MedigapCategory:

Are you trying to navigate the complex world of Medicare but overwhelmed by the sheer number of options available? Enter the Medicare supplement quoting tool – your secret weapon to unlocking the power of Medicare. This article will explore how this innovative tool can help you get the most out of your Medicare coverage.

Are you trying to navigate the complex world of Medicare but overwhelmed by the sheer number of options available? Enter the Medicare supplement quoting tool – your secret weapon to unlocking the power of Medicare. This article will explore how this innovative tool can help you get the most out of your Medicare coverage.

A Medicare supplement quoting tool effortlessly compares plans, costs, and benefits from various insurance carriers. Instead of spending hours on research and guesswork, this user-friendly tool gives you a comprehensive overview of available options, helping you make informed decisions about your healthcare coverage.

Whether new to Medicare or looking to switch plans, this digital tool simplifies the process. It offers personalized quotes based on your specific needs and budget, allowing you to find the perfect Medicare supplement plan that suits you best.

Understanding Medicare and Medicare Supplements

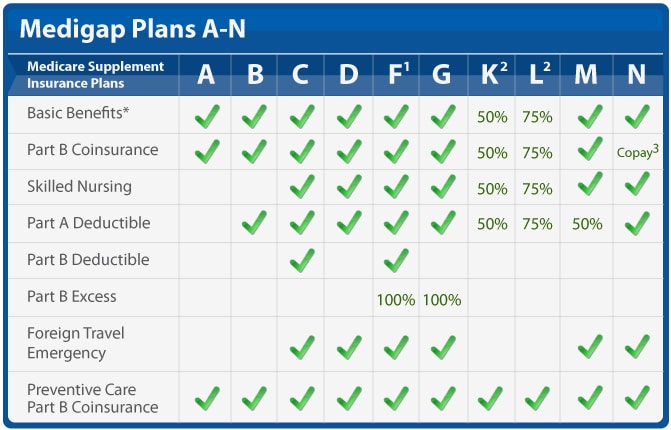

Medicare is a federal health insurance program in the United States that primarily covers individuals aged 65 and older, as well as some younger individuals with certain disabilities. While Medicare provides essential coverage, it doesn’t cover all healthcare costs. There are big gaps in coverage. That’s where Medicare supplements, also known as Medigap plans, come in.

Medicare supplements are private insurance plans designed to fill the gaps in Medicare coverage. These plans help cover out-of-pocket expenses, such as deductibles, co-payments, and coinsurance. However, with numerous insurance carriers offering a wide range of Medigap plans, choosing the right one can be overwhelming.

The Importance of Comparing Medicare Supplement

Comparing Medicare supplement policies is crucial to ensure you get the coverage that best meets your needs and budget. Each plan offers different benefits, and the costs can vary significantly between carriers. Without a clear understanding of the available options, you may end up paying more for coverage that doesn’t align with your healthcare requirements.

Medicare supplement plans are standardized, meaning the benefits for each type of plan are the same across carriers. However, the prices can differ; some carriers may offer additional benefits or discounts. By comparing plans, you can identify the most cost-effective option that provides the coverage you need. Why pay more for the exact same coverage?

Introducing Medicare Supplement Quoting Tools

Medicare supplement quoting tools are online platforms that allow you to compare and evaluate different Medigap plans, costs, and benefits from various insurance carriers. These tools simplify the process of finding the right plan by providing you with personalized quotes based on your specific needs and budget.

Instead of manually researching and contacting multiple insurance carriers for quotes, Medicare supplement quoting tools streamline the entire process. With just a few clicks, you can access a wealth of information and make informed decisions about your healthcare coverage.

How Medicare Supplement Quoting Tools Work

Medicare supplement quoting tools draw their information from insurance companies’ filings with the state insurance commissioner. Each insurance company must file its policy with the commissioner, and the commissioner’s office must approve it. When changes are made to the policy, including price and premium changes, those changes must be updated with the commissioner’s office. All quoting software pulls from this one source.

Medicare supplement quoting tools draw their information from insurance companies’ filings with the state insurance commissioner. Each insurance company must file its policy with the commissioner, and the commissioner’s office must approve it. When changes are made to the policy, including price and premium changes, those changes must be updated with the commissioner’s office. All quoting software pulls from this one source.

Typically, you’ll need to input details such as your age, location, gender, and tobacco usage into the software. Some tools may have the ability to see underwriting guidelines. Usually, it is better to go to the actual insurance company website and their quoting software to get more detailed and accurate quotes. The multi-company software, however, enables you to narrow down the pool of likely policies, but it cannot get into the particulars of the company’s underwriting and application process. The individual insurance company website software can.

Once you’ve entered the necessary information, the quoting tool will analyze the data and present you with a list of Medigap plans available in your area. You can then compare the benefits, costs, and ratings of each plan side-by-side.

Market Insights

Depending on the sophistication of the software, the quoting instrument can get very granular. You can see age increase pricing, history of rate increases, and the number of policies by state and nation for each company. The loss ratio and percentage of market share may even be listed. This type of information will not be very helpful to most people because it is unfamiliar. A professional who understands the data and is trained to interpret it accurately will need to provide context.

This information and insight allow you to evaluate your options and choose the plan that offers the best combination of coverage and affordability.

The more important consideration is the future increases. As you age, the cost of a Medicare Supplement goes up. There are rate increases because medical costs go up. The number and size of claims ultimately determine how much the insurance company increases the premium to offset expenses. That is all in the future and hard, if not impossible, to predict. The information from the Medicare Supplement quoting software does give some insight, but does not predict the future.

Access to Medicare Supplement Quoting Tool

Computer software is usually not free. The Medicare Supplement software we are talking about is not cheap. Most people will not pay the price to have access to the software to do one or two quotes. You usually get access to the software through an insurance agent. Most independent insurance agents or brokers who offer many different companies use quoting tools. At Omaha Insurance Solutions, we use the CSG Actuarial software.

two quotes. You usually get access to the software through an insurance agent. Most independent insurance agents or brokers who offer many different companies use quoting tools. At Omaha Insurance Solutions, we use the CSG Actuarial software.

I attended a Medicare Supplement conference over a decade ago in Florida. In the main hall, where all the vendors gathered, I ran into CSG. I had been looking for a good Medicare Supplement quoting software. In the course of the conversation, I found out a number of the owners and employees were from Mutual of Omaha. Then I asked where the company was located–Omaha, Nebraska. I had to fly to Florida to find software that was in my own backyard.

While there are other quoting tools out there, CGS is the industry standard and widely used. I have found them superb.

For those who do not work with an experienced insurance professional, you can get access to a quoting tool on your MyMedicare.gov personal account. Inside the account, you can run your own quotes. The tool is very rudimentary, but it certainly gives you prices and can narrow down the number of companies you may wish to consider.

Benefits of Using a Medicare Supplement Quoting Tool

Using a Medicare supplement quoting tool offers several benefits.

Time-Saving

Instead of manually researching and contacting insurance carriers, the quoting tool provides instant access to personalized quotes from multiple providers. In Nebraska and Iowa, there are over 40 insurance companies offering more than 300 Medicare Supplements. That’s a lot to sort through. The software does it in an instant.

Comprehensive Overview

The tool presents you with a comprehensive overview of available Medigap plans, allowing you to compare benefits, costs, and ratings in one place. Reseaching a company and policy would take hours. With the tool, the information is at your finger tips.

Informed Decisions

By having all the necessary information at your fingertips, you can make informed decisions about your healthcare coverage, ensuring you choose the plan that best suits your needs and within your budget. I find so many people who over pay for the same coverage because they did not effectively shop.

Cost-Effective

Medicare supplement quoting tools help you identify the most cost-effective plan by comparing prices from different insurance carriers side-by-side.

Factors to Consider When Using a Medicare Supplement Quoting Tool

While Medicare supplement quoting tools can simplify the process of finding the right plan, there are a few factors to consider.

Accuracy of Quotes

Accuracy of Quotes

While the tool provides personalized quotes, the actual premiums may vary based on additional factors such as your health conditions or the insurance carrier’s underwriting guidelines.

