We know what hospitals are. We all have been to a doctor’s office. Many have experienced a relative in a nursing home, but what is home health care?

Home health care is like it sounds. It is the care that takes place in the home. It consists of a wide range of services, like physical therapy, occupational therapy, speech therapy, and nursing care.

The purpose of home health care is short term treatment for an illness or injury, such as a stroke or broken hip. It is about getting the person healthy and independent again. Or, it is for the chronically ill and disabled. The goal is to maintain the highest level of ability and health.

Home health care is not home care. Home care would be services, like housekeeping, bathing, feeding, etc. Medicare does not usually provide those types of personal services, strictly speaking, though there are exceptions at times that allow for a temporary home health aide. It is skilled nursing care provided in the home for those who would not have access otherwise.

Does Medicare Cover It?

Four criteria must be met for Medicare to pay for home health care.

- A physician must certify home health care is necessary.

- The home health care provider must be a Medicare-approved organization.

- The patient must need at least one of the following: skilled nursing care, physical therapy, occupational therapy, or speech therapy.

- The patient must be homebound.

Doctor Certifies Patient For Home Health Care

The doctor must certify a patient needs home health care during an in-person meeting. He signs a certificate certifying that the person meets the Medicare qualification. The doctor lays out a plan of care that care professions implement, and the certification is for 60 days. At the end of the 60 days, or before, he can recertify that patient for an additional 60 days.

The doctor can continue to recertify the patient indefinitely as long as the person qualifies for the medically necessary treatment, and Medicare will continue to cover them.

Home Health Agency Medicare Certified

The home health agency providing the care must be certified by Medicare for the service to be Medicare-covered. In my office building as you come in, a care agency is in the lobby. On the office door, the home health agency lists the various services, and in even bigger letters, it states, “Medicare Certified.”

Medicare certification of a home health agency is an extensive process. Because accreditation is arduous and a source of considerable revenue, home health agencies are very careful about maintaining their certification and advertising their Medicare certification as well. The Omaha metro area has some excellent home health care agencies.

Intermittent Care

Home health care must also be intermittent care. That is, it consists of fewer than seven days a week, or daily care for less than 8 hours each day for up to 21 days. Otherwise, a skilled nursing facility would most likely be recommended for a more intense regimen of care.

Homebound

The patient must be homebound, which means she cannot leave her home without great difficulty and requires help, such as a wheelchair, walker, crutches, or specialized transportation. It doesn’t mean she can never leave her home for important things, like family events, hairdressing appointments, some doctors’ appointments, but getting regular health services outside the house would be an undue burden.

The patient must be homebound, which means she cannot leave her home without great difficulty and requires help, such as a wheelchair, walker, crutches, or specialized transportation. It doesn’t mean she can never leave her home for important things, like family events, hairdressing appointments, some doctors’ appointments, but getting regular health services outside the house would be an undue burden.

People are living longer. Tremendous advances in technology have enabled seniors to stay out of expensive skilled nursing care. Nowadays, patients may receive very sophisticated treatment at home and do not need to be institutionalized, keeping the cost of treatment lower. It is an important and essential service that Medicare covers.

