Skilled Nursing FacilitiesCategory:

As people age, the value of good health becomes more important than ever. When you had a bad fall in your 40s, it would take a few weeks to recover. Now, a bad fall may result in a hip injury that takes months of recovery, doctor visits, physical therapy, or even surgery. Some must go to skilled nursing facilities to recover. The contrast is stark. Seniors’ health issues increase in frequency and complexity as they age. According to the National Council on Aging, nearly 95% of older adults have at least one chronic condition, and 3 million adults aged 65 or older are treated in emergency rooms due to fall-related injuries every year. So Medicare beneficiaries ask: How long Will Medicare Pay for nursing home care and home health care?

Navigating the Complexities of Care: Medicare’s Coverage of Long-Term Care, Skilled Nursing Facilities, and Home Health Care

While preventative care is essential–annual physicals, screenings, and regular tests–and “fall-proofing” your home is critical, you must be prepared financially for the costs associated with extensive medical care if and when that occurs. If a health event puts you in a situation requiring special care or costly in-facility admittance, your first question will probably be, “How am I going to pay for this?”

If you are a Medicare recipient, navigating care in a long-term care facility can be complex and confusing. There are so many different types of care – long-term care (LTC), skilled nursing facility (SNF), and home healthcare (HH) – that it’s hard to know how it all works and how much Medicare is willing to pay for each.

My job is to make that journey a whole lot easier. I’ll break down each of these care types and dive into what Medicare will and won’t cover so that you know your options if you’re faced with a health challenge that requires ongoing care.

The Differences: LTC vs. SNF vs. HH

Understanding the different types of care offerings can feel like a full-time job for aging adults. Terms like assisted living facilities, senior living providers, and skilled nursing facilities are often used interchangeably, but the truth is, there are subtle differences in care and what and how much Medicare pays for the different types of “nursing home care.”

The three essential categories of care for seniors are long-term care (LTC), skilled nursing facilities (SNF), and home healthcare (HH). Understanding what each one does and its purpose can be beneficial when it comes time to finding care for your specific situation.

Long Term Care (LTC)

Long-Term Care facilities are the places we think of as “nursing homes.” A person may go to a long-term care facility for several reasons and lengths of stay. Permanent residents generally go to LTC facilities primarily because they can no longer perform the activities of daily living.

The 5 activities of daily living are:

- Feeding

- Dressing

- Personal Hygiene (bathing, brushing teeth, clipping nails, etc.)

- Continence (control of bladder and bowels)

- Toileting

If you struggle with any of the above, a Long-Term Care facility may be the right choice for you.

Staffed with caregivers, such as certified nurse assistants, registered nurses, various types of therapists, and doctors–these facilities focus more on providing meals, custodial care like dressing and feeding, and offering social environments for their patients. While also providing health care, the primary focus is custodial care because residents can no longer perform those functions for themselves, their families cannot care for them, and they cannot afford to provide those services in their own homes economically.

Skilled Nursing Facility (SNF)

Skilled Nursing Facility (SNF)

Skilled nursing facilities are often in the same physical location as long-term care facilities. The difference comes down to the reason behind your stay. If you need care because of a medical condition – such as a broken hip from a fall, car accident, stroke, or heart attack – then an SNF can provide the medical care you need–intense nursing care, physical therapy, speech pathology. Custodial care, such as feeding or toileting, comes with a stay in the skilled nursing facility, but it is secondary to the primary reason for the stay–intense and daily treatment.

Seniors needing intense physical therapy, speech therapy, occupational therapy, or continuous medical support should reside in Skilled Nursing Facilities until they are recovered, reach a certain level, or plateau. Then you return home, where home healthcare takes over. The nurses, physical & occupational therapists, and speech pathologists come to your home. Eventually, when you have progressed in your recovery and do not need treatment as often, home healthcare stops, and you go to providers’ offices for an appointment.

Home Healthcare (HH)

Home Healthcare providers allow their clients to continue living in the comfort of their homes while providing care. The person still cannot get out and go to appointments easily, so the skilled providers come to you in your home two or three times a week or less, depending upon need. Ideally, in the recovery process, you eventually leave your home and go to their offices to receive treatment until you fully recover. Again, home healthcare does not provide custodial care in the home, except on rare occasions for short periods of time.