On rare occasions, the quoting software is different from the company website. The new prices may not be reflected immediately. The software has the potential to show the different underwriting classes, but you will not know the client’s underwriting class until you make the application and it is confirmed by the insurance carrier. The agent always needs to let the client know that she could be denied or rated. Most agents initially show the lowest rate, which is preferred.

The only way to guarantee the best rating is during a person’s initial enrollment into Medicare. After that, they are subject to underwriting.

A few years ago, I ran a quote for a lady. I only showed the preferred health category. It was an awesome price compared to what she was paying on her current Medicare Supplement. When we started the application process, however, she was subject to the insurance company’s underwriting guidelines. She was not tall enough for her size. Consequently, she went from a preferred rating to a standard rating. The Medigap price went up, but the price was still significantly less than what she was currently paying. She asked why the price was higher than what I initially quoted. I explained it was because of her weight. She was so offended that she would not consider switching to the lower-cost supplement even though it would have saved her $700 a year.

Coverage Options

The quoting tool may not include all available Medigap plans in your area. It’s essential to research and verify the options presented by the tool to ensure you have a comprehensive understanding of the available plans.

Some agents may not show all of the companies and policies in your area. They may not write a particular carrier for various reasons. They could be prohibited from writing a company. The agent may consider the company to be inferior, so they exclude it from the list. The agent, or agency, may have a sweetheart deal with a handful of companies. Those are the only ones they show.

Additional Benefits

Some insurance carriers may offer additional benefits or discounts not included in the quoting tool. It’s worth exploring the carrier’s website or contacting them directly to learn more about their offerings. A couple of Medicare Supplements offer a free gym membership. Almost all have in-house discount programs. But I would say it is rare they offer anything more of substance without additional premium.

Knowing Data Is Different Than Understanding Data

Many people will look at a spreadsheet of Medicare supplement prices and think they understand what it means. They may even have very detailed information on the company and its policies. Someone could have told them what the terms and categories all mean. Why is it that with all the data and the Ivy League-educated analysis, stock pickers still get it wrong and lose money in the market?

Knowing information is not the same as understanding what the data means. I’ve watched the Medicare Supplement landscape for over a decade. It shifts like the sands of the desert. Tools are helpful, but there is a lot that goes into interpreting the data. And none of it guarantees the future. Personal experience as an agent with thousands of clients and years in the industry helps me understand the Medicare Supplement universe. A company’s track record gives the best idea, as long as the CEO or ownership doesn’t change, but at best, choosing a Medicare Supplement, even with sophisticated instruments, is an educated guess.

Bottom Line: Use The Tools to Improve Your Odds

The Medicare Supplement quoting tools more quickly and easily enable you to accurately evaluate many Medicare Supplements in your area. The side-by-side comparisons reduce the chance of overlooking a policy or making a mistake trying to recall a price. The tools sift and narrow down your choices, but they don’t make the choice. The tools do not predict future premiums or guarantee success.

The exercise of running a Medicare Supplement quote will improve your chances of picking a good plan. An experienced and trustworthy insurance professional will increase your

Christopher J. Grimmond

odds of success even more.

Give us a call at 402-614-3389 for a free consultation with a licensed insurance agent professional about your Medicare Supplement plan.

Are you ready to dive into the intricate world of Medicare Supplements? If you’re exploring your options, you’ve probably come across Medicare Supplement Plan N and Plan G. While both plans offer comprehensive coverage, what are the differences between Medicare Plan N vs Plan G?

Supplement Plan N and Plan G. While both plans offer comprehensive coverage, what are the differences between Medicare Plan N vs Plan G?

In this essential guide, we’ll take a closer look at Medigap Plan N and Plan G to help you determine the right fit for your healthcare needs. From coverage details to cost considerations, we’ll cover all the essential aspects to make your decision-making process easier.

Whether you’re new to Medicare or considering switching from your current plan, this guide will provide valuable insights. By the end, you’ll clearly understand each plan’s benefits and potential drawbacks, empowering you to choose the best option for your unique circumstances.

So, grab a cup of coffee, sit back, and let’s explore the intricacies of Medicare Plan N vs Plan G. Aren’t you curious to find out which plan will provide the best coverage for you?

Overview of Medicare Plan N

Overview of Medicare Plan N

Medicare Plan N is a popular choice for individuals who want comprehensive coverage at a more affordable price. Plan N, like Plan G and the other plans, cover virtually everything. Medicare is the most comprehensive health insurance out there. The key difference of Plan N is the cost-sharing structure, which requires you to pay a small copayment or coinsurance for certain services.

Like all Medicare supplement plans, you’ll be free to choose your own healthcare providers with plan N, as the plan doesn’t require you to select a primary care physician or obtain referrals for specialist visits. All physicians and health facilities that accept Medicare will also accept the supplement. This flexibility can be especially beneficial if you prefer to have control over your healthcare decisions.

While Plan N covers a significant portion of your healthcare expenses, it does come with some out-of-pocket costs. For example, you’ll be responsible for paying the Part B deductible and any excess charges that exceed the Medicare-approved amount. However, these costs are usually minimal compared to the plan’s overall coverage.

Medicare Plan N offers a comprehensive range of coverage and benefits.

Here is what is covered:

1. Part A Hospital Coverage: Plan N covers hospital stays, including room and board, nursing care, and other related services.

2. Part B Medical Coverage includes coverage for doctor visits, outpatient services, and preventive care.

3. Emergency Care: Plan N covers emergency room visits and urgent care services.

4. Skilled Nursing Facility Care: If you require skilled nursing care, Plan N covers the costs of this type of facility.

5. Hospice Care: Medicare Plan N includes coverage for hospice care, ensuring that you receive the necessary support during end-of-life care.

In addition to these core benefits, Plan N offers coverage for certain preventive services, such as annual wellness visits and vaccinations. This ensures that you can maintain your health and prevent potential illnesses.

Pros and Cons of Medicare Plan N

Like any healthcare plan, Medicare Plan N has its trade-offs. Here’s a closer look at the advantages and potential drawbacks.

1. Comprehensive Coverage: Plan N offers comprehensive coverage for a wide range of healthcare services, giving you peace of mind knowing that your medical expenses are covered.

2. Affordability: Compared to other Medicare plans, Plan N is often more affordable, making it an attractive option for individuals on a budget.

3. Freedom to Choose Providers: With Plan N, you can choose your own healthcare providers, ensuring you receive care from trusted professionals.

Trade-Offs of Medicare Plan N

1. Out-of-Pocket Costs: While Plan N covers significant healthcare expenses, you’ll still be responsible for out-of-pocket costs, such as the Part B deductible and excess charges.

2. Limited Coverage for Travel: If you frequently travel outside the United States, Plan N may not provide coverage for medical services obtained abroad.

3. Cost-Sharing Requirements: Plan N requires paying copayments or coinsurance for certain services, which can add up over time.

Overall, Medicare Plan N offers comprehensive coverage at an affordable price, making it a popular choice for many individuals. However, it’s essential to carefully consider your healthcare needs and budget before deciding.

Overview of Medicare Plan G

Overview of Medicare Plan G

Medicare Plan G is another option worth considering if you want comprehensive coverage with minimal out-of-pocket costs. This plan is similar to Plan N in terms of coverage, but it has a few key differences that may make it a better fit for certain individuals.

With Medicare Plan G, you have access to the same wide range of benefits, such as hospital stays, doctor visits, and preventive care. Like Plan N, Plan G also has a cost-sharing structure, which requires you to pay the Part B deductible, which is currently $226 annually.

Once the deductible is met, Plan G provides full coverage for Part B services. You pay nothing more. You do not pay the Part B Excess charges. There are no copays for doctor visits or emergency services.

Pros and Cons of Medicare Plan G

Like Medicare Plan N, Plan G has its own set of pros and cons. Here’s a closer look at what you can expect.

1. Comprehensive Coverage: Plan G offers comprehensive coverage for a wide range of healthcare services, giving you peace of mind knowing that your medical expenses are covered.