Jimmo vs. Sebelius On Skilled Nursing

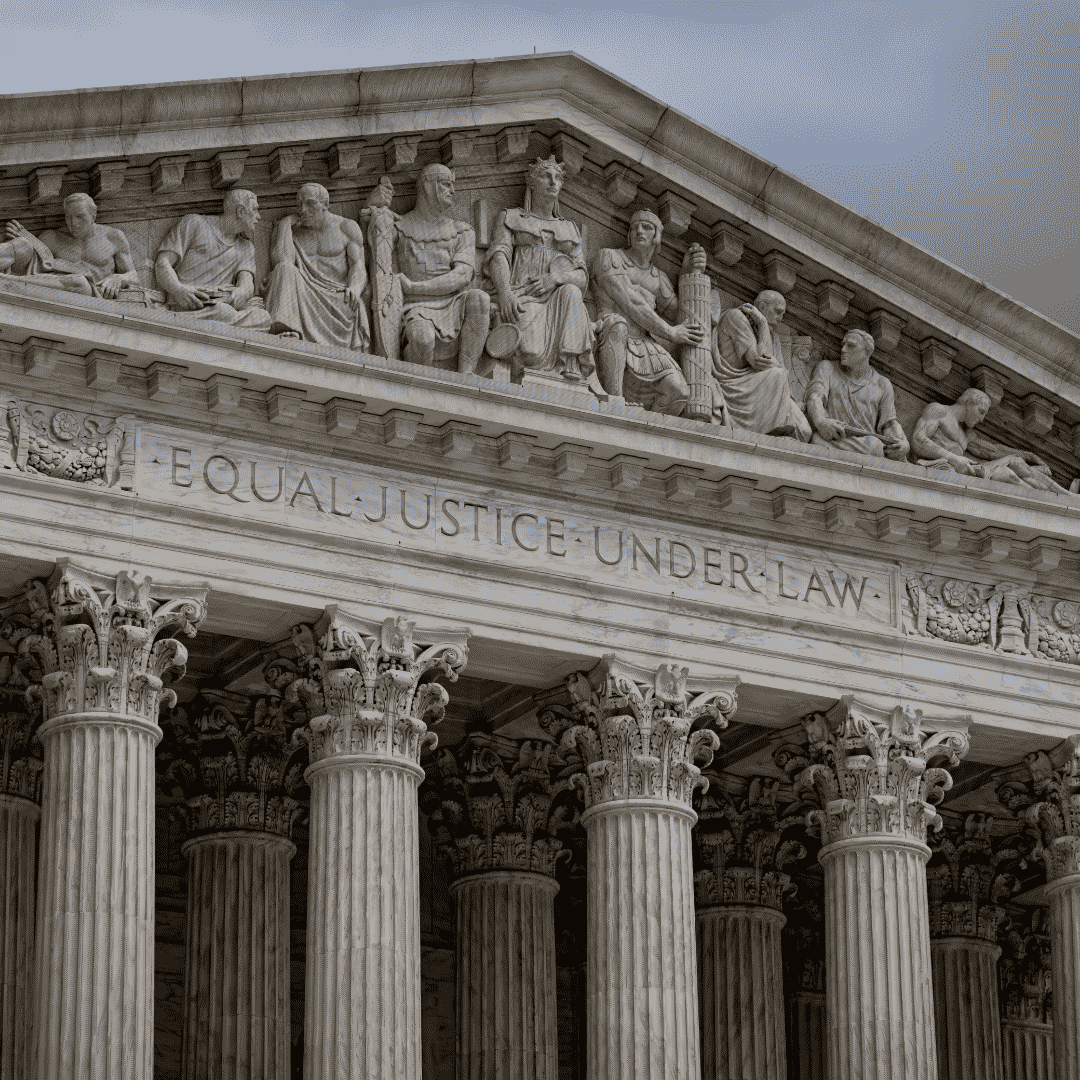

Skilled Nursing Care is amazingly complex. Because the Medicare coverage of Skilled Nursing Facility stays is so confusing, patients sued. The case went all the way to the Federal Courts. Jimmo vs. Sebelius, a class-action lawsuit, challenged the Center For Medicare & Medicaid Services (CMS) interpretation of the “improvement stand” that many used to interpret Medicare coverage of Skilled Nursing Facility booklet.

Medicare Coverage of Skilled Nursing Facility Stays: Improvement Standard

This one hit home for me because of how it affected my mother and our family. My mother was in the last stages of ovarian cancer. It became clear that no treatment was going to work. She was on palliative care. During one of her episodes, she was in extreme pain. The hospital admitted my mother because intravenously administered pain killers were the only way to get her pain under control. After that, she was supposed to come home. But her condition was such that we were not going to be able to care for her adequately. We talked about a nursing home—skilled nursing—but one of the criteria at the time was the patient must be able to improve. Because she was terminal, improvement was definitely not in the cards. We were initially told that Medicare would not pay for her stay in a skilled nursing facility. However, that was not accurate. The people we were talking with were operating off old, outdated information.

This one hit home for me because of how it affected my mother and our family. My mother was in the last stages of ovarian cancer. It became clear that no treatment was going to work. She was on palliative care. During one of her episodes, she was in extreme pain. The hospital admitted my mother because intravenously administered pain killers were the only way to get her pain under control. After that, she was supposed to come home. But her condition was such that we were not going to be able to care for her adequately. We talked about a nursing home—skilled nursing—but one of the criteria at the time was the patient must be able to improve. Because she was terminal, improvement was definitely not in the cards. We were initially told that Medicare would not pay for her stay in a skilled nursing facility. However, that was not accurate. The people we were talking with were operating off old, outdated information.

Slow Deterioration of a Condition

On January 24, 2013, the class action lawsuit Jimmo vs Sebelius settled in favor of the patient, and the Center for Medicare & Medicaid Services (CMS) clarified its policy. Medicare coverage of Skilled Nursing Facility stays no longer required “improvement.” Instead, care could be prescribed to maintain the status of an individual’s condition, or slow the deterioration of a condition, as well as to improve the person’s condition.

Jimmo Website Explains New Medicare Coverage

As ordered by the federal judge in Jimmo v. Sebelius, the Centers for Medicare and Medicaid Services (CMS) published a new webpage containing important  information about the Jimmo Settlement on its CMS.gov website. The Jimmo webpage is the final step in a court-ordered Corrective Action Plan. The action reinforces the fact that Medicare does cover skilled nursing and skilled therapy services needed to maintain a patient’s function or to prevent or slow decline. Improvement or progress is not necessary as long as skilled care is required. The Jimmo standards apply to home health care, nursing home care, outpatient therapies, and, to a certain extent, for care in Inpatient Rehabilitation Facilities.

information about the Jimmo Settlement on its CMS.gov website. The Jimmo webpage is the final step in a court-ordered Corrective Action Plan. The action reinforces the fact that Medicare does cover skilled nursing and skilled therapy services needed to maintain a patient’s function or to prevent or slow decline. Improvement or progress is not necessary as long as skilled care is required. The Jimmo standards apply to home health care, nursing home care, outpatient therapies, and, to a certain extent, for care in Inpatient Rehabilitation Facilities.

In my mother’s case, the skilled nursing facility admitted my mother, even though she was terminal, to help slow the deterioration of her health. As it turned out, she passed away within two weeks of her admittance, and the personnel at her skilled nursing facility were outstanding! They made her last days as bearable as the situation would allow.

Medicare Coverage of Skilled Nursing Facilities Changed

Medicare coverage of Skilled Nursing Facility stays practices have changed. Researchers assessed the impact of the Jimmo settlement by looking at changes to the number of physical therapy and/or occupational therapy visits per year, per patient, focusing specifically on the number of individuals who had 12 or more therapy visits during a 12-month timespan.

