2023 Medicare Changes for Insulin

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Does Medicare Cover Insulin?

Medicare has covered insulin for a long time, but the cost to consumers has gone through the roof over the years. Under the Trump Administration, the Centers for Medicare & Medicaid Services (CMS) announced Medicare changes in 2021 that covered 1,750 Medicare Part D prescription drug plans and Medicare Advantage plans with prescription drug coverage. The plans would reduce insulin prices under the Senior Savings Model. Medicare beneficiaries would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

The Inflation Reduction Act (IRA) law the Biden administration sponsored significantly changed Medicare for 2023. The IRA law set a cap of $35 for insulin that Medicare Part D prescription drug plans offered. The insulin price reduction act went into effect in 2023.

Not all, but many insulin medications to combat diabetes are capped at $35 per month.

Medicare Changes Insulin Prices in 2023

The $35 insulin cap is for both Medicare Part B and Part D. Most people get their insulin medications through their Medicare Part D prescription drug plan. They pay the monthly plan premium and a copay when they pick up their insulin. In the past, the copays were significant. Now insulins on Medicare prescription drug plans in 2023 changed to $35 per month.

What Are 2023 Changes to Insulin Covered by Medicare Part B?

What Are 2023 Changes to Insulin Covered by Medicare Part B?

Many others use insulin delivered through an insulin pump that people wear. The pumps are considered durable medical equipment and are billed under Medicare Part B. Part B has a deductible and an unlimited 20 percent coinsurance. However, when paired with a Medicare supplement, like Plan G, the 20 percent coinsurance is wholly covered. After a small Part B deductible is met, the beneficiary pays nothing for the pump or insulin.

What About Disposable Insulin Patch Pumps?

Insulet Omnipods are very popular. It is a disposable insulin “patch” pump. The disposable pump is a small wireless, tubeless pump worn directly on the body. Beneficiaries get the refills for the Omnipod under the Part D prescription drug plan, not Part B.

The Medicare change for 2023 is insulin refills will be $35 or less.

The patch pump, however, is considered a durable medical device, which falls under Part B. The device will be covered like any other durable medical equipment with no price controls. What you pay is determined by your plan.

How Does Medicare Change Deductibles in 2023 For Insulin?

Most Medicare Part D prescription drug plans and many Medicare Advantage plans with prescription coverage have deductibles. The deductibles aren’t going anywhere; they still exist. However, the deductible no longer applies to covered $35 insulin medications. In other words, Medicare beneficiaries do not have first to meet the deductibles of $505 before they start paying $35 for insulin. This is significant.

Many times the large deductible is an insurmountable obstacle for some clients when they go to the pharmacy to pick up their medication for the first time. They choose not to get their essential medication because of the cost.

I always show clients the prices when we meet. I’m not sure what happens from the showing to when some actually pick up the medication at the pharmacy, but I have fielded many a phone call–“I can’t afford $$$$!”

Medicare changed the rule for $35 insulin on January 1, 2023, to no deductible.

Reimbursement When Overcharged for $35 Insulin

Reimbursement When Overcharged for $35 Insulin

Mistakes happen. If you are charged more than $35 per month for an insulin medication that is part of the program, the Part D plan must reimburse you within 30 days. The insurance company is responsible for the reimbursement. Contact the plan. The customer service 800-number is on the back of your Part D medical card.

Pharmacies Don’t Matter for $35 Insulin.

When I meet with clients, I always show how different pharmacies will affect drug copays. The effect of pharmacies on cost is essential to know if you wish to maximize your Part D plan and pay the least.

Drug plans sign contracts with different pharmacy chains and networks. As part of the deal, copays are lower if you go to one of the plan’s preferred pharmacies versus a non-preferred pharmacy.

Whether a preferred or non-preferred pharmacy, the insulin on the Medicare Part D plan will be $35. Many of my clients have a favorite pharmacy that may not be in the network—non-preferred. It is good to know, wherever you pick up your $35 insulin; it will be $35 insulin.

