Cancer TreatmentCategory:

With the rising prevalence of cancer diagnoses, obtaining affordable and accessible cancer drug coverage with Medicare is critical for patients. Medicare, the government health insurance program primarily for individuals age 65 and older, is vital in ensuring that cancer treatments are financially attainable. Many of my clients will call me when they receive a diagnosis of cancer. As you can imagine, the experience is overwhelming and frightening. Their first question is what they should do about their insurance to ensure maximum coverage.

With the rising prevalence of cancer diagnoses, obtaining affordable and accessible cancer drug coverage with Medicare is critical for patients. Medicare, the government health insurance program primarily for individuals age 65 and older, is vital in ensuring that cancer treatments are financially attainable. Many of my clients will call me when they receive a diagnosis of cancer. As you can imagine, the experience is overwhelming and frightening. Their first question is what they should do about their insurance to ensure maximum coverage.

This article will explore the implications of Medicare’s cancer drug coverage on affordability and access. We will consider the various components of Medicare, including Part B and Part D, and how they differ in covering cancer drugs. Additionally, we will examine the potential out-of-pocket costs that Medicare beneficiaries may face and discuss strategies to navigate these expenses.

Aspects such as drug tiers, formularies, and specific cancer treatments covered by Medicare will also be explored. By the end of this article, you will understand the implications of Medicare’s cancer drug coverage on affordability and access. You will be empowered to make informed decisions regarding your healthcare needs.

Understanding the Implications of Medicare Coverage for Cancer Drugs

Medicare provides crucial coverage for cancer drugs, ensuring beneficiaries can access potentially life-saving treatments. However, it’s important to understand the implications and costs of this coverage to make informed decisions and navigate the system effectively.

Part B Or Part D

One key aspect to consider is the difference between Medicare Part B and Part D coverage for cancer drugs. Medicare Part B covers drugs administered in a medical setting, such as chemotherapy drugs. These drugs are typically covered at 80% of the Medicare-approved amount, with the remaining 20% being the beneficiary’s responsibility. Part B coverage is often more comprehensive for cancer treatments, including essential drugs like intravenous chemotherapy and supportive medications.

When clients tell me their medication falls under Part B, I am relieved. Treatments, like chemotherapy drugs, insulin pumps, and Prolia injections in the doctor’s office, are completely covered when you have Original Medicare and a Medicare Supplement. On Medicare Advantage, there is a maximum out-of-pocket that puts at least a cap on costs.

Part D Formularies

On the other hand, some oral cancer medications and medications used for supportive care, such as anti-nausea drugs, are placed under Part D prescription drug plans. Private insurance companies approved by Medicare offer Part D plans, and coverage may vary depending on the specific plan. Medicare Part D prescription drug plans are not as robust in their coverage compared to Part B.

prescription drug plans. Private insurance companies approved by Medicare offer Part D plans, and coverage may vary depending on the specific plan. Medicare Part D prescription drug plans are not as robust in their coverage compared to Part B.

It’s important to carefully review Part D formularies, which are lists of covered drugs, to ensure that the necessary cancer medications are included. Expensive medications, including expensive cancer drugs, are very expensive on a Medicare Part D plan. While there are limitations, and in 2025 there will be a $2,000 cap, generally, the medications are still very expensive if they are covered.

Understanding the differences between Part B and Part D coverage is crucial for effectively navigating Medicare’s cancer drug coverage. You may not have much choice when it comes to cancer drug treatment and where it falls in terms of Medicare insurance. But, by knowing which drugs fall under each part, beneficiaries can determine the most appropriate coverage for their specific needs and minimize out-of-pocket costs.

Accessing Affordable Cancer Drug Coverage Under Medicare

Accessing Affordable Cancer Drug Coverage Under Medicare

While Medicare plays a significant role in providing cancer drug coverage, beneficiaries may face challenges and barriers when trying to access affordable medications. These issues can impact both the affordability and availability of cancer drugs, making it difficult for patients to receive the treatments they need.

High Cost

One common challenge is the high cost of cancer drugs. Many cancer medications come with a hefty price tag, and even with Medicare coverage, beneficiaries may still face substantial out-of-pocket costs. This can create financial burdens, especially for those with fixed incomes or limited financial resources. Additionally, certain cancer drugs may not be covered by Medicare, leaving beneficiaries to shoulder the entire cost themselves.

Confusing System

Another barrier to affordable cancer drug access is the complex nature of Medicare’s coverage policies. Understanding the intricacies of drug tiers, formularies, and coverage restrictions can be overwhelming, leading to confusion and potential errors in selecting the most suitable coverage option. The lack of clarity and transparency regarding coverage details can further complicate the process of accessing affordable cancer drugs under Medicare.

Medicare Part D and its Impact on Cancer Drug Coverage

Medicare Part D plays a significant role in providing coverage for cancer drugs obtained from a pharmacy. This component of Medicare offers beneficiaries the opportunity to access prescription medications, including oral cancer drugs and supportive care medications.

Private insurance companies approved by Medicare offer Part D plans, which vary in terms of premiums, deductibles, and copayments. Beneficiaries must carefully review and compare different Part D plans to ensure they choose the most suitable coverage.

Formulary

One key consideration when exploring Part D coverage is the formulary. Formularies are lists of drugs covered by each Part D plan. These lists can vary from plan to plan, so it’s essential to review them to ensure that the necessary cancer drugs are included. Some medications may be placed in higher tiers, resulting in higher out-of-pocket costs for beneficiaries. Understanding the formulary and the associated costs can help beneficiaries make informed decisions and minimize their expenses.

Medicare Gap or Donut Hole

Medicare Gap or Donut Hole

Another important aspect of Part D coverage is the coverage gap, commonly known as the “donut hole.” The coverage gap occurs when beneficiaries reach a certain spending threshold, and their out-of-pocket costs increase until they reach catastrophic coverage.