Medicare coverage of Skilled Nursing Facility stays practices have changed. Researchers assessed the impact of the Jimmo settlement by looking at changes to the number of physical therapy and/or occupational therapy visits per year, per patient, focusing specifically on the number of individuals who had 12 or more therapy visits during a 12-month timespan.

Healthcare is very expensive. There are many conflicting groups and interests. The rules, policies, and mechanisms are complex. Some of the people you deal with can be frustrating. The complexity of the system is driven home to me daily as I talk with clients and deal with issues that arise. You need to be aware of the rules and regulations around Medicare coverage and nursing home care. Or have someone who knows them and can help.

The chances are you or someone in your family will require skilled nursing care because of a serious injury, stroke, or surgery.  Twenty-five percent of skilled nursing stays are less than three months. Many, however, are longer. Nursing home care costs vary from state to state and location to location. The questions my clients ask are: how long does Medicare pay for skilled nursing care?

Twenty-five percent of skilled nursing stays are less than three months. Many, however, are longer. Nursing home care costs vary from state to state and location to location. The questions my clients ask are: how long does Medicare pay for skilled nursing care?

Skilled Nursing Care Costs Are High

Depending upon the state in which you reside, the daily costs associated with nursing home care vary widely between $140 and $771 per day for a semi-private room in 2017. The average cost was $235 per day for a semi-private room. Multiplying that out the monthly cost associated with skilled nursing care ran anywhere between $4,258 and $23,451 per month for a semi-private room, with the average being closer to $7,148 each month for a semi-private room. For most people, those are prohibitive costs!

Depending upon the state in which you reside, the daily costs associated with nursing home care vary widely between $140 and $771 per day for a semi-private room in 2017. The average cost was $235 per day for a semi-private room. Multiplying that out the monthly cost associated with skilled nursing care ran anywhere between $4,258 and $23,451 per month for a semi-private room, with the average being closer to $7,148 each month for a semi-private room. For most people, those are prohibitive costs!

How Much Skilled Nursing Does Medicare Pay For?

Many of my clients will call when faced with the possibility of going into a skilled nursing facility. Illness is scary enough. You don’t want to worry about overwhelming medical bills. My people want to know they’re covered. They want to know how much skilled nursing does Medicare pay for. Do Medicare Advantage plans cover skilled nursing facilities? Do Medicare Supplements cover skilled nursing facilities? So, the big question is: who pays?

Medicare Skill Nursing Benefit Period Is 100-Days

So, how many days does Medicare cover skilled nursing facility care? The Medicare Skilled Nursing Facility (SNF) benefit period, or “Spell of care,” is 100 days. The benefit period ends when the patient leaves the SNF for 3o days, and a new 100 day benefit period is available after 60 days.

Skilled Nursing Facility’s Legal Obligations

When a patient leaves a hospital and moves to a nursing home that provides Medicare coverage, the nursing home must give the patient written notice of whether the  nursing home believes that the patient requires a skilled level of care and thus merits Medicare coverage. Even in cases where the SNF initially treats the patient as a Medicare recipient, after two or more weeks, often, the SNF will determine that the patient no longer needs a skilled level of care and will issue a “Notice of Non-Coverage” terminating the Medicare coverage.

nursing home believes that the patient requires a skilled level of care and thus merits Medicare coverage. Even in cases where the SNF initially treats the patient as a Medicare recipient, after two or more weeks, often, the SNF will determine that the patient no longer needs a skilled level of care and will issue a “Notice of Non-Coverage” terminating the Medicare coverage.

Whether the non-coverage determination is made on entering the SNF or after a period of treatment, the patient can submit or not to Medicare. The patient (or his or her representative) should always ask for the bill to be submitted. This requires the nursing home to submit the patient’s medical records for review to the fiscal intermediary, an insurance company hired by Medicare, which reviews the facility’s determination. The review costs the patient nothing and may result in more Medicare coverage. While the review is being conducted, the patient is not obligated to pay the nursing home. However, if the appeal is denied, the patient will owe the facility retroactively for the period under review.

If the fiscal intermediary agrees with the nursing home that the patient no longer requires a skilled level of care, the next level of appeal is to an Administrative Law Judge. This appeal can take a year and involves hiring a lawyer. It should be pursued only if, after reviewing the patient’s medical records, the lawyer believes that the patient was receiving a skilled level of care that should have been covered by Medicare. If you are turned down at this appeal level, there are subsequent appeals to the Appeals Council in Washington, and then to federal court.

Day 101 You Pay

If you need more than 100 days of SNF care in a benefit period, how many days will Medicare pay for skilled nursing care? Nothing. SNF is meant to be short term. You will need to pay out of pocket if your care ends because you are run out of days. The SNF is not required to provide written notice. It is important that you or a caregiver keep track of how many days you spend in a SNF to avoid unexpected costs after Medicare coverage ends.

If you need more than 100 days of SNF care in a benefit period, how many days will Medicare pay for skilled nursing care? Nothing. SNF is meant to be short term. You will need to pay out of pocket if your care ends because you are run out of days. The SNF is not required to provide written notice. It is important that you or a caregiver keep track of how many days you spend in a SNF to avoid unexpected costs after Medicare coverage ends.

How Else to Pay For Skilled Nursing Care

If you are receiving medically necessary physical, occupational, or speech therapy, Medicare may continue to cover those skilled therapy services even when you have used up your SNF days in a benefit period, but Medicare will not pay for your room and board, meaning you may face high costs.

used up your SNF days in a benefit period, but Medicare will not pay for your room and board, meaning you may face high costs.

