How Long Will Medicare Pay for Nursing Home Care?

As people age, the value of good health becomes more important than ever. When you had a bad fall in your 40s, it would take a few weeks to recover. Now, a bad fall may result in a hip injury that takes months of recovery, doctor visits, physical therapy, or even surgery. Some must go to skilled nursing facilities to recover. The contrast is stark. Seniors’ health issues increase in frequency and complexity as they age. According to the National Council on Aging, nearly 95% of older adults have at least one chronic condition, and 3 million adults aged 65 or older are treated in emergency rooms due to fall-related injuries every year. So Medicare beneficiaries ask: How long Will Medicare Pay for nursing home care and home health care?

Navigating the Complexities of Care: Medicare’s Coverage of Long-Term Care, Skilled Nursing Facilities, and Home Health Care

While preventative care is essential–annual physicals, screenings, and regular tests–and “fall-proofing” your home is critical, you must be prepared financially for the costs associated with extensive medical care if and when that occurs. If a health event puts you in a situation requiring special care or costly in-facility admittance, your first question will probably be, “How am I going to pay for this?”

If you are a Medicare recipient, navigating care in a long-term care facility can be complex and confusing. There are so many different types of care – long-term care (LTC), skilled nursing facility (SNF), and home healthcare (HH) – that it’s hard to know how it all works and how much Medicare is willing to pay for each.

My job is to make that journey a whole lot easier. I’ll break down each of these care types and dive into what Medicare will and won’t cover so that you know your options if you’re faced with a health challenge that requires ongoing care.

The Differences: LTC vs. SNF vs. HH

Understanding the different types of care offerings can feel like a full-time job for aging adults. Terms like assisted living facilities, senior living providers, and skilled nursing facilities are often used interchangeably, but the truth is, there are subtle differences in care and what and how much Medicare pays for the different types of “nursing home care.”

The three essential categories of care for seniors are long-term care (LTC), skilled nursing facilities (SNF), and home healthcare (HH). Understanding what each one does and its purpose can be beneficial when it comes time to finding care for your specific situation.

Long Term Care (LTC)

Long-Term Care facilities are the places we think of as “nursing homes.” A person may go to a long-term care facility for several reasons and lengths of stay. Permanent residents generally go to LTC facilities primarily because they can no longer perform the activities of daily living.

The 5 activities of daily living are:

- Feeding

- Dressing

- Personal Hygiene (bathing, brushing teeth, clipping nails, etc.)

- Continence (control of bladder and bowels)

- Toileting

If you struggle with any of the above, a Long-Term Care facility may be the right choice for you.

Staffed with caregivers, such as certified nurse assistants, registered nurses, various types of therapists, and doctors–these facilities focus more on providing meals, custodial care like dressing and feeding, and offering social environments for their patients. While also providing health care, the primary focus is custodial care because residents can no longer perform those functions for themselves, their families cannot care for them, and they cannot afford to provide those services in their own homes economically.

Skilled Nursing Facility (SNF)

Skilled Nursing Facility (SNF)

Skilled nursing facilities are often in the same physical location as long-term care facilities. The difference comes down to the reason behind your stay. If you need care because of a medical condition – such as a broken hip from a fall, car accident, stroke, or heart attack – then an SNF can provide the medical care you need–intense nursing care, physical therapy, speech pathology. Custodial care, such as feeding or toileting, comes with a stay in the skilled nursing facility, but it is secondary to the primary reason for the stay–intense and daily treatment.

Seniors needing intense physical therapy, speech therapy, occupational therapy, or continuous medical support should reside in Skilled Nursing Facilities until they are recovered, reach a certain level, or plateau. Then you return home, where home healthcare takes over. The nurses, physical & occupational therapists, and speech pathologists come to your home. Eventually, when you have progressed in your recovery and do not need treatment as often, home healthcare stops, and you go to providers’ offices for an appointment.

