UncategorizedCategory:

People ask, what is the difference between Traditional Medicare (only Part A & Part B) and Medicare Advantage (or Part C)? Traditional Medicare does not require prior authorization.

People ask, what is the difference between Traditional Medicare (only Part A & Part B) and Medicare Advantage (or Part C)? Traditional Medicare does not require prior authorization.

Prior Authorization Contains Cost

Medicare Advantage is managed healthcare, similar to your health insurance policies under an employer health plan. A tool that managed healthcare uses is prior authorization to contain costs.

Utilization management first appeared in the 1960s after Medicare Part A was created. Once Medicare Part A was instituted, the number and length of hospital stays skyrocketed. To contain costs, President Johnson and Congress approved the practice of utilization reviews for hospital stays.

It Started with Utilization Reviews

Utilization reviews confirm the need for hospital treatment. Two doctors needed to concur on the diagnosis and the need for hospital treatment. The standard of treatment was called “reasonable and customary.” What would most doctors consider “reason and customary” for this diagnosis? Again, the purpose was to limit unnecessary hospital stays and cut costs.

The utilization review process, which gained traction in the health insurance industry, was primarily driven by the need to address issues of medical necessity, misuse, and overutilization of services. As a result, health plans began scrutinizing claims for medical necessity and the duration of hospital stays. In some cases, health plans even mandated that the physician certify the admission and subsequent days after the admission to curb costs.

Traditional Medicare Does Not Require Prior Authorization

Ironically, Traditional Medicare now requires almost no prior authorizations, limited to a few cases involving durable medical equipment. In contrast, Medicare Advantage, as a managed health care system, necessitates prior authorization for a majority of its procedures and tests, with the exception of routine doctor visits and common practices.

Under Traditional Medicare–with no prior authorization processes–the only mechanism to limit fraud, waste, and abuse of tax-payor-funded resources is the 800-number to which people may voluntarily report fraud, waste, and abuse.

Medicare Advantage Organizations are Scrutinized

Medicare Advantage Organizations (MAO) constantly monitor submissions to make sure the requests for treatment are “medically necessary” as defined by the CMS (Center for Medicare & Medicaid Services) regulations for standards of care.

To make sure the MAOs perform their mission correctly,

“CMS (Center for Medicare & Medicare Services) oversees an entity’s continued compliance with the requirements for an MA organization. If an entity no longer meets those requirements, CMS terminates the contract in accordance with procedures described in Subpart K at 42 CFR Part 422 .”

None of us would write a blank check for someone. We want guarantees that our money is spent correctly. Medicare Advantage Organizations (MAO) are no different. They also oversee that requests for reimbursement for treatments and procedures are within the standards of care that CMS authorizes.

An issue that has come up recently is: Are MAOs being too restrictive in their approvals of prior authorizations? After all, on the reverse side, the motivation for profits could motivate MAOs to restrict payments to keep revenue received from CMS for themselves.

Does Prior Authorization Hurt

Does Prior Authorization Hurt

Unfortunately, CMS does not currently require the MAOs to keep data on some aspects of prior authorization rejections. The two most recent studies are inadequate for giving a real idea.

Kaiser Family Foundation studied 35 million prior authorizations and found that less than 5 percent (or 2 million) were denied. It also noted that 82 percent of denials were overturned when appealed.

The Health & Human Services Office of Inspector General did a tiny study of less than 250 denials during one week in 2019. Among those denials, the OIG determined that 18 percent (or 33 cases) should not have been denied. The reasons for denials were not completely clear, though human error and lack of supporting documentation were the dominant reasons.

An objective and thorough study would be beneficial to dispel misunderstandings and false fears.

Prior Authorization Helps More Than Hurts

In my experience, prior authorizations that are denied do not require a formal appeal. The denial quite often is based on wrong codes, insufficient documentation, human error, and a lack of persistence on the part of the doctor’s back office.

part of the doctor’s back office.

The real question is not why Medicare Advantage has prior authorization. Instead, it is why Traditional Medicare does not protect patients and taxpayers from fraud, waste, and abuse with its own prior authorization protocols.

A Health Savings Account (HSA) is a powerful tax-advantaged devise. An HSA, however, can have devastating effect if you do not understand how an HSA works with Medicare.

What Is An HSA?

A Health Savings Account (HSA) is a type of personal savings account introduced in 2003. It is designed to work with employer health plans, especially high deductible plans. HSA are not part of Medicare, though HSA can work with Medicare.

You and your employer can put money into your HSA account. The money contributed is an above-the-line deduction on your income tax and is excluded from gross income. Many HSA accounts have various investment options for the money. Earning from the invested funds grow tax-free inside the HSA account. There is no tax consequence when you used to pay a qualified medical expense. Qualifed medical expenses are deductibles, copayments, coinsurance for a health insurance plan.

You can continue to hold the HSA even when you are no longer employed. You can use it for medical expenses while at a different job or even during retirement. HSAs can work with your Medicare, but there are specific rules.

HSAs Are Coupled with an HDHP

You are eligible to contribute to an HSA when specific high-deductible health plans cover you (HDHPs) with a deductible of at least $1,400 for yourself only or $2,800 for family coverage. With HDHPs, the monthly premium is usually significantly lower. You pay more health care costs upfront before your insurance company starts to pay its share.

You can only contribute to an HSA if your plan has a deductible that requires you to cover initial costs. The plan cannot have what is called “first dollar coverage.”

Many employers now offer HDHP plans paired with an HSA account. Non-employer HSA-eligible plans are available through the Health Insurance Marketplace®, Small Business Health Options Program (SHOP), or outside of the Marketplace. HSA-eligible plans are also available in most states that use HealthCare.gov.

Banks, insurance companies, and other financial institutions offer HSAs. The money you contribute to the account is not taxed as long as it is spent on qualified expenses.

Qualified Medical Expenses for an HSA?

Qualified medical expenses include but are not limited to:

- Acupuncture

- Alcoholism Treatment

- Ambulance Services

- Chiropractic Services

- Contact lens supplies

- Dental Treatments

- Diagnostic Services—MRIs, CT scans, EKGs, etc.

- Doctor’s fees

- Eye exams, glasses, & surgery

- Guide dogs

- Hearing aids & Batteries

- Insulin

- Lab Fees

- Long-Term Care Insurance premiums

- Prescription medications

- Nursing Services

- Surgery

- Psychiatric Care

- Telephone equipment for the visually or hearing impaired

- Therapy or counseling

- Wheelchairs

- X-Ray

Sometimes, you can spend your HSA money on similar medical costs for your spouse or dependents.

How Do HSAs Work?

The money in your HSA rolls over year-to-year if you don’t spend it. The money may also be put into an interest bearing bank and brokerage accounts. You can move the funds among the difference investments without triggering a taxable event.

Health Savings Account (HSA) contribution limits for 2023 are increasing significantly in response to the recent inflation surge. The IRS announced the change on April 29, giving employers that sponsor High-Deductible Health Plans (HDHPs) plenty of time to prepare for open enrollment season later this year.

The annual inflation-adjusted limit on HSA contributions for self-only coverage will be $3,850, up from $3,650 in 2022. The HSA contribution limit for family coverage will be $7,750, up from $7,300. The adjustments represent approximately a 5.5 percent increase over 2022 contribution limits. Last year’s limits rose only by about 1.4 percent between 2021 and 2022.

For 2023, the maximum out-of-pocket (MOOP) limit for self-only coverage is $7,500 or $15,000 for family coverage. According to the IRS, only deductibles and expenses for services within the health plan’s network should be used to determine if the plan meets or exceeds the MOOP limits.