Medicare does not cover long term care or custodial care. You may wish to move to a home health care situation at that point. Medicare pays for home health care, and the costs are much less. If you have long-term care insurance, it may cover your SNF stay after your Medicare coverage ends. If your income is low enough, you may be eligible for Medicaid to cover the cost of your stay.

Unlimited Skilled Nursing Benefit Periods

Once you are out of skilled nursing for 60 days, your SNF benefit period ends, but you may become eligible again for another SNF benefit period after a qualifying hospital stay of 3-days. There is no limit on the number of benefit periods available to a Medicare beneficiary as long as the Medicare requirements are met.

In other words, a person could potentially keep going into Medicare covered skilled nursing care every 100 days after a 60-day break as long as it is preceded by a qualifying hospital stay of 3-days. While repeat 100 day stays in a skilled nursing facility are not likely, that does give an idea of the level of incredible care available to a Medicare beneficiary.

NO Insurance: $176 Per Day

Medicare Supplements and Medicare Advantage plans pick up large portions of the 100-benefit period. The amount covered depends on the type of Medicare Supplement plan and Advantage plan. If the patients has neither, just Original Medicare, she is responsible for 21-100 days. The per day cost is currently $176 (2020).

30 Or 60 Days

An important note on the number of days out of a Skilled Nursing Facility approved stay. If a patient has left the SNF for 30-days or less, she may return without a 3-day inpatient hospital stay to initial the stay, but the 100-day count continues from where it left off. If the patient has been out of the SNF for 60-days for less, but more than 30-days, she will need another 3-day hospital stay for Medicare to pay for the time in the Skilled Nursing Facility. And the 100-day count continues from where it left off. After 60 consecutive days without SNF care, a new benefit may begin. There is no limit to the number of benefit periods.

An important note on the number of days out of a Skilled Nursing Facility approved stay. If a patient has left the SNF for 30-days or less, she may return without a 3-day inpatient hospital stay to initial the stay, but the 100-day count continues from where it left off. If the patient has been out of the SNF for 60-days for less, but more than 30-days, she will need another 3-day hospital stay for Medicare to pay for the time in the Skilled Nursing Facility. And the 100-day count continues from where it left off. After 60 consecutive days without SNF care, a new benefit may begin. There is no limit to the number of benefit periods.

Dave’s Scenario

Let’s layout some common scenarios. You might need your calculator or at least your fingers and toes to keep track.

Imagine David is in the hospital for 4 days because of a stroke. He is then admitted to a skilled nursing facility for 20 days. Dave leaves the skilled nursing facility for 28 days, but he has a complication. Dave falls going to the bathroom. The doctor readmitted him into the nursing home. He is within the 30-day window. No problem. Medicare will pay for that.

If, however, David was out of the nursing home 31 days, and he fell, he would need another 3-day stay in the hospital to be readmitted to the skilled nursing facility so Medicare would pay. Dave’s doctor may or may not be able to get him re-admitted to the hospital based upon his medical condition.

Summary

Skilled Nursing Facilities (SNF) are incredibly expensive. How long does Medicare pay for Skilled Nursing Care? Medicare does cover a 100-day benefit period. Medicare Supplements and Medicare Advantage plans cover large portions of the stay, depending on the plan. The cost, however, starting day 21 is $176 per day to patients without any additional coverage. The 100-day benefit period has very strict rules when it begins and ends. There are rules to which you need to be attentive to avoid unexpected and large bills, and it is worth talking with your insurance agent to make sure you have the maximum amount of coverage you can afford.

Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Do you or a loved one need hospice care in a skilled nursing facility? Understanding Medicare coverage for this essential service is crucial for maximizing benefits and ensuring quality end-of-life care. This article will explore some of the ins and outs of hospice coverage I didn’t know when my mother was in hospice. We discuss the question of whether Medicare pays for hospice in a skilled nursing facility.

Navigating the complex world of healthcare can be overwhelming, especially when faced with a difficult situation like imminent death like I experienced with my mother. That’s why I’m here to break it down for you. I’ll explain what hospice care entails, how it differs from other types of care, and, most importantly, what Medicare covers. With this information, you can be confident in your ability to advocate for yourself or your loved one and ensure that all available resources are utilized.

At Omaha Insurance Solutions, information is power regarding healthcare decisions. We aim to make complex topics accessible, providing you with the tools you need to confidently navigate the healthcare system. So, let’s dive in and discover how Medicare can support you during a challenging time.

What is Hospice Care & Who is Eligible?

Hospice care focuses on providing comfort and support to individuals in the final stages of a terminal illness. The goal is to improve the quality of life for patients by managing pain and symptoms while offering emotional and spiritual support to both the patient and their loved ones. Hospice care can be provided in various settings, including skilled nursing facilities.

To be eligible for hospice care, a person must have a life expectancy of six months or less, as certified by a physician. This certification is required for Medicare coverage, which we will discuss further in the following sections. It’s important to note that choosing hospice care does not mean giving up on treatment altogether. It means shifting the focus to comfort and quality of life rather than curative measures.

Hospice care is a holistic approach that addresses individuals’ physical, emotional, and spiritual needs nearing the end of life. It provides a compassionate and supportive environment where patients receive specialized care tailored to their unique needs. Now that we have a basic understanding of hospice care, let’s explore how it relates to skilled nursing facilities and the coverage provided by Medicare.

