Medicare CostsCategory:

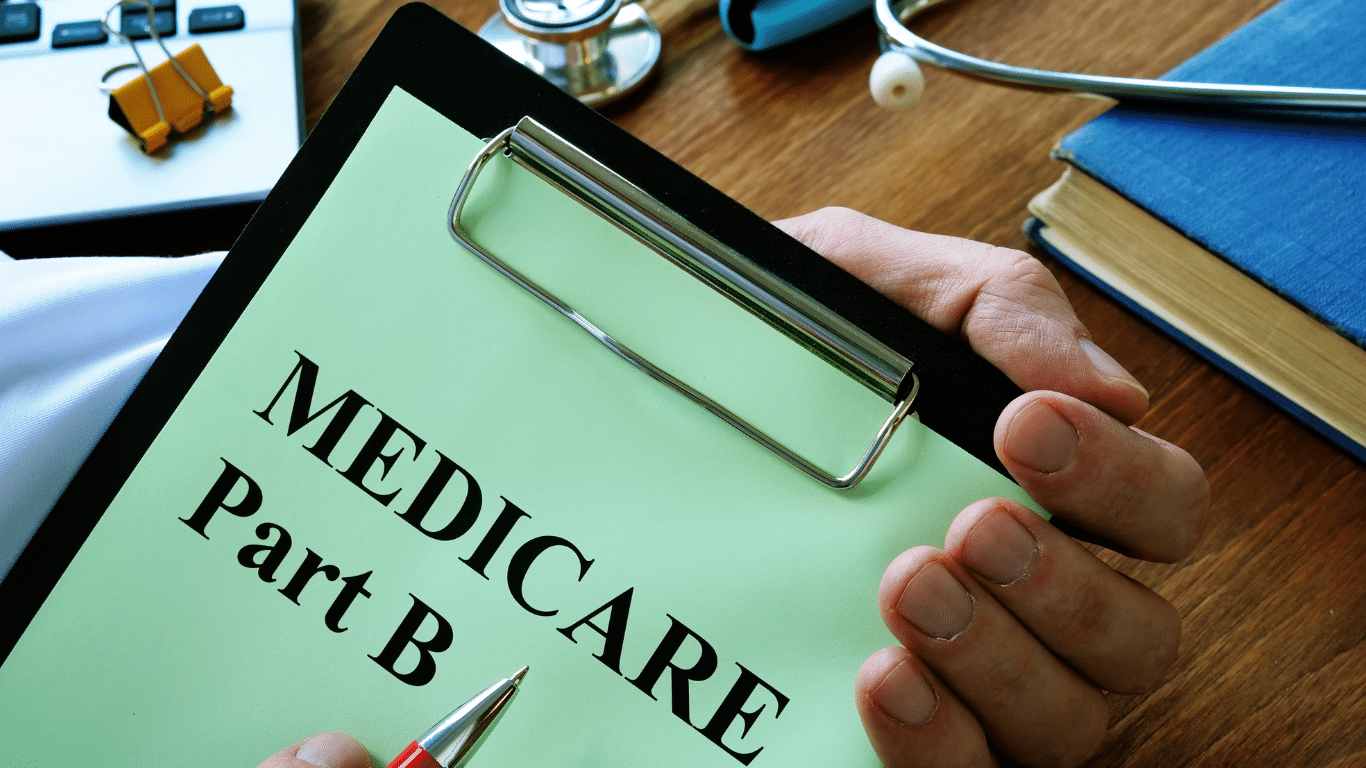

Over the years, the process I use to introduce clients to Medicare and Medicare insurance has evolved. This evolution has been based on my personal and professional growth. The process has evolved chiefly because Medicare and insurance companies have evolved. Clients and their needs change and evolve as well. Paying for Medicare is one of those changes. So, how do Medicare payments work in 2024?

Over the years, the process I use to introduce clients to Medicare and Medicare insurance has evolved. This evolution has been based on my personal and professional growth. The process has evolved chiefly because Medicare and insurance companies have evolved. Clients and their needs change and evolve as well. Paying for Medicare is one of those changes. So, how do Medicare payments work in 2024?

Delayed Social Security Benefits

More clients retire or take Social Security Benefits at full retirement age, which is at least 66 and 10 months. (Next year, full Social Security Benefits will be at age 67 for everyone, or 67 for those born in 1960 or later.) Medicare eligibility, however, remains at 65.

Consequently, Medicare beneficiaries need a way to pay their Medicare Part B premium. In the past, the monthly Part B premium was deducted directly from a person’s Social Security check, but since most are delaying Social Security Benefits, you must pay a different way.

Medicare Payment Options for 2024

Medicare Payment Options for 2024

There are four ways to make your Medicare Part B premium payment for 2024.

- You can pay by check quarterly through the mail upon receipt of your bill for Part B from Social Security. The SSA only accepts checks for quarterly payments.

- Pay online from your checking account monthly with an EFT (electronic funds transfer).

- Pay online by credit card monthly.

- Pay by monthly deduction from your Social Security.

The place where your Medicare payments for 2024 occur is in your MyMedicare.gov online account.

At the end of an enrollment appointment, I ask clients how they wish to pay their Medicare Part B premium if they are not getting Social Security benefits. Most do not have a MyMedicare.gov account, so I set it up for them at the end of the meeting.

Online Medicare Payment for 2024 Instructions

Here is how to do it.

- Type mymedicare.gov in the address bar of your browser. You’ll arrive at the login site.

- Click the green “Create Account” button on the right.

- Fill out your protected health information (PHI). You must have a Medicare number to create an account.

- Create your personal login information: user name, password, and security questions. Press the complete button, and voila—you have a Medicare online account.

- Click the green button on the left of “Pay my premium.”

- Click the link “Set up reoccurring payments.”

- Fill out your banking information. You are done.

Your monthly 2024 Medicare Part B premium payments will be automatically deducted. With Medicare EasyPay, the SSA automatically deducts your monthly Medicare premiums from your checking or savings account. The statement includes the total SSA deductions for that month, which are itemized and broken down. Automatic deductions are generally made on the 20th of the month (or the next business day).

The Medicare Part B premium payment does not include any other payments, such as your Medicare Supplement, Medicare Advantage, or Part D premiums. Those are handled separately.

You do not need to do anything when the Part B premium increases. The withdrawal will be adjusted accordingly.

When you start your Social Security Benefits, the Part B premium will automatically switch to your Social Security check and be withdrawn, and SSA will stop deducting from your personal checking account.

No Forgiveness

No Forgiveness

Part B premium payment is critical. Over a decade with thousands of clients, I have only had a couple of clients forget to pay their Medicare Part B premium. The consequences were devastating. They lost their Medicare, resulting in penalties and lost health insurance. All medical bills came out of their pocket until they reactivated their Medicare insurance many months later. You cannot flip a switch and just turn Medicare back on. You must wait until General Medicare Enrollment Jan 1st-Mar 31st to reapply.

As more people postpone taking Social Security Benefits until well past 65, I have made it part of our enrollment meeting to help clients set up their MyMedicare.gov account to pay their Part B premium out of their checking account. Setting up Medicare EasyPay is not difficult, but when I do it for them, I know it is done and done correctly. There is nothing worse than a distressed phone call from a client who has lost Medicare.

