There is no full-proof way to find the best Medicare insurance agent out there. Still, you can separate a lot of wheat from the chaff by asking a few key questions.

How Many Medicare Clients Do You Have?

How Many Medicare Clients Do You Have?

I recently had surgery. When I met with the surgeon, I asked how many times she had performed this particular surgery. She had to think because it was in the hundreds.

I want a surgeon–or any professional–to do what they do so frequently that they can do it in their sleep. You will find the best Medicare insurance agents can do it in their sleep.

When you are trying to pick a new Medicare insurance agent, ask your prospective agent how many Medicare clients he has. His client base should be in the hundreds. While not a foolproof method, the number tells you how much practice he has. The most important thing is to determine if he has practiced on lots of other people, and over time–you hope–he has worked out all his mistakes on others.

It is important that he gives you an exact number. The generalities of hundreds are meaningless. The “Good Shepherd knows his sheep and they know him.” He knows them by name. I can tell you each day exactly how many clients I take care of.

‘How many active Medicare clients do you currently have in your book of business’?

How Many Years in Service?

Like any profession, there is a history. Insurance products, practices, and trends change and evolve over time. A Medicare insurance agent who has been around the block several times has seen how the business of Medicare works, how various insurance companies performed, and how products functioned and/or failed.

That only comes with time in service. Some call it the school of hard knocks. You want your Medicare insurance agent to have a Ph.D. in hard knocks, not someone who just learned to spell ‘Part A.’

I have been a licensed insurance agent for almost 20 years, but I have only done Medicare planning exclusively for 9. Medicare is a different world from life insurance, home & auto, annuities, and commercial buildings. Those are not bad things to know, but they really add no value to someone doing Medicare insurance.

To find the best Medicare insurance agent, you need to ask specifically about Medicare experience.

‘How long have you been doing Medicare insurance?’

Positive Reviews as A Medicare Insurance Agent

Positive Reviews as A Medicare Insurance Agent

When you are walking down the street hungry in a new town, which restaurant do you choose? You look in the window and at the parking lot of the restaurant. Which restaurants are full and which ones are empty? We look for social proof to determine which is the best place to eat, and you should do the same for your Medicare insurance agent.

How many Google reviews does the person or business have? Google is a third party. Google doesn’t cost anything for someone to use. How many Google reviews does the agent or agency have? Are the reviews positive? Do they specifically mention Medicare?

Agents are marketers. They usually put client reviews on their websites and in their sales brochures. How many reviews do they have? What do the clients say? What is the quality of the reviews? Again, this is not infallible, but it certainly helps you quickly separate out the bad apples and find a better Medicare insurance agent. When you buy something on Amazon, does it make a difference if one product has 5,134 5-Star reviews and the other has 62 3-Star reviews?

‘How many reviews does the Medicare agent have?’

Is There Demonstrated Expertise in Their Field

“Content marketing” is a popular form of marketing. Content marketing is people putting out information from their field of expertise to help others make decisions (like this blog). The content is free. It helps people understand and solve problems, answer questions, and generally improve their lives. Many Medicare insurance agents have websites with information about the insurance world and insurance products.

people understand and solve problems, answer questions, and generally improve their lives. Many Medicare insurance agents have websites with information about the insurance world and insurance products.

When you visit an agent’s website or read his sales literature, does the Medicare insurance agent demonstrate adequate knowledge and expertise about his subject and craft? Is the information generic and uninformative? Is he is calling upon his experience as an agent and telling stories of clients HE helped, problems HE solved, and obstacles in the area of Medicare and insurance HE overcame? Or is the contect bland nothing and useless fluff?

You judge the quality of a Medicare insurance agent by following the bread crumbs of knowledge he leaves for you to follow.

‘Does the Medicare agent demonstrate a high degree of knowledge and professional excellence in his field?’

Do They Have Peer Endorsements as the Best Medicare Insurance Agent in the Area?

You can call insurance companies that offer Medicare plans and Medicare supplements. The local insurance company offices work with hundreds of agents. They know the local Medicare insurance agents who are compliant, competent, and conscientious. Ask an insurance company for a referral.

You can call insurance companies that offer Medicare plans and Medicare supplements. The local insurance company offices work with hundreds of agents. They know the local Medicare insurance agents who are compliant, competent, and conscientious. Ask an insurance company for a referral.

The agent they recommend may favor the referring insurance company, but still, you will find a good Medicare insurance agent in this way. The local insurance company representatives do not want to recommend an agent who would not reflect well on their company.

