The Ultimate Medicare Plan Comparisons Chart: Choosing the Best Plan for Your Needs

Is it overwhelming to choose the best Medicare plan for your needs? With so many options available, it’s understandable. But worry not because we have your ultimate solution – the Medicare Plan Comparisons Chart.

Is it overwhelming to choose the best Medicare plan for your needs? With so many options available, it’s understandable. But worry not because we have your ultimate solution – the Medicare Plan Comparisons Chart.

The best way to compare is side-by-side. We can see each relevant benefit or cost in chart form and compare apples to apples. There is still a lot of information to comb through and remember, but a chart helps to reduce some of the confusion and the mental work of remembering what each Medicare plan offers.

Whether you’re looking for a plan that covers prescription drugs, outpatient surgeries, or dental more favorably, you can look at your options in the Medicare plan comparison chart.

By utilizing this user-friendly chart, you can easily compare different plans side by side, evaluate their features and benefits, and make an informed decision based on your unique healthcare needs.

Choosing the right Medicare plan is crucial because it directly impacts your overall health and pocketbook. At Omaha Insurance Solutions, we aim to simplify your Medicare selection process by providing all the necessary information in one place. With a Medicare Plan Comparisons Chart, you can confidently select the plan that meets your specific requirements and enjoy peace of mind knowing that you have made the best choice for your healthcare coverage.

Understanding Medicare Plans

Medicare is a federal health insurance program that provides coverage for individuals aged 65 and older and younger individuals with certain disabilities. It consists of different parts, each covering specific services and treatments.

To understand which Medicare plan is best for you, it’s essential to familiarize yourself with the different types of plans available and their respective coverage options. This knowledge will enable you to make an informed decision based on your healthcare needs.

Types of Medicare Plans

There are four main types of Medicare plans: Original Medicare (Part A and Part B), Medicare Advantage (Part C), Medicare Supplement Insurance (Medigap), and Prescription Drug Coverage (Part D).

- Original Medicare (Part A and Part B): This is the traditional Medicare plan offered by the government. Part A covers hospital stays, skilled nursing facility care, and some home health services, while Part B covers doctor visits, outpatient care, and preventive services.

- Medicare Advantage (Part C): This is Medicare offered through a private insurance company approved by Medicare. It provides all the benefits of Original Medicare, along with additional coverage for prescription drugs, dental, vision, and hearing services.

- Medicare Supplement (Medigap) plans are designed to fill the gaps in Original Medicare coverage. They help pay for out-of-pocket costs such as deductibles, coinsurance, and copayments. Private insurance companies offer Medigap plans, which are standardized across the states.

- Prescription Drug Plans (Part D): Part D plans are standalone plans offered by private insurance companies. They provide coverage for prescription drugs and can be added to Original Medicare, Medicare Advantage, and some Medicare Cost Plans.

Medicare Plan Comparison Chart

The Medicare Plan Comparisons Chart is a powerful tool that allows you to compare different Medicare plans side by side. It provides a clear and concise overview of each plan’s coverage details, costs, and additional benefits.

Where Can You Find A Chart?

