Medicare Changes Part B Deductible

Medicare Changes Part B Deductible

Medicare changes came out in December. The Medicare changes Part B deductible was an increase. The Medicare Part B deductible for 2016 was $166. The 2017 Part B deductible is $183. While the $17 increase is small in dollar terms, it was a 10% increase. That’s big!

Part B Deductible

Part B Deductible

What is the Medicare Part B deductible? Medicare Part A and Part B have various deductibles and co-insurance costs that you pay. While Medicare covers the majority of medical cost, you have some significant responsibility, especially if there are frequent and/or high dollar medical need. Part B covers doctors visits and outpatient procedures, which is everything other than the hospital. Medicare will cover 80% of those costs. Your portion is 20%, but before the 20% starts, you have an annual deductible. The key to the Part B deductible is that it is an annual deductible. You pay the Part B deductible only once per year, which is different from the Part A hospital deductible.

Plan G Vs. Plan F

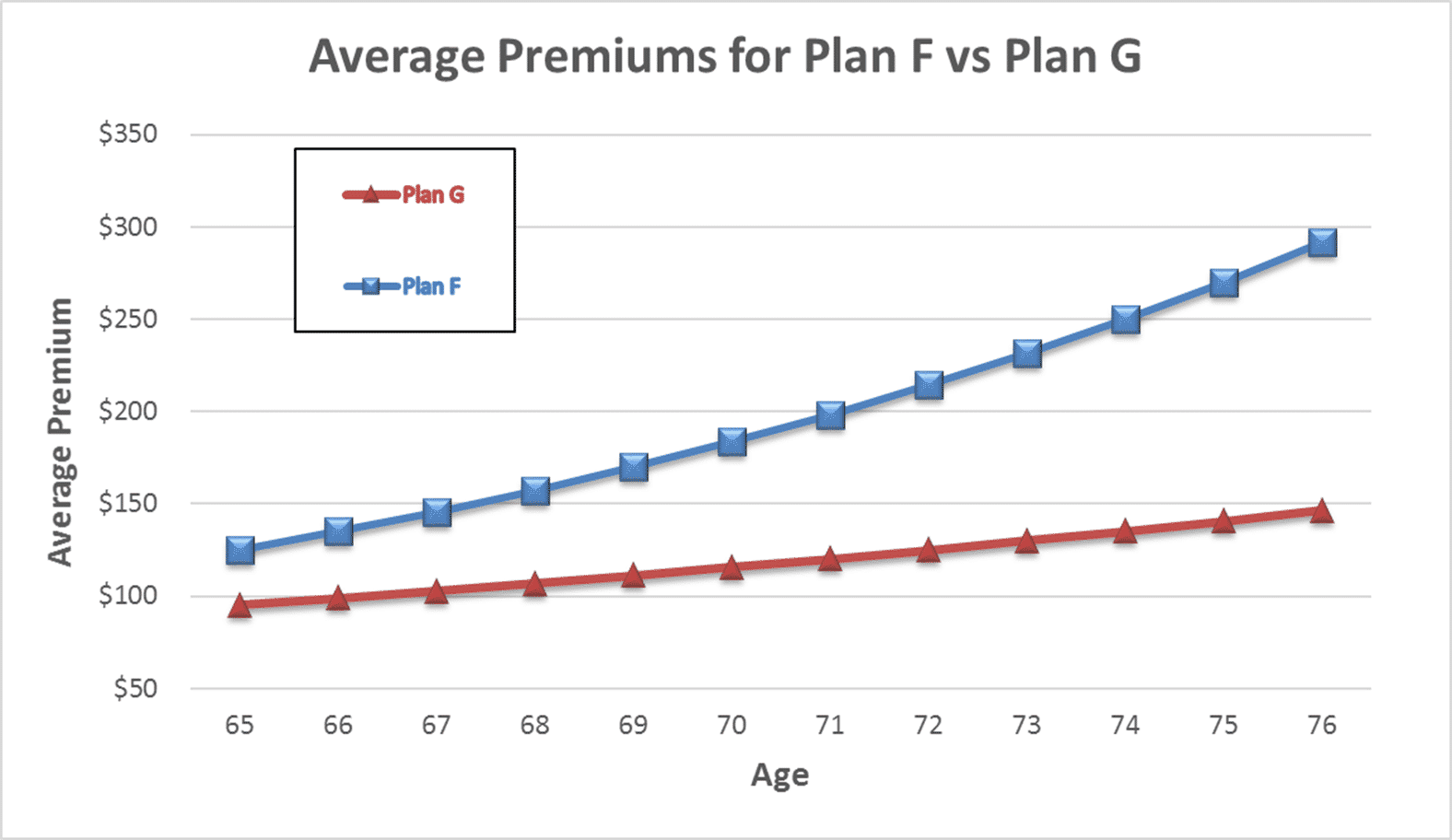

Medicare Supplement Plan G is becoming the most popular supplement plan available. Plan G covers all the Medicare Part A deductibles and Part B co-insurance EXCEPT the Medicare Part B deductible. You pay that directly to the provider after the Medicare discount. Once that is satisfied for the year, you pay nothing else out of pocket.

Medicare Supplement Plan G is becoming the most popular supplement plan available. Plan G covers all the Medicare Part A deductibles and Part B co-insurance EXCEPT the Medicare Part B deductible. You pay that directly to the provider after the Medicare discount. Once that is satisfied for the year, you pay nothing else out of pocket.

You may ask, ‘why don’t I do Plan F where the Part B deductible is also covered?’ If you were on a Plan F, your monthly premium would include the cost of the Part B premium and the increase. You also would pay a substantial fee to the insurance company for them to write the check for $183 for you. By being on Plan G as opposed to Plan F, you avoid the sizeable annual increase and the additional fee for paying the Part B deductible.

While the Medicare changes Part B deductible was not large in dollar terms, the reality is the cost of Medicare will continue to rise along with all medical costs. It is important to have an agent who can help you understand your plan and find the plan that best fits your needs at the lowest cost. Give us a call at 402-614-3389 for a free evaluation.