When I get a phone call from an insurance company referring someone to me, I always tell the company that I will present their products in the best possible light. But, they know I will also show the whole breadth of Medicare products because I am an independent agent. I get calls from insurance companies regularly.

‘Who are your best Medicare insurance agents in my area?’

Five Questions To Ask To Find the Best Medicare Insurance Agent

There is no foolproof way to find the best Medicare agent near you. Still, you can significantly narrow down the field by asking these five crucial questions:

- ‘How many active Medicare clients do you currently have in your book of business’?

- ‘How long have you been doing Medicare insurance?’

- ‘How many reviews does the Medicare insurance agent have?’

- ‘Does the Medicare insurance agent demonstrate a high degree of knowledge and professional excellence in his field?

- Ask a Medicare insurance company, ‘who are your best Medicare insurance agents in my area?’

Chris Grimmond

After you have finished your research, when you are ready to meet the best Medicare insurance agent in the Omaha, Lincoln, Council Bluffs, and the surrounding metropolitan area give me a call! 402-614-3389.

Are You An Independent Medicare Insurance Agent in the Omaha Area?

There are different kinds of Medicare advisors in Omaha, NE. Some Medicare agents are captive, meaning they sell Medicare insurance company products exclusively for one insurance company. Some of those companies may have subsidiaries, so it appears the agent offers multiple companies, but in fact, he commits exclusively to just one Medicare insurance company. By contractual obligation, he cannot offer or sell other insurance companies or their products. If he discusses other insurance companies and products, it is usually to sell against his competition. There are a large number of captive Medicare insurance agents in the Omaha Metro area.

Captive Insurance Agents

The problem with captive agents is that you cannot compare the many different companies and Medicare insurance products available objectively. So inevitably, the captive agent will usually conclude his company and products are the best. Physicians Mutual and Blue Cross Medicare insurance agents in the Omaha area and throughout the state are examples of captive agents.

Career Agents

Some insurance companies have “Independent Career Agents.” Those Medicare insurance agents contract with large insurance carriers that supply them with leads. The agent receives leads from the insurance company and he must only present that company and write for that company. Depending on the insurance company, they may or may not enforce the exclusivity. United Healthcare has many Medicare insurance agents in the Omaha Metro area, along with Nebraska and Iowa, who are career agents.

agent receives leads from the insurance company and he must only present that company and write for that company. Depending on the insurance company, they may or may not enforce the exclusivity. United Healthcare has many Medicare insurance agents in the Omaha Metro area, along with Nebraska and Iowa, who are career agents.

Again, the conflict is you will never know whether you receive disinterested and objective advice when an agent has special relationships with insurance carriers.

Discovering conflicting interests is not easy because the agent will control the plans you see. He will most likely not disclose the higher commission or incentives to you. However, if you shop around and compare plans, you may be able to discover better or less expensive Medicare supplements and plans.

Do You Sell Medicare Supplements AND Medicare Advantage?

Some agents only sell Medicare Advantage plans. I’ve found agents that started in the business selling Medicare Advantage tend to stay with Medicare Advantage. Agents who started selling Medicare Supplements stick with selling Medicare Supplements. Ask the agent if he offers both. They are both very different ways to approach Medicare, but they are not as apples to oranges as some would lead to you believe.

Some agents only sell Medicare Advantage plans. I’ve found agents that started in the business selling Medicare Advantage tend to stay with Medicare Advantage. Agents who started selling Medicare Supplements stick with selling Medicare Supplements. Ask the agent if he offers both. They are both very different ways to approach Medicare, but they are not as apples to oranges as some would lead to you believe.