2. Minimal Out-of-Pocket Costs: Plan G provides complete coverage for Part B services once you meet the Part B deductible, leaving you minimal out-of-pocket costs.

3. Freedom to Choose Providers: With Plan G, you can choose your own healthcare providers, ensuring you receive care from trusted professionals.

Cons of Medicare Plan G

1. Part B Deductible: Plan G requires you to pay the Part B deductible out of pocket. However, once this deductible is met, your out-of-pocket costs are significantly reduced.

2. Potentially Higher Premiums: Plan G may have higher premiums compared to other Medicare plans. However, the comprehensive coverage and minimal out-of-pocket costs may outweigh the higher premium costs for many individuals.

3. Limited Coverage for Travel: Similar to Plan N, Plan G may not provide coverage for medical services obtained outside the United States.

When deciding between Medicare Plan N and Plan G, it’s important to consider your personal healthcare needs, budget, and preferences. Both plans offer comprehensive coverage, but the cost-sharing structure and coverage for the Part B deductible may be deciding factors for many individuals.

Key Differences between Medicare Plan N and Plan G

Key Differences between Medicare Plan N and Plan G

While Medicare Plan N and Plan G cover the same services, and both require you to pay the Part B deductible (currently $226), the other cost-sharing and the monthly premiums differ.

Here are factors to consider:

There is a noticeable difference in premium between Plan N and Plan G. Most of my clients are in the Omaha, Lincoln, and Council Bluffs Metro areas. Looking at the difference in premiums between Plan N and Plan G here, the price range is between $40 to $50 per month (or $460 to $600 per year) more for Plan G than Plan N for a 65-year-old.

The price range for a 75-year-old is $45 to $55 on average (or $540 to $660 per year) more, and an 85-year-old has a premium range of $60 to $80 per month (or $720 to $960) more for Plan G than Plan N.

These premium differences are for Medicare Supplements in the low range of supplements. For higher-priced Medigap policies, the range is even wider.

Why Is Medicare Plan G Premium More Than Plan N?

Depending on your age, you pay $540 to $960 more per year for a Plan G over a Plan N Medicare Supplement. Why?

There are a number of reasons.

- You don’t pay the $20 copay for doctor visits on Plan G. The plan pays the cost, and it is reflected in the premium.

- You don’t pay Part B Excess Charges on Plan G. The plan pays the cost, and it is reflected in the premium.

- You don’t pay the $50 copay for emergency room services on Plan G, and it is reflected in the premium.

- Plan G is the most popular Medigap Plan and the default guarantee issue plan.

How Should I Compare Medicare Plan N to Plan G?

Copays

Copays

How many times would you have to go to the doctor for Plan N to be more expensive than Plan G? The answer is to divide the $20 doctor copay into the annual price difference–$540 premium / $20 copay = 27 doctor visits. For a 65-year-old, you would need to go more than 27 times for Plan N to cost you more than Plan G. That is a lot of doctor visits! How many times do you go to the doctor each year normally? Once, twice, five times?

Medigap Plan N has an emergency room maximum copay of $50. You will probably not go to the emergency room regularly or for prolonged periods. If you go to the emergency room frequently, I guarantee it will NOT be for a prolonged period. We can eliminate the $50 emergency room copay as seriously impacting your total annual cost.

Medicare Part B Excess Charges

Most doctors who are contracted with Medicare do not charge the Part B Excess Change. Of the 2% of doctors who do, they are in mental health and podiatry.

You have control of these charges by asking the physician ahead of time if she takes assignment for Medicare. In other words, does she accept what Medicare bills and does not charge the excess?

Medicare Plan N vs Plan G Rate Increases

Healthcare costs go up. In our current inflationary environment, those increases will be substantial. The insurance companies cover increased costs with rate increases. Your monthly premium will go up in the near future, and if you wish to keep your policy, you must pay the increased cost.

In general, the rate of increase for Medigap Plan G is higher than for Plan N. The difference ranges from 1% to 4% over time and from state to state and company to company, but the rate increases are usually more for Plan G than Plan N, as a rule.

Medigap Plan G Is More Popular

Plan F is still the most popular, with 46% of Medigap policyholders enrolled in Plan F. However, that is quickly decreasing because beneficiaries who turn 65 after 2020 are no longer eligible to purchase Plan F.

Plan G is the most comprehensive Medigap plan because all health issues are paid for after the $226 Part B deductible is met. Like Plan F before, Plan G is the go-to plan for the majority, with 26% currently enrolled in Plan G versus Plan N at 10%.

Medigap Plan G Is Guarantee Issue

After someone’s Initial Enrollment into Medicare at age 65 or when they enroll in Medicare Part B, most people must go through underwriting to get Medicare Supplements. They must answer a series of health questions, and the insurance company can determine whether to accept them into the policy, accept them at a higher premium, or decline them.

There are a handful of exceptions to this rule. Insurance companies must guarantee to issue a Medigap policy when someone comes off a Medicare Advantage plan in their first year on the plan. The other most common instance is when a person has Medicare Part A and Part B, losing their group health plan. Then, they can get a Medigap plan without answering health questions, in other words, guaranteed issue.

The vital point about guaranteed-issued policies is that Plan G is the only plan eligible for the guaranteed issue. Insurance companies cannot screen guarantee issue applicants. They must take them no matter their health. Coupled with the fact that Plan G is now the most popular plan, Plan Gs have a disproportionately large number of unhealthy participants vs Plan N.

Consequently, the Medicare Plan G member pool has proportionally more medical claims than Plan N policies. The higher claims ratio increases the costs for Plan G vs Plan N. The higher costs result in high average annual rate increases between Medicare Plan G vs Plan N. Medicare Plan G rate increases average between 1% to 4% more each year. Over time, there is a significant difference in what a beneficiary pays for their Medigap Plan G vs Plan N.

Rate Increases Are Lower for Plan N

Rate Increases Are Lower for Plan N

For example, if a Medigap Plan G $150 premium at 65 increases by 4% on average for fifteen years, the premium will be $270 at 80. If a Medigap Plan N $110 premium at 65 increases by 2% on average for fifteen years, the premium will be $148 at 80.

The Medicare Plan N premiums are smaller than Plan G, but Plan G premiums more than double in the same time period because of the higher percentage increase and larger initial premium.

While the Plan N $20 doctor copays and the $50 emergency room fee are essential to remember, the smaller percentage increase in annual cost for a Plan N is the real underlying factor to weigh when deciding about your Medicare coverage. Plan G’s percentage increase, because of its popularity and guarantee issue status, ensures you will probably pay significantly more for Medicare Plan G than Plan N over time.

The Bottomline: Medicare Plan N vs Plan G

Choosing the right Medicare plan is crucial and can significantly impact your healthcare and financial well-being. Medicare Plan N and Plan G are excellent options for individuals seeking comprehensive coverage, but it’s important to understand their differences.

Choosing the right Medicare plan is crucial and can significantly impact your healthcare and financial well-being. Medicare Plan N and Plan G are excellent options for individuals seeking comprehensive coverage, but it’s important to understand their differences.

In this comprehensive guide, we’ve explored the coverage details, benefits, pros, and cons of Medicare Plan N vs Plan G. We’ve also discussed the key differences between the two plans and provided factors to consider when deciding.

By evaluating your healthcare needs, budget, and preferences, you can choose the Medicare plan that provides the best coverage for you. Whether you opt for Medicare Plan N vs Plan G, both plans offer comprehensive coverage and the peace of mind that comes with knowing your medical expenses are taken care of.

Medicare Plan G offers the convenience of comprehensive coverage. Once your small Part B deductible of $226 is met for the year, you don’t have to worry about any further out-of-pocket expenses for your health coverage. The tradeoff, however, is you pay for that convenience, especially over time in higher premiums and consistently higher rate increases that may strain your fixed budget as it is eroded more and more by inflation or other unplanned expenses.

