The Power of Negotiation Enables Medicare to Lower Drug Prices

In today’s healthcare landscape, the soaring cost of prescription drugs has become a critical concern for millions of Americans. As Medicare beneficiaries struggle with skyrocketing medication prices, the power to negotiate Medicare drug prices emerges as a potential solution.

In today’s healthcare landscape, the soaring cost of prescription drugs has become a critical concern for millions of Americans. As Medicare beneficiaries struggle with skyrocketing medication prices, the power to negotiate Medicare drug prices emerges as a potential solution.

With over 65 million enrollees, Medicare has significant purchasing power. However, unlike private insurers, Medicare is legally prohibited from directly negotiating drug prices with pharmaceutical companies. This restriction has prevented the program from achieving lower prices for its beneficiaries.

But what if Medicare could negotiate directly? What impact would it have on drug costs?

Empowering Medicare to negotiate drug prices may unlock savings all around, ensuring seniors receive affordable access to the medications they need. Or it may not. Let’s explore the government’s attempt to make Medicare drug prices more affordable through negotiations.

The Inflation Reduction Act of 2022

Medicare, the federal health insurance program for individuals aged 65 and older, is crucial in providing affordable healthcare to millions of Americans. With over 65 million enrollees, Medicare has substantial purchasing power. However, when negotiating drug prices, Medicare cannot negotiate directly with pharmaceutical companies.

healthcare to millions of Americans. With over 65 million enrollees, Medicare has substantial purchasing power. However, when negotiating drug prices, Medicare cannot negotiate directly with pharmaceutical companies.

Medicare is divided into parts, including Part A, which covers hospital insurance, and Part B, which covers medical insurance. Part D, prescription drug coverage, is the focus of this discussion. Medicare Part D provides beneficiaries access to a wide range of prescription medications, but the prices for some of these drugs are often exorbitant. The inability to negotiate directly with pharmaceutical companies has limited Medicare’s ability to control drug costs.

President Biden signed the Inflation Reduction Act of 2022 into law on August 16, 2022. One of the provisions of the law was to lower prescription drug costs for those on Medicare. The law gives the federal government limited power to negotiate drug prices for the costliest Medicare medications.

Non-Interference Clause Changed To Interference

The power to negotiate drug prices for Medicare Part D is a significant policy change. When the Medicare Part D program was created in 2004, the Health & Human Services Secretary was prohibited from interfering with negotiations between drug manufacturers, pharmacies, and prescription drug plan sponsors. This was the agreement at the time of Part D’s creation. It was referred to as the “Part D non-interference clause.”

A provision in the Inflation Reduction Act grants an exception to the non-interference clause. The law permits the HHS Secretary to directly negotiate with pharmaceutical companies on behalf of Medicare and the sponsored plans for a limited number of drugs with only single-source and non-generic brands starting in 2026 for Part D and 2028 for Part B medications.

The schedule for the negotiations is set, but the implementation of the changes is not scheduled to take effect until 2026. That is when the first set of selected drugs with newly negotiated prices covered under Part D will be available.

Price Controls & Punishing Penalties for Pharmaceutical Companies

Another policy change is that drug companies will be penalized for raising prices higher than the current inflation rate. They will be required to pay Medicare rebates for drug prices exceeding the consumer price index (CPI-U). The penalties will be for those most expensive drugs that HHS identifies. This is an entirely new power for the HHS Secretary. The Part D inflation rebate provision takes effect in 2022, so prices and inflation will be measured from that point. The rebate penalty will start in 2023.

$35 Insulin on Medicare

Diabetes is a growing problem in the U.S., including among Medicare beneficiaries. Insulin costs among this population have been staggering. In 2023, as part of the Inflation Reduction Act, insulin offered under Part D is set at $35 during the deductible, the initial phase, and even during the Medicare gap (donut hole). A prescription plan is not required to offer all insulins, but the ones they do must not exceed $35, and some are even $11.

$2,000 Out-of-Pocket Cap on Part D Prescriptions

The Medicare provision of the Inflation Reduction Act caps out-of-pocket spending for Medicare Part D beneficiaries at $2,000 in 2025 for each individual, excluding premiums. The 2024 provision of the law eliminates the 5% catastrophic Part D phase, effectively capping medication costs at $3,250 for 2024.

August 29, 2023: The HHS secretary announced the first list of ten medications for Medicare drug price negotiations.

- Eliquis-Bristol-Myers Squibb-a blood thinner to prevent blood clotting to reduce the risk of stroke

- Xarelto—Johnson & Johnson–a blood thinner to prevent blood clotting to reduce the risk of stroke

- Januvia—Merck–a diabetes drug to lower blood sugar for Type 2 diabetes

- Jardiance—Boehringer Ingelheim–a diabetes drug to lower blood sugar for Type 2 diabetes

- Enbrel—Amgen–a rheumatoid arthritis drug

- Imbruvica—Abbie–a drug for blood cancers

- Farxiga—AstraZeneca–a drug for Type 2diabetes, heart failure, and chronic kidney disease

- Entresto—Novartis–a heart failure drug

- Stelara—Janssen–a drug for psoriasis & Crohn’s disease

- Fiasp & NovoLog—Novo Nordisk—insulins for diabetes

According to CMS (Center for Medicare & Medicaid Services), these ten drugs were selected because they account for $50.5 billion, or 20% of Medicare Part D spending from June 1, 2022 to May 31st. They are very commonly used medications by the Medicare population.

My Experience As An Insurance Professional

I can attest to this fact after the Annual Election Period for 2023. We ran hundreds of Part D prescription drug plans for clients. These medications come up over and over again, and they are the cause of incredibly high copay totals for clients.

For those on Medicare, nearly 1 in 10 have heart conditions that put them at risk of blood clots. I see Eliquis and Xarelto were on many clients’ medication lists this year. Diabetes affects 28%, so Januvia, Jardiance, and NovoLog appear repeatedly. Some of my clients should be on Enbrel for rheumatoid arthritis, but even with Medicare insurance, the cost is beyond their reach.

Medicare Drug Price Negotiations May Be an Empty Jester

The law is not without its challengers. Several pharmaceutical companies are suing the federal government for its overreach into their business. The government is attacking their right to free speech but also threatening industry and individual businesses with extinction if they do not comply with the “negotiated” terms of the “agreement.”

The law is not without its challengers. Several pharmaceutical companies are suing the federal government for its overreach into their business. The government is attacking their right to free speech but also threatening industry and individual businesses with extinction if they do not comply with the “negotiated” terms of the “agreement.”

The U.S. Chamber of Commerce sought an injunction to halt preliminary negotiations on Oct 1, 2023, the day the drug companies were required to sign an agreement to participate in the negotiations. A federal judge, U.S. District Judge Michael Newman, in Dayton, Ohio, ruled on Sept 29, 2023, that negotiation could go forward.

Johnson & Johnson owns the drugmaker Janssen. In a lawsuit filed July 2023 in U.S. District Court in Trenton, N.J., Johnson & Johnson claimed Medicare drug price negotiations are unconstitutional. The situation leaves its company, Janssen, with no choice if it refuses to negotiate on Stelar because it must withdraw all drugs from Medicare and Medicaid, which is 40% of the U.S. healthcare market. “It is akin to the government taking your car on terms that you would never voluntarily accept and threatening to take your house if you do not ‘agree’ that the taking was ‘fair,’” the company said.

The myriad legal challenges could significantly delay or completely overturn the law’s implementation.

Innovation & Markets May Render the Law Meaningless

All of this activity may end up being an exercise in political theater. Politicians appear to care about the average citizen on Medicare, and the insurance companies keep making money from high-priced medications.

All of this activity may end up being an exercise in political theater. Politicians appear to care about the average citizen on Medicare, and the insurance companies keep making money from high-priced medications.

The pharmaceutical behemoth, Merck, will likely lose its exclusivity in 2026 on its medication, Januvia, one of the first ten drugs up for negotiation. If that happens, most of the business will go to cheaper generic versions when the patent expires.