HSA and Medicare Rules

Before the introduction of Health Savings Accounts (HSA), the standard practice was to at least enroll in Medicare Part A even if you continued to work past 65 and remained on employer health cover. It was a generally accepted best practice for any worker who was not already collecting Social Security at the age of 65 to go ahead and sign up for Medicare Part A, regardless of other coverage.

Part A did not interfere with employer health coverage and did not usually cost anything. Part A then reminded the person to enroll in Part B and D when he eventually lost employer health coverage.

This rule of thumb still applies, for the most part, The crucial exception arises for anyone who works past age 65 and wishes to continue contributing to an HSA while on Medicare.

The Number of HSAs Has Exploded

The number of High Deductible Health Plans (HDHP) with HSAs has significantly grown in the two decades since HSAs emerged.

Over the past ten years, especially, HSA growth exploded. Since 2011, the number of HSAs has grown from 6.8 million accounts to 30.2 million in 2020. That’s a growth rate of over 300 percent in a decade and a near-doubling in just five years from 16.7 million in 2015.

The HSA market should reach beyond 36 million by 2023, which is a 20 percent growth rate from 2020.

Many people who joined an HDHP with an HSA ten and twenty years ago are now turning 65. In the past, I rarely spoke about HSAs, even five years ago. The subject comes up much more frequently now. I am careful to ask everyone I talk with about HSAs. Many have old HSAs, many are currently in HDHPs with HSAs, and many plan to work past 65.

Among those working past 65, some are going on Medicare when eligible. Others are deferring Medicare until full Social Security retirement benefits. Some need to stay with their plan because of a spouse or child who needs health insurance. Regardless of the reasons, discussing their HSA, if they have one, and Medicare is critical.

HSA and Medicare Part A

It is important to note once you enroll in Medicare, even if you only enroll in Medicare Part A, you can no longer contribute to an employer’s Health Savings Account (HSA). If you or your employer contribute any amount to your HSA after you enroll in Medicare Part A and/or Part B, you will pay a sizeable tax penalty when you withdraw the money from your account, as well as the unpaid taxes.

Does Medicare Part A Disqualify HSA Contributions?

Do NOT enroll in either Medicare Part A or Part B IF you wish to continue contributing to an employer HSA.

You must also make sure you and your employer stop contributing to your HSA at least six months before your Medicare takes effect if you enroll in Medicare after age 65. Medicare Part A is always backdated six months or to your 65th month of birth, whichever is shorter.

If you turn 65 and enroll in Medicare during the year, you and your employer must stop contributions the month you turn 65. Any contributions you or your employer make before your 65th birthday must be pro-rated for the year only to include the months before you turn 65.

How Does Social Security Benefits Affect an HSA?

Suppose you are already collecting Social Security upon turning age 65. In that case, you will be automatically enrolled in Medicare. You can stop your Part B to avoid paying the monthly premium, but you do NOT have the option to cancel Part A if you continue to receive Social Security benefits. Consequently, you will be penalized if anyone contributes to your HSA past 65 in this circumstance.

The only way to opt-out of this would be to rescind your Social Security election within 12 months and pay back all benefits received.

Social Security will also automatically enroll you in Part A if you start your Social Security benefits when you reach full retirement age. Again, you can no longer make HSA contributions once Part A is activated without penalty.

Can You Use HSA Funds For Medicare-Related Expenses?

Funds already in your HSA account can still be used for qualified medical expenses upon enrollment in Medicare. You could pay your Part A premiums with HSA money if you or your spouse did not work long enough to be eligible for premium-free Part A coverage.

If your Part B premiums are paid directly from your Social Security check, you can withdraw money tax-free from your HSA to reimburse yourself for those expenses. Just remember to keep records of the costs.

Part D prescription drug costs and Medicare Advantage copays are also eligible expenses.

You cannot use HSA funds to cover Medicare supplemental insurance, also called Medigap.

HSAs and Long-Term Care

You can also withdraw money tax-free from an HSA to pay a portion of eligible long-term care insurance premiums based on your age.

You can withdraw up to $4,510 for long-term care premiums if you are age 61 to 70 and $5,640 if you’re older than 71. Your spouse can also withdraw up to that amount based on her age.

The eligible withdrawal limits for long-term care premiums are smaller at younger ages.

What Is the Penalty for HSA Contributions While on Medicare?

You will no longer have the HSA deduction during the period you were on Medicare and contributed to an HSA. You must add your pre-tax HSA contribution back into your income for the year you took the deduction. You will then be responsible for paying those past taxes with any interest due.

The IRS accesses an additional 6% as a penalty on the amount contributed.

HSA Testing Period & Penalty

HSAs also have what is described as a testing period. Contributors may make lump sum contributions, which are averaged out over the testing period. If the person’s Medicare is active at any time during the HSA testing period, an additional 10% IRS penalty is added along with the taxes.

Working Past 65 and Funding an HSA?

Note that a taxpayer must be enrolled in an employer-based group health plan to defer Medicare past age 65 without penalty. An HSA-eligible plan through the private Marketplace, COBRA, or a health care exchange does NOT qualify. In that case, you must cease contributions to the HSA upon reaching age 65 and enroll in Medicare to avoid lifetime late-enrollment penalties.

Once you are 65 or older and no longer have coverage through an employer-based group health plan, you have eight months to enroll in Medicare Part B to avoid a penalty. If you miss that deadline, there is a risk of a lifetime penalty for late enrollment.

Conclusion

The bottom line is that you must be clear on all rules and ramifications when working past age 65 and continuing to fund an HSA when Medicare eligible. You want to avoid penalties for excess HSA contributions or late-enrollment penalties for Medicare Part B and Part D.

If you have paid payroll taxes (FICA) for 40 quarters (or 10 years), you are eligible to apply for Medicare in Nebraska for 2022. You are eligible for Medicare Part A at zero premium and may purchase Part B at the current cost if your income is below the IRMAA (Income Related Monthly Adjustment Amounts) amounts.

The Easy Way To Apply For Medicare in Nebraska For 2022

If you are currently receiving Social Security benefits, you will be automatically enrolled in Medicare Part A for the hospital and Part B for doctor visits and outpatient services. You will then be given the option to cancel Part B if you wish.

You cancel Part B by signing the red, white, and blue Medicare card on the back and mailing it back to Medicare. Otherwise, Medicare Part A and B will start on the effective dates printed on the bottom right corner of the card. The Social Security Administration (SSA) will also start deducting the Medicare Part B premium from your monthly Social Security check.

Applying for Medicare in Nebraska in 2022 is easy that way. It is automatic. The other way is more challenging.

Online Application For Medicare in Nebraska for 2022

Applying for Medicare in Nebraska, Iowa, and throughout the country has become more difficult and complex with each subsequent month. The pandemic pushed the process almost entirely online. Social Security personnel were absent at Social Security Administration Offices throughout Nebraska, Iowa, and the whole country during that time. Offices were closed, and most employees were working remotely.

Identity theft, cyber security, and HIPPA regulations have pushed the Social Security Administration (SSA) to add more and more levels of security to the Medicare application.

I help my prospective clients apply for Medicare all the time. While eligibility for Medicare and Social Security benefits in Nebraska begins at 65, most people are not getting their Social Security benefit checks until much later. Instead, they are waiting until the full benefit age, which is around 66 and 8 months or older. So they need to apply for Medicare online.

I probably average helping five people a week apply for Medicare in Nebraska and Iowa. The level of difficulty each person experiences is amazing. I don’t know how other people do it on their own.

How Do You Apply For Medicare Benefits in Nebraska Online in 2022?