Medicare Plan N gives you the same coverage, but you will be responsible for minimal doctor and emergency room copays. Those copays, while they may

Christopher J. Grimmond

seem to be a nuisance, keeping a lid on the rising cost of healthcare coverage. Your premium may be more palatable ten and fifteen years down the line.

Hopefully, you will be on Medicare for a long time. Weigh carefully the costs and tradeoffs over the next fifteen or more years.

We can help you sort through the confusion that is called Medicare and the seemingly endless number of Medicare Supplements and Medicare Plans at no cost to you. Call us at 402-614-3389 and speak with an experienced and licensed insurance agent professional.

Medicare has lots of rules and regulations. The insurance companies and the State Insurance Commissioners have even more laws. The Medicare supplement 30-day free look period is one of those rules.

Medicare Supplements are called Medigap policies because filling in the gaps is precisely what they do. They fill in the gaps in Original Medicare. Supplements fill in the Part A deductible and Part B coinsurance.

You pay a monthly premium for a Medicare Supplement, and as you age and medical costs increase, the private insurance companies that provide Medigap policies raise rates.

Some companies raise rates higher and faster than other insurance companies, so you may want to change policies. There are rules around changing Medigap policies, and knowing the regulations is essential, like the Medicare supplement free look period.

Medicare Open Enrollment Rules

People often think “Open Enrollment” or “Annual Election Period,” which is from October 15th—December 7th, is when you need to change your Medicare Supplement. You may change then, but it is not a particular time for that purpose. A person will still need to undergo health underwriting to qualify for the new supplement. Preexisting conditions may prevent the person from passing underwriting.

The Open Enrollment for Medicare Supplements is when you turn 65 and/or activate your Medicare Part B. During that period, you are exempt from answering health questions. The insurance company needs to offer you a supplement at the best possible rate no matter your health condition at the time.

The other time you can change Medicare Supplements is by filling out an application and answering the health questions. Most people pass underwriting, but not all. A recent heart attack, stroke, or bout with cancer is an example of why an insurance company would deny new coverage. There are other preexisting conditions that will disqualify an applicant. Of course, you can remain on your current supplement if you continue to pay premiums. Medigap policies are guaranteed renewable.

Medicare Supplement Free Look Period

When you change to a Medicare Supplement, you have a 30-day free look period. During that time, you can cancel the policy without any reason, and the insurance company must return your entire premium without question. If you have another Medicare Supplement, you may wish to continue paying the premium simultaneously. If you cancel the original plan, you may have to go through underwriting to reinstate it.

Medicare Free Look: No Fear

The free look period for a Medicare Supplement, like any insurance product, is to encourage the consumer to purchase because of less fear about changing one’s mind.

There are a few other instances when someone might change to a new Medicare Supplement, and the free look period would also apply in those instances.

Guaranteed issue is when someone is coming off an employer’s group health plan and already has Medicare Part A & B. You have 63 days to enroll in a Medicare Supplement without underwriting.

Another situation is enrolling in a Medicare Advantage plan for the first time. You have a 12-month window when you can change to a Medigap plan without underwriting.

Another rare situation is when an insurance company closes its Medicare Advantage plan in your service area. You are afforded a guaranteed issue opportunity for a Medicare Supplement.

Certain states have laws specific to them. You can change your Medicare Supplement on your birthday without underwriting (California, Oregon, Idaho, Nevada, Illinois, Louisiana), on your anniversary without underwriting (Missouri), and year-round without underwriting (New York, Connecticut, Massachusetts, and Washington). There is no such regulation in Nebraska or Iowa for Medicare Supplements.

Again with any of these transitions, the Medicare Supplement 30-day free look period applies.

Over the years, I have had clients change their minds at the last minute. To change with them, the Medicare Supplement, free look period, makes the process easier and less cumbersome.

You have 30 days to look. No fear.

When people compare Medicare with Medicare Advantage, they usually mean Medicare (Original Medicare) with a Medicare Supplement and a Medicare Part D prescription drug plan versus Medicare Advantage (Part C) with prescription drugs included.

The comparison is difficult because they are drastically different, so I believe a fair side-by-side comparison is impossible. That, however, does not stop people from asking the question of which is better, Medicare Advantage or Medicare Supplement.

Medicare Is Original Medicare: Part A & B

Original Medicare is Part A for hospitals, and Part B for doctor visits and outpatient procedures. Part A has a $1,600 per event deductible in 60 days without a cap. Part B is an 80/20 split. You pay the 20% coinsurance, and there is no limit on the 20%.

Original Medicare + Medicare Supplement

To fill in the gaps in Medicare, you may purchase a Medicare Supplement / Medigap policy. Depending on where you live and the company you choose, the monthly premium can range from $100 to $200 per month. You can fill in the gap entirely except for the first $226 with a Plan G. As you age past 65, the price of your Medicare Supplement will increase.

Sometimes, your supplement may increase by hundreds of dollars. I recently had someone referred to me who was paying over $300 for her Medigap Plan G policy. She was in her mid-70s. She passed through underwriting, so we switched her to another Medigap plan at half the cost. Some people, however, cannot pass underwriting and need to remain on their high and increased Medigap policy.

Medicare Supplement + Medicare Part D PDP

Part D prescriptions drug plan (PDP) is separate from your Medicare Supplement and a separate charge. Again, the premium can range from $10 to $100 per month, with different prices for your medication copays. The key to comparing Part D plans is the year’s total cost — monthly premium plus individual prescription copays.

Medicare Advantage Or Medicare Part C

Medicare Advantage (or Part C) is different. Private insurance companies take what Original Medicare does and has a maximum out-of-pocket cost cap. Original Medicare, remember, is unlimited.

Medicare Advantage breaks out each of the different services. For example, x-rays, outpatient surgeries, labs, emergency services, etc. The service is given small copays versus Original Medicare’s unlimited 20%. These minimal copays add up toward the maximum out-of-pocket (MOOP). Most years, you will not reach your maximum out-of-pocket. In most years, your out-of-pocket will be $500 or less.

Medicare Advantage Has a Maximum Out of Pocket

The maximum out-of-pocket (MOOP) nationally is currently $8,300. The Omaha, Lincoln, and Council Bluffs area average around $4,500 or less for the MOOP. Some of the plans’ MOOP is $3,900. Original Medicare does not cover your coinsurance or deductibles unless you make the additional purchase of a Medigap policy.

Most Medicare Advantage plans also include Part D prescription drug coverage. There is no separate charge. Most of the Medicare Advantage plans in our area are zero premium or are very low premium with prescriptions included. The prescription drug part of Medicare Advantage excludes the Part D deductible on most plans. The current Part D deductible on stand-alone prescription drug plans is $505.

The cost for Medicare Advantage with drug coverage is usually zero. Your only monthly cost is your Medicare Part B premium and possibly copays for the medications.

Over the years, Medicare Advantage copays have increased to reflect rising medical costs and inflation. The increase has been minimal, but that will change, I’m sure, in our current high-inflation atmosphere. The same will be valid for Original Medicare and Medicare Supplements.

Medicare Advantage Has Networks

Another difference that concerns people choosing between Medicare Supplement and Medicare Advantage is medical networks. This is a genuine concern in certain areas. In our Omaha, Lincoln, Council Bluffs metro area, there are principally three networks: CHI Health, Nebraska Medicine, & Methodists Health Systems. The Medicare Advantage plans in our area work with all three networks. It is a non-issue. In other places, the network system may be something to be aware of.

All the Medicare Advantage companies offer PPO (Preferred Provider Organization) options. You can go out of network to someone who accepts Medicare. You may pay more and have a larger MOOP, but there is that option. You are not confined exclusively to the plan network.

Also, many of the larger insurance companies offer national networks, so even within their HMO (Health Maintenance Organization) system, you may still be able to see doctors and hospitals outside your local service area and pay in-network copays.

Medicare Advantage Prior Authorization vs Original Medicare & Supplement

The other difference between Original Medicare / Medicare Supplement and Medicare Advantage is preapproval. Original Medicare does not require prior authorization for most procedures and services. Medicare Advantage is the reverse. This is an unusual concern because, during all your working years, your insurance companies required prior authorization for any services of any cost or significance.

