What Is Medicare Advantage Plans

What Is the Medicare Advantage Controversy About?

What Is the Medicare Advantage Controversy About?

Medicare Advantage plans (MA plans) or Medicare Part C is Medicare. Confused people get it wrong. Some will call MA plans a “Medicare replacement plan.” Others will claim Medicare Part C is not Medicare. Let me let you in on a little secret. Medicare is in the name–“Medicare Part C,” like Medicare Part A, Medicare Part B, and Medicare Part D. The other name it goes by is Medicare Advantage. At the same time, Medicare Part A and Part B are referred to as “Original Medicare” because they were the first Medicare insurance programs in the history of Medicare.

Medicare partners with private health insurance companies. The Center for Medicare & Medicaid Services (CMS) provides the criteria, structure, and funding to private insurance companies. The insurance company designs the Medicare plans under CMS’s direction. CMS must approve the plan before it is offered to the general public. The MA must cover and provide at least everything that Original Medicare (Part A and Part B) provides, though it may offer more. Many times MA plans include Part D prescription drug coverage as well. These types of plans have existed since the early 1990s.

Who’s Eligibility For Medicare Advantage?

Any Medicare beneficiary is eligible to enroll in a Medicare Advantage plan that is in his area. There are no health questions as with Medigap plans. Medigap (or Medicare Supplements) is private insurance. Outside your initial enrollment period for a Medigap policy, the insurance company may ask you health questions. Based upon your response, you could be rated or even denied coverage. Medicare Advantage plans, however, cannot deny coverage based upon preexistent conditions, current health issues, or weight.

Until this year, the one exception for Medicare Advantage plans was End-Stage Renal Disease (ESRD). ESRD means kidney disease that results in a significant reduction in kidney function. ESRD usually puts people on dialysis which makes them eligible for Medicare if they are younger than 65. Many become eligible for Socially Security disability too. Medicare Advantage plans, unless specially designed, did not cover ESRD until this year. Yeah!

My father’s had ESRD. We didn’t realize what was happening to him until years later. He went on dialysis. Eventually, he qualified for disability. It was not a smooth process back in the ’90s. Now that I am the age it happened to my father, I appreciate the hardship he went through and how scary it must have been both physically and financially. He never let on, and I didn’t realize.

How Does Medicare Advantage Plans Benefit You?

Medicare Advantage/Part C provides the health cover that Original Medicare (Part A and Part B) provides, but the pay structure is different. Instead of a Part A deductible per event in a 60 day period, there are small co-pays per event and/or per day.  While Medicare Part B co-insurance 20% is unlimited, MA plans have a Maximum Out-of-Pocket. Original Medicare’s share of cost is virtually unlimited. Medicare Advantage is limited in overall cost and in particular instances with minimal co-pays.

While Medicare Part B co-insurance 20% is unlimited, MA plans have a Maximum Out-of-Pocket. Original Medicare’s share of cost is virtually unlimited. Medicare Advantage is limited in overall cost and in particular instances with minimal co-pays.

Medicare Advantage also usually includes the drug plan at no additional cost. Many people who are on no medications or very few find this beneficial. They don’t want the expense of a Part D plan and premium, but they also do not want the Part D premium penalty for not enrolling in a Part D plan when eligible.

Many Medicare Advantage plans have some vision and dental coverage attached. Original Medicare does not cover these areas. The Medigap plans do not cover dental and vision unless you purchase a separate dental and vision plan and pay an additional amount.

Many Medicare Advantage plans include extra benefits like a free gym membership, over-the-counter (OTC) items, and transportation.

What Medicare Advantage Plans Are Near Me?

Medicare Advantage plans are not uniform across the country, like Medigap plans. Since the Medicare Modernization Act, Medigap plans were standardized across the US with few exceptions. While the states control insurance in their domain, the structure and payment of Medigap plans are the same. Each plan fills in the gaps in Original Medicare the same from company to company. Only the price you pay varies.

Medicare Advantage plans are not uniform across the country, like Medigap plans. Since the Medicare Modernization Act, Medigap plans were standardized across the US with few exceptions. While the states control insurance in their domain, the structure and payment of Medigap plans are the same. Each plan fills in the gaps in Original Medicare the same from company to company. Only the price you pay varies.

