What is Medicare?Category:

Which Is A Better Deal for You? Medicare Or Employer Health Insurance

Congress created a problem in the 1980s when it increased the age for full Social Security benefits. Eligibility was age 65 for both Social Security AND Medicare. Medicare eligibility is still age 65, but full Social Security benefit now is 66 and six months or 67 for those born in 1960 or later.

Many people delay retirement now until they reach the age of full Social Security benefits at 66 and six months. The issue for those who continue to work is whether they should go on Medicare at age 65 or stay on their employer plan. The quandary is, which is a better deal: Medicare or your employer-provided health insurance? People are stumped. Which way to go?

Many of my clients who come to us after retiring at 66 or older complain they should have gone on Medicare instead of staying on their employer’s health insurance plan. Medicare would have been a far better deal. Medicare typically costs less and typically provides better coverage than their employer plan, but they didn’t know any better. They didn’t understand Medicare, the rules, and the costs. Medicare was a mystery. Consequently, they made misinformed decisions.

Find out what they didn’t know.

What Is Medicare?

First of all, what is Medicare?

Medicare is a federal health insurance program that Congress created in 1965. The program was designed to provide health insurance for those who work in the U.S. and are 65 or older. At the time, there was little access to reliable, low-cost health insurance once you retired and lost employer-provided health insurance.

How Do You Qualify for Medicare?

You must have worked at least 40 quarters (10 years). To qualify for Medicare, you must have paid FICA (Federal Insurance Contribution Act) payroll taxes.

Once you turn 65 or are certified as disabled by the Social Security Administration (SSA) after 24 months, you can enroll in Medicare.

- Those with End-Stage Renal Disease (ESRD) (permanent kidney failure requiring dialysis and/or transplant) are immediately covered by Medicare.

- Those with ALS (Amyotrophic Lateral Sclerosis, also called Lou Gehrig’s Disease) will likewise qualify for Medicare immediately.

I have clients in every category, but most of my Medicare beneficiaries are 65 and older.

What Is Part A?

Medicare is divided into two parts–Part A and Part B. Medicare Part A is hospital insurance. Part A covers

- Inpatient Hospital

- Skilled Nursing Facilities

- Home Health Care

- Hospice

How Much Does Medicare Part A Cost Compare to Employer Health Insurance?

You would pay nothing for Part A coverage if you or your spouse paid FICA for at least ten years. Of course, the zero premium for Medicare beats the premium employees pay for their employer-provided health insurance.

If you are not eligible for free Part A, consult the article on paying for Part A.

Part A Penalty and Medicare Fake News

If you are eligible for free Medicare Part A, there is no penalty for not enrolling in Part A when first eligible.

People call me up in a panic because they are worried about “the penalty.” They fear if they do not enroll in Medicare Part A, there will be a lifetime penalty. There is no penalty for not enrolling in Part A. Medicare Part B, however, is a different story.

Why Should You Enroll in Medicare Part A?

That being said, I encourage people to enroll in Medicare Part A when they are eligible. You will establish your identity with the Social Security Administration (SSA) and CMS (Center for Medicare & Medicaid Services).

Sometimes my clients go to enroll in Medicare, and they discover they cannot. There are errors with their personal information in the government’s database that results in problems and delays.

Delayed enrollment in Medicare is especially critical when there is a strict timeline. Sometimes clients have hard retirement dates when they will lose their employer-provided health insurance, and Medicare has not approved them. Over the years–especially during COVID–I had several clients run-up to the deadline, and even a few went over it. Not a good situation to be in. That is why I recommend you enroll in Medicare as soon as you are eligible, even if it is only Part A.

Medicare Enrollment Problems

For example, I have had clients who were scheduled to lose their health insurance in a few weeks. They needed a Medicare number to enroll in a Medicare plan, Medicare drug plan, or Medicare Supplement. We cannot process any application without their Medicare number. We are dead in the water without the number.

Clients had begun the process as early as Social Security allowed–3 months–but they still did not have Medicare insurance. SSA or CMS was backed up, there was a mistake in personal data, and/or documents were lost and needed to be resent.

Starting Medicare and Medicare insurance on time is critical because essential prescriptions may need to be filled. Hard to get doctor’s appointments, and vital surgeries are sometimes on the calendar. The dates are inflexible. These plans blow up when Medicare delays someone’s enrollment past their expected start date.

While these incidents were a small percentage of my clients, I guarantee, you are stressed to the max when it happens to you. Most of the time, I coach them across the finish line. Everything starts on the desired date, but being in that time crunch is not comfortable.