If you are eligible for Medicare in Nebraska, type ssa.gov into your address bar. Do NOT Google ssa.gov. You will end up at all kinds of websites trying to sell you Medicare plans. The Social Security Administration logo will be in the top left corner if you are successful.

Click on Menu in the top right section of the website. Go under Benefits and click Medicare. Then, scroll down the page until you see a bright blue button that says “Apply for Medicare Only.” Click on the button that will take you to a page with a gray button that says, “Start New Application.” Click it.

Follow the prompts. The most crucial part is your My Social Security login. This is the tricky part.

Hundreds of people swear they never set up an online Social Security account. Then, when we start the enrollment process, we discovered they have a My Social Security account, and SSA requires us to use it.

Logging in to your My Social Security account may become an insurmountable obstacle if you need to provide personal verification information, like the answers to the three security questions you had set up previously. At that point, you will be stopped out and need to call or go to the Omaha, Lincoln, or Council Bluffs Social Security Administration office to get access to continue applying for Medicare in Nebraska in 2022.

If you do not have an online My Social Security account, you create one. In creating the account, you will need immediate access to email and text. With that, you will be able to set up an online account.

Follow the prompts to set up the account.

Second Form of Identification When Applying for Medicare in Nebraska for 2022

Giving SSA a second form of identification, such as your driver’s license, is vital. SSA will text a link to your phone. Then you take a photo of your driver’s license to verify who you are. Taking the photo so the system receives it can be problematic. This is the most difficult part of applying for Medicare.

Your phone’s camera software may not work well with SSA’s system, the cellular or internet connection may be weak, or the SSA system may be in a bad mood that day. Many factors can go into making the system unworkable. Be warned.

If you cannot set up a second means of verification, you will probably have to wait for a verification code to be mailed to your physical address. Then you go back in to complete the enrollment process.

More than half of the time, the system works. We get the text verification and complete the My Social Security online account setup.

When you enter your My Social Security online account through the Medicare prompts, the system pulls up the application for Medicare. Fill in the details and complete the application. The application process will assume you want Medicare Part A for the hospital since it is free. The system will ask if you want Medicare Part B for doctor visits and outpatient procedures. Medicare Part B costs something. You have the option to say yes or no.

Check On Your Online Medicare Application

When you have completed the application, you can go back in and check on your Medicare application status. A newly created box is in your My Social Security account for Medicare. There will be three grey horizontal bars going across the page. When you complete the application, one bar will be blue. When all three bars are blue, a comment underneath will say you are approved. Congrats!

Above will be a “Verification of Benefits Letter” link. Click on the link. A letter will open up. In the body of the letter will be your Medicare number (MBI), which is made up of eleven digits consisting of a combination of numbers and letters. The letter will also have the dates when your Part A and/or Part B will start.

Sometimes clients tell me they want to wait for the Medicare card to come in the mail. Bad decision. It may take over a month for your Medicare card to show up in the mail, significantly decreasing your time to select, enroll, and get your medical cards from the insurance company before your start date.

Online Medicare Application Problems

Check your account two weeks after you apply for Medicare online, and keep checking it until you have a Medicare number.

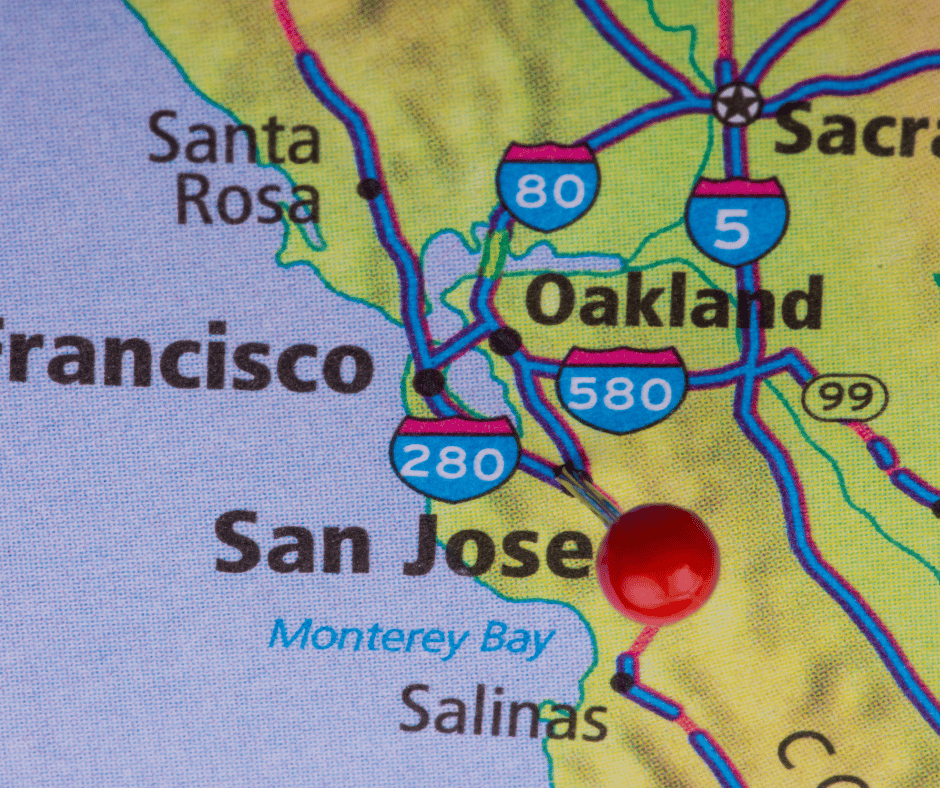

If your account says your case was sent to Salinas, CA, for processing, you need to call your local SSA office to find out why. Salinas, CA, is a black hole.

There is a problem with your application that needs to be solved sooner rather than later, and the folks in Salina, CA, are not very proactive or even active in solving your problem–whatever it may be.

All of this above-said information works if your personal information is in good order with SSA. There may be problems of which you are only aware once you enroll. For example, your name is misspelled with SSA, your birthday is wrong, your address is out-of-date, your maiden name was not changed to your married name or back after a divorce, and your naturalization date or number is incorrect. You could also be flagged as a terrorist, Russian mole, or affiliated with the opposing political party–just kidding.

I’ve experienced all of these with clients–except the terrorist one. Making corrections takes lots of time. I had a gentleman born at a Japanese civilian hospital instead of the U.S. military hospital on the base where his father served, which created a whole set of problems that plagued him throughout his life.

Getting the correct documentation takes time if it can be found. Then SSA takes time to verify the documentation and may ask for more. Then there is the processing time, which could result in you missing your intended start date. That is why you start applying for Medicare in Nebraska as early as possible in 2022.

Calling the SSA Office

You, of course, can call the SSA office or stop in to apply for Medicare in Nebraska for 2022. If you contact them too early, they will not talk with you. Too early is more than 3 months before you turn 65. Then, when they talk with you, SSA generally will set the appointment a month or two later, so you are right up against your birth month and start date. This will work if there are no problems and everything else works smoothly, but this situation usually causes anxiety for most people.

My Experience Helping Clients Apply for Medicare

I’m an insurance agent. I am not an employee of the SSA, but I feel like an unpaid auxiliary staff member. My clients need help, so I’ve learned to navigate the SSA Medicare enrollment system through trial and error. It is a system that is continually evolving.

I’m happy to help my clients. The process creates a tremendous amount of empathy for my clients for what they have to go through. Not only are they confused with all the information and choices that come with going on Medicare, but they have a government bureaucracy that is an unfriendly and confusing obstacle to overcome. I try my best to help and give encouragement when I can’t do specific tasks for them, like finding an original birth certificate with a raised seal.

