Medicare Insurance Agents Near MeCategory:

Are you searching for a trustworthy Medicare Advantage plan insurance agent near you? Look no further! In this article, we will provide you with key tips and insights to help you find the right agent to meet your healthcare needs. Medicare Advantage plans offer additional benefits beyond the basic coverage of Original Medicare. Choosing the right plan can be overwhelming. So, who’s the trustworthy Medicare Advantage plan insurance agent near me?

Finding a trusted agent involves more than just a quick Google search. It requires careful consideration and research. We will guide you through the process, outlining important factors to consider when selecting an agent. From checking their credentials and experience to evaluating their customer satisfaction ratings, we will provide you with the tools you need to make an informed decision.

By the end of this article, you will clearly understand what to look for in a Medicare Advantage plan insurance agent near you. So, let’s dive in and find the perfect agent to help you navigate the complex world of Medicare Advantage plans.

Understanding Medicare Advantage Plans

Understanding Medicare Advantage Plans

Medicare Advantage plans, also known as Medicare Part C, are private health insurance plans that provide an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare. They combine the coverage of Medicare Parts A and B, and often include additional benefits such as prescription drug coverage, dental, vision, and hearing services, and wellness programs.

Medicare Advantage plans come in different types, including Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), and Special Needs Plans (SNPs). Each type has its own network of doctors, hospitals, and other healthcare providers. It’s important to understand the differences between these plan types and choose the one that best suits your needs.

The Importance of a Trustworthy Medicare Advantage Insurance Agent

Navigating the world of Medicare Advantage plans can be confusing. That is why working with a trustworthy insurance agent is crucial. A reliable agent can help you understand the complexities of different plan options, guide you through the enrollment process, and provide ongoing support for any questions or concerns you may have.

A trustworthy insurance agent is knowledgeable about Medicare rules and regulations, stays up to date with changes in the healthcare industry, and has a good understanding of the Medicare Advantage plans available in your area. They should be able to explain the pros and cons of each plan, and help you determine which plan aligns with your specific healthcare needs and budget.

Researching Medicare Advantage Insurance Agents Near Me

When searching for a Medicare Advantage plan insurance agent near you, it’s important to conduct thorough research to ensure you find a trustworthy professional. Here are some key steps to follow.

Checking for Licenses and Certifications

Checking for Licenses and Certifications

Start by checking if the agent is licensed to sell Medicare Advantage plans in your state. The agent should hold a valid insurance license and be authorized to sell Medicare products. You can verify their license status with your state’s insurance department or through the National Insurance Producer Registry (NIPR) website.

Local Department of Insurance Website

For Nebraska, you can go to the Nebraska Department of Insurance website. Once there, look at the tabs on the top of the page. Go to Policyholder. Under that tab, there is Agent/Company Search. Click Agent/Agency Search. Pick the state and choose the licensee. Type in the last name. You don’t need the agent number, but it helps, especially with common last names. There is your agent.

The importance of checking out an agent is you can quickly verify if he is licensed in your state. You can see how long he has held an insurance license. The date of the first activation will be there.

That may not be completely accurate, however. I noticed my activation date is 2012. I was first licensed in Nebraska in 2002, but I moved outside of Nebraska for a short time. My residence insurance license was not Nebraska, I was a non-residence licensed agent for Nebraska. Then, I returned in 2012 to Nebraska. So, the Nebraska Dept of Insurance site does not show the lifetime duration of a licensee.

Insurance Company Appointments

Toward the bottom of the page are the agent’s appointments. You must be licensed to sell insurance in a particular state. You must be licensed in each state you sell, and you must be appointed with each insurance company before you sell their products.

Medicare Certification

Insurance company appointments may require product training before you can be appointed. Sometimes you must pay a fee to be appointed. Insurance companies that offer Medicare Advantage plans require the agent to pass the AHIP exam. You only get three tries to pass the exam. If you fail the 3rd try, you cannot sell any Medicare Advantage plans or Part D prescription drug plans for any insurance company in any state.

