Medicare Plan N vs Plan G: Understanding the Differences

Are you ready to dive into the intricate world of Medicare Supplements? If you’re exploring your options, you’ve probably come across Medicare Supplement Plan N and Plan G. While both plans offer comprehensive coverage, what are the differences between Medicare Plan N vs Plan G?

Supplement Plan N and Plan G. While both plans offer comprehensive coverage, what are the differences between Medicare Plan N vs Plan G?

In this essential guide, we’ll take a closer look at Medigap Plan N and Plan G to help you determine the right fit for your healthcare needs. From coverage details to cost considerations, we’ll cover all the essential aspects to make your decision-making process easier.

Whether you’re new to Medicare or considering switching from your current plan, this guide will provide valuable insights. By the end, you’ll clearly understand each plan’s benefits and potential drawbacks, empowering you to choose the best option for your unique circumstances.

So, grab a cup of coffee, sit back, and let’s explore the intricacies of Medicare Plan N vs Plan G. Aren’t you curious to find out which plan will provide the best coverage for you?

Overview of Medicare Plan N

Overview of Medicare Plan N

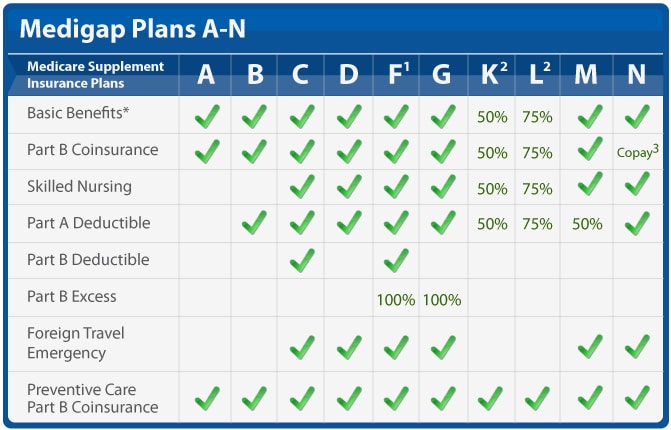

Medicare Plan N is a popular choice for individuals who want comprehensive coverage at a more affordable price. Plan N, like Plan G and the other plans, cover virtually everything. Medicare is the most comprehensive health insurance out there. The key difference of Plan N is the cost-sharing structure, which requires you to pay a small copayment or coinsurance for certain services.

Like all Medicare supplement plans, you’ll be free to choose your own healthcare providers with plan N, as the plan doesn’t require you to select a primary care physician or obtain referrals for specialist visits. All physicians and health facilities that accept Medicare will also accept the supplement. This flexibility can be especially beneficial if you prefer to have control over your healthcare decisions.

While Plan N covers a significant portion of your healthcare expenses, it does come with some out-of-pocket costs. For example, you’ll be responsible for paying the Part B deductible and any excess charges that exceed the Medicare-approved amount. However, these costs are usually minimal compared to the plan’s overall coverage.

Medicare Plan N offers a comprehensive range of coverage and benefits.

Here is what is covered:

1. Part A Hospital Coverage: Plan N covers hospital stays, including room and board, nursing care, and other related services.

2. Part B Medical Coverage includes coverage for doctor visits, outpatient services, and preventive care.

3. Emergency Care: Plan N covers emergency room visits and urgent care services.

4. Skilled Nursing Facility Care: If you require skilled nursing care, Plan N covers the costs of this type of facility.

5. Hospice Care: Medicare Plan N includes coverage for hospice care, ensuring that you receive the necessary support during end-of-life care.

In addition to these core benefits, Plan N offers coverage for certain preventive services, such as annual wellness visits and vaccinations. This ensures that you can maintain your health and prevent potential illnesses.

Pros and Cons of Medicare Plan N

Like any healthcare plan, Medicare Plan N has its trade-offs. Here’s a closer look at the advantages and potential drawbacks.

1. Comprehensive Coverage: Plan N offers comprehensive coverage for a wide range of healthcare services, giving you peace of mind knowing that your medical expenses are covered.

2. Affordability: Compared to other Medicare plans, Plan N is often more affordable, making it an attractive option for individuals on a budget.

3. Freedom to Choose Providers: With Plan N, you can choose your own healthcare providers, ensuring you receive care from trusted professionals.

Trade-Offs of Medicare Plan N

1. Out-of-Pocket Costs: While Plan N covers significant healthcare expenses, you’ll still be responsible for out-of-pocket costs, such as the Part B deductible and excess charges.

2. Limited Coverage for Travel: If you frequently travel outside the United States, Plan N may not provide coverage for medical services obtained abroad.

3. Cost-Sharing Requirements: Plan N requires paying copayments or coinsurance for certain services, which can add up over time.

