What Is Medicare Hospice?

Medicare pays for hospice, but what is hospice exactly?

Medicare defines hospice as a program of care and support for people who are terminally ill. Terminal illness, as Medicare definites it, is a life expectancy of six months or less. The primary goal of hospice in Medicare is to help terminally ill people live a comfortable life and manage their pain and discomfort. Hospice care is palliative care versus skilled nursing and home health care. Hospice does not cure the patient but rather aids the person in the dying process.

Death & dying is an area most people do not wish to ponder, so there are many misconceptions about Medicare-covered hospice care.

What Medicare Hospice Is Not?

Hospice is not a place. When my mother was terminally ill with ovarian cancer, I was thinking of taking her to a place.

When I was in college in the 80s, I had volunteered in a hospice facility run by the Hawthorne Dominican sisters. The hospice facility was an actual place people went to die. The nuns took care of everything: medical, personal care, food & lodging; and patients stayed there until the end.

That is what I had in mind when the doctors spoke to my family about hospice for our mother. That is not, however, how Medicare thinks of hospice.

Medicare does not pay for a hospice facility that provides room & board unless the care is tied to something like a skilled nursing facility. Medicare does, however, pay for hospice personnel and the medications they administer during hospice.

Where Do You Go For Hospice?

Hospice can be given virtually anywhere. A Medicare beneficiary can receive hospice at a hospital, hospice in a skilled nursing facility, hospice in an assisted living residence, and hospice at home. Medicare will pay for hospice care in assisted living, nursing homes, and other facilities if it is a Medicare-approved facility.

The end of life movement that started in the ’70s sees passing at home as the ideal. Most Medicare patients, when surveyed, prefer hospice in the home. That is where people feel most comfortable, but because of the level of care required, hospice care may have to move to a hospital in the last few days or another location.

Hospice can be given virtually anywhere.

Medicare.gov

What Kind of Illness Makes You Hospice Eligible?

When we think of hospice, we usually think of cancer, but there are other illnesses that result in hospice.

Grandpa Joe was 98. Grandpa had beaten cancer 4 times, lockjaw, and the Second World War. Dying didn’t seem possible. He had always been there, and we grandkids assumed he would always be there. Terminal illness and Grandpa Joe didn’t fit.

When Grandma Hilda announced to the family, Grandpa had congestive heart failure and was going into hospice, it didn’t quite register with us grandkids.

Grandpa Joe seemed the same old Grandpa Joe. When I was home from college, we chatted about the Cornhuskers, baseball, and politics. Nothing seemed to have changed, but there was a procession of nurses and therapists who came in and out of their home.

When Grandma Hilda finally called to tell us Grandpa had passed in his sleep, his death hit me like a sledgehammer.

Grandpa’s passing was hard on everyone, but Medicare providing and paying for hospice lightened the burden, especially for my parents and grandparents.

Who Can Go Into Hospice?

Hospice is also not exclusively for the old. I have a number of clients who are in their twenties and thirties. Not everyone on Medicare is sixty-five and older, though the majority are.

Accidents or illnesses permanently disabled some, and some are terminal. Hospice is for them too.

How Much Is Hospice?

Hospice care is not expensive for those on Medicare. Medicare pays for the vast majority of the hospice costs under Medicare Part A with very little out-of-pocket costs. Medications, some equipment, and nurses are covered.

Like I said earlier, hospice does not usually include custodial care or housekeeping. That can be very costly if the family cannot provide that type of care themselves.

How Do You Get Medicare To Pay For Hospice?

A Medicare beneficiary is eligible for Medicare’s hospice care benefit if she is entitled to Medicare Part A and meets the following conditions.

- The hospice doctor and the person’s regular physician certify that the person is terminally ill with a life expectancy of six months or less if the illness runs its

expected course.

expected course. - The person accepts palliative care for comfort instead of care to cure her illness.

- The person must sign a statement choosing hospice care instead of other Medicare-covered treatments for her terminal illness and related conditions.

- The care is provided by a Medicare-certified hospice agency.

When these 4 critical are met, Medicare pays for hospice. At any time, a person may choose to exit hospice.

Is Hospice Euthanasia?

Hospice does not accelerate the dying process.

I have had people describe hospice to me as akin to euthanasia where someone actively terminates a life. Hospice is not euthanasia or assisted suicide. You do not intentionally cut short a person’s life. Hospice is about allowing the dying process to take its natural and inevitable course without assistance. Hospice care is about alleviating the suffering and providing comfort while the person dies.

An uncle of mine was a retired Omaha police captain. Uncle Bill had a severe stroke with many complications. He was put on a ventilator.

Uncle Bill was a strong and courageous individual. A vegetative existence was not for him not to mention impoverishing his wife with medical bills. He ordered the ventilator turned off.

Without the ventilator, he would quickly stop breathing. He knew it. The doctors made him as comfortable as possible with heavy sedation. His body fought hard against the loss of breath.

