Medicare Supplement Plans in Nebraska

Providing Omaha-Lincoln Metro Area Medicare Supplement Insurance Plans

What is Medicare Insurance?

Medicare is a federal health insurance program administered by the Center for Medicare & Medicaid Services (CMS), and pays for a variety of healthcare expenses. Beneficiaries are typically seniors aged 65 and older. Others eligible for Medicare benefits include adults with certain approved medical conditions or qualifying permanent disabilities.

Like Social Security, the majority of U.S. Citizens earn the right to enroll in Medicare by working and paying their taxes for a minimum required period. Even if the time you work doesn’t entitle you to Medicare benefits, you may still be eligible to enroll, but you may have to pay more for coverage.

Four Parts to Medicare Program

The Medicare program is comprised of four different parts:

- Original Medicare (Parts A & B): This is coverage managed by the federal government and provides for Hospital insurance (Part A) – inpatient hospital stays as well as care in skilled nursing care, hospice and some home care up to a certain amount; and certain doctors’ services, outpatient care, medical supplies, and preventive services (Part B).

- Part C, or Medicare Advantage, is private health insurance.

- Medicare Part D offers coverage for prescription drugs.

Enhancing Your Healthcare Coverage Through Medicare Supplement

There are limitations and shared costs under Medicare Parts A &B, which is why Medicare Supplement Insurance Plans, Medicare Advantage and Medicare Part D plans are offered. For example, under Medicare Part A, the full amount of your hospital bill is generally not covered, so you will most likely be responsible for a share in the cost. You will also have to pay a deductible before your Medicare benefits begin.

Additionally, Medicare Part B beneficiaries are usually responsible for a portion of their healthcare costs. You’ll have to pay a small deductible each year before your Medicare Part B benefits kick in, and then typically pay 20% of the bill when you go to a participating Medicare doctor.

At Omaha Insurance Solutions, we will review the ins and outs of Medicare coverage with you and determine which is the approach for you, including whether an additional plan is best for you and your healthcare. We specialize in providing seniors with Medicare Supplement Insurance Plans throughout the Omaha-Lincoln area to help fill in the gaps by Original Medicare, Medicare Advantage to enhance coverage and Prescription Drug plans. We’ll review the options available with you, your concerns and budgetary parameters to find health coverage that fits your personal needs.

Why Get a Medicare Supplement Plan?

While Original Medicare provides benefits for healthcare it doesn’t cover 100% for procedures or exposures, leaving costly gaps especially as we get older and need increased medical attention. These gaps can be significant for individuals without additional coverage. That’s where Nebraska Medicare Supplement Insurance, also called Medigap policies, comes in.

What Makes Sense for You

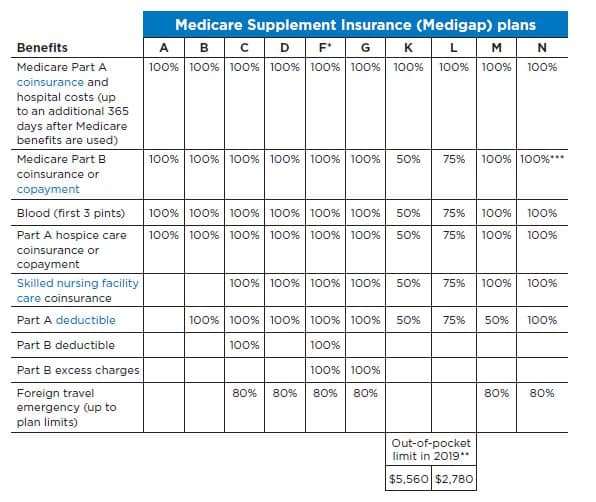

There are 10 Nebraska Medicare Supplement Plans available, each named by a single letter and identical regardless of the provider. Different plans are designed to address varied situations. For example, a Medicare Supplement Plan A may be ideal for those who don’t wish to pay costly premiums for benefits they might never use, however there is the potential for higher out-of-pocket costs if the need for inpatient hospital care arises. Plan F on the other hand is the most comprehensive plan but also the most expensive. You have no out-of-pocket expenses as the plan covers all remaining hospital and doctor costs after Original Medicare (Part A and/or Part B) has paid its portion. At Omaha Insurance Solutions, we will review each of the 10 Nebraska Medicare Supplement plans to provide you with a cost-benefit analysis so you understand what you are purchasing.

It’s also important to note that the way in each plan is rated varies considerably among providers using one of these three methods to determine premiums:

- Community-rated

- Issue-age-rated

- Attained-age-rated

Most policies (70%) sold in Nebraska are based on your attained age, which means premiums are based on your current age and will rise annually as you get older. We will sit with you and show you how different plans are rated and the effect each has on what you pay over time. Together, we’ll see what makes sense for you today as well as review your plan year after year to determine if a change should be made.

