Does Medicare Cover Hospice?

Does Medicare Cover Hospice?

Many people are still not very familiar with Medicare and hospice. It is actually a fairly new idea. The “end of life movement” began in the ’70s. (The “end of life movement” is separate and distinct from the Euthanasia movement and organizations, like the Hemlock Society.) Medicare did not cover Hospice when Medicare started in 1965. Medicare and hospice were only put together in 1982 as part of the Tax, Equity, and Fiscal Responsibility Act under President Reagan in response to a growing awareness of end of life concerns. The legislation was an attempt to fill the gap in care. Awareness was growing in the country of the importance of what transpired at the end of life.

A Happy Death Is Not A New Idea

I remember when I was a teenager. My father was up before me in the mornings. He would take me to school on his way to work. I would see him praying when I came into the kitchen in the morning. One time I asked him what he was reading. It was a small devotional booklet. He was praying the novena to St. Joseph for a “Happy Death.” I was startled by the subject matter.

Teenagers don’t think much about death unless forced. I had a buddy, Herbert Woltz, killed in a motorcycle accident my senior year in high school. That was my abrupt intro to death.

I asked my father why pray for such a crazy thing as a “happy death”? The two subjects were oxymoronic to me. What’s happy about death? He reminded me that is how the Hail Mary ends. “Pray for us . . . now and at the hour of our death. Amen.”

After birth, he said, death is the most important event in your life. The difference, however, is you’re aware of what’s going on in the end, and you make the most important decisions of your life at “the hour of your death.” Praying for a “Happy Death” is about minimizing the pain and maximizing your moment of entrance into eternity. You’re asking for God and all the heavenly hosts to be at your side to handle the fear, pain, discouragement, and loneliness a person faces when approaching death and the moment of death.

I didn’t think much about what my father shared until many years had gone by and many friends and family members had passed away, including my dad. Medicare and hospice are something with which I have had extensive experience. Now I know why you would want to pay for a “happy death.”

End of Life Care Is Different

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

While I was there, I got to know the sisters. They were remarkable young ladies. The convent was inside the hospice facility. The nuns lived, prayed, and worked with their dying residents around them twenty-four hours a day. The Hawthorne Dominicans were some of the happiest people I ever met.

Their foundress, Rose Lanthrop-Hawthorne, was the youngest daughter of the famous author, Nathanial Hawthorne, and a convert to Catholicism. In her day, cancer patients were put on an island in New York harbor–Blackwell Island–because it was believed that cancer was contagious. Many people, especially the poor, died in incredible misery, isolation, and squalor.

Medicare and hospice were a century away. Rose, like Mother Teresa of our time, saw the face of Jesus in the poor, and she started a ministry to the dying among the poor immigrants of the New York slums. The Hawthorne Dominicans is a purely American woman’s religious order. Most woman’s religious orders in our country came from Europe originally.

End of Life Care Rediscovered With Hospice & Medicare

The end of life movement in our time found its origin during a 1967 lecture at Yale University by Cicely Saunders. She introduced the idea that the dying needed specialized care that served their unique situation. She later founded St. Christopher’s Hospice in London.

Dr. Elisabeth Kubler-Ross, MD research into death and dying identified five stages terminally ill patients go through. Her popular and groundbreaking book, On Death & Dying, fueled a movement to deal with issues of death and dying.

In 1972 she testified at the first national hearings on death with dignity conducted by the U.S. Senator Special Committee on Aging. Organizations, like The National Hospice and Palliative Care Organization (NHPCO), sprang up to study and promote awareness around the end of life issues. Finally, because of raised public interest and concerns, Medicare added hospice care to the list of services provides in 1982.

Medicare And Hospice Are Huge

In 2014 approximately 2.6 million people died in the US. Of those deaths, 80% were on Medicare. Medicare is the largest insurer for persons during the last year of life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

Today, hospice is an important benefit for terminally ill Medicare beneficiaries. Currently, nearly half of Medicare beneficiaries receive hospice benefits before their deaths. Medicare is the primary source of payment for hospice care in this country. Yet, hospice still remains somewhat of a mystery, and Medicare beneficiaries know very little about what Medicare does with hospice until they are forced into the situation.

How Does Medicare Cover Hospice?

Hospice is defined as a program of care and support for people who are terminally ill. Terminally ill means a life expectancy of six months or less. The primary goal of hospice in Medicare is to help terminally ill people live a comfortable life and manage their pain and discomfort. Hospice care is palliative care versus skilled nursing and home health care. That is, it is not designed to cure the patient, but rather to aid the person in the dying process. Because hospice care is so intimately involved and in such a big way with Medicare beneficiaries, understanding Medicare and hospice is essential.

Prayer to St. Joseph

O St. Joseph whose protection is so great, so strong, so prompt before the throne of God, I place in you all my interests and desires. O St. Joseph do assist me by your powerful intercession and obtain for me from your Divine Son all spiritual blessings through Jesus Christ, Our Lord; so that having engaged here below your heavenly power I may offer my thanksgiving and homage to the most loving of fathers. O St. Joseph, I never weary contemplating you and Jesus asleep in your arms. I dare not approach while He reposes near your heart. Press Him in my name and kiss His fine head for me, and ask Him to return the kiss when I draw my dying breath. St. Joseph, patron of departing souls, pray for us. Amen.