Bottom Line: Don’t Miss Your Monthly Medicare Payment for 2024

Medicare insurance has many moving parts, and mistakes are unforgiven. At Omaha Insurance Solutions, we have helped thousands of clients over the years, so we know all that needs to be done for a

Christopher Grimmond

successful and happy retirement with Medicare health insurance. We will help you set up your 2024 Medicare Part B premium payments if you like. Give us a call at 402-614-3389 to speak with a professional and experienced licensed insurance agent about your Medicare needs. We’ll make sure nothing is missed or forgotten.

Are you in the lucky top 4% of earners? You will pay more for your Medicare benefits. The more is IRMAA (Income-Related Monthly Adjustment Amount). The amount you pay for your Medicare health and prescription drug coverage depends on your level of income. There is a ladder.

Are you in the lucky top 4% of earners? You will pay more for your Medicare benefits. The more is IRMAA (Income-Related Monthly Adjustment Amount). The amount you pay for your Medicare health and prescription drug coverage depends on your level of income. There is a ladder.

Would you like to avoid paying that tax or possibly pay a smaller portion of it? We will guide you through the key IRS exceptions for Medicare IRMAA (Income-Related Monthly Adjustment Amount). By understanding and leveraging these exceptions, you can potentially lower your Medicare expenses and put more money back in your pocket.

Medicare IRMAA is an additional premium that high-income Medicare beneficiaries are required to pay. However, there are exceptions that may enable you to reduce or even eliminate this extra cost. Knowing the ins and outs of these exceptions can make a significant difference in your healthcare expenses.

In our comprehensive guide, we will break down each exception and provide you with the information you need to take advantage of them. From ‘Life-Changing Events’ to ‘Reconsideration Requests,’ we will explore all the options available to you.

Understanding the IRS Exceptions for IRMAA

The Income-Related Monthly Adjustment Amount, or IRMAA, is an additional premium that high-income Medicare beneficiaries have to pay. However, the IRS provides exceptions that may allow you to reduce or eliminate this extra cost. Let’s explore these exceptions in detail.

Life-Changing Event

Life-Changing Event

One of the exceptions to IRMAA is a life-changing event. This includes events like marriage, divorce, death of a spouse, or work stoppage. If you experience any of these events, you may be eligible for a reduction in your Medicare costs.

To qualify for this exception, you will need to provide documentation of the life-changing event and submit it to the IRS. Documentation is key. The IRS will not take your word for it. You need to prove your income decreased.

Examples of documentation may include a marriage license or divorce decree, death certificate, or proof of work stoppage. By leveraging this exception, you can potentially save a significant amount of money on your monthly Medicare premium.

Medicare IRMAA Exception 1: Marriage or Divorce

Getting married or divorced can have a significant impact on your income and, consequently, your Medicare costs.

If you are recently divorced and you are a lower income earner, you may drop below the IRMAA threshold or at least step down the ladder, which would reduce your tax.

For some individuals, marriage may reduce their income because alimony is lost. The threshold is increased because it is for two persons. The initial threshold for a single individual is $103,000. For married filing jointly, it is $206,000. Either of these lifestyle changes may affect your income in that year and, consequently, your IRMAA tax, even if your income was higher in the previous year.

To take advantage of this exception, you must provide documentation of the marriage or divorce and proof of the change in income. By doing so, you can potentially save a significant amount on your Medicare expenses.

Medicare IRMAA Exception 2: Work Stoppage or Reduction

If you experience a work stoppage or a significant reduction in your work hours, you may be eligible for an exception to IRMAA. This can happen if you retire, get laid off, or experience a reduction in your income due to other circumstances. This is probably the most common reason high-income earners should apply for the exception. Their income was significantly higher the previous year because of work, but the year they retire and must pay the Medicare premium, their income is drastically smaller. That is what the exception is for.

To qualify for this exception, you will need to provide documentation of the work stoppage or reduction in work hours, along with proof of the decrease in income. By doing so, you can potentially reduce or eliminate the additional premium you have to pay.

Medicare IRMAA Exception 3: Loss of Income-Producing Property

If you experienced a loss of income-producing property, such as rental properties or investments, you may be eligible for an exception to IRMAA. This can happen if your rental property becomes unprofitable or if you experience significant losses in your investments.

I had a high-net-worth client who lost significant rental income because of flooding in Missouri. His properties produced nothing for several years as he settled with insurance companies and repaired buildings.

I had a high-net-worth client who lost significant rental income because of flooding in Missouri. His properties produced nothing for several years as he settled with insurance companies and repaired buildings.

To qualify for this exception, you will need to provide documentation of the loss of income-producing property, along with proof of the decrease in income. By leveraging this exception, you can potentially lower your Medicare costs and save money.

Medicare IRMAA Exception 5: Loss of Pension Income

Pension plans go bankrupt. Some pensions are for a particular duration. The cessation of a pension may impact your income significantly enough to affect the IRMAA tax.

To qualify for this exception, you will need to provide documentation of the change in income, along with proof of the decrease in income. By taking advantage of this exception, you can potentially reduce or eliminate the additional premium you have to pay.

Medicare IRMAA Exception 6: Employer Settlement Payment

Employers pay out settlements to employees for many reasons. These settlements may increase income in a given year or for several. The settlement may have its own legal stipulations.

To qualify for this exception, you will need to provide documentation of the change in income, along with proof of the decrease in income. Some legal settlements may be placed legally outside of your modified adjusted gross income. By taking advantage of this exception, you can potentially reduce or eliminate the additional premium you have to pay.

Medicare IRMAA Exception 7: Correcting An Erroneous Determination

Sometimes, the IRS may make an erroneous determination regarding your Medicare costs. If you believe that the IRS made a mistake in calculating your IRMAA, you can submit a reconsideration request and provide additional documentation to correct the error.

To qualify for this exception, you will need to provide evidence that the IRS made an error in its determination. This can include documentation of your income, tax returns, or any other relevant information that supports your case. Correcting an erroneous determination can potentially save you a significant amount on your Medicare expenses.

Applying for a IRMAA exception

To apply for an exception to IRMAA and reduce your Medicare costs, you will need to follow a few steps.

First, gather all the necessary documentation to support your case. This includes marriage or divorce certificates, death certificates, proof of work stoppage or reduction, documentation of the loss of income-producing property, proof of a change in tax-exempt income, or evidence of an erroneous determination.

Next, complete the appropriate forms provided by the IRS SSA-44 (12-2023). These forms may vary depending on the exception you are applying for. Make sure to fill them out accurately and include all the required information.

Once you have completed the forms, submit them to the IRS along with the supporting documentation. It is crucial to keep copies of all the documents and forms for your records.

After submitting your application, the IRS will review your case and make a determination. If your exception is approved, you will receive a notification informing you of the reduction or elimination of your IRMAA.

By applying for an exception and reducing your Medicare costs, you can put more money back in your pocket and have a significant impact on your overall healthcare expenses.

Bottom Line: Don’t Ignore the IRMAA Exceptions

Leveraging the key IRS exceptions for IRMAA can reduce your Medicare costs. Whether you have experienced a life-changing event, a change in income, or an erroneous determination, understanding these

Christopher J. Grimmond

exceptions can significantly reduce your healthcare expenses.

Don’t let high-income Medicare premiums burden your finances. Take the necessary steps to apply for an exception and potentially reduce or eliminate your IRMAA. By doing so, you can save money and have more control over your healthcare expenses.

Many years ago, I was still new to the Medicare insurance business. I had a few hundred clients but no high-income earners. I knew what Medicare IRMAA was, but I had never met someone subject to the IRMAA tax before Doug. He was an improbable candidate. After many years and thousands of clients later, I am very familiar with IRMAA, and I can tell you what the Medicare IRMAA 2024 schedule is all about.