At Least Enroll in Part A When You Turn 65

Enrolling in Medicare Part A even when you are on an employer health plan is the smart thing to do. There is no critical timeline because you have insurance. It gives you plenty of time and space to fix any problems that may arise without the rush and pressure.

Then the process is much easier and quicker when you go to activate your Medicare Part B later. Your identity is already established, you have a Medicare (MBI) number, and you are an active Medicare beneficiary. Activating Part B is the simple matter of submitting a couple of forms.

Medicare Beneficiary Identifiers (MBI) Is the Ticket to the Dance

The old Medicare number was the Health Insurance Claim Number (HICN). It served as your personal Medicare beneficiary identification number. The HICN was used for paying claims and for determining eligibility for services across multiple entities (e.g., Social Security Administration (SSA), Railroad Retirement Board (RRB), States, Medicare providers, health plans, etc.)

The MBI (Medicare Beneficiary Identifiers) is the new number. SSA generates the number for you when you enroll in at least Medicare Part A. The MBI is necessary when enrolling in any Medicare Advantage Plan, Part D Prescription Drug Plan, or Medicare Supplement.

Your Medicare card (a.k.a. Red, White, & Blue Card) has your MBI printed on the front. The card also shows your coverage. CMS prints Part A in the bottom right corner for hospital coverage and Part B for doctor’s visits and outpatient services if you also have Part B.

How the MBI Affects Picking A Medicare Supplement

In the past, some insurance agents would enroll people in Medicare Supplements as early as six months before their 65th birthday. They aimed to lock down the business so another insurance agent could not get in there. Then, people’s Medicare number (HICN) was their Social Security number with a letter on the end. It was easy to figure out their Medicare number. But since April 2019, the only number CMS (Center for Medicare & Medicare Services) will process is the new MBI. The MBI is a series of random numbers and letters.

Some unscrupulous insurance agents will still fill out applications with your signature six months before you turn 65. Again the purpose is to lock down the business. The agent does not date the application at the time he takes it. Eventually, when you get your Medicare (MBI) number to him, he completes the application. He dates it since you have already signed the application and submits it to the insurance company. Major violation of the rules!

What Is Part B?

Medicare Part B is for medical insurance, which means doctor visits and outpatient procedures. Part B covers medically necessary services in these areas as well as preventative care.

How Do You Pay For Part B?

Your Medicare Part B health insurance has a monthly premium. You pay your Part B premium out of your Social Security check if you receive benefits.

Suppose you are not receiving a monthly Social Security check. In that case, you can set up an ETF automatic monthly draft from your bank account. Medicare Easy Pay is the program through which you pay monthly. A detailed explanation of how to pay is on the Medicare.gov website. If you do not set up an ETF, the Social Security Administration will bill you quarterly. Those are the three options.

Who Pays For Part B?

The actual Part B cost is more than four times your monthly premium. Taxpayers pay the remaining cost of Medicare through the federal budget.

The Medicare Part B premium can change as medical expenses and Medicare administrative costs increase. The current 2023 premium is $164.90. The 2022 premium was $170.10, 2021-$148.50, 2020-$144.60, 2019-$135.50, and 2018-$134. You can see the increasing trend. With current inflationary pressures, your Part B premium increasing cost will probably accelerate.

If you are in the top 4% of income earners, your Medicare Part B and Part D premiums will be higher depending upon your level of income. Please, consult Blog: IRMAA Tax.

Lifetime Medicare Late Enrollment Penalty

If you do not enroll in Medicare Part B when first eligible, you will pay a late enrollment penalty for the rest of your life.

You will also be required to wait until General Enrollment Period (from January 1—March 31) to enroll in Part B. When you enroll during General Enrollment, Medicare coverage will not start until July 1 of that year. (FYI: these rules will change in 2023. Please, consult Blog: 2023 Medicare Changes.)

UNLESS: If you are an active participant in an employer health insurance plan as good as Medicare, or other qualifying health plans, you may delay enrolling in Medicare Part B (or Part A and Part B) indefinitely without penalty.

You will also have an open enrollment period if you wish to enroll in Medicare Part B (or Part A and Part B) at any time after 65 when you are actively covered by employer health insurance.

Many people are completely unaware of this exception to the rule. As a matter of fact, insurance agents will take advantage of this rule and omit the exception to induce people to meet with them.

When Can I Sign Up for Medicare?

If you are eligible for Medicare when you turn 65, you can sign up

- 3 months before the month of your 65th birthday,

- The month of your 65th birthday

- The 3 months following your 65th birthday.

Enrolling when you are first eligible for Medicare is vital in case of delays. The Social Security Administration (SSA) and CMS (Center for Medicare & Medicaid Services) are very slow.

