Everything You Need to Know About Medicare Coverage for Ozempic

Are you looking for comprehensive information on Medicare coverage for Ozempic? Look no further! In this article, we’ll provide everything you need to know about this medication and how Medicare covers it.

Are you looking for comprehensive information on Medicare coverage for Ozempic? Look no further! In this article, we’ll provide everything you need to know about this medication and how Medicare covers it.

Ozempic is a popular prescription medication used to treat type 2 diabetes. It belongs to a class of drugs called GLP-1 receptor agonists, which help lower blood sugar levels and improve overall glycemic control in individuals with diabetes. However, understanding how Medicare covers this medication can sometimes be confusing.

Whether you’re already enrolled in Medicare or planning to do so, it’s crucial to understand the coverage options available for Ozempic clearly. This knowledge can help you make informed decisions about your healthcare and ensure you receive the treatment you need while minimizing out-of-pocket costs.

In this article, we’ll dive into various aspects of Medicare coverage for Ozempic, including the different parts of Medicare, potential costs, coverage criteria, and more. So, if you’re ready to learn about Medicare coverage for Ozempic, let’s get started!

What is Ozempic?

Ozempic is a medication used to treat type 2 diabetes in the class of drugs called GLP-1 receptor agonists, which help lower blood sugar levels. This medication is administered once weekly via injection, making it a convenient option for those managing diabetes. Ozempic is effective in reducing A1C levels and promoting weight loss in patients.

-

How Does Ozempic Work?

Ozempic works by mimicking the action of a naturally occurring hormone called glucagon-like peptide-1 (GLP-1) in the body. GLP-1 helps regulate blood sugar levels by stimulating insulin release, slowing down digestion, and reducing appetite. By activating GLP-1 receptors, Ozempic helps lower blood sugar levels, decrease appetite, and promote weight loss.

body. GLP-1 helps regulate blood sugar levels by stimulating insulin release, slowing down digestion, and reducing appetite. By activating GLP-1 receptors, Ozempic helps lower blood sugar levels, decrease appetite, and promote weight loss.

-

Who Can Benefit from Ozempic?

Ozempic is primarily prescribed to individuals with type 2 diabetes who have not achieved adequate glycemic control through lifestyle changes, such as diet and exercise, or oral diabetes medications alone. It is typically used as an adjunct to diet and exercise to improve blood sugar control.

Like any medication, Ozempic may have potential side effects. Common side effects may include nausea, vomiting, diarrhea, and constipation. These side effects are usually mild and tend to improve over time. However, discussing any concerns or persistent side effects with your healthcare provider is essential.

The Importance of Medicare Coverage for Ozempic

The Importance of Medicare Coverage for Ozempic

Understanding Medicare coverage for Ozempic is crucial, especially for individuals with type 2 diabetes who rely on this medication for their health and well-being. Medicare is a federal health insurance program that provides coverage for eligible individuals aged 65 and older, as well as individuals with specific disabilities. Having Medicare coverage for Ozempic can significantly reduce out-of-pocket costs for an expensive medication and ensure access to this essential treatment. According to CMS (Center for Medicare & Medicaid Services), over 459,000 Medicare beneficiaries were on Ozempic, costing CMS over $2.6 billion in 2021.

Understanding Medicare Part D Prescription Drug Coverage

Medicare Part D is the prescription drug coverage portion of Medicare. It is an optional benefit that helps cover the cost of prescription medications, including Ozempic. To receive Medicare Part D coverage, individuals must be enroll in a standalone prescription drug plan (PDP) or a Medicare Advantage plan (Part C) that includes prescription drug coverage.

Private insurance companies approved by Medicare offer Medicare Part D plans. These plans have formularies, which are lists of covered medications. Ozempic is typically included in the formularies of most Medicare Part D plans, but the specific coverage details may vary. It’s essential to review the formulary of the plan you’re considering to ensure Ozempic is covered and to understand any associated costs.