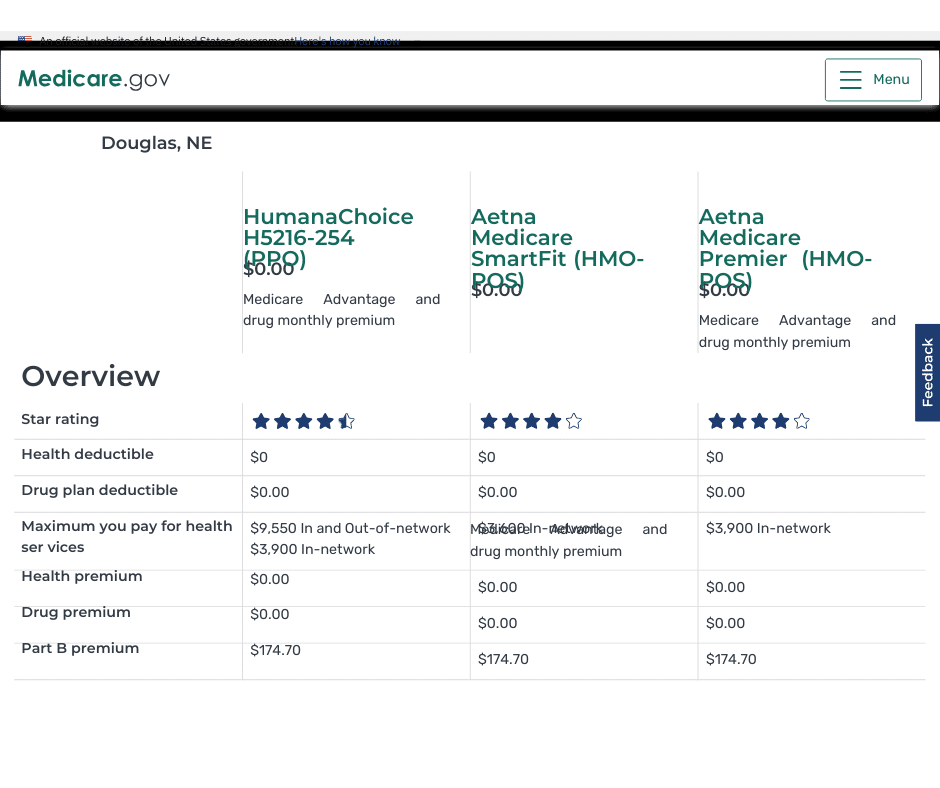

A public tool is on the Medicare website. Type Medicare.gov in your browser address bar and hit enter. You will be taken to the official Medicare website. Click on the button for “Find health & drug plans.” You can create your own account or just type in your zip code without creating an account.

Choose the type of plans you wish to compare: Medicare Advantage Plan (Part C), Medicare drug plan (Part D), or Medigap policy.

Click the button that applies to your situation. Do you get financial help with your plan or not? If you qualify, financial help would be from Nebraska or Iowa Medicaid. Have you qualified for EXTRA HELP? Click Next.

Prescription Drug Comparison

The tool will ask if you wish to include drug costs—type in the specific medications with the dosages.

You may use various filters, but before that, scroll down and look at the plans first. You can look at each plan individually and study the benefits and pricing. There is also a box to check “Add to compare” to examine the plans side-by-side. You are limited to 3 plans at a time.

At the bottom of the screen, you can see the plans’ names and a comparison button. Click the comparison button to bring them up on the screen. The plans will be placed side by side, and all the categories will be matched up between them.

You can see the similarities and differences between the plans in one place and make your determinations. The limitation is that the Medicare.gov software does not provide great detail about the plans individually or together.