Don’t Judge A Book by Its Cover

Doug drove up to my office on a loud Harley Davidson hog, his long hair waving in the wind. He was a big dude, and his leathers made him even bigger. I was a little nervous, but we sat down and took care of Medicare business.

Medicare business.

A few months later, when Doug’s Medicare started, I got a distressed phone call. “You said my Medicare premium was going to be this amount. It’s three times that!”

I was befuddled. I got my calculator out but couldn’t figure out why it was so high. Finally, I said, “Your income would have to be unusually high to be charged that much.”

Doug got quiet. “How high?” he asked. The first IRMAA bracket was $85,000 for a single person at the time. Doug guffawed and said, “Hell, my income is way more than that.”

Turns out Doug was not only a retired municipal employee with a pension and Social Security. He was also retired from the military with 20 years of service and a pension. On top of that, he had built up a stock portfolio that kicked out around $30,000 in dividend income a year.

I should have taken the adage, ‘Don’t judge a book by its cover’ more seriously.

Since then, I have always brought up income in my introductory meetings and how income affects Medicare Part B premiums. Zip code or fashion choices are no guarantee of what someone’s income may be.

What Is Medicare IRMAA?

IRMAA stands for income-related monthly adjustment amount. The government loves acronyms. Medicare IRMAA is a surcharge that high-earners pay for their Medicare Part B monthly premium.

IRMAA stands for income-related monthly adjustment amount. The government loves acronyms. Medicare IRMAA is a surcharge that high-earners pay for their Medicare Part B monthly premium.

Everyone pays a tax for Medicare during their working years. The Medicare tax is included in the FICA (Federal Insurance Contribution Act) you pay and is recorded on your pay stubs. Your Medicare tax is currently 1.45%. It is graduated up for higher earners.

In 1966 when the Medicare program began, the cost to workers was $3 per person per month, which is approximately $30 in today’s dollars. The baby boomers are leaving the workforce in huge numbers currently, so fewer workers are paying the Medicare tax. Medicare tax revenue is dropping like a stone in relation to the number of people collecting.

As Baby Boomers leave the workforce, they enter Medicare. The number of workers paying into Medicare is contracting, and the number taking out of the program is ballooning. Medical expenses are climbing. The current demographics are crushing Medicare’s ability to provide the same level of service as in the past because expenses are outpacing tax revenue.

Medicare Prescription Drug Improvement & Modernization Act

In 2003 Congress passed the Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA). In the legislation, Congress addressed the coming shortfall in Medicare revenue. Congress’s answer was to raise taxes. The top 7 percent of earners were required to pay more into the program. There are currently 65 million Medicare beneficiaries. The IRMAA tax will affect approximately 4.6 million people out of the 65 million. If you are a politician, it is better to keep 60.4 million voters happy, even at the expense of making 4.6 million unhappy.

Congress’s answer was to raise taxes. The top 7 percent of earners were required to pay more into the program. There are currently 65 million Medicare beneficiaries. The IRMAA tax will affect approximately 4.6 million people out of the 65 million. If you are a politician, it is better to keep 60.4 million voters happy, even at the expense of making 4.6 million unhappy.

A little-known fact is Medicare beneficiaries pay less than 25 percent of the actual Medicare cost. The current Part B premium is only $174.70. That premium covers about a fifth of the actual cost. In the MMA, Congress increased the Part B premium based upon your income. The IRMAA increases the percentage that upper-income Medicare beneficiaries actually pay for their Medicare. Instead of paying only 25 percent of the Medicare cost, IRMAA payors pay for 35, 50, 65, 80, or 85 percent of the actual Medicare cost. The additional revenue the IRMAA tax brings in is allocated to offset Medicare’s budget shortfall.

How Does the Medicare IRMAA 2024 Schedule Work?

How Does the Medicare IRMAA 2024 Schedule Work?

Medicare IRMAA is a different calculation from the progress income tax rates the IRS uses for federal income tax brackets.

You do not pay a federal income tax rate on everything you make. The federal government divides your taxable income into chunks — also known as tax brackets — and each chunk gets taxed at a progressively higher rate. The beauty of this is that no matter which bracket you’re in, you won’t pay the highest tax rate on your entire income! Only the “chunk” in that bracket. For example, you pay 10% on the first $40,000 of income, 25% on the next $20,000 of income (total of $60,000), and 35% on the next $15,000 of income (total of $75,000).

Me dicare IRMAA 2024 schedule utilizes a “cliff” style of assessment instead. That means if you are just $1 over the cut-off for the next tier of IRMAA, you will pay the higher amount. There are no brackets for each chuck of income like federal income tax and no graduation or progression in the amount you pay. The Medicare 2024 Part B IRMAA premium brackets change when you earn one dollar more above the line.

dicare IRMAA 2024 schedule utilizes a “cliff” style of assessment instead. That means if you are just $1 over the cut-off for the next tier of IRMAA, you will pay the higher amount. There are no brackets for each chuck of income like federal income tax and no graduation or progression in the amount you pay. The Medicare 2024 Part B IRMAA premium brackets change when you earn one dollar more above the line.

What Is Medicare IRMAA Based Upon in 2024?

The IRS and Social Security work with Medicare. Medicare determines your income based on your most recent tax filing. So, for example, you are going on Medicare in 2023. The most recent tax filing was in 2022 for 2021. Usually, IRMAA is based on a two-year lag in your income.

How Is Medicare IRMAA Calculated?

Your adjusted gross income (AGI) determines where you fall in the Medicare IRMAA 2024 schedule. The AGI, however, differs from the MAGI (Modified Adjusted Gross Income) you usually think of when doing your taxes. AGI for IRMAA is a Medicare-specific form of MAGI. It is your AGI with tax-exempt bonds–-both earned and accrued interest–-added back into your income. Interest from U.S. Savings bonds used for higher education is added back. Earned income from working abroad that was not added to gross income is included. MAGI (Modified Adjusted Gross Income) for Medicare differs from what MAGI usually means for non-healthcare-related purposes.

You will be sent your Medicare IRMAA Initial Determination Notice soon after you enroll in Medicare Part B. Confirm the income amounts the IRS uses are correct–they make mistakes, too.

Medicare Financial Planning

Medicare Financial Planning

Examine the Medicare IRMAA 2024 schedule to see if you are close to any of the limits.

What are your plans for the future? Will you withdraw from retirement savings this year or in future years? A home sale can spike your income when your intention is only to downsize and move to a one-story home. Capital gains from a stock and property sale or other appreciated assets may come back to visit you as an unexpected IRMAA tax.

Any of these actions may increase your income substantially enough to move you into and/or up the IRMAA brackets, requiring you to pay more. Knowing and planning for these events, you can move assets in smaller amounts over time to avoid large spikes in income and, consequently, increases in your income tax and IRMAA Part B premium.

How Do I Reduce Medicare IRMAA?

Charitable donations of cash, appreciated assets, and appreciated stock can reduce your taxable and IRMAA surcharge, as well as contributions to 401ks, IRAs, and other qualified programs. Some minor adjustments may drop you down a bracket and save you some money.

What Is the Medicare IRMAA 2024 Schedule?