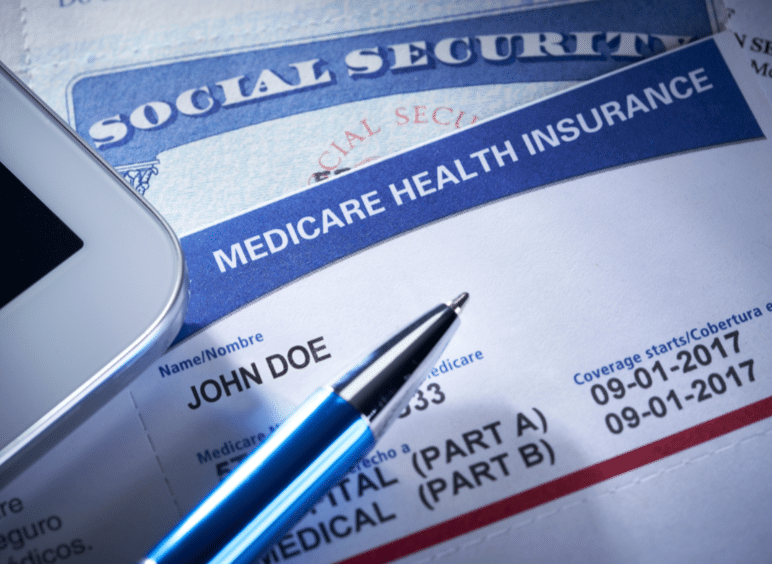

Understanding that Medicare is health insurance. It covers and pays for doctors, nurses, tests, hospitals–all the things you associate with medical treatment and recovery. Medicare does not provide custodial care, housekeeping, meal & laundry service, or taxis.

Will Medicare Cover Long-Term Care?

When someone says “long-term care” or “nursing home,” they generally mean the person is residing permanently in a facility because she cannot take care of herself–she cannot perform the 5 activities of daily living. Medicare does not pay for nursing home care. Even when medical necessity requires admittance to a nursing home (skilled nursing facility), the length of stay is capped at 100 days. There are rules around stopping and starting this coverage, coming from a hospital stay, and restarting a stay, but essentially, Medicare will only pay for 100 days per year in a nursing home. And Medicare approval for a stay of that length is rare. Again, Medicare pays for “nursing home” care for purposes of intense but temporary medical treatment.

Will Medicare Cover Skilled Nursing Facilities?

Medicare provides “Skilled Nursing Facilities” coverage, but patients must qualify based on stringent requirements. Medicare will only cover SNF care if all of the following are true:

- You are a recipient of Medicare Part A and have days of coverage remaining in your benefit period.

- A qualifying hospital stay preceded the need for SNF. An inpatient stay of at least 3 consecutive days in the hospital followed by admission into an SNF within 30 days of leaving the hospital is required for coverage.

- A doctor must have ordered inpatient SNF care based on medical necessity.

- Your condition requires skilled care daily.

- You need skilled services for an ongoing condition that was treated during your 3-day hospital stay OR a new condition that started while you were already receiving SNF care for an ongoing condition.

- The services must be reasonable and necessary for the treatment of your condition.

- You obtain care through a Medicare-certified SNF.

Even if you qualify, your stay will not last indefinitely.

How Many Days Will Medicare Pay for Skilled Nursing Care?

After qualifying for SNF care, your progress will be closely monitored for the length of your stay, the care you are receiving, and the above requirements to ensure Medicare will continue providing coverage. At a high level, Medicare will cover up to 100 days of SNF coverage within a single benefit period. Again, approval for that length of stay is rare. Medicare wishes to move you to less costly home healthcare as soon as medically possible.

In those 100 days, Medicare will cover the cost of the following:

- A semi-private room

- Meals

- Skilled nursing care

- Medical social services

- Medications

- Medical supplies and equipment usage

- Ambulance transport when required

- Dietary counseling

- Physical therapy, occupational therapy, and speech-language pathology when required to meet your health goal

It’s important to note that while Medicare will provide coverage for 100 days, you will have to supplement the coverage starting on day 21.