John Joseph Grimmond 1934-2013 R.I.P.

Medicare Advantage and Home Health Care

Medicare Advantage and Home Health Care

All Medicare Advantage (MA) plans must provide at least the same level of coverage for home health care as does Original Medicare, so Medicare Advantage pays for home health care. However, an MA plan may have different rules, costs, and restrictions on services. For example, depending on a person’s MA plan, it may require him to:

- Obtain care from a home health agency that has contracted with the plan.

- Receive prior authorization or a referral before receiving home health care.

- Pay a copayment for home health care.

Coverage of Non-Skilled Care and Other In-Home Support Services

Center for Medicare & Medicaid Services (CMS) recently announced that Medicare Advantage plan will be able to cover certain types of home health care related services that were not previously able to be offered, beginning in 2019. This will be possible because CMS has expanded the definitional scope of “supplemental benefits” that Medicare Advantage plans can offer. Starting in 2019, insurers can offer additional services to help improve enrollees’ health and quality of life.

Medicare Advantage Can Pay for Home Health Care Supplemental Benefits

Medicare Advantage plans may offer additions benefits not offered by Original Medicare. Previously, CMS did not allow any item or service to qualify as a supplemental benefit. Supplemental benefits were items of “daily maintenance.” In other words, MA plans could not offer items and services that were not directly for medical treatments. The agency has now reinterpreted the requirement for supplemental benefits to include a “primarily health-related” definition as follows:

an item or service that is used to diagnose, prevent, or treat an illness or injury, compensate for physical impairments, act to ameliorate the functional/psychological impact of injuries or health conditions, or reduce avoidable emergency and healthcare utilization

Some Medicare Advantage Supplemental Benefits

Accordingly, this reinterpretation of supplemental benefits will allow Medicare health plans to offer coverage or benefits for the following:

- Adult daycare services are services provided outside the home, such as assistance with activities of daily living (ADLs) and instrumental activities of daily living (IADLs)

- In-home support services are services a personal care attendant provides. She assists disabled or medically needy individuals with activities of daily living, such as eating, bathing, and transferring, and instrumental activities of daily living. These activities may include managing money, preparing meals, and cleaning a house. Services must be performed by individuals licensed to provide personal care services, or in a manner that is otherwise consistent with state requirements.

- Home-based palliative care services Medicare does not cover if life expectancy is more than six months. Palliative care (“comfort care”) is to diminish symptoms of a terminally ill patient.

- Transportation for nonemergency medical services is transportation to obtain Part A, Part B, Part D, and supplemental benefit items and services. The

transportation must be used to accommodate the enrollee’s health care needs: it cannot be used for nonmedical services, such as groceries or errands.

transportation must be used to accommodate the enrollee’s health care needs: it cannot be used for nonmedical services, such as groceries or errands. - Home safety devices and modifications are safety devices to prevent injuries in the home and/or bathroom. The modifications must be non-structural and non-Medicare covered. This benefit can include home and/or bathroom safety inspection to identify any need for safety devices or modifications.

A physician or licensed medical professional must recommend these home care services.

Medicare’s expansion of MA plan benefits, like adult days care, helps patients remain in their homes as they age rather than being institutionalized, which could also result in lower costs for Medicare and Medicaid.

The Advantage of Medicare Advantage for Home Health Care

The Advantage of Medicare Advantage for Home Health Care

Medicare Advantage plans may impose different rules, limitations, and costs than Original Medicare, but they must provide at least the same level of home health care benefits.

Starting in 2019, Medicare Advantage plans may offer supplemental benefits that help enrollees with daily maintenance, including transportation for medicare services, in-home support services, and home-based palliative care. Consult the individual MA plan for the details of coverage.

In the Omaha metro area, the MA plans offer some of these benefits. Currently, the plans that do offer a lot of these benefits are the “Dual” or “Special Needs” plans. Those plans are for a person on full Medicaid as well as Medicare or have some special needs because of chronic illness, such as COPD, Diabetes, etc.

In other areas with high population densities, many of the MA plans are much richer with benefits. As it stands in eastern Nebraska and western Iowa, principally Omaha, Lincoln, Bellevue, and Council Bluffs, the supplemental benefits seem to be growing in number and scope each year. A couple of insurance companies recently added transportation to their health plans. More insurance companies are developing Medicare Advantage plans and including this type of home health services.

Medicare covers Home Health Care, but the Medicare beneficiary must meet particular criteria, maintain a status of medical need, and follow Medicare regulations and processes to enjoy the benefits.

Medicare covers Home Health Care, but the Medicare beneficiary must meet particular criteria, maintain a status of medical need, and follow Medicare regulations and processes to enjoy the benefits.

Eligibility For Medicare Home Health Care Benefits

- A physician must certify that skilled care is needed and must prescribe the plan of care.

- A participating Medicare-approved home health care organization must provide the care.

- The patient must need at least one of the services: intermittent skilled nursing care, physical therapy, speech-language pathology, and continued occupational therapy.

- The patient must be confined to the home.

Plan of Care

A physician must meet face-to-face with the patient 90 days before the start of home health care or within 30 days after the start of home health care. She must sign and date a certification that the patient needs skilled care and meets all the Medicare eligibility criteria for home health care. As part of the certification, she must determine from the in-person meeting a plan of care.