The same can be said for AstraZeneca’s Farxiga for Type 2 diabetics. AstraZeneca will lose its exclusive patent in 2026. Johnson & Johnson’s Xarelto, Novartis, and Entresto will lose exclusivity in 2027. Many of these drugs on the first list may come down significantly in price naturally through market forces, especially if the current schedule of drug negotiations is delayed through litigation. The desired effect will take place. Lower drug costs. The cause may not be government coercion but rather the effects of innovations and competition. The politicians, however, will take the bows if it works.

Eliquis, taken for blood thinning, will no longer be protected by its patent in 2028. Bristol-Myers Squibb and Pfizer’s revenue will decline, whether by government legislation or patents ending.

Competition is also eroding prices. AstraZeneca has Calquence, and Beigene has Brukinsa. Both are for blood cancer, which now competes directly against AbbVie’s Imbruvica.

Ultimately, the consumer may still benefit, but it may not be by the hands of the politicians who claim credit.

Help Is on the Way

Whether from government intervention or efficient capital markets and technological advances, medication prices, like microchips, computers, and flat-screen televisions, will go down. I remember when Celebrex was a high-dollar medication. Celecoxib, the generic, is now $5 or even zero on some plans. Then, there will be new medications that are better than the ones we use now, but if we want to use those newer, better medications, we will have to pay new, higher prices.

Every year during the Annual Election Period, we run the medications for our clients to ensure they have a reliable plan with the lowest possible overall costs, regardless of Medicare drug price negotiations. We look at all the moving parts: premium, deductible, gap.

Christopher J. Grimmond, MA, CFP

Call us at Omaha Insurance Solutions at 402-614-3389 to speak with a licensed insurance agent professional to make sure you have the plan that meets your needs and budget.

Finding a Medicare approved chiropractor can be a daunting task, especially if you’re dealing with chronic pain or a specific condition requiring specialized care. Knowing where to turn for effective treatment is crucial. That’s where our comprehensive guide comes in, dedicated to helping you navigate the world of Medicare approved chiropractors near you with ease.

Finding a Medicare approved chiropractor can be a daunting task, especially if you’re dealing with chronic pain or a specific condition requiring specialized care. Knowing where to turn for effective treatment is crucial. That’s where our comprehensive guide comes in, dedicated to helping you navigate the world of Medicare approved chiropractors near you with ease.

In this article, we’ll walk you through the process of finding local chiropractors near you who are covered by Medicare. You’ll learn about the specific criteria that chiropractors need to meet to be Medicare approved, ensuring you receive the best chiropractic care near you.

We’ll also provide tips on finding chiropractors in your area who accept Medicare, saving you valuable time and energy. From understanding Medicare coverage for chiropractic services to reviewing online directories and seeking referrals, we’ll cover it all.

Whether you’re new to Medicare or simply need a chiropractor who accepts this insurance, our guide will equip you with the knowledge and resources necessary to make informed decisions about your chiropractic care. Stay tuned for valuable insights and expert advice in the pages ahead.

Understanding Medicare Coverage for Chiropractic Services

Medicare coverage for chiropractic services can be complex, and it’s essential to understand what is and isn’t covered before seeking treatment. Chiropractic care falls under Medicare Part B, which covers medically necessary services and preventive care.

To be eligible for Medicare coverage, chiropractic services must meet specific criteria. Firstly, the treatment must be considered medically necessary, meaning it is aimed at diagnosing or treating a specific health condition. Additionally, the chiropractor must be a Medicare approved provider, and they must accept assignment. This means they agree to accept the Medicare approved amount as full payment for their services.

The process with Medicare Advantage plans is similar to Original Medicare. Each plan must approve the chiropractor to be in the network. There is a credentialing process providers go through to be accepted into the plan’s network. As part of the acceptance, they agree to the plan’s payment amounts.

It’s worth noting that Medicare only covers manual manipulation of the spine to correct a subluxation. Other services, such as acupuncture or massage therapy, are not covered under Original Medicare. Some Medicare Advantage plans may cover additional benefits, like acupuncture. Understanding these limitations will help you make informed decisions about your chiropractic care and plan.

The Importance of Choosing a Medicare Approved Chiropractor

The Importance of Choosing a Medicare Approved Chiropractor

Choosing a Medicare approved chiropractor is crucial for several reasons. Firstly, it ensures that the chiropractor meets the necessary standards and qualifications Medicare sets. This gives you peace of mind, knowing you’re receiving care from a professional vetted by a trusted authority. That is for those who are on Original Medicare, which is Medicare Part A and Part B.

professional vetted by a trusted authority. That is for those who are on Original Medicare, which is Medicare Part A and Part B.

Medicare Advantage plans are managed care plans. The insurance company that runs the Medicare plans contracts with networks of doctors, health networks, hospitals, other healthcare facilities, and health professionals, like chiropractors. Each company and Medicare plan has its own vetting process called credentialing.

Secondly, choosing a Medicare approved chiropractor or in-network provider ensures that your services will be covered by Medicare or the particular Medicare Advantage plan in your area. This is particularly important if you’re relying on Medicare or Advantage plans to help with the cost of your chiropractic care. By selecting an approved provider, you can avoid unexpected out-of-pocket expenses.

Lastly, Medicare approved chiropractors have experience working with Medicare patients and navigating the complexities of billing and reimbursement. This means they are well-equipped to handle the administrative aspects of your care, allowing you to focus on your health and well-being.

How to Find Medicare Approved Chiropractors Near You

Finding Medicare-approved chiropractors in your local area is easier than you might think. Here are a few tips to help you get started:

Use the Medicare.gov Physician Compare tool. This online directory allows you to search for chiropractors in your area who accept Original Medicare. Simply enter your location and select “chiropractor” as the specialty to find a list of Medicare approved chiropractors near you.

Use the Medicare.gov Physician Compare tool. This online directory allows you to search for chiropractors in your area who accept Original Medicare. Simply enter your location and select “chiropractor” as the specialty to find a list of Medicare approved chiropractors near you.

If you are on a Medicare Advantage plan, you can do the same with any of the insurance companies that sponsor a Medicare Advantage plan. The three largest plans in the Omaha, Lincoln, and Council Bluffs metro areas are United Healthcare, Aetna, and Humana. Go to their provider search tools on the plan website or downloadable their app on your phone. You can find all the chiropractors near you who accept the plan in order of distance from you.

you.

Check with your primary care physician. Your primary care physician may be able to recommend chiropractors who accept Medicare. They can provide valuable insights based on their knowledge of your medical history and specific needs.

Ask for referrals. Reach out to friends, family, or colleagues who have received chiropractic care with Medicare coverage. They can provide recommendations and share their experiences, helping you make an informed decision. Then check the chiropractor on one of the provider search tools.

Factors to consider when selecting a chiropractor

Factors to consider when selecting a chiropractor

When selecting a chiropractor, there are several important factors to consider. These include:

1. Qualifications and credentials: Ensure that the chiropractor is licensed and has the necessary qualifications to provide chiropractic care. This includes checking their educational background, certifications, and any additional training they may have undergone.

2. Experience: Look for a chiropractor with experience treating your specific condition or dealing with similar cases. This can help ensure they have the expertise necessary to provide effective care.

3. Communication and bedside manner: A good chiropractor should communicate effectively, listen to your concerns, and make you feel comfortable throughout the treatment process. Pay attention to their communication style and how well they address your questions and concerns.

4. Treatment approach: Chiropractors may use different treatment approaches, so finding one whose approach aligns with your preferences and needs is important. Some chiropractors may focus on manual adjustments, while others may incorporate additional therapies or techniques.

By considering these factors, you can select a chiropractor who not only meets the Medicare-approved criteria but also aligns with your specific needs and preferences.