- Days 1 – 20: Medicare will pay the total cost; you pay nothing.

- Days 21 – 100: You pay the daily coinsurance, which can be up to $204 per day in 2024.

- Days 101+: Medicare pays nothing; you incur the total cost of care if you remain.

A detailed breakdown of coverage details can be found in Medicare’s SNF handbook. Medicare does not pay for nursing home care unless it is tied to a treatment program while you are in residence.

Will Medicare Cover Home Health Care?

Home healthcare falls under both Medicare Part A and Part B. Home healthcare is defined as part-time or intermittent skilled care when you are “homebound.” Homebound means you cannot leave your home without assistance. Assistance could be using a walker, wheelchair, crutches, or even a cane. You may need special transportation because of your condition. Your doctor may advise you not to leave your home because of your medical condition. These all constitute reasons Medicare will accept for home healthcare.

The usual services home healthcare provides on a part-time basis are:

- physical therapy

- occupation therapy

- speech-language pathology services

- Injectable osteoporosis drugs

- durable medical equipment

A doctor must certify you need home health care through a face-to-face meeting. You need part-time or intermittent care, which may be up to 8 hours per day but with a maximum of 28 hours per week.

Home Healthcare does not include:

- 24-hour adult day care at home

- Meals delivered to the home

- Homemaker services

- Custodial (or personal) care help.

If you do attend adult day care in a facility, you can still qualify for home healthcare.

Getting the Most from Your Medicare: Which Direction?

There are two ways for you to receive Medicare: Original Medicare or Medicare Advantage.

There are two ways for you to receive Medicare: Original Medicare or Medicare Advantage.

Original Medicare

Original Medicare is Part A for inpatient hospital stays and Part B for outpatient services and doctor visits. There are no networks for Original Medicare. It is fee-for-service (FFS), which means if the doctor or facility accepts Medicare–accept assignment for Medicare is the proper terminology–then Medicare will reimburse the provider for medically necessary services rendered.

Original Medicare does not include Part D for prescriptions, and Orignal Medicare has big gaps in coverage. A quarter of people purchase some sort of supplemental insurance policy, such as Medigap, to fill in the gaps in coverage.

Medicare Advantage/Part C

The other direction is Medicare Advantage (or Part C). These plans are provided by a private insurance company that is Medicare-approved to provide health coverage that is equal to or better than Original Medicare.

The gaps in coverage are structured differently than Original Medicare. Medicare Advantage plans have a maximum out-of-pocket. Original Medicare does not. For example, the most popular Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs have a maximum out-of-pocket of less than $4,000. Original Medicare, on the other hand, does not have a maximum. The sky is the limit for your out-of-pocket costs.

Medicare Advantage is also built on provider networks. The Omaha, Lincoln, Council Bluffs metro area has four healthcare networks: CHI (Catholic Health Initiative), Nebraska Medicine, Methodist Health Systems, and Bryan Hospital. All these networks work with the Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs. Access to providers is a non-issue for us. In other places and with other Medicare Advantage plans, there can be issues and problems, but not here.

Home healthcare is zero for both Original Medicare and most Medicare Advantage plans.

Skilled nursing is zero for the first 20 days for both. On the 21st day, Original Medicare has a copay of $204 during the potential 100 days of coverage–again with no cap on expenses for Part B. Medicare Advantage plans have copays of various sizes, but the key is a limit to what you could pay– a maximum out-of-pocket.

For those who pay the additional premium for the Medigap plan, the skilled nursing facility copay will usually be covered entirely.

Medicare Part D

Medicare Part D prescription drug plans are another premium. Most Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs include the prescription drug plan and are mostly at zero cost.

Neither Original Medicare with a Medigap plan nor Medicare Advantage provides long-term care, custodial care, housekeeping, or adult day care. They may cover some of these services as incidental to providing skilled nursing care in a facility or home but for short periods.