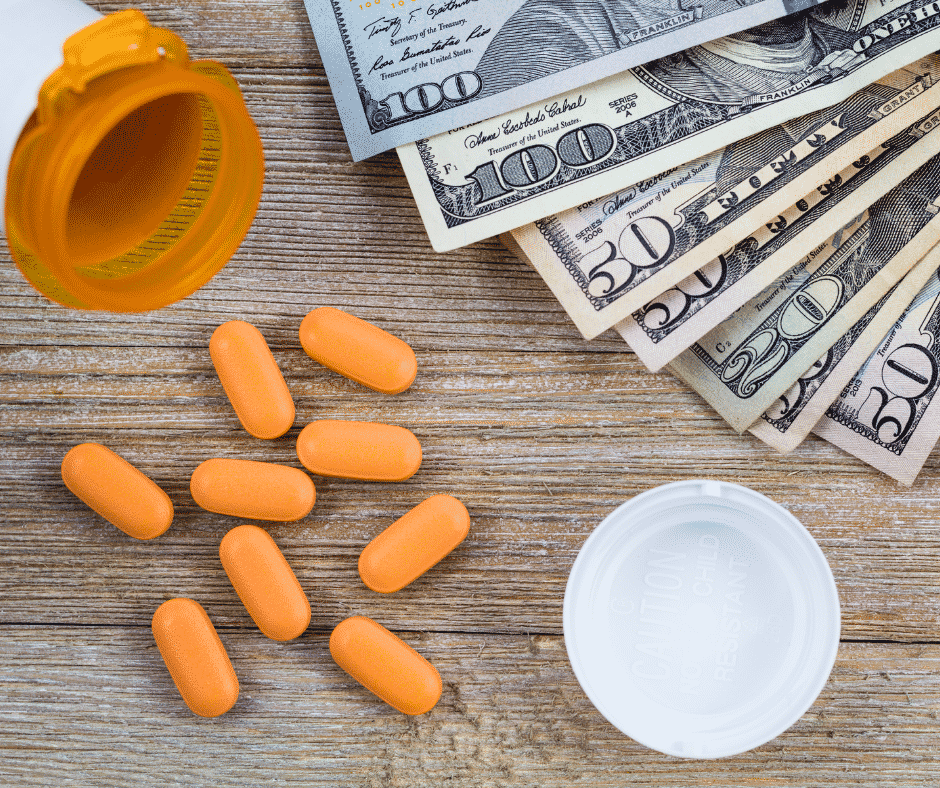

Do You Enroll Clients In Medicare Part D Prescription Drug Plans?

One of the difficulties I have found with agents who only sell Medicare Supplements (Medigap) is they are not certified to offer Medicare Part D prescription drug plans. Certification is costly, time-consuming, and challenging. If you are not certified to sell Part D, you cannot offer Part D prescription drug plans. Those kinds of agents give their clients an 800-number and tell them to call Medicare for their prescription drug plan rather than help them pick one. The insurance companies pay very little for Part D drug plans. Most agents find it does not make financial sense to get involved.

I find prescriptions are sometimes the most critical part of a person’s health plan. On top of that, prescriptions can be costly, difficult to understand, and hard to navigate. Ask your Medicare agent to run your medications for you to see which of the Part D plans or Medicare Part C/Medicare Advantage plans are the best fit for your mix of prescriptions. He can do that on the Medicare.gov website or his private software package. If he can not easily do that for you, you have a good idea of the level of his knowledge and expertise or lack thereof.

Are You A Local Medicare Insurance Agent?

When you turn 65, Medicare insurance companies and Medicare insurance agents will bombard you with mail, email, and phone calls non-stop. You almost need to go into witness protection! Some of my clients tell me they receive 10 or 15 phone calls a day. Most of the phone calls come from call centers in Florida, So. Carolina, California. Hundreds of insurance agents stacked on top of one another in rooms full of phones are cranking out thousands of phone calls a second. They use automatic dialers that simultaneously dial ten persons at once. The first person who answers they solicit. After that, the other lines go dead.

When you turn 65, Medicare insurance companies and Medicare insurance agents will bombard you with mail, email, and phone calls non-stop. You almost need to go into witness protection! Some of my clients tell me they receive 10 or 15 phone calls a day. Most of the phone calls come from call centers in Florida, So. Carolina, California. Hundreds of insurance agents stacked on top of one another in rooms full of phones are cranking out thousands of phone calls a second. They use automatic dialers that simultaneously dial ten persons at once. The first person who answers they solicit. After that, the other lines go dead.

Persons you never met, persons you will never meet, persons you never heard of until that moment will ask you for your banking information, Medicare number, and birth date. You will probably never hear from them again after you sign up with them. They may or may not be in the insurance industry by the end of the month. These call centers churn and burn agents like they do clients.

If that is how you like to do business, then it will be very convenient. Our method is to have Medicare insurance agents sit down with people face-to-face at least once if not more times. I grew up in Omaha, went to South High, own a home here. I will be buried next to my parents at Calvary Cemetery. We are as local as local can be. With thousands of clients, we are not going anywhere. So if you like that, you will like us.

Independent Agent Or Broker

Independent Medicare insurance agents or Medicare insurance brokers will show you a wide variety of insurance companies and products. For example, they can show you the Medicare Supplements and Part D prescription drug plans along with the Medicare Advantage plans. Medicare insurance brokers should share their experience with the various companies and plans over the years and show you data and statistics that prove their points. There are many Medicare advisors in Omaha, NE.