However, it’s important to note that the coverage gap is gradually being phased out due to the Affordable Care Act. By 2020, beneficiaries are responsible for only 25% of the cost of their medications while in the coverage gap. The Inflation Reduction Act of 2022 put a cap of $2,000 on Part D drug costs in 2025.

Run the Numbers

When we run clients’ medications, we can show them the cost of the medication in the initial phase of drug cover and the gap phase. The software also performs calculations showing approximately when you will fall into the gap phase of the Part D prescription drug coverage. So you can at least see what you will be paying each month and make the appropriate adjustments.

Exploring the intricacies of Medicare Part D coverage is crucial for beneficiaries seeking affordable and accessible cancer drug coverage. By understanding the formulary, costs, and potential coverage gaps, individuals can select the most suitable Part D plan and ensure that their necessary cancer medications are covered.

Medicare Cancer Drug Coverage Appeals Process

Medicare Cancer Drug Coverage Appeals Process

Medicare beneficiaries may encounter situations where their cancer drug coverage is denied or not approved as expected. I find this rare, except with experimental procedures.

In such cases, it’s important to understand the Medicare appeals process to challenge these denials and ensure access to necessary medications. That being said, before beginning the formal appeal process, check to make sure the provider’s back office correctly processed the preapproval. I’ve found that some doctors’ office do not go through the insurance company’s required protecals. As a consequence, the authorization is denied because an incorrect code was used, the wrong form was submitted, or inadequate documentation accompanied the request. Once it is clear the preapproval was correctly done and denied, move on to the formal appeals process.

The appeals process consists of several stages. Each is designed to allow beneficiaries to present their case and request a reconsideration of the initial decision. Following the proper steps and providing the necessary documentation to support the appeal is crucial.

Step 1

The first step in the appeals process is the redetermination stage. This involves submitting a written request to the Medicare Administrative Contractor (MAC) that made the initial decision. The MAC will review the case and decide. If the redetermination does not favor the beneficiary, they can proceed to the next stage.

Step 2

The second stage is the reconsideration stage. This involves requesting reconsideration by a Qualified Independent Contractor (QIC) who was not involved in the initial decision. The QIC will review the case and decide. If the reconsideration is not in favor of the beneficiary, they can proceed to the further stages of the appeals process.

Step 3, 4, & 5

The subsequent stages include a hearing by an Administrative Law Judge (ALJ), a review by the Medicare Appeals Council, and, finally, a judicial review by a federal district court. These stages provide additional opportunities for beneficiaries to present their case and challenge the denial of cancer drug coverage.

Navigating the Medicare appeals process can be complex and time-consuming. However, it is an essential avenue for beneficiaries to pursue if they believe their cancer drug coverage has been unfairly denied.

Seeking assistance from healthcare advocates or legal professionals specializing in Medicare appeals can be beneficial in guiding individuals through this process and increasing their chances of a favorable outcome.

Maximizing Medicare Coverage for Cancer Drugs

Here are some tips to help make the most of their Medicare coverage.

Review your Medicare Plan Annually

Medicare plans can change yearly, including drug formularies and costs. It’s important to review your plan during the Annual Election Period, Oct 15th–Dec 7th. Ensure that your current medications are covered and affordable under the plan.

I send out emails and letters to my clients every year during Annual Election Period to remind them. The client will tell me that their medications have not changed, but I emphatically remind them that it doesn’t matter. The drug plans change, and in some cases, the change can be drastic. Premiums go up, deductibles go up, tiers change, and drugs are dropped and added to plans. For the little time it requires, the review can save hundreds if not thousands of dollars.

Utilize Prior Authorization

Some cancer drugs may require prior authorization from Medicare before they are covered. Work closely with your healthcare provider to ensure that the necessary documentation is submitted. Over the years, I have had clients denied because the doctor’s office did not properly submit the request. Sometime I got the client to encourage second try with the correct codes and documentation, and it worked.

Explore Patient Assistance Programs (PAP)

Many pharmaceutical companies offer assistance programs that provide eligible individuals with financial assistance or free medications. Research and inquire about these programs to determine whether you qualify for assistance. I have a number of clients who come to me who are on these programs before they even get on Medicare. Some programs will even continue once you are on Medicare.

These programs provide free or discounted medications to individuals who meet specific eligibility criteria. Each program has its requirements, so it’s important to research and apply for programs that may apply to your situation. Pharmaceutical companies are always testing their medications. You may qualify, depending on your health issues, for free medications as part of a study.

Nonprofit Organizations

nonprofit organizations and foundations may offer financial assistance or grants specifically for cancer patients. These organizations aim to alleviate the financial burden associated with cancer treatment and provide support to individuals in need. Research and reach out to these organizations to explore potential assistance options.

It’s important to note that these alternative options may have their own eligibility criteria and limitations. However, for individuals who do not qualify for Medicare or need additional assistance, exploring these alternatives can be instrumental in accessing affordable cancer drugs.

Cancer Organizations

Cancer-specific organizations like the American Cancer Society may also offer resources and support services for cancer patients on Medicare. These organizations can provide information on financial assistance programs, educational materials, and support groups to help individuals navigate their cancer journey.

Utilizing these resources and assistance programs can help Medicare beneficiaries access the support they need in terms of understanding their coverage and obtaining affordable cancer drugs. By taking advantage of these resources, individuals can enhance their overall healthcare experience and improve their quality of life during cancer treatment.

Bottom Line: Research your Medicare Cancer Drug Coverage

Bottom Line: Research your Medicare Cancer Drug Coverage

You can not control whether you get cancer or not. You may not have much control over the treatment, but you can see the costs and what insurance covers. Understanding the implications of Medicare’s cancer drug coverage, including the differences between Part B and Part D, the challenges and barriers faced, and the various strategies and resources available, empowers beneficiaries to make informed decisions and navigate the system effectively.

By reviewing Medicare plans annually, utilizing prior authorization, and exploring patient assistance programs, beneficiaries can maximize their coverage and minimize out-of-pocket costs. Additionally, alternative options such as Medicaid and Patient Assistance Programs can provide additional support for individuals who may not qualify for Medicare or need extra assistance.