After you pass the AHIP, you submit the certification to the insurance company. Then, you must pass the individual product training for each Medicare product you wish to sell. Again, there is a limited amount of time you can take the test to pass.

Then, the appointment paperwork is completed. Your appointment is listed on your state insurance department’s website. If not appointed, the agent cannot sell that company and/or product.

I recall meeting with a couple once whose financial advisor said he could get them any plan they wanted, including Medicare Advantage. I was suspicious because most financial advisors who offer financial advice as their primary business generally do not get deeply involved in Medicare. When I looked them up on the Nebraska Dept of Insurance, they were not appointed with any of the Medicare Advantage carriers in the area.

Reading Reviews & Testimonials

Online reviews and testimonials can provide valuable insights into the quality of service provided by the Medicare Advantage insurance agents near you.

I do not like to shop, so I use Amazon for a lot of my shopping. Once I know what I want, I look at star ratings and reviews. More and better reviews, the higher the chance I click on that product.

Look for reviews on reputable websites, such as Google, Facebook, or the Better Business Bureau. Pay attention to overall ratings, as well as specific feedback regarding the agent’s knowledge, responsiveness, and ability to help clients find suitable Medicare Advantage plans.

It’s important to note that while reviews can be helpful, they should be considered along with other factors. Negative reviews may not always reflect the agent’s true capabilities, as individual experiences can vary. Use reviews as a starting point for further investigation and gathering more information about the agent.

Referrals from Friends and Family

Reach out to friends, family members, or colleagues who have experience with Medicare Advantage plans. Ask them if they have worked with a trustworthy insurance agent and if they would recommend their services. Personal recommendations can be invaluable, as they come from people you trust who have first-hand experience with the agent’s professionalism and expertise.

Keep in mind that everyone’s healthcare needs are different, so while a certain agent may have been a great fit for someone you know, it doesn’t guarantee the same experience for you. Still, personal recommendations can help you narrow down your options and consider agents who have a proven track record of delivering excellent service.

Most of my new clients come from client referrals. The difference between referrals and prospects who come to us through other marketing avenues is usually night and day.

The trust level is already there because a trusted friend or family member referred them. The prospect starts learning about Medicare and the insurance products right from the start because they trust us. While we still work on building repertoire, there is enough trust present so they are listening attentively and learning what they need to know from the beginning. They can make much better decisions about their Medicare.

Meeting with a Medicare Advantage Insurance Agents Near Me

Meeting with a Medicare Advantage Insurance Agents Near Me

Once you have identified a few potential Medicare Advantage insurance agents near you, it’s time to schedule consultations to further assess their suitability. Meeting face-to-face or having a phone conversation allows you to gauge their expertise, ask important questions, and evaluate their communication skills. Trust is built not only upon believing the person has your best interest at heart. Trust is also built on competence. Does he know what he’s talking about?

During the meeting, pay attention to the agent’s ability to explain complex concepts clearly and understandably. They should be patient, attentive, and willing to address your concerns. Consider their level of professionalism, as well as their ability to listen and tailor their recommendations to your unique needs.

Do they show you the universe of Medicare Supplements, Medicare Advantage plans, and Medicare Part D Prescription Drug plans in your area? Or do they go immediately to only one or two companies? Or do they only do Medicare Advantage or only offer Medicare Supplements?

You want an independent agent or broker who represents most companies and plans in your areas and can objectively and impartially present all your Medicare options. Then, he can take you through the process of matching the various plans and their benefits to your unique needs and concerns. One size does not fit all.

Questions to Ask a Medicare Advantage Insurance Agent

To ensure you make an informed decision, it’s essential to ask the right questions during your meetings with potential insurance agents. Here are some basic questions to consider:

- Can you explain the different types of Medicare Advantage plans available in my area?

- How do these plans differ in terms of cost, coverage, and network of providers?

- What additional benefits can I expect from the Medicare Advantage plans you recommend?