How Often Do You Contact Your Clients?

There are three certainties. Medicare will change, the Medicare plans will change, and your needs will change. Consequently, your agent needs to contact you to keep you abreast of those changes.

The Annual Election Period (AEP) is October 15th–December 7th. That is the period when you can change your Medicare Part D and Medicare Part C plans. In addition, I send out several letters and emails to remind clients of their opportunities.

Most of the time, “if it’s not broke, don’t fix it” is good advice, but it doesn’t mean to ignore clients. For example, clients on expensive medications, like insulin and anti-diabetic medications, need to check their prescriptions annually because plans change. Your medications may have remained the same, but the insurance company can drop or add a prescription. In addition, they can raise or lower a drug on a particular tier level, which affects the price.

I’ve had clients ignore my letters and calls. After Annual Election Period passes, some clients call because their prescriptions have gone through the roof. There is nothing I can do at that point except to ask the insurance company for an exception.

Many Medicare insurance brokers in the Omaha Metro area do not call their clients regularly. Some not at all. They sign you up and disappear. Ask how often they will call you and check.

Happy Birthday!

I like to call clients on their birthday. Everyone likes well wishes on their birthday, but I also like to check in to make sure the Medicare plan is operating as designed. Sometimes problems come up, and sometimes clients don’t call. I like to be proactive and deal with issues head-on.

Also, for those on Medicare Supplements, their premium may increase because of age or rate increases. I like to check and see what clients are paying. I can do a quick quote over the phone. If there is a lower-cost supplement available, we complete an application over the phone. Saving $300 or $500 a year is always a good birthday present.

It is essential to see how often your agent will contact you because circumstances change, and you want to know he will be on top of those changes and problems. Also, Medicare insurance agents tend to disappear.

I have been in insurance since 2002–20 years. Getting an insurance license is not very difficult or expensive. The barrier to entry into this industry is not high. Lots of people get into insurance, and lots of people get out. A friend of mine was a human resource manager for a large Medicare insurance company recruiting Medicare agents. The average length of time in service for his company was six months.

Many times a Medicare agent will sign up a person and disappear. They disappear because they get out of the industry, have a full-time job doing something else, or are just lazy. Make sure to ask how often your Medicare agent plans on contacting you and hold him to that.

When Did You Become A Medicare Insurance Agent in the Omaha Area?

The insurance industry goes through a lot of people. Insurance recruiters make promises of flexible hours, high income, being your own boss. While writing this article, I got an email with the title, “There’s No Limit On How Much Cash You Can Earn.” Depending on the company or agency, they may promise lots of leads and opportunities.

The reality is selling insurance products is hard work. The vast majority fail. Even those who struggle for several years and others who do it part-time end up quitting because the costs, constant testing, compliance requirements, and client service needs are too much with the other life demands.

How long an agent has been doing Medicare planning is critical because Medicare has lots of rules. The insurance products have their own intricacies, and the Medicare bureaucracy itself is not easy to deal with. I learn something new each week. The companies provide training. Medicare sends out notifications. The state insurance commissions are a source of information. I especially learn from clients as problems come up. Every year each Medicare insurance company has training meetings. It is interesting to see the new Medicare advisors in Omaha, NE, at the meetings and those who are no longer there.

How Many Medicare Clients Do You Have?

Chris is very pleasant and knowledgeable about Medicare. My husband has been a satisfied client for the past 7 years. That’s why I am here. Elaine H.

I recently had an operation on my Achilles tendon. I asked the surgeon how often he was in surgery per week. He said he performed between 10-15 surgeries per week. I like that number. When someone comes at me with a sharp object, I want to know that they know what they are doing.

This is the same for Medicare. The amount of time you have been a Medicare insurance agent and the number of clients you have tells you a lot about the agent. Most people never ask. If you have been making Medicare sales for five years and have only a hundred clients, you haven’t even averaged two new clients a month. How can you be good at anything when you only do it twice per month?

What Is Your Medicare Insurance Agent Process in Omaha?

Every salesperson has a process. If they do not have a process, that is their process. Ask your potential Medicare insurance agent to explain his process of working with clients. If he gives you a blank stare or hems and haws, that would not be a positive sign.

This is a little of what my process looks like when a prospective client meets with me for the first time. I take them through a 3 step process.