Medicare Advantage or Medicare Part C is another way to receive Medicare. “Original Medicare” is a combination of Medicare Part A and Part B. It is called “Original Medicare” because that was its first plan in the late 60’s. Medicare Part A was hospital insurance and Medicare Part B was added later. It included doctor visits and outpatient procedures. Some people call it traditional Medicare. It became “Original Medicare” when a new form of Medicare was created–Medicare Advantage, also called Medicare Part C. What is the advantage of Medicare Advantage over Original Medicare?

The Advantage of Medicare Advantage vs Original Medicare

Let’s explain “Original Medicare” first. Medicare Part A covers hospital stays. The Part A has a deductible. It is currently $1,340 for every hospital stay for the same event in a 60 day period. If a completely unrelated event lands you in the hospital, e.g., car accident, heart attack, stroke, etc., even within the first events 60-day period, you will still pay the $1,340 deductible for those unrelated events. That kind of deductible schedule could add up to a significant cash outlay in a year. Likewise, Medicare Part B exposes you to a great deal of risk. While Medicare Part B pays 80% of doctor and outpatient costs, your 20% co-insurance has no cap on it. There is no maximum out-of-pocket. Sky is the limit. If you have a million dollars worth of bills under Part B, 20% is $200,000.

Maximum Out-Of-Pocket

Maximum Out-Of-Pocket

The Advantage of Medicare Advantage is a maximum out-of-pocket. The highest maximum out-of-pocket for Medicare Advantage plans in 2018 is $6,700. Some plans maximum out-of-pocket are much less, depending on the area, the company, and the type of plan. However, the easiest and clearest difference between Original Medicare and Medicare Advantage is a definite limit on what you pay out of your pocket. Medicare Advantage has a maximum out-of-pocket. Original Medicare does not.

Minimum Co-Payments

Each Medicare Advantage Plan has its own schedule of co-pays, deductibles, and co-insurance. One co-pay that is standardized in all plans is the emergency room visit. In 2018, the emergency room visit co-pay is $80. I would rather pay $80 with a Medicare Advantage plan rather than 20% of any amount on Original Medicare. I broke my arm a number of years ago biking. My emergency room visit was $3,000. The advantage of Medicare Advantage I think is an $80 co-pay rather than 20% bill–$3,000 x 20% = $600.

Part D Prescription Drug Included

Part D Prescription Drug Included

With Original Medicare, you still need to get a Medicare Part D prescription drug plan, even if you don’t take any medications. Otherwise, you will be penalized when you eventually do enroll in a Medicare Part D plan. The Part D plan is generally included in a Medicare Advantage plan at zero or little cost. If you purchase a Part D plan, you may pay between $21–$100 per month. The advantage of Medicare Advantage is paying zero or very little for your drug plan.

Vision and Dental

Mo st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

Compared to Original Medicare, the advantage of Medicare Advantage makes complete sense. It limits your maximum out-of-pocket, combines Part D at little or no cost most times, includes extra benefits, like dental and vision. There are usually many plans in your area. Here is Omaha there are eleven Medicare Advantage plans among five insurance companies. You should be able to find something that fits your needs among that variety. Call us to find out 402-614-3389.

Medicare Advantage Growing

Medicare Advantage or Medicare Part C is an alternative to traditional or original Medicare. While the majority of Medicare beneficiaries are still on original Medicare, Medicare Advantage has grown to 31% of all Medicare beneficiaries, which is triple the number from only twelve years ago. In Nebraska the number of Medicare beneficiaries in a Medicare Advantage plan is 12% and growing each year. The percentage would be much higher if Nebraska had a higher population density. The success of the Medicare Advantage plans depends upon concentrated pools of beneficiaries which is a challenge because the majority of Nebraska is rural. Though Medicare Advantage is growing, consistent concerns continue to arise. People may wish to consider something to backup Medicare Advantage.

Backup Medicare Advantage

Medicare Advantage is “a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.” The co-pays, deductibles, co-insurance is set up differently from original Medicare. Like original Medicare, there are co-pays, deductibles, and co-insurance. While many Medicare beneficiaries chose to backup their Medicare Part A and Part B with a supplement, most people on Medicare Advantage plans chose not to purchase any additional insurance. They don’t backup Medicare Advantage. The reasons may be because co-pays are minimal. Medicare Advantage also has a maximum out-of-pocket where original Medicare does not. Still, people on Medicare Advantage do have concerns about serious illness and possible large co-pays, such as from a hospital stay. They may wish to backup Medicare Advantage, but they don’t know how.

Medicare Advantage is “a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.” The co-pays, deductibles, co-insurance is set up differently from original Medicare. Like original Medicare, there are co-pays, deductibles, and co-insurance. While many Medicare beneficiaries chose to backup their Medicare Part A and Part B with a supplement, most people on Medicare Advantage plans chose not to purchase any additional insurance. They don’t backup Medicare Advantage. The reasons may be because co-pays are minimal. Medicare Advantage also has a maximum out-of-pocket where original Medicare does not. Still, people on Medicare Advantage do have concerns about serious illness and possible large co-pays, such as from a hospital stay. They may wish to backup Medicare Advantage, but they don’t know how.

Cover Co-Pays and Deductible

A possible solution to backup Medicare Advantage would be to add an indemnity plan. Indemnity plans are not health insurance. They are insurance plans that reimburse clients for certain specified events. For example, insurance company ABC will pay $500 each day you are in the hospital for a total of ten days. The money paid is to the policy holder to use as he or she wishes, not to the hospital or another insurance company. Indemnity plans may pay for skilled nursing stays past the 21st day when the co-pay is added. A stroke could require prolonged stays in a nursing home. A skilled nursing facility co-pay from day 21-57 could be as high as $160 per day. Most indemnity plans have options for cancer treatment too. The indemnity plan could reimburse several hundred dollars per treatment to compensate for high co-pays or just present a one-time lump sum, such as $5,000 or $10,000 for an occurrence of cancer.

