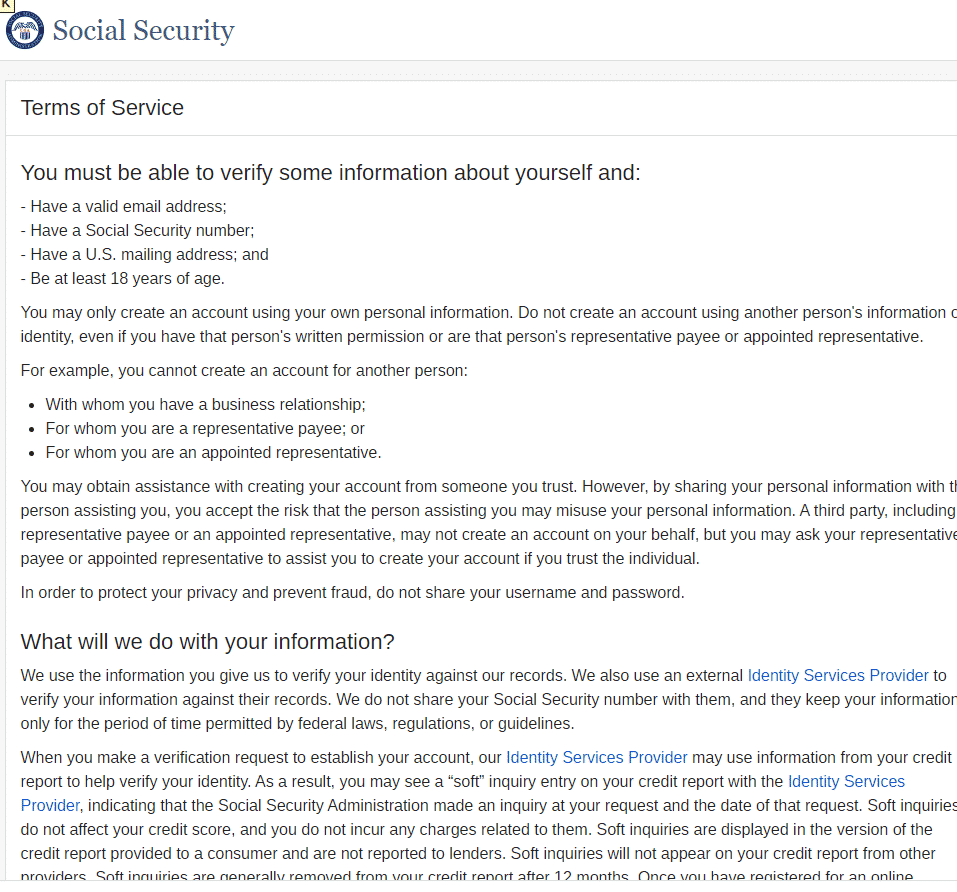

Click on the blue button. (If you wish to enroll in both Medicare and Social Security, that is a similar but different process.) The Terms of Service screen will come up.

Step 5:

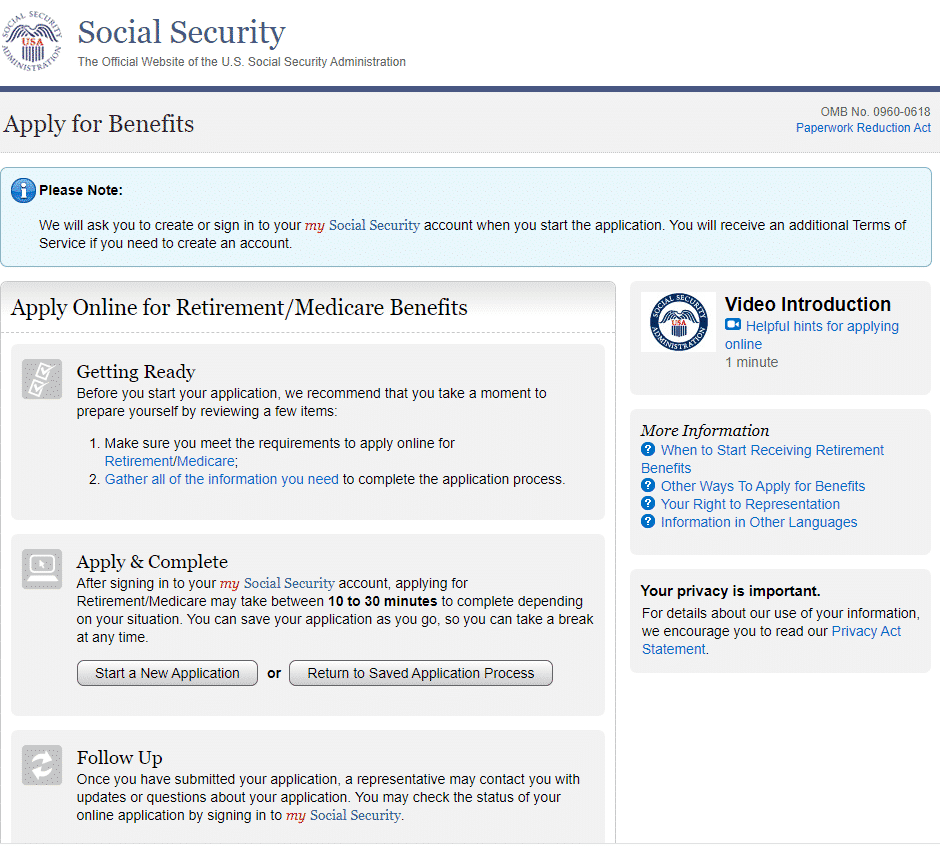

Read the terms of service. Check the “I understand and agree” box and hit “Next.” The “Apple for Benefits” screen is where you formally begin to enroll in Medicare.

In the middle of the “Apply for Benefits” screen is the grey “Start a New Application” button.

Step 6:

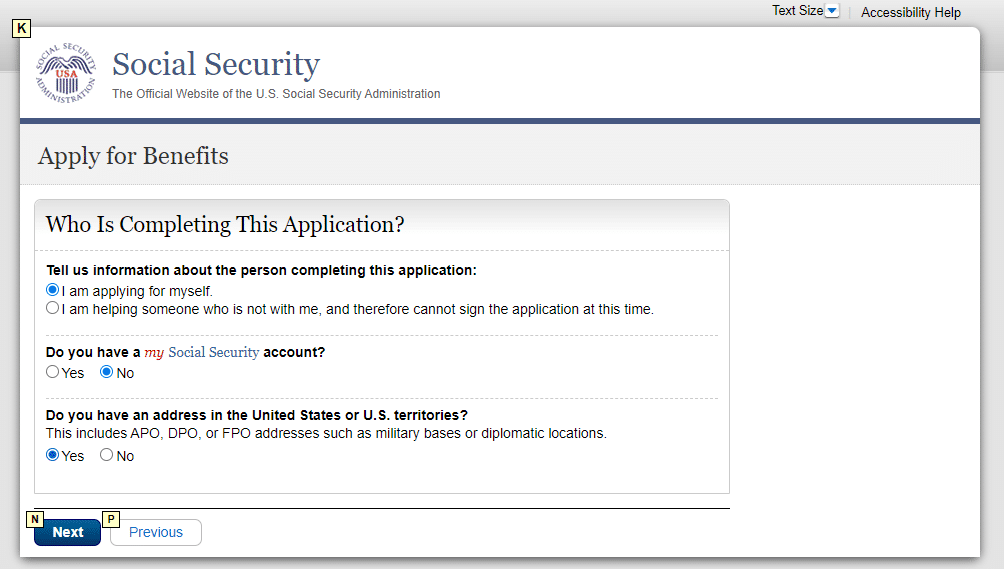

Click on that button to start enrolling in Medicare. Follow the directions.

You are probably applying for yourself. Click that button. The second button is crucial. Do you have a “My Social Security” account online? If you do, of course, mark yes. You will move along quickly.

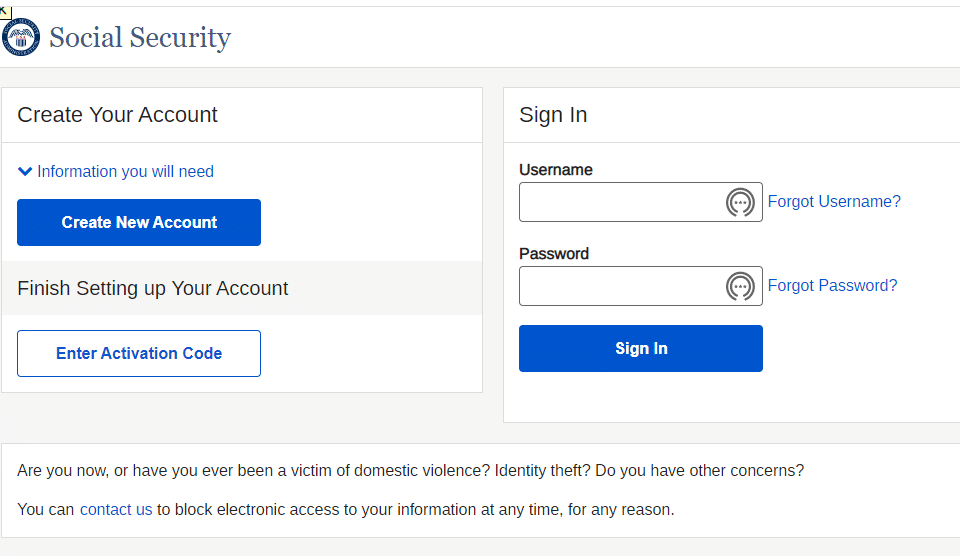

If you do not have a “My Social Security” online account, you need to create one. Creating an account is the tricky part. Most people click yes for a U.S address. Then hit next. The “Create Your Account” and “Sign In” screen will appear.