As the bugs get worked out of the SSA/Medicare system, and Medicare beneficiaries become more tech-savvy, the process for applying for Medicare in Nebraska for 2022 will become more efficient–I hope.

Until then, use this guide to navigate and find your way to the end of the Medicare application maze.

Medicare Wants You To Live A Healthy Life

Medicare Wants You To Live A Healthy Life

Medicare will be a different health insurance experience than when you were on your employer’s health plan. Many employer health plans try to reduce how often you use the program to keep down costs. In contrast, Medicare understands that more health issues arise in the Medicare age population. A big driver for Medicare is prevention, monitoring, and early detection. Medicare health screenings are the most effective ways for Medicare to keep its costs lower. Both Medicare and the insurance companies that manage Medicare Advantage plans are highly motivated to push beneficiaries to use the preventative programs to the maximum.

Medicare Health Screenings Could Have Saved My Parents

My father was a kidney transplant recipient. He also was COPD and had an endless list of other maladies. My mother kept an eagle eye on him, ensuring his screenings, physicals, and other monitoring took place on an unyielding schedule. Despite my mother’s vigilance, we believed my father would be the first to go.

My mother took care of herself, but she was a smoker most of her life. I couldn’t believe it when she called me to say she had stage 4 ovarian cancer. She was so careful. I assumed she did all the Medicare health screenings. She may not have been as vigilant for herself, unfortunately.

Mom courageously underwent all the treatments the doctors recommended, but in the end, a year later, cancer took her. My youngest brother was angry to the point of wanting to sue the doctors. I was befuddled that cancer would sneak up on my mom. I never pushed or prodded my mother about what she did or didn’t do about her health. You don’t question parents in my family, especially about personal things like that. The door is closed to children. I can’t help to think if she had done more Medicare health screening, the outcome may have been better.

Education to Prevention

Original Medicare and especially the Medicare Advantage plans encourage a healthy lifestyle. Medicare Advantage plans expend enormous amounts of resources to inform people about preventing disease through exercising, eating well, reducing body weight, and not smoking. These activities affect the health of everyone, but they significantly affect Medicare-age persons.

activities affect the health of everyone, but they significantly affect Medicare-age persons.

Medicare designs health screenings around regular, annual shots, frequent lab tests, and consistent screenings in important high-risk areas. Health monitoring for higher-risk individuals is critical to catch symptoms early on before the situation is more complex and less treatable. Education is essential for all these areas. Medicare Advantage plans aggressively share information with clients about all the benefits, tools, and opportunities that are available to Medicare beneficiaries. Sometimes my clients complain about how often the insurance companies will call to remind them about physicals and screenings, though they like the treats and rewards they get after performing mammograms, physicals, hemoglobin A1c tests, etc.

Tools

Tools

You can register at MyMedicare.gov to get direct access to preventive health information—24 hours a day, every day. You can set up your account and track your preventive services. Medicare has a 2-year calendar of the Medicare-covered tests and health screenings for which you’re eligible. You and Medicare can enter the dates of screenings and treatments. You have your own “on-the-go” report to see where you are with your screenings. You can even take the report to your doctor’s appointments to ensure you get all the benefits you can out of your Medicare prevention program.

Preventive services fall under Medicare Part B. The preventive services are usually at no cost with physicians who accept Medicare. If you are on a Medicare Advantage plan, consult the Evidence of Coverage for your Medicare Advantage plan for costs. The Evidence of Coverage lays out what is covered and the approximate costs. Most preventives are at zero cost.

Screening Schedule

Talk with your doctor about which screenings and tests are more relevant for your health circumstances. Medicare may or may not cover some of those screenings. Also, Medicare has a schedule of when these health screenings should occur and with what frequency. Any abnormalities may require more frequent testing. Other screenings may be less frequent because of your health history and situation.

may require more frequent testing. Other screenings may be less frequent because of your health history and situation.

Medicare Screening For Abdominal Aortic Aneurysm

Medicare covers a one-time abdominal aortic aneurysm ultrasound for people at risk. You’re considered at risk if you have a family history of abdominal aortic aneurysms, or you’re a man 65–75 and have smoked at least 100 cigarettes in your lifetime. Medicare covers this screening once in your lifetime if you get a referral from your doctor. You pay nothing for this screening if the doctor or other qualified health care provider accepts Medicare assignment.

Alcohol Misuse Screening & Counseling

Alcohol misuse screening is for Medicare beneficiaries who use alcohol but don’t meet the medical criteria for alcohol dependency. Medicare covers one alcohol misuse screening per year. If your primary care doctor or other primary care practitioner determines you’re misusing alcohol, you can get up to 4 brief face-to-face counseling sessions per year. The practitioner must provide the counseling in a primary care setting, like a doctor’s office. You pay nothing if the doctor accepts Medicare assignment.

Bone Mass Measurements

Medicare covers bone mass measurements to see if you’re at risk for broken bones due to osteoporosis. Osteoporosis is a disease in which your bones become weak and brittle. In general, the lower your bone density, the higher your risk for a fracture. Bone mass measurement results will help you and your doctor choose the best way to keep your bones strong.

I have several clients with varying levels of osteoporosis. Some are just in the monitoring phase. Others get Prolia shots in the doctor’s office because of the determination of the bones. The Medicare health screening for those at risk for osteoporosis must have one of these medical conditions:

- A woman whose doctor or health care provider says she’s estrogen-deficient and at risk for osteoporosis, based on her medical history and other findings

- A person with vertebral abnormalities as demonstrated by an X-ray

- A person getting (or expecting to get) steroid treatments

- A person with hyperparathyroidism

- A person taking an osteoporosis drug

The screening may be performed once every 24 months or more often if medically necessary. You pay nothing for this test if the doctor accepts Medicare assignment.

Medicare Breast Cancer Screening

Medicare Breast Cancer Screening

Breast cancer is the most common non-skin cancer in women and the second leading cause of cancer death in women in the U. S. Every woman is at risk, and this risk increases with age. Breast cancer can usually be treated successfully when found early. Medicare covers screening mammograms to check for breast cancer before you or a doctor may be able to find it manually.

Women 40 and older are eligible for a screening mammogram every 12 months. Medicare also covers one baseline mammogram for women between 35–39. Once every 12 months. You pay nothing for the test if the doctor accepts Medicare assignment.

Your risk of developing breast cancer increases if any of these are true:

- You had breast cancer in the past.

- You have a family history of breast cancer (like a mother, sister, daughter, or 2 or more close relatives who’ve had breast cancer).

- You had your first baby after 30.

- You’ve never had a baby.

Cardiovascular Disease Screening

Medicare covers cardiovascular disease health screenings that check your cholesterol and other blood fat (lipid) levels. High levels of cholesterol can increase your risk for heart disease and stroke. These screenings will tell if you have high cholesterol. All people with Medicare are covered when a doctor orders the screenings–tests for cholesterol, lipid, and triglyceride levels. Medicare covers cardiovascular health screening once every five years unless history and other circumstances dictate more often. You pay nothing for this screening.

Cervical & Vaginal Cancer Screening

Medicare covers Pap tests and pelvic exams to check for cervical and vaginal cancers. Medicare also covers a clinical breast exam to check for breast cancer as part of the pelvic exam. All women with Medicare are covered for a Medicare health screening for cervical and vaginal cancer once every 24 months, or once every 12 months if you’re at high risk for cervical or vaginal cancer, or if you’re of child-bearing age and had an abnormal Pap test in the past 36 months. This also includes Human Papillomavirus (HPV) tests (as part of Pap tests) once every five years if you’re 30-65 without HPV symptoms.