A possible solution to backup Medicare Advantage would be to add an indemnity plan. Indemnity plans are not health insurance. They are insurance plans that reimburse clients for certain specified events. For example, insurance company ABC will pay $500 each day you are in the hospital for a total of ten days. The money paid is to the policy holder to use as he or she wishes, not to the hospital or another insurance company. Indemnity plans may pay for skilled nursing stays past the 21st day when the co-pay is added. A stroke could require prolonged stays in a nursing home. A skilled nursing facility co-pay from day 21-57 could be as high as $160 per day. Most indemnity plans have options for cancer treatment too. The indemnity plan could reimburse several hundred dollars per treatment to compensate for high co-pays or just present a one-time lump sum, such as $5,000 or $10,000 for an occurrence of cancer.

Indemnity plans could be a nice way to fill in the gaps to a Medicare Advantage plan, and they could be a great addition to Medicare supplements or health plans in general. Medicare and health insurance only pays for medical cost that are incurred from approved medically necessary treatments. Heart attacks, strokes, and cancer come with many other non-medical expenses. You may need assistance at home after a stroke that neither Medicare or your health plan cover. Transportation to doctors’ offices are an expense because you cannot safely drive. Wages are lost when your illness prevents you from going to work. Health care costs go beyond the doctor and hospital bills. Indemnity plans may help off set the losses due to illness.

Health insurance is like a puzzle. There are many pieces and different sizes. They can be put together in a multiplicity of ways. They best way to put the puzzle together is to get all the pieces out on the table and see what fits together the best. If you have gone the way of Medicare Advantage, it may be beneficial to backup your Medicare Advantage plan. We can help you see how the puzzle works at Omaha Insurance Solutions 402-614-3389.

What is Medicare? A basic question. Or rather, why should anyone care about Medicare? The reason people should care is that most bankruptcies are medical bankruptcies. In other words, if you wish to protect your retirement nest egg from bill collectors, Medicare is important to know about. There are few things that are more disturbing than a pile of medical bills sitting on the kitchen table. The golden years could be tarnished with worrying about actual or potential medical expenses. Medicare–if implemented proper–will protect you from a potential catastrophe. It is critical for people entering into retirement to understand what is Medicare.

What is Medicare?

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare Part A

Medicare is divided into two parts: Medicare Part A and Medicare Part B. Medicare Part A has everything to do with the hospital. It doesn’t cost anything because you paid for it during your working years. It was one of the deductions in your payroll taxes. Medicare Part A covers a 100% of the medical expenses incurred in the hospital, but there is deductible that many people are not aware of. The Medicare Part A deductible is currently $1,288. This is NOT an annual deductible. It is a deductible per benefit period, and a benefit period is 60 days. So each event has a deductible, and the time for the event is 60 days. In other words, you could have multiple events and pay multiple deductibles because the event is not limited to just a 60 day period. Each new event, even if it overlaps with another event, has its own 60 day timeline. While rare, it could happen, and probably more importantly, you could pay the Part A $1,288 deductible more than once in any given year.

Medicare Part B

Medicare Part B, however, does cost something. For most people going on Medicare and Social Security in 2016, the Medicare Part B premium is $121.80 per month. It is generally taken out of your Social Security check. Medicare Part B covers doctors’ visits and outpatient procedures, such as X-rays, blood work, emergency room visits, etc. Medicare Part B covers 80% of the cost. Your portion is 20%. The 20% coinsurance, however, is unusual. There is no cap. There is no maximum out-of-pocket. Most group plans you were ever on probably had a maximum out-of-pocket. It may have been $1,000, $2,000, even $10,000, but at some point, you stopped paying and the insurance company covered everything. Medicare Part B does not have that, so 20% of a big number will be a big number. You keep paying your 20% coinsurance as long as the bills come in.

These are the basic building blocks to what is Medicare. You must understand Medicare, Medicare Part A, and Medicare Part B to understand the rest that follows. In the next blogs and videos, we will cover how to get Medicare, how to cover the Part A deductible, and how to fill the unlimited 20% gap in Part B coverage.

Delay Medicare Enrollment

Many people work past 65. They continue on with them employer group coverage. They delay Medicare enrollment. At 66+, they wonder what to do about Medicare.

How to Enroll after 65

Here is what to do. Go to Medicare.gov. Click on “Forms, Help, Resources” on the top right. Then click on “Medicare Forms” on the left middle. You will see the enrollment forms in the middle of the page in PDF form. There are two forms: one to enroll in Medicare Part B and a second for your employer to sign off on your coverage. You fill out the enrollment in Part B. Give the second form to your employer. Your employer will verify that you have had health coverage as good as Medicare since you turned 65. They will sign the form. It is important for you to write in the date that you wish your Medicare Part B to start. Give yourself enough time to find a Medicare plan and prescription drug plan. (There are much shorter and restrictive time limits when you have delayed Medicare Part B enrollment.) Drop the forms in the mail or hand deliver them to the local Social Security office.

Medicare Employer Enrollment Forms

Why do you want to involve your employer with your enrollment in Medicare Part B? If you do not have your employer verify that you had health coverage from the time you could have enrolled in Medicare until the time you did take Part B, Medicare will assume you did not have creditable coverage and will asset a penalty. The penalty is a 10% increase in Part B premium for every year you did not have coverage. That can be significant over time and completely unnecessary. Delay Medicare enrollment at your own risk. Get the form. Your employer is required to verify. The human resource department will know exactly what to do. It is a very simple matter.

At Omaha Insurance Solutions, we help clients who delay Medicare enrollment all the time. We can get this done quickly and easily. Give us a call 402-614-3389. We can email you the forms, walk you through filling them out, and explain what to do.