Medicare Billing & Reimbursement for Chiropractic Services

Understanding Medicare billing and reimbursement for chiropractic services can be complex. Medicare typically covers 80% of the Medicare approved amount for chiropractic services after you have met your annual deductible. This means you will be responsible for the remaining 20% as well as any applicable copayments or coinsurance. Medicare Supplements will fill in the gaps with Original Medicare. Medicare Advantage plans will probably have specific copays.

To ensure proper billing and reimbursement, it’s crucial to choose a chiropractor who accepts assignment. This means they agree to accept the Medicare-approved amount as full payment for their services. If the chiropractor does not accept assignment, you may be responsible for paying the difference between the Medicare-approved amount and their actual charges.

If on a Medicare Advantage plan, make sure he accepts that particular plan. Again consult the provider search tool the plan provides and/or ask the provider.

It’s also important to keep in mind that Medicare has specific documentation requirements for chiropractic services. The chiropractor must provide documentation that supports the medical necessity of the services provided. This documentation is crucial for proper billing and reimbursement. When clients call me complaining a service was denied, mistakes, lack of documentation, or incorrect billing codes are the usual reason. The medical office needs to correct any errors to receive approval and payment.

Common Misconceptions about Medicare Coverage for Chiropractic Care

There are several common misconceptions about Medicare coverage for chiropractic care. It’s important to debunk these misconceptions to ensure you clearly understand what is and isn’t covered. Here are a few common misconceptions:

1. Chiropractic care is covered without restrictions: While Original Medicare and Medicare Advantage plans do cover chiropractic care, it is subject to specific criteria. The treatment must be medically necessary and aimed at correcting a subluxation of the spine.

2. All chiropractors accept Medicare, and all insurance companies offer Medicare Advantage. Not all chiropractors accept Medicare or every Medicare Advantage plan in the area. Verifying that the chiropractor you choose is a Medicare-approved provider and in the network is vital.

3. Medicare covers all chiropractic services: Medicare only covers manual manipulation of the spine to correct a subluxation. Additional services, such as acupuncture or massage therapy, are not covered by Original Medicare.

3. Medicare covers all chiropractic services: Medicare only covers manual manipulation of the spine to correct a subluxation. Additional services, such as acupuncture or massage therapy, are not covered by Original Medicare.

By understanding these misconceptions, you can make informed decisions about your chiropractic care and avoid unexpected expenses.

The Bottomline: Take Control of Your Healthcare with Medicare Approved Chiropractors

Navigating the world of Medicare-approved chiropractors doesn’t have to be overwhelming. With the information and resources provided in this guide, confidently search for chiropractic care that meets your needs and is covered by Medicare near you.

Remember to understand the specific criteria for Medicare coverage, choose a Medicare approved chiropractor, and ask the right questions during consultations. By staying informed and utilizing available resources, you can take control of your healthcare and receive the quality chiropractic care you deserve. We can help you sort through the confusion at Omaha Insurance Solutions. Give us a call at 402-614-3389 to speak with an experienced and licensed insurance agent professional.

Christopher J. Grimmond

Whether seeking relief from chronic pain or improving your overall well-being, Medicare approved chiropractors near you are here to help. Take the first step towards better health by exploring your options and finding a chiropractor who meets your needs. Your journey to wellness starts now.

Are you ready to dive into the intricate world of Medicare Supplements? If you’re exploring your options, you’ve probably come across Medicare Supplement Plan N and Plan G. While both plans offer comprehensive coverage, what are the differences between Medicare Plan N vs Plan G?

Supplement Plan N and Plan G. While both plans offer comprehensive coverage, what are the differences between Medicare Plan N vs Plan G?

In this essential guide, we’ll take a closer look at Medigap Plan N and Plan G to help you determine the right fit for your healthcare needs. From coverage details to cost considerations, we’ll cover all the essential aspects to make your decision-making process easier.

Whether you’re new to Medicare or considering switching from your current plan, this guide will provide valuable insights. By the end, you’ll clearly understand each plan’s benefits and potential drawbacks, empowering you to choose the best option for your unique circumstances.

So, grab a cup of coffee, sit back, and let’s explore the intricacies of Medicare Plan N vs Plan G. Aren’t you curious to find out which plan will provide the best coverage for you?

Overview of Medicare Plan N

Overview of Medicare Plan N

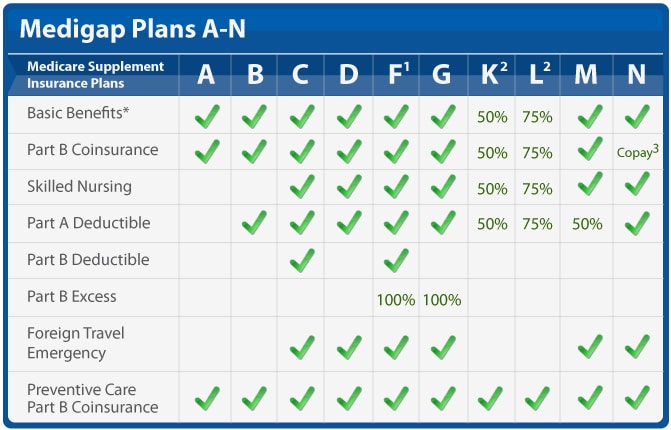

Medicare Plan N is a popular choice for individuals who want comprehensive coverage at a more affordable price. Plan N, like Plan G and the other plans, cover virtually everything. Medicare is the most comprehensive health insurance out there. The key difference of Plan N is the cost-sharing structure, which requires you to pay a small copayment or coinsurance for certain services.

Like all Medicare supplement plans, you’ll be free to choose your own healthcare providers with plan N, as the plan doesn’t require you to select a primary care physician or obtain referrals for specialist visits. All physicians and health facilities that accept Medicare will also accept the supplement. This flexibility can be especially beneficial if you prefer to have control over your healthcare decisions.

While Plan N covers a significant portion of your healthcare expenses, it does come with some out-of-pocket costs. For example, you’ll be responsible for paying the Part B deductible and any excess charges that exceed the Medicare-approved amount. However, these costs are usually minimal compared to the plan’s overall coverage.

Medicare Plan N offers a comprehensive range of coverage and benefits.

Here is what is covered:

1. Part A Hospital Coverage: Plan N covers hospital stays, including room and board, nursing care, and other related services.

2. Part B Medical Coverage includes coverage for doctor visits, outpatient services, and preventive care.

3. Emergency Care: Plan N covers emergency room visits and urgent care services.

4. Skilled Nursing Facility Care: If you require skilled nursing care, Plan N covers the costs of this type of facility.

5. Hospice Care: Medicare Plan N includes coverage for hospice care, ensuring that you receive the necessary support during end-of-life care.

In addition to these core benefits, Plan N offers coverage for certain preventive services, such as annual wellness visits and vaccinations. This ensures that you can maintain your health and prevent potential illnesses.

Pros and Cons of Medicare Plan N

Like any healthcare plan, Medicare Plan N has its trade-offs. Here’s a closer look at the advantages and potential drawbacks.

1. Comprehensive Coverage: Plan N offers comprehensive coverage for a wide range of healthcare services, giving you peace of mind knowing that your medical expenses are covered.

2. Affordability: Compared to other Medicare plans, Plan N is often more affordable, making it an attractive option for individuals on a budget.

3. Freedom to Choose Providers: With Plan N, you can choose your own healthcare providers, ensuring you receive care from trusted professionals.

Trade-Offs of Medicare Plan N

1. Out-of-Pocket Costs: While Plan N covers significant healthcare expenses, you’ll still be responsible for out-of-pocket costs, such as the Part B deductible and excess charges.

2. Limited Coverage for Travel: If you frequently travel outside the United States, Plan N may not provide coverage for medical services obtained abroad.

3. Cost-Sharing Requirements: Plan N requires paying copayments or coinsurance for certain services, which can add up over time.

Overall, Medicare Plan N offers comprehensive coverage at an affordable price, making it a popular choice for many individuals. However, it’s essential to carefully consider your healthcare needs and budget before deciding.