Home Healthcare (HH)

Home Healthcare providers allow their clients to continue living in the comfort of their homes while providing care. The person still cannot get out and go to appointments easily, so the skilled providers come to you in your home two or three times a week or less, depending upon need. Ideally, in the recovery process, you eventually leave your home and go to their offices to receive treatment until you fully recover. Again, home healthcare does not provide custodial care in the home, except on rare occasions for short periods of time.

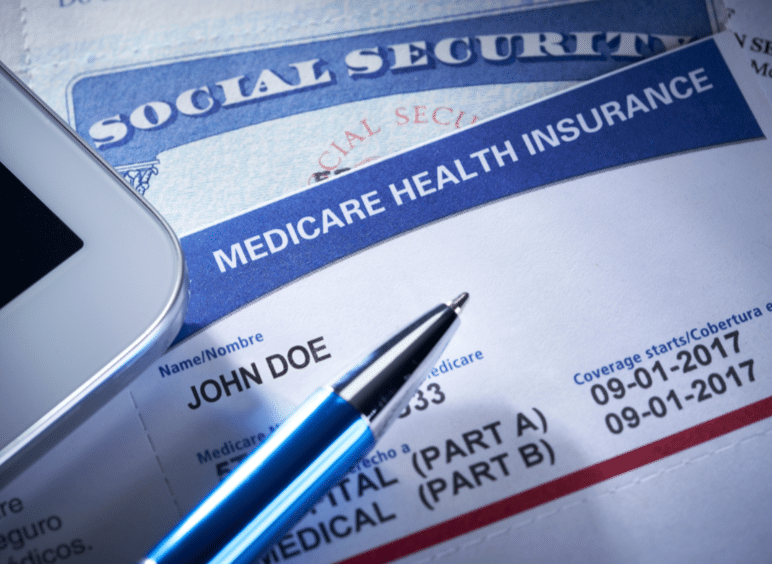

Understanding that Medicare is health insurance. It covers and pays for doctors, nurses, tests, hospitals–all the things you associate with medical treatment and recovery. Medicare does not provide custodial care, housekeeping, meal & laundry service, or taxis.

Will Medicare Cover Long-Term Care?

When someone says “long-term care” or “nursing home,” they generally mean the person is residing permanently in a facility because she cannot take care of herself–she cannot perform the 5 activities of daily living. Medicare does not pay for nursing home care. Even when medical necessity requires admittance to a nursing home (skilled nursing facility), the length of stay is capped at 100 days. There are rules around stopping and starting this coverage, coming from a hospital stay, and restarting a stay, but essentially, Medicare will only pay for 100 days per year in a nursing home. And Medicare approval for a stay of that length is rare. Again, Medicare pays for “nursing home” care for purposes of intense but temporary medical treatment.

Will Medicare Cover Skilled Nursing Facilities?

Medicare provides “Skilled Nursing Facilities” coverage, but patients must qualify based on stringent requirements. Medicare will only cover SNF care if all of the following are true:

- You are a recipient of Medicare Part A and have days of coverage remaining in your benefit period.

- A qualifying hospital stay preceded the need for SNF. An inpatient stay of at least 3 consecutive days in the hospital followed by admission into an SNF within 30 days of leaving the hospital is required for coverage.

- A doctor must have ordered inpatient SNF care based on medical necessity.

- Your condition requires skilled care daily.

- You need skilled services for an ongoing condition that was treated during your 3-day hospital stay OR a new condition that started while you were already receiving SNF care for an ongoing condition.

- The services must be reasonable and necessary for the treatment of your condition.

- You obtain care through a Medicare-certified SNF.

Even if you qualify, your stay will not last indefinitely.

How Many Days Will Medicare Pay for Skilled Nursing Care?

After qualifying for SNF care, your progress will be closely monitored for the length of your stay, the care you are receiving, and the above requirements to ensure Medicare will continue providing coverage. At a high level, Medicare will cover up to 100 days of SNF coverage within a single benefit period. Again, approval for that length of stay is rare. Medicare wishes to move you to less costly home healthcare as soon as medically possible.