We gathered around his hospital bed. Over the course of a day, he passed peacefully from this life to next surrounded by his loving wife and children.

Hospice Is Up To You

I’ve known many individuals over the years who have gone on hospice for a time. Instead of dying, their health improved, or they resumed a normal life and quit hospice because the decline stopped. You are free to remove yourself from hospice at any time.

Hospice Is Also For The Living

Hospice is the option when all other alternatives have been exhausted. It is the option to bring the highest possible quality of life to a person’s remaining time. The hope is family members will look back on their time and know that everything was done to preserve, prolong, and then peacefully say goodbye.

While you may struggle with the challenge of terminal illness, the end of your life and hospice is as much about your loved ones as it is about you. Watching you suffer and your family’s grief afterward will be their burden. Dying is equally about them. Understanding that there is something for them as well as you in a scary time can give you all hope that the last great challenge in life will be a little less daunting.

While hospice ends with a patient’s death, family grief counseling can continue for up to a year. Medicare pays for that hospice care too.

One’s mortality is difficult to face, but the chance you will go on Medicare hospice at the end of your life is more than 50%. That is an extraordinary number, so having confidence Medicare will pay for hospice is critical.

Medicare Modernization Caused Medicare Confusion

Medicare Modernization Caused Medicare Confusion

After Congress created Medicare and President Lyndon Johnson signed the Medicare program into law, insurance companies began designing and offering health plans to fill in the gaps in Medicare-covered services. Insurance companies started developing many Medigap policies to fill in Medicare Part A and Part B gaps. There were no federal guidelines or laws for Medigap policies at the time. Each state insurance department regulates the private plans within its own state. The growing number and complexity of the Medigap policies started to confuse consumers. Shopping and comparison among plans were difficult. Medicare needed the Medicare Modernization Act only a few years after the creation of Medicare.

The National Association of Insurance Commissioners (NAIC) develops rules for insurance regulation and coordinates those laws among the states. They devised rules for the new Medigap policies that eventually were widely accepted. In 1980, Congress established its own policy standards for Medigap plans that each state could adhere to voluntarily. Congress finally directed the NAIC to update the model regulations for Medigap plans, and Congress enacted mandatory federal Medigap standardization requirements in the Omnibus Budget Reconciliation Act of 1990 (OBRA). By 1992 state insurance commissioners standardized Medigap policies across the states. Congress prohibited insurance companies from selling Medigap policies that did not conform to the new standardized Medigap insurance regulations.

What Are the Implications of the Medicare Modernization Act of 2003?

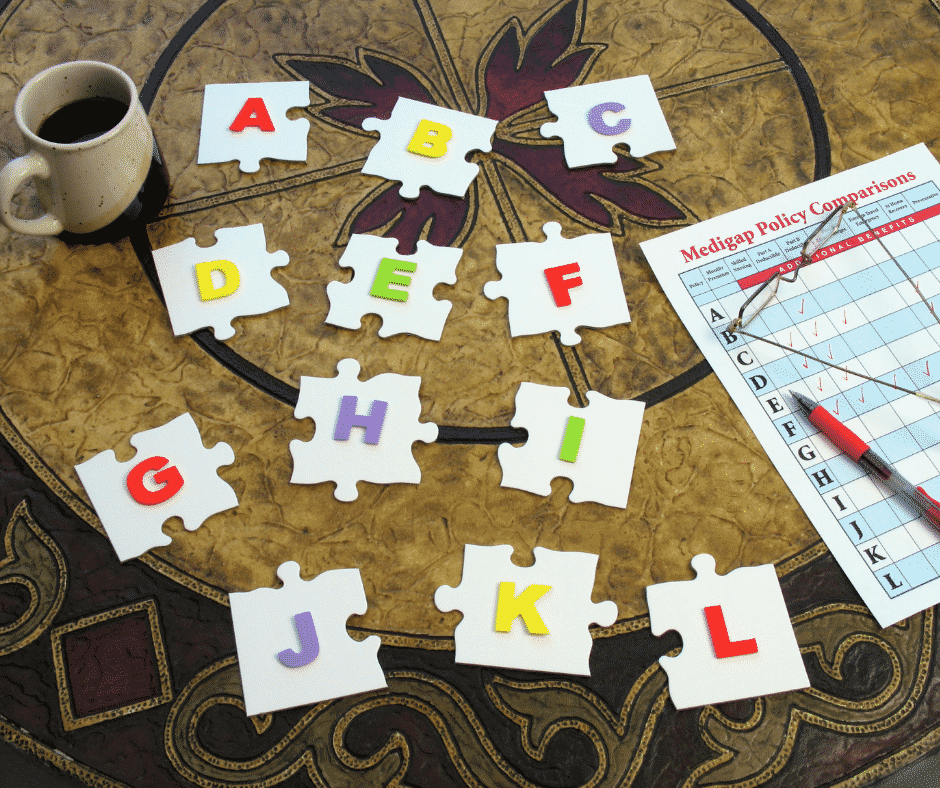

The initial standardization of Medigap policies in 1992 created ten different health plans, labeled Plan A through Plan J. Congress required each plan to provide the same benefits and provisions, regardless of the issuing insurance company. In effect, the plans were identical except for the price. The Medicare Modernization Act of 2003 enabled consumers to compare Medigap plans more easily. The plans were limited to a smaller number with the same features and benefits. The only variable was the price. By reducing the number and variations of Medigap plans, the standardization reduced confusion significantly.