- Educate them on the basics of Medicare using the Official Medicare Handbook

- Show them the hundreds of supplements and plans with pricing

- Find out about their unique and particular health concerns

At the end of the meeting, I hand them a brochure with the details of the meeting, printouts of the supplements with prices, Medicare Advantage Benefit Highlights sheets, and a prescription drug list run through the Medicare.gov software, along with an email of those materials.

Printed Quotes and Follow Up Phone Calls

As a Medicare Insurance agent in Omaha, I mail them the printed materials again after the meeting. I follow up in a week with a phone call to see if there are any questions or need for clarification. I call and schedule the second appointment when they are in their open enrollment period. We review the Medicare materials again with updated details until they are comfortable making a decision. We complete the paperwork. My office sends a follow-up letter going through the details of what we did in the enrollment meeting. We call within ten days to update the client on the application and give the policy numbers. Then in another ten days, we call to make sure the client has all their cards and customer service phone numbers.

As a Medicare Insurance agent in Omaha, I mail them the printed materials again after the meeting. I follow up in a week with a phone call to see if there are any questions or need for clarification. I call and schedule the second appointment when they are in their open enrollment period. We review the Medicare materials again with updated details until they are comfortable making a decision. We complete the paperwork. My office sends a follow-up letter going through the details of what we did in the enrollment meeting. We call within ten days to update the client on the application and give the policy numbers. Then in another ten days, we call to make sure the client has all their cards and customer service phone numbers.

Thirty days after the policy starts, we follow up to make sure everything is going fine with the plan. In another thirty days, we double-check again to see if there are any issues. The following contact is either on a birthday or during the Annual Election Period in October of every year. The client, of course, can all at any time with questions or concerns.

I tell people this is a long-term relationship. ‘Until death does us part.’ I hope you are my client for the rest of your life, and I will be in contact with you during all that time to make whatever adjustments are needed. I have one client who is 102!

Should Medicare Insurance Agents in Omaha Have Testimonials?

Should Medicare Insurance Agents in Omaha Have Testimonials?

I ask many of my clients to share a testimonial for my website. You can see them on the bottom of the home page and the last page of the website. Many say ‘Yes!’

I take their picture and write down what they liked about working with me. My clients are very kind and generous.

Christopher J. Grimmond

Of course, you could say that is very self-serving, so I use Google Reviews. Clients can go to my profile on Google. There is a spot they can click and write a review. You can see those reviews. Google curates them and serves as the third party. I cannot delete or alter them. Those reviews should give you a good idea of how we work and the quality of our work.

Like on Amazon or other companies, you should be able to check an agents’ references. Ask the agent if there is some way to see the quality of their work. With hundreds of clients, a Medicare insurance agent in the Omaha area should very quickly be able to produce some testimonials about his service.

These are some ways to evaluate the quality of your potential Medicare insurance agent.

Finding a Medicare advisor in Omaha, NE, is not difficult. If you are turning 65, marketing companies sell your contact information, including birthday and phone numbers, to insurance agents. Lead companies are mailing you business reply cards (BRC) in hope that you will fill them out and mail them back in. Direct mail marketing companies are sending you postcards, flyers, and brochures because they want you to call their 800-Medicare number. Joe Namath and Jimmy J.J. Walker are on an endless loop of commercials coming into your living room telling you about the unbelievable Medicare benefits you do not qualify for. Dynomite!

Finding a Medicare advisor in Omaha, NE, is not difficult. If you are turning 65, marketing companies sell your contact information, including birthday and phone numbers, to insurance agents. Lead companies are mailing you business reply cards (BRC) in hope that you will fill them out and mail them back in. Direct mail marketing companies are sending you postcards, flyers, and brochures because they want you to call their 800-Medicare number. Joe Namath and Jimmy J.J. Walker are on an endless loop of commercials coming into your living room telling you about the unbelievable Medicare benefits you do not qualify for. Dynomite!

You will have to contact the FBI witness protection program to avoid the onslaught leveled against you as you approach Medicare eligibility!

