A prospective client called me about saving money on her Medicare supplement. I asked her the basic supplement health questions and gave a quote. We set up a time to meet. At the meeting, I started going through the standard health questions on the application. When I came to the question about recommended future treatments, she said no, but the way she answered bothered me. So I asked it a different way. “Did the doctor suggest that you have anything done, like cataract surgery, knee or hip replacement?” Then she lit up. “My hips are really bad,” she said. “He thinks I should replace them sometime.” “So when you say sometime, are you talking about in a year or two?” “Oh no,” she said. “In the next couple of months.” I closed my notebook. We were done.

Supplement Health Questions Broken Down

Recommended treatments by a physician could potentially cause a problem when you switch supplements. Three things to know: 1.) what is a recommended treatment, 2.) why does it matter, 3.) what should you do about it.

Most of the time when we see the doctor it is because we are sick right now. She makes a diagnosis and recommends an immediate treatment. ‘Take this pill now.’ ‘Have open heart surgery next week.’ Sometimes the diagnosis leads to a recommendation for treatment sometime in the future. ‘Your knees are deteriorating. You should have a knee replacement in the next year or so.’ When your doctor puts a recommendation in your medical records for a future treatment, that is a big deal. To an insurance company, that means there will be a future big bill for whoever is insuring you at that time.

Understand the Supplement Health Questions

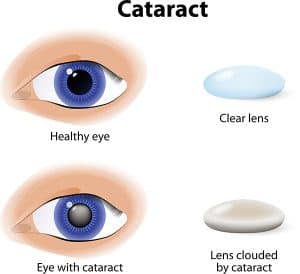

The problem is that you could get stuck with the bill instead of the insurance company if you don’t follow the rules. If you have something done that was recommend before you got the new policy, like cataract surgery within six months after getting a new Medicare Supplement, the insurance company will probably not pay their share of the expense. The health questions in the application are designed to disclose recommended treats and prevent the new insurance company from getting stuck with the bill. They would likely refuse payment and call for doctor’s records to see if there was a recommendation for treatment before you signed the application. After six months, you are less likely to have any trouble. They cannot hold back paying for treatment indefinitely. The bottom line is, if you have any recommended treatments, finish them up before switching supplements.

The problem is that you could get stuck with the bill instead of the insurance company if you don’t follow the rules. If you have something done that was recommend before you got the new policy, like cataract surgery within six months after getting a new Medicare Supplement, the insurance company will probably not pay their share of the expense. The health questions in the application are designed to disclose recommended treats and prevent the new insurance company from getting stuck with the bill. They would likely refuse payment and call for doctor’s records to see if there was a recommendation for treatment before you signed the application. After six months, you are less likely to have any trouble. They cannot hold back paying for treatment indefinitely. The bottom line is, if you have any recommended treatments, finish them up before switching supplements.

Manage the Supplement Health Questions

This problem, of course, can be avoided. Check with your doctor. See if he is recommending any treatments and see if he put that in your medical records. Check with the insurance company if you recently switched supplements. Doctor’s offices will not usually check with an insurance company on a supplement because they will assume the insurance company will pay when Medicare pays. If you recently switched supplements, call and ask ahead of time if there will be any issues about a procedure. It is always good to cross your T’s and dot your I’s when it comes to new insurance plans.

This problem, of course, can be avoided. Check with your doctor. See if he is recommending any treatments and see if he put that in your medical records. Check with the insurance company if you recently switched supplements. Doctor’s offices will not usually check with an insurance company on a supplement because they will assume the insurance company will pay when Medicare pays. If you recently switched supplements, call and ask ahead of time if there will be any issues about a procedure. It is always good to cross your T’s and dot your I’s when it comes to new insurance plans.

Ask an Expert about Supplement Health Questions

A mistake around a recommended treatment when changing Medicare supplements could result in bills to you for thousands of dollars. Know whether you have any recommendations from a physician for future treatments in your records. Understand what that means in relationship to a new Medicare supplement. Talk with someone who can ask you the right questions when you are making a change to your supplement coverage 402-614-3389. OmahaInsuranceSolutions.com