If you have a My Social Security online account, type in your Username and Password. If you don’t remember them, no worry. Click the “Forgot Username and Password.” You will need access to text or email to receive the new password and activation code. If you do not have those handy, you can stop and begin again later when you have access to your personal information, or Social Security will mail you a code via U.S. Postal Service. I do not recommend that because it will take days.

The good part about having an existing My Social Security account is that you are already verified before you begin the process of enrolling in Medicare.

However, if you do not have an account, you can create one on the left-hand side of the screen.

Step 7:

Click the “Create New Account” blue button. The second “Terms of Service” screen will come up.

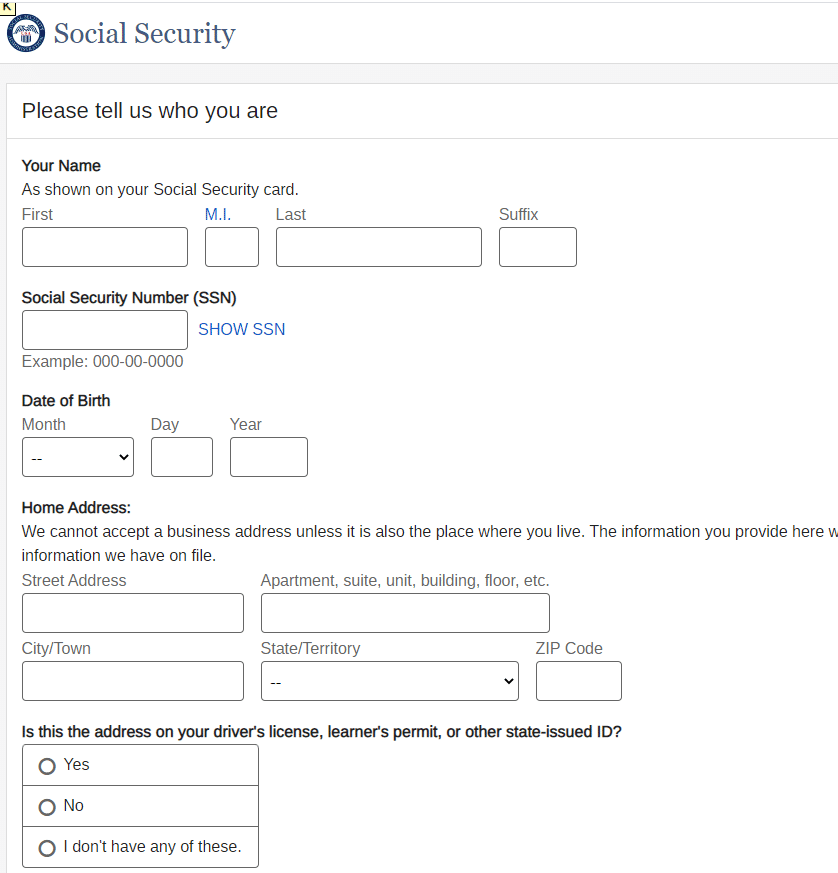

At the bottom of the “Terms of Service” page, check the agreement box and hit next. Now you will verify yourself. A current driver’s license is required, and a smartphone with text and email capabilities. Have your Social Security number available or memorized.

Step 8:

Fill out the personal information. Enter your driver’s license information manually or by photo.

Fill in all your information correctly. Double-check your work because Social Security is entirely unforgiving of mistakes when enrolling in Medicare.

Driver’s License Identity Verification: Is it really you?

Driver’s License Identity Verification: Is it really you?

When you get to your Omaha, Nebraska driver’s license, you will be sent a link via text to click. An app will appear on your phone. The app is for taking a photograph of your Nebraska driver’s license on both sides. Follow the directions.

The Social Security digital scanner application is not foolproof. There may be difficulties with clicking the photo. I suggest putting a white background behind the driver’s license. To reduce glare on the plastic covering the license, you may wish to dim the lighting. The scanning application will usually give you four tries. If you cannot take an adequate photo by that time, it will have you enter the information from the card into the computer manually.

The point of the exercise is to verify your identity. Social Security has experimented with several ways to do this over the past few months. I’m sure it will continue to evolve. If you currently have a My Social Security online account, you will sail through the process because your identity is already established.

Essential Aspects of Enrolling in Medicare in Omaha, Nebraska

Once through, you complete the application with your personal information to enroll in Medicare in Omaha, Nebraska.

If you want Part B and Part A, you will click a button requesting Part B. Social Security will assume you want Part A, but some people do not always get Part B at the same time.