Just Having An Insurance License Does Not Make You A Medicare Advisor

As you age into Medicare, an army is coming after you–an army of insurance agents. Some insurance agents, like me, have been around for a while. I earned my Nebraska & Iowa insurance licenses in 2003. Other agents just get their license for the Medicare Annual Election Period (AEP) when Medicare beneficiaries can change their Medicare plans. During those seven weeks of Medicare Annual Election Period AEP (Oct 15th–Dec 7th)–sometimes called “Open Enrollment”—Medicare insurance agents in Omaha, NE, are looking to make some money. They want to get new Medicare clients who are looking to change their Medicare plans.

earned my Nebraska & Iowa insurance licenses in 2003. Other agents just get their license for the Medicare Annual Election Period (AEP) when Medicare beneficiaries can change their Medicare plans. During those seven weeks of Medicare Annual Election Period AEP (Oct 15th–Dec 7th)–sometimes called “Open Enrollment”—Medicare insurance agents in Omaha, NE, are looking to make some money. They want to get new Medicare clients who are looking to change their Medicare plans.

People, however, are trying to find a Medicare advisor in Omaha, Ne, who is knowledgeable, competent, and trustworthy.

What Does It Take To Become A Medicare Insurance Agent in Nebraska?

A Nebraska insurance license only means that you passed the licensing test and paid the $50 licensing fee. It doesn’t tell you how many times the person took the test to finally pass. It doesn’t tell you her score. You cannot even determine how long the person has been licensed, though you can find out their license number on the Nebraska Department of Insurance website.

A Nebraska insurance license only means that you passed the licensing test and paid the $50 licensing fee. It doesn’t tell you how many times the person took the test to finally pass. It doesn’t tell you her score. You cannot even determine how long the person has been licensed, though you can find out their license number on the Nebraska Department of Insurance website.

While doctors, lawyers, real estate agents, and even hairdressers go through a lengthy and difficult training and testing process, insurance agents for Medicare do not. I do not say this with any sort of pride, but as a matter of fact. Many of my fellow Medicare agents in Omaha, NE, have little or no training, are doing this as a temporary part-time gig, and/or will probably let their license drop at the end of the year.

Baby Boomers Increased The Demand For Medicare Advisors

Medicare health insurance is a federal program that began in 1965. The government created it because most insurance companies did not offer affordable health insurance to seniors. Congress intervened to create a program to protect seniors who were going bankrupt handling healthcare as the American population was living significantly longer in large numbers by the 1960s.

Insurance companies quickly developed insurance products to supplement Medicare where it was lacking. Insurance agents started selling these Medicare supplements. As the baby boomers started aging into Medicare, the demand exploded. There was more demand than what insurance companies and agencies could handle, so they began mass recruiting to find people to sell Medicare supplements. Recruiters promised the usual things to attract large numbers of people–huge sums of money and easy work.

supplements. As the baby boomers started aging into Medicare, the demand exploded. There was more demand than what insurance companies and agencies could handle, so they began mass recruiting to find people to sell Medicare supplements. Recruiters promised the usual things to attract large numbers of people–huge sums of money and easy work.

The sales pitch works because each year, thousands of people get their insurance licenses and become Medicare advisors in Omaha, NE, but quickly they find the work is not easy and they do not become rich overnight. Consequently, after they sell to a few friends and relatives, they let their license lapse. The people they signed up then lose their agent.

The Fallout from Poor Medicare Advisors

The consequence is Medicare beneficiaries are left on their own with an insurance product they probably do not understand in a health insurance program that is as foreign as a foreign language. The agent-less persons are now older. Their needs and circumstances are probably changed, and their income is even more limited. It is a bad situation.

While Medicare is not rocket science and I am not a brain surgeon, Medicare and Medicare insurance products have a certain level of complexity. A person needs a knowledgeable advisor to help them avoid pitfalls and maximize their benefits because Medicare and insurance products are always changing.

Independent Medicare Advisors in Omaha, NE

We are independent Medicare advisors in Omaha, NE. That means we do not work for an insurance company. We are not captive to an insurance company restricted to selling only one company or brand. We offer a large variety of companies in Nebraska and Iowa–the big names and the small. They all pay us the same commission, so there is no incentive to offer one company over the other. We are Omaha, Nebraska, Medicare insurance brokers, so we look for the best deal for our clients.

How to Pick a Good Medicare Insurance Agent in Omaha, NE

How to Pick a Good Medicare Insurance Agent in Omaha, NE

First, we offer both Medicare Supplements and Medicare Advantage. These are both great options for those whom they fit. Our goal is to educate you on Medicare. The official Medicare handbook, Medicare & You, is over 120 pages of incredibly dull reading. We make it simple and understandable.

Secondly, we show you the actual Medigap and Medicare Advantage plans. Our software pulls together the policies and prices in nice neat rows and columns so you can compare and contrast. You can see the plans on one big four-foot computer screen, and we print out the quotes on one sheet of paper you can take with you.