- How do I know if my preferred doctors and hospitals are included in the plan’s network?

- What prescription drug coverage options are available?

- Can you provide an estimate of the monthly premiums, deductibles, and out-of-pocket costs for the plans you recommend?

- How do I qualify for extra help with Medicare costs, such as the Low-Income Subsidy?

Asking these questions will help you gain a better understanding of the agent’s knowledge, expertise, and ability to find a plan that meets your healthcare and financial needs.

Comparing Quotes and Plans

After meeting with several insurance agents and gathering information, it’s time to compare the quotes and coverage options they have provided. Keep in mind that the lowest premium may not always be the best option, as it’s important to consider factors such as deductibles, copayments, and the network of providers.

After meeting with several insurance agents and gathering information, it’s time to compare the quotes and coverage options they have provided. Keep in mind that the lowest premium may not always be the best option, as it’s important to consider factors such as deductibles, copayments, and the network of providers.

Evaluate the coverage options based on your specific healthcare needs. Consider factors such as prescription drug coverage, access to specialists, and the availability of preferred hospitals or healthcare facilities. Consider the estimated out-of-pocket costs for each plan, including copayments, coinsurance, and deductibles.

Enrolling in a Medicare Advantage Plan with Your Local Agent

Once you have thoroughly researched and compared the different Medicare Advantage plans and insurance agents, you should have at least a couple of names to answer the questions: who’s the trustworthy Medicare Advantage plan insurance agent near me?

Contact the chosen agent and inform them of your decision. They will guide you through the enrollment process, ensuring that you understand the terms and conditions of the plan you have selected.

Remember to review all the relevant documents, including the Summary of Benefits and the plan’s provider directory. If you have any doubts or questions, don’t hesitate to reach out to your agent for clarification.

At Omaha Insurance Solutions, we have taken thousands of clients over the years through the process of understanding and selecting the Medicare plan that best fits their needs, and each year, we review that

Christopher Grimmond

plan to make sure it still meets their needs.

Give us a call at 402-614-3389 for a free, no-obligation consultation to find out your Medicare options.

Are you trying to navigate the complex world of Medicare but overwhelmed by the sheer number of options available? Enter the Medicare supplement quoting tool – your secret weapon to unlocking the power of Medicare. This article will explore how this innovative tool can help you get the most out of your Medicare coverage.

Are you trying to navigate the complex world of Medicare but overwhelmed by the sheer number of options available? Enter the Medicare supplement quoting tool – your secret weapon to unlocking the power of Medicare. This article will explore how this innovative tool can help you get the most out of your Medicare coverage.

A Medicare supplement quoting tool effortlessly compares plans, costs, and benefits from various insurance carriers. Instead of spending hours on research and guesswork, this user-friendly tool gives you a comprehensive overview of available options, helping you make informed decisions about your healthcare coverage.

Whether new to Medicare or looking to switch plans, this digital tool simplifies the process. It offers personalized quotes based on your specific needs and budget, allowing you to find the perfect Medicare supplement plan that suits you best.

Understanding Medicare and Medicare Supplements

Medicare is a federal health insurance program in the United States that primarily covers individuals aged 65 and older, as well as some younger individuals with certain disabilities. While Medicare provides essential coverage, it doesn’t cover all healthcare costs. There are big gaps in coverage. That’s where Medicare supplements, also known as Medigap plans, come in.

Medicare supplements are private insurance plans designed to fill the gaps in Medicare coverage. These plans help cover out-of-pocket expenses, such as deductibles, co-payments, and coinsurance. However, with numerous insurance carriers offering a wide range of Medigap plans, choosing the right one can be overwhelming.

The Importance of Comparing Medicare Supplement

Comparing Medicare supplement policies is crucial to ensure you get the coverage that best meets your needs and budget. Each plan offers different benefits, and the costs can vary significantly between carriers. Without a clear understanding of the available options, you may end up paying more for coverage that doesn’t align with your healthcare requirements.