Overall, Medicare Plan N offers comprehensive coverage at an affordable price, making it a popular choice for many individuals. However, it’s essential to carefully consider your healthcare needs and budget before deciding.

Overview of Medicare Plan G

Overview of Medicare Plan G

Medicare Plan G is another option worth considering if you want comprehensive coverage with minimal out-of-pocket costs. This plan is similar to Plan N in terms of coverage, but it has a few key differences that may make it a better fit for certain individuals.

With Medicare Plan G, you have access to the same wide range of benefits, such as hospital stays, doctor visits, and preventive care. Like Plan N, Plan G also has a cost-sharing structure, which requires you to pay the Part B deductible, which is currently $226 annually.

Once the deductible is met, Plan G provides full coverage for Part B services. You pay nothing more. You do not pay the Part B Excess charges. There are no copays for doctor visits or emergency services.

Pros and Cons of Medicare Plan G

Like Medicare Plan N, Plan G has its own set of pros and cons. Here’s a closer look at what you can expect.

1. Comprehensive Coverage: Plan G offers comprehensive coverage for a wide range of healthcare services, giving you peace of mind knowing that your medical expenses are covered.

2. Minimal Out-of-Pocket Costs: Plan G provides complete coverage for Part B services once you meet the Part B deductible, leaving you minimal out-of-pocket costs.

3. Freedom to Choose Providers: With Plan G, you can choose your own healthcare providers, ensuring you receive care from trusted professionals.

Cons of Medicare Plan G

1. Part B Deductible: Plan G requires you to pay the Part B deductible out of pocket. However, once this deductible is met, your out-of-pocket costs are significantly reduced.

2. Potentially Higher Premiums: Plan G may have higher premiums compared to other Medicare plans. However, the comprehensive coverage and minimal out-of-pocket costs may outweigh the higher premium costs for many individuals.

3. Limited Coverage for Travel: Similar to Plan N, Plan G may not provide coverage for medical services obtained outside the United States.

When deciding between Medicare Plan N and Plan G, it’s important to consider your personal healthcare needs, budget, and preferences. Both plans offer comprehensive coverage, but the cost-sharing structure and coverage for the Part B deductible may be deciding factors for many individuals.

Key Differences between Medicare Plan N and Plan G

Key Differences between Medicare Plan N and Plan G

While Medicare Plan N and Plan G cover the same services, and both require you to pay the Part B deductible (currently $226), the other cost-sharing and the monthly premiums differ.

Here are factors to consider:

There is a noticeable difference in premium between Plan N and Plan G. Most of my clients are in the Omaha, Lincoln, and Council Bluffs Metro areas. Looking at the difference in premiums between Plan N and Plan G here, the price range is between $40 to $50 per month (or $460 to $600 per year) more for Plan G than Plan N for a 65-year-old.

The price range for a 75-year-old is $45 to $55 on average (or $540 to $660 per year) more, and an 85-year-old has a premium range of $60 to $80 per month (or $720 to $960) more for Plan G than Plan N.

These premium differences are for Medicare Supplements in the low range of supplements. For higher-priced Medigap policies, the range is even wider.

Why Is Medicare Plan G Premium More Than Plan N?

Depending on your age, you pay $540 to $960 more per year for a Plan G over a Plan N Medicare Supplement. Why?

There are a number of reasons.

- You don’t pay the $20 copay for doctor visits on Plan G. The plan pays the cost, and it is reflected in the premium.

- You don’t pay Part B Excess Charges on Plan G. The plan pays the cost, and it is reflected in the premium.

- You don’t pay the $50 copay for emergency room services on Plan G, and it is reflected in the premium.

- Plan G is the most popular Medigap Plan and the default guarantee issue plan.

How Should I Compare Medicare Plan N to Plan G?

Copays

Copays

How many times would you have to go to the doctor for Plan N to be more expensive than Plan G? The answer is to divide the $20 doctor copay into the annual price difference–$540 premium / $20 copay = 27 doctor visits. For a 65-year-old, you would need to go more than 27 times for Plan N to cost you more than Plan G. That is a lot of doctor visits! How many times do you go to the doctor each year normally? Once, twice, five times?

Medigap Plan N has an emergency room maximum copay of $50. You will probably not go to the emergency room regularly or for prolonged periods. If you go to the emergency room frequently, I guarantee it will NOT be for a prolonged period. We can eliminate the $50 emergency room copay as seriously impacting your total annual cost.

Medicare Part B Excess Charges

Most doctors who are contracted with Medicare do not charge the Part B Excess Change. Of the 2% of doctors who do, they are in mental health and podiatry.

You have control of these charges by asking the physician ahead of time if she takes assignment for Medicare. In other words, does she accept what Medicare bills and does not charge the excess?

Medicare Plan N vs Plan G Rate Increases

Healthcare costs go up. In our current inflationary environment, those increases will be substantial. The insurance companies cover increased costs with rate increases. Your monthly premium will go up in the near future, and if you wish to keep your policy, you must pay the increased cost.