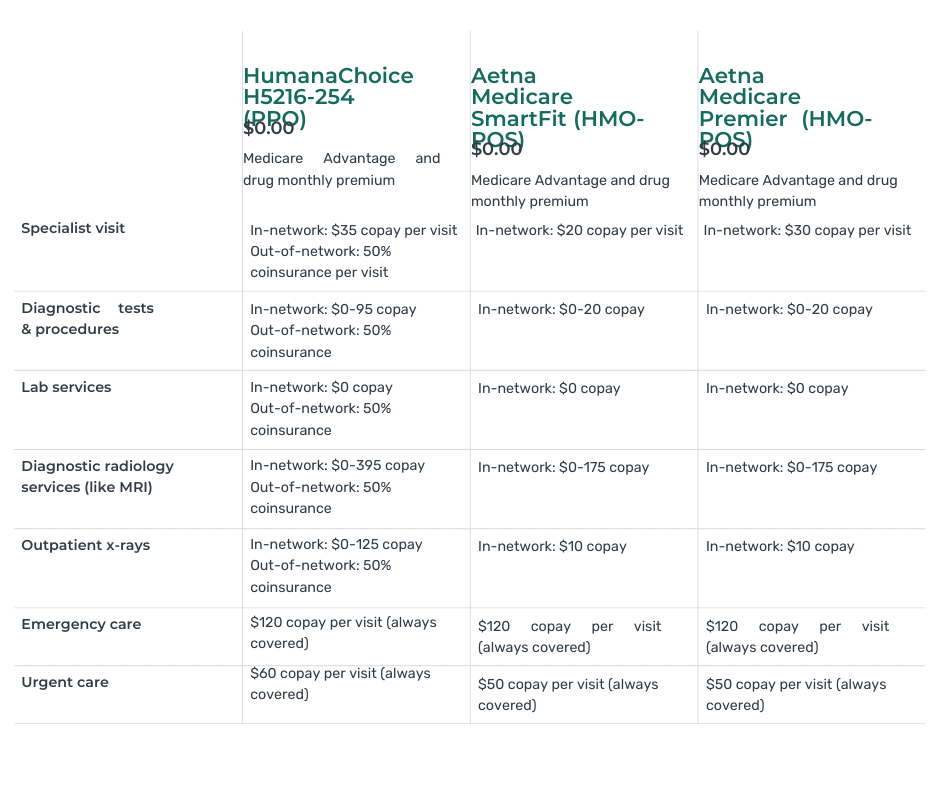

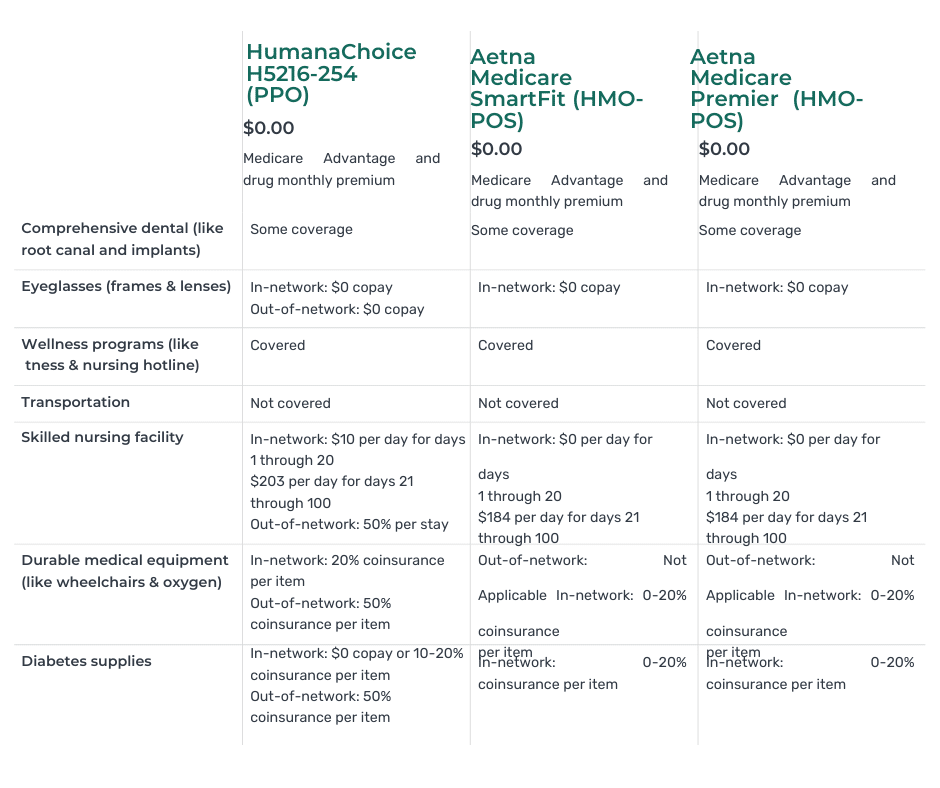

At Omaha Insurance Solutions we use a propriety software that goes into much greater detail about each plan. You can see the most common medical plan details: doctor & specialist visits, inpatient & outpatient surgeries, skilled nursing stays, MRIs, and X-rays, etc., compared side-by-side and line by line. Medications are calculated in various totals and subtotals. The provider network search tool is right there to access and find out if your doctors are in the plan or not. We run hundreds of these Medicare plan comparison charts each year for the Medicare plans in the Omaha, Lincoln, & Council Bluffs areas. Contact us for a FREE comparison at 402-614-3389.

Medicare Plan Comparison Chart Interpretation

How do you interpret and analyze the information in front of you? Information can be overwhelming when there is a lot of it, and it is new and unfamiliar.

We help clients understand the information and how to weigh the various benefits, particularly in relation to their specific needs and ways of handling their health concerns.