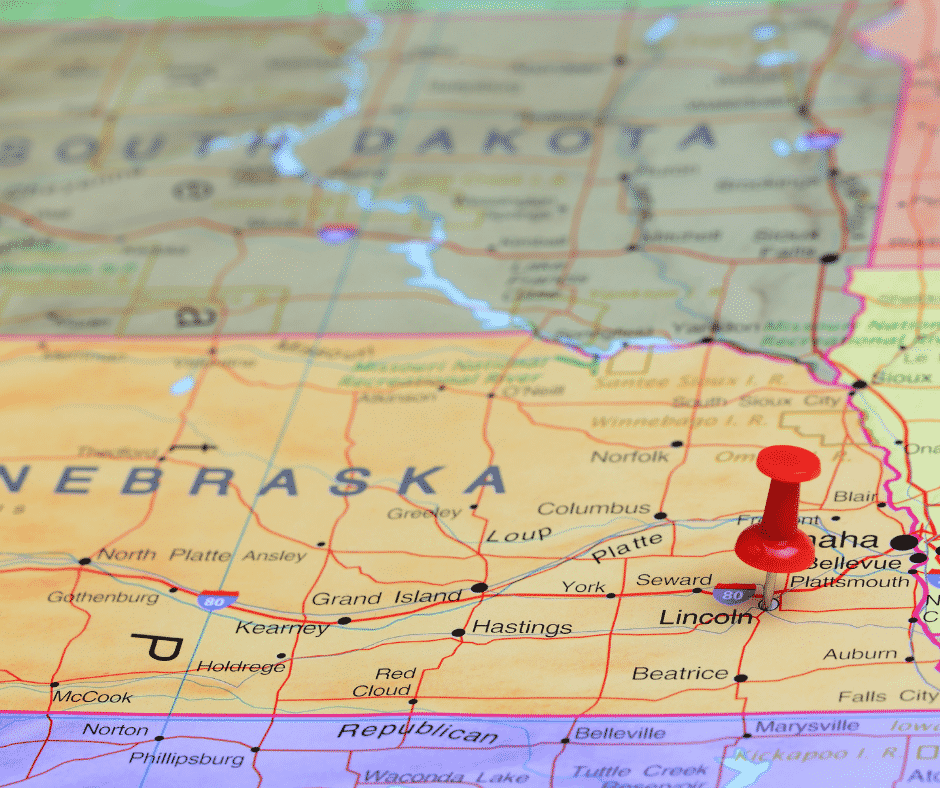

Medicare Advantage plans were designed for a particular county and region. Like an employer’s health plan, the structure of the plan depends on the number and demographic of the population and consequently the financial scale the plan can use to pay claims. More and richer plans appear in the higher population cities and states. MA plans are few or non-existent in rural or low population areas.

The percentage of Medicare beneficiaries on Medicare Advantage in New York and California are 43% and 43% respectively. Minnesota is the highest at 48%. Nebraska is 19%, and most of that is in the Omaha Metro area. In Iowa, Medicare Advantage makes up 24% of the state’s population on Medicare. Iowa’s overall population is higher than Nebraska’s, and it is more evenly spread out across the whole state.

What Are the Medicare Advantage Plans in Nebraska?

In Douglas, Sarpy, Cass, Washington, Saunders, Dodge, and Lancaster Counties in Nebraska, there are 20 Medicare Advantage plans among 6 insurance companies. If you look in Cherry County, which is the largest county in terms of landmass but lowest in population, there are no MA plans. You may purchase a Medigap plan if you live there, but a Medicare Advantage plan is not an option. As for other parts of Nebraska, you can guess the number and quality of the MA plans based upon the local population or lack of population.

The number of people choosing MA plans nationwide in 2020 was 39% over just Original Medicare or Original Medicare with a Medigap plan, which amounts to 24.1 million out of 62 million Medicare beneficiaries–1 in 4. In 2003, only 13% of the overall population chose Medicare Advantage. The number of people choosing MA is growing significantly.

During the past nine years, I personally have seen the Medicare Advantage plans in Nebraska expand to more counties and increase in richness of benefits. When I started, most plans did not have dental and vision. Now in the Omaha-Lincoln-Council Bluffs Metro area, all the plans have some level of dental, vision, hearing, gym membership, and over-the-counter (OTC) benefits.

Are There MA Plans in Iowa?

Are There MA Plans in Iowa?