Your costs, if you have Original Medicare, are nothing. You pay nothing for the lab Pap test and the lab HPV with Pap test. If the doctor accepts Medicare assignment, you also pay nothing for the Pap test specimen collection and pelvic and breast exams.

Your risk for cervical cancer increases if any of these are true:

- You’ve had an abnormal Pap test.

- You’ve had cervical or vaginal cancer in the past.

- You have a history of sexually transmitted diseases (including HIV infection).

- You began having sex before 16.

- You’ve had five or more sexual partners.

- Your mother took DES (Diethylstilbestrol), a hormonal drug, when she was pregnant with you.

Colorectal Cancer Screening

Colorectal Cancer Screening

Medicare covers colorectal cancer health screening tests to help find pre-cancerous polyps (growths in the colon), so polyps can be removed before they become cancerous and help find colorectal cancer at an early stage when treatment works best. All people with Medicare who are 50 and older, but there’s no minimum age for having a covered screening colonoscopy.

- Screening fecal occult blood test—Once every 12 months for people 50 or older.

- Screen flexible sigmoidoscopy—Once every 48 months after the last flexible sigmoidoscopy or barium enema, or 120 months after a previous colonoscopy.

- Screening colonoscopy—Once every 120 months (high risk every 24 months), or 48 months after a previous flexible sigmoidoscopy.

- Screening barium enema—Once every 48 months (high risk every 24 months) when used instead of sigmoidoscopy or colonoscopy.

Multi-target stool DNA test—Once every three years if you meet all of these conditions:

- You’re between 50–85.

- You show no signs or symptoms of colorectal disease, including, but not limited to, lower gastrointestinal pain, blood in stool, positive guaiac fecal occult blood test, or fecal immunochemical test.

- You’re at average risk for developing colorectal cancer, meaning you have no personal history of adenomatous polyps, colorectal cancer, or inflammatory bowel disease, including Crohn’s Disease and ulcerative colitis.

- You have no family history of colorectal cancers or adenomatous polyps, familial adenomatous polyposis, or hereditary nonpolyposis colorectal cancer.

You pay nothing for the fecal occult blood test if you get a written referral from your doctor, physician assistant, nurse practitioner, or clinical nurse specialist. If your doctor accepts assignment, you pay nothing for the flexible sigmoidoscopy or screening colonoscopy.

Polypectomy During Colonoscopy

If a polyp or other tissue is found and removed during the colonoscopy, you may have to pay 20% of the Medicare-approved amount for the doctor’s services and a copayment in a hospital outpatient setting, unless you have a Medicare supplement or Advantage plan. Consult the plan for your costs.

The risk for colorectal cancer increases with age. It’s essential to continue with screenings, even if you were screened before you had Medicare. Your risk for colorectal cancer increases if any of these are true:

- You’ve had colorectal cancer before.

- You have a close relative who had colorectal polyps or colorectal cancer.

- You have a history of polyps.

- You have inflammatory bowel disease (like ulcerative colitis or Crohn’s disease).

Medicare Depression Health Screening

Medicare Depression Health Screening

All people with Medicare are covered for depression screenings. Medicare covers one depression screening per year. The screening has to be done in a primary care setting, like a doctor’s office., followed-up with referrals and treatment. You pay nothing for this test if your doctor accepts Medicare assignment.

Medicare Health Screening for Diabetes

Medicare covers a blood screening test to check for diabetes for people at risk. Diabetes is a medical condition where your body does not make enough insulin or has a reduced insulin response. Diabetes causes your blood sugar to be too high because your body needs insulin to use sugar properly. A high blood sugar level isn’t good for your health. For people with diabetes, Medicare covers educational training to help manage their diabetes. Medicare covers people at risk for diabetes and gets a referral from a doctor. Based on the results of your screening tests, you may be eligible for up to 2 diabetes screenings per year. You pay nothing for this screening.

You’re considered at risk if you have high blood pressure, dyslipidemia (history of abnormal cholesterol and triglyceride levels), obesity, or a history of high blood sugar (glucose). Medicare also covers these tests if two or more of these apply to you:

- You’re 65 or older.

- You’re overweight.

- You have a family history of diabetes (parents, brothers, or sisters).

- You have a history of gestational diabetes (diabetes during pregnancy), or you’ve had a baby weighing more than 9 pounds.

Diabetes self-management training

This training is for people with diabetes to teach them to manage their condition and prevent complications. You need a written order from a doctor or other qualified health care provider. You pay 20% of the Medicare-approved amount after the yearly Part B deductible. This will be different if you have a Medicare Supplement or Medicare Advantage plan.

Glaucoma Tests

Glaucoma is an eye disease caused by high pressure in the eye. It can develop gradually without warning and often without symptoms. The best way for people at high risk for glaucoma to protect themselves is to have regular eye exams. Medicare covers people with Medicare at high risk for glaucoma. They may test once every 12 months. You pay 20% of the Medicare-approved amount after the yearly Part B deductible if you do not have a Medicare Supplement or Medicare Advantage plan. Your risk for glaucoma increases if any of these are true:

- You have diabetes.

- You have a family history of glaucoma.

- You’re African-American and 50 or older.

- You’re Hispanic and 65 or older.

There are many more Medicare health screenings that you may review on Medicare.gov.

Flu & Pneumonia Shot

Flu & Pneumonia Shot

Medicare covers more than screenings and monitoring as part of Medicare’s preventative program. Medicare tries to prevent illnesses, particularly illnesses that can severely affect people with other underlying conditions. Medicare offers flu, pneumonia, and Hepatitis B shots. The COVID shot will soon be officially part of the Medicare regimen. Flu, pneumococcal infections, and Hepatitis B can be life-threatening to an older person. All people 65 and older should get flu and pneumococcal shots. People with Medicare who are under 65 should also get a flu shot. This is especially important for chronic illnesses, including heart disease, lung disease, diabetes, or End-Stage Renal Disease (ESRD) (permanent kidney failure requiring dialysis or a kidney transplant). People are at medium to high risk for Hepatitis.

All people with Medicare are covered for the shots once each flu season at no cost. The pneumonia shot is given once in a lifetime. A different second shot is covered 11 months after the first shot. Again you pay nothing if your doctor or other qualified health care provider accepts Medicare assignment for giving the shot.

Hepatitis B shots

Certain people with Medicare who are at medium or high risk for Hepatitis B are covered. Three shots are needed for complete protection. Check with your doctor about when to get these shots if you qualify to get them. Your costs on Medicare are nothing as well.

These are some of the factors that put you at medium or high risk for Hepatitis B:

- Hemophilia.

- ESRD (End-Stage Renal Disease).

- Diabetes.

- Certain other conditions increase your risk for infection, like if you live with someone who has Hepatitis B or if you’re a health care worker and have frequent contact with blood or body fluids.

I will never know if my mother’s cancer could have been prevented with better screening, monitors, and tests. I hope my clients utilize all the tools and opportunities to live the healthiest life possible, especially those that cost nothing.

Medicare is a federal government program. Like anything government program, there are lots of rules and regulations. Medicare Open Enrollment has rules. Inattentiveness to those rules may result in unwanted penalties and painful costs.

What is Medicare Open Enrollment?

What is Medicare Open Enrollment?

Open Enrollment Period, now called Annual Election Period (AEP), is from October 15th–December 7th. You can change your Medicare Part D prescription drug plan and your Medicare Advantage plan during that time. People still call Annual Election Period “Open Enrollment” even on the Medicare.gov website. The use of two names make for confusion, but the correct term is now Annual Election Period (AEP). The primary reason for the name change is that another period in the Medicare calendar is called “Open Enrollment.”

