OmahaCategory:

Are you ready to unlock the potential benefits of Medicare Advantage in your area? Look no further. This informative article will explore the advantages of Medicare Advantage plans and how they can enhance your healthcare coverage.

Are you ready to unlock the potential benefits of Medicare Advantage in your area? Look no further. This informative article will explore the advantages of Medicare Advantage plans and how they can enhance your healthcare coverage.

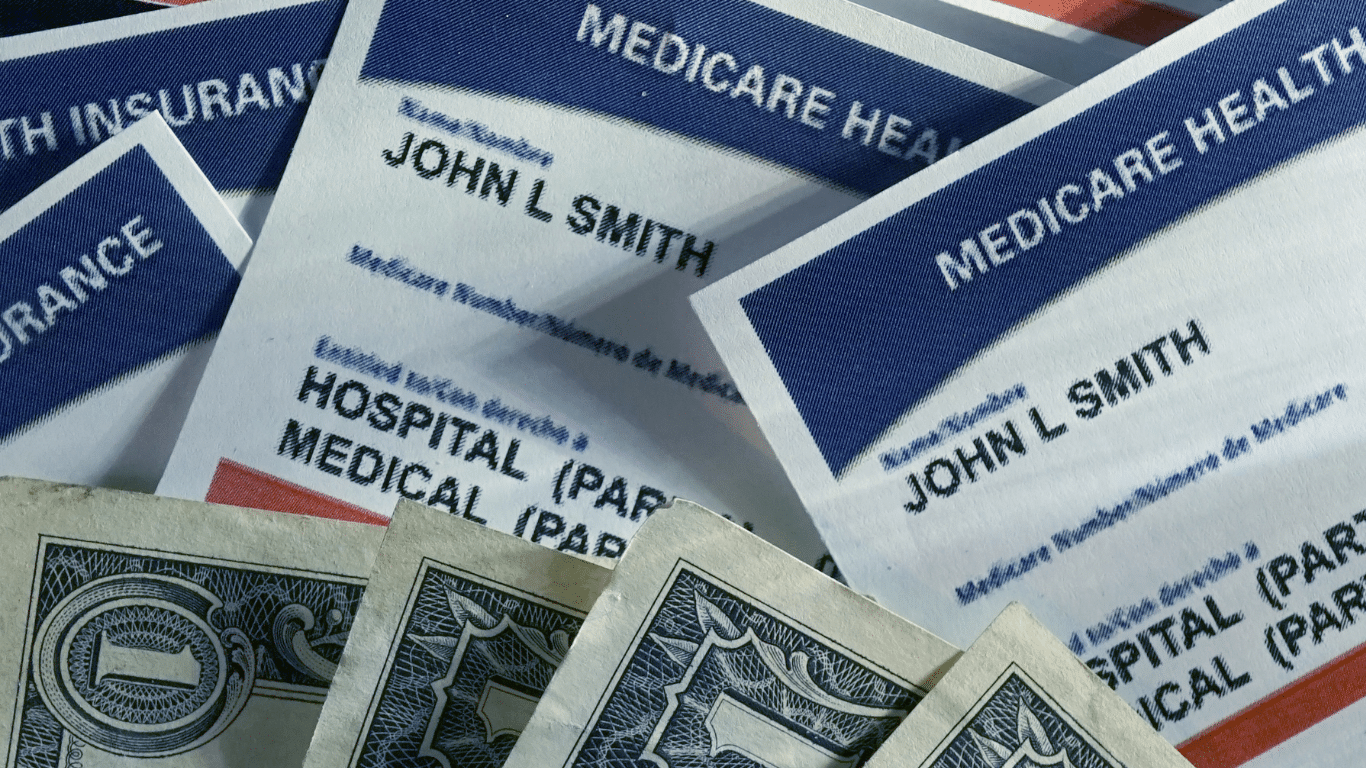

Medicare Advantage, also known as Medicare Part C, goes beyond what Original Medicare provides. With a Medicare Advantage plan, you can enjoy additional benefits like prescription drug coverage, dental care, and vision services in one convenient package. But that’s not all – some plans even offer fitness memberships, transportation services, and telehealth options.

By delving into the specifics of Medicare Advantage, we’ll help you understand how these plans work, what they cover, and whether they align with your unique healthcare needs. We’ll also examine how you can find the right plan for you in your local area.

Don’t settle for one-size-fits-all healthcare coverage. Discover the customized benefits and added features that Medicare Advantage plans can offer. Read on to learn more about the advantages waiting for you right around the corner.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of health insurance plan offered by private insurance companies that contract with Medicare. These plans provide an alternative way to receive your Medicare benefits, combining the coverage of Parts A (hospital insurance) and B (medical insurance) and often including additional benefits not covered by Original Medicare.

One key characteristic of Medicare Advantage plans is that they are required to provide at least the same level of coverage as Original Medicare. However, many plans go above and beyond. They put a cap on spending. Original Medicare is unlimited. There are small copays for services. Original Medicare Part B is an unlimited 20%. Part D prescription drug plans are usually included. With Original Medicare, you must purchase a separate Part D plan. Many Medicare Advantage plans have no deductible for the prescription side of the plan in the Omaha, Lincoln, & Council Bluffs areas. Most of the Part D plans have a large deductible. The most common deductible for 2024 is $545. Medicare Advantage offers additional benefits such as dental care, vision services, and hearing aids. That would be a separate policy and monthly premium on Original Medicare.

In summary, Medicare Advantage plans offer a comprehensive and convenient way to receive your Medicare benefits, often with added benefits not available through Original Medicare alone.

Medicare Advantage Enrollment & Eligibility

Now that we’ve explored the benefits of Medicare Advantage let’s discuss how you can enroll in a plan and determine your eligibility.

To be eligible for Medicare Advantage, you must meet the following criteria:

- You must be enrolled in both Medicare Part A and Part B. You still must continue to pay your Medicare Part B premium.

- You must live in the service area of the Medicare Advantage plan you wish to enroll in. If you leave that area, you will be disenrolled. You will then need to enroll in another plan in your new area in a timely manner.

Once you meet these eligibility requirements, you can enroll in a Medicare Advantage plan during specific enrollment periods.

- Initial Enrollment Period (IEP) occurs when you first become eligible for Medicare, typically three months before your 65th birthday, the month of your 65th birthday, and three months afterward.

- Annual Enrollment Period (AEP) takes place from October 15th to December 7th each year, during which you can switch or enroll in a Medicare Advantage plan.

- Special Election Periods (SEP) occur for special circumstances. For example, you move out of the service area. Another common SEP is when you lose employer health coverage. There are many others.

It’s important to note that Medicare Advantage plans may have different networks of doctors and healthcare providers, so it’s essential to confirm that your preferred healthcare providers are included in the plan’s network before enrolling. Each area has its unique circumstances.