Overview of Medicare Plan G

Overview of Medicare Plan G

Medicare Plan G is another option worth considering if you want comprehensive coverage with minimal out-of-pocket costs. This plan is similar to Plan N in terms of coverage, but it has a few key differences that may make it a better fit for certain individuals.

With Medicare Plan G, you have access to the same wide range of benefits, such as hospital stays, doctor visits, and preventive care. Like Plan N, Plan G also has a cost-sharing structure, which requires you to pay the Part B deductible, which is currently $226 annually.

Once the deductible is met, Plan G provides full coverage for Part B services. You pay nothing more. You do not pay the Part B Excess charges. There are no copays for doctor visits or emergency services.

Pros and Cons of Medicare Plan G

Like Medicare Plan N, Plan G has its own set of pros and cons. Here’s a closer look at what you can expect.

1. Comprehensive Coverage: Plan G offers comprehensive coverage for a wide range of healthcare services, giving you peace of mind knowing that your medical expenses are covered.

2. Minimal Out-of-Pocket Costs: Plan G provides complete coverage for Part B services once you meet the Part B deductible, leaving you minimal out-of-pocket costs.

3. Freedom to Choose Providers: With Plan G, you can choose your own healthcare providers, ensuring you receive care from trusted professionals.

Cons of Medicare Plan G

1. Part B Deductible: Plan G requires you to pay the Part B deductible out of pocket. However, once this deductible is met, your out-of-pocket costs are significantly reduced.

2. Potentially Higher Premiums: Plan G may have higher premiums compared to other Medicare plans. However, the comprehensive coverage and minimal out-of-pocket costs may outweigh the higher premium costs for many individuals.

3. Limited Coverage for Travel: Similar to Plan N, Plan G may not provide coverage for medical services obtained outside the United States.

When deciding between Medicare Plan N and Plan G, it’s important to consider your personal healthcare needs, budget, and preferences. Both plans offer comprehensive coverage, but the cost-sharing structure and coverage for the Part B deductible may be deciding factors for many individuals.

Key Differences between Medicare Plan N and Plan G

Key Differences between Medicare Plan N and Plan G

While Medicare Plan N and Plan G cover the same services, and both require you to pay the Part B deductible (currently $226), the other cost-sharing and the monthly premiums differ.

Here are factors to consider:

There is a noticeable difference in premium between Plan N and Plan G. Most of my clients are in the Omaha, Lincoln, and Council Bluffs Metro areas. Looking at the difference in premiums between Plan N and Plan G here, the price range is between $40 to $50 per month (or $460 to $600 per year) more for Plan G than Plan N for a 65-year-old.

The price range for a 75-year-old is $45 to $55 on average (or $540 to $660 per year) more, and an 85-year-old has a premium range of $60 to $80 per month (or $720 to $960) more for Plan G than Plan N.

These premium differences are for Medicare Supplements in the low range of supplements. For higher-priced Medigap policies, the range is even wider.

Why Is Medicare Plan G Premium More Than Plan N?

Depending on your age, you pay $540 to $960 more per year for a Plan G over a Plan N Medicare Supplement. Why?

There are a number of reasons.

- You don’t pay the $20 copay for doctor visits on Plan G. The plan pays the cost, and it is reflected in the premium.

- You don’t pay Part B Excess Charges on Plan G. The plan pays the cost, and it is reflected in the premium.

- You don’t pay the $50 copay for emergency room services on Plan G, and it is reflected in the premium.

- Plan G is the most popular Medigap Plan and the default guarantee issue plan.

How Should I Compare Medicare Plan N to Plan G?

Copays

Copays

How many times would you have to go to the doctor for Plan N to be more expensive than Plan G? The answer is to divide the $20 doctor copay into the annual price difference–$540 premium / $20 copay = 27 doctor visits. For a 65-year-old, you would need to go more than 27 times for Plan N to cost you more than Plan G. That is a lot of doctor visits! How many times do you go to the doctor each year normally? Once, twice, five times?

Medigap Plan N has an emergency room maximum copay of $50. You will probably not go to the emergency room regularly or for prolonged periods. If you go to the emergency room frequently, I guarantee it will NOT be for a prolonged period. We can eliminate the $50 emergency room copay as seriously impacting your total annual cost.

Medicare Part B Excess Charges

Most doctors who are contracted with Medicare do not charge the Part B Excess Change. Of the 2% of doctors who do, they are in mental health and podiatry.

You have control of these charges by asking the physician ahead of time if she takes assignment for Medicare. In other words, does she accept what Medicare bills and does not charge the excess?

Medicare Plan N vs Plan G Rate Increases

Healthcare costs go up. In our current inflationary environment, those increases will be substantial. The insurance companies cover increased costs with rate increases. Your monthly premium will go up in the near future, and if you wish to keep your policy, you must pay the increased cost.

In general, the rate of increase for Medigap Plan G is higher than for Plan N. The difference ranges from 1% to 4% over time and from state to state and company to company, but the rate increases are usually more for Plan G than Plan N, as a rule.

Medigap Plan G Is More Popular

Plan F is still the most popular, with 46% of Medigap policyholders enrolled in Plan F. However, that is quickly decreasing because beneficiaries who turn 65 after 2020 are no longer eligible to purchase Plan F.

Plan G is the most comprehensive Medigap plan because all health issues are paid for after the $226 Part B deductible is met. Like Plan F before, Plan G is the go-to plan for the majority, with 26% currently enrolled in Plan G versus Plan N at 10%.

Medigap Plan G Is Guarantee Issue

After someone’s Initial Enrollment into Medicare at age 65 or when they enroll in Medicare Part B, most people must go through underwriting to get Medicare Supplements. They must answer a series of health questions, and the insurance company can determine whether to accept them into the policy, accept them at a higher premium, or decline them.

There are a handful of exceptions to this rule. Insurance companies must guarantee to issue a Medigap policy when someone comes off a Medicare Advantage plan in their first year on the plan. The other most common instance is when a person has Medicare Part A and Part B, losing their group health plan. Then, they can get a Medigap plan without answering health questions, in other words, guaranteed issue.

The vital point about guaranteed-issued policies is that Plan G is the only plan eligible for the guaranteed issue. Insurance companies cannot screen guarantee issue applicants. They must take them no matter their health. Coupled with the fact that Plan G is now the most popular plan, Plan Gs have a disproportionately large number of unhealthy participants vs Plan N.

Consequently, the Medicare Plan G member pool has proportionally more medical claims than Plan N policies. The higher claims ratio increases the costs for Plan G vs Plan N. The higher costs result in high average annual rate increases between Medicare Plan G vs Plan N. Medicare Plan G rate increases average between 1% to 4% more each year. Over time, there is a significant difference in what a beneficiary pays for their Medigap Plan G vs Plan N.

Rate Increases Are Lower for Plan N

Rate Increases Are Lower for Plan N

For example, if a Medigap Plan G $150 premium at 65 increases by 4% on average for fifteen years, the premium will be $270 at 80. If a Medigap Plan N $110 premium at 65 increases by 2% on average for fifteen years, the premium will be $148 at 80.

The Medicare Plan N premiums are smaller than Plan G, but Plan G premiums more than double in the same time period because of the higher percentage increase and larger initial premium.

While the Plan N $20 doctor copays and the $50 emergency room fee are essential to remember, the smaller percentage increase in annual cost for a Plan N is the real underlying factor to weigh when deciding about your Medicare coverage. Plan G’s percentage increase, because of its popularity and guarantee issue status, ensures you will probably pay significantly more for Medicare Plan G than Plan N over time.

The Bottomline: Medicare Plan N vs Plan G

Choosing the right Medicare plan is crucial and can significantly impact your healthcare and financial well-being. Medicare Plan N and Plan G are excellent options for individuals seeking comprehensive coverage, but it’s important to understand their differences.