In Pottawatomie County and Council Bluffs, Iowa, there are 4 insurance companies offering 13 Medicare Advantage plans. Because Council Bluffs is adjacent to Omaha, which is another high population area, the plans are more numerous and richer than in Page County Iowa. The towns of Shenandoah and Clarina Iowa are six and seven thousand people each with most of the county being rural. There are only 2 insurance companies offering 6 MA plans in Page. Population is key to the number and quality of the MA plans.

How Do I Find Out Which MA Plans Are In My Area?

The best way to find out what MA plans are available in your area is to go to Medicare.gov. Click on “Find Plan.” Click on continue without logging in. Click the button for “Medicare Advantage Plan.” Put in your zip code. Click “I’m not sure.” Continue without Logging in. Click the button for “No” to see drugs. Click next. You will see all the MA plans in that zip code.

You should probably do this before meeting with an insurance agent. Even if he does Medicare Advantage as well as Medigap plans, some agents may offer only one or two insurance companies. You want to know all the plans in your area, and you want to know if the agent can offer them.

How Do I Plan Comparison MA Plans?

The Medicare.gov website is the official comparison tool for Medicare Advantage and Part D Prescription Drug Plans. The tool will show the benefits, copays, extra benefits, medication copays, and type of plans. You can put the plans side-by-side to compare. The website is certainly helpful, but the comparison mechanism is limited.

When I meet with prospective clients and clients, I will usually pull out the insurance company’s brochures. Each company does the best job of explaining the benefits of its own plans. My conference table can become a little overwhelmed with paper, booklets, and brochures at times. I would like to think that more information is better than less. However, I do realize for those just coming into Medicare all the information and plans can be a bit overwhelming. I would rather give prospective clients more rather than less of the relevant information.

Even with all of the information in front of you, it is difficult to weigh and decipher its meaning. From my practical experience with thousands of Medicare clients in these plans over years and in multiple parts of the country, I have refined my opinions about what matters and what matters less. I share that with prospective clients, but they make their own decisions.

Ultimately the comparison and evaluation hinge on you. How much do you value a low or higher Maximum Out-of-Pocket (MOOP)? What difference does it make to you between a zero copay for a primary care physician (PCP) versus a larger MRI copay? More dental or less dental. All of these variables go into the mix when a person is determining one MA plan over another. It is a lot of information. I explain and educate so you can make an informed decision.

How Much Are Plans? Are MA Plans Free?

How Much Are Plans? Are MA Plans Free?

People are amazed that many MA plans have no premium other than Medicare Part B. As a matter of fact, ninety-six percent of beneficiaries have access to a MA plan with prescription drug coverage in their area with no monthly premium. It is a misconception, however, that Medicare Advantage plans cost nothing. Everyone must pay the Part B premium. The money that beneficiaries pay plus the allotment that Medicare pays from the federal tax revenues to the private insurance companies with Medicare Advantage contracts covers the cost for the plans.

While many plans have no premium, some plans do. When all averaged together, the monthly MA plan premium is $21 nationally. The premium is the monthly payment. It is different and separate from copays.

What Is A Medicare Star Rating?

Medicare uses a star rating system. Five out of five stars is the best. One star is the worst. Medicare uses the star rating system for nursing homes, hospitals, skilled nursing, etc. The Medicare star rating system was implemented for MA plans in 2008 by CMS. The Medicare Advantage star rating methodology is extensive. It measures the quality of 56 aspects of each plan. Created under the ACA, the categories measured are healthiness of beneficiaries through screening, tests, and vaccines; managing chronic, long-term conditions; enhanced member experience of the health plan; managing member complaints, problems getting services, and choosing to leave the plan; and health plan customer service.

Medicare assigns a star rating to MA plans in the fall before the Annual Election Period (AEP) October 15th–December 7th, which is the time of year members may make changes to their plan. The star rating system gives beneficiaries a way to evaluate plans. The star rating system is not used, however, to rate Original Medicare’s performance. Only the private insurance companies. Medicare itself does not have to meet these standards. It is only for insurance companies that have Medicare Advantage contracts.

The star rating is also valuable to the insurance companies because the star rating determines what Medicare pays the plans. The payment system is referred to as per member per month (PMPM). For plans that are rated 3.5 stars or less, they are paid a base rate in the county where the plan serves. For plans awarded a 4-star rating or better, a 5 percent bonus is paid on top of the base rate. Those rare plans that earn a 5-star rating, can enroll beneficiaries year-round. They do not need to wait until AEP.