Also, there may be errors in your personal data that will require time to correct. The corrections will require supporting documentation, like a birth certificate or naturalization papers. The SSA bureaucratic process does not function with the same instantaneous efficiency to which you may be accustomed.

Making corrections, processing documents, and verifying your identity must be completed before your Medicare enrollment process begins. So begin your enrollment process as early as possible.

Over the years, many of my clients had their Medicare postponed beyond their intended start time. Errors in their personal information delayed the process. The back and forth with SSA to make corrections dragged on.

Part A Post-Dated Six Months Back

After your Initial Enrollment Period (IEP), you may enroll in Medicare Part A at any time. However, your Part A will be post-dated six months back from the date you apply for Medicare part A, but no earlier than the first month you were eligible for Medicare or turned 65. This rule applies only to Part A.

The six-month backdating is important to be aware of if you contribute to an HSA (Health Savings Account). An HSA is attached to an employer’s high deductible health insurance plan. Medicare has rules and penalties around HSAs as well.

Birthday on the First of the Month with Medicare

If your birthday is on the first day of the month, your coverage will start on the first day of the prior month.

For example, Mr. O’Shea’s 65th birthday is May 1, 2022. His Medicare will start on April 1 if he enrolls in January, February, or March.

Enroll in Medicare After 65 During Initial Enrollment Period

For many years, if you enrolled in Medicare after the month of your 65th birthday, your start date for Medicare was set for two to three months later. The Consolidate Appropriate Act of 2021 (CAA) changed the rule so in 2023, those who enroll in Medicare in the last three months of their initial enrollment period will begin Medicare the following month.

The old rule was confusing and created unexpected hardships for people who may have delayed initial enrollment by only a couple of months. Over the years, I had some clients who were forced to go without health coverage for a month or two because they were unaware of the law or delayed enrollment because of unforeseen circumstances.

Medicare Special Enrollment with Employer Health Insurance

Once your Initial Enrollment Period ends, you have another chance to sign up for Part B. This new election period is called a Special Enrollment Period. You need to meet specific requirements.

Suppose you are covered under an employer health insurance plan that is as good as Medicare. Then you have a Special Enrollment Period to sign up for Part A and/or Part B as long as you (or your spouse) are working and covered by an employer health insurance plan Medicare recognizes. Medicare will allow you to enroll at any time.

You may decide to retire, or you change jobs. The new employer’s health plan is not as good as your previous employer’s or as good as Medicare. So you decide to go completely on Medicare.

No matter the reason–retirement or job change–you will not pay a Medicare Part B late enrollment penalty or Part D late enrollment penalty because you were covered by an employer health plan.

COBRA & Retiree Employer Insurance and Medicare

COBRA and retiree health plans are not considered coverage based on current employment. You are not eligible for a Special Enrollment Period when that coverage ends.

General Enrollment Period

Suppose you don’t sign up for Part A and/or Part B when you are first eligible and do not qualify for a Special Enrollment Period. In that case, you may have to wait until the Medicare General Enrollment Period (from January 1st-March 31st) to enroll in Medicare.

Coverage will not start until the following July 1st of that year.

What Is the Medicare Late Enrollment Penalty?

In most cases, you will have to pay a late enrollment penalty for the rest of your life if you sign up during the General Enrollment. You did not have Medicare Part B and had no employer health insurance plan when you were eligible.

The penalty is 10% of the current Part B premium for each full 12-month period you did not have coverage when you should have.

Yes, if you did not have Part B for five years when you should have and had no employer health insurance either, your late enrollment penalty would result in a 50% surcharge permanently added to your Medicare Part B premium. Not good.

When Are You Automatically Enrolled in Part A and Part B?

If you are getting your Social Security (or Railroad Retirement Board) benefits, you will automatically be enrolled in Medicare Part A and Part B starting the first day of the month you turn 65. If your birthday is on the first day of the month, Part A and Part B will start on the first day of the prior month. You should receive your Medicare card three months before the month of your birthday.

If you want to keep Part B, you do not need to do anything.

If you do not want Part B, you can cancel Part B by signing the back of the card and returning it to CMS. A new Medicare card will be reissued to you with only Part A for hospital coverage. You always have the option to activate your Part B at a later date.

You have the option to purchase a Medicare Part D prescription drug plan with Part A only.

However, if you want to purchase a Medicare Supplement or enroll in a Medicare Part C (Medicare Advantage Plan), you will need both Part A and Part B active.

What if I Am Under 65 and Disabled?

Suppose you are eligible for Medicare because of a disability. You will automatically get Part A and Part B after receiving disability benefits from Social Security (or RRB) for 24 months.