In those 100 days, Medicare will cover the cost of the following:

- A semi-private room

- Meals

- Skilled nursing care

- Medical social services

- Medications

- Medical supplies and equipment usage

- Ambulance transport when required

- Dietary counseling

- Physical therapy, occupational therapy, and speech-language pathology when required to meet your health goal

It’s important to note that while Medicare will provide coverage for 100 days, you will have to supplement the coverage starting on day 21.

- Days 1 – 20: Medicare will pay the total cost; you pay nothing.

- Days 21 – 100: You pay the daily coinsurance, which can be up to $204 per day in 2024.

- Days 101+: Medicare pays nothing; you incur the total cost of care if you remain.

A detailed breakdown of coverage details can be found in Medicare’s SNF handbook. Medicare does not pay for nursing home care unless it is tied to a treatment program while you are in residence.

Will Medicare Cover Home Health Care?

Home healthcare falls under both Medicare Part A and Part B. Home healthcare is defined as part-time or intermittent skilled care when you are “homebound.” Homebound means you cannot leave your home without assistance. Assistance could be using a walker, wheelchair, crutches, or even a cane. You may need special transportation because of your condition. Your doctor may advise you not to leave your home because of your medical condition. These all constitute reasons Medicare will accept for home healthcare.

The usual services home healthcare provides on a part-time basis are:

- physical therapy

- occupation therapy

- speech-language pathology services

- Injectable osteoporosis drugs

- durable medical equipment

A doctor must certify you need home health care through a face-to-face meeting. You need part-time or intermittent care, which may be up to 8 hours per day but with a maximum of 28 hours per week.

Home Healthcare does not include:

- 24-hour adult day care at home

- Meals delivered to the home

- Homemaker services

- Custodial (or personal) care help.

If you do attend adult day care in a facility, you can still qualify for home healthcare.

Getting the Most from Your Medicare: Which Direction?

There are two ways for you to receive Medicare: Original Medicare or Medicare Advantage.

There are two ways for you to receive Medicare: Original Medicare or Medicare Advantage.

Original Medicare

Original Medicare is Part A for inpatient hospital stays and Part B for outpatient services and doctor visits. There are no networks for Original Medicare. It is fee-for-service (FFS), which means if the doctor or facility accepts Medicare–accept assignment for Medicare is the proper terminology–then Medicare will reimburse the provider for medically necessary services rendered.

Original Medicare does not include Part D for prescriptions, and Orignal Medicare has big gaps in coverage. A quarter of people purchase some sort of supplemental insurance policy, such as Medigap, to fill in the gaps in coverage.

Medicare Advantage/Part C

The other direction is Medicare Advantage (or Part C). These plans are provided by a private insurance company that is Medicare-approved to provide health coverage that is equal to or better than Original Medicare.

The gaps in coverage are structured differently than Original Medicare. Medicare Advantage plans have a maximum out-of-pocket. Original Medicare does not. For example, the most popular Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs have a maximum out-of-pocket of less than $4,000. Original Medicare, on the other hand, does not have a maximum. The sky is the limit for your out-of-pocket costs.

Medicare Advantage is also built on provider networks. The Omaha, Lincoln, Council Bluffs metro area has four healthcare networks: CHI (Catholic Health Initiative), Nebraska Medicine, Methodist Health Systems, and Bryan Hospital. All these networks work with the Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs. Access to providers is a non-issue for us. In other places and with other Medicare Advantage plans, there can be issues and problems, but not here.

Home healthcare is zero for both Original Medicare and most Medicare Advantage plans.

Skilled nursing is zero for the first 20 days for both. On the 21st day, Original Medicare has a copay of $204 during the potential 100 days of coverage–again with no cap on expenses for Part B. Medicare Advantage plans have copays of various sizes, but the key is a limit to what you could pay– a maximum out-of-pocket.

For those who pay the additional premium for the Medigap plan, the skilled nursing facility copay will usually be covered entirely.

Medicare Part D

Medicare Part D prescription drug plans are another premium. Most Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs include the prescription drug plan and are mostly at zero cost.