Alternative Ways to Pay for the Care You Need

In 2021, the average cost of long-term care services ranged from $20,280 to $108,405 annually. These prices are exorbitant, and they’re only going up. As you age, the best thing you can do for your health and your wallet is to ensure you have the coverage you can rely on if you need long-term care. Since Medicare doesn’t pay for many long-term care scenarios–“nursing home care”–knowing your other options for coverage is crucial.

Private Pay

Private Pay

Although challenging, some people will pay for their nursing home care from their savings and assets. By dipping into retirement accounts, tapping into assets such as property or investments, or simply saving up over their lifetimes, some seniors pay out-of-pocket for all the care they receive. This is rare.

One major benefit to this approach is that LTC facilities often prioritize private pay clients when space is limited. With the looming senior care crisis, this will get even more important in the years to come.

Long-Term Care Insurance

A separate long-term care insurance policy can pay the cost of residing in a long-term care facility. In most scenarios, these policies require that you need help with two or more of the activities of daily living (feeding, dressing, hygiene, continence, and toileting) before they take effect. There are usually elimination periods of 30, 60, 90, and 120 days before a policy will pay. The premiums for these insurance plans are not cheap. As you age, like life insurance, the price goes up and can be beyond the budget of many people. You also need to pass underwriting when you apply for the policy, though it will be guaranteed renewal for the rest of your life, no matter your health, as long as you continue to pay the monthly premium.

Veteran Benefits

If you served in the military, you may qualify for some sort of long-term care benefits from the Department of Veterans Affairs. Eligibility will depend upon length of service, type of service, military-related disabilities, and even income. Then, there may be limited or no facility access in your area. Where there is a facility, availability may be limited in terms of beds. Contact the Department of Veteran Affairs to determine for what you qualify. Access is very limited in Nebraska.

Veterans Affairs. Eligibility will depend upon length of service, type of service, military-related disabilities, and even income. Then, there may be limited or no facility access in your area. Where there is a facility, availability may be limited in terms of beds. Contact the Department of Veteran Affairs to determine for what you qualify. Access is very limited in Nebraska.

Medicaid

Often confused with Medicare, Medicaid is an entirely different health program. It’s partially funded by the federal government but funded and managed by the state.

Medicaid provides low-income seniors with financial help for long-term care. Each state has its own eligibility guidelines, but you’ll need to demonstrate financial need to qualify.

Many times people will tell me that so-in-so is in a “nursing home,” and they pay nothing. That is because all their assets have been depleted, and they are on county assistance. Medicaid is paying the bill, and all their assets are gone or will be upon death. The state takes homes and any other assets to offset the loss to the taxpayer who covers the expense.

Medicare Does Not Pay for Nursing Home Care: Your Health is in Your Hands

Medicare Does Not Pay for Nursing Home Care: Your Health is in Your Hands

LTC, SNF, and HH are a jungle of terms, regulations, insurance, and costs. It is even confusing for experts. Like figuring out your income tax or finances, consulting an insurance professional will be helpful. You need someone who knows Medicare, Medicare insurance, the CMS rules and regulations, and possesses years of experience dealing with Medicare. He can guide you through the maze of Medicare and help you take your health care into your own hands and plan for the best outcome.

You’re in the right place if you’re unsure where to start. Every week, I spend time helping those on Medicare just like you find the right coverage for their needs. At Omaha Insurance Solutions, we can help you figureout the best direction for you, enroll you in Medicare, choose a plan, and get all the T’s cross and I’s dotted on forms and applications. Each year, we will review your needs and the plans available to maximize your Medicare benefits.

Christopher Grimmond

Get in touch with us today at 402-614-3389 for a free, no-obligation consultation about your Medicare options.

Is Hospice Care Covered by Medicare?

Is Hospice Care Covered by Medicare?

When a loved one receives a terminal diagnosis, they’re typically given an average of six months to live. The next step is to find a place that can meet those special needs. While this is devastating news, the next logical step is to seek out options regarding hospice care to ensure a comfortable transition as their health continues to decline. Of course, figuring out how to pay for hospice care is part of that step. For those on Medicare, how much does Medicare cover for hospice care?