Medicare Advantage in the Omaha, Lincoln, & Council Bluffs areas is exceptionally good when it comes to networks. There are four provider networks: CHI (Catholic Health Initiative), Methodist Health Systems, Nebraska Medicine (UNMC), and Bryan Health. All of these networks work with the six insurance companies with Medicare Advantage contacts in the area.

Original Medicare vs. Medicare Advantage

Original Medicare vs. Medicare Advantage

Original Medicare is only Part A for hospital and Part B for doctor visits and outpatient services. Part A currently has a deductible of $1,632 for an event in 60 days. Part B is a 20% coinsurance that is unlimited.

Medicare Advantage covers the same as Part A & Part B, but there is a maximum out-of-pocket (MOOP). The MOOP is potentially $8,850 in-network and $13,300 out-of-network. These amounts are the maximum cap a plan can have. All Medicare Advantage plans MOOPs in Omaha, Lincoln, and Council Bluffs are much lower. The most popular plan MOOP is $3,800.

Medicare Advantage plans have small copays for various services. For example, doctor visits maybe 0-$10, emergency rooms $120-$135, and outpatient surgeries $250-$350. All of the copays go against the maximum out-of-pocket (MOOP).

How to choose the Right Medicare Advantage Plan for You

With numerous Medicare Advantage plans available, choosing the right one that meets your healthcare needs is crucial. Here are some factors to consider when selecting a Medicare Advantage plan:

Medications Covered

Run your medications through the various software available, including the Plan Finder on the Medicare.gov website. Make sure your medications are on the formulary. Look for the plans with the lowest total copays for your medications.

Provider Network

Medicare Advantage is managed care, so there are networks, versus Original Medicare, which is fee-for-service (FFS). Check to make sure your doctors and hospitals are in the plan network.

Medicare Advantage is managed care, so there are networks, versus Original Medicare, which is fee-for-service (FFS). Check to make sure your doctors and hospitals are in the plan network.

We are fortunate to have strong network affiliations with the Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs. There are four networks: CHI, Nebraska Medicine, Methodist Health Systems, and Bryan Hospital. All six Medicare Advantage companies in our area work with these networks. However, we still check to confirm providers are in the network.

Maximum Out-of-Pocket in Budget

The maximum out-of-pocket is the most you must pay in a calendar year. Does that amount work in your budget? A Medicare Supplement coupled with Original will cost approximately $2,000-$3,000 per year, depending upon your age and location. You will pay the monthly Medicare Supplement premium regardless of any medical expenses. With an Advantage plan, you only pay copays if you see a doctor or have something done medically.

HMO vs. PPO

Medicare Advantage plans that are Health Maintenance Organizations (HMO) will only pay for services provided in the plan’s network. That is the limitation. When traveling, you are covered anywhere for an emergency.

Medicare Advantage plans that are Preferred Provider Organizations (PPO) cover services in and out of the network. Out-of-network care providers who accept Medicare but are not in the local service area network are covered. Those providers may charge more, and the maximum out-of-pocket expenses are usually larger.

PPO plans are best for people living in multiple locations or with limited local network coverage. Again, a PPO Medicare Advantage Plan has no real advantage in the Omaha, Lincoln, and Council Bluffs areas because all providers are in the four local networks.

Many insurance companies with Medicare Advantage contracts also have national networks. That means you can access doctors and hospitals in other parts of the country far from home, still be in the network, and pay in-network copays. It is always important to confirm a provider’s status before seeking treatment. I have had a number of clients leave the Omaha area and go to facilities in other states while on their HMO Medicare Advantage plan and pay in-network copays.

Copays

Copays

To explore the Medicare Advantage plans available in your area, you can use the Medicare Plan Finder tool on the official Medicare website (medicare.gov). This tool allows you to enter your zip code and compare the different plans offered in your local area.

The Medicare Advantage comparison tool is helpful when looking at copays. There are many plans, and copays differ from plan to plan and service to service. If you are looking through company sales brochures, you will become cross-eyed. A comparison tool, either at Medicare.gov or through an insurance agent you are working with, will make the review process much more manageable.

Over the years, I have listened to many clients voice their opinions on which copays are more important than others. I try to make clients aware of essential copays and the differences between the plans. They come to their own conclusions and rankings for the plans based on what they see.

Additional Benefits

The big attraction of Medicare Advantage is the additional benefits. It is interesting to listen to clients’ comments and compare the additional benefits between plans. Those who don’t wear glasses pass over that benefit, and those who have issues with their teeth will laser focus on the size of the dental benefit and the network.

Over-the-counter (OTC) benefits are getting a second glance this year because some companies reduced their amount, and another company kept it comparatively large. When the plans are very similar in terms of all other benefits, one benefit, like OTC, can make the deciding difference.

Once you have covered these essential aspects of the plans in your area, you should have a feeling about which plan (or plans) best address your needs. Going through this checklist will narrow your selection to a plan or couple of plans that will serve you best.

Exploring Medicare Advantage Plans in Your Area

Some large metro areas have many, many plans. In the Omaha area, we have six insurance companies that offer 27 Medicare Advantage plans in the Nebraska counties of Douglas, Sarpy, Washington, Cass, Saunders, and Lancaster, and five insurance companies offer 26 plans in Pottawatomie County in Iowa.

Some large metro areas have many, many plans. In the Omaha area, we have six insurance companies that offer 27 Medicare Advantage plans in the Nebraska counties of Douglas, Sarpy, Washington, Cass, Saunders, and Lancaster, and five insurance companies offer 26 plans in Pottawatomie County in Iowa.

So there is an excellent variety. The complaint I hear quite often is that there are too many choices. The large number of plans and the different copay amounts and benefits are overwhelming and make the selection process confusing for many of my clients.

If an independent agent lives and works in the area, he should be able to compare and explain most plans. One of the problems I have with agents out of call centers in Florida, California, or the Philippines is that they do not know the local area and the plans because they don’t live here. They are unaware of the subtle differences between the companies and plans. The telesale agent has no lived experience or history with the Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs.

Their primary concern is to switch you into the plan they are selling so they get paid. If there are problems later, they will not be there to answer your calls. They may not even be in the business after Open Enrollment.

Bottom Line: Is Medicare Advantage Right for You?

Medicare Advantage plans offer a wealth of benefits and added features that can enhance your healthcare coverage. From additional benefits like prescription drug coverage and dental care to added perks like fitness memberships and telehealth options, Medicare Advantage plans provide a comprehensive and convenient way to receive your Medicare benefits.

When considering Medicare Advantage, it’s important to carefully compare the plans available, review their coverage and benefits, and consider your specific healthcare needs. Doing so lets you choose the right Medicare Advantage plan that aligns with your preferences and provides the coverage you require.