MA plans can use the increased funds to add more benefits and richer benefits. That is where you get the dental, vision, hearing, gym membership, transportation, etc. Insurance companies can enrich the plans by lowering the maximum out-0f-pocket, decreasing copays, and eliminating medication deductibles.

The most numerous and richer benefits attract more people to the plan. It develops into a virtuous circle where more members join increasing the plan revenues. The plan adds more benefits and increases quality. It is awarded a higher star rating and is paid bigger reimbursements to put toward benefits. More people join the plan and the improvement cycle continues.

On the other side, Medicare’s higher reimbursement enables the plan to pay providers and medical facilities more. More doctors join the plan and invest in the success of the plan. New reimbursement modeling focuses on successful outcomes versus the number of services provided. The new modeling incentivizes providers to work with plans for better outcomes for beneficiaries to receive their maximum reimbursement.

What Are the Pro’s & Con’s of MA Plans vs. Medicare

What Are the Pro’s & Con’s of MA Plans vs. Medicare

In the Douglas & Sarpy County area, over 90,000 persons are on Medicare. A third of those people are in a Medicare Advantage plan. Some are still on employer health plans. Others have retiree health plans from employers. A good number are retired military with access to TRICARE and other retired state and federal employees who have access to their health plans. Many, however, do not enroll in anything other than regular Medicare–Medicare Part A and Part B.

The disadvantage of not enrolling in a Medicare Advantage plan versus Original Medicare is you do not have a Medicare Part D prescription drug plan. You will pay full price for any medications you are on or maybe on in the future. While you are without the Part D plan, the penalty for not enrolling continues to actively increase. At which point you do choose a Part D plan, you will have a permanent penalty added to your Medicare Part B premium.

Original Medicare has no maximum out-of-pocket. The Part A hospital deductible is $1,484 per event in a 60 period without a cap on how many times this deductible may be charged. The Part B coinsurance of 20% is unlimited. In other words, a million dollars worth of medical bills means a 20% bill to you = $200,000. Medicare Advantage has a maximum out-of-pocket (MOOP). The national maximum allowable MOOP is currently $7,550, though few plans implemented that maximum amount this year. The current average MOOP is $4,925 in 2020. In the Omaha Metro area, the MOOP is lower on some plans. The advantage of Medicare Advantage compared to just Original Medicare is a limiting maximum out of pocket and a Part D plan at no premium or very low premium.

MA Plans vs. Medigap

With a Medicare Supplement (Medigap) policy, you are paying between $1,800–$5,000 a year to fill in the gaps in Original Medicare on top of the Medicare Part B premium of $148.50. For the top 6% of earners, you also have the IRMAA (income-related monthly adjustment amount) tax. Those are hefty amounts for health insurance each year versus no premium or a very low premium.

Medicare Advantage members pay copays as services are needed. Most years most people will not require extensive medical service, just as most people, most of the time are not in car accidents or home fires. The money paid for Medigap premium will exceed what most people pay most of the time for copays on advantage plans. The thousands of dollars paid in Medigap premium could more than cover Medicare Advantage copays most of the time. As people age, the Medigap premium increases significantly while the average Medicare Advantage MOOP and premiums have gone down in the past few years.

Medicare Advantage Plans Disadvantages

The disadvantage of Medicare Advantage depends on the service area of your plan. The doctors, hospitals, and medical facilities that work with MA plans may be very limited in some regions. In the Omaha Metro area, I have not found this to be an issue. For those with serious and persistent medical needs the copays, even with a MOOP, may be more than what you would pay in monthly premium for a Medigap policy. For clients who are concerned they could have a bad year and incur a lot of copays, MA would be more anxiety-inducing than financially beneficial.

Are Medicare Advantage Plans Good

Medicare Advantage plans are good for the right person. For those who wish to limit their health insurance costs upfront, the low or no premium plans are superb. They limit the most a person may be charged each year, provide additional benefits, like prescript drug, dental, vision, hearing, OTC (over-the-counter) items, and gym membership. The focus of the plan is to actively engage members to live healthier lifestyles. They provide the same coverage as Original Medicare without the financial risks and no or little costs. Medicare Advantage plans are good for beneficiaries who see these benefits as good.