- A plan of care describes the type of services and care a person will receive for their health concerns. The program will list:

- the variety of services, supplies, and equipment needed.

- the health care professional who will deliver these services

- how often services will be needed

- the beneficiary’s function limitations

- nutritional requirements]

- the results that the physician expects from the treatment

The home health agency is responsible for providing all of the care listed in a person’s plan of care. The agency may do this through its staff or an arrangement with another agency.

The doctor certifies the person as eligible for an initial 60-day benefit period. At the end of the period or before, the doctor may recertify the person, or if the person’s condition has changed, determine the care is no longer needed. Only the doctor can certify the patient or make changes to the plan of care, not the home health agency.

Medicare-Certified Home Health Care Agency

Medicare-Certified Home Health Care Agency

Medicare will pay for home health care only if a Medicare-certified home health care agency provides it. Medicare approves agencies that meet specific federal health and safety requirements as well as Medicare standards necessary for reimbursement. To ensure that these standards met, Medicare regularly inspects home health agencies. However, Medicare certification does not guarantee a legal warrant of the individuals performing the services.

A Medicare-certified home health agency agrees to:

- be paid by Medicare

- accept only the amount that Medicare approves for its services.

The patient has the right to choose any agency to provide the services as long as they are Medicare certified. The agency is not required to accept the person if it cannot meet that person’s medical needs.

Skilled Care Required But Intermittent

To qualify for Medicare provided home health care, the person needs specialized care. Skilled care means services, such as skilled nursing care, physical therapy, speech therapy, and/or continuing occupational therapy.

The key to determining home health care versus skilled nursing care in a facility is the quantity of care. Home health care must be intermittent. That is, the care must be part-time, meaning less than eight hours each day for up to 21 days–although coverage may be extended in particular circumstances when the need for additional skilled nursing is finite and predictable.

Required Homebound

The homebound criterium does not mean the person is a prisoner in her home. It means leaving is an undue burden. She has trouble leaving home without help because she must use a cane, wheelchair, walker, crutches, or specialized transportation.

It does not mean that person does not leave home on occasion because of important family events, specific medical tests, funerals, or weddings. Even attending adult daycare would not be a violation of being homebound.

Home Health Care May Cover A Health Aide

Home health aide services get a great deal of play. Medicare will cover a health aide for short periods. The aide service must be coupled with home health care  services. Medicare does not cover it exclusively.

services. Medicare does not cover it exclusively.

The home health aide is in support of the healing process with the other skilled nursing professionals. The home health aid does not have a nursing license. For example, a home health aide might help a person with personal care, such as bathing, using the toilet, or dressing–in other words, services that do not require the skills of a licensed nurse.

Other services are help with medications that are self-administered, assistance with activities that are directly supportive of skilled therapy. The aide may help with routine exercises and/or practicing functional communication skills. Where appliable, she may help with regular care of prosthetic and orthotic devices. Medicare will not cover the home health aide if the patient is not receiving skilled care.

Home Health Care Can Cover Social Services

Many injuries and illnesses come with an emotional cost. A patient of my wife recently was hospitalized because his son assaulted him while under the influence of illegal drugs. He was defending his wife, who was likewise being assaulted. The father was hospitalized with broken bones. He is also currently going through chemotherapy treatment and is eighty-six years old.

As you can imagine, the emotional trauma to this couple was extensive and may require counseling and other intervention when the gentleman returns home. Home health care provides these types of services as well.

Durable Medical Equipment

Durable Medical Equipment

Home health agencies will also help with durable medical equipment. A patient may need a hospital bed, walker, wheelchair, or oxygen. Medicare also covers Medicare supplies, like wound dressings or catheters that are ordered as part of a patient’s care.

If a home health agency doesn’t supply durable medical equipment directly, its staff will typically arrange for a home equipment supplier to bring the items need to the person’s home.

Does Medicare Exclude Some Home Health Care Services?

Medicare does not pay for the following:

- 24-hour-per-day care at home

- meals delivered to the home

- homemaker services like shopping, cleaning, and laundry

- personal care given by home health aides (like bathing, using the toilet, or help in getting dressed)when this is the only care needed.

Does Medicare cover home health care? It certainly does when the patient meets the established criteria. Home health care is a rich source of benefits to beneficiaries that are delivered in a variety of ways and circumstances as needed.

Jimmo vs. Sebelius On Skilled Nursing

Skilled Nursing Care is amazingly complex. Because the Medicare coverage of Skilled Nursing Facility stays is so confusing, patients sued. The case went all the way to the Federal Courts. Jimmo vs. Sebelius, a class-action lawsuit, challenged the Center For Medicare & Medicaid Services (CMS) interpretation of the “improvement stand” that many used to interpret Medicare coverage of Skilled Nursing Facility booklet.

Medicare Coverage of Skilled Nursing Facility Stays: Improvement Standard

This one hit home for me because of how it affected my mother and our family. My mother was in the last stages of ovarian cancer. It became clear that no treatment was going to work. She was on palliative care. During one of her episodes, she was in extreme pain. The hospital admitted my mother because intravenously administered pain killers were the only way to get her pain under control. After that, she was supposed to come home. But her condition was such that we were not going to be able to care for her adequately. We talked about a nursing home—skilled nursing—but one of the criteria at the time was the patient must be able to improve. Because she was terminal, improvement was definitely not in the cards. We were initially told that Medicare would not pay for her stay in a skilled nursing facility. However, that was not accurate. The people we were talking with were operating off old, outdated information.