The Medicare Modernization Act 2003 (MMA) added two new plans, K and L, to the lineup of standard plans bringing the total available for sale at that time to 12 Medigap plans. Congress added high-deductible options to two of the existing plans (F and J). The improvement and modernization act also included two significant changes.

Medicare Advantage Renamed & Medicare Part D Created

Medicare Advantage Renamed & Medicare Part D Created

The Medicare Modernization Act modified Medicare + Choice and renamed it Medicare Advantage. They also added prescription drug coverage as a new and standalone plan. Skyrocketing drug costs devastated seniors, so the Bush administration spearheaded prescription drug plans to limit out-of-pocket costs. (For time’s sake, we will modify this discussion to only Medigap plans and discuss managed care in other blogs.)

Third Generation Medigap

The Medicare Improvements for Patients and Providers Act (MIPPA) of 2008 expressly authorized

the implementation of Medigap policy revisions adopted by the NAIC in 2008. Each state regulates all insurance within its borders. Federal authorities pressured state insurance commissioners to adopt the NAIC changes.

The 2008 Act also introduced the “third-generation” of Medigap standardized plans. Medicare insurance companies introduced new Medigap plans and eliminated others effectively on June 1, 2010. Plans M and N increased cost-sharing features. Medicare insurance companies stopped Plan E, H, I, and J to eliminate duplicative and outdated Medigap plans. Center for Medicare & Medicaid Services (CMS) required Medicare insurance companies to stop offering prescription drug plans in all Medigap policies. (Those currently enrolled in discontinued plans may keep them.) CMS’s changes meant that beginning June 1, 2010, the “third-generation” of standardized plans consisted of ten different Medigap plans. Only these Medigap plans were available to purchase for new customers from that point on—including two with high-deductible options.

Latest Medigap Policy Changes

Medicare’s next stage of development from the Medicare Modernization Act was the Medicare Access and CHIP Reauthorization Act MACRA of 2015. Congress created a Medicare Quality Payment Program intended to encourage medical providers to focus on value over patient volume. Medicare Access and CHIP Reauthorization Act also included a significant change to Medicare supplement insurance options. Effective January 1, 2020, the sale of Plan C and Plan F (including the Plan F high-deductible option) policies stopped for newly eligible. “Newly eligible” means anyone who attains age 65 on or after January 1, 2020.

Individuals who purchased Plans C or F policies sold before January 1, 2020, are grandfathered into those plans. Beneficiaries may keep their Plan C or F. Those eligible for Medicare before that date may also still purchase them going forward. The eligible includes individuals who were eligible for Medicare before January 1, 2020. Medigap insurers will continue to maintain existing C and F plan policies. Still, they may not sell a new C or F (including high-deductible F) plan to anyone who was not qualified for Medicare before January 1, 2020. In other words, they turned 65 after January 1, 2020.

Individuals who purchased Plans C or F policies sold before January 1, 2020, are grandfathered into those plans. Beneficiaries may keep their Plan C or F. Those eligible for Medicare before that date may also still purchase them going forward. The eligible includes individuals who were eligible for Medicare before January 1, 2020. Medigap insurers will continue to maintain existing C and F plan policies. Still, they may not sell a new C or F (including high-deductible F) plan to anyone who was not qualified for Medicare before January 1, 2020. In other words, they turned 65 after January 1, 2020.

Medicare Access and CHIP Reauthorization Act of 2015 change is significant because Plans C and F are the only plans that include coverage for the Medicare Part B deductible. These plans were very popular. Eliminating these plan options was difficult but necessary to reduce future Medicare costs by discouraging unnecessary medical services. Congress reasoned paying a small deductible, such as the Part B deductible, would prevent unnecessary medical treatment and consequently help curb waste and abuse.

Understanding Evolution and Changes Avoids Confusion

Understanding the history of the evolution of Medigap policies and the government regulations that mandated the changes is vital to avoid confusion. Medicare beneficiaries hear about Plan F, Plan J, Plan this or that. They don’t understand why they can’t get those plans. There are fears they may lose coverage. Medicare beneficiaries do not realize CMS grandfathered them into their Medigap F or C plans. Awareness of Medicare’s continual changes prevents people from making wrong or outdated choices about their health care.

Change is a constant. Since its inception, Medicare has changed. The Medicare Modernization Act and subsequent Congressional legislation have tried to keep up with the changes in healthcare, consumers’ needs, and a drive for more efficient and cost-effective healthcare systems. Congress and President Johnson could not have imagined that what they started would become the complex and colossal system that cares for so many Americans today.

efficient and cost-effective healthcare systems. Congress and President Johnson could not have imagined that what they started would become the complex and colossal system that cares for so many Americans today.