Medicare supplement plans are standardized, meaning the benefits for each type of plan are the same across carriers. However, the prices can differ; some carriers may offer additional benefits or discounts. By comparing plans, you can identify the most cost-effective option that provides the coverage you need. Why pay more for the exact same coverage?

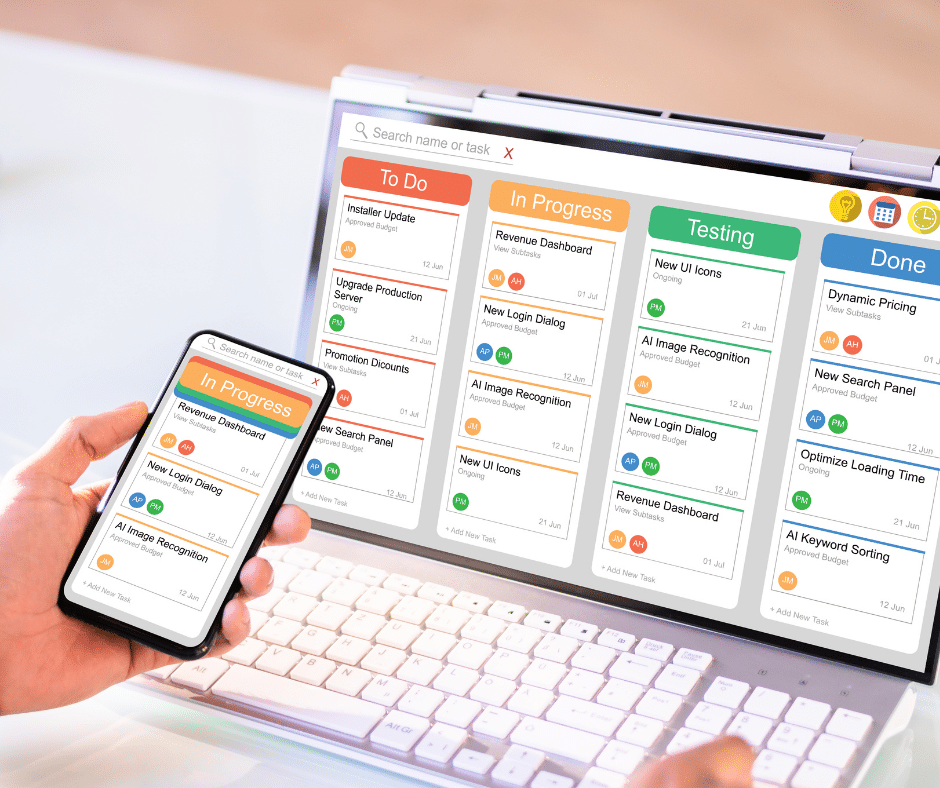

Introducing Medicare Supplement Quoting Tools

Medicare supplement quoting tools are online platforms that allow you to compare and evaluate different Medigap plans, costs, and benefits from various insurance carriers. These tools simplify the process of finding the right plan by providing you with personalized quotes based on your specific needs and budget.

Instead of manually researching and contacting multiple insurance carriers for quotes, Medicare supplement quoting tools streamline the entire process. With just a few clicks, you can access a wealth of information and make informed decisions about your healthcare coverage.

How Medicare Supplement Quoting Tools Work

Medicare supplement quoting tools draw their information from insurance companies’ filings with the state insurance commissioner. Each insurance company must file its policy with the commissioner, and the commissioner’s office must approve it. When changes are made to the policy, including price and premium changes, those changes must be updated with the commissioner’s office. All quoting software pulls from this one source.

Medicare supplement quoting tools draw their information from insurance companies’ filings with the state insurance commissioner. Each insurance company must file its policy with the commissioner, and the commissioner’s office must approve it. When changes are made to the policy, including price and premium changes, those changes must be updated with the commissioner’s office. All quoting software pulls from this one source.