This one hit home for me because of how it affected my mother and our family. My mother was in the last stages of ovarian cancer. It became clear that no treatment was going to work. She was on palliative care. During one of her episodes, she was in extreme pain. The hospital admitted my mother because intravenously administered pain killers were the only way to get her pain under control. After that, she was supposed to come home. But her condition was such that we were not going to be able to care for her adequately. We talked about a nursing home—skilled nursing—but one of the criteria at the time was the patient must be able to improve. Because she was terminal, improvement was definitely not in the cards. We were initially told that Medicare would not pay for her stay in a skilled nursing facility. However, that was not accurate. The people we were talking with were operating off old, outdated information.

Slow Deterioration of a Condition

On January 24, 2013, the class action lawsuit Jimmo vs Sebelius settled in favor of the patient, and the Center for Medicare & Medicaid Services (CMS) clarified its policy. Medicare coverage of Skilled Nursing Facility stays no longer required “improvement.” Instead, care could be prescribed to maintain the status of an individual’s condition, or slow the deterioration of a condition, as well as to improve the person’s condition.

Jimmo Website Explains New Medicare Coverage

As ordered by the federal judge in Jimmo v. Sebelius, the Centers for Medicare and Medicaid Services (CMS) published a new webpage containing important  information about the Jimmo Settlement on its CMS.gov website. The Jimmo webpage is the final step in a court-ordered Corrective Action Plan. The action reinforces the fact that Medicare does cover skilled nursing and skilled therapy services needed to maintain a patient’s function or to prevent or slow decline. Improvement or progress is not necessary as long as skilled care is required. The Jimmo standards apply to home health care, nursing home care, outpatient therapies, and, to a certain extent, for care in Inpatient Rehabilitation Facilities.

information about the Jimmo Settlement on its CMS.gov website. The Jimmo webpage is the final step in a court-ordered Corrective Action Plan. The action reinforces the fact that Medicare does cover skilled nursing and skilled therapy services needed to maintain a patient’s function or to prevent or slow decline. Improvement or progress is not necessary as long as skilled care is required. The Jimmo standards apply to home health care, nursing home care, outpatient therapies, and, to a certain extent, for care in Inpatient Rehabilitation Facilities.

In my mother’s case, the skilled nursing facility admitted my mother, even though she was terminal, to help slow the deterioration of her health. As it turned out, she passed away within two weeks of her admittance, and the personnel at her skilled nursing facility were outstanding! They made her last days as bearable as the situation would allow.

Medicare Coverage of Skilled Nursing Facilities Changed

Medicare coverage of Skilled Nursing Facility stays practices have changed. Researchers assessed the impact of the Jimmo settlement by looking at changes to the number of physical therapy and/or occupational therapy visits per year, per patient, focusing specifically on the number of individuals who had 12 or more therapy visits during a 12-month timespan.

Medicare coverage of Skilled Nursing Facility stays practices have changed. Researchers assessed the impact of the Jimmo settlement by looking at changes to the number of physical therapy and/or occupational therapy visits per year, per patient, focusing specifically on the number of individuals who had 12 or more therapy visits during a 12-month timespan.

Healthcare is very expensive. There are many conflicting groups and interests. The rules, policies, and mechanisms are complex. Some of the people you deal with can be frustrating. The complexity of the system is driven home to me daily as I talk with clients and deal with issues that arise. You need to be aware of the rules and regulations around Medicare coverage and nursing home care. Or have someone who knows them and can help.

Medicare Coverage For Skilled Nursing Facilities

Skilled Nursing Facilities—or better known in the jargon of Medicare as SNF—is the cause of much consternation among people on Medicare. The reason for the  distress and stress is because Medicare beneficiaries are sometimes denied coverage. This both confuses and angers Medicare beneficiaries because there doesn’t seem to be any rhyme or reason to the denials. People ask: does Medicare cover Skilled Nursing Facility?

distress and stress is because Medicare beneficiaries are sometimes denied coverage. This both confuses and angers Medicare beneficiaries because there doesn’t seem to be any rhyme or reason to the denials. People ask: does Medicare cover Skilled Nursing Facility?

Medicare Billing Guidelines For Skilled Nursing Facility

From my observation over the years, doctors’ offices sometimes don’t follow the Medicare billing guidelines for Skilled Nursing Facility. I understand everyone is busy and people are certainly well-intentioned, but Medicare is insurance. Insurance has rules, protocols, and forms. A lack of adequate explanation to Medicare is many times the cause of Medicare denials, I’ve seen over the years. Other times the situation does not meet the Medicare criteria for Skilled Nursing Facility stays.

What are the Medicare Skilled Nursing Facility Requirements?

When skilled nursing is prescribed, five Medicare Skilled Nursing Facility requirements must be met. The first is a qualifying hospital stay.

When skilled nursing is prescribed, five Medicare Skilled Nursing Facility requirements must be met. The first is a qualifying hospital stay.