Neither Original Medicare with a Medigap plan nor Medicare Advantage provides long-term care, custodial care, housekeeping, or adult day care. They may cover some of these services as incidental to providing skilled nursing care in a facility or home but for short periods.

Alternative Ways to Pay for the Care You Need

In 2021, the average cost of long-term care services ranged from $20,280 to $108,405 annually. These prices are exorbitant, and they’re only going up. As you age, the best thing you can do for your health and your wallet is to ensure you have the coverage you can rely on if you need long-term care. Since Medicare doesn’t pay for many long-term care scenarios–“nursing home care”–knowing your other options for coverage is crucial.

Private Pay

Private Pay

Although challenging, some people will pay for their nursing home care from their savings and assets. By dipping into retirement accounts, tapping into assets such as property or investments, or simply saving up over their lifetimes, some seniors pay out-of-pocket for all the care they receive. This is rare.

One major benefit to this approach is that LTC facilities often prioritize private pay clients when space is limited. With the looming senior care crisis, this will get even more important in the years to come.

Long-Term Care Insurance

A separate long-term care insurance policy can pay the cost of residing in a long-term care facility. In most scenarios, these policies require that you need help with two or more of the activities of daily living (feeding, dressing, hygiene, continence, and toileting) before they take effect. There are usually elimination periods of 30, 60, 90, and 120 days before a policy will pay. The premiums for these insurance plans are not cheap. As you age, like life insurance, the price goes up and can be beyond the budget of many people. You also need to pass underwriting when you apply for the policy, though it will be guaranteed renewal for the rest of your life, no matter your health, as long as you continue to pay the monthly premium.

Veteran Benefits

If you served in the military, you may qualify for some sort of long-term care benefits from the Department of Veterans Affairs. Eligibility will depend upon length of service, type of service, military-related disabilities, and even income. Then, there may be limited or no facility access in your area. Where there is a facility, availability may be limited in terms of beds. Contact the Department of Veteran Affairs to determine for what you qualify. Access is very limited in Nebraska.

Veterans Affairs. Eligibility will depend upon length of service, type of service, military-related disabilities, and even income. Then, there may be limited or no facility access in your area. Where there is a facility, availability may be limited in terms of beds. Contact the Department of Veteran Affairs to determine for what you qualify. Access is very limited in Nebraska.

Medicaid

Often confused with Medicare, Medicaid is an entirely different health program. It’s partially funded by the federal government but funded and managed by the state.

Medicaid provides low-income seniors with financial help for long-term care. Each state has its own eligibility guidelines, but you’ll need to demonstrate financial need to qualify.

Many times people will tell me that so-in-so is in a “nursing home,” and they pay nothing. That is because all their assets have been depleted, and they are on county assistance. Medicaid is paying the bill, and all their assets are gone or will be upon death. The state takes homes and any other assets to offset the loss to the taxpayer who covers the expense.

Medicare Does Not Pay for Nursing Home Care: Your Health is in Your Hands

Medicare Does Not Pay for Nursing Home Care: Your Health is in Your Hands

LTC, SNF, and HH are a jungle of terms, regulations, insurance, and costs. It is even confusing for experts. Like figuring out your income tax or finances, consulting an insurance professional will be helpful. You need someone who knows Medicare, Medicare insurance, the CMS rules and regulations, and possesses years of experience dealing with Medicare. He can guide you through the maze of Medicare and help you take your health care into your own hands and plan for the best outcome.

You’re in the right place if you’re unsure where to start. Every week, I spend time helping those on Medicare just like you find the right coverage for their needs. At Omaha Insurance Solutions, we can help you figureout the best direction for you, enroll you in Medicare, choose a plan, and get all the T’s cross and I’s dotted on forms and applications. Each year, we will review your needs and the plans available to maximize your Medicare benefits.

Christopher Grimmond

Get in touch with us today at 402-614-3389 for a free, no-obligation consultation about your Medicare options.