Signing Up for Part A and Part B

If you are not currently receiving Social Security (or Railroad Retirement Board (RRB)) benefits, you will need to sign up for Medicare Part A and/or Part B to activate them. You will not receive Medicare automatically like those already receiving Social Security Benefits.

Enrolling in Medicare Online

Social Security is the gatekeeper for Medicare. Signing up for Medicare has been an evolving adventure because of the pandemic. Enrolling online is the preferred way to initiate your Medicare since the pandemic. The Medicare online enrollment iterations have been myriad. Enrolling online has grown progressively more complex and difficult over time.

I help my clients enroll in Medicare online weekly. I am relieved when the process goes smoothly, but that is not as often as I would like. There frequently seems to be some sort of glitch. I highly encourage people to enroll as soon as they are eligible. You do not know how the system may or may not work when you try to enroll. Also, it is possible the government does not have your correct personal information.

What Could Delay Medicare Enrollment?

For example, I had a client named Gregory, but the Social Security Administration had his name as Greg. That stopped his enrollment process cold. He needed to produce an original birth certificate. After several time-consuming meetings at the local Social Security Administration Office, SSA approved Greg for Medicare.

I had another client who had divorced and moved to a different residence. However, SSA still had his old address, where he had not resided for three years. SSA blocked his enrollment until he made the corrections.

Many a time, I have had a client’s enrollment delayed because a birthday was off by a single digit. One client moved one house down from their previous residence. SSA did not have the current address, which was one digit different from the old one. That person went two months past her start date because of processing delays. Fortunately, for her, she could carry her employer coverage until Medicare kicked in.

You are probably getting the idea. You need to deal with Medicare as early as possible and attentively monitor the process.

How Do You Sign Up For Medicare?

You can call the National Social Security Administration (SSA) phone number (800) 772-1213. I do not recommend that. The hold times are maddening.

Do not call Medicare. They cannot enroll you in Medicare, only SSA can enroll you in Medicare–typical government.

If you wish to enroll in Medicare over the phone, I suggest calling the local SSA office. Omaha (866-716-8299), Lincoln (866-593-2880), or Council Bluffs (866-331-9094). They will probably set up an appointment many weeks in the future to perform the actual enrollment.

You can also drop in at the local offices. They are now open. Prepare to wait.

| Old Mill Center 604 N 109th Ct Omaha, NE 68154 |

Room 240 Centennial Mall N Lincoln, NE 68508 |

Mid-America Center Arena Way Suite 1 Council Bluffs, IA 51501 |

The fastest and easiest way to enroll in Medicare is online at the Social Security Administration website (ssa.gov). Click on Benefits, then Medicare. Follow the prompts.

You will need immediate access to email and text messages to complete the enrollment process. If you do not have a computer and/or phone with internet, email, and text access, you will not be able to enroll.

How to Enroll in Medicare When Leaving Employer-Provided Health Insurance?

Many people delay enrolling in Medicare because they have an employer health insurance plan through work or their spouse’s employer. Several years may pass before they decide to completely go on Medicare and leave their employer’s health insurance plan. At some point, however, people retire, quit, or stop working and go entirely on Medicare Part A and Part B.

Center for Medicare & Medicaid Services (CMS) Forms

To enroll in Medicare Part B in this situation, you will need to complete two CMS forms. The forms are: Request For Employer Information and Application For Enrollment in Part B. You will find these forms on the CMS.com website under forms. You can also use the search tool on the website and type “enrollment.”

If you have not enrolled in Medicare Part A by this point, you need to also enroll in Part A on the SSA website. Enrolling online for Part A is the preferred method. Calling the SSA office or visiting is usually a time-consuming process. If you already have Medicare Part A, simply complete the two required forms.

(When you enroll in Part A, Medicare will backdate Part A six months or to your sixty-fifth birthday, whichever is shorter.)

Then fax the two forms to the local Social Security Administration Office. Omaha (Fax: 833-515-0443), Lincoln (Fax: 833-641-3167), or Council Bluffs (Fax: 833-950-2936). I would not fax the forms to the National SSA fax number. Black Hole. I would also mail the forms USPS to the local office. Then call the local office to confirm the forms were received and processed. If you do all three of these steps, you significantly increase the chances of a timely and successful enrollment. No joke. We help our clients do this all the time. It works. If you eliminate any of the steps, you will have diminished levels of success.

How Does A Health Savings Account (HSA) Affect My Medicare?