The Medicare beneficiary must stay as an inpatient for three consecutive days in the hospital. Each of these is an essential ingredient. The beneficiary must be admitted to the hospital. If the patient is only admitted for “observation,” she will not qualify. She must be an “inpatient.” Next, the stay must be consecutive. It can’t be a day or two within a short period of time. It must be at least 3 consecutive days. And finally, it must be at least 3 days, not counting the day of dismissal.

Many times, people assume the day of dismissal counts, but that is definitely not the case. Three days of inpatient care at least with a fourth day for the dismissal. Sometimes people will complain that the patient doesn’t need a third day, but if you want the person to qualify, she must stay at least three consecutive days.

Medicare Skilled Nursing Facility Benefit Period

The second ingredient for Medicare to cover a skilled nursing facility stay is the admittance must occur with 30 days of dismissal from the qualifying hospital stay.

My mother-in-law had open heart surgery a while back. Her cardiologist prescribed that she stay in a skilled nursing facility for cardiac rehab. She was not a very cooperative patient. She refused. My wife was insistent and explained that if she didn’t go then, she would lose the opportunity for skilled nursing rehab. My mother-in-law’s response was she would do it later if she needed it.

My mother-in-law had open heart surgery a while back. Her cardiologist prescribed that she stay in a skilled nursing facility for cardiac rehab. She was not a very cooperative patient. She refused. My wife was insistent and explained that if she didn’t go then, she would lose the opportunity for skilled nursing rehab. My mother-in-law’s response was she would do it later if she needed it.

Many people mistakenly think they can go to a nursing home for rehab if they simply want to. It must be within the 30-day window after dismissal from an inpatient stay. Otherwise, Medicare will not pay. Now you may think it is not fair, or right, or make sense. I am simply stating the rules and facts.

Medicare Guidelines for Skilled Nursing Facility

The third requirement for admittance to a skilled nursing facility (SNF) is the treatment can only be provided by a skilled nursing facility.

The third requirement for admittance to a skilled nursing facility (SNF) is the treatment can only be provided by a skilled nursing facility.

What this usually means is “full time” or five day a week care. In other words, the same level of treatment cannot be provided by going to a treatment center by appointment a few times a week. Only an inpatient skilled nursing facility can provide the level of intense treatment needed for adequate recovery. This can be a tricky call and where judgments can and are questioned.

Medicare Denial Skilled Nursing Facility

I had a client who had a knee replacement. Usually a knee replacement, even with  complications, does not require admittance to a skilled nursing facility (SNF) because physical therapy is something that can be completed by going to the physical therapist’s office and/or doing exercises on your own. This situation was different.

complications, does not require admittance to a skilled nursing facility (SNF) because physical therapy is something that can be completed by going to the physical therapist’s office and/or doing exercises on your own. This situation was different.

She was living in a small apartment with lots of furniture. There was a pet. The husband was feeble. While she was not very old, her knee was not recovering at the usual pace. The doctor recommended skilled nursing care, but Medicare denied the prescription.

The family came to me with questions. I suggested they explain the situation to the doctor in greater detail and with more urgency. She was a serious “fall risk” because of her living situation.

Once the idea was emphasized sufficiently in the doctor’s notes to Medicare, Medicare understood that the work that had been done would be undone if she fell at home because of a pet, furniture, and/or feeble husband, etc. The request was approved.

Skilled nursing is very expensive. Medicare needs to understand the “medical necessity” of a prescription. Once the idea is communicated effectively, things can happen.

List of Medicare Approved Skilled Nursing Facilities

The fourth ingredient is that a doctor, or another appropriate medical professional, certifies that the patient needs the type of daily therapy that can only be performed in a skilled nursing facility. The skilled nursing facility must also be a Medicare-certified skilled nursing facility. You can go to Medicare.gov to find certified sites and Medicare the star ratings for Skilled Nursing Facilities.

The fifth and final requirement can be confusing. The skilled nursing care must be for the reason the patient was in the hospital for the three days.

Imagine John goes to the hospital because of a broken hip. While John was in the hospital, he has a stroke. The doctor certifie s John for treatment at a skilled nursing facility for the stroke, not the hip issue. The skilled nursing recommendation does not have to be based on the reason the person was admitted to the hospital, but it does need to be because of something he was treated for during the 3-day hospital stay.

s John for treatment at a skilled nursing facility for the stroke, not the hip issue. The skilled nursing recommendation does not have to be based on the reason the person was admitted to the hospital, but it does need to be because of something he was treated for during the 3-day hospital stay.

As you can see, Medicare coverage for skilled nursing facilities can be complex. It’s important to have some understanding so that you know what to expect, or not to expect, when it comes to Medicare coverage of skilled nursing facility care, and how to navigate the processes to your benefit and the benefit of loved ones. Medicare Part A covers the Skilled Nursing Facility, but the rule must be followed for Skilled Nursing Facility Medicare reimbursement to happen.

Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Do you or a loved one need hospice care in a skilled nursing facility? Understanding Medicare coverage for this essential service is crucial for maximizing benefits and ensuring quality end-of-life care. This article will explore some of the ins and outs of hospice coverage I didn’t know when my mother was in hospice. We discuss the question of whether Medicare pays for hospice in a skilled nursing facility.

Navigating the complex world of healthcare can be overwhelming, especially when faced with a difficult situation like imminent death like I experienced with my mother. That’s why I’m here to break it down for you. I’ll explain what hospice care entails, how it differs from other types of care, and, most importantly, what Medicare covers. With this information, you can be confident in your ability to advocate for yourself or your loved one and ensure that all available resources are utilized.