Unlock the potential benefits of Medicare Advantage in your area. With over two decades of experience at Omaha Insurance Solutions, we know the Medicare Advantage plans well in Nebraska & Iowa. We can guide you through the selection process.

With the right plan, you can enjoy comprehensive benefits, cost savings, and a more convenient healthcare experience. Take control of your healthcare today and call us at 402-614-3389 to speak with an insurance agent professional to explore the possibilities of Medicare Advantage.

With the right plan, you can enjoy comprehensive benefits, cost savings, and a more convenient healthcare experience. Take control of your healthcare today and call us at 402-614-3389 to speak with an insurance agent professional to explore the possibilities of Medicare Advantage.

Are You An Independent Medicare Insurance Agent in the Omaha Area?

There are different kinds of Medicare advisors in Omaha, NE. Some Medicare agents are captive, meaning they sell Medicare insurance company products exclusively for one insurance company. Some of those companies may have subsidiaries, so it appears the agent offers multiple companies, but in fact, he commits exclusively to just one Medicare insurance company. By contractual obligation, he cannot offer or sell other insurance companies or their products. If he discusses other insurance companies and products, it is usually to sell against his competition. There are a large number of captive Medicare insurance agents in the Omaha Metro area.

Captive Insurance Agents

The problem with captive agents is that you cannot compare the many different companies and Medicare insurance products available objectively. So inevitably, the captive agent will usually conclude his company and products are the best. Physicians Mutual and Blue Cross Medicare insurance agents in the Omaha area and throughout the state are examples of captive agents.

Career Agents

Some insurance companies have “Independent Career Agents.” Those Medicare insurance agents contract with large insurance carriers that supply them with leads. The agent receives leads from the insurance company and he must only present that company and write for that company. Depending on the insurance company, they may or may not enforce the exclusivity. United Healthcare has many Medicare insurance agents in the Omaha Metro area, along with Nebraska and Iowa, who are career agents.

agent receives leads from the insurance company and he must only present that company and write for that company. Depending on the insurance company, they may or may not enforce the exclusivity. United Healthcare has many Medicare insurance agents in the Omaha Metro area, along with Nebraska and Iowa, who are career agents.

Again, the conflict is you will never know whether you receive disinterested and objective advice when an agent has special relationships with insurance carriers.

Discovering conflicting interests is not easy because the agent will control the plans you see. He will most likely not disclose the higher commission or incentives to you. However, if you shop around and compare plans, you may be able to discover better or less expensive Medicare supplements and plans.

Do You Sell Medicare Supplements AND Medicare Advantage?

Some agents only sell Medicare Advantage plans. I’ve found agents that started in the business selling Medicare Advantage tend to stay with Medicare Advantage. Agents who started selling Medicare Supplements stick with selling Medicare Supplements. Ask the agent if he offers both. They are both very different ways to approach Medicare, but they are not as apples to oranges as some would lead to you believe.

Some agents only sell Medicare Advantage plans. I’ve found agents that started in the business selling Medicare Advantage tend to stay with Medicare Advantage. Agents who started selling Medicare Supplements stick with selling Medicare Supplements. Ask the agent if he offers both. They are both very different ways to approach Medicare, but they are not as apples to oranges as some would lead to you believe.

Do You Enroll Clients In Medicare Part D Prescription Drug Plans?

One of the difficulties I have found with agents who only sell Medicare Supplements (Medigap) is they are not certified to offer Medicare Part D prescription drug plans. Certification is costly, time-consuming, and challenging. If you are not certified to sell Part D, you cannot offer Part D prescription drug plans. Those kinds of agents give their clients an 800-number and tell them to call Medicare for their prescription drug plan rather than help them pick one. The insurance companies pay very little for Part D drug plans. Most agents find it does not make financial sense to get involved.

I find prescriptions are sometimes the most critical part of a person’s health plan. On top of that, prescriptions can be costly, difficult to understand, and hard to navigate. Ask your Medicare agent to run your medications for you to see which of the Part D plans or Medicare Part C/Medicare Advantage plans are the best fit for your mix of prescriptions. He can do that on the Medicare.gov website or his private software package. If he can not easily do that for you, you have a good idea of the level of his knowledge and expertise or lack thereof.

Are You A Local Medicare Insurance Agent?

When you turn 65, Medicare insurance companies and Medicare insurance agents will bombard you with mail, email, and phone calls non-stop. You almost need to go into witness protection! Some of my clients tell me they receive 10 or 15 phone calls a day. Most of the phone calls come from call centers in Florida, So. Carolina, California. Hundreds of insurance agents stacked on top of one another in rooms full of phones are cranking out thousands of phone calls a second. They use automatic dialers that simultaneously dial ten persons at once. The first person who answers they solicit. After that, the other lines go dead.

When you turn 65, Medicare insurance companies and Medicare insurance agents will bombard you with mail, email, and phone calls non-stop. You almost need to go into witness protection! Some of my clients tell me they receive 10 or 15 phone calls a day. Most of the phone calls come from call centers in Florida, So. Carolina, California. Hundreds of insurance agents stacked on top of one another in rooms full of phones are cranking out thousands of phone calls a second. They use automatic dialers that simultaneously dial ten persons at once. The first person who answers they solicit. After that, the other lines go dead.

Persons you never met, persons you will never meet, persons you never heard of until that moment will ask you for your banking information, Medicare number, and birth date. You will probably never hear from them again after you sign up with them. They may or may not be in the insurance industry by the end of the month. These call centers churn and burn agents like they do clients.

If that is how you like to do business, then it will be very convenient. Our method is to have Medicare insurance agents sit down with people face-to-face at least once if not more times. I grew up in Omaha, went to South High, own a home here. I will be buried next to my parents at Calvary Cemetery. We are as local as local can be. With thousands of clients, we are not going anywhere. So if you like that, you will like us.

Independent Agent Or Broker

Independent Medicare insurance agents or Medicare insurance brokers will show you a wide variety of insurance companies and products. For example, they can show you the Medicare Supplements and Part D prescription drug plans along with the Medicare Advantage plans. Medicare insurance brokers should share their experience with the various companies and plans over the years and show you data and statistics that prove their points. There are many Medicare advisors in Omaha, NE.

How Often Do You Contact Your Clients?

There are three certainties. Medicare will change, the Medicare plans will change, and your needs will change. Consequently, your agent needs to contact you to keep you abreast of those changes.

The Annual Election Period (AEP) is October 15th–December 7th. That is the period when you can change your Medicare Part D and Medicare Part C plans. In addition, I send out several letters and emails to remind clients of their opportunities.