Once you enroll in Medicare, even if you only enroll in Medicare Part A, you can no longer contribute to an employer’s Health Savings Account (HSA). If you or your employer contribute any amount to your HSA after you enroll in Medicare Part A and/or Part B, you will pay a sizeable tax penalty when you withdraw the money from your account as well as unpaid taxes.

Do not enroll in either Medicare Part A or Part B if you wish to continue contributing to an employer HSA.

You must make sure you and your employer stop contributing to your HSA at least six months before your Medicare takes effect if you enroll in Medicare after age 65. Medicare Part A is always backdated six months or to your 65th month of birth, whichever is shorter.

What Is the IRS Penalty for HSA Contributions While on Medicare?

The amount of your pre-tax contributions to your HSA during the time you are prohibited will be added back into your past taxable income. You will then be responsible for those past taxes. You will no longer have the HSA deduction for that period.

There will also be an additional 6% amount charged as an IRS penalty accessed on the amount contributed.

HSA Testing Period & Penalty

HSAs also have what is described as a testing period. Contributors may make lump sum contributions, which are averaged out over the testing period. If the person’s Medicare is active at any time during this testing period, an additional 10% IRS penalty is added along with the taxes.

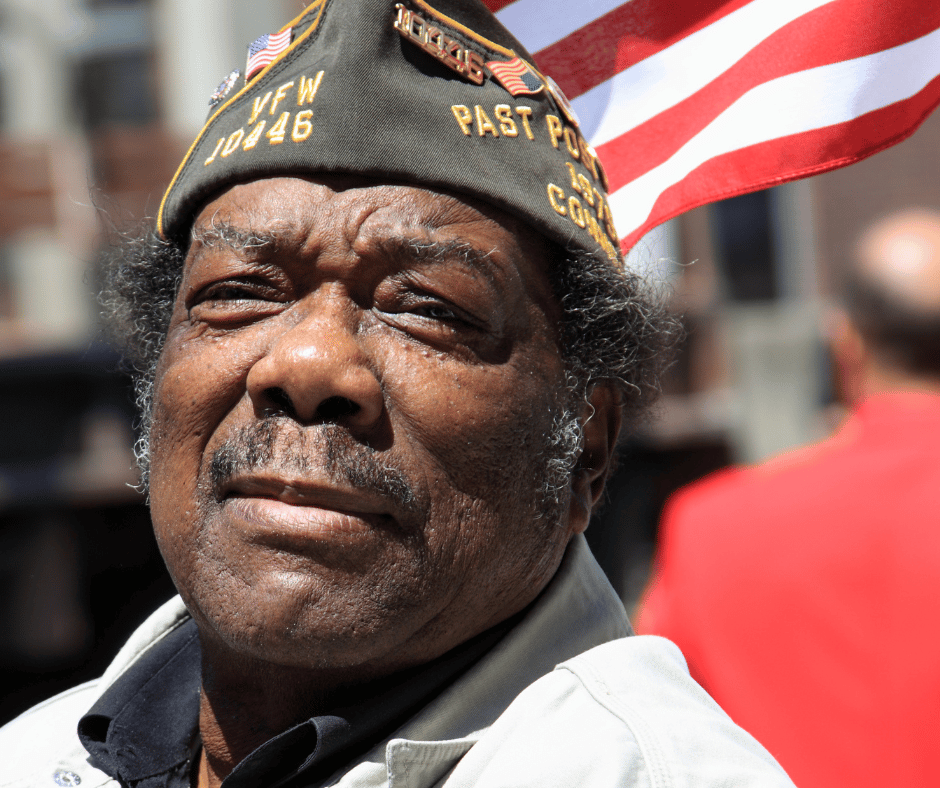

How Do Veterans Benefits Affect Medicare?

Military veterans have access to veteran benefits. Veteran benefits are separate from Medicare benefits. The Veterans Administration (VA) administers the Veterans Administration. Benefits are based upon the person’s service, time and place of service, disabilities, and even income. Consult the Veteran Administration for your benefits. VA benefits do not affect your Medicare benefits, though they may work with them. They are two completely separate entities.

I Have Marketplace Health Insurance Coverage, a.k.a. ObamaCare

The Health Insurance Marketplace is generally for people who need to

buy individual or family health insurance or for people who are offered

employer coverage through the Marketplace.

Medicare is not part of the Marketplace. Once your Medicare coverage starts, health insurance companies cannot sell you a plan through the Marketplace.

Should You Stay on Your Employer’s Health Insurance Or Switch to Medicare?

More and more people are working past age 65 for various reasons. While working, you will still have access to your employer’s health insurance. The question is whether you should remain on your employer-provided health insurance when you have access to Medicare. Or should you go completely on Medicare?