You will need to know in which city you were born. Sometimes this can be a challenge because your place of birth may be very rural, or a military base overseas, or you are a naturalized citizen (Need naturalization paperwork with date and code). This bit of data is necessary before beginning the application if you do not know it off the top of your head. Have it handy before applying for Medicare.

Follow all the prompts. Double check your information. Press the button to submit. A “Thank You For Applying” will appear in green with a re-entry code. Print or write down the code. You are done. You will receive an email confirmation for your submission. Now you wait.

Follow Up On Your Application With Social Security

Follow Up On Your Application With Social Security

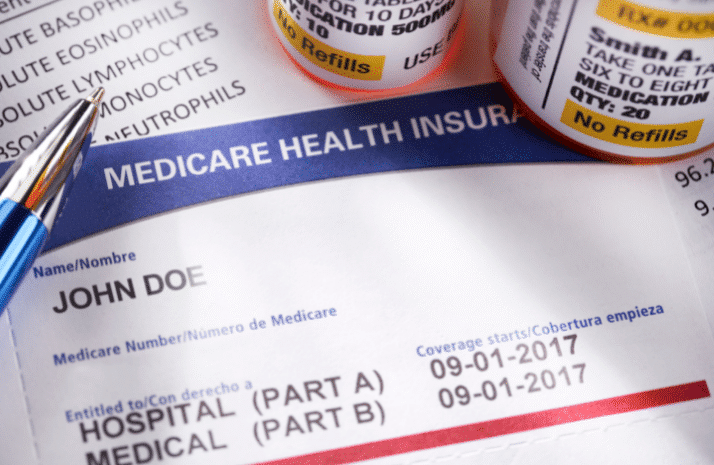

It may be a couple of weeks before your Medicare number appears in your My Social Security account. It could be months before you receive your Medicare number–MBI (Medicare Beneficiary Identifier) in a letter or your red, white, and blue Medicare card.

The fastest way to access your Medicare number is going back into your My Social Security account. You go to ssa.gov again. Click Menu, and select My Social Security. Put in your username and password. When you open the account, there is a section for Medicare. It will say pending or processing, or it will have a details button. Click the details button, and there should be a letter from Social Security with your Medicare number.

If you wait long enough, you may receive a letter and the actual red, white, and blue Medicare card in the mail. The Medicare number is essential to enroll in a Medicare plan, Medicare Part D, and Medicare Supplement. By the third week, I would call Social Security to check on the application if you do not have a number. I know it is a headache calling Social Security, and you will probably be on hold for a long time. But it is better to be pound wise than a penny foolish. I have seen applications “sit on someone’s desk” for months because the client didn’t want to make the call.

If you wait long enough, you may receive a letter and the actual red, white, and blue Medicare card in the mail. The Medicare number is essential to enroll in a Medicare plan, Medicare Part D, and Medicare Supplement. By the third week, I would call Social Security to check on the application if you do not have a number. I know it is a headache calling Social Security, and you will probably be on hold for a long time. But it is better to be pound wise than a penny foolish. I have seen applications “sit on someone’s desk” for months because the client didn’t want to make the call.

Medicare Application Enrolling Woes

Sometimes there are problems with your Medicare enrollment. Usually, the problem is with identification.

The first time it happened to a client of mine Social Security had his name as Greg, but his legal name was Gregory. It took several trips to the Social Security office to finally rectify his identity.

The second time it happened to a client, Social Security had a three-year-old previous address as his current residence. The address was his ex-wife’s. That only took a couple of phone calls.

Another client had come here from Greece at 14 years of age. Social Security had the wrong number for her naturalization documents. (Yes, Social Security makes mistakes!)

Births at military bases in foreign countries are a quagmire all their own. All of these problems are fixable, but they take time. That is why you want to start your application as soon as you can, which is three months before your 65th birthday. If you are past 65, Social Security gives you a three-month window to get the proper enrollment forms into them. I have had clients who used up the whole three months because of problems and Social Security’s slowness.

Be Ready to Respond When Social Security Calls

Sometimes Social Security will call within seven days or less of an online application because of an issue. Social Security rarely calls, so some clients think it is a scam. However, with Medicare online enrollments, Social Security tries to rectify problems with applications quickly if possible, so they do call.

We Can Help With Applying For Medicare in Omaha, Nebraska

I suppose because of identity theft, the Medicare enrollment process has become more and more complex. I enroll people in Medicare online daily, so it is easy for me. But I do it all the time! I can’t imagine how overwhelming it must seem to a first-timer.

daily, so it is easy for me. But I do it all the time! I can’t imagine how overwhelming it must seem to a first-timer.

As part of the Medicare education and plan selection process I take people through, I am happy to help apply for Medicare and take that burden off your shoulders.

My parents only used computers to play cards. I can’t imagine them enrolling in Medicare online now.