Why Nebraska Medicare Advantage Plans Do It Better

What Are Medicare Advantage Plans First of All?

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are an “all in one” alternative to Original Medicare. Original Medicare is just Part A and Part B. It is Original Medicare because that is how “originally” Medicare started.

Private insurance companies approved by Medicare create and offer Medicare Advantage plans. The Medicare Advantage plan must offer as much as Original Medicare but usually offer much more. CMS (Center For Medicare & Medicaid Services) oversees the design of each plan and monitors and evaluates the plan’s service.

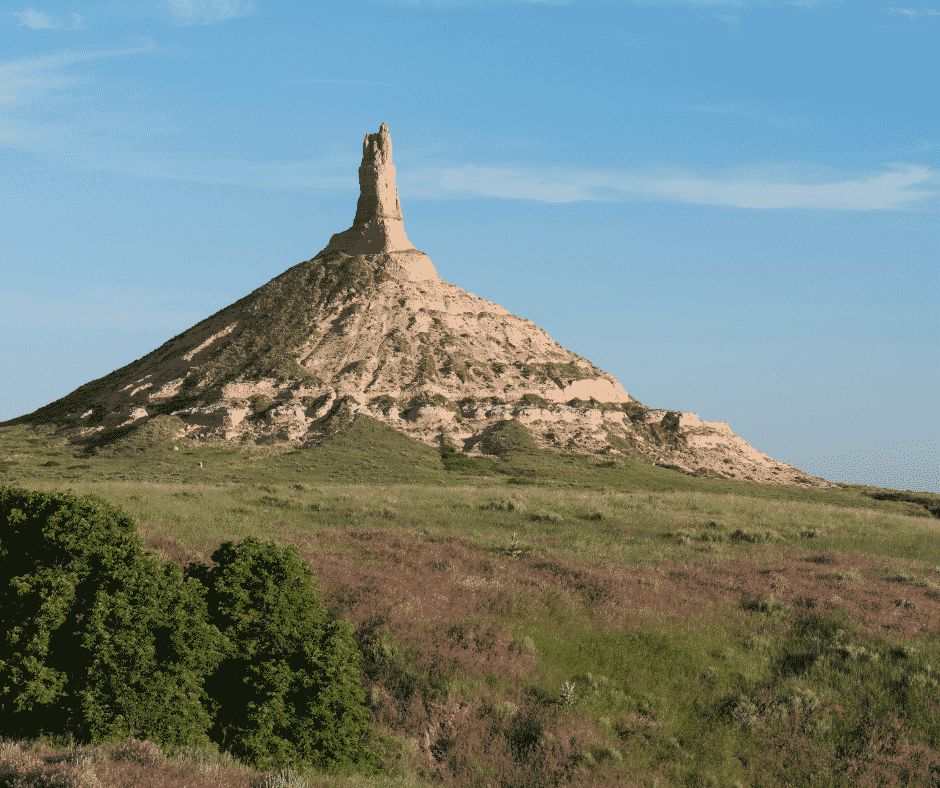

If you join a Medicare Advantage Plan, you still have Medicare. These “bundled” plans include Medicare Part A for hospital insurance, Medicare Part B for doctor and outpatient procedures, and usually Medicare Part D for prescription drug plans. Nebraska Medicare Advantage Plans cover the state from Omaha to Scotts Bluff.

Is Medicare Advantage plans worth it?

County Is King With Medicare Advantage Plans

Medicare Advantage plans are established geographically compared with Original Medicare, which is a homogeneous, national program. The Nebraska Medicare Advantage plans are designed for a specific county, the size of the population in the county, and the average health care costs in that county. The amount of monthly payments from Medicare depends on two main factors.

and the average health care costs in that county. The amount of monthly payments from Medicare depends on two main factors.

What Are the Mechanics of How Medicare Advantage Plans Work?

The two factors are: what are the medical costs in certain areas of Nebraska, and what are those particular Nebraskans’ health?

CMS (Center for Medicare & Medicaid Services) constructed a bidding process for the insurance companies. The advantage plan submits bids to Medicare based on the estimated cost of Part A and Part B per person. Then Medicare compares the amount of the bid against benchmarks. Each county has its own benchmarks based upon average billing for specific procedures. If the bid is above the average, the beneficiary pays the difference. If the bid is below, the additional funds supplement the overall plan through lower co-pays and premiums.

CMS (Center for Medicare & Medicaid Services) constructed a bidding process for the insurance companies. The advantage plan submits bids to Medicare based on the estimated cost of Part A and Part B per person. Then Medicare compares the amount of the bid against benchmarks. Each county has its own benchmarks based upon average billing for specific procedures. If the bid is above the average, the beneficiary pays the difference. If the bid is below, the additional funds supplement the overall plan through lower co-pays and premiums.

The patient risk assessment determines the amount paid to the Nebraska Medicare Advantage plan. Each patient has a risk assessment. A person may be at average risk if they have a certain illness, greater risk, or less. Their score determines what Medicare pays for the beneficiary in the Nebraska Medicare Advantage plan.