Navigating the Complexities: What You Need to Know About Medicare and Home Healthcare Coverage

Navigating the Complexities: What You Need to Know About Medicare and Home Healthcare Coverage

Are you confused about Medicare and home health care coverage? If so, you’re not alone. Navigating the complexities of these topics can be overwhelming. It’s essential to understand your options and ensure you receive the care you need.

Does Medicare pay for home health care services?

This article will delve into the ins and outs of Medicare and home healthcare coverage, providing the information you need to make informed decisions. We’ll explore the different types of Medicare plans and how they relate to home healthcare services, eligibility requirements, coverage limitations, and common misconceptions.

Whether you’re a senior seeking assistance or a caregiver supporting a loved one, understanding how long Medicare pays for home health care is crucial. By the end of this article, you’ll clearly understand what options are available and how to navigate the complex healthcare landscape.

Stay tuned to discover everything you need about Medicare and home healthcare coverage. Don’t let the confusion hold you back from accessing the care you deserve.

Different Types of Medicare Coverage

Medicare is a federal health insurance program that covers people over 65 and those with specific disabilities or chronic conditions. There are several types of Medicare plans, each with benefits and limitations. Knowing how long each Medicare plan pays for health care is critical.

Original Medicare, also known as Medicare Part A and Part B, provides coverage for hospital stays, doctor visits, home healthcare, and some medical equipment. Medicare Part C, also known as Medicare Advantage, is a private insurance option combining Parts A and B, often including additional benefits such as prescription drug coverage and dental care. Both provide home healthcare coverage, but in specific ways unique to the plans.

Medicare Part D provides coverage for prescription drugs, while Medicare Supplement plans, also known as Medigap, help cover the costs of out-of-pocket expenses not covered by Original Medicare.

Understanding the differences between these plans is essential because they approach home health care differently.

Understanding Home Healthcare Services

Understanding Home Healthcare Services

As the name suggests, home healthcare services provide medical care and support to individuals in their homes. This can include services such as nursing care, physical therapy, and speech-language therapy. Home health care is often a more convenient and cost-effective option than hospital or skilled nursing facility (SNF) care and can provide a higher level of comfort and independence for patients. It is skilled nursing care but provided in the home for those who would not have access to medical care otherwise.

The purpose of home health care is short-term treatment for an illness or injury, such as a stroke or broken hip. It is about getting back your health and independence again.

For the chronically ill and disabled, the goal of home health care is to maintain the highest level of ability and health.

Home healthcare services can be provided by a variety of healthcare professionals, including registered nurses, licensed practical nurses, physical therapists, occupational therapists, and speech-language pathologists. A physician typically orders services, and they are covered by Medicare and/or private insurance.

Home health care is not home care. Home care would be custodial services like housekeeping, bathing, feeding, etc. Medicare does not usually provide those types of personal services, strictly speaking. There are exceptions, however. On occasion, Medicare allows for a temporary home health aide to assist in the healing process.

Some injuries and illnesses may last for a long time. While home health care is a necessary service, the bigger question is: how long does Medicare pay for home healthcare?

Medicare Eligibility for Home Healthcare Coverage

Individuals must meet specific requirements to be eligible for Medicare home healthcare coverage. First, they must be enrolled in Medicare Part A and/or Part B. Both Medicare Part A and Part B provide home healthcare coverage.

Under Part B, a person is eligible for home health care if she is homebound, requires skilled care, and is certified as needing care by a physician. The added benefit is Part B does not require a qualifying hospital stay.

The essential requirements of eligibility and access to Medicare home healthcare services are: homebound, physician certification, and Medicare-certified agency care.

Homebout, in Medicare terms, means that leaving the home requires a considerable and taxing effort. A physician is the gatekeeper of Medicare home healthcare. The physician certifies and/or recertifies a patient for access to home healthcare. Finally, a Medicare-certified agency must provide home healthcare services, not any healthcare provider.

Medicare Part A Coverage

In contrast, Medicare Part A provides home health care coverage in some situations. A hospital or skilled nursing facility stay triggers Part A. If a person has a three-day inpatient stay at a hospital or has a Medicare-covered Skilled Nursing Facility (SNF) stay, Part A will cover up to 100 days of home health care.

Note that a person must still meet the other eligibility requirements to receive home health care, such as needing skilled care, being homebound, and having a doctor certify that such care is necessary.

A person also must receive home health services within 14 days of being discharged from a hospital or SNF. If a person doesn’t meet all of the requirements for Part A coverage but is otherwise eligible for home health care benefits, her care will be financed under Part B.

Medicare Coverage For Home Healthcare Services Amounts

Regardless of whether Part A or Part B covers a person’s care, Medicare will pay:

- The entire approved cost of all covered home health services.