Not All Medicare Insulin Is $35

Medicare Part D prescription drug plans create formularies, a list of the medications the plan covers. The medications are put in tiers that determine copays and deductibles. Medicare requires the insurance companies to cover at least two medications in each category. Sometimes companies make choices, like covering Humalog insulin types but not Novolog insulin. The new law requires the plan to keep insulin at $35, but only insulins the plan carries. Not every brand or type. This is important in selecting a Part D plan. You need to know which brands and types of insulins are covered under a particular plan. And plans can change and often do change drugs on the formulary from year to year.

We always run clients’ medications when we meet to ensure they have the lowest cost plan for their specific list of medications. During Annual Election Period (AEP) Oct 15th–Dec 7th, we re-run clients’ medications to make sure they still have the best plan for them. If necessary, we change their plan.

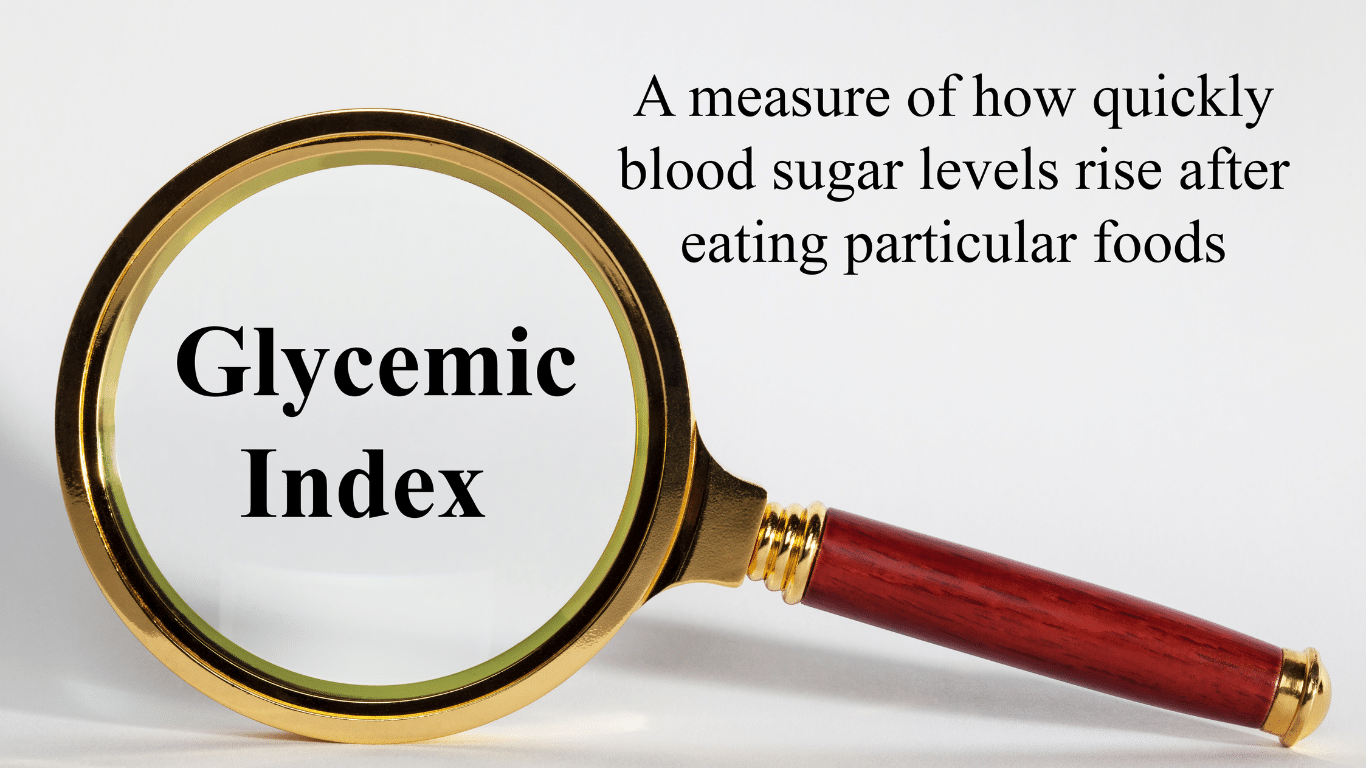

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

While Medicare’s $35 insulin is a tremendous financial relief for Medicare beneficiaries who are diabetic, other medications are equally important to improve and maintain glycemic control. Some popular non-insulin and anti-diabetic medications are Trulicity, Bydureon, Ozempic, and Victoza. Oral and injectable (non-insulin) pharmacological options are available for treating diabetes. Medicare, however, did not change the pricing for these medications for 2023. They are not part of the price reduction program currently.