Typically, you’ll need to input details such as your age, location, gender, and tobacco usage into the software. Some tools may have the ability to see underwriting guidelines. Usually, it is better to go to the actual insurance company website and their quoting software to get more detailed and accurate quotes. The multi-company software, however, enables you to narrow down the pool of likely policies, but it cannot get into the particulars of the company’s underwriting and application process. The individual insurance company website software can.

Once you’ve entered the necessary information, the quoting tool will analyze the data and present you with a list of Medigap plans available in your area. You can then compare the benefits, costs, and ratings of each plan side-by-side.

Market Insights

Depending on the sophistication of the software, the quoting instrument can get very granular. You can see age increase pricing, history of rate increases, and the number of policies by state and nation for each company. The loss ratio and percentage of market share may even be listed. This type of information will not be very helpful to most people because it is unfamiliar. A professional who understands the data and is trained to interpret it accurately will need to provide context.

This information and insight allow you to evaluate your options and choose the plan that offers the best combination of coverage and affordability.

The more important consideration is the future increases. As you age, the cost of a Medicare Supplement goes up. There are rate increases because medical costs go up. The number and size of claims ultimately determine how much the insurance company increases the premium to offset expenses. That is all in the future and hard, if not impossible, to predict. The information from the Medicare Supplement quoting software does give some insight, but does not predict the future.

Access to Medicare Supplement Quoting Tool

Computer software is usually not free. The Medicare Supplement software we are talking about is not cheap. Most people will not pay the price to have access to the software to do one or two quotes. You usually get access to the software through an insurance agent. Most independent insurance agents or brokers who offer many different companies use quoting tools. At Omaha Insurance Solutions, we use the CSG Actuarial software.

two quotes. You usually get access to the software through an insurance agent. Most independent insurance agents or brokers who offer many different companies use quoting tools. At Omaha Insurance Solutions, we use the CSG Actuarial software.

I attended a Medicare Supplement conference over a decade ago in Florida. In the main hall, where all the vendors gathered, I ran into CSG. I had been looking for a good Medicare Supplement quoting software. In the course of the conversation, I found out a number of the owners and employees were from Mutual of Omaha. Then I asked where the company was located–Omaha, Nebraska. I had to fly to Florida to find software that was in my own backyard.

While there are other quoting tools out there, CGS is the industry standard and widely used. I have found them superb.

For those who do not work with an experienced insurance professional, you can get access to a quoting tool on your MyMedicare.gov personal account. Inside the account, you can run your own quotes. The tool is very rudimentary, but it certainly gives you prices and can narrow down the number of companies you may wish to consider.

Benefits of Using a Medicare Supplement Quoting Tool

Using a Medicare supplement quoting tool offers several benefits.

Time-Saving

Instead of manually researching and contacting insurance carriers, the quoting tool provides instant access to personalized quotes from multiple providers. In Nebraska and Iowa, there are over 40 insurance companies offering more than 300 Medicare Supplements. That’s a lot to sort through. The software does it in an instant.

Comprehensive Overview

The tool presents you with a comprehensive overview of available Medigap plans, allowing you to compare benefits, costs, and ratings in one place. Reseaching a company and policy would take hours. With the tool, the information is at your finger tips.

Informed Decisions

By having all the necessary information at your fingertips, you can make informed decisions about your healthcare coverage, ensuring you choose the plan that best suits your needs and within your budget. I find so many people who over pay for the same coverage because they did not effectively shop.

Cost-Effective

Medicare supplement quoting tools help you identify the most cost-effective plan by comparing prices from different insurance carriers side-by-side.

Factors to Consider When Using a Medicare Supplement Quoting Tool

While Medicare supplement quoting tools can simplify the process of finding the right plan, there are a few factors to consider.

Accuracy of Quotes

Accuracy of Quotes

While the tool provides personalized quotes, the actual premiums may vary based on additional factors such as your health conditions or the insurance carrier’s underwriting guidelines.