- Eighty percent of the Medicare-approved amount is for durable medical equipment.

Medicare covers a wide range of home health care visits, including skilled nursing care, physical therapy, occupational therapy, speech-language pathology, and medical social services. These services are typically provided part-time or intermittently, depending on the individual’s needs.

Medicare also covers specific durable medical equipment and supplies, such as wheelchairs, hospital beds, and oxygen equipment.

However, coverage limitations and restrictions may apply, and it’s essential to understand what services are covered and how much you may be responsible for paying out of pocket. The agencies providing the equipment and supplies can give details of costs.

Limitations and restrictions of Medicare coverage for home health care

Limitations and restrictions of Medicare coverage for home health care

While Medicare provides coverage for many home healthcare services, there are limitations and restrictions to be aware of. For example, Medicare typically only covers part-time or intermittent care and may not cover 24-hour or long-term care.

In addition, Medicare may not cover certain services considered custodial care, such as help with bathing, dressing, and eating. Finally, there may be coverage limitations based on the individual’s medical condition. Some coverage is subject to annual or lifetime caps.

Certified Home Health Agency Disclosure of Covered Costs

Before home health care starts, the certified home health agency must tell the person how much Medicare will pay. The agency must also disclose if Medicare does not cover needed items or services. Then tell how much the person will have to pay for them.

For example, charges to a person may be:

- Medical services and supplies that Original Medicare doesn’t cover, such as prescription drugs or routine foot care

- 20 percent of the approved amount for Medicare-covered durable medical equipment such as wheelchairs, walkers, and oxygen equipment

Tips for Navigating Medicare and Home Healthcare Coverage

Navigating the complexities of Medicare and home healthcare coverage can be challenging, but several tips help make the process easier. First, it’s important to understand your needs and choose the Medicare plan that best fits them.

Second, work with your healthcare provider to ensure that a Medicare-certified agency orders and provides home healthcare services.

Finally, read the fine print and understand any coverage limitations or restrictions that may apply. The Medicare-certified agency is well versed in the cover limitations and costs. Be sure to consult with them ahead of time.

Alternative options for home health care coverage

While Medicare provides coverage for many home health care services, alternative options may be available to better meet your needs. For example, private insurance plans may offer more comprehensive coverage for certain services. Medicaid is another route for low-income individuals.

Private Home Health Care Insurance Policies

Home health care insurance is typically a private insurance policy purchased ahead of time to assist Medicare in caring for someone receiving home health care. The policy covers activities of daily living in the home, such as bathing, feeding, transportation, and housekeeping. Like any insurance, these alternative options must be purchased before the health issues arise. Many insurance carriers offer a variety of these types of policies.

In addition, a variety of community-based programs and organizations offer support and assistance to seniors and individuals with disabilities. These programs may include meal delivery, transportation services, and assistance with daily living activities.

Home Health Agency Advance Beneficiary Notice of Noncoverage

Home Health Agency Advance Beneficiary Notice of Noncoverage

When a certified home health agency believes that Medicare may not pay for some or all of a person’s home health care, it must give the person a written notice called an Advance Beneficiary Notice of Noncoverage (ABN). The ABN might occur, for example, if the home health agency thinks that Medicare will not pay for items or services because:

- The care is not considered medically reasonable and necessary.

- The care is only unskilled, a home health care aide, like help with bathing or dressing.

- The person is not homebound.

- The person does not need skilled care on an intermittent basis.

The ABN must describe the service and/or items that may not be covered and explain why Medicare probably won’t pay. The notice must also include an estimate of the costs for the items and services so that the beneficiary can decide whether to receive the services, understanding that she may have to pay out-of-pocket for such care.

The ABN also gives directions for getting an official decision from Medicare about payment for home health services and supplies and for filing an appeal if Medicare won’t pay.

How Long Does Medicare Pay for Home Health Care?

There is no limit to the length of time that a person can receive home health care services. Once the initial qualifying criteria are met, Medicare will cover home health care as long as it is medically necessary. However, care is limited. There are a maximum number of visits per week and a certain amount of hours per day of care.

When a person first begins receiving home health care, the plan of care will allow for up to 60 days. At the end of this period, the physician must decide whether to recertify the patient for another 60 days. The patient must be recertified at least every 60 days if home health care is to continue.

Medicare does not limit the number of times a physician may recertify a patient. Provided all eligibility requirements continue, he can recertify an unlimited number.

What Happens When Medicare Stops Paying for Home Health Care?

A home health agency must give a beneficiary a written Home Health Change of Care Notice (HHCCN) when the patient’s plan of care changes because the home health agency decides to reduce or stop providing some or all of the home health services or supplies. Or, the patient’s doctor has changed the orders, which may reduce or stop certain home healthcare services or supplies that Medicare covers.

doctor has changed the orders, which may reduce or stop certain home healthcare services or supplies that Medicare covers.