Understanding Skilled Nursing Facility Care and Medicare Coverage

Skilled nursing facilities (SNFs) are residential facilities that provide round-the-clock nursing care for individuals requiring more intensive medical attention than they could receive at home. SNFs are equipped with trained healthcare professionals, including nurses and therapists, who can address the complex needs of patients. SNF care is often required when individuals have conditions that require ongoing medical monitoring, such as chronic illnesses or post-surgical recovery. Medicare covers certain SNF services, including skilled nursing care, rehabilitation therapy, and medications. However, it’s important to note that not all services provided in a SNF are covered by Medicare, and this includes hospice care.

Medicare Coverage for Hospice in a Skilled Nursing Facility

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

The criteria are the same as for hospice. Firstly, the individual must be eligible for Medicare Part A, which covers inpatient hospital stays, skilled nursing facility care, and hospice care. Secondly, the hospice care must be certified by a Medicare-approved hospice provider. Thirdly, the individual must have a life expectancy of six months or less, as certified by a physician. Lastly, individuals must agree to forgo curative treatments for their terminal illness and receive only palliative care.

The SNF is not primarily providing hospice care. A hospice team coordinates with the SNF to provide the service in the SNF. The location of the hospice care is secondary. The SNF is a location, like the home.

However, there must be a Medicare-covered reason or treatment to be granted admittance to a skilled nursing facility. The SNF is primarily a medical facility for patients to get better. It is not a hospice facility providing room and board, housekeeping, bathroom transfers, etc.

Medicare Hospice Benefits for My Mom

The doctors diagnosed my mother with ovarian cancer in 2012. I was living in Kansas at the time. I wasn’t able to go on doctor visits with her. My brother, Paul, was taking care of my mom. I would get information about her situation, but it was spotty.

My mother was an ‘I’m in charge’ type of person. Phyllis determined the flow of information, and it was sparse.

Talking with your mother about her health when her mortality is so tightly fixed to it is hard. Looking back now, I was a chicken. Who wants to talk about saying goodbye? I didn’t realize the seriousness of her health situation until much later. I assumed she didn’t speak about her own death, and I didn’t know how to initiate the conversation. We were all in different forms of denial.

At the end of 2012, the doctors said there was nothing more to be done. I don’t think I fully grasped what that meant at the time. I also did not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

My mother was admitted to hospice care (Medicare Hospice Benefits Booklet).

Mom’s Terminal Illness

Nature, in its less than glorious side, took its course rapidly. My mother’s health deteriorated in a few short weeks.

Cancer is a painful disease. The healthcare personnel gave her various painkillers, but even as they did so, we all insanely talked about not wishing to cause addiction. The pain had its own mind.

At various times, my mother’s suffering would be such that she needed to go to the hospital. There, the doctors administered intravenous medications that were faster acting and stabilized her pain level.

During the last visit, it became clear that we could not care for her at home. My father, John Grimmond–who would pass away six months later–was not physically able to care for our mother. I was in Kansas, my other brother, Tom, was in Sioux Falls, and Paul was in Omaha but busy with his career and family.

My mother needed around-the-clock care. We asked, ‘Does Medicare pay for hospice in a skilled nursing facility?’ The real question was whether Medicare would pay for a skilled nursing facility while my mother died. Strictly speaking, Medicare does not pay for custodial care. Custodial care is bathing, feeding, toileting, etc. Medicare doesn’t cover room and board if you get hospice care while in a nursing home or a hospice inpatient facility. That is out of your pocket.

Qualifying for Skilled Nursing Facility Care while on Hospice

The staff at the hospital initially told us that our mother needed to go to a skilled nursing facility (SNF) because they recognized she required more care than we could provide. They informed us that Medicare would provide and pay for hospice care in the Skilled Nursing Facility, but the cost of room and board and custodial nursing care would not be covered, and they were correct. Medicare coverage for skilled nursing when you are in hospice is tricky.

skilled nursing when you are in hospice is tricky.

The fortunate occurrence, however, was the intravenous nature of my mother’s painkillers. Other than a hospital, you can only receive intravenous medication treatment in a skilled nursing facility. The nature of my mom’s treatment triggered a reason Medicare would accept her being admitted to a skilled nursing facility and pay for it.

Medicare does cover skilled nursing care after a qualifying hospital stay of 3-days or more. Intravenous medication administration also requires a skilled nursing facility. A home health care nurse showing up several times at home would not be adequate. Also, my mother needed physical therapy to improve her strength after the reaction to the pain. From Medicare Part A and Part B, there were sufficient reasons for Medicare to pay for her stay in the skilled nursing facility (SNF) while she was in hospice.

Does Medicare Pay For Skilled Nursing Care During Hospice?

Strictly speaking, Medicare does not pay for skilled nursing care because someone is in hospice, but other triggering events often cause Medicare to cover skilled nursing care.

For example, someone who is in hospice falls and breaks a hip. That situation would justify skilled nursing care. A person develops an infection or pneumonia that results in hospitalization. Then, they qualify for a skilled nursing stay.

How to Navigate the Medicare Coverage Process for Hospice in a Skilled Nursing Facility

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

1. The first step is to consult with the individual’s physician to determine if they meet the eligibility criteria for hospice care in a SNF. The physician can provide the necessary certification and guidance through the process. He knows the triggering circumstances that justify a skilled nursing facility stay.

2. It’s important to choose a Medicare-approved hospice provider with experience providing SNF care. They will be able to guide you through the necessary paperwork and ensure that all requirements are met. The health professionals are very familiar with Medicare’s billing codes and protocols for admittance to a SNF.