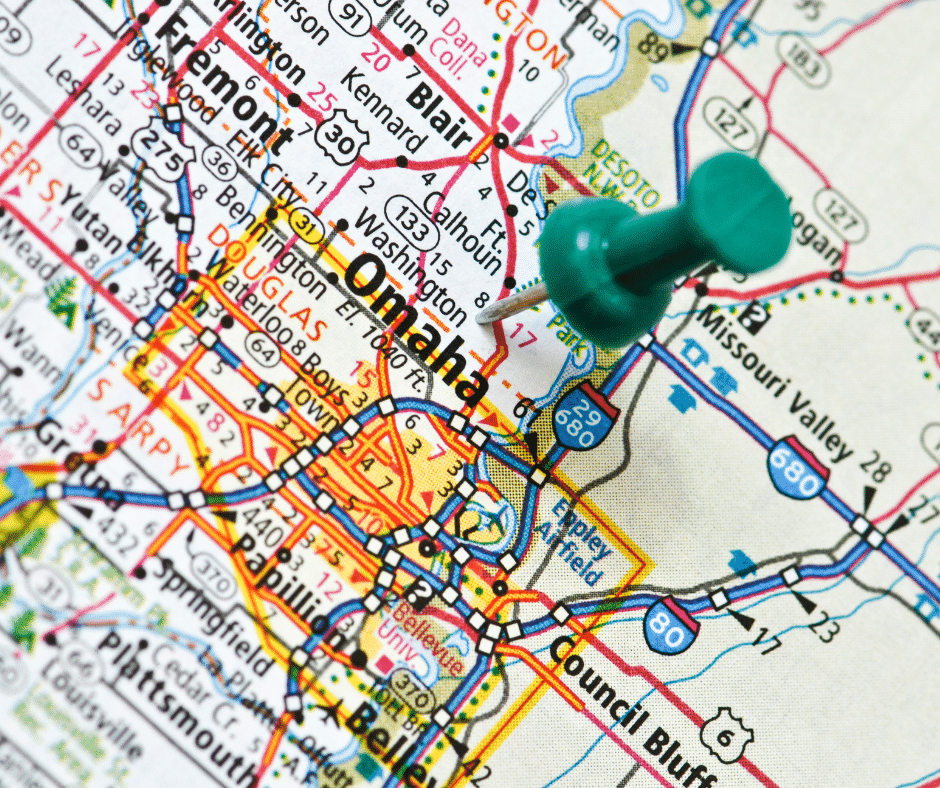

Medicare Part D in the Omaha Metro

There are 21 Medicare Part D prescription drug plans among seven private insurance companies in the Omaha, Lincoln, and Council Bluffs areas. Seventeen Part D prescription drug plans cover Ozempic. Four do not currently include Ozempic on the formulary. If you are enrolled in those plans, you will have to work with the plan and your doctor for an exception.

There are 21 Medicare Part D prescription drug plans among seven private insurance companies in the Omaha, Lincoln, and Council Bluffs areas. Seventeen Part D prescription drug plans cover Ozempic. Four do not currently include Ozempic on the formulary. If you are enrolled in those plans, you will have to work with the plan and your doctor for an exception.

The plan cost of Ozempic ranges from approximately $800-$950 per month. This amount is used to calculate the levels of cost sharing between the plan and you. This cost-sharing also includes any other medications you are taking. The total will determine how quickly you go from the initial phase, where your Ozempic may cost only $11 to $47 for a month’s supply, to the Gap, when Ozempic may jump to $150–$250, depending upon the plan, excluding your monthly premium for the plan itself.

Medicare Part C or Medicare Advantage in the Omaha Metro

Medicare Part C or Medicare Advantage in the Omaha Metro

There are 22 Medicare Advantage/Part C plans with prescription drug coverage among six private insurance companies in the Omaha, Lincoln, and Council Bluffs areas. All 21 Advantage plans list Ozempic on their formulary. The plan cost of Ozempic ranges from approximately $890 to $950 per month. This amount is used to calculate the levels of cost sharing between the plan and you. This cost-sharing also includes any other medications you are taking. The total will determine how quickly you go from the initial phase, where your Ozempic may cost only $47 for a month’s supply, to the Gap, when Ozempic may jump to $225–$295, depending upon the plan, excluding your monthly premium for the plan itself if it is not zero.

Eligibility Criteria for Medicare Coverage of Ozempic

To be eligible for Medicare coverage of Ozempic, you must be enrolled in Medicare Part D or a Medicare Advantage plan that includes prescription drug coverage. Individuals eligible for Medicare Part A and/or Part B are generally eligible for Medicare Part D.

To be eligible for Medicare coverage of Ozempic, you must be enrolled in Medicare Part D or a Medicare Advantage plan that includes prescription drug coverage. Individuals eligible for Medicare Part A and/or Part B are generally eligible for Medicare Part D.

Additionally, Medicare Part D plans may have their own eligibility criteria, such as residence in a specific service area or specific medical conditions. Reviewing the eligibility requirements of the Part D plans in your area is essential to ensure you meet the criteria.

Generally, once your doctor prescripts Ozempic within the standard amounts, the plan will cover Ozempic if it is on the formulary. If it is not on the formulary, you will need to apply for an exception.