For example, the doctor changes the care plan from five to three days a week. The agency issues an HHCCN. The beneficiary receives a notification in writing of the change.

The HHCCN lists the services or supplies that will be changed and gives the beneficiary instructions on what to do if she disagrees. The home health agency is not required to give a person an HHCCN when a Notice of Medicare Noncoverage is issued.

Notice of Medicare Noncoverage

When a person’s Medicare-covered services end, the home health agency must give the beneficiary a Notice of Medicare Noncoverage (NOMNC). This notice states when services will end as well as how to appeal the decision. The NOMNC also provides information on contacting the Beneficiary and Family-Centered Care Quality Improvement Organization (BFCC-QIO) to request an expedited appeal.

Once a person decides to appeal and has reached the BFCC-QIO, the home health agency must give the patient a detailed notice explaining why it believes Medicare-covered care should end. The agency should tell the applicable coverage rules and other information about the person’s situation.

A physician must submit a statement of appeal to the BFCC-QIO. It says the patient’s health will be jeopardized if care is discontinued. These factors determine how long Medicare pays for home health care. Knowledge of these rules is vital to maximize benefits and avoid costly mistakes.

Importance of understanding Medicare and home health care coverage

Understanding Medicare and home health care coverage is crucial for seniors and individuals with chronic conditions or disabilities. These programs provide access to essential medical care. They support individuals to maintain their independence and quality of life.

By understanding the different types of Medicare plans, eligibility requirements, coverage limitations, and alternative options, individuals can make informed decisions about their healthcare and ensure they receive the care they need.

Bottomline: Taking Advantage of Medicare and Home Healthcare Benefits

In conclusion, navigating the complexities of Medicare and home healthcare coverage can be challenging, but it’s essential for seniors and individuals with chronic conditions or disabilities. By understanding the different types of Medicare plans, eligibility requirements, coverage

Christopher J. Grimmond

limitations, and alternative options, individuals can make informed decisions about their healthcare and ensure they receive the care they need.

Whether you’re seeking home healthcare services for yourself or a loved one, working with your healthcare provider and understanding the coverage options available is essential. By taking advantage of Medicare and other home healthcare benefits, you can maintain your independence, improve your quality of life, and ensure you receive the care you deserve.

At Omaha Insurance Solutions, we help you understand the many Medicare rules. We navigate you through the forms and get the care you need. Call us at 402-614-3389 to speak with an experienced, licensed insurance agent professional.

Jimmo vs. Sebelius On Skilled Nursing

Skilled Nursing Care is amazingly complex. Because the Medicare coverage of Skilled Nursing Facility stays is so confusing, patients sued. The case went all the way to the Federal Courts. Jimmo vs. Sebelius, a class-action lawsuit, challenged the Center For Medicare & Medicaid Services (CMS) interpretation of the “improvement stand” that many used to interpret Medicare coverage of Skilled Nursing Facility booklet.

Medicare Coverage of Skilled Nursing Facility Stays: Improvement Standard

This one hit home for me because of how it affected my mother and our family. My mother was in the last stages of ovarian cancer. It became clear that no treatment was going to work. She was on palliative care. During one of her episodes, she was in extreme pain. The hospital admitted my mother because intravenously administered pain killers were the only way to get her pain under control. After that, she was supposed to come home. But her condition was such that we were not going to be able to care for her adequately. We talked about a nursing home—skilled nursing—but one of the criteria at the time was the patient must be able to improve. Because she was terminal, improvement was definitely not in the cards. We were initially told that Medicare would not pay for her stay in a skilled nursing facility. However, that was not accurate. The people we were talking with were operating off old, outdated information.

This one hit home for me because of how it affected my mother and our family. My mother was in the last stages of ovarian cancer. It became clear that no treatment was going to work. She was on palliative care. During one of her episodes, she was in extreme pain. The hospital admitted my mother because intravenously administered pain killers were the only way to get her pain under control. After that, she was supposed to come home. But her condition was such that we were not going to be able to care for her adequately. We talked about a nursing home—skilled nursing—but one of the criteria at the time was the patient must be able to improve. Because she was terminal, improvement was definitely not in the cards. We were initially told that Medicare would not pay for her stay in a skilled nursing facility. However, that was not accurate. The people we were talking with were operating off old, outdated information.

Slow Deterioration of a Condition

On January 24, 2013, the class action lawsuit Jimmo vs Sebelius settled in favor of the patient, and the Center for Medicare & Medicaid Services (CMS) clarified its policy. Medicare coverage of Skilled Nursing Facility stays no longer required “improvement.” Instead, care could be prescribed to maintain the status of an individual’s condition, or slow the deterioration of a condition, as well as to improve the person’s condition.