Since 2007, some Medicare beneficiaries’ Part B monthly premiums included a surcharge based on income. The Medicare IRMAA for 2024 is in the table below.

|

Individual |

Couple | IRMAA Tax |

Part B Total Monthly Premium |

|

Less than $103,000 |

Less than $206,000 | $0.00 |

$174.70 |

|

$103,000 < $129,000 |

$206,000 < $258,000 | $69.90 |

$244.60 |

|

$129,000 < $161,000 |

$258,000 < $322,000 | $174.70 |

$349.40 |

|

$161,000 < $193,000 |

$322,000 < $386,000 | $279.50 |

$454.20 |

|

$193,000 < $500,000 |

$386,000 < $750,000 | $384.30 |

$559.00 |

|

$500,000 < Greater |

$750,000 < Greater | $419.30 |

$594.00 |

Since 2011, higher-income Medicare beneficiaries have paid a surcharge on top of their Medicare Part D premium. The Medicare IRMAA for 2023 prescription drug plans is in the table below. This does not include premiums for specific Medicare Part D plans, Medicare supplements, or Medicare Part C/Medicare Advantage plans. The totals only reflect Part B premiums and Medicare IRMAA 2023 surcharges.

These IRMAA surcharges for Part D have nothing to do with the Part D Gap (or Donut Hole).

|

Individual |

Couple | IRMAA Tax Part D |

Total Monthly Part B & Part D |

|

Less than $103,000 |

Less than $206,000 | $00.00 |

$174.70 |

|

$103,000 < $129,000 |

$206,000 < $258,000 | $12.90 |

$257.50 |

|

$129,000 < $161,000 |

$258,000 < $322,000 | $33.30 |

$382.70 |

|

$161,000 < $193,000 |

$322,000 < $386,000 | $53.80 |

$580.00 |

|

$193,000 < $500,000 |

$386,000 < $750,000 | $74.20 |

$633.20 |

|

$500,000 < Greater |

$750,000 < Greater | $81.00 |

$675.00 |

The Bottom Line For Medicare IRMAA in 2024

Medicare has rules. Lots of rules, including how much you pay if you are successful in our country. We are about helping you navigate the rules, and in the case of Medicare IRMAA for 2024, make sure you do not

Christopher Grimmond

pay one penny more than is required.

If you fall into one of the Medicare IRMAA brackets, talk with your financial planner and tax consultant about minimizing the damage. Get started positioning assets well before 65 and have a plan to move yourself down the Medicare IRMAA 2024 schedule.

We are licensed and experienced insurance professionals. This may be your first Medicare IRMAA rodeo in 2024. It is not ours at Omaha Insurance Solutions. Give us a call and speak with an experienced & licensed insurance agent professional at 402-614-3389.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Does Medicare Cover Insulin?

Medicare has covered insulin for a long time, but the cost to consumers has gone through the roof over the years. Under the Trump Administration, the Centers for Medicare & Medicaid Services (CMS) announced Medicare changes in 2021 that covered 1,750 Medicare Part D prescription drug plans and Medicare Advantage plans with prescription drug coverage. The plans would reduce insulin prices under the Senior Savings Model. Medicare beneficiaries would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

The Inflation Reduction Act (IRA) law the Biden administration sponsored significantly changed Medicare for 2023. The IRA law set a cap of $35 for insulin that Medicare Part D prescription drug plans offered. The insulin price reduction act went into effect in 2023.

Not all, but many insulin medications to combat diabetes are capped at $35 per month.

Medicare Changes Insulin Prices in 2023

The $35 insulin cap is for both Medicare Part B and Part D. Most people get their insulin medications through their Medicare Part D prescription drug plan. They pay the monthly plan premium and a copay when they pick up their insulin. In the past, the copays were significant. Now insulins on Medicare prescription drug plans in 2023 changed to $35 per month.

What Are 2023 Changes to Insulin Covered by Medicare Part B?

What Are 2023 Changes to Insulin Covered by Medicare Part B?

Many others use insulin delivered through an insulin pump that people wear. The pumps are considered durable medical equipment and are billed under Medicare Part B. Part B has a deductible and an unlimited 20 percent coinsurance. However, when paired with a Medicare supplement, like Plan G, the 20 percent coinsurance is wholly covered. After a small Part B deductible is met, the beneficiary pays nothing for the pump or insulin.

What About Disposable Insulin Patch Pumps?

Insulet Omnipods are very popular. It is a disposable insulin “patch” pump. The disposable pump is a small wireless, tubeless pump worn directly on the body. Beneficiaries get the refills for the Omnipod under the Part D prescription drug plan, not Part B.

The Medicare change for 2023 is insulin refills will be $35 or less.

The patch pump, however, is considered a durable medical device, which falls under Part B. The device will be covered like any other durable medical equipment with no price controls. What you pay is determined by your plan.

How Does Medicare Change Deductibles in 2023 For Insulin?

Most Medicare Part D prescription drug plans and many Medicare Advantage plans with prescription coverage have deductibles. The deductibles aren’t going anywhere; they still exist. However, the deductible no longer applies to covered $35 insulin medications. In other words, Medicare beneficiaries do not have first to meet the deductibles of $505 before they start paying $35 for insulin. This is significant.

Many times the large deductible is an insurmountable obstacle for some clients when they go to the pharmacy to pick up their medication for the first time. They choose not to get their essential medication because of the cost.

I always show clients the prices when we meet. I’m not sure what happens from the showing to when some actually pick up the medication at the pharmacy, but I have fielded many a phone call–“I can’t afford $$$$!”

Medicare changed the rule for $35 insulin on January 1, 2023, to no deductible.

Reimbursement When Overcharged for $35 Insulin

Reimbursement When Overcharged for $35 Insulin

Mistakes happen. If you are charged more than $35 per month for an insulin medication that is part of the program, the Part D plan must reimburse you within 30 days. The insurance company is responsible for the reimbursement. Contact the plan. The customer service 800-number is on the back of your Part D medical card.

Pharmacies Don’t Matter for $35 Insulin.

When I meet with clients, I always show how different pharmacies will affect drug copays. The effect of pharmacies on cost is essential to know if you wish to maximize your Part D plan and pay the least.

Drug plans sign contracts with different pharmacy chains and networks. As part of the deal, copays are lower if you go to one of the plan’s preferred pharmacies versus a non-preferred pharmacy.

Whether a preferred or non-preferred pharmacy, the insulin on the Medicare Part D plan will be $35. Many of my clients have a favorite pharmacy that may not be in the network—non-preferred. It is good to know, wherever you pick up your $35 insulin; it will be $35 insulin.

Not All Medicare Insulin Is $35

Medicare Part D prescription drug plans create formularies, a list of the medications the plan covers. The medications are put in tiers that determine copays and deductibles. Medicare requires the insurance companies to cover at least two medications in each category. Sometimes companies make choices, like covering Humalog insulin types but not Novolog insulin. The new law requires the plan to keep insulin at $35, but only insulins the plan carries. Not every brand or type. This is important in selecting a Part D plan. You need to know which brands and types of insulins are covered under a particular plan. And plans can change and often do change drugs on the formulary from year to year.

We always run clients’ medications when we meet to ensure they have the lowest cost plan for their specific list of medications. During Annual Election Period (AEP) Oct 15th–Dec 7th, we re-run clients’ medications to make sure they still have the best plan for them. If necessary, we change their plan.

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

While Medicare’s $35 insulin is a tremendous financial relief for Medicare beneficiaries who are diabetic, other medications are equally important to improve and maintain glycemic control. Some popular non-insulin and anti-diabetic medications are Trulicity, Bydureon, Ozempic, and Victoza. Oral and injectable (non-insulin) pharmacological options are available for treating diabetes. Medicare, however, did not change the pricing for these medications for 2023. They are not part of the price reduction program currently.