Choosing the right Medicare plan is crucial and can significantly impact your healthcare and financial well-being. Medicare Plan N and Plan G are excellent options for individuals seeking comprehensive coverage, but it’s important to understand their differences.

In this comprehensive guide, we’ve explored the coverage details, benefits, pros, and cons of Medicare Plan N vs Plan G. We’ve also discussed the key differences between the two plans and provided factors to consider when deciding.

By evaluating your healthcare needs, budget, and preferences, you can choose the Medicare plan that provides the best coverage for you. Whether you opt for Medicare Plan N vs Plan G, both plans offer comprehensive coverage and the peace of mind that comes with knowing your medical expenses are taken care of.

Medicare Plan G offers the convenience of comprehensive coverage. Once your small Part B deductible of $226 is met for the year, you don’t have to worry about any further out-of-pocket expenses for your health coverage. The tradeoff, however, is you pay for that convenience, especially over time in higher premiums and consistently higher rate increases that may strain your fixed budget as it is eroded more and more by inflation or other unplanned expenses.

Medicare Plan N gives you the same coverage, but you will be responsible for minimal doctor and emergency room copays. Those copays, while they may

Christopher J. Grimmond

seem to be a nuisance, keeping a lid on the rising cost of healthcare coverage. Your premium may be more palatable ten and fifteen years down the line.

Hopefully, you will be on Medicare for a long time. Weigh carefully the costs and tradeoffs over the next fifteen or more years.

We can help you sort through the confusion that is called Medicare and the seemingly endless number of Medicare Supplements and Medicare Plans at no cost to you. Call us at 402-614-3389 and speak with an experienced and licensed insurance agent professional.

How Does Medicare Advantage Work In Nursing Homes?

Taking care of our loved ones is always a top priority, especially regarding their health and well-being. For many seniors, nursing home care is necessary as they require specialized medical attention, like intense physical & occupational therapy and speech-language pathology. In such situations, it’s crucial to understand the nursing home coverage options available in Medicare Advantage plans.

Medicare Advantage plans offer all that Original Medicare (Part A & Part B) offers but through a private insurance company. The insurance companies that are the biggest underwriters of Medicare Advantage are United Healthcare, Humana, Aetna, and Blue Cross. Medicare Advantage plans must offer at least as much as Original Medicare but often offer even more. Nursing home care (the proper term is skilled nursing) is essential to Medicare Advantage. Exploring the different options among the various plans is critical.

This article will delve into nursing home coverage in Medicare Advantage plans, helping you make informed decisions about your loved one’s care. We will explore the different types of nursing home services, eligibility requirements, and potential limitations or restrictions. Whether you’re just considering nursing home care or actively searching for the right plan, this article will provide valuable insights to ensure you find the best solution for your loved one’s needs.

Understanding Medicare Advantage Plans Options

It seems like every year, I get at least one phone call from someone who has moved into a skilled nursing facility. “You sold me the wrong Medicare plan!”

They discover there is a gap in what they want and what Medicare provides. Sometimes billing personnel share misleading, incomplete, or incorrect information to fuel emotion and frustration.

Medicare Advantage plans are required by CMS (Center for Medicare & Medicaid Services) to cover all the services that Original Medicare covers. However, they can offer additional benefits such as prescription drug coverage, dental and vision care, and fitness programs. These plans may also have rules, costs, and restrictions that differ from Original Medicare. It’s important to carefully review the details of each plan to understand the specific nursing home coverage options available.

What Is Nursing Home Care & Why’s It So Important?

Nursing home care, also known as skilled nursing facility (SNF) care, is provided to individuals with a medical condition requiring round-the-clock nursing care. The patient may also need assistance with activities of daily living, such as, help with bathing, dressing, and eating. Their complex medical needs prevent them from being safely cared for at home or in an assisted living facility. SNF provides a safe and supportive environment where seniors can receive the care they need to improve their health and quality of life.

Nursing Home Care vs. Home Healthcare

Home healthcare, which is an alternative to residence in a skilled nursing facility, would not be an adequate solution in some cases because patients would not be able to get the necessary therapy in a timely manner, with the same intensity, and in a safe environment. Their home lacks the equipment and personnel to ensure their therapy is conducted safely and with enough frequency.

Each Medicare Advantage plan may cover nursing home care differently. Some plans may provide full coverage for certain days in a skilled nursing facility, while others may require a copayment or coinsurance for each day of care. It’s essential to review the specific details of each plan to understand the coverage options available.

How Long Does Medicare Pay?

How Long Does Medicare Pay?

Original Medicare covers skilled nursing facility care at 100% for the first 20 days. Days 21-100, the copay is $200 or more. Of course, if you purchase a Medicare supplement for an additional premium, you can fill in some or all of that gap. Premiums in the Omaha, Lincoln, & Council Bluff metro area are around $100-$175 for 65-year-olds.

Medicare Advantage plans vary in the extent of their coverage. I’m always surprised how quickly people pass over the skilled nursing facility section of the benefit highlights in the Medicare Advantage plan’s outline of coverage. I think the assumption is they will never be in a nursing home.

One Medicare Advantage plan in our area covers the first 20 days at zero copays. Days 21-40 (or 19 days) are $196 per day. On day 41, the copay returns to zero on that plan until day 100. Another Medicare Advantage plan in our area covers the first 20 days at zero, but day 21-100 is $196 for the entire period. The second plan has some other very enticing benefits, but that is a huge hole in coverage.

Differences like that are certainly worth considering more than other benefits like dental and vision, even if those benefits are richer. A skilled nursing facility stay can significantly dent one’s pocketbook.

What Is Home Healthcare?

What Is Home Healthcare?

In addition to coverage for skilled nursing facility care, Medicare Advantage plans also offer home health care services. Home healthcare is the alternative to skilled nursing facility care or the logical progression from skilled nursing.

Home healthcare is, as it says, care in the home. Physical and occupational therapists come to the home. Speech pathologists perform therapy in the home. Wound nurses come to the home to change dressings.

Home healthcare is less intense. For example, in home healthcare, a patient would get by seeing a therapist thrice a week for an hour versus three hours daily in a skilled nursing facility. The person’s illness does not require custodial care, like bathing, dressing, and feeding, during the treatment process. She is independent enough to carry out these activities on her own or with the assistance of a family member.

Home healthcare is also less expensive, so it may be chosen over skilled nursing care in a facility. The high cost of SNF is why the flow is to get the patient home and out of the skilled nursing facility as soon as adequate progress is made.

Qualifying Criteria for Nursing Homes in Medicare Advantage

Individuals generally need to meet specific criteria to qualify for nursing home coverage in a Medicare Advantage plan, as well as Original Medicare. This includes a qualifying hospital stay, where they are admitted for at least three consecutive days as an inpatient before being transferred to a skilled nursing facility. In addition, individuals must require skilled nursing care or therapy services daily. It is important to understand the purpose of a skilled nursing facility is not nursing home care. The SNF is not a place of convalescence after surgery or a traumatic event. SNF is for intense therapy; the term ends when the therapy ends or can be continued as an outpatient.

Limitations & Restrictions on Nursing Homes in Medicare Advantage

Limitations & Restrictions on Nursing Homes in Medicare Advantage

While Medicare Advantage plans may offer coverage for nursing home care, it’s important to be aware of any applicable limitations or restrictions. For example, the plan may require prior authorization to continue treatment beyond twenty days. Patients and/or family members often want the nursing home stay prolonged. The plan, however, will not approve any more days because the person has completed the treatment or has reached a plateau in her recovery.

This can cause distress because the person is not ready to be alone at home. Their home is not adequately equipped with ramps or lifts. No one can attend to the patient without significant expense or inconvenience during her continued recovery.

Medicare Advantage plans are managed care plans. They carefully monitor treatment following Medicare’s criteria. The point is to protect from waste or abuse of the limited resources from the Medicare trust fund while also providing the proper care.