Understanding Medicare’s Hospice Care Coverage

Medicare, the federal health insurance program for individuals age 65 and over, offers coverage for hospice care under Part A. This coverage is available to eligible beneficiaries who have a terminal illness and have a life expectancy of six months or less. Medicare’s hospice care coverage includes a range of services, such as medical and nursing care, pain management, counseling, and medication.

To be eligible for Medicare hospice care, individuals must also be enrolled in Medicare Part A and have their doctor certify that they have a terminal illness with a life expectancy of six months or less. Additionally, individuals must sign a statement choosing hospice care instead of other Medicare-covered benefits for their terminal illness.

How Does Medicare Pay?

Medicare provides financial assistance for hospice care through its hospice benefit under Part A. Medicare Part A covers medications, medical equipment, nursing care, and counseling. The hospice provider is reimbursed directly by Medicare, and the provider must be Medicare-approved to receive reimbursements from Medicare. Beneficiaries are not responsible for any copays.

medical equipment, nursing care, and counseling. The hospice provider is reimbursed directly by Medicare, and the provider must be Medicare-approved to receive reimbursements from Medicare. Beneficiaries are not responsible for any copays.

Medicare’s payment structure for hospice care is based on a per diem (daily) rate. This means that Medicare pays a fixed amount to the hospice provider for each day that an individual is enrolled in hospice care. The per diem rate varies depending on the level of care provided. There may be higher rates for individuals receiving continuous home care or inpatient respite care.

However, it’s important to note that Medicare’s hospice benefit does not cover room and board in a hospice facility. If a beneficiary chooses to receive hospice care in a hospice facility, they may be responsible for paying the room and board costs out of pocket. Alternatively, if a beneficiary receives hospice care at home, Medicare will cover the cost of necessary medical equipment and supplies.

Medigap & Medicare Advantage with Hospice Care

Medigap & Medicare Advantage with Hospice Care

Medicare Part A covers everything hospice-related. Patient costs are copays for hospice-covered medications and respite care. The copay for hospice medications is no higher than $5. Medicare Part A covers 95% of respite care for persons who have taken responsibility for the dying patient. The patient would be responsible for 5% of the costs.

If an individual has a Medigap policy, the Medigap policy would cover the hospice medications and the coinsurance for respite care. Medicare Advantage would continue to cover everything as before, but it would not normally cover the hospice medication copay or respite coinsurance payment.

It is important to note that there are many other medical costs for hospice patients during their time–non-hospice doctors, hospital beds, emergency room visits, ambulances, oxygen, walkers & wheelchairs, and other non-hospice medications, etc. These expenses fall under Original Medicare and the Medigap policy or Medicare Advantage. Hospice care does not cover these other medical needs. It is important to understand this fact.

Once time the daughter of a client called me to let me know her mother was going into hospice. One of the hospice workers told her to save money by canceling her Medigap policy. I tried to explain there were other medical costs her mother would incur from doctors and other providers, but she was convinced it was an unnecessary expense. Unfortunately, they don’t find out about their mistaken decisions until after the fact and the bills roll in.

Eligibility Requirements for Medicare Covered Hospice Care

To be eligible for Medicare hospice care, individuals must meet certain requirements. First, they must be enrolled in Medicare Part A, which provides hospital insurance coverage. Second, they must have a terminal illness. Terminal is defined as a life expectancy of six months or less, as certified by their doctor. Finally, they must sign a statement choosing hospice care instead of other Medicare-covered benefits for their terminal illness.

A beneficiary can stop hospice care at any point. They are not obliged to remain in hospice once they sign the statement.

It’s important to note that individuals can still receive Medicare hospice care even if they are enrolled in a Medicare Advantage plan. Medicare Advantage plans are private health insurance plans that provide Medicare benefits. You don’t lose Part A when you enroll in a Medicare Advantage plan. It is Part A that pays for hospice, even when you are enrolled in a Medicare Advantage plan.

How Long Does Medicare Pay for Hospice Care?

Once you are certified at the terminal with approximately six months or less of life expectancy, your doctor may recertify you. There are usually two 90-day periods and then every 60 days. You do not need to recommit to hospice. The doctor determines that you are still terminal with a six-month or less time period to live. You can remain in hospice almost indefinitely if you meet the criteria.