Working with thousands of clients over many years with different health concerns that repeatedly ask many of the same questions, we have learned how to quickly assist you in evaluating and interpreting the information as it is relevant to your needs, situation, and budget.

The chart includes information such as monthly premiums, annual deductibles, coinsurance, copayments, and maximum out-of-pocket costs. It also highlights any limitations or restrictions that may apply to a plan.

By using the chart, you can quickly identify which plans offer the specific coverage you need. For example, if you require prescription drug coverage, you can quickly identify the plans that include Part D that cover your prescriptions at the most affordable prices. If you frequently travel and need coverage outside your local area, you can find plans that offer nationwide coverage.

Key Factors to Consider When Choosing a Medicare Plan

When comparing Medicare plans, there are several key factors to consider. These factors help you determine which plan best suits your needs and preferences. Here are some important considerations:

- Coverage: Evaluate each plan’s coverage options. Consider your existing health conditions and any specific treatments or services you anticipate needing in the future.

- Cost: Compare the costs associated with each plan, including premiums, deductibles, coinsurance, and copayments. Consider your budget and how much you can afford to pay for healthcare services.

- Provider Network: Check whether your preferred healthcare providers, such as doctors and hospitals, are included in the plan’s network. This ensures that you can continue receiving care from your trusted providers.

- Prescription Drug Coverage: If you take prescription medications, ensure the plan offers comprehensive coverage for the needed drugs. Review the formulary to see if your medications are included and at what cost.

- Additional benefits: Some Medicare plans offer additional benefits such as dental, vision, hearing coverage, OTC (Over-the-Counter) items, free gym memberships, and transportation. Consider whether these benefits are important to you and, whether they justify the additional cost, and which provide the maximum coverage.

How to Use the Medicare Plan Comparisons Chart Effectively

The Medicare Plan Comparisons Chart is designed to simplify choosing a Medicare plan. Here are some tips on how to use the chart effectively:

- Identify your healthcare needs: Before using the chart, take some time to assess your healthcare needs. Consider factors such as existing health conditions, prescription medications, and any specific treatments or services you anticipate needing in the future. This will help you narrow your options and focus on the plans that meet your requirements.

- Focus on relevant information: The chart provides detailed information about each Medicare plan, including coverage details, costs, and additional benefits. Focus on the information that is most relevant to your needs. For example, if you require prescription drug coverage, pay close attention to the details of Part D plans.

- Compare side by side: One of the greatest advantages of the chart is that it allows you to compare different plans side by side. This enables you to evaluate their features and benefits in a clear and concise manner. Take advantage of this feature to identify the plans that offer the specific coverage you need.

- Consider the cost: While coverage is necessary, it’s also essential to consider the cost associated with each plan. Evaluate factors such as monthly premiums, deductibles, copayments, and coinsurance. Consider your budget and how much you can afford to pay for healthcare services.

- Seek assistance if needed: If you find the process overwhelming or have specific questions about the chart or Medicare plans, don’t hesitate to seek assistance. Reach out to a licensed insurance agent or contact Medicare directly for guidance. Making an informed decision based on accurate and up-to-date information is important.

Bottom Line: Finding the Best Medicare Plan for Your Needs

Bottom Line: Finding the Best Medicare Plan for Your Needs

Choosing the best Medicare plan for your needs is a crucial decision that directly impacts your healthcare coverage and bank account. With the help of the Medicare Plan Comparisons Chart, you can simplify this process and make an informed decision based on your unique healthcare needs.

By understanding the different types of Medicare plans, comparing their coverage options, and considering key factors such as cost, provider networks, and additional benefits, you can confidently select the plan that meets your specific requirements.

Remember to utilize the Medicare Plan Comparisons Chart effectively, focusing on relevant information, comparing plans side by side, and considering both coverage and cost. If needed, seek assistance from

Christopher Grimmond

licensed insurance agents, or contact Medicare directly for guidance.

With the right Medicare plan in place, you can enjoy peace of mind, knowing that you have made the best choice for your healthcare coverage. We take people through this process daily. At no cost to you, we will show you the plans in your area that you are eligible for, break down the information on the chart, and match up with your unique needs and concerns. Call us at 402-614-3389 for a free consultation with a licensed insurance professional.