Most of the time, “if it’s not broke, don’t fix it” is good advice, but it doesn’t mean to ignore clients. For example, clients on expensive medications, like insulin and anti-diabetic medications, need to check their prescriptions annually because plans change. Your medications may have remained the same, but the insurance company can drop or add a prescription. In addition, they can raise or lower a drug on a particular tier level, which affects the price.

I’ve had clients ignore my letters and calls. After Annual Election Period passes, some clients call because their prescriptions have gone through the roof. There is nothing I can do at that point except to ask the insurance company for an exception.

Many Medicare insurance brokers in the Omaha Metro area do not call their clients regularly. Some not at all. They sign you up and disappear. Ask how often they will call you and check.

Happy Birthday!

I like to call clients on their birthday. Everyone likes well wishes on their birthday, but I also like to check in to make sure the Medicare plan is operating as designed. Sometimes problems come up, and sometimes clients don’t call. I like to be proactive and deal with issues head-on.

Also, for those on Medicare Supplements, their premium may increase because of age or rate increases. I like to check and see what clients are paying. I can do a quick quote over the phone. If there is a lower-cost supplement available, we complete an application over the phone. Saving $300 or $500 a year is always a good birthday present.

It is essential to see how often your agent will contact you because circumstances change, and you want to know he will be on top of those changes and problems. Also, Medicare insurance agents tend to disappear.

I have been in insurance since 2002–20 years. Getting an insurance license is not very difficult or expensive. The barrier to entry into this industry is not high. Lots of people get into insurance, and lots of people get out. A friend of mine was a human resource manager for a large Medicare insurance company recruiting Medicare agents. The average length of time in service for his company was six months.

Many times a Medicare agent will sign up a person and disappear. They disappear because they get out of the industry, have a full-time job doing something else, or are just lazy. Make sure to ask how often your Medicare agent plans on contacting you and hold him to that.

When Did You Become A Medicare Insurance Agent in the Omaha Area?

The insurance industry goes through a lot of people. Insurance recruiters make promises of flexible hours, high income, being your own boss. While writing this article, I got an email with the title, “There’s No Limit On How Much Cash You Can Earn.” Depending on the company or agency, they may promise lots of leads and opportunities.

The reality is selling insurance products is hard work. The vast majority fail. Even those who struggle for several years and others who do it part-time end up quitting because the costs, constant testing, compliance requirements, and client service needs are too much with the other life demands.

How long an agent has been doing Medicare planning is critical because Medicare has lots of rules. The insurance products have their own intricacies, and the Medicare bureaucracy itself is not easy to deal with. I learn something new each week. The companies provide training. Medicare sends out notifications. The state insurance commissions are a source of information. I especially learn from clients as problems come up. Every year each Medicare insurance company has training meetings. It is interesting to see the new Medicare advisors in Omaha, NE, at the meetings and those who are no longer there.

How Many Medicare Clients Do You Have?

Chris is very pleasant and knowledgeable about Medicare. My husband has been a satisfied client for the past 7 years. That’s why I am here. Elaine H.

I recently had an operation on my Achilles tendon. I asked the surgeon how often he was in surgery per week. He said he performed between 10-15 surgeries per week. I like that number. When someone comes at me with a sharp object, I want to know that they know what they are doing.

This is the same for Medicare. The amount of time you have been a Medicare insurance agent and the number of clients you have tells you a lot about the agent. Most people never ask. If you have been making Medicare sales for five years and have only a hundred clients, you haven’t even averaged two new clients a month. How can you be good at anything when you only do it twice per month?

What Is Your Medicare Insurance Agent Process in Omaha?

Every salesperson has a process. If they do not have a process, that is their process. Ask your potential Medicare insurance agent to explain his process of working with clients. If he gives you a blank stare or hems and haws, that would not be a positive sign.

This is a little of what my process looks like when a prospective client meets with me for the first time. I take them through a 3 step process.

- Educate them on the basics of Medicare using the Official Medicare Handbook

- Show them the hundreds of supplements and plans with pricing

- Find out about their unique and particular health concerns

At the end of the meeting, I hand them a brochure with the details of the meeting, printouts of the supplements with prices, Medicare Advantage Benefit Highlights sheets, and a prescription drug list run through the Medicare.gov software, along with an email of those materials.

Printed Quotes and Follow Up Phone Calls

As a Medicare Insurance agent in Omaha, I mail them the printed materials again after the meeting. I follow up in a week with a phone call to see if there are any questions or need for clarification. I call and schedule the second appointment when they are in their open enrollment period. We review the Medicare materials again with updated details until they are comfortable making a decision. We complete the paperwork. My office sends a follow-up letter going through the details of what we did in the enrollment meeting. We call within ten days to update the client on the application and give the policy numbers. Then in another ten days, we call to make sure the client has all their cards and customer service phone numbers.

As a Medicare Insurance agent in Omaha, I mail them the printed materials again after the meeting. I follow up in a week with a phone call to see if there are any questions or need for clarification. I call and schedule the second appointment when they are in their open enrollment period. We review the Medicare materials again with updated details until they are comfortable making a decision. We complete the paperwork. My office sends a follow-up letter going through the details of what we did in the enrollment meeting. We call within ten days to update the client on the application and give the policy numbers. Then in another ten days, we call to make sure the client has all their cards and customer service phone numbers.

Thirty days after the policy starts, we follow up to make sure everything is going fine with the plan. In another thirty days, we double-check again to see if there are any issues. The following contact is either on a birthday or during the Annual Election Period in October of every year. The client, of course, can all at any time with questions or concerns.

I tell people this is a long-term relationship. ‘Until death does us part.’ I hope you are my client for the rest of your life, and I will be in contact with you during all that time to make whatever adjustments are needed. I have one client who is 102!

Should Medicare Insurance Agents in Omaha Have Testimonials?

Should Medicare Insurance Agents in Omaha Have Testimonials?

I ask many of my clients to share a testimonial for my website. You can see them on the bottom of the home page and the last page of the website. Many say ‘Yes!’

I take their picture and write down what they liked about working with me. My clients are very kind and generous.

Christopher J. Grimmond

Of course, you could say that is very self-serving, so I use Google Reviews. Clients can go to my profile on Google. There is a spot they can click and write a review. You can see those reviews. Google curates them and serves as the third party. I cannot delete or alter them. Those reviews should give you a good idea of how we work and the quality of our work.

Like on Amazon or other companies, you should be able to check an agents’ references. Ask the agent if there is some way to see the quality of their work. With hundreds of clients, a Medicare insurance agent in the Omaha area should very quickly be able to produce some testimonials about his service.

These are some ways to evaluate the quality of your potential Medicare insurance agent.

Navigating the Complexities: What You Need to Know About Medicare and Home Healthcare Coverage

Navigating the Complexities: What You Need to Know About Medicare and Home Healthcare Coverage

Are you confused about Medicare and home health care coverage? If so, you’re not alone. Navigating the complexities of these topics can be overwhelming. It’s essential to understand your options and ensure you receive the care you need.