On rare occasions, the quoting software is different from the company website. The new prices may not be reflected immediately. The software has the potential to show the different underwriting classes, but you will not know the client’s underwriting class until you make the application and it is confirmed by the insurance carrier. The agent always needs to let the client know that she could be denied or rated. Most agents initially show the lowest rate, which is preferred.

The only way to guarantee the best rating is during a person’s initial enrollment into Medicare. After that, they are subject to underwriting.

A few years ago, I ran a quote for a lady. I only showed the preferred health category. It was an awesome price compared to what she was paying on her current Medicare Supplement. When we started the application process, however, she was subject to the insurance company’s underwriting guidelines. She was not tall enough for her size. Consequently, she went from a preferred rating to a standard rating. The Medigap price went up, but the price was still significantly less than what she was currently paying. She asked why the price was higher than what I initially quoted. I explained it was because of her weight. She was so offended that she would not consider switching to the lower-cost supplement even though it would have saved her $700 a year.

Coverage Options

The quoting tool may not include all available Medigap plans in your area. It’s essential to research and verify the options presented by the tool to ensure you have a comprehensive understanding of the available plans.

Some agents may not show all of the companies and policies in your area. They may not write a particular carrier for various reasons. They could be prohibited from writing a company. The agent may consider the company to be inferior, so they exclude it from the list. The agent, or agency, may have a sweetheart deal with a handful of companies. Those are the only ones they show.

Additional Benefits

Some insurance carriers may offer additional benefits or discounts not included in the quoting tool. It’s worth exploring the carrier’s website or contacting them directly to learn more about their offerings. A couple of Medicare Supplements offer a free gym membership. Almost all have in-house discount programs. But I would say it is rare they offer anything more of substance without additional premium.

Knowing Data Is Different Than Understanding Data

Many people will look at a spreadsheet of Medicare supplement prices and think they understand what it means. They may even have very detailed information on the company and its policies. Someone could have told them what the terms and categories all mean. Why is it that with all the data and the Ivy League-educated analysis, stock pickers still get it wrong and lose money in the market?

Knowing information is not the same as understanding what the data means. I’ve watched the Medicare Supplement landscape for over a decade. It shifts like the sands of the desert. Tools are helpful, but there is a lot that goes into interpreting the data. And none of it guarantees the future. Personal experience as an agent with thousands of clients and years in the industry helps me understand the Medicare Supplement universe. A company’s track record gives the best idea, as long as the CEO or ownership doesn’t change, but at best, choosing a Medicare Supplement, even with sophisticated instruments, is an educated guess.

Bottom Line: Use The Tools to Improve Your Odds

The Medicare Supplement quoting tools more quickly and easily enable you to accurately evaluate many Medicare Supplements in your area. The side-by-side comparisons reduce the chance of overlooking a policy or making a mistake trying to recall a price. The tools sift and narrow down your choices, but they don’t make the choice. The tools do not predict future premiums or guarantee success.

The exercise of running a Medicare Supplement quote will improve your chances of picking a good plan. An experienced and trustworthy insurance professional will increase your

Christopher J. Grimmond

odds of success even more.

Give us a call at 402-614-3389 for a free consultation with a licensed insurance agent professional about your Medicare Supplement plan.

Why Do You Need a Medicare Agent?

Why Do You Need a Medicare Agent?

Many who turn 65 realize why they need a licensed Medicare insurance agent specializing in Medicare planning. Insurance companies and insurance agents inundated you with letters, postcards, brochures, booklets, and phone calls. You need to contact the FBI for witness protection to avoid the bombardment you get from all the phone calls.

Anyone going through the experience of turning 65 and going on Medicare knows the anxiety, confusion, and overwhelming nature of the situation. There are all these insurance companies and hundreds of Medicare plans. Add in your unique mix of medications and personal health requirements. Include the foreign language called Medicare, and your head is spinning with all the stuff.

It would be best if you had someone, but whom do you trust. You turn to friends and relatives for advice. Their information is confusing and contradictory. Friends and relatives may be trustworthy, but do they really know what they are talking about?