3. If the individual is already receiving care in a SNF, it’s important to coordinate with the facility to ensure a smooth transition to hospice care. The SNF staff can provide valuable information and support during this process.

4. Familiarize yourself with Medicare’s costs and coverage for hospice care in a SNF. This will help you plan and make informed decisions regarding the individual’s care.

The professionals you deal with know the Medicare rules and the subtleties of maximizing coverage in different circumstances. Listen attentively to their guidance.

Common Misconceptions about Medicare Coverage of SNF During Hospice

Several common misconceptions exist about Medicare coverage for hospice care in a SNF. Let’s address some of these misconceptions and provide clarity:

provide clarity:

1. Medicare only covers hospice care in certain settings: Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, and skilled nursing facilities. As long as the eligibility criteria are met, Medicare will cover hospice care in a SNF.

2. Medicare covers room and board in a SNF. As a rule, Medicare does not cover room and board in a SNF because the individual is receiving hospice care, though room and board may be covered because the patient is in the SNF for reasons other than hospice.

3. Medicare coverage for hospice care is limited to specific conditions: Medicare coverage for hospice care is not limited to specific conditions or illnesses. As long as the eligibility criteria are met, Medicare will provide coverage for hospice care in a SNF for any terminal illness.

4. Medicare coverage for hospice care is limited to a certain time frame: Medicare does not limit the duration of hospice care coverage in a SNF. As long as the individual meets the eligibility criteria, Medicare will continue to cover the necessary services.

Bottomline: Ensuring Quality Care and Coverage for Hospice in a SNF through Medicare

Maximizing Medicare coverage for hospice care in a skilled nursing facility is essential for ensuring quality end-of-life care. By understanding the eligibility criteria, coverage details, and navigating the Medicare system, you can advocate for yourself or your loved one and ensure all available resources are utilized.

Remember, hospice care is a compassionate and holistic approach that focuses on providing comfort and support during the final stages of a terminal illness. Medicare provides coverage for hospice care in a SNF, including room and board, medications, and necessary medical equipment. By staying informed and proactive, you can maximize Medicare coverage and ensure that the individual receives the care they need.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Phyllis Grimmond 1935-2013 R.I.P.

The Bottomline: Benefit Knowledge Makes for Maximum Benefits

At Omaha Insurance Solutions, we understand the importance of access to accurate and reliable information regarding healthcare

Christopher J. Grimmond

decisions. We aim to empower you with the knowledge and resources to navigate the complex world of Medicare coverage. It is important to know that Medicare pays for hospice care in a skilled nursing facility.

By maximizing benefits and ensuring quality care, we can make a difference in the lives of individuals and their loved ones during this challenging time. Call us at 402-614-3389 to ensure you have a Medicare plan protecting you and your loved ones. Speak with an experienced licensed insurance agent profession.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

Part A Deductible

Medicare is a generous health plan. It covers a majority of the hospital and doctor costs, but there is some important exposure to be aware of. Medicare Part A covers the hospital, but only after you pay the deductible of $1,288. That deductible is not an annual deductible. It is per event within a 60 day period. While you would have to be very unlucky, very sick, or both, you could pay that deductible an endless number of times. That is your exposure.

Part B Co-Insurance

Medicare Part B covers 80% of the doctor and outpatient procedures. While that is quite generous, 20% of a big number is still a big number. Heart attacks, strokes, cancer treatment can run into the hundreds of thousands of dollars. Twenty percent of a $200,000 bill is $40,000. Most people would find that beyond the family budget.

MOOP

And with Part A & B, there is NO maximum-out-of-pocket (MOOP). In other words, you continue to pay as the bills roll in. You do not stop paying on deductibles and co-insurance if all you have is Original Medicare without anything else.

So comes the questions from clients: ‘What should I do about Medicare?’ Medicare supplements or Medigap plans fill in those gaps in Medicare. They cover the hospital deductibles and 20% co-insurance for doctor and outpatient use. Depending on how much you wish to cover, the Medigap plan can cover everything 100%, most of everything, or a potion. You choose. There are ten plans available.

12,200,000 Satisfied Medigap Clients

The fact that 22% of people on Medicare choose a supplement and stay on a supplement for 20-30 years tells you the level of satisfaction. There are currently 55,200,000 Medicare beneficiaries. Of that number 12,200,000 chose a supplement. That number grows each year: 9.7 million in 2010 to 12.2 million in 2015. The key number is that 9 out of 10 Medigap beneficiaries say that they are satisfied with their coverage and keep their coverage. Med Sup Conference Stats

While Medicare is a wonderful health insurance program for seniors, it doesn’t cover everything. You still have exposure to significant financial loss if you only have Medicare alone.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

Does Medicare Cover Cancer Treatment After Age 76

Does Medicare Cover Cancer Treatment After Age 76

My mother had her routine physical in Nov of 2011. There were many tests. One test came back positive for cancer. We were stunned. She had no symptoms. Everything was fine, we thought.

As the doctors performed more tests, they determined my mother had stage four ovarian cancer. The next week, she was in chemotherapy.

I learned a lot about Medicare and cancer after that. Yes, cancer treatment is covered by Medicare.

Medicare covered her cancer treatments, radiation treatment for cancer, and chemotherapy. She had a Medicare Supplement Plan F. Medically, everything was covered. My mother was 76. Medicare covers cancer treatment after age 76. There is no age at which Medicare will not cover radiation treatment for cancer or chemotherapy.