From my experience, people come to us with separate quotes from various companies and a number of different agents. The mess of papers adds to your confusion. We pull the data up and let you see all the copays, co-insurance, maximum out-of-pocket, and premiums. It is only when you can look at them side-by-side on one computer screen and sheet of paper you can really see and compare.

We print out the quotes so you can take the material home with you. There shouldn’t be any pressure to decide or buy ‘right now.’ Picking a Medicare plan should not be a rush.

Finally, we find out about you and how you wish to manage your healthcare needs. Everyone is unique in how they wish to handle healthcare. Some of that has to do with your personality. Other reasons are your health. Your budget is an important determining factor. We work with you to see what fits you and is most comfortable for you.

Find A Medicare Advisor in Omaha, NE

You will be on Medicare hopefully for a long time. You want your Medicare advisor in Omaha, NE, to walk with you during that time to help you adjust and change as needs and times change. This is an important relationship for the long haul. Give us a call and find out how we help 402-614-3389.

#1. A Good Medicare Insurance Agent Should Ask “What Kind of Prescription Medications You Are Taking?”

#1. A Good Medicare Insurance Agent Should Ask “What Kind of Prescription Medications You Are Taking?”

After almost a decade of being a Medicare insurance agent, I still get nervous when prospective clients push their list of medications across the conference table. When I look at the list, I either tense up or breathe a sigh of relief.

Medication Costs Can Be Devastating

As a licensed Medicare agent in Omaha, Nebraska for more than 10 years, I see examples of this every day. Yesterday I was completing an application for a relative of mine in Texas. He is a great guy. Jim is older than me. I remember playing together when we were kids. He was like a big brother. Being the firstborn in my family, I didn’t have an older brother, so I idolized Jim.

together when we were kids. He was like a big brother. Being the firstborn in my family, I didn’t have an older brother, so I idolized Jim.

Jim is retiring in a few days. He is bone tired and is looking forward to getting out of the rat race. For the past year, his doctor gave him samples of Entresto for his heart. The manufacturer offered coupons for the medication too, but those stop once you are on Medicare. He was mainly paying nothing for it. When I told him the medication was around $600 a month, you could feel the ice-cold silence through the phone.

The Reality of A Fixed Income

The Reality of A Fixed Income

On the Medicare Part D plan, the deductible would be $445 upfront, and the monthly dose would be $47 per month. After his icy pause, the response that we Medicare Insurance Agents hear too often came, “I can’t pay that.”

Like many people going on Medicare and retiring, his Social Security is really all he has. Even a part-time job isn’t a viable option when his body and nerves are shot. So I took a big swallow.

Jim thought I had it wrong or made a mistake. I explained the reality to him about Medicare Part D and prescription costs if you are on high-dollar medications. I don’t think he believed me even after that.

His response was he would quit the medication, which is what many of my Medicare insurance clients say. And a few do that. Others listen to their doctor, a pleading spouse and children, or their body that sometimes tells them they need the medication.

A Medicare Insurance Agent Should Find Out The Medication Costs At the Beginning

A Medicare Insurance Agent Should Find Out The Medication Costs At the Beginning

It is painful to watch people go through this. Consequently, I have learned early on as a Medicare insurance agent to find out what medications people are on right away. The various software, including the Medicare.gov website, are helpful–though not infallible. I explain to clients the reality that sometimes Medicare and the Medicare insurance companies make mistakes in listing their medications. They may take medications off the formulary or raise the tier level. Consequently, even if we do everything right, there may be some surprises down the road on their medications.

As a longtime Medicare insurance agent, an old trick I’ve seen insurance companies pull is to put a medium-cost medication in tier 3, so you get hit with the deductible versus keeping it in tier 2, where it has been for a long time.

Fortunately, most of these problems are infrequent, but expensive medications, like Entresto, insulin, or other anti-diabetic medications, can be bank-breaking.

If you are on no medications, very few medications, or inexpensive medications, God bless you. Of course, circumstances can always change, but you should still understand that a good Medicare insurance agent will very carefully ask about your medications and conscientiously show you the plans that best address those medication needs. “What are your medications?” is a very important question, and it should be one of the first.

#2. A Good Medicare Insurance Agent Should Ask “How Do You Handle Risk?”

When you go to the casino, which slot machines do you play? The nickel slots? The quarter slots? Or the dollar slots? Or don’t you play at all?

Everyone handles risk differently. When I was in the investment side of financial services, before becoming a Medicare agent, we would put clients through a risk assessment. We walked them through several scenarios of their investments going up and down based upon the level of risk they were willing to take.