Four Questions

To review your Medicare options for your employer’s health insurance plan, we need answers to four basic questions.

Premium

1.) What is your monthly premium? If you are on your spouse’s employer-provided health insurance, your premium may be significantly more because you are a non-employee. The premium is not always identical. Double-check.

Deductible

2.) What is the deductible per individual? And if there is a total between a couple, what is that?

The deductible is the amount you pay upfront for medical expenses before the plan’s coinsurance kicks in. These expenses include hospital stays, outpatient surgeries, emergency room visits, diagnostics, tests, etc. Doctor visits and other services may have minimal copays that do not count toward the deductible.

Coinsurance

3.) What is the coinsurance? Many times the coinsurance is an 80% / 20% percentage split. Sometimes, however, it is 70% / 30%. I’ve even seen 90% / 10% on a rare occasion, which is very nice.

The coinsurance is the percentage you pay of the actual cost after the deductible is met. For instance, you could have a $10,000 medical bill. The deductible is $2,000. After you pay the first $2,000, you then pay 20% on the next $8,000, which is $1,600. The coinsurance amount is then added to the deductible for a $3,600 total.

Maximum Out-of-Pocket

4.) The final question is the maximum out-of-pocket (MOOP). The MOOP is the total amount you pay out of your pocket, independent of the insurance company’s payment. Your MOOP could be $5,000, $7,500, $10,000, or even higher.

In the above example, if your MOOP is $3,500, you would pay $3,500. If your MOOP were $4,000, you would pay $3,600.

When you have the answers to these four questions, you can compare your employer’s health insurance plan and Medicare.

Weighing The Options As A 65-Year-Old

People will often look at the monthly premium to determine which is a better plan. The lower the premium, the better the plan; the higher the premium, the worse. Premium is undoubtedly a factor among the four, but the deductible is really the first consideration.

You are eligible for Medicare at age 65. That number is not arbitrary. Even though your health may have been excellent before age 65, health significantly declines in the remaining 18 years, which is the average life expectancy once you turn 65.

Chronic conditions, such as diabetes, arthritis, and heart disease, disproportionally affect older persons. Eighty percent have at least one chronic condition, and nearly 70% of Medicare beneficiaries have two or more.

National Poll on Health & Aging

What is the chance you have outpatient surgery?

Considering elective surgery was more common among adults aged 65–80 than adults aged 50–64 (36% vs. 25%).

The five most common elective surgeries older adults considered were joint surgery (18%), eye surgery (12%), abdominal surgery (10%), cosmetic surgery (9%), and foot or leg surgery (7%).

Among those who had considered an elective surgery in the past five years, 65% had surgery within that timeframe, 24% planned to have the surgery in the future, and 11% said they were not planning to have surgery.

Adults aged 65–80 were more likely than adults aged 50–64 to have had elective surgery (73% vs. 57%), as were adults who were retired or not working compared with those employed (71% vs. 55%).

University of Michigan National Poll on Health & Aging

The Deductible Is Upfront Money

You pay the deductible portion immediately before the employer’s health insurance begins to cover the surgery. You pay the first $1,000, $2,500, or $5,000 of the $10,000 knee replacement. Then the coinsurance is 20% of the remainder.

The chance that an unforeseen health issue will occur after 65 is significantly higher. The deductible, which is your upfront expense, can instantly wipe out any momentary savings you may have had with a smaller employer premium.

MOOP Is Total Risk

The second most important number to consider is the maximum out-of-pocket (MOOP). The MOOP is the most you pay yourself personally. It is the maximum risk for which you are on the hook. After reaching that number, the health insurance covers your medical expenses 100%. MOOPs are generally large numbers. Paying the MOOP would significantly affect most families’ bottom line.

What is your employer’s health insurance MOOP compared to a Medicare Advantage Plan, Medicare Supplement, and Medicare Part D prescription drug plan? These numbers are usually figured differently, so be careful to make sure you are comparing apples to apples.

When you accurately review your Medicare options with your current employer’s health insurance plan, you have the essential information for making a decision. Will you stay on your employer’s health plan or drop the plan and go on Medicare?

Spouses & Children Are Part of the Equation

Other considerations are spouses and perhaps even children.

If your spouse, who may be younger, cannot find health insurance from an employer or marketplace at a reasonable price, and you plan to continue working anyway, remaining on your employer’s health insurance will probably be the better choice. The same is especially true when children are involved.

Real Numbers

To make a real comparison, you need real numbers. You need the numbers from your employer’s health insurance plan, and you need the numbers from Medicare, the many Medigap policies, the Part D prescription drug plans, and the Medicare Advantage plans.