A distressed prospective client told me that Medicare did not cover mental health treatment. I stammered a bit because the subject had never come up before, and I was surprised. I said that it did. She had read that it only covered a one time welcome visit to Medicare. I then showed her in the Medicare & You Handbook on pages 40 and 59 where it detailed the coverage. There is the welcome to Medicare screening, an annual screening, and complete medical coverage. She was surprised and relieved there was Medicare mental health care.

Seniors Need Mental Health Care

Mental health is a serious problem in society, and it is growing among seniors. The World Health Organization documents how important among seniors this issue is. Depression is under reported, little recognized, and often an untreated illness; but Medicare mental health cares for beneficiaries with mental health concerns, like depression. It probably does it better than most employer plans do.

Medicare Mental Health Part A

Medicare Part A deals with the hospital. The same rules around hospital deductibles and co-insurance apply to psychiatric hospitals as to other hospitals. There is, however, one difference. Medicare only allows a lifetime amount of 190 days for a stand alone psychiatric hospitals.

Medicare Mental Health Part B

Medicare Part B covers psychiatrists, counselors, treatment groups. Again the same 20% co-insurance applies as to any other Part B doctor visit. If you have a long standing relationship with a psychologists before Medicare, you may keep that relationship going after you go on Medicare if the medical professional takes assignment for Medicare.

Medicare Supplements will cover Medicare mental health issues and professionals the same as other fees in accordance with your particular Medicare supplement plan. Medicare Advantage will have the same co-pays for psychiatrists and psychologists as for other specialists.

No need to be stressed or depressed about Medicare mental health. You are covered.

A gentleman called me who was losing his group health coverage from a former employer. He was a retiree from a Fortune 100 company. You would recognize the name of the company immediately. As part of his retirement package, he had a very generous health plan for himself and his wife. He had been on it for decades, but the company could no longer afford to maintain it. They canceled the plan, so my client found himself cast out into the Medigap world at 92 not knowing what to do, and he didn’t realize that he would need a Medigap guarantee issue to be get a plan.

Medigap Guarantee Issue Solution

When you are a Medicare beneficiary and you loss group coverage, you have what is called a guarantee issue period. It is a very limited opportunity that has an exasperation date on it. It is an incredibly important guarantee for those who have pre-existing conditions.

What is Medigap Guarantee Issue?

What is guarantee issue for a Medigap policy? How does it work? What should you do to make sure you don’t miss out? Guarantee issue for a Medigap policy applies to a number of situations. I will just speak to one—when you involuntarily lose your group health coverage while on Medicare Part A & B. Guarantee issue means that an insurance company must offer you a Medigap plan—usually plans A, B, C, & F—without asking health questions. They must sell it to you no matter your health condition. For those with pre-existing conditions that would exclude them, this is a treasure. (Each state may handle guarantee issue situations somewhat differently, but this is the general concept.)

How Does Medigap Guarantee Issue Work?

How Does Medigap Guarantee Issue Work?

How does guarantee issue work for a Medigap policy when you have involuntarily lost your group health coverage? The company that is ending group health coverage will usually give you sufficient time to find other coverage. You are able to purchase a supplement as early as 90 days ahead of time. After coverage has ended, you usually only have 63 days to find coverage without going through underwriting. If you miss that time frame and you have a serious health issue, you will not find a Medigap policy. You will only have Medicare.

What Should You Do to Get Your Medigap Guarantee Issue?

What should you do if you are losing your group plan that covers your Medicare deductibles and coinsurance? First get educated about Medicare. Second get a quote and start looking for a Medigap plan. Third see if you can pass underwriting so you are not restricted to the more expensive plans, but please don’t doddle. There is a clock ticking in terms of your guaranteed issue period.

To summarize, you have a special opportunity to get a Medigap plan when you lose your group plan. The special opportunity is that you do not have to answer health questions for a defined period and the insurance company has to sell you a plan. You need to be aware of the rules and follow them so you do not miss out. Still try underwriting so you have more options, but you have the guarantee provision to fall back on. There are rules and time limits around guaranteed issues. Make sure you fully understand these rules and the ramifications. Call to find out the facts so you don’t miss out. 402-614-3389 OmahaInsuranceSolutions.com

I quoted a prospective client a Medicare supplement rate that was significantly less than the plan he was currently on. When I explained that he would have to go through Medicare supplement underwriting and answer some health questions because he was no longer in his Open Enrollment, he wasn’t happy.

Why was he upset? Because he remembered how time-consuming and intrusive it was to apply for life insurance. A nurse came to his home, weighed and measured him, took blood and urine, and asked a bunch of questions. Then, they got reports from the various doctors and a letter about a certain health issue.

The client claimed there was no amount of money that could induce him to go through all again. That’s understandable. However, when I said I could probably do the Medicare supplement underwriting in sixty seconds or less, his tone changed.

How can Medicare supplement underwriting be so simple, though? Let me explain.

Medicare Supplement Underwriting

How is Medicare underwriting defined in Omaha? In short, it’s a simple process used by insurance companies to learn more about you and your health. There’s no need for medical exams or doctor’s visits – all you’re doing is answering a basic set of health questions.

What are the Health Questions for Medicare or Medigap Supplement Underwriting?

The questions can be grouped broadly into four categories:

- Knock-out questions

- Height and weight

- Current health issues

- Smoking status

If you answer “yes” to certain knock-out questions, then you can’t get Medigap or a Medicare Supplement – here’s how it works.

Medigap Underwriting Questions: What Are Knock Out Questions?

They are questions relating to serious medical conditions. If you have this serious medical condition, you are ineligible for a Medicare supplement or “knocked out” of consideration.

To clarify, you can’t be denied Medicare, but a private insurance company can deny coverage for a supplement outside of your Open Enrollment Period.

What are some examples of knock out questions? They vary, but they include:

- Are you currently confined to a wheelchair, nursing facility, or hospital bed?

- Do you currently receive assistance bathing, transferring, toileting, eating, dressing or need the assistance of a walker?

- In the last two years, have you received treatment for cancer, leukemia, heart attack, congestive heart failure, multiple sclerosis, chronic kidney disease, diabetes with hypertension, stroke, etc.?