How Does Annual Election Period Effect Medigap Policies?

Medicare supplements can be changed year-round in Nebraska and Iowa. There is no particular time or “Open Enrollment” for Medigap. You simply have to answer some underwriting health questions during the application process for a new Medigap policy. Then, you are either approved, denied, or rated. The old Medigap policy is canceled, and you seamlessly move over to the new policy. However, when someone is on an Advantage plan, you must wait until Annual Election if you wish to change from Medigap to Medicare Advantage or from Medicare Advantage to Medigap.

some underwriting health questions during the application process for a new Medigap policy. Then, you are either approved, denied, or rated. The old Medigap policy is canceled, and you seamlessly move over to the new policy. However, when someone is on an Advantage plan, you must wait until Annual Election if you wish to change from Medigap to Medicare Advantage or from Medicare Advantage to Medigap.

When someone first comes on to Medicare, the expression “Open Enrollment” is commonly used. More confusion. Again, that is not correct. The proper phrase is “Initial Enrollment Period.” Your Initial Enrollment Period is when you either turn 65 and enroll in Medicare or when you activate your Medicare Part B sometime after you turn 65, usually after dropping an employer’s health plan. During your Initial Enrollment, you have a whole set of rules. You are not required to answer health questions when applying for a Medigap policy, and the insurance company cannot use your height and weight to determine anything about the policy. You are guaranteed a policy at the lowest possible rate.

Underwriting During Annual Election

Underwriting During Annual Election

There is no underwriting to change from your Part D prescription drug plan or Medicare Advantage plan to another. You are guaranteed acceptance.

Again, Medigap plans must be underwritten after your Initial Enrollment Period. AEP does not affect Medigap applications. The insurance company can accept you, reject you, or ask for a higher price–rate you.

Annual Reviews During Medicare Annual Election Period

With my clients, I send out a couple of letters and emails reminding them when AEP (Annual Election Period) is upon us. I ask clients to call if there are any problems or concerns about their Medicare plan. AEP is important because it is the one time clients can make adjustments to their plan. AEP is also a period when the insurance companies make changes to their plans. They sometimes increase copays, premiums, deductibles, and coinsurance. On the Part D plans, they can add or drop medications, change the copays, and move drugs to a different tier.

So I highly encourage clients to call for a review. Most of the time, the review is a ten-minute phone call. Other times, it requires making changes, meetings, and doing paperwork.

High Dollar Drugs

High Dollar Drugs

Those with expensive medications especially need a review. Clients will say, “My medications haven’t changed. Why call?” The answer is simple. The plans change every year. You could find a $600 medication no longer covered on your Part D formulary. I don’t know any clients who have an extra $600 a month jingling in their pockets they don’t need.

The insurance company can also move a drug into a higher and more expensive tier, include it with the deductible, or make other changes that result in painful increases. So I say emphatically to my clients who take insulin, anti-diabetic medications, Eliquis or Xarelto, and many other high-dollar meds, call me! We need to talk during Annual Election.

emphatically to my clients who take insulin, anti-diabetic medications, Eliquis or Xarelto, and many other high-dollar meds, call me! We need to talk during Annual Election.

On my part, it is easier for me to do nothing. Changing someone’s plan is work, especially when I have hundreds of people asking for help during the short election period, but I think of my parents. I know an additional $300 or $500 coming out of their monthly budget for medication would have meant real hardship for them. I don’t want that for anyone, especially my clients. Ensuring clients have the lowest cost prescription drug plan with a high Medicare star rating is my goal during the Annual Election Period.

Don’t Miss the Boat

Don’t Miss the Boat

Inevitably I get the call on December 8th, “Can I change my Medicare plan?” It is sad and angering. I’m always struck by the irony when they get mad at me. After all, they only had 10 weeks to do something.

How hard is it to remember it is Annual Election Period when your mailbox is loaded with postcards, brochures, and letters reminding you it is Medicare Open Enrollment? Life is busy, but you don’t notice the Joe Namath and Jimmy JJ Walker commercials running 24/7 selling Medicare Advantage plans with exaggerated claims and gross distortions of the truth? Ultimately we are all responsible for our actions or lack of action.

When Is Medicare Advantage Open Enrollment Period (OEP)

There is a second chance to make a change as far as Medicare Advantage goes. From January 1st–March 31st are Medicare Advantage Open Enrollment dates (OEP). A person on a Medicare Advantage plan can change from one Medicare Advantage plan to another Medicare Advantage plan. Again there are no underwriting questions. A person is allowed one chance and one change during OEP.

plan can change from one Medicare Advantage plan to another Medicare Advantage plan. Again there are no underwriting questions. A person is allowed one chance and one change during OEP.

The reason for the second chance with Medicare Advantage is because people make mistakes. For example, you changed your plan during AEP. Your doctor is not in-network with the new plan. During OEP, you can change back to the other plan and keep your doctor. The same is true for medications. The new plan does not cover your medications, so you move to a plan that does during OEP.

Open Enrollment Mistakes

Open Enrollment Mistakes

During OEP, people change because a fast-talking salesperson convinces them the other plan is way better, but in a rush to change, the beneficiary does not accurately confirm that all their medical professionals are in the network with the plan. They also may not correctly confirm that all their medications are on the plan’s formulary at the same or lower copays.

After the Medicare Open Enrollment deadline of March 31st, they find themselves in a bad situation. However, they cannot change back. You only get one chance to change during OEP.

Original Medicare During Medicare Open Enrollment

The other side of Medicare Advantage Open Enrollment is that you can drop your Part C plan and return to Original Medicare. Original Medicare is only Part A (for the hospital) and Part B (for doctor visits and patient procedures). You then receive a one-time opportunity to enroll in a Medicare Part D prescription drug plan. Again you get only one chance to enroll in a Part D plan. You can’t change your mind again a month later and switch to another Part D plan. After that selection, the only next time you can change will be during Annual Election Period in October, unless you have some sort of Special Election Period (SEP).

No Guarantee Issue During Medicare Open Enrollment

Once you return to Original Medicare, you may apply for a Medigap policy. In Nebraska & Iowa, you will need to answer underwriting questions about your health, give height & weight, and whether or not you use tobacco. The insurance company, at that point, determines if they will accept you at the offered price, charge a higher premium, or deny your application altogether.

Again, you will not be able to re-enroll in a Medicare Advantage plan until Annual Election Period in October.

Medicare Enrollment Mistakes

I remember a person who was referred to me. The family moved her into a skilled nursing facility because she could not take care of herself adequately after a fall. The skilled nursing facility said that Original Medicare was better than Medicare Advantage. The family dropped the Medicare Advantage plan and enrolled her in a drug plan. They thought they could get her a Medicare Supplement.

By the time they realized she would not pass underwriting for a supplement, she had moved out of the nursing home. She could not return to the Advantage plan until October’s annual election. She had the unlimited 20% coinsurance of Medicare Part B to pay for her many health concerns.

Skilled nursing facilities receive higher reimbursement from Original Medicare than from most Advantage plans. Their treatments receive less scrutiny from Medicare than the insurance company’s advantage plan’s managed care. They prefer that.

Her income and assets were meager, but the change ensured the money was dissipated more quickly, and the county and the taxpayer came in sooner to cover her medical expenses through state Medicaid.

When Does Medicare Advantage Open Enrollment End?

Every year during April, I get phone calls from clients. “What happened to my plan?” After some research, I found out that someone called and switched him to a different plan during the Medicare Advantage Open Enrollment Period.