Steps to Obtain Medicare Coverage for Ozempic

To obtain Medicare coverage for Ozempic, follow these general steps:

- Enroll in Medicare Part A and/or Part B if you haven’t already done so.

- Decide whether to enroll in a standalone Medicare Part D plan or a Medicare Advantage plan with prescription drug coverage.

- Research and compare Part D plans available in your area to find one that covers Ozempic and meets your healthcare needs.

- Enroll in the Part D plan of your choice during the initial or annual open enrollment period.

- Once enrolled, work with your healthcare provider to obtain a prescription for Ozempic.

- Take your prescription to a pharmacy in-network with your Part D plan and fill your prescription.

It’s important to note that the specific steps and requirements may vary depending on your location and the Part D plan you choose. Consult with Medicare resources or a licensed insurance agent for personalized guidance.

Medicare Coverage Limitations for Ozempic

While Medicare Part D covers Ozempic, certain limitations and cost-sharing requirements may exist. These limitations can include:

- Deductible: Part D plans may have an annual deductible that must be met before coverage begins. The deductible amount varies by plan. The maximum deductible for 2024 is $545. Twelve Part D plans in

our area out of 21 have a $545 deductible. Three Part D plans have a zero deductible.

our area out of 21 have a $545 deductible. Three Part D plans have a zero deductible. - Copayments or Coinsurance: After meeting the deductible, you may be responsible for copayments or coinsurance for each prescription. The amount will depend on the specific plan and formulary tier Ozempic falls under.

- Quantity Limits: Some Part D plans may impose quantity limits on Ozempic, meaning they will only cover a certain amount per prescription or within a specific time frame.

- Prior Authorization: Certain Part D plans may require prior authorization before covering Ozempic. This means that your healthcare provider will need to provide additional information to the plan to demonstrate medical necessity.

Reviewing the details of your chosen Part D plan to understand any limitations and cost-sharing requirements associated with Ozempic is crucial.

Alternative Options for Obtaining Ozempic

In addition to Medicare Part D coverage, there are alternative options for obtaining Ozempic. These options include:

- Manufacturer Assistance Programs: The manufacturer of Ozempic may offer assistance programs to individuals who meet certain eligibility criteria. These programs can provide financial assistance or free medication to eligible individuals.

- Pharmaceutical Discount Cards: Various pharmaceutical discount cards are available that can help reduce the cost of medications, including Ozempic. These cards are typically free and can be used in addition to Medicare Part D coverage.

- State Pharmaceutical Assistance Programs (SPAPs): Some states offer SPAPs that provide additional prescription drug coverage or financial assistance to eligible individuals. These programs can help lower the cost of Ozempic for those who qualify. Nebraska and Iowa do not have these programs.

- EXTRA HELP is a federal program for those on Medicare to help with medication costs. Assistance depends upon income limits and asset levels.

It’s important to explore these alternative options to ensure you’re taking advantage of all available resources for obtaining Ozempic at an affordable cost.

Additional Resources for Understanding Medicare Coverage for Ozempic

Understanding the intricacies of Medicare coverage for Ozempic can be complex. Fortunately, there are additional resources available to help you navigate this process:

- Medicare.gov: The official Medicare website provides comprehensive information about Medicare coverage options, including Part D and prescription drug coverage. The website provides detailed information, plan comparisons, and enrollment resources.

- State Health Insurance Assistance Programs (SHIPs): Each state has SHIPs that offer free, personalized assistance to Medicare beneficiaries. These programs can guide Medicare coverage options, including Part D, and help you understand how Ozempic is covered in your specific state.

- Licensed Insurance Agents: Working with a licensed insurance agent specializing in Medicare can provide valuable guidance and support. These professionals can help you navigate your area’s various Part D plans and assist with enrollment.

The Bottom Line On Ozempic Medicare Coverage

Christopher Grimmond

Medicare coverage for Ozempic is an important consideration for individuals with type 2 diabetes. Understanding how Medicare Part D works and the potential costs associated with obtaining Ozempic can help ensure you have access to this medication while minimizing out-of-pocket expenses. By utilizing the resources available and exploring alternative options, you can make informed decisions about your healthcare and receive the necessary coverage for Ozempic.

We are a local and independent Medicare insurance agency. Let us find the plan that covers your medications within your budget. We cost you nothing. We charge you nothing. We’re FREE. Call us at 402-614-3389 to speak with a licensed insurance agent professional with over 20 years of insurance experience and over 2,000 Medicare insurance clients. We will get it done right.