With Medicare Advantage, there is really no change. Those who do not favor Medicare Advantage put this out as a deficiency in the program. In my experience and statistically speaking, most denials in the big picture are overturned. The national average for Medicare Advantage denials is 4 percent. Those denials are usually attributed to a lack of explanation and documentation on the provider’s part. The fix is usually an easy and quick remedy when the effort is put in to correct the error.

How Much Risk Do You Want to Carry?

Original Medicare with a Medigap policy and Part D prescription drug plan is the most comprehensive Medicare insurance. You have reduced risk to the lowest level. The trade-off is you pay an ever-increasing premium for the convenience of not paying copays or an expensive year when you require many medical services.

Medicare Advantage saves you a monthly premium upfront, but you will pay copays as services are required. You may even reach your maximum out-of-pocket during a challenging year. That is the trade-off.

Networks are something to consider with Medicare Advantage. That consideration should be based on a case-by-case basis, depending on your location. But with national networks and PPO plans, the network issue is not the issue it was a few years ago.

How much risk do you wish to assume, and how much do you want to budget toward healthcare? The answer to those questions is the solution to which is better Medicare Advantage vs. Medicare Supplements.

Medicare Modernization Caused Medicare Confusion

Medicare Modernization Caused Medicare Confusion

After Congress created Medicare and President Lyndon Johnson signed the Medicare program into law, insurance companies began designing and offering health plans to fill in the gaps in Medicare-covered services. Insurance companies started developing many Medigap policies to fill in Medicare Part A and Part B gaps. There were no federal guidelines or laws for Medigap policies at the time. Each state insurance department regulates the private plans within its own state. The growing number and complexity of the Medigap policies started to confuse consumers. Shopping and comparison among plans were difficult. Medicare needed the Medicare Modernization Act only a few years after the creation of Medicare.

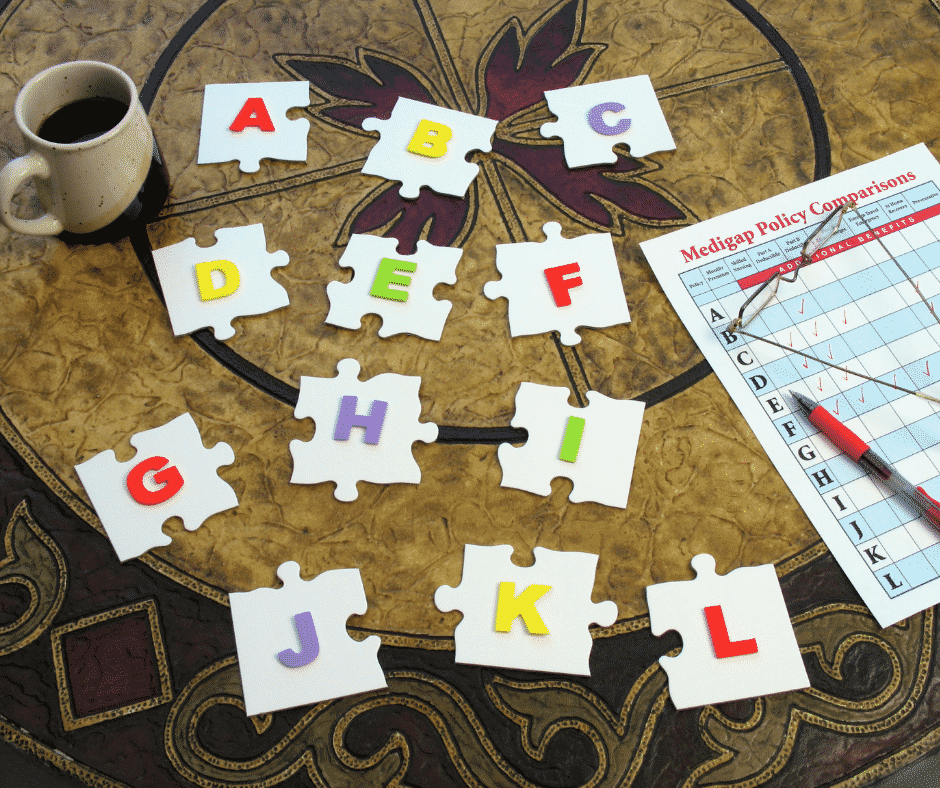

The National Association of Insurance Commissioners (NAIC) develops rules for insurance regulation and coordinates those laws among the states. They devised rules for the new Medigap policies that eventually were widely accepted. In 1980, Congress established its own policy standards for Medigap plans that each state could adhere to voluntarily. Congress finally directed the NAIC to update the model regulations for Medigap plans, and Congress enacted mandatory federal Medigap standardization requirements in the Omnibus Budget Reconciliation Act of 1990 (OBRA). By 1992 state insurance commissioners standardized Medigap policies across the states. Congress prohibited insurance companies from selling Medigap policies that did not conform to the new standardized Medigap insurance regulations.

What Are the Implications of the Medicare Modernization Act of 2003?

The initial standardization of Medigap policies in 1992 created ten different health plans, labeled Plan A through Plan J. Congress required each plan to provide the same benefits and provisions, regardless of the issuing insurance company. In effect, the plans were identical except for the price. The Medicare Modernization Act of 2003 enabled consumers to compare Medigap plans more easily. The plans were limited to a smaller number with the same features and benefits. The only variable was the price. By reducing the number and variations of Medigap plans, the standardization reduced confusion significantly.

The Medicare Modernization Act 2003 (MMA) added two new plans, K and L, to the lineup of standard plans bringing the total available for sale at that time to 12 Medigap plans. Congress added high-deductible options to two of the existing plans (F and J). The improvement and modernization act also included two significant changes.

Medicare Advantage Renamed & Medicare Part D Created

Medicare Advantage Renamed & Medicare Part D Created

The Medicare Modernization Act modified Medicare + Choice and renamed it Medicare Advantage. They also added prescription drug coverage as a new and standalone plan. Skyrocketing drug costs devastated seniors, so the Bush administration spearheaded prescription drug plans to limit out-of-pocket costs. (For time’s sake, we will modify this discussion to only Medigap plans and discuss managed care in other blogs.)

Third Generation Medigap

The Medicare Improvements for Patients and Providers Act (MIPPA) of 2008 expressly authorized

the implementation of Medigap policy revisions adopted by the NAIC in 2008. Each state regulates all insurance within its borders. Federal authorities pressured state insurance commissioners to adopt the NAIC changes.

The 2008 Act also introduced the “third-generation” of Medigap standardized plans. Medicare insurance companies introduced new Medigap plans and eliminated others effectively on June 1, 2010. Plans M and N increased cost-sharing features. Medicare insurance companies stopped Plan E, H, I, and J to eliminate duplicative and outdated Medigap plans. Center for Medicare & Medicaid Services (CMS) required Medicare insurance companies to stop offering prescription drug plans in all Medigap policies. (Those currently enrolled in discontinued plans may keep them.) CMS’s changes meant that beginning June 1, 2010, the “third-generation” of standardized plans consisted of ten different Medigap plans. Only these Medigap plans were available to purchase for new customers from that point on—including two with high-deductible options.

Latest Medigap Policy Changes

Medicare’s next stage of development from the Medicare Modernization Act was the Medicare Access and CHIP Reauthorization Act MACRA of 2015. Congress created a Medicare Quality Payment Program intended to encourage medical providers to focus on value over patient volume. Medicare Access and CHIP Reauthorization Act also included a significant change to Medicare supplement insurance options. Effective January 1, 2020, the sale of Plan C and Plan F (including the Plan F high-deductible option) policies stopped for newly eligible. “Newly eligible” means anyone who attains age 65 on or after January 1, 2020.

Individuals who purchased Plans C or F policies sold before January 1, 2020, are grandfathered into those plans. Beneficiaries may keep their Plan C or F. Those eligible for Medicare before that date may also still purchase them going forward. The eligible includes individuals who were eligible for Medicare before January 1, 2020. Medigap insurers will continue to maintain existing C and F plan policies. Still, they may not sell a new C or F (including high-deductible F) plan to anyone who was not qualified for Medicare before January 1, 2020. In other words, they turned 65 after January 1, 2020.