Why Does Medicare Ask Questions About Height and Weight?

The second category of questions has to do with height and weight. This is always a difficult question. If I asked my wife her weight, it would be very quiet and cold in the Grimmond household for a while. However,height and weight is an important determiner of future health, so it has an impact on price.

What Are Current Medical Issues?

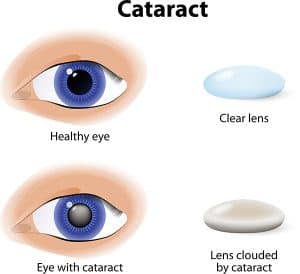

Current issues cover existing medical conditions and related future treatment. For example, you may have a diagnosis for a future treatment, like a knee replacement or cataract surgery.

For Medicare supplement underwriting purposes, you’ll probably need to address these medical issues before you can change supplements or the insurer simply won’t cover that procedure for the first six months.

You may have had respiratory issues in the past that do not exclude you now, but if you are currently being treated for the issue, they could prevent you from getting the supplement for a time.

Why Am I Asked About Smoking Status?

There is plenty of medical evidence about the health risks associated with smoking, which also includes chewing.

I met with a gentleman who described himself as a non-smoker, but when I pointed out he had a circle print on his back jeans pocket, he fessed up that he dipped occasionally. In medical underwriting, even occasional dipping means you’re still considered a tobacco user.

Smoker/Non-smoker is the one health question that can be asked during Open Enrollment.

Medicare Supplement Underwriting is Easy

Why does this matter to you? Because your answers determine whether the insurance company accepts or denies you. It determines your health category and consequently your monthly premium. Underwriting is not a difficult or a daunting task with a skilled insurance agent such as myself. It just takes a few minutes of your time, and you may be able to save yourself some money and maybe improve your coverage as well.

Medicare Supplement Underwriting Omaha Insurance Solutions

The key thing to understand is that not all insurance companies have the same underwriting guidelines. Some may be laxer or more restrictive than others. They may be lenient on one condition or more severe on another. That is when an experienced agent can help you with getting the best outcome for your underwriting. He can guide you to the company that will be most favorable to your condition for the best possible price.

Call OmahaInsuranceSolutions.com 402-614-3389 for help with your Medicare Supplement underwriting in Nebraska

A prospective client called me about saving money on her Medicare supplement. I asked her the basic supplement health questions and gave a quote. We set up a time to meet. At the meeting, I started going through the standard health questions on the application. When I came to the question about recommended future treatments, she said no, but the way she answered bothered me. So I asked it a different way. “Did the doctor suggest that you have anything done, like cataract surgery, knee or hip replacement?” Then she lit up. “My hips are really bad,” she said. “He thinks I should replace them sometime.” “So when you say sometime, are you talking about in a year or two?” “Oh no,” she said. “In the next couple of months.” I closed my notebook. We were done.

Supplement Health Questions Broken Down

Recommended treatments by a physician could potentially cause a problem when you switch supplements. Three things to know: 1.) what is a recommended treatment, 2.) why does it matter, 3.) what should you do about it.

Most of the time when we see the doctor it is because we are sick right now. She makes a diagnosis and recommends an immediate treatment. ‘Take this pill now.’ ‘Have open heart surgery next week.’ Sometimes the diagnosis leads to a recommendation for treatment sometime in the future. ‘Your knees are deteriorating. You should have a knee replacement in the next year or so.’ When your doctor puts a recommendation in your medical records for a future treatment, that is a big deal. To an insurance company, that means there will be a future big bill for whoever is insuring you at that time.

Understand the Supplement Health Questions

The problem is that you could get stuck with the bill instead of the insurance company if you don’t follow the rules. If you have something done that was recommend before you got the new policy, like cataract surgery within six months after getting a new Medicare Supplement, the insurance company will probably not pay their share of the expense. The health questions in the application are designed to disclose recommended treats and prevent the new insurance company from getting stuck with the bill. They would likely refuse payment and call for doctor’s records to see if there was a recommendation for treatment before you signed the application. After six months, you are less likely to have any trouble. They cannot hold back paying for treatment indefinitely. The bottom line is, if you have any recommended treatments, finish them up before switching supplements.

The problem is that you could get stuck with the bill instead of the insurance company if you don’t follow the rules. If you have something done that was recommend before you got the new policy, like cataract surgery within six months after getting a new Medicare Supplement, the insurance company will probably not pay their share of the expense. The health questions in the application are designed to disclose recommended treats and prevent the new insurance company from getting stuck with the bill. They would likely refuse payment and call for doctor’s records to see if there was a recommendation for treatment before you signed the application. After six months, you are less likely to have any trouble. They cannot hold back paying for treatment indefinitely. The bottom line is, if you have any recommended treatments, finish them up before switching supplements.

Manage the Supplement Health Questions

This problem, of course, can be avoided. Check with your doctor. See if he is recommending any treatments and see if he put that in your medical records. Check with the insurance company if you recently switched supplements. Doctor’s offices will not usually check with an insurance company on a supplement because they will assume the insurance company will pay when Medicare pays. If you recently switched supplements, call and ask ahead of time if there will be any issues about a procedure. It is always good to cross your T’s and dot your I’s when it comes to new insurance plans.

This problem, of course, can be avoided. Check with your doctor. See if he is recommending any treatments and see if he put that in your medical records. Check with the insurance company if you recently switched supplements. Doctor’s offices will not usually check with an insurance company on a supplement because they will assume the insurance company will pay when Medicare pays. If you recently switched supplements, call and ask ahead of time if there will be any issues about a procedure. It is always good to cross your T’s and dot your I’s when it comes to new insurance plans.