Special Election Period Because of $35 Insulin

The $35 insulin for Medicare beneficiaries is a new regulation, so Medicare has allowed a special enrollment period for “Exceptional Circumstances.” The rule is only for those who are on insulin. You have a one-time opportunity to change your Medicare Part D prescription drug plan from December 8, 2022, until December 31, 2023. The reason is to take advantage of the favorable pricing for insulin medications.

Again, the ability to change Part D plans is only for those on insulin medications, a one-time opportunity during this period.

True Out-of-Pocket Costs Carry Over

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Remember, there are four phases in pricing for Medicare Part D prescription drug plans: deductible, initial phase, the gap (or Donut Hole), and catastrophic phase. Switching Part D plans during the year does not mess this up. You do not start over again. The amounts, totals, and placement within Part D plan phases transfer to the new plan.

If you are in the gap phase in one plan, you will be in the same phase and place in the new plan. You did not lose your place or are forced to start over again.

Medicare Changes the Catastrophic Phase in 2023

The fourth phase in the four stages of tracking Part D prescription drug costs is called “Catastrophic.” When a beneficiary reaches the catastrophic phase, they and the plan have paid out approximately $7,400 in out-of-pocket costs between the beneficiary and the plan. The actual out-of-pocket for the beneficiary is $3,100. The prescription costs are usually minimal unless it is an expensive medication. The coinsurance in the catastrophic phase for expensive medications is an unlimited 5 percent, and 5 percent of a large amount is still significant for most pocketbooks.

The effect of the new legislation in 2024 is beneficiaries will no longer pay the unlimited 5 percent. The out-of-pocket cost will stop at a hard cap of $3,250 out-of-pocket max for beneficiaries. While still not a small amount, it is significantly less than what some beneficiaries paid who were on costly medications in previous years.

Medicare Part D Annual Limit In 2025

The Inflation Reduction Act (IRA) mandates that the annual limit of the Medicare Part D prescription drug will be $2,000 starting in 2025 and indexed for inflation yearly after that. Part D expenses are not currently capped. This Medicare change starting in 2023 is enormous.

I think of my clients on various insulins, anti-diabetic medications, Eliquis for the heart, Humira & Enbrel for rheumatoid arthritis. Their costs have been thousands of dollars for years. That will stop.

The Medicare Part D $2,000 cap is for all tiers of drugs. The limit is for all medications on the plan’s formulary, and the $2,000 limit is for all Medicare beneficiaries regardless of past or current income. IRMAA does not apply.

Inflation Cap on Part D Premiums

The law also includes a 6 percent limit on Part D premium increases. With current inflation around 6 percent now and medical costs usually at a higher rate of inflation growth than regular inflation, how the system will really work is yet to be seen.

Smoothing Part D Out-of-Pocket Costs

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

One month the cost may be $1,000, and the next month is $100. Most consumers’ incomes are consistently the same each month, and large spikes in expenses create extreme hardship.

The IRA law offers an option for “smoothing” the payments evenly over the year.

In 2025 when the medication copays are set at a total out-of-pocket of $2,000 per year, “smoothing” would look like a $167 monthly payment for those on medications that reach the cost cap.

The smoothing idea aims to reduce prescription abandonment, dosage reductions, and delays in treatment because of high-cost specialty drugs. I had gotten phone calls too many times from the pharmacy when a client went to pick up a medication during the deductible phase. “I can’t afford $500 for this #%&* drug!” I explained their cost would not be $500 every month. They are in the deductible phase. Clients tell me they can’t afford the drug, so they leave it at the pharmacy. Not good.

The Bottom Line For 2023 Medicare Changes

The Medicare Part D prescription drug program has evolved since its inception in 2006. The Inflation Reduction Act (IRA) introduces significant changes to Medicare from 2023 to 2025. The law addresses the growing senior population dependent upon insulin and its rising cost. The IRA law reduces costs for those on limited incomes to afford critical life-sustaining medications.

It is essential to be aware of these new rules to benefit from them and get the proper medications to enhance your life’s quality.

Medicare has had an exciting history with prior authorization. Medicare prior authorization has become controversial over the years because of Medicare Advantage.

Have You Always Been Subject to Prior Authorization?

Health plans started using prior authorization in the 1960s. Hospital admittance grew after the creation of Medicare and Medicaid. At the same time, more employers began offering employees health insurance as part of their compensation package. Medical costs grew significantly, particularly hospital stays.

Insurance companies began implementing utilization reviews in the 1960s. Utilization reviews were a process to reduce the overutilization of resources and identify waste. Registered nurses initially performed utilization reviews in hospital settings. The skillset gained popularity within the health insurance industry as research grew around medical necessity, misuse, and overutilization of services.

Health plans reviewed claims for medical necessity and hospital length of stay. Health plans began to require physicians to certify the admission and subsequent days after admission to help contain costs. Prior authorization originated from the use of utilization reviews.

Fast-forward to the present day. You were subject to prior authorization when you entered the workforce and received employer-provided group health insurance as a benefit. The insurance company determines if it is “medically necessary” and covered by the policy your company purchased when you have any medical procedure. Then there is further discussion about the appropriate charges. Whether or not you were aware of it, prior authorization has always been part of your health insurance coverage.

Why Do Insurance Companies Use Prior Authorization?

Prior authorization is a medical management tool. Doctors and insurance companies work together to ensure that a specific treatment or service is the best option for the patient’s needs.

The purpose of prior authorization is to identify and discourage unnecessary and costly low-value services to reduce wasteful spending without impeding quality healthcare services.

Prior authorization, supervision, audits, and other compliance tools help identify and root out fraud, waste, and abuse in the healthcare system. The ultimate purpose is to reduce costs for the consumer and prevent unnecessary treatments.

The Department of Justice announced today (Feb 17, 2021) criminal charges against 138 defendants, including 42 doctors, nurses, and other licensed medical professionals, in 31 federal districts across the United States for their alleged participation in various healthcare fraud schemes that resulted in approximately $1.4 billion in alleged losses.

The charges target approximately $1.1 billion in fraud committed using telemedicine, $29 million in COVID-19 healthcare fraud, $133 million connected to substance abuse treatment facilities or “sober homes,” and $160 million connected to other healthcare fraud and illegal opioid distribution schemes across the country.

While most doctors, medical professionals, and medical facilities are honest and act with integrity, an element will always and continually seek illicit gain costing consumers and taxpayers untold amounts. This results in higher insurance premiums and medical costs. It is naive to believe all are good actors and that every recommended treatment and service is the best fit.

Why Does Original Medicare Not Use Prior Authorization?

In part, the Medicare prior authorization controversy is that “Original Medicare” does not require prior authorization for most procedures, and Medicare Advantage does. (Original Medicare is just Medicare Part A and Part B. The payment structure is called fee-for-service. Medicare Advantage (or Part C) is Medicare administered by a private insurance company contracted and approved by Medicare.)

At first glance, you probably ask, ‘Why does Original Medicare not require prior authorization’ because prior authorization is common practice in the health insurance world? No company will leave the decision to spend potentially tens of thousands of dollars, even millions, to one person without some oversight.

When Medicare was established, Congress included certain arrangements and excluded others. In Section 1862(a)(1)(A) of the Social Security Act:

“No payment may be made under Part A or Part B for any expenses incurred for items or service which . . .. are not reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed member . . ..”

The key phrase is “reasonable and necessary.” “Reasonable and necessary” has been interpreted over the years very broadly. If a submitted claim is in an allowed category and not excluded, the submission is “reasonable and necessary.”