Does Medicare pay for home health care services?

This article will delve into the ins and outs of Medicare and home healthcare coverage, providing the information you need to make informed decisions. We’ll explore the different types of Medicare plans and how they relate to home healthcare services, eligibility requirements, coverage limitations, and common misconceptions.

Whether you’re a senior seeking assistance or a caregiver supporting a loved one, understanding how long Medicare pays for home health care is crucial. By the end of this article, you’ll clearly understand what options are available and how to navigate the complex healthcare landscape.

Stay tuned to discover everything you need about Medicare and home healthcare coverage. Don’t let the confusion hold you back from accessing the care you deserve.

Different Types of Medicare Coverage

Medicare is a federal health insurance program that covers people over 65 and those with specific disabilities or chronic conditions. There are several types of Medicare plans, each with benefits and limitations. Knowing how long each Medicare plan pays for health care is critical.

Original Medicare, also known as Medicare Part A and Part B, provides coverage for hospital stays, doctor visits, home healthcare, and some medical equipment. Medicare Part C, also known as Medicare Advantage, is a private insurance option combining Parts A and B, often including additional benefits such as prescription drug coverage and dental care. Both provide home healthcare coverage, but in specific ways unique to the plans.

Medicare Part D provides coverage for prescription drugs, while Medicare Supplement plans, also known as Medigap, help cover the costs of out-of-pocket expenses not covered by Original Medicare.

Understanding the differences between these plans is essential because they approach home health care differently.

Understanding Home Healthcare Services

Understanding Home Healthcare Services

As the name suggests, home healthcare services provide medical care and support to individuals in their homes. This can include services such as nursing care, physical therapy, and speech-language therapy. Home health care is often a more convenient and cost-effective option than hospital or skilled nursing facility (SNF) care and can provide a higher level of comfort and independence for patients. It is skilled nursing care but provided in the home for those who would not have access to medical care otherwise.

The purpose of home health care is short-term treatment for an illness or injury, such as a stroke or broken hip. It is about getting back your health and independence again.

For the chronically ill and disabled, the goal of home health care is to maintain the highest level of ability and health.

Home healthcare services can be provided by a variety of healthcare professionals, including registered nurses, licensed practical nurses, physical therapists, occupational therapists, and speech-language pathologists. A physician typically orders services, and they are covered by Medicare and/or private insurance.

Home health care is not home care. Home care would be custodial services like housekeeping, bathing, feeding, etc. Medicare does not usually provide those types of personal services, strictly speaking. There are exceptions, however. On occasion, Medicare allows for a temporary home health aide to assist in the healing process.

Some injuries and illnesses may last for a long time. While home health care is a necessary service, the bigger question is: how long does Medicare pay for home healthcare?

Medicare Eligibility for Home Healthcare Coverage

Individuals must meet specific requirements to be eligible for Medicare home healthcare coverage. First, they must be enrolled in Medicare Part A and/or Part B. Both Medicare Part A and Part B provide home healthcare coverage.

Under Part B, a person is eligible for home health care if she is homebound, requires skilled care, and is certified as needing care by a physician. The added benefit is Part B does not require a qualifying hospital stay.

The essential requirements of eligibility and access to Medicare home healthcare services are: homebound, physician certification, and Medicare-certified agency care.

Homebout, in Medicare terms, means that leaving the home requires a considerable and taxing effort. A physician is the gatekeeper of Medicare home healthcare. The physician certifies and/or recertifies a patient for access to home healthcare. Finally, a Medicare-certified agency must provide home healthcare services, not any healthcare provider.

Medicare Part A Coverage

In contrast, Medicare Part A provides home health care coverage in some situations. A hospital or skilled nursing facility stay triggers Part A. If a person has a three-day inpatient stay at a hospital or has a Medicare-covered Skilled Nursing Facility (SNF) stay, Part A will cover up to 100 days of home health care.

Note that a person must still meet the other eligibility requirements to receive home health care, such as needing skilled care, being homebound, and having a doctor certify that such care is necessary.

A person also must receive home health services within 14 days of being discharged from a hospital or SNF. If a person doesn’t meet all of the requirements for Part A coverage but is otherwise eligible for home health care benefits, her care will be financed under Part B.

Medicare Coverage For Home Healthcare Services Amounts

Regardless of whether Part A or Part B covers a person’s care, Medicare will pay:

- The entire approved cost of all covered home health services.

- Eighty percent of the Medicare-approved amount is for durable medical equipment.

Medicare covers a wide range of home health care visits, including skilled nursing care, physical therapy, occupational therapy, speech-language pathology, and medical social services. These services are typically provided part-time or intermittently, depending on the individual’s needs.

Medicare also covers specific durable medical equipment and supplies, such as wheelchairs, hospital beds, and oxygen equipment.

However, coverage limitations and restrictions may apply, and it’s essential to understand what services are covered and how much you may be responsible for paying out of pocket. The agencies providing the equipment and supplies can give details of costs.

Limitations and restrictions of Medicare coverage for home health care

Limitations and restrictions of Medicare coverage for home health care

While Medicare provides coverage for many home healthcare services, there are limitations and restrictions to be aware of. For example, Medicare typically only covers part-time or intermittent care and may not cover 24-hour or long-term care.

In addition, Medicare may not cover certain services considered custodial care, such as help with bathing, dressing, and eating. Finally, there may be coverage limitations based on the individual’s medical condition. Some coverage is subject to annual or lifetime caps.

Certified Home Health Agency Disclosure of Covered Costs

Before home health care starts, the certified home health agency must tell the person how much Medicare will pay. The agency must also disclose if Medicare does not cover needed items or services. Then tell how much the person will have to pay for them.

For example, charges to a person may be:

- Medical services and supplies that Original Medicare doesn’t cover, such as prescription drugs or routine foot care

- 20 percent of the approved amount for Medicare-covered durable medical equipment such as wheelchairs, walkers, and oxygen equipment

Tips for Navigating Medicare and Home Healthcare Coverage

Navigating the complexities of Medicare and home healthcare coverage can be challenging, but several tips help make the process easier. First, it’s important to understand your needs and choose the Medicare plan that best fits them.

Second, work with your healthcare provider to ensure that a Medicare-certified agency orders and provides home healthcare services.

Finally, read the fine print and understand any coverage limitations or restrictions that may apply. The Medicare-certified agency is well versed in the cover limitations and costs. Be sure to consult with them ahead of time.

Alternative options for home health care coverage

While Medicare provides coverage for many home health care services, alternative options may be available to better meet your needs. For example, private insurance plans may offer more comprehensive coverage for certain services. Medicaid is another route for low-income individuals.