We help clients lay out these many plans and numbers clearly and concisely, so you can consider your options and make thoughtful plans and good choices.

We cost you nothing. The insurance companies and Medicare cover the cost.

Call us at 402-614-3389 to speak with a licensed and experienced insurance professional.

56972_072022_MK

When people arrive at the doorstep of Medicare at age 65, they are confronted with the daunting task of picking a Medicare plan. Most people find picking Medicare plan overwhelming and confusing.

100’s of Supplements to Pick From

Insurance companies offer hundreds of different Medicare supplements, Medicare Advantage plans, and Medicare Part D prescription drug plans. Picking Medicare plan means choosing between Medicare supplements and a Part D prescription drug plan OR Medicare Advantage/Part C. Next picking Medicare plan means choosing the plan type. Medigap plans range from plan A through the alphabet to plan N, which doesn’t include a Part D drug plan. The drug plans can be a little simpler because you can use the Medicare tool to narrow down the selection. The Medicare calculator bases the plan selection upon the prescriptions you enter into the system. The calculator picks the Medicare Part D plan that will cost the least in total costs for you. On the other side, Medicare Advantage plans consist of a wide variety of co-pays, co-insurance, deductibles, and maximum out-of-pocket costs and amounts that may or may not include a Part D plan.

Foreign Language of Medicare

Medicare itself is like a foreign language of Part A, Part B, and Part D with rules around enrollment that includes penalties when you do not comply. The Medicare.gov website is meant to be helpful, but the shear amount of information, jargon, legalese makes it a barrier to entry rather than a door. Even the Medicare handbook is hundreds of pages. Its size makes the evaluation of information almost impossible.

The Pain of Picking Medicare Plan

The Pain of Picking Medicare Plan

As a consequence, picking a Medicare plan is a frustrating and painful process for people. That is why I take people through a 3-step process. 1.) There is a brief, foundational explanation of Medicare and how it works. 2.) Look at ALL of the plans, but in an organized and ordered fashion. The first step helps you evaluate the plans. I share the story behind each company from my fifteen years of insurance experience because each company has a history in the market. 3.) I find out about you. Everyone is unique. Some people are risk takers. Others are not. Some have health concerns that are foremost of mind. Others do not have any.

Logical Process

The logic of the process enables people to narrow down choices and make the best one for them. I ask questions as we go along. Test and probe. Explain aspects of the plans as we go through each. Constantly test for understanding. So the process of picking a Medicare plan becomes clearer as we move through it. I generally meet with people twice. The first time is usually months before they can do anything. There is no pressure to make a decision or ‘buy right now.’ Clients have time to think, collect more information, verify what they’ve learned, talk with confidants. The next time we get together is to review with updated information. That is the time for picking a Medicare plan. By then you are comfortable and confident with your decision because your decision is well informed. It is logical. The decision is made over time without pressure. You know what you are doing when you pick your Medicare plan.

If you would like to go through this process, there is not cost or obligation. Call 402-614-3389 to find out more.

Medicare Changes Part A Deductible

Medicare changes for 2017 came out in December. One of the changes was for Medicare Part A. Part A is the hospital side of Medicare. It does not cost anything because you paid the Medicare Part A premium during your working years. It was part of your payroll taxes. The premium is zero if you have enough quarters of work and paid in to Medicare; however, Medicare Part A has a deductible. The deductible was $1,288 for 2016. The Part A deductible for 2017 is $1,316.

Remember the Medicare Part A deductible is for each event within a 60 day period. If you revisit the hospital 61 days later OR there is a different and separate event resulting in admittance to the hospital, you pay the $1,316 again.

Increases Passed On To You

Increases Passed On To You

The significance of the increased Part A deductible will be an increase in the cost of your Medicare Supplement. Most Medicare supplements cover the Part A deductible as many times as it may occur in a given year. Because the insurance company will now be on for more deductible, it will have to offset that expense and risk with higher premiums. Your premium may not increase significantly, but it does cost the insurance company more. Consequently it will ultimately cost you more.

Medicare Advantage Is Different

For those on Medicare Advantage plans, you are not directly effected. Your hospital co-pays, as well as the other co-pays, are determined by your individual plan. They are already set for 2017. Any increases may result in increases in hospital co-pays down the line because, like supplements, someone needs to pay for the additional expense. The actual co-pay is determined by your Medicare Advantage plan, and they are now set for 2017. Check the changes to your Medicare Advantage plan for 2017. You received your notification of changes in October. If you cannot find it, call the customer service phone number on the back of your card. They will send you a new statement of understanding with all the 2017 co-pays, deductibles, and co-insurance.