You may hear horror stories from others–-whether real, imagined, or exaggerated–-about going on Medicare. How do you avoid the mistakes others have made?

You Need Someone Knowledgeable You Can Trust

You need an honest, knowledgeable, and experienced licensed Medicare insurance agent who does Medicare planning. His task is to educate you on Medicare, explain the various plans, and guide you through the process of enrolling in Medicare, searching for a plan, and implimenting that plan. And, after you are on Medicare, he needs to monitor your situation so that he can respond to any issues or changes in your circumstances. Things are always changing including with Medicare.

You need an honest, knowledgeable, and experienced licensed Medicare insurance agent who does Medicare planning. His task is to educate you on Medicare, explain the various plans, and guide you through the process of enrolling in Medicare, searching for a plan, and implimenting that plan. And, after you are on Medicare, he needs to monitor your situation so that he can respond to any issues or changes in your circumstances. Things are always changing including with Medicare.

What Does a Real Independent Licensed Medicare Insurance Agent Do?

A real independent, licensed Medicare insurance agent, knows what to do. He has more knowledge than what is gained from just passing the state insurance licensing exam. Experienced agents work with Medicare, insurance companies, and clients. They get constant feedback on what is working or not. Licensed agents know the process of enrolling in Medicare and enrolling in a Medicare plan. He knows all this information because he is licensed, certified, trained, and experienced.

Which surgeon would you like operating on you? A surgeon who just passed his state licensing exam or one who has practiced for a decade with thousands of surgeries under his belt? Experience, experience, and more experience. With any professional, you hope he has worked out all his mistakes on someone else.

Insurance Agent Problems

The barrier to entry into the insurance business is shallow. You only need to pass the state license exam. Consequently, hundreds of people are getting into the Medicare insurance business, particularly in the Omaha Metro area, each year.

They know very little about insurance, Medicare, and insurance plans. The newbie agents often reflect the prejudices and biases of insurance companies that recruited them. These newbies do not know what they don’t know. They don’t know they are pawns and being used. They see an opportunity to make “big, easy money.” That is how the recruiters present the job. So most newbie agents fail and quit pretty quickly because there is no “big, easy money.”

Should I Use A Medicare Broker?

An experienced, independent, licensed Medicare agent can teach you about Medicare. He can make the Medicare & You Handbook make sense.

An experienced, independent, licensed Medicare agent can teach you about Medicare. He can make the Medicare & You Handbook make sense.

If he is independent, he is a broker. He can show you many Medigap plans and Medicare Advantage plans. He is not restricted to one company. There are no restrictions on the product he can present. Brokers are like grocery stores full of products. He can explain Medicare Supplements (Medigap) policies A thru N. He shows the pricing of all the major and minor supplements. An experienced agent should know the history of the companies he offers and how they have done business over the years.

In the Omaha, Lincoln, and Council Bluffs Metro area, over 30+ insurance companies offer over 300+ Medicare Supplement, 7 insurance companies offer 26 Medicare Advantage plans, and 10 insurance companies offer 22 Medicare Part D prescription drug plans. It sounds overwhelming, but we have a simple, logical process that narrows your selection down quickly.

offer 22 Medicare Part D prescription drug plans. It sounds overwhelming, but we have a simple, logical process that narrows your selection down quickly.

An independent licensed Medicare agent can explain Medicare Advantage/Part C without prejudice, talking about the pros and cons of Medicare Advantage, the various companies, and the particular plans, especially in relationship to Original Medicare and Medigap policies.

An independent licensed Medicare agent can go through your list of prescription medications and show you which plans are better because of coverage, price, and rating.

This process is not full proof assuming you find such an agent because consumers still make bad choices, hear what they want, or forget what they signed up for.

What Does A Licensed Medicare Agent Do?

What Does A Licensed Medicare Agent Do?

A licensed Medicare agent should have a repeatable process he takes you through. He should educate you on Medicare. Without an understanding of Medicare, nothing makes sense.