Private Home Health Care Insurance Policies

Home health care insurance is typically a private insurance policy purchased ahead of time to assist Medicare in caring for someone receiving home health care. The policy covers activities of daily living in the home, such as bathing, feeding, transportation, and housekeeping. Like any insurance, these alternative options must be purchased before the health issues arise. Many insurance carriers offer a variety of these types of policies.

In addition, a variety of community-based programs and organizations offer support and assistance to seniors and individuals with disabilities. These programs may include meal delivery, transportation services, and assistance with daily living activities.

Home Health Agency Advance Beneficiary Notice of Noncoverage

Home Health Agency Advance Beneficiary Notice of Noncoverage

When a certified home health agency believes that Medicare may not pay for some or all of a person’s home health care, it must give the person a written notice called an Advance Beneficiary Notice of Noncoverage (ABN). The ABN might occur, for example, if the home health agency thinks that Medicare will not pay for items or services because:

- The care is not considered medically reasonable and necessary.

- The care is only unskilled, a home health care aide, like help with bathing or dressing.

- The person is not homebound.

- The person does not need skilled care on an intermittent basis.

The ABN must describe the service and/or items that may not be covered and explain why Medicare probably won’t pay. The notice must also include an estimate of the costs for the items and services so that the beneficiary can decide whether to receive the services, understanding that she may have to pay out-of-pocket for such care.

The ABN also gives directions for getting an official decision from Medicare about payment for home health services and supplies and for filing an appeal if Medicare won’t pay.

How Long Does Medicare Pay for Home Health Care?

There is no limit to the length of time that a person can receive home health care services. Once the initial qualifying criteria are met, Medicare will cover home health care as long as it is medically necessary. However, care is limited. There are a maximum number of visits per week and a certain amount of hours per day of care.

When a person first begins receiving home health care, the plan of care will allow for up to 60 days. At the end of this period, the physician must decide whether to recertify the patient for another 60 days. The patient must be recertified at least every 60 days if home health care is to continue.

Medicare does not limit the number of times a physician may recertify a patient. Provided all eligibility requirements continue, he can recertify an unlimited number.

What Happens When Medicare Stops Paying for Home Health Care?

A home health agency must give a beneficiary a written Home Health Change of Care Notice (HHCCN) when the patient’s plan of care changes because the home health agency decides to reduce or stop providing some or all of the home health services or supplies. Or, the patient’s doctor has changed the orders, which may reduce or stop certain home healthcare services or supplies that Medicare covers.

doctor has changed the orders, which may reduce or stop certain home healthcare services or supplies that Medicare covers.

For example, the doctor changes the care plan from five to three days a week. The agency issues an HHCCN. The beneficiary receives a notification in writing of the change.

The HHCCN lists the services or supplies that will be changed and gives the beneficiary instructions on what to do if she disagrees. The home health agency is not required to give a person an HHCCN when a Notice of Medicare Noncoverage is issued.

Notice of Medicare Noncoverage

When a person’s Medicare-covered services end, the home health agency must give the beneficiary a Notice of Medicare Noncoverage (NOMNC). This notice states when services will end as well as how to appeal the decision. The NOMNC also provides information on contacting the Beneficiary and Family-Centered Care Quality Improvement Organization (BFCC-QIO) to request an expedited appeal.

Once a person decides to appeal and has reached the BFCC-QIO, the home health agency must give the patient a detailed notice explaining why it believes Medicare-covered care should end. The agency should tell the applicable coverage rules and other information about the person’s situation.

A physician must submit a statement of appeal to the BFCC-QIO. It says the patient’s health will be jeopardized if care is discontinued. These factors determine how long Medicare pays for home health care. Knowledge of these rules is vital to maximize benefits and avoid costly mistakes.

Importance of understanding Medicare and home health care coverage

Understanding Medicare and home health care coverage is crucial for seniors and individuals with chronic conditions or disabilities. These programs provide access to essential medical care. They support individuals to maintain their independence and quality of life.

By understanding the different types of Medicare plans, eligibility requirements, coverage limitations, and alternative options, individuals can make informed decisions about their healthcare and ensure they receive the care they need.

Bottomline: Taking Advantage of Medicare and Home Healthcare Benefits

In conclusion, navigating the complexities of Medicare and home healthcare coverage can be challenging, but it’s essential for seniors and individuals with chronic conditions or disabilities. By understanding the different types of Medicare plans, eligibility requirements, coverage

Christopher J. Grimmond

limitations, and alternative options, individuals can make informed decisions about their healthcare and ensure they receive the care they need.

Whether you’re seeking home healthcare services for yourself or a loved one, working with your healthcare provider and understanding the coverage options available is essential. By taking advantage of Medicare and other home healthcare benefits, you can maintain your independence, improve your quality of life, and ensure you receive the care you deserve.

At Omaha Insurance Solutions, we help you understand the many Medicare rules. We navigate you through the forms and get the care you need. Call us at 402-614-3389 to speak with an experienced, licensed insurance agent professional.

Medicare Advantage or Medicare Part C is another way to receive Medicare. “Original Medicare” is a combination of Medicare Part A and Part B. It is called “Original Medicare” because that was its first plan in the late 60’s. Medicare Part A was hospital insurance and Medicare Part B was added later. It included doctor visits and outpatient procedures. Some people call it traditional Medicare. It became “Original Medicare” when a new form of Medicare was created–Medicare Advantage, also called Medicare Part C. What is the advantage of Medicare Advantage over Original Medicare?

The Advantage of Medicare Advantage vs Original Medicare

Let’s explain “Original Medicare” first. Medicare Part A covers hospital stays. The Part A has a deductible. It is currently $1,340 for every hospital stay for the same event in a 60 day period. If a completely unrelated event lands you in the hospital, e.g., car accident, heart attack, stroke, etc., even within the first events 60-day period, you will still pay the $1,340 deductible for those unrelated events. That kind of deductible schedule could add up to a significant cash outlay in a year. Likewise, Medicare Part B exposes you to a great deal of risk. While Medicare Part B pays 80% of doctor and outpatient costs, your 20% co-insurance has no cap on it. There is no maximum out-of-pocket. Sky is the limit. If you have a million dollars worth of bills under Part B, 20% is $200,000.

Maximum Out-Of-Pocket

Maximum Out-Of-Pocket

The Advantage of Medicare Advantage is a maximum out-of-pocket. The highest maximum out-of-pocket for Medicare Advantage plans in 2018 is $6,700. Some plans maximum out-of-pocket are much less, depending on the area, the company, and the type of plan. However, the easiest and clearest difference between Original Medicare and Medicare Advantage is a definite limit on what you pay out of your pocket. Medicare Advantage has a maximum out-of-pocket. Original Medicare does not.