The doctor authorizes an MRI of the shoulder because the patient complains of problems. MRIs are covered. This procedure is “reasonable and necessary” because it is not an uncommon practice, even if there may be less expensive diagnostic procedures or treatments.

As you can probably guess, this broad interpretation with no oversight or accountability will result in large amounts of fraud, waste, and abuse.

Why Is Medicare Advantage Prior Authorization So Controversial?

The short answer to why is that Original Medicare doesn’t require prior authorization. The controversy is some believe beneficiaries are being denied essential medical services and treatments. Beneficiaries and medical professionals do not even attempt to overturn denials because they believe the appeal process is so burdensome.

The facts, however, do not paint such a sad picture. The Office of the Inspector General reviewed a large number of Medicare Advantage Organizations (MAO), reviewing 448 million preauthorization requests in 2016. Of those, MAOs denied about 1 million preauthorization requests for a denial rate of 4 percent—4 percent is tiny.

The September 2018 Office of Inspector General report found that Medicare Advantage Organizations (MAO) overturned 75 percent of their own denials from 2014-2016, overturning approximately 216,000 yearly. During that same period, independent reviews discovered additional requests that had been inappropriately denied.

The most surprising finding, however, is that only one percent of beneficiaries and providers appealed their denial, which raised the question: how many were denied necessary treatment because the process is so arduous?

Unfortunately, the study does not give a coherent explanation of the denials. From my experience of doing Medicare planning for a decade with thousands of beneficiaries, doctors’ offices do not always submit requests with detailed documentation in support. When the request is denied, they blame the insurance company, and the effort stops unless the patient pushes the issue.

The other reason I find for denial is the doctor’s office uses the wrong billing code. Quite often, the insurance company does not give any explanation in those cases. The response is “denied.” The solution requires the doctor’s office to call and talk with the claims department about billing codes, documentation, and supporting tests. In the absence of these items, nothing happens.

Unfair Statistics and Sensational Journalism

The Department of Health and Human Services Office of Inspect General (OIG) conducted a study of Medicare Advantage Organizations’ (MAO) denial of prior authorizations during one week (June 1-7, 2019). In that week, there were 250 denials. The OIG discovered that 13 percent of these prior authorizations were incorrect. This amounted to 33 cases.

Later in the same report, they admitted the usual national average is 5 percent. No reason was given why the study was not expanded when the conclusions from their study did not coincide with other long-standing evidence, particularly when the study was so microscopic–one week and 250 cases.

In the same study, they did not review the cases where the prior authorization was approved when it should have actually been denied. There was also no control group to compare against. The OIG did not study fee-for-service Medicare billing for fraudulent or wasteful claims or denials on their part.

The New York Times piled on in an April 2022 article. They presented a very slanted view of the study, beginning the article with “Medicare Advantage plans often deny needed care, federal report finds.” Only toward the very end of the article did the author get into any of the facts of the report. The general impression during the first half of the article is Medicare Advantage denies its clients the necessary medical care they need.

Why Are Medicare Prior Authorization Denials Overturned?

Denials may be overturned for many reasons. First, there were errors on the part of the insurance company. The decision was incorrect.

Errors on the part of the doctor’s office or medical facility. They did not include sufficient documentation or incorrect information. The denial is reversed, then. The provider may add new information from additional tests in the appeal process that contributes to an overturn.

The overturn does not necessarily mean the MAO acted inappropriately, but the process and extra steps critics claim create friction in the system. Patients may wish to avoid going through the trouble of appeal. Doctors may not make recommendations because of a history of denials.

Did Medicare Ever Use Prior Authorization?

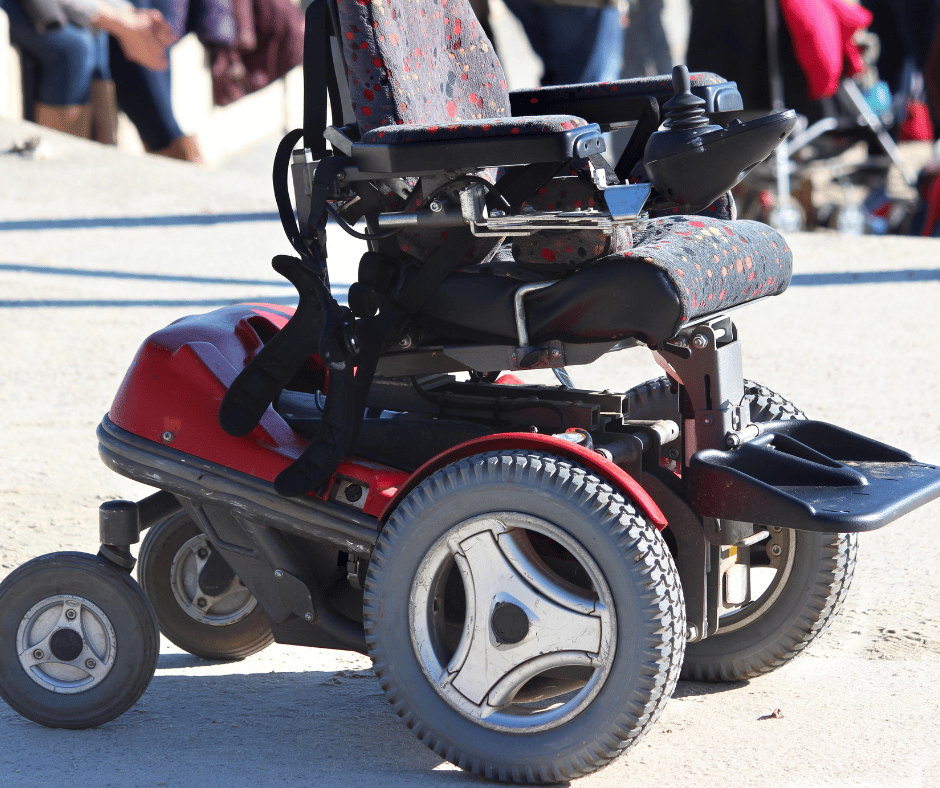

The Medicare practice of accepting bills from providers at face value without question as “reasonable and necessary” was an established and haloed practice from the beginning of Medicare. All parties who benefited the most—except U.S. taxpayers—were unmotivated to change until the wheelchair scandal.

In 1999 it was discovered that Medicare spent $8.2 billion to procure power wheelchairs and “scooters” for 2.7 million people. A large portion was paid to scammers because they discovered that Medicare not only did not require prior authorization for wheelchairs, but Medicare did not even review the authenticity of the claims.

A Washington Post article published in August 2014 highlighted the massive fraud of Medicare’s resources. The article chronicled the sensational scams and trials of many Medicare swindlers. The outrageous theft of public funds and the massive fraud shamed CMS to amend its regulations to finally require preauthorization for some “durable medical equipment,” i.e., electric wheelchairs.

Bureaucrats inside CMS admitted they knew how the wheelchair scheme worked as early as 1998. But it was not until 15 years later that officials finally did enough to curb the practice significantly. Durable medical equipment—electric wheelchairs—is the only exception to the “reasonable and necessary” practice. They must be preapproved.

Consequently, hundreds of millions of false and unnecessary claims were paid over many years in a massive Medicare fraud. Once the bureaucratic problem was fixed, and claims were more thoroughly reviewed, an enormous shift occurred. Medicare reimbursements for motorized wheelchairs fell from $32 million every month to $7 million—a 78 percent decrease.

The Medicare Claims System Is Designed for Fraud, Waste, & Abuse

By law, Medicare must pay most of its claims within 30 days. In that short window, it is supposed to filter out the fraud and uncover claims where the diagnosis or the prescription is bogus.