For those on Medicare Advantage plans, you are not directly effected. Your hospital co-pays, as well as the other co-pays, are determined by your individual plan. They are already set for 2017. Any increases may result in increases in hospital co-pays down the line because, like supplements, someone needs to pay for the additional expense. The actual co-pay is determined by your Medicare Advantage plan, and they are now set for 2017. Check the changes to your Medicare Advantage plan for 2017. You received your notification of changes in October. If you cannot find it, call the customer service phone number on the back of your card. They will send you a new statement of understanding with all the 2017 co-pays, deductibles, and co-insurance.

Consult with your agent or give us a call to see how any changes to Medicare may affect your situation.

Medicare Part B

Medicare Part B

Medicare changes almost every year. Medicare changes for 2017 are significant. The Medicare Part B monthly premium is the change that hits people first. For Medicare beneficiaries who were on Medicare before 2016, the increase will be from $104.90 to $109 per month. For those who began Medicare Part B in 2016, the premium will move from $121.80 to $134. There are some minor variations on these numbers out there. Eventually Medicare will catch everyone up to the same amount. I am getting a lot of calls as clients see the higher premium. For those with annual individual incomes above $85,000 and joint incomes above $170,000, the increases are much larger.

Part B Premium Increase

The reason for the increase is the rising cost of Medicare. Fewer persons are working in relationship to the number of new beneficiaries going on Medicare. The baby boomer population turns 65 at a rate of 10,000 per day in our country. The cost of health care also consistently grows at a rate well above inflation. The CPI (Consumer Price Index) is currently about 2%. It is safe to say that Medicare Part B premiums will continue to rise in coming years.

Protection Again Medicare Changes

Protection Again Medicare Changes

Medicare Part B premium is just one of the costs that are going up. Other deductibles, co-insurance, and co-pays are increasing as well. More and more of the burden of health care is being placed upon consumers, so it makes it even more critical that you select the plan that best fits your needs and budget each and every year. It may make sense to take on some deductibles, co-pays, and/or co-insurance so that the monthly premium is not so burdensome, especially if your monthly income is limited. Medical emergencies do not occur regularly, but premiums do. You must pay them every month. One of the most common calls I get is ‘how do I reduce my monthly health care expenses?’

What is Medicare? A basic question. Or rather, why should anyone care about Medicare? The reason people should care is that most bankruptcies are medical bankruptcies. In other words, if you wish to protect your retirement nest egg from bill collectors, Medicare is important to know about. There are few things that are more disturbing than a pile of medical bills sitting on the kitchen table. The golden years could be tarnished with worrying about actual or potential medical expenses. Medicare–if implemented proper–will protect you from a potential catastrophe. It is critical for people entering into retirement to understand what is Medicare.

What is Medicare?

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare Part A

Medicare is divided into two parts: Medicare Part A and Medicare Part B. Medicare Part A has everything to do with the hospital. It doesn’t cost anything because you paid for it during your working years. It was one of the deductions in your payroll taxes. Medicare Part A covers a 100% of the medical expenses incurred in the hospital, but there is deductible that many people are not aware of. The Medicare Part A deductible is currently $1,288. This is NOT an annual deductible. It is a deductible per benefit period, and a benefit period is 60 days. So each event has a deductible, and the time for the event is 60 days. In other words, you could have multiple events and pay multiple deductibles because the event is not limited to just a 60 day period. Each new event, even if it overlaps with another event, has its own 60 day timeline. While rare, it could happen, and probably more importantly, you could pay the Part A $1,288 deductible more than once in any given year.

Medicare Part B

Medicare Part B, however, does cost something. For most people going on Medicare and Social Security in 2016, the Medicare Part B premium is $121.80 per month. It is generally taken out of your Social Security check. Medicare Part B covers doctors’ visits and outpatient procedures, such as X-rays, blood work, emergency room visits, etc. Medicare Part B covers 80% of the cost. Your portion is 20%. The 20% coinsurance, however, is unusual. There is no cap. There is no maximum out-of-pocket. Most group plans you were ever on probably had a maximum out-of-pocket. It may have been $1,000, $2,000, even $10,000, but at some point, you stopped paying and the insurance company covered everything. Medicare Part B does not have that, so 20% of a big number will be a big number. You keep paying your 20% coinsurance as long as the bills come in.

These are the basic building blocks to what is Medicare. You must understand Medicare, Medicare Part A, and Medicare Part B to understand the rest that follows. In the next blogs and videos, we will cover how to get Medicare, how to cover the Part A deductible, and how to fill the unlimited 20% gap in Part B coverage.