Individuals who purchased Plans C or F policies sold before January 1, 2020, are grandfathered into those plans. Beneficiaries may keep their Plan C or F. Those eligible for Medicare before that date may also still purchase them going forward. The eligible includes individuals who were eligible for Medicare before January 1, 2020. Medigap insurers will continue to maintain existing C and F plan policies. Still, they may not sell a new C or F (including high-deductible F) plan to anyone who was not qualified for Medicare before January 1, 2020. In other words, they turned 65 after January 1, 2020.

Medicare Access and CHIP Reauthorization Act of 2015 change is significant because Plans C and F are the only plans that include coverage for the Medicare Part B deductible. These plans were very popular. Eliminating these plan options was difficult but necessary to reduce future Medicare costs by discouraging unnecessary medical services. Congress reasoned paying a small deductible, such as the Part B deductible, would prevent unnecessary medical treatment and consequently help curb waste and abuse.

Understanding Evolution and Changes Avoids Confusion

Understanding the history of the evolution of Medigap policies and the government regulations that mandated the changes is vital to avoid confusion. Medicare beneficiaries hear about Plan F, Plan J, Plan this or that. They don’t understand why they can’t get those plans. There are fears they may lose coverage. Medicare beneficiaries do not realize CMS grandfathered them into their Medigap F or C plans. Awareness of Medicare’s continual changes prevents people from making wrong or outdated choices about their health care.

Change is a constant. Since its inception, Medicare has changed. The Medicare Modernization Act and subsequent Congressional legislation have tried to keep up with the changes in healthcare, consumers’ needs, and a drive for more efficient and cost-effective healthcare systems. Congress and President Johnson could not have imagined that what they started would become the complex and colossal system that cares for so many Americans today.

efficient and cost-effective healthcare systems. Congress and President Johnson could not have imagined that what they started would become the complex and colossal system that cares for so many Americans today.

Mistake 1–The Cost of Medicare Supplement Plans is Different, but the Plans Are the Same

The line I hear repeatedly is ‘I’m looking for the best coverage for the least amount of money.’ Here are some common mistakes consumers make when selecting their Medigap plan.

The key to understanding the cost of Medicare supplement plans is knowing the law.

Since Medicare’s creation in 1965, insurance companies jumped in to fill in the gap figuratively and literally. They designed Medicare supplements or Medigap policies to fill in the gaps in Medicare coverage. The number and variety of Medigap policies grew exponentially which is the blessing and curse of capitalism. The number and kind of policies were so many that it was a problem for consumers.

Consumers were confused. They could not understand and discern the best plan and policy for their individual needs and budget. Congress eventually went through three different legislative processes over the years to regulate Medicare, the supplements, and plans. One of the purposes was to improve the consumer experience through simplification and consolidation.

The result is that Medicare supplements are limited to a certain number–plans A through N. All of these plans are standardized. They are essentially the same in their structure and coverage. A Plan G is a Plan G. It does not matter which insurance company offers the plan G. It will be the same plan G, or Plan N, or Plan A, etc. with any company.

The Only Difference of Note is the Price.

Prospective clients have a hard time believing that the cost of Medicare supplements plans is different when the coverage is identical. They think supplements should be like other products, e.g., tires, jeans, cell phones, cars, and houses. There should be a measurable qualitative difference to correspond to the higher price.

Medicare supplements, however, are intangibles. They are a promise to provide a service. Consequently, it is more difficult to create a difference with a corresponding price point.

The other incredulity is why some people pay more if the policies are all the same? The reason is people are unaware of what I just shared, and they do not shop. They usually go for the familiar and the big names. It is human nature to go to what is familiar and perceived safe.

Mistake 2–Impartial Shopping the Cost of Medicare Supplement Plans

I suspect people want to shop for a Medicare supplement about as much as they want to go to the dentist to get their teeth drilled. They do not want to do it, so they make as little effort as possible.

Some agents count on that. They show you the most common or popular brand names. They usually are names you are asking for anyway.

Agents do this for several reasons. First, it is easy. They prefer to use the same company, application, brochures, software repeatedly. Second, they may have a preferred contract with the company that pays them or their agency more than other companies.

Sometimes this may include contest prizes, like trips for selling a certain number of policies within the year. If an agent divides up his business among several insurance companies, it is hard to hit that quota. That is why they stick to one company and push it.

And the higher the premium, the more the agent is paid. That is the game of the cost of Medicare  supplement plans

supplement plans

Impartial & Objective

I find the best, fairest, and clearest way to show Medicare supplements is with a quoting software that puts the plans side-by-side. The only differentiator is the price. In descending price, I put the quotes assuming most people would rather pay less rather than more for the same coverage.

CSG Actuarial is the software company that I use. I believe the Nebraska & Iowa SHIP offices use the same software. It is a very robust software offering more information than most people realistically need.

The purpose of this tool is to impartially and objectively shop Medicare supplements for prospects and clients. I show you my work. I am not holding back any cards or favoring any companies.

Shop your supplement impartially and objectively.

Mistake 3–Company Strength

Some prospective clients ask me about the insurance company’s strength. I point to the rating agencies. There are four principal rating agencies: Moody’s, A.M. Best, Fitch, and Standard & Poors. AM Best is probably the premier rating agency for insurance companies. The other agencies spread out their expertise among bonds, banks, and other financial institutions and products.

Some prospective clients ask me about the insurance company’s strength. I point to the rating agencies. There are four principal rating agencies: Moody’s, A.M. Best, Fitch, and Standard & Poors. AM Best is probably the premier rating agency for insurance companies. The other agencies spread out their expertise among bonds, banks, and other financial institutions and products.

The purpose of the credit rating agencies is to determine the probability a company will pay on all its obligations.

While I don’t wish to discredit the credit agencies, I would like to offer some context. Many of you may remember the Great Recession of 2008. Up until 2007, the credit agencies were still rating the CDO’s (Credit Default Obligations) as AAA. It wasn’t until after the bottom had started to fall out that the credit ratings changed.

There are some great scenes in the movie, The Big Short, where Steve Carell playing Mark Baum, asks a representative of one of the credit agencies–S&P (Standards and Poors)–why they had not downgraded the CDO’s even though the defaults on the loans were through the floor. “If we don’t give the banks the ratings they want, they will go down the street to Moody’s or one of the other rating agencies.”

The ratings that the credit rating agencies put out are helpful, but not infallible, complete, or perfect. Each company has a story. I have been around for several years, so I am familiar with many of the companies. I have worked with some, watched others, heard from other agents about some. There are many factors that should be weighed when selecting a company with which to entrust your Medicare plan.

Mistake 4–Age & Rate Increases

The two ways an insurance company prevents itself from going broke when medical costs increase, or claims are unexpectedly higher is through age increases and rate increases.

Age increases are hard-baked into the price of the supplement. There is a schedule that goes out a certain number of years. As the client ages, the price goes up.

Secondly, insurance companies can increase the premiums across the board on everyone in a pool of policyholders. Clients submit claims. The insurance company has factored in the approximate number of claims in a particular zip code, county, region, or state.

That is the art of actuarial science. Sometimes they are spot on. Other times, they miss, even a great amount. The number they are shooting for, of course, is always moving as medical costs rise due to inflation–or pandemics.

Insurance companies cannot pick out an individual or group that may cost them more because of claims. It must be on the wider group or pool of policyholders.

Mistake 5–Understanding Customer Service

Customer service is a perennial concern. We have all been on hold with customer service with different  companies and had atrocious experiences. They hang up on us after a long wait. The customer service rep’s accent is too strong to understand. We are caught in a labyrinth of auto prompts that take us in a circle.

companies and had atrocious experiences. They hang up on us after a long wait. The customer service rep’s accent is too strong to understand. We are caught in a labyrinth of auto prompts that take us in a circle.