The system attempts to ameliorate the damage through a “pay and chase” policy. The bill is paid, then it is reviewed. Only a tiny fraction of claims — 3 percent or less — are reviewed by a live person before they are paid. The rest are reviewed only after the money is spent. If at all.

The whole Medicare claims process is set up as an honor system for the richest program managed by the U.S. government. It is a thief’s dream.

Medicare Prior Authorization Test Program

In March 2017, CMS (Center for Medicare & Medicaid Services) designed a test program for preauthorization for fee-for-service Original Medicare. In the month of March, the GAO (U.S. Government Accountability Office), in a Senate report, estimated a savings of $1.1 to $1.9 billion when preauthorization was used that month. The report estimated the federal government made an estimated $36.2 billion in improper payments for the Medicare fee-for-service program from July 2015 to June 2016.

The committee’s recommendation became the report’s title— “CMS Should Take Actions to Continue Prior Authorization Efforts to Reduce Spending.” The prior authorization programs created to monitor and measure improper payments were discontinued and never recommissioned.

Original Medicare Fee-For-Service vs. Medicare Advantage

The government created Medicare in 1965. It had been a long-time project of the Democratic Party. CMS (Center for Medicare & Medicaid Services), Department of Health & Human Services, and Social Security Administration are government agencies. Politicians of all political parties exercise control and funding over these agencies and programs. The agencies are staffed by thousands of bureaucrats and government union workers. A tremendous amount of various and conflicting self-interests, power, and money are all mixed together.

To save Medicare from ballooning budgets and to offer an alternative to citizens, the same politicians, programs, and agencies partnered with private insurance companies to control spending and improve patient care. What is now known as Medicare Advantage began back in the 90s.

The two ways of doing government healthcare for seniors are in competition. Politicians view the world through different ideologies and support policies and programs based upon their political views. Those who support the various political ideologies will support or attack these two platforms accordingly.

It is vital to find all the relevant facts, make your own comparisons and analysis, and determine where lies the truth and the better path.

When I meet with prospective clients, I begin with a brief explanation of Medicare. Then move on to the hundreds of plans. Drugs are next. This is hard. Clients must lay down their cards; some hold a straight flush of costly medications.

The Inflation Reduction Act of 2022 is a long-awaited solution to improve Medicare drug plans and make Part D affordable for those on costly medications.

Inflation Reduction Act of 2022 Deals with Medicare Drug Changes

When Medicare Part D was first established, Medicare contracted with private plan sponsors to provide the prescription drug benefit. The private insurance company created the Part D Prescription Drug Plans (PDP), sold the PDPs, and managed the PDPs. Each company negotiated separately with the pharmaceutical companies the price of the medications and which medications would be included on the plan formularies–the list of authorized drugs.

The insurance companies had the leverage of their brand and how many customers they would bring to the pharmaceutical companies. They were also competing with the other insurance companies to get more medications at the lowest cost. The pharmaceutical companies, of course, were trying to maximize their revenues and profits.

Ideally, it was hoped that the competition and freedom of the market would keep prices low. However, patent laws create a temporary monopoly for pharmaceutical companies that develop these very effective and popular new drugs. The patent, and the consequent monopoly, benefit the nation and the world with the newest and best medications. Unfortunately, it is a substantial financial burden for those who need the medication.

The Inflation Reduction Act Creates Leverage for Medicare

When Part D was created in 2004, a law was established known as “non-interference.” Non-interference means that the Secretary of Health and Human Services (HHS) cannot negotiate drug pricing with pharmaceutical companies, pharmacies, and insurance companies. Instead, the prices would be determined exclusively between the insurance companies, pharmaceutical companies, and pharmacies competing amongst one another.

With the Inflation Reduction Act of 2022, Medicare changes the law. The Secretary of HHS is granted a narrow exception to the non-interference clause. The HHS Secretary can negotiate on behalf of the 84 million Medicare and 76 million Medicaid beneficiaries for the lowest prices for a very limited number of costly prescriptions. The category of medications is single-source brand-name drugs or biologics without generic or biosimilar competitors.

Inflation Reduction Act of 2022 Effects Medicare Change in 2026

The Drug Price Negotiation Program begins in 2026 and is limited to 10 Part D drugs. Another 15 Part D drugs will be added in 2027, 15 Part D in 20228, and 20 Part in 2029. The HHS Secretary will select the drugs from among the 50 highest total cost Part D medications.

The timeline for the negotiation process will span roughly two years. For those companies that do not comply, there is an excise tax. The tax penalty starts at 65% of the product sales in the U.S. and increases by 10% every quarter to a maximum of 95%. The other option is that company can remove all its medications from the Medicare and Medicaid market.

Is the CBO Accurate, Reliable, & Trustworthy?

The Congressional Budget Office (CBO) claims HHS Secretaries’ ability to negotiate prices with Part D producers will significantly reduce what Medicare spends over the next ten years. The CBO also claims that reducing the revenue to pharmaceutical companies will have little effect upon developing new and better drugs. These are all projections and opinions to support the policy change. There is no evidence.

Drug Manufacturers Are Penalized for Inflation

The Inflation Reduction Act of 2002 adds another Medicare change. The Act requires drug manufacturers to pay a rebate to Medicare if prices for single-source drugs covered under Medicare Part B and nearly all covered frugs under part D increase faster than the rate of inflation reflected by the Consumer Price Index (CPI). The rebate dollars will be deposited in the Medicare Supplementary Medical Insurance (SMI) trust fund.

Cap Out-of-Pocket Part D Spending

Medicare Part D currently provides catastrophic coverage for high out-of-pocket drug costs. Still, there is no limit on the total amount beneficiaries pay out of pocket each year. Under the current design, Part D enrollees qualify for catastrophic coverage when the amount that they pay out of pocket plus the value of the manufacturer discount on the price of brand-name drugs in the coverage gap phase exceeds a certain threshold amount. Enrollees with drug costs high enough to exceed the catastrophic threshold must pay 5% of their total drug costs above the threshold until the end of the year. This can be huge.

The Inflation Reduction Act of 2022 amends Medicare’s design of Part D. For 2024, the law eliminates the 5% coinsurance requirement above the catastrophic coverage threshold, effectively capping out-of-pocket costs at approximately $3,250 that year.

The legislation adds a hard cap on out-of-pocket spending of $2,000 per person in 2025. How this will be funded, other than with savings, is still being determined.

Inflation Reduction Act of 2022 Puts Medicare Insulin at $35

Insulin is probably the most common high-dollar medication that burdens many Medicare beneficiaries. Most plans relieve several insulin products, beginning with the Trump Administration and now Biden.

Currently, Medicare beneficiaries can choose to enroll in a Part D plan participating in an Innovation Center model in which enhanced drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit.

Participating plans do not have to cover all insulin products at the $35 monthly copayment amount, just one of each dosage form and insulin type (rapid-acting, short-acting, intermediate-acting, and long-acting).

While Medicare is incredible health insurance, Part D prescription drug plans are the weakness because of the light coverage for higher-end medication. The Inflation Reduction Act of 2022 helps Medicare better service citizens with more reasonably priced medications.

We can ensure you have the plan that best covers your prescription drug needs at the lowest possible cost.

Call 402-614-3389 to speak with an experienced and licensed agent and insurance professional.

What is Medicare?

What is Medicare?