Cancer Is Scary, And So Are Medical Bills

The C-word is a scary word. I don’t know your relationship to the C-word. You may have had a family member or friend contract cancer? Did she die, recover, or is still struggling? Or maybe it was you?

Cancer is a dirty word that ignites intense feelings because you are fighting for your life.

You also realize there is a price tag, and you immediately begin to ask, ‘Is cancer treatment covered by Medicare?‘ ‘What will I have to pay?’

I suggest you ask yourself several serious questions about your Medicare health coverage.

- How much would you be willing to pay out of your pocket in a year–$2,000, $5,000, $7,550?

- How much would you be willing to pay to avoid paying hefty bills?

The cost of cancer is high, both emotionally in terms of pain and financially. I remember seeing some of my mother’s EOBs (Explanation of Benefits). There were no small bills.

Does Medicare Part A Cover Cancer Treatment?

Does Medicare Part A Cover Cancer Treatment?

Medicare Part A covers the hospital, and Part B takes care of doctors and outpatient services. You will not be in the hospital as an inpatient with cancer most of the time. The oncological treatments are done as an outpatient, but there may be instances when you need hospitalization.

My mother was admitted to the hospital during the year because the pain was too intense. The doctors needed to use intervenience medications to beat back the pain that was overwhelming mom. In those instances, Medicare Part A picked up the tab.

Medicare Part A also includes skilled nursing, home health care, and hospice, not just inpatient hospital.

After a 3-day stay in the hospital, a person may be admitted to skilled nursing for a number of reasons. The person can continue cancer treatment while in the skilled nursing facility, and Medicare Part A will pay. My mother did that toward the end.

Does Medicare Part B Cover Cancer Treatment?

Medicare Part B is where most patients will experience Medicare for cancer treatments. The doctors administer chemotherapy drugs through your veins in an outpatient clinic or doctor’s office. Some oral chemotherapy is administered in the doctor’s office, though more are moving toward self-administration. The doctors also give radiation treatments in an outpatient setting. Medicare Part B covers cancer treatment when administered in this way.

administer chemotherapy drugs through your veins in an outpatient clinic or doctor’s office. Some oral chemotherapy is administered in the doctor’s office, though more are moving toward self-administration. The doctors also give radiation treatments in an outpatient setting. Medicare Part B covers cancer treatment when administered in this way.

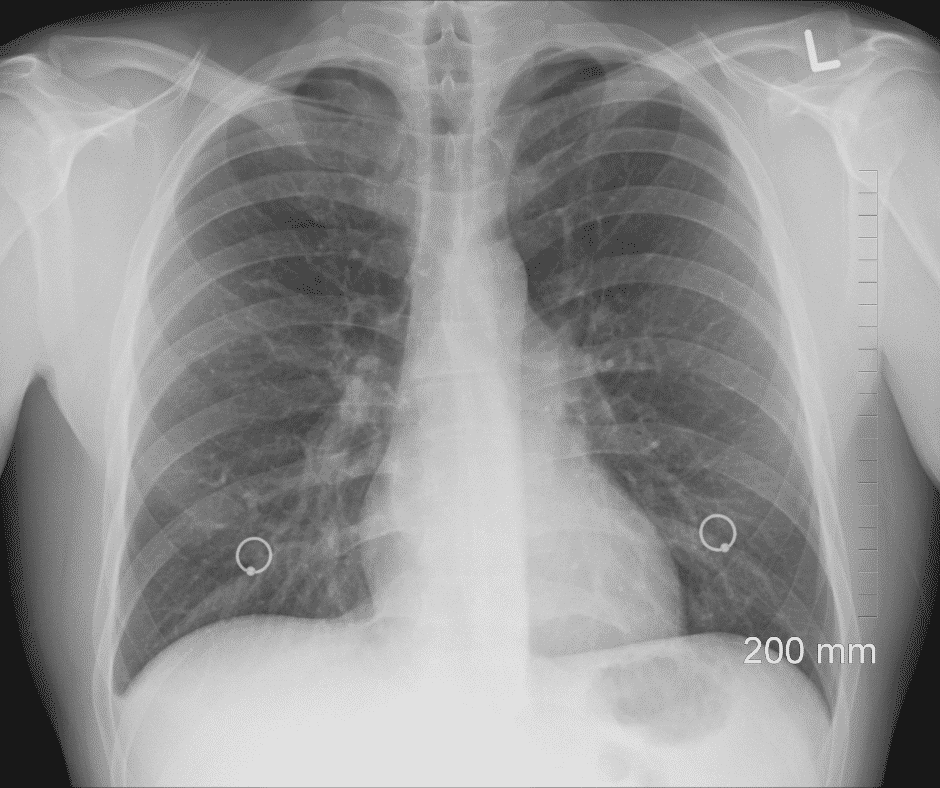

The doctors need to check on the progress of treatments, so Medicare Part B covers cancer treatment for diagnostic tests like X-rays and CT scans.

Cancer treatment is incredibly taxing for the person, so durable medical equipment is often needed. Medicare covers wheelchairs, walkers, and feeding pumps for cancer treatment.

When appropriate, surgeons will operate to stop or curtail cancer. You see this most often with skin cancer. Outpatient surgeries are likewise covered.

The strain is not only physical for the patient but mental. Counseling and other mental health support may be appropriate and would be covered by Medicare.

What Does Medigap Do to Cancer Costs?

What Does Medigap Do to Cancer Costs?

