A prospective client called me about saving money on her Medicare supplement. I asked her the basic supplement health questions and gave a quote. We set up a time to meet. At the meeting, I started going through the standard health questions on the application. When I came to the question about recommended future treatments, she said no, but the way she answered bothered me. So I asked it a different way. “Did the doctor suggest that you have anything done, like cataract surgery, knee or hip replacement?” Then she lit up. “My hips are really bad,” she said. “He thinks I should replace them sometime.” “So when you say sometime, are you talking about in a year or two?” “Oh no,” she said. “In the next couple of months.” I closed my notebook. We were done.

Supplement Health Questions Broken Down

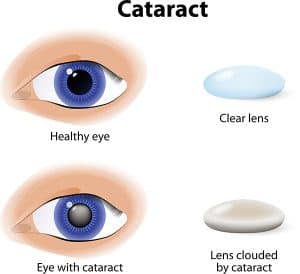

Recommended treatments by a physician could potentially cause a problem when you switch supplements. Three things to know: 1.) what is a recommended treatment, 2.) why does it matter, 3.) what should you do about it.

Most of the time when we see the doctor it is because we are sick right now. She makes a diagnosis and recommends an immediate treatment. ‘Take this pill now.’ ‘Have open heart surgery next week.’ Sometimes the diagnosis leads to a recommendation for treatment sometime in the future. ‘Your knees are deteriorating. You should have a knee replacement in the next year or so.’ When your doctor puts a recommendation in your medical records for a future treatment, that is a big deal. To an insurance company, that means there will be a future big bill for whoever is insuring you at that time.

Understand the Supplement Health Questions

The problem is that you could get stuck with the bill instead of the insurance company if you don’t follow the rules. If you have something done that was recommend before you got the new policy, like cataract surgery within six months after getting a new Medicare Supplement, the insurance company will probably not pay their share of the expense. The health questions in the application are designed to disclose recommended treats and prevent the new insurance company from getting stuck with the bill. They would likely refuse payment and call for doctor’s records to see if there was a recommendation for treatment before you signed the application. After six months, you are less likely to have any trouble. They cannot hold back paying for treatment indefinitely. The bottom line is, if you have any recommended treatments, finish them up before switching supplements.

The problem is that you could get stuck with the bill instead of the insurance company if you don’t follow the rules. If you have something done that was recommend before you got the new policy, like cataract surgery within six months after getting a new Medicare Supplement, the insurance company will probably not pay their share of the expense. The health questions in the application are designed to disclose recommended treats and prevent the new insurance company from getting stuck with the bill. They would likely refuse payment and call for doctor’s records to see if there was a recommendation for treatment before you signed the application. After six months, you are less likely to have any trouble. They cannot hold back paying for treatment indefinitely. The bottom line is, if you have any recommended treatments, finish them up before switching supplements.

Manage the Supplement Health Questions

This problem, of course, can be avoided. Check with your doctor. See if he is recommending any treatments and see if he put that in your medical records. Check with the insurance company if you recently switched supplements. Doctor’s offices will not usually check with an insurance company on a supplement because they will assume the insurance company will pay when Medicare pays. If you recently switched supplements, call and ask ahead of time if there will be any issues about a procedure. It is always good to cross your T’s and dot your I’s when it comes to new insurance plans.

This problem, of course, can be avoided. Check with your doctor. See if he is recommending any treatments and see if he put that in your medical records. Check with the insurance company if you recently switched supplements. Doctor’s offices will not usually check with an insurance company on a supplement because they will assume the insurance company will pay when Medicare pays. If you recently switched supplements, call and ask ahead of time if there will be any issues about a procedure. It is always good to cross your T’s and dot your I’s when it comes to new insurance plans.

Ask an Expert about Supplement Health Questions

A mistake around a recommended treatment when changing Medicare supplements could result in bills to you for thousands of dollars. Know whether you have any recommendations from a physician for future treatments in your records. Understand what that means in relationship to a new Medicare supplement. Talk with someone who can ask you the right questions when you are making a change to your supplement coverage 402-614-3389. OmahaInsuranceSolutions.com

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

Part A Deductible

Medicare is a generous health plan. It covers a majority of the hospital and doctor costs, but there is some important exposure to be aware of. Medicare Part A covers the hospital, but only after you pay the deductible of $1,288. That deductible is not an annual deductible. It is per event within a 60 day period. While you would have to be very unlucky, very sick, or both, you could pay that deductible an endless number of times. That is your exposure.

Part B Co-Insurance

Medicare Part B covers 80% of the doctor and outpatient procedures. While that is quite generous, 20% of a big number is still a big number. Heart attacks, strokes, cancer treatment can run into the hundreds of thousands of dollars. Twenty percent of a $200,000 bill is $40,000. Most people would find that beyond the family budget.

MOOP

And with Part A & B, there is NO maximum-out-of-pocket (MOOP). In other words, you continue to pay as the bills roll in. You do not stop paying on deductibles and co-insurance if all you have is Original Medicare without anything else.

So comes the questions from clients: ‘What should I do about Medicare?’ Medicare supplements or Medigap plans fill in those gaps in Medicare. They cover the hospital deductibles and 20% co-insurance for doctor and outpatient use. Depending on how much you wish to cover, the Medigap plan can cover everything 100%, most of everything, or a potion. You choose. There are ten plans available.

12,200,000 Satisfied Medigap Clients

The fact that 22% of people on Medicare choose a supplement and stay on a supplement for 20-30 years tells you the level of satisfaction. There are currently 55,200,000 Medicare beneficiaries. Of that number 12,200,000 chose a supplement. That number grows each year: 9.7 million in 2010 to 12.2 million in 2015. The key number is that 9 out of 10 Medigap beneficiaries say that they are satisfied with their coverage and keep their coverage. Med Sup Conference Stats

While Medicare is a wonderful health insurance program for seniors, it doesn’t cover everything. You still have exposure to significant financial loss if you only have Medicare alone.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.