Of course, everyone was happy when the investments went up, and no one was happy when the investments went down. They understood, however, unless they were going to put their money in a can and bury it in the dirt, they would have to assume some level of risk.

What Is Your Tolerance For Risk?

People’s risk tolerance was all over the board. Some were conservative. Others moderate. A small group was high-risk takers. In the end, they would sign and date the risk assessment form, and it was put in their file. Then, the investment advisor would invest their money based upon how much risk they were willing to take. What does this have to do with Medicare insurance? I’ll explain.

People’s risk tolerance was all over the board. Some were conservative. Others moderate. A small group was high-risk takers. In the end, they would sign and date the risk assessment form, and it was put in their file. Then, the investment advisor would invest their money based upon how much risk they were willing to take. What does this have to do with Medicare insurance? I’ll explain.

I remember when clients came back during downtimes in the market. All of them were angry that their assets went down. The advisor showed them the history of the different asset classes and how they go up and down depending on markets and the type of assets. Clients were not impressed.

In the end, the clients complained their money went down too far. So then the advisor pulled out the risk assessment the clients all had completed months or years earlier. Right there in black and white was their signature next to the level of risk they were willing to assume, and their assets went down precisely what was predicted.

When the asset went up, they never called. A Medicare insurance agent should be testing your ability to handle risk.

No One Knows The Future: That’s Why You Buy Insurance

Over the years, in my role as a Medicare insurance agent, I have talked with clients months and years after choosing their Medicare Advantage plan or Medigap policy. I go through the same presentation with everyone. Thousands of clients have heard the exact same words over the years. I could do it in a coma.

People still come back and say I didn’t think the copays on my Advantage plan would end up being this much. I didn’t think my supplement premium would go up this high.

Whether you purchase a Medicare supplement or a Medicare Advantage plan, there are costs. Over time and as you age, those costs will go up. Unavoidable. The reality of those costs hit us differently than the idea of those costs when we are considering our options. It is crucial when considering your options to look at how you have handled risk in the past.

Did you pick the car insurance or the homeowners insurance with the high deductible? Were you ok when s__t happened?

Or did you pay the much more expensive premium, so you didn’t have a hefty deductible? Or did you switch after a while? That will tell you more about the type of Medicare insurance you should choose. How do you handle risk?

#3. A Good Medicare Insurance Agent Should Ask “Which Way? Pay As You Go Or Pay Upfront?”

Would you prefer to pay upfront and not worry, or would you rather pay when you actually use the service?

I love to travel. Over the years, I have been all over the United States and the world for pleasure and business. No style of travel is more appealing. I have gone on tours. Put some stuff in a knapsack and just gone out the door with no place in mind.

Depending on what I’m doing and how much money I have for the project, I make my strategic travel plans.

When I have gone on the cheap, I pay for the bare minimum. It saves money. I don’t mind sleeping on overnight trains and park benches–at least when I was younger. I paid for things when I wanted them or really needed them.

Other times, usually when I had more money, I did the all-inclusive thing. I didn’t have to worry about the nickel-and-dime stuff. I was comfortable with everything being taken care of and paying a lot for it.

Two different styles. Two different experiences. Two different outcomes. What type of experience do you want? As a Medicare insurance agent, that’s a question I need to ask.

What Kind of Experience Do You Want with Medicare?

Medicare Advantage is pay as you go. You don’t pay any copays unless you see a doctor, get a test, have surgery. The nice thing is you save money at that moment. But when something serious happens, like cancer treatment, you may be paying thousands of dollars–with a limit–for that year.

year.

On the supplement side, you pay your monthly premium. Remember, this premium will keep going up each year. So when you are probably your healthiest on Medicare in those initial years, you may not use Medicare and your supplement much, but you are paying.

As you get older, the premium will go up. It may double at some point from what you initially paid when you turned 65. At that point, you are older. You are starting to have medical needs, but nothing serious yet. Do you change to an Advantage plan because supplement premiums are going up? But now the likelihood of something costly happening during the twilight years of life significantly increases. You have already forked out a considerable sum on Medigap premium. Do you keep trudging along and pay increasing premiums, or do you cut your losses? Do you risk potentially high copays or pay certain higher premiums? What if I can’t afford Medicare premiums anymore?

Which scenario is less damning? What do the questions cause you to think and feel?

A good Medicare insurance agent asks these hard questions, but only you can answer them.