Beneficiaries on Original Medicare would be responsible for the Part A deductible and the Part B coinsurance unless they have a Medigap policy. Depending on the type of Medigap policy, it will come in and pay most or all of the remaining amounts. Regarding cancer treatments, Medigap policies, such as Plan G and Plan N, are very powerful in the amount of coverage, filling in the 20% Part coinsurance gap after the Part B deductible.

What Are Cancer Policies?

Medicare does not cover some benefits that may be helpful for people going through cancer treatment, like room and board in assisted living facilities, adult day care, long-term nursing home care, and services of daily living–bathing and feeding. Neither Medicare nor the Medigap policy will cover those expenses. Another type of insurance could be helpful in these instances–indemnity plans.

You should ask us about cancer policies.

Does Medicare Advantage Cover Cancer Treatment?

Each Medicare Part C (or Medicare Advantage) plan is unique. Looking at the Medicare Advantage plans in the Omaha Metro area, most cover cancer treatment at 80%. Beneficiaries will need to pay the 20% for chemo and radiological treatments for cancer. Your coinsurance payments will go against the maximum out-of-pocket for the particular plan, and because of the high cost of cancer treatment, it would not be unusual for you to reach the maximum out-of-pocket (MOOP). Each plan has a designated MOOP amount, for example, $4,900, $5,500, or even $6,700. Once the Medicare beneficiary reaches the MOOP, you pay no more. The Medicare Advantage plan covers everything at 100%. The MOOP, however, is a large expense for most people in a given year.

Drugs Are An Essential Part

Drugs Are An Essential Part

Medications are also an essential part of cancer treatment. Beneficiaries may purchase a stand-alone Medicare Part D prescription drug plan. Most Medicare Part C/Medicare Advantage plans have a Medicare Part D prescription drug plan included in the plan.

Part D covers some oral chemotherapy drugs not covered under Part B. Anti-nausea drugs and other prescriptions used in cancer treatment, like pain medications, will come under Part D.

Questions To Ask Yourself About Medicare & Cancer Treatment

There are two important questions I would ask myself about Medicare and cancer treatment in the Omaha metro area.

- How likely do you think you will contract cancer?

- How easily will you cover the costs out of your pocket?

The A merican Cancer Society says that the elderly are ten times more likely than younger people to get cancer. Medicare beneficiaries over age 65 account for 54% of all new cancer cases. Cancer is the leading cause of death among the elderly.

merican Cancer Society says that the elderly are ten times more likely than younger people to get cancer. Medicare beneficiaries over age 65 account for 54% of all new cancer cases. Cancer is the leading cause of death among the elderly.

While those are generalizations, you can further add your own analysis to the formula if you have had cancer. Cancer among family members raises your chance of you contracting cancer.

The reality is that there is a probability that you may develop cancer during your time on Medicare. What is your estimate of that probability?

The second question to consider is cost. There is no one number for the cost of cancer. It depends on the type of cancer, the number of treatments, the type of treatments, etc. But there are ranges.

A study by Avalere Health gives prices as low as $25,000 to as high as $45,000 for chemotherapy. What do you think of that cost?

Avalere Health gives prices as low as $25,000 to as high as $45,000 for chemotherapy. What do you think of that cost?

With Medicare, you will only pay 20% of the expense. Most of it will probably be covered if you have a Medigap policy. The relevant cost for a Medigap policy will be the ever-growing monthly premium.

A Medicare Advantage plan will guarantee you pay no more than the maximum out-of-pocket (MOOP). In 2022, the largest possible MOOP nationally is currently $7,550. The MOOP in the Omaha Metro area is about $4,500 on average.

Is that something you can afford?

Is that something you can afford?

Does Medicare Cover Breast Cancer, Prostate Cancer, and Lung Cancer Treatment?

Medicare does not make any distinction between the types of cancer. All cancer is covered by the customary treatments doctors and hospitals use to combat cancer.

The Wheel of Fortune Or Misfortune?

James Bond was so cool when I was growing up. When he would sit down at the Roulette table in the casino across from the pretty girl, I was rooting for him to win. But would you want to leave the cost of your health care to the spin of the wheel?

There are 37 slots in a roulette wheel–0-36. The numbers divide into the colors red and black. Predicting the color is much easier than choosing a winning number. The house takes it most of the time, but people keep playing! It is incredible.

There are 37 slots in a roulette wheel–0-36. The numbers divide into the colors red and black. Predicting the color is much easier than choosing a winning number. The house takes it most of the time, but people keep playing! It is incredible.

Most people will not get cancer, though a certain percentage will. Do you want to spin the wheel and take your chances that you won’t end up with back-breaking bills, or do you want to offload the problem?

You could purchase a Medicare Supplement for a reasonable monthly premium. The Medigap policy will cover the 20% that Medicare does not. You then can go to any of the excellent medical systems we have in the Omaha, Lincoln, and Council Bluffs metro area or anywhere in the country without concern about costs.

You could choose a Medicare Advantage plan that limits your maximum out-of-pocket to a manageable number, and you will pay very little or nothing beyond your Part B premium.

The choice is yours. Choose wisely.

My mother died on February 4, 2013. We worried a lot about her during the illness. There was fear, pain, and grief. I think about her daily and all she did for me to make me the man that I am. I pray for the repose of her soul. But during the trial that was her treatment and ultimately her death, there was no concern about medical bills. She had prepared.

pain, and grief. I think about her daily and all she did for me to make me the man that I am. I pray for the repose of her soul. But during the trial that was her treatment and ultimately her death, there was no concern about medical bills. She had prepared.