Medicare Advantage Is Bad Insurance

In my experience, this situation is exasperated when SNF billing personnel complain to patients and their families that Original Medicare is not as strict as the Medicare Advantage plans in monitoring and restricting treatment. I probably get this phone call once a year. “You sold me the wrong Medicare plan!”

restricting treatment. I probably get this phone call once a year. “You sold me the wrong Medicare plan!”

Patients and families are already in extreme distress because of the medical situation of their loved ones. I find it cruel and unprofessional to burden the family with medical billing challenges, mainly because nothing can be done to change the immediate circumstances of their insurance.

Skilled Nursing Facilities are also far from impartial and unbiased. Their monetary gain is significant if they can keep patients for the full 100 days and bill for therapy versus only 20 or even 30 days.

The reality is therapy has come to an end. The patient can be cared for at home, and treatment may continue with home healthcare. Medicare is health insurance and is not designed for caretaking, food preparation, maid service, and companion care.

People, however, observe that nursing homes are full of people who are cared for in this manner. Those individuals pay for that custodial service out of their own pocket or have long-term care (LTC) insurance. Or they are indigent and on state Medicaid. The citizens then of the county where they reside are paying the monthly rate.

Tips for Choosing the Right Medicare Advantage Plan for Nursing Home Coverage

If you choose to go the direction of Medicare Advantage instead of Original Medicare with a Medicare Supplement, understanding the place of nursing home coverage in a Medicare Advantage plan is important.

If you choose to go the direction of Medicare Advantage instead of Original Medicare with a Medicare Supplement, understanding the place of nursing home coverage in a Medicare Advantage plan is important.

Here are some tips to help you navigate the process:

1. Consider the specific nursing home coverage options offered by each plan. What are the copays for which days?

2. Review the costs associated with nursing home care in each plan. We have 22 Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas. Put them side-by-side.

3. Research the network of skilled nursing facilities covered by each plan. Have the agent look up the skilled nursing facilities you would be most interested in. Make sure they are in the network.

4. Consider the reputation and customer satisfaction ratings of the insurance companies offering Medicare Advantage plans. Medicare has a star rating system: 5-star is best; 1-star is worst.

5. Look at ancillary insurance products that may fill in the gaps that Original Medicare or Medicare Advantage do not cover, like Long-Term Care; Home Care; Cancer, Heart Attack, and Stroke policies.

6. Consult with an independent and impartial insurance agent who can act as a broker for both Medicare Advantage plans in your area as well as Medicare Supplements.

The Bottom Line: Making informed decisions about nursing home coverage in Medicare Advantage plans

All insurance, even Medicare, has rules, limitations, and restrictions. Healthcare, especially when it comes to critical illness, is expensive. When caring for our loved ones, understanding the nursing home coverage options in Medicare Advantage plans is essential. By exploring the different types of nursing home services covered, eligibility requirements, and potential limitations or restrictions, you can make informed decisions to ensure your loved one receives the care they need.

Christopher J. Grimmond

Omaha Insurance Solutions offers Medicare Supplements and Medicare Advantage plans from all major insurance companies. We can explain the plans, the differences, the pros & cons, so you can determine what is the best fit for you. Your health needs change over time, so we review your plan annually to ensure you have the best Medicare plan that meets your unique needs. Call us at 402-614-3389 to speak with an experienced and licensed insurance agent profession.

You don’t get Medicare because you want it. You must be eligible for Medicare. Medicare eligibility doesn’t mean you can enroll in Medicare whenever you wish. You can only enroll in Medicare during specific periods under particular circumstances.

These special times are called election periods, each governed by criteria and circumstances. You must meet specific criteria to be eligible for Medicare and can enroll in Medicare during a specific time period or circumstance.

These special times are called election periods, each governed by criteria and circumstances. You must meet specific criteria to be eligible for Medicare and can enroll in Medicare during a specific time period or circumstance.

Congress passed the Consolidated Appropriations Act of 2021 (CAA), which expanded, streamlined, and made Medicare eligibility and enrollment easier.

Two areas of change are very relevant to newbies going on Medicare in 2023.

The Last 3 Months of Medicare Initial Enrollment

You have probably heard you have seven months to enroll in Medicare—3 months before your 65th birthday, the month of your 65th birthday, and 3 months after your 65th birthday. This is referred to as your Initial Enrollment Period. The problem for years was a bizarre rule when you enroll during the last 3 months of this period that affected your Medicare eligibility.

The old rule was if you enrolled during the 3 months before your 65th birthday, Medicare started the month you turned 65. That remains the same. For example, your 65th birthday is in July. Your Medicare will start in July if you enroll in April, May, or June.

If you enrolled during the 3 months after your 65th birthday, Medicare did not start until 2 months later for month 5, 3 months later for month 6, and 3 months later for month 7. For example, if you enroll in August, Medicare starts in October. You enroll in October, Medicare starts in January. Crazy.

Now when you enroll during the last 3 months, Medicare starts immediately the following month. For example, if your 65th birthday is in July and you enroll in Medicare in August, Medicare starts September 1st instead of October 1st.

Or if your 65th birthday is in July and you enroll in Medicare in September, Medicare starts October 1st instead of December 1st.

This makes way more sense. It shortens the waiting time and prevents lapses in coverage from employer health plans ending on an immovable date. Not sure why this Medicare eligibility wasn’t fixed years ago.

Medicare General Enrollment Period Eligibility

Over the years, a few people came to me who missed enrolling in Medicare when they were first eligible. Consequently, they were assessed the famous Medicare 10% penalty compounded for each year without Medicare, but more importantly, their Medicare eligibility was affected. They could not start their Medicare health coverage until months later.

Over the years, a few people came to me who missed enrolling in Medicare when they were first eligible. Consequently, they were assessed the famous Medicare 10% penalty compounded for each year without Medicare, but more importantly, their Medicare eligibility was affected. They could not start their Medicare health coverage until months later.

Quite often, they have no health coverage for months. They are entirely on their own, paying for any medical services out of their own pocket.

Imagine you are 67 and decide it’s time to get on Medicare. You retired a few years back but never signed up for Medicare or had any other health insurance. You cannot just show up at the Social Security office, sign up for Medicare and have it start the next month. You must wait until the General Enrollment Period from January 1st—March 31st. This is just for enrollment. Medicare then did not start until July 1st, and you could only purchase a Part D drug plan and/or Medicare Supplement. No Medicare Part C/Medicare Advantage until January 1st. Not sure about the confused thinking behind such a bad rule.

In 2023, when a Medicare beneficiary signs up for Medicare during the General Enrollment Period, Medicare coverage starts on the 1st of the following month. For example, if you sign up in February, Medicare starts March 1st. You don’t need to wait anymore until July 1st for Medicare to start.

People constantly complain about how confusing Medicare is. Medicare rules, however—believe it or not—remain very constant over time. These two rule changes from the Consolidated Appropriations Act of 2021 (CAA) are unusual because Medicare does not change much. These new rules about Medicare eligibility and enrollment periods are a welcome adjustment to how Medicare operates.

The Bottom Line On Medicare Eligibility & Enrollment

When you do not deal with Medicare rules daily, they feel overwhelming. I understand and sympathize. Also, understand Medicare eligibility and the ability to enroll in Medicare is critical. There is no room for mistakes.

You want to know how Medicare works, the rules, and the intricacies so that you have the best possible Medicare health coverage.

You can also just call us rather than trying to remember the Medicare eligibility and enrollment rules. We listen to your situation and provide the most up-to-date and relevant Medicare information.

Christopher Grimmond

Call 402-614-3389 to speak with an experienced insurance professional and licensed agent.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Does Medicare Cover Insulin?