At Omaha Insurance Solutions, information is power regarding healthcare decisions. We aim to make complex topics accessible, providing you with the tools you need to confidently navigate the healthcare system. So, let’s dive in and discover how Medicare can support you during a challenging time.

What is Hospice Care & Who is Eligible?

Hospice care focuses on providing comfort and support to individuals in the final stages of a terminal illness. The goal is to improve the quality of life for patients by managing pain and symptoms while offering emotional and spiritual support to both the patient and their loved ones. Hospice care can be provided in various settings, including skilled nursing facilities.

To be eligible for hospice care, a person must have a life expectancy of six months or less, as certified by a physician. This certification is required for Medicare coverage, which we will discuss further in the following sections. It’s important to note that choosing hospice care does not mean giving up on treatment altogether. It means shifting the focus to comfort and quality of life rather than curative measures.

Hospice care is a holistic approach that addresses individuals’ physical, emotional, and spiritual needs nearing the end of life. It provides a compassionate and supportive environment where patients receive specialized care tailored to their unique needs. Now that we have a basic understanding of hospice care, let’s explore how it relates to skilled nursing facilities and the coverage provided by Medicare.

Understanding Skilled Nursing Facility Care and Medicare Coverage

Skilled nursing facilities (SNFs) are residential facilities that provide round-the-clock nursing care for individuals requiring more intensive medical attention than they could receive at home. SNFs are equipped with trained healthcare professionals, including nurses and therapists, who can address the complex needs of patients. SNF care is often required when individuals have conditions that require ongoing medical monitoring, such as chronic illnesses or post-surgical recovery. Medicare covers certain SNF services, including skilled nursing care, rehabilitation therapy, and medications. However, it’s important to note that not all services provided in a SNF are covered by Medicare, and this includes hospice care.

Medicare Coverage for Hospice in a Skilled Nursing Facility

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

The criteria are the same as for hospice. Firstly, the individual must be eligible for Medicare Part A, which covers inpatient hospital stays, skilled nursing facility care, and hospice care. Secondly, the hospice care must be certified by a Medicare-approved hospice provider. Thirdly, the individual must have a life expectancy of six months or less, as certified by a physician. Lastly, individuals must agree to forgo curative treatments for their terminal illness and receive only palliative care.

The SNF is not primarily providing hospice care. A hospice team coordinates with the SNF to provide the service in the SNF. The location of the hospice care is secondary. The SNF is a location, like the home.

However, there must be a Medicare-covered reason or treatment to be granted admittance to a skilled nursing facility. The SNF is primarily a medical facility for patients to get better. It is not a hospice facility providing room and board, housekeeping, bathroom transfers, etc.

Medicare Hospice Benefits for My Mom

The doctors diagnosed my mother with ovarian cancer in 2012. I was living in Kansas at the time. I wasn’t able to go on doctor visits with her. My brother, Paul, was taking care of my mom. I would get information about her situation, but it was spotty.

My mother was an ‘I’m in charge’ type of person. Phyllis determined the flow of information, and it was sparse.

Talking with your mother about her health when her mortality is so tightly fixed to it is hard. Looking back now, I was a chicken. Who wants to talk about saying goodbye? I didn’t realize the seriousness of her health situation until much later. I assumed she didn’t speak about her own death, and I didn’t know how to initiate the conversation. We were all in different forms of denial.

At the end of 2012, the doctors said there was nothing more to be done. I don’t think I fully grasped what that meant at the time. I also did not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

My mother was admitted to hospice care (Medicare Hospice Benefits Booklet).

Mom’s Terminal Illness

Nature, in its less than glorious side, took its course rapidly. My mother’s health deteriorated in a few short weeks.

Cancer is a painful disease. The healthcare personnel gave her various painkillers, but even as they did so, we all insanely talked about not wishing to cause addiction. The pain had its own mind.

At various times, my mother’s suffering would be such that she needed to go to the hospital. There, the doctors administered intravenous medications that were faster acting and stabilized her pain level.