Ask an Expert about Supplement Health Questions

A mistake around a recommended treatment when changing Medicare supplements could result in bills to you for thousands of dollars. Know whether you have any recommendations from a physician for future treatments in your records. Understand what that means in relationship to a new Medicare supplement. Talk with someone who can ask you the right questions when you are making a change to your supplement coverage 402-614-3389. OmahaInsuranceSolutions.com

Does Medicare Cover Cancer Treatment After Age 76

Does Medicare Cover Cancer Treatment After Age 76

My mother had her routine physical in Nov of 2011. There were many tests. One test came back positive for cancer. We were stunned. She had no symptoms. Everything was fine, we thought.

As the doctors performed more tests, they determined my mother had stage four ovarian cancer. The next week, she was in chemotherapy.

I learned a lot about Medicare and cancer after that. Yes, cancer treatment is covered by Medicare.

Medicare covered her cancer treatments, radiation treatment for cancer, and chemotherapy. She had a Medicare Supplement Plan F. Medically, everything was covered. My mother was 76. Medicare covers cancer treatment after age 76. There is no age at which Medicare will not cover radiation treatment for cancer or chemotherapy.

Cancer Is Scary, And So Are Medical Bills

The C-word is a scary word. I don’t know your relationship to the C-word. You may have had a family member or friend contract cancer? Did she die, recover, or is still struggling? Or maybe it was you?

Cancer is a dirty word that ignites intense feelings because you are fighting for your life.

You also realize there is a price tag, and you immediately begin to ask, ‘Is cancer treatment covered by Medicare?‘ ‘What will I have to pay?’

I suggest you ask yourself several serious questions about your Medicare health coverage.

- How much would you be willing to pay out of your pocket in a year–$2,000, $5,000, $7,550?

- How much would you be willing to pay to avoid paying hefty bills?

The cost of cancer is high, both emotionally in terms of pain and financially. I remember seeing some of my mother’s EOBs (Explanation of Benefits). There were no small bills.

Does Medicare Part A Cover Cancer Treatment?

Does Medicare Part A Cover Cancer Treatment?

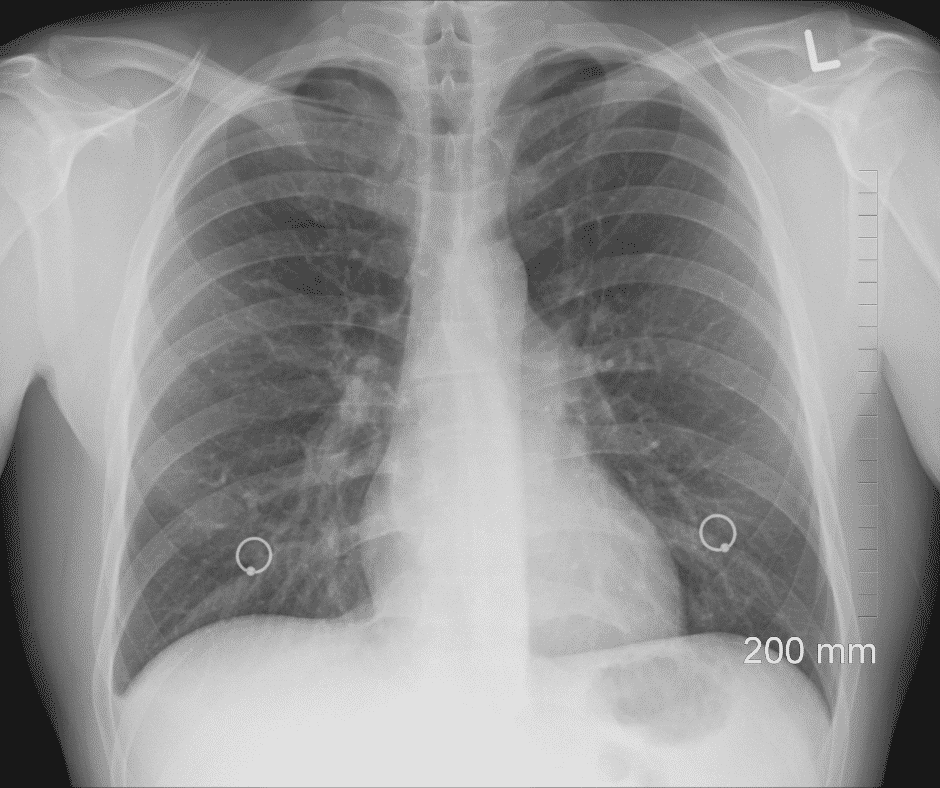

Medicare Part A covers the hospital, and Part B takes care of doctors and outpatient services. You will not be in the hospital as an inpatient with cancer most of the time. The oncological treatments are done as an outpatient, but there may be instances when you need hospitalization.

My mother was admitted to the hospital during the year because the pain was too intense. The doctors needed to use intervenience medications to beat back the pain that was overwhelming mom. In those instances, Medicare Part A picked up the tab.

Medicare Part A also includes skilled nursing, home health care, and hospice, not just inpatient hospital.

After a 3-day stay in the hospital, a person may be admitted to skilled nursing for a number of reasons. The person can continue cancer treatment while in the skilled nursing facility, and Medicare Part A will pay. My mother did that toward the end.

Does Medicare Part B Cover Cancer Treatment?

Medicare Part B is where most patients will experience Medicare for cancer treatments. The doctors administer chemotherapy drugs through your veins in an outpatient clinic or doctor’s office. Some oral chemotherapy is administered in the doctor’s office, though more are moving toward self-administration. The doctors also give radiation treatments in an outpatient setting. Medicare Part B covers cancer treatment when administered in this way.

administer chemotherapy drugs through your veins in an outpatient clinic or doctor’s office. Some oral chemotherapy is administered in the doctor’s office, though more are moving toward self-administration. The doctors also give radiation treatments in an outpatient setting. Medicare Part B covers cancer treatment when administered in this way.

The doctors need to check on the progress of treatments, so Medicare Part B covers cancer treatment for diagnostic tests like X-rays and CT scans.

Cancer treatment is incredibly taxing for the person, so durable medical equipment is often needed. Medicare covers wheelchairs, walkers, and feeding pumps for cancer treatment.