In general, the rate of increase for Medigap Plan G is higher than for Plan N. The difference ranges from 1% to 4% over time and from state to state and company to company, but the rate increases are usually more for Plan G than Plan N, as a rule.

Medigap Plan G Is More Popular

Plan F is still the most popular, with 46% of Medigap policyholders enrolled in Plan F. However, that is quickly decreasing because beneficiaries who turn 65 after 2020 are no longer eligible to purchase Plan F.

Plan G is the most comprehensive Medigap plan because all health issues are paid for after the $226 Part B deductible is met. Like Plan F before, Plan G is the go-to plan for the majority, with 26% currently enrolled in Plan G versus Plan N at 10%.

Medigap Plan G Is Guarantee Issue

After someone’s Initial Enrollment into Medicare at age 65 or when they enroll in Medicare Part B, most people must go through underwriting to get Medicare Supplements. They must answer a series of health questions, and the insurance company can determine whether to accept them into the policy, accept them at a higher premium, or decline them.

There are a handful of exceptions to this rule. Insurance companies must guarantee to issue a Medigap policy when someone comes off a Medicare Advantage plan in their first year on the plan. The other most common instance is when a person has Medicare Part A and Part B, losing their group health plan. Then, they can get a Medigap plan without answering health questions, in other words, guaranteed issue.

The vital point about guaranteed-issued policies is that Plan G is the only plan eligible for the guaranteed issue. Insurance companies cannot screen guarantee issue applicants. They must take them no matter their health. Coupled with the fact that Plan G is now the most popular plan, Plan Gs have a disproportionately large number of unhealthy participants vs Plan N.

Consequently, the Medicare Plan G member pool has proportionally more medical claims than Plan N policies. The higher claims ratio increases the costs for Plan G vs Plan N. The higher costs result in high average annual rate increases between Medicare Plan G vs Plan N. Medicare Plan G rate increases average between 1% to 4% more each year. Over time, there is a significant difference in what a beneficiary pays for their Medigap Plan G vs Plan N.

Rate Increases Are Lower for Plan N

Rate Increases Are Lower for Plan N

For example, if a Medigap Plan G $150 premium at 65 increases by 4% on average for fifteen years, the premium will be $270 at 80. If a Medigap Plan N $110 premium at 65 increases by 2% on average for fifteen years, the premium will be $148 at 80.

The Medicare Plan N premiums are smaller than Plan G, but Plan G premiums more than double in the same time period because of the higher percentage increase and larger initial premium.

While the Plan N $20 doctor copays and the $50 emergency room fee are essential to remember, the smaller percentage increase in annual cost for a Plan N is the real underlying factor to weigh when deciding about your Medicare coverage. Plan G’s percentage increase, because of its popularity and guarantee issue status, ensures you will probably pay significantly more for Medicare Plan G than Plan N over time.

The Bottomline: Medicare Plan N vs Plan G

Choosing the right Medicare plan is crucial and can significantly impact your healthcare and financial well-being. Medicare Plan N and Plan G are excellent options for individuals seeking comprehensive coverage, but it’s important to understand their differences.

Choosing the right Medicare plan is crucial and can significantly impact your healthcare and financial well-being. Medicare Plan N and Plan G are excellent options for individuals seeking comprehensive coverage, but it’s important to understand their differences.

In this comprehensive guide, we’ve explored the coverage details, benefits, pros, and cons of Medicare Plan N vs Plan G. We’ve also discussed the key differences between the two plans and provided factors to consider when deciding.

By evaluating your healthcare needs, budget, and preferences, you can choose the Medicare plan that provides the best coverage for you. Whether you opt for Medicare Plan N vs Plan G, both plans offer comprehensive coverage and the peace of mind that comes with knowing your medical expenses are taken care of.

Medicare Plan G offers the convenience of comprehensive coverage. Once your small Part B deductible of $226 is met for the year, you don’t have to worry about any further out-of-pocket expenses for your health coverage. The tradeoff, however, is you pay for that convenience, especially over time in higher premiums and consistently higher rate increases that may strain your fixed budget as it is eroded more and more by inflation or other unplanned expenses.

Medicare Plan N gives you the same coverage, but you will be responsible for minimal doctor and emergency room copays. Those copays, while they may

Christopher J. Grimmond

seem to be a nuisance, keeping a lid on the rising cost of healthcare coverage. Your premium may be more palatable ten and fifteen years down the line.

Hopefully, you will be on Medicare for a long time. Weigh carefully the costs and tradeoffs over the next fifteen or more years.

We can help you sort through the confusion that is called Medicare and the seemingly endless number of Medicare Supplements and Medicare Plans at no cost to you. Call us at 402-614-3389 and speak with an experienced and licensed insurance agent professional.