One technique is for the salesperson to make the phone call sound official. “Mrs. O’Leary, this is Medicare Open Enrollment, and you have one chance to make sure you have the right Medicare plan. Which plan are you currently on?”

It doesn’t matter which plan the person is on. The point is to find out the current plan and explain how another plan is much better. These agents are flippers.

The agent flips the person from the plan they are on to a different plan, so they get paid. Getting paid is the goal.

It is all done by phone. The agent never meets the person. There is no follow-up or long-term relationship. Then, the agent moves on to the next person. The agent may not even be in the business after Medicare Open Enrollment ends.

Inevitably, I get the phone call on April 1st after Medicare Advantage Open Enrollment has ended, “What happened to my Medicare plan?” I have to tell them, “Sorry, Mama, the Medicare Advantage Open Enrollment deadline was Dec. 7th.”

Inevitably, I get the phone call on April 1st after Medicare Advantage Open Enrollment has ended, “What happened to my Medicare plan?” I have to tell them, “Sorry, Mama, the Medicare Advantage Open Enrollment deadline was Dec. 7th.”

Nothing Can Be Done Until Annual Election in October Usually

Over the years, I’ve had several clients tricked. Sometimes I’m able to repair the damage. Sometimes not.

The first time it happened to one of my clients was in 2013. The day before my client’s plan was scheduled to start, he got a call from one of these salespersons pretending to be from his Medicare insurance company. They acted as though they were checking in on him. As she was ending the call, she said there had been some recent changes, and a new and improved plan was available. She convinced him to enroll in the other plan. He didn’t think anything of it, so he didn’t call me.

Medicare insurance company. They acted as though they were checking in on him. As she was ending the call, she said there had been some recent changes, and a new and improved plan was available. She convinced him to enroll in the other plan. He didn’t think anything of it, so he didn’t call me.

Six months later, he was scheduled for surgery. He called me frantic a few days before the surgery because the doctor was not in-network. I always check things like doctors, so I was stumped.

To give you the short version, after some research, I discovered the agent had changed him from the Medicare Advantage HMO plan he had selected that covered all the doctors and hospitals in his area to a select HMO plan that only worked with one network in the Omaha area with the same insurance company. (I never use those sorts of plans for precisely this reason.) The agent did not confirm that his doctors were in the plan network. She probably didn’t care.

The happy ending was that he decided to go in the direction of a Medicare supplement, and I was able to make the switch immediately because he was still within his first 12 months of being on a Medicare Advantage plan–the 12-month rule. He got his surgery, and everything was covered. The story, however, does not always end so favorably.

How Long Does Medicare Advantage Open Enrollment Last?

How Long Does Medicare Advantage Open Enrollment Last?

Medicare Advantage Open Enrollment is a long season–3 months. The insurance agents’ and insurance companies’ marketing is intense. They have 3 months to flip people. They use every trick in the book.

Most of my clients call me when they get these kinds of phone calls. We dealt with clients’ issues and concerns during Annual Election, and so they usually have the right plan for their needs. Sometimes, however, it does make sense to change their plan because something new came up. But, Medicare Advantage Open Enrollment is definitely a time for the Barracudas.

Who Is Medicare Advantage Open Enrollment For?

Ideally, this period is for those who made a mistake with their Medicare Advantage plan–their doctor is not in-network, medication is not on the formulary, the price of a medication is in a higher tier, the copays or maximum out-of-pocket went up unexpectedly. They have a second chance to correct the oversights or select a better plan before the Medicare Advantage Open Enrollment Period ends March 31st.

The Reasons to Pay Attention During the Open Enrollment Periods

The three eternal truths of Medicare over time are:

- Medicare will change

- Medicare plans will change

- Your health needs will change

Not understanding Medicare rules, not knowing the plan costs, and not being attentive to the calendar may result in costly mistakes. Be advised.

Medicare Advantage or Medicare Part C is another way to receive Medicare. “Original Medicare” is a combination of Medicare Part A and Part B. It is called “Original Medicare” because that was its first plan in the late 60’s. Medicare Part A was hospital insurance and Medicare Part B was added later. It included doctor visits and outpatient procedures. Some people call it traditional Medicare. It became “Original Medicare” when a new form of Medicare was created–Medicare Advantage, also called Medicare Part C. What is the advantage of Medicare Advantage over Original Medicare?

The Advantage of Medicare Advantage vs Original Medicare

Let’s explain “Original Medicare” first. Medicare Part A covers hospital stays. The Part A has a deductible. It is currently $1,340 for every hospital stay for the same event in a 60 day period. If a completely unrelated event lands you in the hospital, e.g., car accident, heart attack, stroke, etc., even within the first events 60-day period, you will still pay the $1,340 deductible for those unrelated events. That kind of deductible schedule could add up to a significant cash outlay in a year. Likewise, Medicare Part B exposes you to a great deal of risk. While Medicare Part B pays 80% of doctor and outpatient costs, your 20% co-insurance has no cap on it. There is no maximum out-of-pocket. Sky is the limit. If you have a million dollars worth of bills under Part B, 20% is $200,000.

Maximum Out-Of-Pocket

Maximum Out-Of-Pocket

The Advantage of Medicare Advantage is a maximum out-of-pocket. The highest maximum out-of-pocket for Medicare Advantage plans in 2018 is $6,700. Some plans maximum out-of-pocket are much less, depending on the area, the company, and the type of plan. However, the easiest and clearest difference between Original Medicare and Medicare Advantage is a definite limit on what you pay out of your pocket. Medicare Advantage has a maximum out-of-pocket. Original Medicare does not.

Minimum Co-Payments

Each Medicare Advantage Plan has its own schedule of co-pays, deductibles, and co-insurance. One co-pay that is standardized in all plans is the emergency room visit. In 2018, the emergency room visit co-pay is $80. I would rather pay $80 with a Medicare Advantage plan rather than 20% of any amount on Original Medicare. I broke my arm a number of years ago biking. My emergency room visit was $3,000. The advantage of Medicare Advantage I think is an $80 co-pay rather than 20% bill–$3,000 x 20% = $600.

Part D Prescription Drug Included

Part D Prescription Drug Included

With Original Medicare, you still need to get a Medicare Part D prescription drug plan, even if you don’t take any medications. Otherwise, you will be penalized when you eventually do enroll in a Medicare Part D plan. The Part D plan is generally included in a Medicare Advantage plan at zero or little cost. If you purchase a Part D plan, you may pay between $21–$100 per month. The advantage of Medicare Advantage is paying zero or very little for your drug plan.

Vision and Dental

Mo st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

Compared to Original Medicare, the advantage of Medicare Advantage makes complete sense. It limits your maximum out-of-pocket, combines Part D at little or no cost most times, includes extra benefits, like dental and vision. There are usually many plans in your area. Here is Omaha there are eleven Medicare Advantage plans among five insurance companies. You should be able to find something that fits your needs among that variety. Call us to find out 402-614-3389.

A number of distressed clients called me because they saw announcements on the news that Aetna and United Healthcare (UHC) were pulling out of individual states and would not be offering health insurance any more. It is true that Aetna and UHC are pulling out of some healthcare plans, but Aetna exits ACA NOT Medicare.

Aetna Exits ACA Not Medicare

Aetna individual plans are on the market place exchanges through the ACA (Affordable Care Act). ACA has nothing to do with Medicare, and Aetna and UHC, which are the largest Medicare plan providers, will continue to offer Medicare Supplement plans and Medicare Advantage plans in all the states. Aetna and UHC Medicare Part D and Medicare Part C plans will not be affected.