Medicare is under the Social Security Administration (SSA). SSA is the bookkeeper for Medicare collecting premiums from Medicare beneficiaries and distributing funds to Medicare and insurance companies with Medicare contracts. The Centers for Medicare & Medicaid Services (CMS) is the federal agency that manages the Medicare Program. CMS is under the Department of Health and Human Services (HHS).

So who pays for the Medicare bureaucracy?

In 2019, Medicare covered over 61.4 million people. Total expenditures in 2019 were $796.2 billion. A large portion comes from the Medicare Trust Funds, but how else is Medicare funded?

Who Pays For Medicare?

Medicare, like Social Security, is a “pay as you go” program funded each year by current taxpayers. That means the current income taxpaying workforce is who pays into Medicare.

When workers’ ratio to retirees was much higher in past decades, there was little trouble meeting revenue needs. With the vast baby boomer population going on Medicare each month, the number of workers is at a record low level compared to those on Medicare.

Other Sources of Medicare Funding

Medicare also has a trust fund. The U.S. Treasury holds two accounts for Medicare: the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) Trust Fund. Medicare can only use these monies in the trust funds for Medicare operations.

Payroll Taxes Fund Medicare

I remember when I started working at 14. I picked up my first paycheck. Chuck Wagon Buffet on Center St. paid me $1.46 an hour for washing pots and pans in 1975. While working, I would calculate how much I was making in my head. When my first payday arrived, I was excited. I was expecting a specific amount of money. In my mind, it was already wholly spent on useless teenage stuff. When I got the check, my jaw dropped. The amount was way lower than the amount, I figured.

I told my dad they had made a mistake. He explained that the company took out the FICA (Federal Insurance Contribution Act) taxes for Social Security and Medicare. I was not a taxpayer who pays into Medicare. I told him I wanted my money back. He just laughed and told me I might see it back when I got older.

The Medicare tax is a percentage taken from your gross pay. There is no opting out of the Medicare tax. The more you make, the more you pay. The employer is required to match the same percentage amount. You pay 1.45% of your gross wages. The employer himself matches 1.45% of your wages also.

Medicare and Obamacare

However, there is a difference between the Social Security and Medicare tax. The Social Security tax is higher. It is 6.2% from the employee and 6.2% match from the employer. Medicare is 1.45% for both the employee and employer. The difference between Social Security and Medicare is that the Social Security tax ends at $145,000 in income. Any income above the $145,000 mark is Social Security tax-free. The Medicare 1.45% tax, is levied on all earned income, no matter how much. There is no limit. You keep paying the 1.45 even if you are making $500,000. Your income will also affect your Medicare Part B premium.

Further, the government adds an 0.9% Medicare tax for incomes over $200,000 for a total of 2.35%. Congress, with the Affordable Care Act (ACA), a.k.a Obamacare, in 2013 created this new tax. FICA taxes accounted for 88% of Part A revenue in 2019. The taxpaying worker is who pays for Medicare Part A.

Trust Fund Investments Do Little

A source of income for the trust fund is the trust fund investments. However, the investment interest is not actual interest like in your savings account.

When receipts from taxes exceed the HI Trust Fund’s expenditures, the Treasury takes the cash and replaces it with IOUs. The debt instruments are called Government Account Series (GAS) securities. They are nonmarketable, and the US Treasury issues them. Interagency transfers of funds are done with GASs. The interest “earned” is the current interest rate on Treasury bonds and notes. When the actual debt needs to be redeemed, the Treasury must go into the open market to sell US Treasuries to find the cash to cover the Trust fund’s GAS. At the end of the fiscal year 2019, the trust funds held $5.2 trillion in such securities. The internal debt does not count toward the national debt, which is $28,000,000,000,000 and growing.

The Trust Fund investment interest is a tiny portion of the total trust funds. The interest credited is an insignificant amount in relation to the whole budget.

Medicare Part A Premiums From Those Who Did Not Work Enough

Sometimes people are surprised that Medicare costs something. They assume Medicare is free, especially since they paid for Medicare all their working lives. I assure them that Medicare is “free”–the Part A for the hospital. They, of course, thought the whole thing was free.

Medicare Part A, however, is not free for everyone. For those who have worked less than 40 calendar quarters or ten years, Part A has a price. Your Part A monthly premium will depend on how many years you or your spouse worked and paid FICA taxes in the U.S. These people are those who pay for Medicare Part A with monthly premiums.

Paying the FICA is critical. I have known some individuals who worked and earned income, but all of their earnings were not reported to Uncle Sam. As a consequence, their Social Security is small. They are not eligible for Medicare or must purchase Medicare Part A if they want health insurance past 65.

Persons getting Railroad Retirement benefits and some federal, state, and local employees fall into other categories.

How Much Does Medicare Part A Cost?

For individuals or couples who worked between 30 and 39 quarters, which is 7.5 to 10 years, the premium is currently $240 per month. For individuals or couples who worked less than 30 quarters, the Part A premium is $437 per month.

If you do not meet the criteria above, you will likely pay a monthly premium for Part A. Your monthly Part A premium will depend on how many years you or your spouse worked in any job you paid Social Security taxes in the U.S.

State Medicaid will probably pick up the premium cost for Part A and Part B for low-income individuals. The Part A premiums paid to go toward the Medicare expenses.

Supplementary Medical Insurance (SMI) Trust Fund Is Not Much of a Source

The Supplemental Medical Insurance (SMI) Trust Fund supports two Medicare programs. Part B is for doctor and outpatient services as well as medical supplies. Part D started in 2008. It helps seniors with the cost of medications, especially expensive medications. Both programs are voluntary. Monthly premiums from beneficiaries and taxes from the general fund support the programs.

Those enrolled in Part B pay a monthly premium of $170.10 currently out of their Social Security check or paid directly to Social Security. The premium payment options for Part D prescription drug plans are similar. However, the Part B and Part D premiums do not cover most of the actual cost. The general fund supports most of the funding, which is financed with income taxes, corporate taxes, and excise taxes. Part B and D are not financed by FICA payroll taxes like Part A.

Interest Income

For example, in 2017, the federal government general fund paid $253 billion for the Part B expenses. Part B premiums Medicare beneficiaries paid amounted to only $93 billion. Part D revenue from the general fund was $68 billion. Beneficiaries only paid $16 billion for their prescription drug plan premiums. General tax revenues fund the vast majority of Medicare.

Medicare is truly a pay-as-you-go program. There is no stockpile of cash accumulated over decades to cover the expenses. As the ratio of taxpaying workers to beneficiaries declines, the program will experience significant strain.

The SMI Trust Fund itself has very little money reserves and supplies a small fraction of the Medicare budget through interest income. The purpose of the fund is to aid in cash flow. The real source of revenue for Medicare Part B and Part D is taxes. The Part B and Part D premiums paid are a small percentage of the overall revenue.

Do You Have to Pay For Medicare Benefits?

Who pays for Medicare? The answer is the tax payor. The tax payor pays over a lifetime through FICA payroll taxes out of his monthly check. He pays mostly through income tax that goes into the general fund. He finally pays in the form of premiums to Medicare directly, Medigap premiums to private insurance companies, copays, and co-insurance to doctors and medical institutions.

That being said, who pays for Medicare begs how it will be paid in the future. More and more of the burden for the cost of Medicare is falling on seniors in the form of insurance premiums and coinsurance. The working taxpayer is paying less because there are fewer actively employed in relation to those who are receiving Medicare benefits.

The projects and public policies currently in place make that clear. The curiosity that prompts someone to ask who pays for Medicare should lead to additional questions about how we will continue to pay and for what level of benefits.