Medicare supplements insurance is quite simple. If Medicare pays, the supplement pays. If Medicare does not pay, the supplement does not pay. It is rare for someone to need to call about bills. Generally, then you call Medicare itself, not the insurance company.

Quality of Service

Not all companies’ customer service is created equal. The difficulty I sometimes have with clients is convincing them that one insurance company with which they had a good experience on their employer health plan is not so good on the Medicare side.

On the reverse, clients who had a negative experience with a certain insurance company on a particular plan are great when it comes to Medicare.

It is funny that people generally blame the insurance company for a bad plan when an insurance company has many different health insurance plans from which to choose. People do not often deduce that their employer is the one who picked the plan, and if they picked a poor-quality plan–to save on employee overhead–employees may have a poor experience of healthcare from that company.

Feedback On Customer Service

One of the experiences I have had as an insurance agent is daily feedback. That is why I am not a great fan of the SHIP programs. SHIP is a semi-government group of paid and unpaid volunteers who help citizens with Medicare. They are supposed to be impartial. The problem is they do not get feedback from consumers on the advice they gave. Policyholders are not calling them complaining when something goes wrong when procedures are denied when Medicare or the

One of the experiences I have had as an insurance agent is daily feedback. That is why I am not a great fan of the SHIP programs. SHIP is a semi-government group of paid and unpaid volunteers who help citizens with Medicare. They are supposed to be impartial. The problem is they do not get feedback from consumers on the advice they gave. Policyholders are not calling them complaining when something goes wrong when procedures are denied when Medicare or the insurance companies mess something up. No one calls them two years later to say, “I got a 15% increase to my Medigap policy with the company you suggested.” The person they talked to is probably no longer there.

insurance companies mess something up. No one calls them two years later to say, “I got a 15% increase to my Medigap policy with the company you suggested.” The person they talked to is probably no longer there.

Dealing with many insurance companies over time and in various situations and circumstances is important in helping consumers get a fuller context for their plan selection.

Medicare Advantage or Medicare Part C is another way to receive Medicare. “Original Medicare” is a combination of Medicare Part A and Part B. It is called “Original Medicare” because that was its first plan in the late 60’s. Medicare Part A was hospital insurance and Medicare Part B was added later. It included doctor visits and outpatient procedures. Some people call it traditional Medicare. It became “Original Medicare” when a new form of Medicare was created–Medicare Advantage, also called Medicare Part C. What is the advantage of Medicare Advantage over Original Medicare?

The Advantage of Medicare Advantage vs Original Medicare

Let’s explain “Original Medicare” first. Medicare Part A covers hospital stays. The Part A has a deductible. It is currently $1,340 for every hospital stay for the same event in a 60 day period. If a completely unrelated event lands you in the hospital, e.g., car accident, heart attack, stroke, etc., even within the first events 60-day period, you will still pay the $1,340 deductible for those unrelated events. That kind of deductible schedule could add up to a significant cash outlay in a year. Likewise, Medicare Part B exposes you to a great deal of risk. While Medicare Part B pays 80% of doctor and outpatient costs, your 20% co-insurance has no cap on it. There is no maximum out-of-pocket. Sky is the limit. If you have a million dollars worth of bills under Part B, 20% is $200,000.

Maximum Out-Of-Pocket

Maximum Out-Of-Pocket

The Advantage of Medicare Advantage is a maximum out-of-pocket. The highest maximum out-of-pocket for Medicare Advantage plans in 2018 is $6,700. Some plans maximum out-of-pocket are much less, depending on the area, the company, and the type of plan. However, the easiest and clearest difference between Original Medicare and Medicare Advantage is a definite limit on what you pay out of your pocket. Medicare Advantage has a maximum out-of-pocket. Original Medicare does not.

Minimum Co-Payments

Each Medicare Advantage Plan has its own schedule of co-pays, deductibles, and co-insurance. One co-pay that is standardized in all plans is the emergency room visit. In 2018, the emergency room visit co-pay is $80. I would rather pay $80 with a Medicare Advantage plan rather than 20% of any amount on Original Medicare. I broke my arm a number of years ago biking. My emergency room visit was $3,000. The advantage of Medicare Advantage I think is an $80 co-pay rather than 20% bill–$3,000 x 20% = $600.

Part D Prescription Drug Included

Part D Prescription Drug Included

With Original Medicare, you still need to get a Medicare Part D prescription drug plan, even if you don’t take any medications. Otherwise, you will be penalized when you eventually do enroll in a Medicare Part D plan. The Part D plan is generally included in a Medicare Advantage plan at zero or little cost. If you purchase a Part D plan, you may pay between $21–$100 per month. The advantage of Medicare Advantage is paying zero or very little for your drug plan.

Vision and Dental

Mo st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

st Medicare Advantage plans have additional benefits, such as vision, dental, and over the counter items. How would you like to get your teeth cleaned twice a year at zero cost? That is all most people are interested in when it comes to dental usually. They don’t want to spend $50 a month on a dental plan when cleanings are all they really want or need.

Compared to Original Medicare, the advantage of Medicare Advantage makes complete sense. It limits your maximum out-of-pocket, combines Part D at little or no cost most times, includes extra benefits, like dental and vision. There are usually many plans in your area. Here is Omaha there are eleven Medicare Advantage plans among five insurance companies. You should be able to find something that fits your needs among that variety. Call us to find out 402-614-3389.

When people arrive at the doorstep of Medicare at age 65, they are confronted with the daunting task of picking a Medicare plan. Most people find picking Medicare plan overwhelming and confusing.

100’s of Supplements to Pick From

Insurance companies offer hundreds of different Medicare supplements, Medicare Advantage plans, and Medicare Part D prescription drug plans. Picking Medicare plan means choosing between Medicare supplements and a Part D prescription drug plan OR Medicare Advantage/Part C. Next picking Medicare plan means choosing the plan type. Medigap plans range from plan A through the alphabet to plan N, which doesn’t include a Part D drug plan. The drug plans can be a little simpler because you can use the Medicare tool to narrow down the selection. The Medicare calculator bases the plan selection upon the prescriptions you enter into the system. The calculator picks the Medicare Part D plan that will cost the least in total costs for you. On the other side, Medicare Advantage plans consist of a wide variety of co-pays, co-insurance, deductibles, and maximum out-of-pocket costs and amounts that may or may not include a Part D plan.

Foreign Language of Medicare

Medicare itself is like a foreign language of Part A, Part B, and Part D with rules around enrollment that includes penalties when you do not comply. The Medicare.gov website is meant to be helpful, but the shear amount of information, jargon, legalese makes it a barrier to entry rather than a door. Even the Medicare handbook is hundreds of pages. Its size makes the evaluation of information almost impossible.

The Pain of Picking Medicare Plan

The Pain of Picking Medicare Plan

As a consequence, picking a Medicare plan is a frustrating and painful process for people. That is why I take people through a 3-step process. 1.) There is a brief, foundational explanation of Medicare and how it works. 2.) Look at ALL of the plans, but in an organized and ordered fashion. The first step helps you evaluate the plans. I share the story behind each company from my fifteen years of insurance experience because each company has a history in the market. 3.) I find out about you. Everyone is unique. Some people are risk takers. Others are not. Some have health concerns that are foremost of mind. Others do not have any.

Logical Process

The logic of the process enables people to narrow down choices and make the best one for them. I ask questions as we go along. Test and probe. Explain aspects of the plans as we go through each. Constantly test for understanding. So the process of picking a Medicare plan becomes clearer as we move through it. I generally meet with people twice. The first time is usually months before they can do anything. There is no pressure to make a decision or ‘buy right now.’ Clients have time to think, collect more information, verify what they’ve learned, talk with confidants. The next time we get together is to review with updated information. That is the time for picking a Medicare plan. By then you are comfortable and confident with your decision because your decision is well informed. It is logical. The decision is made over time without pressure. You know what you are doing when you pick your Medicare plan.

If you would like to go through this process, there is not cost or obligation. Call 402-614-3389 to find out more.