Jimmo Website Explains New Medicare Coverage

As ordered by the federal judge in Jimmo v. Sebelius, the Centers for Medicare and Medicaid Services (CMS) published a new webpage containing important  information about the Jimmo Settlement on its CMS.gov website. The Jimmo webpage is the final step in a court-ordered Corrective Action Plan. The action reinforces the fact that Medicare does cover skilled nursing and skilled therapy services needed to maintain a patient’s function or to prevent or slow decline. Improvement or progress is not necessary as long as skilled care is required. The Jimmo standards apply to home health care, nursing home care, outpatient therapies, and, to a certain extent, for care in Inpatient Rehabilitation Facilities.

information about the Jimmo Settlement on its CMS.gov website. The Jimmo webpage is the final step in a court-ordered Corrective Action Plan. The action reinforces the fact that Medicare does cover skilled nursing and skilled therapy services needed to maintain a patient’s function or to prevent or slow decline. Improvement or progress is not necessary as long as skilled care is required. The Jimmo standards apply to home health care, nursing home care, outpatient therapies, and, to a certain extent, for care in Inpatient Rehabilitation Facilities.

In my mother’s case, the skilled nursing facility admitted my mother, even though she was terminal, to help slow the deterioration of her health. As it turned out, she passed away within two weeks of her admittance, and the personnel at her skilled nursing facility were outstanding! They made her last days as bearable as the situation would allow.

Medicare Coverage of Skilled Nursing Facilities Changed

Medicare coverage of Skilled Nursing Facility stays practices have changed. Researchers assessed the impact of the Jimmo settlement by looking at changes to the number of physical therapy and/or occupational therapy visits per year, per patient, focusing specifically on the number of individuals who had 12 or more therapy visits during a 12-month timespan.

Medicare coverage of Skilled Nursing Facility stays practices have changed. Researchers assessed the impact of the Jimmo settlement by looking at changes to the number of physical therapy and/or occupational therapy visits per year, per patient, focusing specifically on the number of individuals who had 12 or more therapy visits during a 12-month timespan.

Healthcare is very expensive. There are many conflicting groups and interests. The rules, policies, and mechanisms are complex. Some of the people you deal with can be frustrating. The complexity of the system is driven home to me daily as I talk with clients and deal with issues that arise. You need to be aware of the rules and regulations around Medicare coverage and nursing home care. Or have someone who knows them and can help.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

Part A Deductible

Medicare is a generous health plan. It covers a majority of the hospital and doctor costs, but there is some important exposure to be aware of. Medicare Part A covers the hospital, but only after you pay the deductible of $1,288. That deductible is not an annual deductible. It is per event within a 60 day period. While you would have to be very unlucky, very sick, or both, you could pay that deductible an endless number of times. That is your exposure.

Part B Co-Insurance

Medicare Part B covers 80% of the doctor and outpatient procedures. While that is quite generous, 20% of a big number is still a big number. Heart attacks, strokes, cancer treatment can run into the hundreds of thousands of dollars. Twenty percent of a $200,000 bill is $40,000. Most people would find that beyond the family budget.

MOOP

And with Part A & B, there is NO maximum-out-of-pocket (MOOP). In other words, you continue to pay as the bills roll in. You do not stop paying on deductibles and co-insurance if all you have is Original Medicare without anything else.

So comes the questions from clients: ‘What should I do about Medicare?’ Medicare supplements or Medigap plans fill in those gaps in Medicare. They cover the hospital deductibles and 20% co-insurance for doctor and outpatient use. Depending on how much you wish to cover, the Medigap plan can cover everything 100%, most of everything, or a potion. You choose. There are ten plans available.

12,200,000 Satisfied Medigap Clients

The fact that 22% of people on Medicare choose a supplement and stay on a supplement for 20-30 years tells you the level of satisfaction. There are currently 55,200,000 Medicare beneficiaries. Of that number 12,200,000 chose a supplement. That number grows each year: 9.7 million in 2010 to 12.2 million in 2015. The key number is that 9 out of 10 Medigap beneficiaries say that they are satisfied with their coverage and keep their coverage. Med Sup Conference Stats

While Medicare is a wonderful health insurance program for seniors, it doesn’t cover everything. You still have exposure to significant financial loss if you only have Medicare alone.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

Most people show up at the steps of Medicare without any idea about how to buy Medigap insurance. If they have health insurance company A at their work, they call up health insurance company A and buy their Medigap insurance from company A. They don’t shop, and most pay more without getting more.

Most people show up at the steps of Medicare without any idea about how to buy Medigap insurance. If they have health insurance company A at their work, they call up health insurance company A and buy their Medigap insurance from company A. They don’t shop, and most pay more without getting more.

Amateur Or Professional?

A few years ago, a friend of mine told me that he was going to finish off his basement himself. His wife wanted it done because she was going to host her large family for Thanksgiving that year. Tom thought he could save some money by doing it himself.

himself.

He figured out a design, went to the hardware store, and bought some lumber. It sat there for several months because he got busy with coaching the kids, work, and other projects. His wife got on him because there was a deadline. He started the project, but because he wasn’t an experienced carpenter, he made a few mistakes. The mistakes started adding up.