When appropriate, surgeons will operate to stop or curtail cancer. You see this most often with skin cancer. Outpatient surgeries are likewise covered.

The strain is not only physical for the patient but mental. Counseling and other mental health support may be appropriate and would be covered by Medicare.

What Does Medigap Do to Cancer Costs?

What Does Medigap Do to Cancer Costs?

Beneficiaries on Original Medicare would be responsible for the Part A deductible and the Part B coinsurance unless they have a Medigap policy. Depending on the type of Medigap policy, it will come in and pay most or all of the remaining amounts. Regarding cancer treatments, Medigap policies, such as Plan G and Plan N, are very powerful in the amount of coverage, filling in the 20% Part coinsurance gap after the Part B deductible.

What Are Cancer Policies?

Medicare does not cover some benefits that may be helpful for people going through cancer treatment, like room and board in assisted living facilities, adult day care, long-term nursing home care, and services of daily living–bathing and feeding. Neither Medicare nor the Medigap policy will cover those expenses. Another type of insurance could be helpful in these instances–indemnity plans.

You should ask us about cancer policies.

Does Medicare Advantage Cover Cancer Treatment?

Each Medicare Part C (or Medicare Advantage) plan is unique. Looking at the Medicare Advantage plans in the Omaha Metro area, most cover cancer treatment at 80%. Beneficiaries will need to pay the 20% for chemo and radiological treatments for cancer. Your coinsurance payments will go against the maximum out-of-pocket for the particular plan, and because of the high cost of cancer treatment, it would not be unusual for you to reach the maximum out-of-pocket (MOOP). Each plan has a designated MOOP amount, for example, $4,900, $5,500, or even $6,700. Once the Medicare beneficiary reaches the MOOP, you pay no more. The Medicare Advantage plan covers everything at 100%. The MOOP, however, is a large expense for most people in a given year.

Drugs Are An Essential Part

Drugs Are An Essential Part

Medications are also an essential part of cancer treatment. Beneficiaries may purchase a stand-alone Medicare Part D prescription drug plan. Most Medicare Part C/Medicare Advantage plans have a Medicare Part D prescription drug plan included in the plan.

Part D covers some oral chemotherapy drugs not covered under Part B. Anti-nausea drugs and other prescriptions used in cancer treatment, like pain medications, will come under Part D.

Questions To Ask Yourself About Medicare & Cancer Treatment

There are two important questions I would ask myself about Medicare and cancer treatment in the Omaha metro area.

- How likely do you think you will contract cancer?

- How easily will you cover the costs out of your pocket?

The A merican Cancer Society says that the elderly are ten times more likely than younger people to get cancer. Medicare beneficiaries over age 65 account for 54% of all new cancer cases. Cancer is the leading cause of death among the elderly.

merican Cancer Society says that the elderly are ten times more likely than younger people to get cancer. Medicare beneficiaries over age 65 account for 54% of all new cancer cases. Cancer is the leading cause of death among the elderly.

While those are generalizations, you can further add your own analysis to the formula if you have had cancer. Cancer among family members raises your chance of you contracting cancer.

The reality is that there is a probability that you may develop cancer during your time on Medicare. What is your estimate of that probability?

The second question to consider is cost. There is no one number for the cost of cancer. It depends on the type of cancer, the number of treatments, the type of treatments, etc. But there are ranges.

A study by Avalere Health gives prices as low as $25,000 to as high as $45,000 for chemotherapy. What do you think of that cost?

Avalere Health gives prices as low as $25,000 to as high as $45,000 for chemotherapy. What do you think of that cost?

With Medicare, you will only pay 20% of the expense. Most of it will probably be covered if you have a Medigap policy. The relevant cost for a Medigap policy will be the ever-growing monthly premium.

A Medicare Advantage plan will guarantee you pay no more than the maximum out-of-pocket (MOOP). In 2022, the largest possible MOOP nationally is currently $7,550. The MOOP in the Omaha Metro area is about $4,500 on average.

Is that something you can afford?

Is that something you can afford?

Does Medicare Cover Breast Cancer, Prostate Cancer, and Lung Cancer Treatment?

Medicare does not make any distinction between the types of cancer. All cancer is covered by the customary treatments doctors and hospitals use to combat cancer.

The Wheel of Fortune Or Misfortune?

James Bond was so cool when I was growing up. When he would sit down at the Roulette table in the casino across from the pretty girl, I was rooting for him to win. But would you want to leave the cost of your health care to the spin of the wheel?

There are 37 slots in a roulette wheel–0-36. The numbers divide into the colors red and black. Predicting the color is much easier than choosing a winning number. The house takes it most of the time, but people keep playing! It is incredible.

There are 37 slots in a roulette wheel–0-36. The numbers divide into the colors red and black. Predicting the color is much easier than choosing a winning number. The house takes it most of the time, but people keep playing! It is incredible.

Most people will not get cancer, though a certain percentage will. Do you want to spin the wheel and take your chances that you won’t end up with back-breaking bills, or do you want to offload the problem?

You could purchase a Medicare Supplement for a reasonable monthly premium. The Medigap policy will cover the 20% that Medicare does not. You then can go to any of the excellent medical systems we have in the Omaha, Lincoln, and Council Bluffs metro area or anywhere in the country without concern about costs.

You could choose a Medicare Advantage plan that limits your maximum out-of-pocket to a manageable number, and you will pay very little or nothing beyond your Part B premium.

The choice is yours. Choose wisely.

My mother died on February 4, 2013. We worried a lot about her during the illness. There was fear, pain, and grief. I think about her daily and all she did for me to make me the man that I am. I pray for the repose of her soul. But during the trial that was her treatment and ultimately her death, there was no concern about medical bills. She had prepared.

pain, and grief. I think about her daily and all she did for me to make me the man that I am. I pray for the repose of her soul. But during the trial that was her treatment and ultimately her death, there was no concern about medical bills. She had prepared.