We’ve all experienced that less than happy holiday vacation spent ill. What’s worse is getting sick abroad and worrying about Medicare insurance coverage. If you’re planning a winter getaway, check out and share our healthy Medicare travel tips to ensure your vacation goes off without a hitch.

Prevention

Whether you’re going foreign or domestic, Medicare travel tip #1. Always research your destination. Even learning about a stomach bug going around could help save your trip. Also be sure to take a look into potential health facilities by contacting the U.S. embassy in the country you’re going to visit or by getting help from your hotel. Know and have the contact information for the hospitals and urgent care centers that could be available to you during your trip.

Common Traveling Illnesses

Important Medicare travel tips is to know what to avoid on your trip. Here are some common illnesses you can bring back from your vacation:

Important Medicare travel tips is to know what to avoid on your trip. Here are some common illnesses you can bring back from your vacation:

- Malaria – Often found in tropical climates, Malaria is contracted though an infected mosquito bite. Although the disease has flu-like symptoms, it may become deadly. The CDC (Centers for Disease Control and Prevention) has the need-to-know information on Malaria for travelers.

- Traveler’s Tummy – One of the most common maladies foreigners experience when traveling abroad. Traveler’s tummy is common throughout Asia, Africa, Latin America and the Middle East. You can learn more about the gastro-intestinal sickness and how to avoid it from the CDC.

- Zika Virus – Zika is something we’ve all heard about on the news in the past year. Symptoms can range from flu-like to joint pain and rashes. It’s been linked to Asia, Brazil, Central America, Mexico, The Caribbean and The Pacific Islands. This CDC Infographic has tips on preventing Zika while traveling abroad.

You can read up on what to specifically watch out for depending on where you’re going on the travel section of the CDC website.

Check Your Coverage

Compare Plans and Explore Your Options

Your health coverage will vary depending on your Medicare plan. Original Medicare will usually only provide coverage within the U.S. Some Medigap plans have travel coverage. Some Medicare Advantage Plans may as well, but you’ll have to check your specific plan.

Your health coverage will vary depending on your Medicare plan. Original Medicare will usually only provide coverage within the U.S. Some Medigap plans have travel coverage. Some Medicare Advantage Plans may as well, but you’ll have to check your specific plan.

If you need some help navigating your Medicare coverage options, our agents can help and are available all year-round.

Doctor Knows Best

Before traveling, meet with your doctor to have a check-up, talk about any health concerns you may have, if you’ll need any vaccinations, etc. Your physician should be able to inform you on any must-know health concerns in regards to wherever you’re going.

Pack Smart Most Important of Medicare Travel Tips

Pack weather-friendly, and don’t forget your necessary prescriptions and medications in your carry-on luggage. That is the most important of Medicare travel tips. If you’re traveling by car, keep your meds in an easy-to-access designated location. If you have any special medical supplies that you need to use, get a note from your doctor that explains why you need them. It’s better to be safe than sorry! If you need help thinking through these Medicare travel tips or you want to invest in travel insurance, give us a call at OmahaInsuranceSolutions.com 402-614-3389

Pack weather-friendly, and don’t forget your necessary prescriptions and medications in your carry-on luggage. That is the most important of Medicare travel tips. If you’re traveling by car, keep your meds in an easy-to-access designated location. If you have any special medical supplies that you need to use, get a note from your doctor that explains why you need them. It’s better to be safe than sorry! If you need help thinking through these Medicare travel tips or you want to invest in travel insurance, give us a call at OmahaInsuranceSolutions.com 402-614-3389

With these tips, you should be enjoying your vacation in no time. Happy travels!

Medicare Advantage Growing

Medicare Advantage or Medicare Part C is an alternative to traditional or original Medicare. While the majority of Medicare beneficiaries are still on original Medicare, Medicare Advantage has grown to 31% of all Medicare beneficiaries, which is triple the number from only twelve years ago. In Nebraska the number of Medicare beneficiaries in a Medicare Advantage plan is 12% and growing each year. The percentage would be much higher if Nebraska had a higher population density. The success of the Medicare Advantage plans depends upon concentrated pools of beneficiaries which is a challenge because the majority of Nebraska is rural. Though Medicare Advantage is growing, consistent concerns continue to arise. People may wish to consider something to backup Medicare Advantage.

Backup Medicare Advantage

Medicare Advantage is “a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.” The co-pays, deductibles, co-insurance is set up differently from original Medicare. Like original Medicare, there are co-pays, deductibles, and co-insurance. While many Medicare beneficiaries chose to backup their Medicare Part A and Part B with a supplement, most people on Medicare Advantage plans chose not to purchase any additional insurance. They don’t backup Medicare Advantage. The reasons may be because co-pays are minimal. Medicare Advantage also has a maximum out-of-pocket where original Medicare does not. Still, people on Medicare Advantage do have concerns about serious illness and possible large co-pays, such as from a hospital stay. They may wish to backup Medicare Advantage, but they don’t know how.

Medicare Advantage is “a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.” The co-pays, deductibles, co-insurance is set up differently from original Medicare. Like original Medicare, there are co-pays, deductibles, and co-insurance. While many Medicare beneficiaries chose to backup their Medicare Part A and Part B with a supplement, most people on Medicare Advantage plans chose not to purchase any additional insurance. They don’t backup Medicare Advantage. The reasons may be because co-pays are minimal. Medicare Advantage also has a maximum out-of-pocket where original Medicare does not. Still, people on Medicare Advantage do have concerns about serious illness and possible large co-pays, such as from a hospital stay. They may wish to backup Medicare Advantage, but they don’t know how.

Cover Co-Pays and Deductible

A possible solution to backup Medicare Advantage would be to add an indemnity plan. Indemnity plans are not health insurance. They are insurance plans that reimburse clients for certain specified events. For example, insurance company ABC will pay $500 each day you are in the hospital for a total of ten days. The money paid is to the policy holder to use as he or she wishes, not to the hospital or another insurance company. Indemnity plans may pay for skilled nursing stays past the 21st day when the co-pay is added. A stroke could require prolonged stays in a nursing home. A skilled nursing facility co-pay from day 21-57 could be as high as $160 per day. Most indemnity plans have options for cancer treatment too. The indemnity plan could reimburse several hundred dollars per treatment to compensate for high co-pays or just present a one-time lump sum, such as $5,000 or $10,000 for an occurrence of cancer.

A possible solution to backup Medicare Advantage would be to add an indemnity plan. Indemnity plans are not health insurance. They are insurance plans that reimburse clients for certain specified events. For example, insurance company ABC will pay $500 each day you are in the hospital for a total of ten days. The money paid is to the policy holder to use as he or she wishes, not to the hospital or another insurance company. Indemnity plans may pay for skilled nursing stays past the 21st day when the co-pay is added. A stroke could require prolonged stays in a nursing home. A skilled nursing facility co-pay from day 21-57 could be as high as $160 per day. Most indemnity plans have options for cancer treatment too. The indemnity plan could reimburse several hundred dollars per treatment to compensate for high co-pays or just present a one-time lump sum, such as $5,000 or $10,000 for an occurrence of cancer.

Indemnity plans could be a nice way to fill in the gaps to a Medicare Advantage plan, and they could be a great addition to Medicare supplements or health plans in general. Medicare and health insurance only pays for medical cost that are incurred from approved medically necessary treatments. Heart attacks, strokes, and cancer come with many other non-medical expenses. You may need assistance at home after a stroke that neither Medicare or your health plan cover. Transportation to doctors’ offices are an expense because you cannot safely drive. Wages are lost when your illness prevents you from going to work. Health care costs go beyond the doctor and hospital bills. Indemnity plans may help off set the losses due to illness.

Health insurance is like a puzzle. There are many pieces and different sizes. They can be put together in a multiplicity of ways. They best way to put the puzzle together is to get all the pieces out on the table and see what fits together the best. If you have gone the way of Medicare Advantage, it may be beneficial to backup your Medicare Advantage plan. We can help you see how the puzzle works at Omaha Insurance Solutions 402-614-3389.