Special Election Period Because of $35 Insulin

The $35 insulin for Medicare beneficiaries is a new regulation, so Medicare has allowed a special enrollment period for “Exceptional Circumstances.” The rule is only for those who are on insulin. You have a one-time opportunity to change your Medicare Part D prescription drug plan from December 8, 2022, until December 31, 2023. The reason is to take advantage of the favorable pricing for insulin medications.

Again, the ability to change Part D plans is only for those on insulin medications, a one-time opportunity during this period.

True Out-of-Pocket Costs Carry Over

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Remember, there are four phases in pricing for Medicare Part D prescription drug plans: deductible, initial phase, the gap (or Donut Hole), and catastrophic phase. Switching Part D plans during the year does not mess this up. You do not start over again. The amounts, totals, and placement within Part D plan phases transfer to the new plan.

If you are in the gap phase in one plan, you will be in the same phase and place in the new plan. You did not lose your place or are forced to start over again.

Medicare Changes the Catastrophic Phase in 2023

The fourth phase in the four stages of tracking Part D prescription drug costs is called “Catastrophic.” When a beneficiary reaches the catastrophic phase, they and the plan have paid out approximately $7,400 in out-of-pocket costs between the beneficiary and the plan. The actual out-of-pocket for the beneficiary is $3,100. The prescription costs are usually minimal unless it is an expensive medication. The coinsurance in the catastrophic phase for expensive medications is an unlimited 5 percent, and 5 percent of a large amount is still significant for most pocketbooks.

The effect of the new legislation in 2024 is beneficiaries will no longer pay the unlimited 5 percent. The out-of-pocket cost will stop at a hard cap of $3,250 out-of-pocket max for beneficiaries. While still not a small amount, it is significantly less than what some beneficiaries paid who were on costly medications in previous years.

Medicare Part D Annual Limit In 2025

The Inflation Reduction Act (IRA) mandates that the annual limit of the Medicare Part D prescription drug will be $2,000 starting in 2025 and indexed for inflation yearly after that. Part D expenses are not currently capped. This Medicare change starting in 2023 is enormous.

I think of my clients on various insulins, anti-diabetic medications, Eliquis for the heart, Humira & Enbrel for rheumatoid arthritis. Their costs have been thousands of dollars for years. That will stop.

The Medicare Part D $2,000 cap is for all tiers of drugs. The limit is for all medications on the plan’s formulary, and the $2,000 limit is for all Medicare beneficiaries regardless of past or current income. IRMAA does not apply.

Inflation Cap on Part D Premiums

The law also includes a 6 percent limit on Part D premium increases. With current inflation around 6 percent now and medical costs usually at a higher rate of inflation growth than regular inflation, how the system will really work is yet to be seen.

Smoothing Part D Out-of-Pocket Costs

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

One month the cost may be $1,000, and the next month is $100. Most consumers’ incomes are consistently the same each month, and large spikes in expenses create extreme hardship.

The IRA law offers an option for “smoothing” the payments evenly over the year.

In 2025 when the medication copays are set at a total out-of-pocket of $2,000 per year, “smoothing” would look like a $167 monthly payment for those on medications that reach the cost cap.

The smoothing idea aims to reduce prescription abandonment, dosage reductions, and delays in treatment because of high-cost specialty drugs. I had gotten phone calls too many times from the pharmacy when a client went to pick up a medication during the deductible phase. “I can’t afford $500 for this #%&* drug!” I explained their cost would not be $500 every month. They are in the deductible phase. Clients tell me they can’t afford the drug, so they leave it at the pharmacy. Not good.

The Bottom Line For 2023 Medicare Changes

The Medicare Part D prescription drug program has evolved since its inception in 2006. The Inflation Reduction Act (IRA) introduces significant changes to Medicare from 2023 to 2025. The law addresses the growing senior population dependent upon insulin and its rising cost. The IRA law reduces costs for those on limited incomes to afford critical life-sustaining medications.

It is essential to be aware of these new rules to benefit from them and get the proper medications to enhance your life’s quality.