Why Are Aetna and UHC Pulling Out?

The plans that are on the exchanges are not inexpensive plans. They are loaded with all types of services. The pricing is also designed to transfer money from beneficiaries who have higher incomes to those who have lower incomes in the form of subsidies. That is why the majority of Americans are paying significantly more for less insurance. At the same time, the number of people on the exchange in health insurance plans are far less than the estimates the government initial provided. The numbers are low for two principle reasons. Fewer people are purchasing the product. Instead they are accepting to pay the penalty. Second the employer mandate was weakened and delayed each year by the president. The result is that less people were pushed on to the exchanges than anticipated. The overall result is that insurance companies who administer the ACA plans on the exchanges have consistently lost money each year. The share holders and boards decided to stop losing money by pulling out.

This has no direct affect on Medicare and your individual plans, even if it is an Aetna or UHC Medicare Supplement plan or Medicare Advantage plan. Aetna exits ACA NOT Medicare.

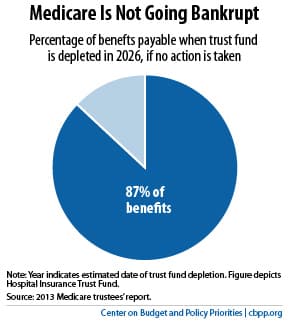

The leading cause of bankruptcies in the U.S. are medical bills. Coupled with the headlines “Medicare Going Bankrupt,” the question is: whose going bankrupt first? Health care and Medicare have been in the news and will be even more so as the political season kicks into high gear. Don’t let Medicare’s budget problems became yours.

Medicare Going Bankrupt

The headlines that state “Medicare Going Bankrupt” are not accurate. Medicare is divided into three parts: A, B, & D. Medicare Part B, which covers doctors and outpatient procedures, is covered by participants’ premiums and general revenues from the government budget. Medicare Part D, which covers drugs, is the same. They can never run out of money. Medicare Part A covers hospital expenses. Payroll taxes finance Part A. The Government Accountability Office report says that Part A will not be able to pay 100% of its bills by 2030 at present estimates. It will only be able to pay 86% of expenses which is a problem that can be easily solved in a couple of ways. Medicare going bankrupt is the wrong issue.

The headlines that state “Medicare Going Bankrupt” are not accurate. Medicare is divided into three parts: A, B, & D. Medicare Part B, which covers doctors and outpatient procedures, is covered by participants’ premiums and general revenues from the government budget. Medicare Part D, which covers drugs, is the same. They can never run out of money. Medicare Part A covers hospital expenses. Payroll taxes finance Part A. The Government Accountability Office report says that Part A will not be able to pay 100% of its bills by 2030 at present estimates. It will only be able to pay 86% of expenses which is a problem that can be easily solved in a couple of ways. Medicare going bankrupt is the wrong issue.

Rising Health Care Costs

Rising cost is the issue. Medicare benefits will be paid for. In the past, there were three ways to pay for the program. They are still the same. Increase taxes, increase the premiums, reduce benefits or a combination of all three. This year the premium for Part B was increased from $104.90 to $121.80 for new members. The Part A deductible was increased from $1,260 to $1,288. The Part B deductible was increased from $147 to $166.

You Pay It

Medicare costs will go up in the future, like all health care costs. The bottom line is you will be effected by what the government does or doesn’t do about Medicare. More of the cost for your health coverage will be placed in your lap, so it becomes even more important that you have the most efficient supplement to your Medicare. You need to manage your health care costs more efficiently, even if government doesn’t.

Don’t be a victim who is at the mercy of Congress or Medicare. Find the best coverage at the price you can afford before you are forced to search. Protect yourself from future Medicare benefit reductions with a more efficient supplement—one that covers those co-pays, deductibles, coinsurance but at a lower premium. FREE Quote 402-614-3389.

One of the most painful calls I get is from a client who is calling on behalf of a parent. They want to know if there is anything I can do for a parent who is paying huge monthly premiums for her Medicare supplement. The agent who signed them up is long gone. The supplement has increased over the years due to age and rate increases. Now the parent is in her 80’s and in poor health, and the monthly premium is financially crushing. Many times there is nothing I can do because their mom or dad cannot pass the underwriting questions to change to a supplement that would be significantly less. They missed out on one of the keys to unlocking Medicare–an agent who shops her policy each year.

Five Keys to Unlocking Medicare

There are five keys to unlocking Medicare. First you need to do some research yourself. The bible for Medicare is Medicare & You. It is the official Medicare Handbook that the Center for Medicare & Medicaid Services publishes each year. The Medicare.gov website is an endless source of resources. It is important to do your own research so you are familiar with the proper Medicare terminology. That way, you can better understand a serious discussion around Medicare.

There are five keys to unlocking Medicare. First you need to do some research yourself. The bible for Medicare is Medicare & You. It is the official Medicare Handbook that the Center for Medicare & Medicaid Services publishes each year. The Medicare.gov website is an endless source of resources. It is important to do your own research so you are familiar with the proper Medicare terminology. That way, you can better understand a serious discussion around Medicare.

The Big Key

Key number two: search for an experienced, independent agent. Experience means they have been doing this for years. Ask them when they got their insurance license. They should be able to spit that out without thinking. Ask if they do this fulltime. There are a lot of insurance companies and agencies who hire part-time people to increase their production. They give them little education or training. Even less support. Most drop out of the business after six or nine months. That probably is not the person you want. Ask if they are independent. Some insurance agents can only offer one company. They cannot shop the world of Medicare plans. Ask them to list the companies they offer. If they change the subject or only list one or two, you have your answer.

Key number three: ask questions. As I tell my clients who are aging into Medicare, you turn 65 once in a lifetime. I help people turning 65 going on Medicare four or five times in a day. I am excited when someone asks me a question I haven’t heard before. An experienced agent should be able to quickly and easily explain the details of Medicare, supplements, advantage plans, prescription drugs, etc. If not, you may wish to look somewhere else.

Key number three: ask questions. As I tell my clients who are aging into Medicare, you turn 65 once in a lifetime. I help people turning 65 going on Medicare four or five times in a day. I am excited when someone asks me a question I haven’t heard before. An experienced agent should be able to quickly and easily explain the details of Medicare, supplements, advantage plans, prescription drugs, etc. If not, you may wish to look somewhere else.

Price Compare Med Sups

Key number four: compare every year. I talk to my clients at least once a year. I want to know that everything is going well. Part of the conversation is the price of their supplement. With age and rate increases, what are you currently paying? I shop their supplement right then and there over the phone. I tell them if there is a plan of equal or better value at a lower price. That prevents you from getting into the situation in your later years of a plan with back breaking premiums.

Key number five: stay healthy! Go to the gym. Eat healthy. Chase grandchildren, pets, moving cars, anything that will get your heart rate up. One of the keys to unlocking Medicare supplements is your ability to pass underwriting questions so you can change plans and pay less. I can try different companies that have more liberal underwriting guidelines, but ultimately there are limitations for serious health issues.

Key number five: stay healthy! Go to the gym. Eat healthy. Chase grandchildren, pets, moving cars, anything that will get your heart rate up. One of the keys to unlocking Medicare supplements is your ability to pass underwriting questions so you can change plans and pay less. I can try different companies that have more liberal underwriting guidelines, but ultimately there are limitations for serious health issues.

Medicare and Medicare supplements are awesome health insurance, but to enjoy the greatest benefits from this awesome resource, you need to follow these simple five keys. Call me 402-614-3389 or the American Association of Medicare Supplements to find an experienced, independent agent near you.