Second, he should explain how the insurance products work with Medicare to complete or augment Medicare’s health coverage. After listening to your story, he then matches the insurance product to your unique needs.

The process of choosing a Medicare plan is not perfect because circumstances change. Unexpected things happen, but you have the assurance you made the best decision at that time.

What Is The Difference Between A Medicare Agent and Medicare Broker?

A broker or an independent licensed Medicare agent generally means they can offer several companies. Some agents are captive. They can offer only one or two companies because of their contractual obligation.

obligation.

I’ve found some agents in the Omaha area misrepresent themselves. They tell prospective clients they are independent when they are not. How could you know she is a captive agent?

The simplest way to check is to go to the Nebraska or Iowa Department of Insurance website–any state insurance department. There will be a tab for Agent and Agency search. Type in the agent’s name. You will see all the information you need. The insurance department lists the agent’s insurance company appointments, in other words, who they can sell. If there are only one or two companies, they are not brokers.

How Are Licensed Medicare Agents Paid?

How Are Licensed Medicare Agents Paid?

The insurance companies pay the agents when they enroll you in a plan. If the agent is selling a Medicare Supplement, he is paid a percentage of the monthly premium. If he sells a Medicare Advantage plan, the commission is a flat payment that Medicare determines. The commission is the same amount among all the insurance companies in that state. With Medicare Advantage plans, the first-year Medicare Advantage commission is more than the if the person had already been on Medicare for a year or more.

Going Agent-Less Gains You Nothing

People have asked me if they would save money going directly to the insurance carrier. No. The price is exactly the same. The difference is that you do not have an agent. You have the 800-number of the insurance company. When you call the company with questions, you will speak with a different person every time. You will probably get different answers depending on the person you speak with.

When you have problems with the supplement or advantage plan, I can guarantee you that the insurance company will not tell you to go to another insurance company.

Since we are brokers, our only concern is the well-being and happiness of our clients, so if the problem cannot be resolved, there are always other companies that will take your business.

Are Medicare Advisors Free?

Are Medicare Advisors Free?

Medicare insurance agents do not cost you anything. Their compensation is the commission they receive from enrolling you in the Medicare Supplement or Medicare Advantage plan. You need not pay anything in addition. As a matter of fact, the insurance company pays the agent for the clients they retain.

The idea behind the commission renewal is that the agent will continue to service you. Unfortunately, it does not seem to work that way. Many people referred to me who are already on Medicare have no idea who their agent is. I cannot say how often someone comes to me for help with their Medicare plan. Clients refer their friends and relatives. I always ask who their agent is. ‘What’s that?’ Of course, some agents are out of the business. That is the main reason, but others are still licensed and receiving renewals. They just don’t do anything because they’re lazy.

Good Medicare Insurance Agents Stay in Touch

We actively engage clients because we want to serve you. And we want more of you. We want you to refer your family and friends to us! So we call, email, and send letters, especially during the Annual Election Period (AEP) October 15th–December 7th. I also like to call on birthdays because the price is likely to increase if you are on a Medicare Supplement. I want to check if a less expensive supplement may be available with the same coverage.

We actively engage clients because we want to serve you. And we want more of you. We want you to refer your family and friends to us! So we call, email, and send letters, especially during the Annual Election Period (AEP) October 15th–December 7th. I also like to call on birthdays because the price is likely to increase if you are on a Medicare Supplement. I want to check if a less expensive supplement may be available with the same coverage.

Some people are do-it-yourself-ers. I understand that, but I think it is a mistake. There is so much to consider regarding Medicare health insurance that an amateur will do an amateur job. That being said, some agents are amateurs too.

Conclusion

Christopher Grimmond

A genuinely independent, experienced, licensed Medicare insurance agent will educate you on Medicare, show you all the available plans, and help match that plan to your unique needs at that time at no cost to you. He will be there for you over the years as your needs and circumstances change. That is why you want an experienced, independent, licensed Medicare insurance agent taking care of you.

Give us a call at 402-614-3389, so we can take care of you.