After establishing the base rate, Medicare uses risk adjustment to change the rate to reflect the anticipated healthcare costs of a person enrolled in a plan. For example, if someone has a risk score of 1.0, it means that their expected costs are equal to those of an individual with average health. A risk score of 0.5 indicates that the expected costs are half of those of the average person, while a risk score of 2.0 indicates the expected costs are double those of the average person. Can you believe how complex Medicare has made this?

There are 24 Nebraska Medicare Advantage Plans in the Omaha metro. The Nebraska Medicare Advantage plans in rural Nebraska are much fewer. For example, Nebraska Medicare Advantage plans number only two in the Scotts Bluff area. There are four Medicare Advantage plans in North Platte, while Kearney, Nebraska Medicare Advantage plans number fourteen. The strength of the plan depends upon the size of the senior population.

The plans in the rural areas are also not as rich as the Medicare Advantage plans in Omaha and Lincoln.

The Blue Cross insurance companies are not-for-profit organizations, and they are tied to a particular state, such as Blue Cross & Blue Shield of Nebraska. Consequently, the Blues make a big effort to cover as much of a state as possible, but even with that intent and their financial where-for-all, Blue Cross cannot suspend the laws of economics. There is not enough Medicare reimbursement to create a Nebraska Medicare Advantage plan to cover every county and provide a minimum coverage.

What Is A Medicare Dual Advantage Plan?

Nebraska Medicare Advantage Plans also work with Nebraska Medicaid. Dual Medicare Advantage plans refer to someone who has both Medicare and Medicaid simultaneously. Nebraska Medicaid acts as a supplement to the Medicare plan. The state Medicaid program pays the Part B monthly premium. It covers copays when the person has “full Medicaid.” There are four levels of Medicaid. The bottom two are full Medicaid. Nebraska has three Medicare dual advantage plans among three different insurance companies.

Medicaid simultaneously. Nebraska Medicaid acts as a supplement to the Medicare plan. The state Medicaid program pays the Part B monthly premium. It covers copays when the person has “full Medicaid.” There are four levels of Medicaid. The bottom two are full Medicaid. Nebraska has three Medicare dual advantage plans among three different insurance companies.

The advantage of these Medicare Nebraska dual advantage plans is doctors who may not normally take Medicaid may be in-network for the dual plan. This could expand your access to doctors you otherwise could not see in some areas. The Nebraska Dual Medicare Advantage plans provide extra benefits that Original Medicare or Medicaid alone do not offer, such as additional dental, vision, hearing, over-the-count items, transportation, and gym membership.

The insurance companies design dual plans for the chronically ill, such as diabetics, coronary disease, and COPD. These special needs Medicare Advantage plans provide extra benefits that specifically address clients’ unique health needs. The insurance companies have special teams of health professionals who serve the chronically ill. Original Medicare and Medicaid are not structured to provide these higher levels of service for a more vulnerable population.

Tens of millions of people are currently utilizing these plans throughout the country. These Nebraska dual Medicare Advantage plans are mostly on the higher population eastern side of the state.

Where Are the Best Medicare Advantage Plans in Nebraska?

Best is always a relative term. What is best for one person may not be for another.

Best is always a relative term. What is best for one person may not be for another.

One of the advantages of the Medicare Advantage plans in Nebraska is access to networks. Doctor and medical facility access is one of the major criticisms of advantage plans, but access in the Omaha, Lincoln, and Council Bluffs areas is superb.

There are principally three networks in the Omaha area: CHI (Creighton Health Initiative), UNMC (University of Nebraska Medical Center), and Methodist. All three of these networks work with the insurance companies offering Medicare Advantage plans in Nebraska. Unfortunately, the access diminishes once you are west of Lincoln and Lancaster county. People in more rural areas need to be careful that their doctors and hospitals are in their plans system.

Is Medicare Advantage Worth It?

The Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs Metro are as rich as in other parts of the country. Premiums are very low or zero, co-pays and maximum out-of-pockets are low. Additional benefits, like dental, vision, and hearing, are very good and getting better. That is why the number of people enrolling in Medicare Advantage plans nationwide and locally in Omaha, Lincoln, and Council Bluffs continues to grow. The year-over-year growth in Medicare Advantage plans in the Omaha Metro area is the sign Medicare Advantage is worth it.

Christopher Grimmond

There are seven insurance companies that have Medicare Advantage plan contracts in Nebraska: United Healthcare, Aetna, Humana, and Blue Cross of Nebraska with very strong Medicare star ratings. These plans have been in the area for years.

Bright, Medica, and Wellcare Medicare Advantage plans just came to Nebraska in 2022. They will not have star ratings from CMS (Center For Medicare & Medicaid Services) for another two years.

As part of our presentation, we review these 22 plans–the copays, maximum out-of-pockets, and the additional benefits. There are no preference or sweetheart deals with any of the insurance companies. We objectively lay out the details of each plan for your inspection and consideration. Medicare Supplements are also, of course, part of the presentation.

Call us at 402-614-3389 to see if the Medicare Advantage plans in Nebraska are worth it for you.