Medicare has covered insulin for a long time, but the cost to consumers has gone through the roof over the years. Under the Trump Administration, the Centers for Medicare & Medicaid Services (CMS) announced Medicare changes in 2021 that covered 1,750 Medicare Part D prescription drug plans and Medicare Advantage plans with prescription drug coverage. The plans would reduce insulin prices under the Senior Savings Model. Medicare beneficiaries would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

The Inflation Reduction Act (IRA) law the Biden administration sponsored significantly changed Medicare for 2023. The IRA law set a cap of $35 for insulin that Medicare Part D prescription drug plans offered. The insulin price reduction act went into effect in 2023.

Not all, but many insulin medications to combat diabetes are capped at $35 per month.

Medicare Changes Insulin Prices in 2023

The $35 insulin cap is for both Medicare Part B and Part D. Most people get their insulin medications through their Medicare Part D prescription drug plan. They pay the monthly plan premium and a copay when they pick up their insulin. In the past, the copays were significant. Now insulins on Medicare prescription drug plans in 2023 changed to $35 per month.

What Are 2023 Changes to Insulin Covered by Medicare Part B?

What Are 2023 Changes to Insulin Covered by Medicare Part B?

Many others use insulin delivered through an insulin pump that people wear. The pumps are considered durable medical equipment and are billed under Medicare Part B. Part B has a deductible and an unlimited 20 percent coinsurance. However, when paired with a Medicare supplement, like Plan G, the 20 percent coinsurance is wholly covered. After a small Part B deductible is met, the beneficiary pays nothing for the pump or insulin.

What About Disposable Insulin Patch Pumps?

Insulet Omnipods are very popular. It is a disposable insulin “patch” pump. The disposable pump is a small wireless, tubeless pump worn directly on the body. Beneficiaries get the refills for the Omnipod under the Part D prescription drug plan, not Part B.

The Medicare change for 2023 is insulin refills will be $35 or less.

The patch pump, however, is considered a durable medical device, which falls under Part B. The device will be covered like any other durable medical equipment with no price controls. What you pay is determined by your plan.

How Does Medicare Change Deductibles in 2023 For Insulin?

Most Medicare Part D prescription drug plans and many Medicare Advantage plans with prescription coverage have deductibles. The deductibles aren’t going anywhere; they still exist. However, the deductible no longer applies to covered $35 insulin medications. In other words, Medicare beneficiaries do not have first to meet the deductibles of $505 before they start paying $35 for insulin. This is significant.

Many times the large deductible is an insurmountable obstacle for some clients when they go to the pharmacy to pick up their medication for the first time. They choose not to get their essential medication because of the cost.

I always show clients the prices when we meet. I’m not sure what happens from the showing to when some actually pick up the medication at the pharmacy, but I have fielded many a phone call–“I can’t afford $$$$!”

Medicare changed the rule for $35 insulin on January 1, 2023, to no deductible.

Reimbursement When Overcharged for $35 Insulin

Reimbursement When Overcharged for $35 Insulin

Mistakes happen. If you are charged more than $35 per month for an insulin medication that is part of the program, the Part D plan must reimburse you within 30 days. The insurance company is responsible for the reimbursement. Contact the plan. The customer service 800-number is on the back of your Part D medical card.

Pharmacies Don’t Matter for $35 Insulin.

When I meet with clients, I always show how different pharmacies will affect drug copays. The effect of pharmacies on cost is essential to know if you wish to maximize your Part D plan and pay the least.

Drug plans sign contracts with different pharmacy chains and networks. As part of the deal, copays are lower if you go to one of the plan’s preferred pharmacies versus a non-preferred pharmacy.

Whether a preferred or non-preferred pharmacy, the insulin on the Medicare Part D plan will be $35. Many of my clients have a favorite pharmacy that may not be in the network—non-preferred. It is good to know, wherever you pick up your $35 insulin; it will be $35 insulin.

Not All Medicare Insulin Is $35

Medicare Part D prescription drug plans create formularies, a list of the medications the plan covers. The medications are put in tiers that determine copays and deductibles. Medicare requires the insurance companies to cover at least two medications in each category. Sometimes companies make choices, like covering Humalog insulin types but not Novolog insulin. The new law requires the plan to keep insulin at $35, but only insulins the plan carries. Not every brand or type. This is important in selecting a Part D plan. You need to know which brands and types of insulins are covered under a particular plan. And plans can change and often do change drugs on the formulary from year to year.

We always run clients’ medications when we meet to ensure they have the lowest cost plan for their specific list of medications. During Annual Election Period (AEP) Oct 15th–Dec 7th, we re-run clients’ medications to make sure they still have the best plan for them. If necessary, we change their plan.

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

While Medicare’s $35 insulin is a tremendous financial relief for Medicare beneficiaries who are diabetic, other medications are equally important to improve and maintain glycemic control. Some popular non-insulin and anti-diabetic medications are Trulicity, Bydureon, Ozempic, and Victoza. Oral and injectable (non-insulin) pharmacological options are available for treating diabetes. Medicare, however, did not change the pricing for these medications for 2023. They are not part of the price reduction program currently.

Special Election Period Because of $35 Insulin

The $35 insulin for Medicare beneficiaries is a new regulation, so Medicare has allowed a special enrollment period for “Exceptional Circumstances.” The rule is only for those who are on insulin. You have a one-time opportunity to change your Medicare Part D prescription drug plan from December 8, 2022, until December 31, 2023. The reason is to take advantage of the favorable pricing for insulin medications.

Again, the ability to change Part D plans is only for those on insulin medications, a one-time opportunity during this period.

True Out-of-Pocket Costs Carry Over

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Remember, there are four phases in pricing for Medicare Part D prescription drug plans: deductible, initial phase, the gap (or Donut Hole), and catastrophic phase. Switching Part D plans during the year does not mess this up. You do not start over again. The amounts, totals, and placement within Part D plan phases transfer to the new plan.

If you are in the gap phase in one plan, you will be in the same phase and place in the new plan. You did not lose your place or are forced to start over again.

Medicare Changes the Catastrophic Phase in 2023

The fourth phase in the four stages of tracking Part D prescription drug costs is called “Catastrophic.” When a beneficiary reaches the catastrophic phase, they and the plan have paid out approximately $7,400 in out-of-pocket costs between the beneficiary and the plan. The actual out-of-pocket for the beneficiary is $3,100. The prescription costs are usually minimal unless it is an expensive medication. The coinsurance in the catastrophic phase for expensive medications is an unlimited 5 percent, and 5 percent of a large amount is still significant for most pocketbooks.

The effect of the new legislation in 2024 is beneficiaries will no longer pay the unlimited 5 percent. The out-of-pocket cost will stop at a hard cap of $3,250 out-of-pocket max for beneficiaries. While still not a small amount, it is significantly less than what some beneficiaries paid who were on costly medications in previous years.

Medicare Part D Annual Limit In 2025

The Inflation Reduction Act (IRA) mandates that the annual limit of the Medicare Part D prescription drug will be $2,000 starting in 2025 and indexed for inflation yearly after that. Part D expenses are not currently capped. This Medicare change starting in 2023 is enormous.

I think of my clients on various insulins, anti-diabetic medications, Eliquis for the heart, Humira & Enbrel for rheumatoid arthritis. Their costs have been thousands of dollars for years. That will stop.

The Medicare Part D $2,000 cap is for all tiers of drugs. The limit is for all medications on the plan’s formulary, and the $2,000 limit is for all Medicare beneficiaries regardless of past or current income. IRMAA does not apply.

Inflation Cap on Part D Premiums

The law also includes a 6 percent limit on Part D premium increases. With current inflation around 6 percent now and medical costs usually at a higher rate of inflation growth than regular inflation, how the system will really work is yet to be seen.

Smoothing Part D Out-of-Pocket Costs

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

One month the cost may be $1,000, and the next month is $100. Most consumers’ incomes are consistently the same each month, and large spikes in expenses create extreme hardship.

The IRA law offers an option for “smoothing” the payments evenly over the year.

In 2025 when the medication copays are set at a total out-of-pocket of $2,000 per year, “smoothing” would look like a $167 monthly payment for those on medications that reach the cost cap.