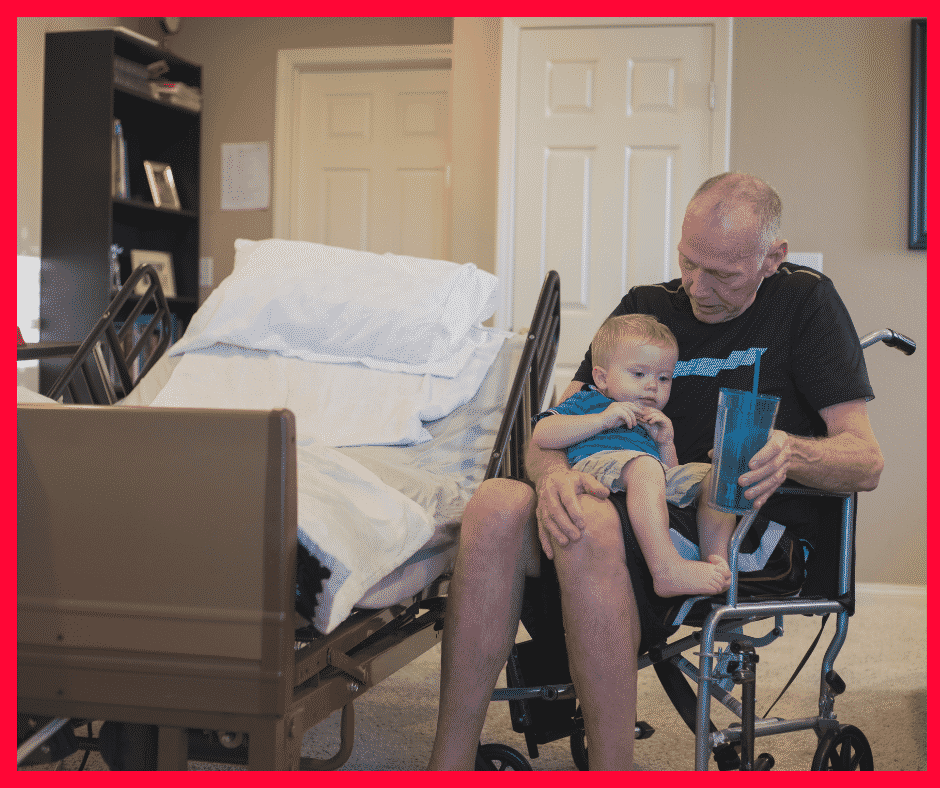

During the last visit, it became clear that we could not care for her at home. My father, John Grimmond–who would pass away six months later–was not physically able to care for our mother. I was in Kansas, my other brother, Tom, was in Sioux Falls, and Paul was in Omaha but busy with his career and family.

My mother needed around-the-clock care. We asked, ‘Does Medicare pay for hospice in a skilled nursing facility?’ The real question was whether Medicare would pay for a skilled nursing facility while my mother died. Strictly speaking, Medicare does not pay for custodial care. Custodial care is bathing, feeding, toileting, etc. Medicare doesn’t cover room and board if you get hospice care while in a nursing home or a hospice inpatient facility. That is out of your pocket.

Qualifying for Skilled Nursing Facility Care while on Hospice

The staff at the hospital initially told us that our mother needed to go to a skilled nursing facility (SNF) because they recognized she required more care than we could provide. They informed us that Medicare would provide and pay for hospice care in the Skilled Nursing Facility, but the cost of room and board and custodial nursing care would not be covered, and they were correct. Medicare coverage for skilled nursing when you are in hospice is tricky.

skilled nursing when you are in hospice is tricky.

The fortunate occurrence, however, was the intravenous nature of my mother’s painkillers. Other than a hospital, you can only receive intravenous medication treatment in a skilled nursing facility. The nature of my mom’s treatment triggered a reason Medicare would accept her being admitted to a skilled nursing facility and pay for it.

Medicare does cover skilled nursing care after a qualifying hospital stay of 3-days or more. Intravenous medication administration also requires a skilled nursing facility. A home health care nurse showing up several times at home would not be adequate. Also, my mother needed physical therapy to improve her strength after the reaction to the pain. From Medicare Part A and Part B, there were sufficient reasons for Medicare to pay for her stay in the skilled nursing facility (SNF) while she was in hospice.

Does Medicare Pay For Skilled Nursing Care During Hospice?

Strictly speaking, Medicare does not pay for skilled nursing care because someone is in hospice, but other triggering events often cause Medicare to cover skilled nursing care.

For example, someone who is in hospice falls and breaks a hip. That situation would justify skilled nursing care. A person develops an infection or pneumonia that results in hospitalization. Then, they qualify for a skilled nursing stay.

How to Navigate the Medicare Coverage Process for Hospice in a Skilled Nursing Facility

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

1. The first step is to consult with the individual’s physician to determine if they meet the eligibility criteria for hospice care in a SNF. The physician can provide the necessary certification and guidance through the process. He knows the triggering circumstances that justify a skilled nursing facility stay.

2. It’s important to choose a Medicare-approved hospice provider with experience providing SNF care. They will be able to guide you through the necessary paperwork and ensure that all requirements are met. The health professionals are very familiar with Medicare’s billing codes and protocols for admittance to a SNF.

3. If the individual is already receiving care in a SNF, it’s important to coordinate with the facility to ensure a smooth transition to hospice care. The SNF staff can provide valuable information and support during this process.

4. Familiarize yourself with Medicare’s costs and coverage for hospice care in a SNF. This will help you plan and make informed decisions regarding the individual’s care.

The professionals you deal with know the Medicare rules and the subtleties of maximizing coverage in different circumstances. Listen attentively to their guidance.

Common Misconceptions about Medicare Coverage of SNF During Hospice

Several common misconceptions exist about Medicare coverage for hospice care in a SNF. Let’s address some of these misconceptions and provide clarity:

provide clarity:

1. Medicare only covers hospice care in certain settings: Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, and skilled nursing facilities. As long as the eligibility criteria are met, Medicare will cover hospice care in a SNF.

2. Medicare covers room and board in a SNF. As a rule, Medicare does not cover room and board in a SNF because the individual is receiving hospice care, though room and board may be covered because the patient is in the SNF for reasons other than hospice.

3. Medicare coverage for hospice care is limited to specific conditions: Medicare coverage for hospice care is not limited to specific conditions or illnesses. As long as the eligibility criteria are met, Medicare will provide coverage for hospice care in a SNF for any terminal illness.