Minimum Co-Payments

Each Medicare Advantage Plan has its own schedule of co-pays, deductibles, and co-insurance. One co-pay that is standardized in all plans is the emergency room visit. In 2018, the emergency room visit co-pay is $80. I would rather pay $80 with a Medicare Advantage plan rather than 20% of any amount on Original Medicare. I broke my arm a number of years ago biking. My emergency room visit was $3,000. The advantage of Medicare Advantage I think is an $80 co-pay rather than 20% bill–$3,000 x 20% = $600.

Part D Prescription Drug Included

Part D Prescription Drug Included

With Original Medicare, you still need to get a Medicare Part D prescription drug plan, even if you don’t take any medications. Otherwise, you will be penalized when you eventually do enroll in a Medicare Part D plan. The Part D plan is generally included in a Medicare Advantage plan at zero or little cost. If you purchase a Part D plan, you may pay between $21–$100 per month. The advantage of Medicare Advantage is paying zero or very little for your drug plan.

Vision and Dental

Mo st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

Compared to Original Medicare, the advantage of Medicare Advantage makes complete sense. It limits your maximum out-of-pocket, combines Part D at little or no cost most times, includes extra benefits, like dental and vision. There are usually many plans in your area. Here is Omaha there are eleven Medicare Advantage plans among five insurance companies. You should be able to find something that fits your needs among that variety. Call us to find out 402-614-3389.

When people arrive at the doorstep of Medicare at age 65, they are confronted with the daunting task of picking a Medicare plan. Most people find picking Medicare plan overwhelming and confusing.

100’s of Supplements to Pick From

Insurance companies offer hundreds of different Medicare supplements, Medicare Advantage plans, and Medicare Part D prescription drug plans. Picking Medicare plan means choosing between Medicare supplements and a Part D prescription drug plan OR Medicare Advantage/Part C. Next picking Medicare plan means choosing the plan type. Medigap plans range from plan A through the alphabet to plan N, which doesn’t include a Part D drug plan. The drug plans can be a little simpler because you can use the Medicare tool to narrow down the selection. The Medicare calculator bases the plan selection upon the prescriptions you enter into the system. The calculator picks the Medicare Part D plan that will cost the least in total costs for you. On the other side, Medicare Advantage plans consist of a wide variety of co-pays, co-insurance, deductibles, and maximum out-of-pocket costs and amounts that may or may not include a Part D plan.

Foreign Language of Medicare

Medicare itself is like a foreign language of Part A, Part B, and Part D with rules around enrollment that includes penalties when you do not comply. The Medicare.gov website is meant to be helpful, but the shear amount of information, jargon, legalese makes it a barrier to entry rather than a door. Even the Medicare handbook is hundreds of pages. Its size makes the evaluation of information almost impossible.

The Pain of Picking Medicare Plan

The Pain of Picking Medicare Plan

As a consequence, picking a Medicare plan is a frustrating and painful process for people. That is why I take people through a 3-step process. 1.) There is a brief, foundational explanation of Medicare and how it works. 2.) Look at ALL of the plans, but in an organized and ordered fashion. The first step helps you evaluate the plans. I share the story behind each company from my fifteen years of insurance experience because each company has a history in the market. 3.) I find out about you. Everyone is unique. Some people are risk takers. Others are not. Some have health concerns that are foremost of mind. Others do not have any.

Logical Process

The logic of the process enables people to narrow down choices and make the best one for them. I ask questions as we go along. Test and probe. Explain aspects of the plans as we go through each. Constantly test for understanding. So the process of picking a Medicare plan becomes clearer as we move through it. I generally meet with people twice. The first time is usually months before they can do anything. There is no pressure to make a decision or ‘buy right now.’ Clients have time to think, collect more information, verify what they’ve learned, talk with confidants. The next time we get together is to review with updated information. That is the time for picking a Medicare plan. By then you are comfortable and confident with your decision because your decision is well informed. It is logical. The decision is made over time without pressure. You know what you are doing when you pick your Medicare plan.

If you would like to go through this process, there is not cost or obligation. Call 402-614-3389 to find out more.

What is Medicare? A basic question. Or rather, why should anyone care about Medicare? The reason people should care is that most bankruptcies are medical bankruptcies. In other words, if you wish to protect your retirement nest egg from bill collectors, Medicare is important to know about. There are few things that are more disturbing than a pile of medical bills sitting on the kitchen table. The golden years could be tarnished with worrying about actual or potential medical expenses. Medicare–if implemented proper–will protect you from a potential catastrophe. It is critical for people entering into retirement to understand what is Medicare.

What is Medicare?

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare Part A

Medicare is divided into two parts: Medicare Part A and Medicare Part B. Medicare Part A has everything to do with the hospital. It doesn’t cost anything because you paid for it during your working years. It was one of the deductions in your payroll taxes. Medicare Part A covers a 100% of the medical expenses incurred in the hospital, but there is deductible that many people are not aware of. The Medicare Part A deductible is currently $1,288. This is NOT an annual deductible. It is a deductible per benefit period, and a benefit period is 60 days. So each event has a deductible, and the time for the event is 60 days. In other words, you could have multiple events and pay multiple deductibles because the event is not limited to just a 60 day period. Each new event, even if it overlaps with another event, has its own 60 day timeline. While rare, it could happen, and probably more importantly, you could pay the Part A $1,288 deductible more than once in any given year.

Medicare Part B

Medicare Part B, however, does cost something. For most people going on Medicare and Social Security in 2016, the Medicare Part B premium is $121.80 per month. It is generally taken out of your Social Security check. Medicare Part B covers doctors’ visits and outpatient procedures, such as X-rays, blood work, emergency room visits, etc. Medicare Part B covers 80% of the cost. Your portion is 20%. The 20% coinsurance, however, is unusual. There is no cap. There is no maximum out-of-pocket. Most group plans you were ever on probably had a maximum out-of-pocket. It may have been $1,000, $2,000, even $10,000, but at some point, you stopped paying and the insurance company covered everything. Medicare Part B does not have that, so 20% of a big number will be a big number. You keep paying your 20% coinsurance as long as the bills come in.

These are the basic building blocks to what is Medicare. You must understand Medicare, Medicare Part A, and Medicare Part B to understand the rest that follows. In the next blogs and videos, we will cover how to get Medicare, how to cover the Part A deductible, and how to fill the unlimited 20% gap in Part B coverage.

More Than Medicare Supplement Plans

I help people sign up for Medicare Part A and Medicare Part B. We go to Medicare.gov and run their medications. I check to make sure their doctors and hospitals are in network for the Medicare Advantage plans. I explain their Medicare eligibility and show All the Medicare supplement plans, Medicare Advantage Plans, and Medicare Part D Plans, but there is much more to being an independent insurance agent who offers Medicare insurance. It is about a long term relationship with my clients. It is more than Medicare supplement plans.