How Medicare Supplement Insurance Plans in Nebraska Work

Medicare Supplement Insurance Plans in Nebraska are a Medigap policy designed to kick in and help cover costs not covered under Original Medicare (Parts A and B) coverage. You’re filling in the gaps created by co-payments, coinsurance and deductibles under Medicare, which can add up quickly with frequent doctor visits, an health emergency or chronic illness.

The Medigap policy you buy must be clearly identified as “Medicare Supplement Insurance Plan.” There are 10 different Medigap coverage options to choose from. Plans are labeled A, B, C, D, F, G, K, L, M, and N.

Please Note: When we refer to a Medigap Plan, we are talking about Medicare Supplement Insurance Plans in Nebraska. Medigap is the term that refers to filling the gap between your regular Medicare coverage and the remaining balance. So throughout this article when you see “Medigap”, just think “Medicare Supplement Insurance Plan.”

How A Medigap Policy Works (Remember: “Medigap” means “Medicare Supplement Insurance Plans”)

- You must have Medicare Part A (hospital insurance) and Part B (medical insurance).

- Medigap covers Medicare Part A and Part B, but it does not cover Medicare Part C (Medicare Advantage Plans), Medicare Part D (Prescription Drug Plans), or any other private health insurance, Medicaid, Veterans’ Administration benefits, or TRICARE.

- You pay a monthly premium to the private insurer you choose for your Medigap policy in addition to your monthly Part B premium that you pay to Medicare.

- The policy only covers one person. A spouse must buy a separate policy.

Medigap policies are regulated by Nebraska state and Federal laws, with benefits for all coverage options the same regardless of the provider. The differences will be in the price, who administers the plan, and which of the 10 options the health insurer chooses to offer. With Omaha Insurance Solutions by your side, we will assist you in determining which health insurer best suits your needs, and help you shop around for the best prices.

When to Purchase Nebraska Medigap Supplement Plan

Keep in mind that the best time to buy a Medigap policy is during your Medigap Enrollment Period. This six-month period begins on the first day of the month in which you’re 65 or older and enrolled in Medicare Part B. After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more. If you opt to delay enrolling in Part B because you have group health coverage based on your (or your spouse’s) current employment, your Medigap Open Enrollment Period won’t start until you sign up for Part B.

Also, if you enroll in a Medicare Advantage Plan, you are not permitted to and can’t be sold a Medigap policy. However, if you later return to Original Medicare, Parts A and B, you have a 12-month special enrollment period to sign up for a Medigap Supplement Plan.

Remember, all Nebraska Medigap policies are standardized (Plans A through N), but the prices are not. We’ll give you a complete breakdown on all Medicare Supplemental insurance policies and benefits.

Changing a Medicare Supplement Insurance Plan in Omaha, NE

You may find that the Medical Supplement Plan you chose is no longer right for you and want to make a switch. Perhaps you realized that you’re paying for certain benefits you don’t need or that you need even more benefits than you previously thought. Or, maybe you’re happy with the benefits provided under your current policy but you want to change insurers or find a policy that is less expensive. Can you change your Medigap policy?

Under Federal law generally in order to change your Medigap policy, you must be eligible under a specific circumstance or guaranteed issue rights, or you must be within your six-month Medigap open enrollment period. You don’t have to wait a certain length of time after buying your first Medigap policy before you can switch to a different Medigap policy.

Our staff at Omaha Insurance Solutions can go through the various situations under which you may want to switch plans and what is possible and how the process works. We can help you choose the policy that is right for you and assist you in cancelling your current policy if you’re eligible to change. You have a 30-day free look period to decide if you want to keep the new Medigap policy, which begins when you get your new Medigap policy. You’ll need to pay both premiums for one month.

Medicare Supplement Insurance Plans, also known as Medigap policies, helps you pay for costs that are not covered under Original Medicare insurance. This includes stepping in to help cover your co-payments, coinsurance and deductibles under Medicare, which can add up quickly should you require hospitalization, frequent doctor visits and other healthcare services.

The professionals at Omaha Insurance Solutions can review the various Medicare Supplement Insurance Plans on the market with you. Available from private insurers, all policies offer the same basic benefits, but some providers offer additional benefits to meet individual needs. What’s more, providers charge differently for the same policy, which is why it’s important to look to our expertise to help you make an apples-to-apples comparison and ultimately an informed choice.

Helping You Choose the Right Medigap Plan

Below is an outline of the various Medicare Supplement Insurance plans available and what they cover. The plan you choose will depend on your specific needs. Also, as you can see, in some cases there is a percentage of coverage listed; in these instances, the Medigap plan will cover a percentage of the benefit with you paying the remainder of the cost.