4. Medicare coverage for hospice care is limited to a certain time frame: Medicare does not limit the duration of hospice care coverage in a SNF. As long as the individual meets the eligibility criteria, Medicare will continue to cover the necessary services.

Bottomline: Ensuring Quality Care and Coverage for Hospice in a SNF through Medicare

Maximizing Medicare coverage for hospice care in a skilled nursing facility is essential for ensuring quality end-of-life care. By understanding the eligibility criteria, coverage details, and navigating the Medicare system, you can advocate for yourself or your loved one and ensure all available resources are utilized.

Remember, hospice care is a compassionate and holistic approach that focuses on providing comfort and support during the final stages of a terminal illness. Medicare provides coverage for hospice care in a SNF, including room and board, medications, and necessary medical equipment. By staying informed and proactive, you can maximize Medicare coverage and ensure that the individual receives the care they need.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Phyllis Grimmond 1935-2013 R.I.P.

The Bottomline: Benefit Knowledge Makes for Maximum Benefits

At Omaha Insurance Solutions, we understand the importance of access to accurate and reliable information regarding healthcare

Christopher J. Grimmond

decisions. We aim to empower you with the knowledge and resources to navigate the complex world of Medicare coverage. It is important to know that Medicare pays for hospice care in a skilled nursing facility.

By maximizing benefits and ensuring quality care, we can make a difference in the lives of individuals and their loved ones during this challenging time. Call us at 402-614-3389 to ensure you have a Medicare plan protecting you and your loved ones. Speak with an experienced licensed insurance agent profession.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

Part A Deductible

Medicare is a generous health plan. It covers a majority of the hospital and doctor costs, but there is some important exposure to be aware of. Medicare Part A covers the hospital, but only after you pay the deductible of $1,288. That deductible is not an annual deductible. It is per event within a 60 day period. While you would have to be very unlucky, very sick, or both, you could pay that deductible an endless number of times. That is your exposure.

Part B Co-Insurance

Medicare Part B covers 80% of the doctor and outpatient procedures. While that is quite generous, 20% of a big number is still a big number. Heart attacks, strokes, cancer treatment can run into the hundreds of thousands of dollars. Twenty percent of a $200,000 bill is $40,000. Most people would find that beyond the family budget.

MOOP

And with Part A & B, there is NO maximum-out-of-pocket (MOOP). In other words, you continue to pay as the bills roll in. You do not stop paying on deductibles and co-insurance if all you have is Original Medicare without anything else.

So comes the questions from clients: ‘What should I do about Medicare?’ Medicare supplements or Medigap plans fill in those gaps in Medicare. They cover the hospital deductibles and 20% co-insurance for doctor and outpatient use. Depending on how much you wish to cover, the Medigap plan can cover everything 100%, most of everything, or a potion. You choose. There are ten plans available.

12,200,000 Satisfied Medigap Clients

The fact that 22% of people on Medicare choose a supplement and stay on a supplement for 20-30 years tells you the level of satisfaction. There are currently 55,200,000 Medicare beneficiaries. Of that number 12,200,000 chose a supplement. That number grows each year: 9.7 million in 2010 to 12.2 million in 2015. The key number is that 9 out of 10 Medigap beneficiaries say that they are satisfied with their coverage and keep their coverage. Med Sup Conference Stats

While Medicare is a wonderful health insurance program for seniors, it doesn’t cover everything. You still have exposure to significant financial loss if you only have Medicare alone.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

I learned to sing the alphabet before I learned to say it, and from that humble beginning, language opened up to me.

You can’t understand language without first understanding its alphabet. Medicare has a language, and Medicare has an alphabet. It begins with A, B, & D. They are the three essential components of Medicare.

A is for Medicare Part A. A covers the hospital 100% for 60 days but only after you pay a $1,260 deductible out of your pocket. Ouch! Part A is free because you paid for it during your working years. Eligibility for A is 3 months before your 65th birthday, the month of your birthday, & three months after. If you don’t enroll then, there will be a penalty.

B is for Medicare Part B. B covers doctor visits and outpatient procedures, such as, blood work, x-rays, emergency room, ambulatory surgeries, walkers, wheel chairs, oxygen tanks, etc. Part B does cost something. Currently $104.90 per month. Medicare Part B pays 80% of the costs. Your portion is 20%. Important fact about your 20% co-insurance is that there is no cap. As long as the bills roll in, your money rolls out. Bigger Ouch! The penalty for late enrollment for Part B is 10% for every 12 month period.

The final letter is not C. It’s D—D as in drugs. Medicare Part D was started in 2006 after people complained about the crushing cost of medications. Prescription drug plans are administered by private insurance companies approved by Medicare. Prescription Drug Plans (PDP) can range in cost from $20–$50 per month with deductibles and co-pays. There is a penalty for not enrolling in a Part D plan when you are eligible. It accrues each month you are not enrolled and is permanently added to your Medicare premium when you do enroll.

Medical expense can be astronomical. If the correct insurance is not in place with sufficient coverage, costs may surprise and overwhelm you. Not following the eligibility requirements could result in surprise penalties and permanent costs from Medicare. Call 402-614-3389 or email us at [email protected] for a free consultation to make sure all your letters are in place.