Losing a Medicare Client

I recently lost a couple of clients. They passed away suddenly. I happened to have spoken with one of them a few days before her passing. She had called about some photos she had seem on my personal Facebook page. It is painful when a client dies because I get connect with my clients, especially over time.

More Than Apply for Medicare

The recent loss also reminded me of the nature of my relationship with my Medicare clients. It is a relationship that is meant to last over time. It is more than helping them apply for Medicare. I tell my clients when I enroll them that this is a relationship until “Death do us part.” I will be checking in on them every six months to make sure their plan is working well. I check in especially during Open Enrollment Period when beneficiaries may make changes to their plans. I want to make sure that clients have the best possible plan that fits their needs at the best possible price because we know three things for certain. Medicare will change, the Medicare plans will change, and their needs will change. I want to be on top of those changes for them.

If you want someone who will take care of your Medicare needs over the years, give us a call 402-614-3389.

Delay Medicare Enrollment

Many people work past 65. They continue on with them employer group coverage. They delay Medicare enrollment. At 66+, they wonder what to do about Medicare.

How to Enroll after 65

Here is what to do. Go to Medicare.gov. Click on “Forms, Help, Resources” on the top right. Then click on “Medicare Forms” on the left middle. You will see the enrollment forms in the middle of the page in PDF form. There are two forms: one to enroll in Medicare Part B and a second for your employer to sign off on your coverage. You fill out the enrollment in Part B. Give the second form to your employer. Your employer will verify that you have had health coverage as good as Medicare since you turned 65. They will sign the form. It is important for you to write in the date that you wish your Medicare Part B to start. Give yourself enough time to find a Medicare plan and prescription drug plan. (There are much shorter and restrictive time limits when you have delayed Medicare Part B enrollment.) Drop the forms in the mail or hand deliver them to the local Social Security office.

Medicare Employer Enrollment Forms

Why do you want to involve your employer with your enrollment in Medicare Part B? If you do not have your employer verify that you had health coverage from the time you could have enrolled in Medicare until the time you did take Part B, Medicare will assume you did not have creditable coverage and will asset a penalty. The penalty is a 10% increase in Part B premium for every year you did not have coverage. That can be significant over time and completely unnecessary. Delay Medicare enrollment at your own risk. Get the form. Your employer is required to verify. The human resource department will know exactly what to do. It is a very simple matter.

At Omaha Insurance Solutions, we help clients who delay Medicare enrollment all the time. We can get this done quickly and easily. Give us a call 402-614-3389. We can email you the forms, walk you through filling them out, and explain what to do.

A distressed prospective client told me that Medicare did not cover mental health treatment. I stammered a bit because the subject had never come up before, and I was surprised. I said that it did. She had read that it only covered a one time welcome visit to Medicare. I then showed her in the Medicare & You Handbook on pages 40 and 59 where it detailed the coverage. There is the welcome to Medicare screening, an annual screening, and complete medical coverage. She was surprised and relieved there was Medicare mental health care.

Seniors Need Mental Health Care

Mental health is a serious problem in society, and it is growing among seniors. The World Health Organization documents how important among seniors this issue is. Depression is under reported, little recognized, and often an untreated illness; but Medicare mental health cares for beneficiaries with mental health concerns, like depression. It probably does it better than most employer plans do.

Medicare Mental Health Part A

Medicare Part A deals with the hospital. The same rules around hospital deductibles and co-insurance apply to psychiatric hospitals as to other hospitals. There is, however, one difference. Medicare only allows a lifetime amount of 190 days for a stand alone psychiatric hospitals.

Medicare Mental Health Part B

Medicare Part B covers psychiatrists, counselors, treatment groups. Again the same 20% co-insurance applies as to any other Part B doctor visit. If you have a long standing relationship with a psychologists before Medicare, you may keep that relationship going after you go on Medicare if the medical professional takes assignment for Medicare.

Medicare Supplements will cover Medicare mental health issues and professionals the same as other fees in accordance with your particular Medicare supplement plan. Medicare Advantage will have the same co-pays for psychiatrists and psychologists as for other specialists.

No need to be stressed or depressed about Medicare mental health. You are covered.

A gentleman called me who was losing his group health coverage from a former employer. He was a retiree from a Fortune 100 company. You would recognize the name of the company immediately. As part of his retirement package, he had a very generous health plan for himself and his wife. He had been on it for decades, but the company could no longer afford to maintain it. They canceled the plan, so my client found himself cast out into the Medigap world at 92 not knowing what to do, and he didn’t realize that he would need a Medigap guarantee issue to be get a plan.

Medigap Guarantee Issue Solution

When you are a Medicare beneficiary and you loss group coverage, you have what is called a guarantee issue period. It is a very limited opportunity that has an exasperation date on it. It is an incredibly important guarantee for those who have pre-existing conditions.

What is Medigap Guarantee Issue?

What is guarantee issue for a Medigap policy? How does it work? What should you do to make sure you don’t miss out? Guarantee issue for a Medigap policy applies to a number of situations. I will just speak to one—when you involuntarily lose your group health coverage while on Medicare Part A & B. Guarantee issue means that an insurance company must offer you a Medigap plan—usually plans A, B, C, & F—without asking health questions. They must sell it to you no matter your health condition. For those with pre-existing conditions that would exclude them, this is a treasure. (Each state may handle guarantee issue situations somewhat differently, but this is the general concept.)

How Does Medigap Guarantee Issue Work?

How Does Medigap Guarantee Issue Work?

How does guarantee issue work for a Medigap policy when you have involuntarily lost your group health coverage? The company that is ending group health coverage will usually give you sufficient time to find other coverage. You are able to purchase a supplement as early as 90 days ahead of time. After coverage has ended, you usually only have 63 days to find coverage without going through underwriting. If you miss that time frame and you have a serious health issue, you will not find a Medigap policy. You will only have Medicare.

What Should You Do to Get Your Medigap Guarantee Issue?

What should you do if you are losing your group plan that covers your Medicare deductibles and coinsurance? First get educated about Medicare. Second get a quote and start looking for a Medigap plan. Third see if you can pass underwriting so you are not restricted to the more expensive plans, but please don’t doddle. There is a clock ticking in terms of your guaranteed issue period.

To summarize, you have a special opportunity to get a Medigap plan when you lose your group plan. The special opportunity is that you do not have to answer health questions for a defined period and the insurance company has to sell you a plan. You need to be aware of the rules and follow them so you do not miss out. Still try underwriting so you have more options, but you have the guarantee provision to fall back on. There are rules and time limits around guaranteed issues. Make sure you fully understand these rules and the ramifications. Call to find out the facts so you don’t miss out. 402-614-3389 OmahaInsuranceSolutions.com