The smoothing idea aims to reduce prescription abandonment, dosage reductions, and delays in treatment because of high-cost specialty drugs. I had gotten phone calls too many times from the pharmacy when a client went to pick up a medication during the deductible phase. “I can’t afford $500 for this #%&* drug!” I explained their cost would not be $500 every month. They are in the deductible phase. Clients tell me they can’t afford the drug, so they leave it at the pharmacy. Not good.

The Bottom Line For 2023 Medicare Changes

The Medicare Part D prescription drug program has evolved since its inception in 2006. The Inflation Reduction Act (IRA) introduces significant changes to Medicare from 2023 to 2025. The law addresses the growing senior population dependent upon insulin and its rising cost. The IRA law reduces costs for those on limited incomes to afford critical life-sustaining medications.

It is essential to be aware of these new rules to benefit from them and get the proper medications to enhance your life’s quality.

Why do so many people bash Medicare Advantage? Yet, in every Part of the country, Medicare plans are expanding, and more people are joining. Why are Medicare Advantage plans considered so bad when they attract so many people and keep them as loyal customers?

What Makes Medicare Advantage Plans Bad?

What Makes Medicare Advantage Plans Bad?

The main reason is location, location, location. Medicare Advantage plans are designed for a particular location, usually a county or collection of counties that make up a region. Medicare Advantage is unlike Original Medicare (only Part A and Part B). Original Medicare is uniform and homogenous throughout the country. Medicare Advantage is not. One plan with the same insurance company may drastically differ from one city to another. In the same state, a plan may be great in an urban area but incredibly poor in a rural area 40 miles away.

When people criticize Medicare Advantage, they create a straw man. They pick the worst locations and the weakest plans. Then they compare those Advantage plans to Original Medicare with the additional insurance product of a supplement. The plans they use as models have high out-of-pocket costs, high copays, limited networks, and low star ratings. Consequently, Medicare Advantage makes a poor showing in those instances.

What Are the Common Pitfalls of Medicare Advantage?

High Out-of-Pocket Costs

Critics claim that Medicare Advantage plans have high out-of-pocket costs. Medicare Advantage’s maximum out-of-pocket (MOOP) for 2023 is $8,300 nationally. That is the highest out-of-pocket an insurance company may charge on a Medicare Advantage plan.

highest out-of-pocket an insurance company may charge on a Medicare Advantage plan.

Insurance companies can set the maximum out-of-pocket (MOOP) lower than the allowed amount. On average, the MOOP was $4,972 in 2022 for in-network and $9,245 out-of-network nationwide.

The MOOP is the highest amount you are responsible for on the plan. Copays add up. If you meet the MOOP total of $8,330–or whatever the amount is–the plan pays 100% on any claims after that.

No Maximum Out-of-Pocket for Original Medicare

Compared to Original Medicare, however, Medicare Advantage has a top limit–a maximum out-of-pocket. Original Medicare has no maximum or cap on the Part A deductible. The Part B coinsurance is an unlimited 20%. Twenty percent of a million dollars is real money!

Those costs that Original Medicare does not pay are only covered if you purchase additional health insurance with a Medigap plan. You need to pay an additional amount to add a Medicare Supplement. A Medicare Supplement in the Omaha, Lincoln, and Council Bluffs areas for a 65-year-old ranges from $1,400–$2,000 per year for a Plan G on top of your Medicare Part B premium, which is currently $164.90.

I work primarily in the Omaha, Lincoln, and Council Bluffs Metro areas. Our maximum out-of-pockets are lower than the national average. Some Medicare Advantage plan MOOPs are as low as $3,800.

Nonetheless, $3,800 or $8,300 is a great deal of money for most people to come up with in a year’s time. It is a legitimate concern, so a person may wish to consider a Medigap Plan N or even High-Deductible Plan G as an alternative to Medicare Advantage. However, many people feel a $4,000 or $5,000 maximum annual out-of-pocket is reasonable for a health insurance plan. It is the same or lower than many employer health plans people had in the course of their working years.

‘Is There A Doctor In the House?’

Like your employer health plans, Medicare Advantage plans are usually network plans. The most common types of plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). The HMO plans generally mean you can only see health providers in the plan’s networks. If you go outside of the network–aside from emergencies–the plan will not pay. PPO plans allow you to go outside the networks to providers who take Medicare, but you may pay more for those services, and your MOOP will be higher.

Like your employer health plans, Medicare Advantage plans are usually network plans. The most common types of plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). The HMO plans generally mean you can only see health providers in the plan’s networks. If you go outside of the network–aside from emergencies–the plan will not pay. PPO plans allow you to go outside the networks to providers who take Medicare, but you may pay more for those services, and your MOOP will be higher.

Network plans can be limited in certain areas. Many rural areas have weak Medicare advantage plans. One of the reasons is that many providers or medical facilities do not work with the plans yet. In those instances, Original Medicare would probably be a better choice with or without a Medicare Supplement.

In other places, I’ve found that the different medical networks compete aggressively against one another. Part of their strategies is to align with specific insurance companies providing Medicare Advantage against their competitors. In this way, a plan might have a limited network of doctors and hospitals. In those situations, an agent must be acutely aware of his client’s needs and weigh all the factors. Depending upon the limitations, Original Medicare may be the better alternative.

Medicare in our Omaha, Lincoln, and Council Bluffs areas are blessed with three robust networks that cooperate with the six insurance companies offering plans in the area. The three networks work with all the plans. Networks and access to providers are non-issues here.

Referral, Or Not Referral

Some Medicare Advantage plans require a referral from your primary care physician (PCP) to see a specialist. The purpose of the referral system is to coordinate care and reduce costs.

costs.

In our area, the HMO plans are “open access.” Open access means no referral is required to go to a specialist when you need one. As a matter of fact, it has been years since Medicare Advantage plans required referrals in our area. However, some plans in some areas still require referrals, which some feel is a drawback.

Medicare Advantage Plans Change Benefits Every Year

Critics of Medicare Advantage site plan changes as a negative for Medicare Advantage. However, Original Medicare also changes. Medigap companies increase premiums almost every year, even several times a year, because of age, higher than normal claims, and inflation. Medicare Part D prescription drug plans DEFINITELY change yearly–premiums, deductibles, copays, and formularies are reworked every year.

Each year the Medicare Advantage plans mail out the ANOC (Annual Notice Of Changes). An example of changes is: the maximum out-of-pocket may increase. Copays may increase or decrease. Extra benefits, like dental and vision, may be increased or reduced, added or eliminated. You will experience change no matter which direction you go with Medicare.

Each year the Medicare Advantage plans mail out the ANOC (Annual Notice Of Changes). An example of changes is: the maximum out-of-pocket may increase. Copays may increase or decrease. Extra benefits, like dental and vision, may be increased or reduced, added or eliminated. You will experience change no matter which direction you go with Medicare.

Over the decade I have offered Medicare Supplements, Medicare Advantage Plans, and Medicare Part D prescription drug plans, all of them changed. Nobody is not changing–sorry for the bad grammar. Some years there are a lot of adjustments. Most of the time, the changes are minor. The changes really hinge on the funding the federal government pumps into Medicare or not and the rate of inflation.

In our area, the Medicare Advantage plans have actually gotten significantly stronger over time. MOOPs have lowered. Additional benefits, like dental, vision, and over-the-counter (OTC) items, were introduced and increased.

Medicare Part A & Part B usually change each year. The Part B premium increases, though it went down slightly this year. Deductibles increase. Part A deductible increased from $1,556 to $1,600 for 2023. Most people don’t notice Original Medicare changes because, if they have a Medigap policy, their supplement takes up the slack. They may not be aware until they get notice of a rate increase from the insurance company. Then, they blame the insurance company for the higher premium, not Medicare. A big part of the higher premium is because Medicare expanded the gap the insurance company needed to fill.

Part D Drug Changes