Mistakes are expensive. The deadline was looming. Finally, he called in a professional. The basement was done in six weeks, just in time for Thanksgiving. He also realized that the basement was much nicer than what he could have done.

What does this have to do with how to buy Medigap Insurance?

How Do You Find The Lowest Price?

A true insurance professional will show you how to buy Medigap insurance at the lowest cost for the coverage you want. He will have the knowledge and experience to better serve you than doing Medigap insurance yourself, visiting with a friend of a friend who does Medigap insurance part-time, or talking to someone in a call center thousands of miles away.

The benefits of working with an experienced and independent local Medigap insurance professional are that he or she understands the laws and regulations around Medicare in that state and county. The Medicare Handbook is over 150 pages. It takes a while to absorb all the regulations, and that is just from Medicare. Each insurance company has its underwriting guidelines, policies, and procedures. In other words, buying Medigap insurance is complicated.

And all of these organizations are run by humans, and humans make mistakes—lots of mistakes. Have you ever had an insurance company make a mistake that affected you? I’ve seen a few, and an experienced Medigap insurance agent can quickly and easily help you resolve snags that inevitably will arise when you’re trying to figure out how to buy Medigap insurance.

How Do You Buy Medigap Insurance With So Many Choices?

Showing you how to buy Medigap insurance means shopping for Medicare supplements and plans for you. In Nebraska or Iowa, there are over 30+ insurance companies offering hundreds of supplements, 20 Medicare Part C Advantage plans, and 28 Medicare Part D prescription drug plans, which all interact with Medigap insurance.

That is a tremendous amount of information, and prices and information are not easily available to persons not licensed and appointed with Medigap insurance companies. A truly independent agent will be able to show you all the plans and pricing, not just one company with a few plans or a handful of cherry-picked companies. Using sophisticated software, he or she can line up the Medigap insurance plans in your area down to the zip code, showing you how to buy Medigap insurance.

A Plan G is a Plan G

A dirty little secret that most people do not know is all the Medigap insurance plans are the same. By law and regulation, the plans are exactly the same.

“It’s important to compare Medigap policies since the costs can vary between insurance companies for exactly the same coverage . . . .” The Official U.S. Medicare Handbook: Medicare & You

A Plan G is a Plan G is a Plan G. The only difference is the price. An independent Medicare insurance broker should be able to line up all the Plan G’s and Plan N’s in a row from the least expensive to the most for you to see. How to buy Medigap insurance should be straightforward.

Lowest Price vs. Biggest Brand

While brands are not unimportant, saving money is more important. Some companies trade on their name. You pay more, but the Medigap insurance you buy does not cover anymore, pay any faster, or do anything extra.

There are other things to consider when you think about how to buy Medigap insurance. You will hopefully be using Medicare for twenty or thirty years. Picking a Medicare plan is not like getting a tattoo. It is not a one-and-done thing. Each year Medicare makes changes in rules. Medigap insurance policies go up in price because of age or rate increases. The insurance companies are constantly adjusting plans based upon Medicare, markets, inflation, pharmaceutical companies, etc.

Medigap Age & Rate Increases

How to buy Medigap insurance should also consider the history of age increases to the policy and rate increases. For an insurance company to stay alive, not to mention be profitable, it must be able to adjust its prices. The two ways an insurance company adjusts are through age and rate increases. An independent Medicare insurance broker should be able to show you the age increases. In other words, what will your Medigap insurance policy be at 66, 67, 68, etc.

An independent Medicare insurance agent should also have access to the history of rate increases. Some companies will increase their rates each year a little bit. Other companies will wait a couple of years. Those increases can be quite large. Either way, the price will go up. While past performance does not guarantee the future, you still get an idea of how any insurance company handles prices and inflation. With inflation over 4% this quarter, prices will definitely be going up.

How To Buy Medigap Insurance?

An experienced and independent agent lives in this world and can guide you through the changes to supplements and plans that are most beneficial to you. She can shop Medicare supplements each year and show you how to buy Medigap insurance at the lowest price.

New people are constantly recruited to sell Medigap insurance. Some last a few days, a few months, or a few years. Most do not last at all. The Medicare rules are confusing and unforgiving. Insurance companies follow strict underwriting guidelines and are constantly changing prices. Do you really want to do it yourself or entrust yourself to an amateur?

A Professional Will Show You How to Buy Medigap Insurance

The insurance companies will not give you a discount for going direct. When you do that—and the insurance companies love that—your agent is now whoever answers the 800-number you call. You will speak to a different person each time. That person may be in the insurance industry for two days, two months, or two years. You’ll never know. Or would you rather have an experienced and independent local insurance professional who will be your advocate for the next twenty or thirty years, to help you learn how to buy Medigap insurance? He can show you how to buy Medigap insurance at the best price for you.

for two days, two months, or two years. You’ll never know. Or would you rather have an experienced and independent local insurance professional who will be your advocate for the next twenty or thirty years, to help you learn how to buy Medigap insurance? He can show you how to buy Medigap insurance at the best price for you.