The Bottom Line: How Long Does Medicare Cover Palliative Care?

Christopher Grimmond

A quarter of the Medicare budget each year goes to cover the last year of Medicare beneficiaries’ lives. That is an incredible number. Hospice care is an essential part of Medicare.

The practice of hospice exists to provide comfort and optimal quality of life to individuals approaching the end. Medicare provides peace of mind that medical bills will be paid and that care will be provided uninterrupted. As long as a person continues to be certified for hospice, Medicare will continue to cover hospice care. You can be assured Medicare will be there for them the entire time.

Hospice is a difficult time. I have gone through this with both of my parents and with hundreds of clients. Contact us at Omaha Insurance Solutions to speak with a caring insurance professional about your Medicare needs. We are a call away at 402-614-3389.

How Does Medicare Advantage Work In Nursing Homes?

Taking care of our loved ones is always a top priority, especially regarding their health and well-being. For many seniors, nursing home care is necessary as they require specialized medical attention, like intense physical & occupational therapy and speech-language pathology. In such situations, it’s crucial to understand the nursing home coverage options available in Medicare Advantage plans.

Medicare Advantage plans offer all that Original Medicare (Part A & Part B) offers but through a private insurance company. The insurance companies that are the biggest underwriters of Medicare Advantage are United Healthcare, Humana, Aetna, and Blue Cross. Medicare Advantage plans must offer at least as much as Original Medicare but often offer even more. Nursing home care (the proper term is skilled nursing) is essential to Medicare Advantage. Exploring the different options among the various plans is critical.

This article will delve into nursing home coverage in Medicare Advantage plans, helping you make informed decisions about your loved one’s care. We will explore the different types of nursing home services, eligibility requirements, and potential limitations or restrictions. Whether you’re just considering nursing home care or actively searching for the right plan, this article will provide valuable insights to ensure you find the best solution for your loved one’s needs.

Understanding Medicare Advantage Plans Options

It seems like every year, I get at least one phone call from someone who has moved into a skilled nursing facility. “You sold me the wrong Medicare plan!”

They discover there is a gap in what they want and what Medicare provides. Sometimes billing personnel share misleading, incomplete, or incorrect information to fuel emotion and frustration.

Medicare Advantage plans are required by CMS (Center for Medicare & Medicaid Services) to cover all the services that Original Medicare covers. However, they can offer additional benefits such as prescription drug coverage, dental and vision care, and fitness programs. These plans may also have rules, costs, and restrictions that differ from Original Medicare. It’s important to carefully review the details of each plan to understand the specific nursing home coverage options available.

What Is Nursing Home Care & Why’s It So Important?

Nursing home care, also known as skilled nursing facility (SNF) care, is provided to individuals with a medical condition requiring round-the-clock nursing care. The patient may also need assistance with activities of daily living, such as, help with bathing, dressing, and eating. Their complex medical needs prevent them from being safely cared for at home or in an assisted living facility. SNF provides a safe and supportive environment where seniors can receive the care they need to improve their health and quality of life.

Nursing Home Care vs. Home Healthcare

Home healthcare, which is an alternative to residence in a skilled nursing facility, would not be an adequate solution in some cases because patients would not be able to get the necessary therapy in a timely manner, with the same intensity, and in a safe environment. Their home lacks the equipment and personnel to ensure their therapy is conducted safely and with enough frequency.

Each Medicare Advantage plan may cover nursing home care differently. Some plans may provide full coverage for certain days in a skilled nursing facility, while others may require a copayment or coinsurance for each day of care. It’s essential to review the specific details of each plan to understand the coverage options available.

How Long Does Medicare Pay?

How Long Does Medicare Pay?

Original Medicare covers skilled nursing facility care at 100% for the first 20 days. Days 21-100, the copay is $200 or more. Of course, if you purchase a Medicare supplement for an additional premium, you can fill in some or all of that gap. Premiums in the Omaha, Lincoln, & Council Bluff metro area are around $100-$175 for 65-year-olds.

Medicare Advantage plans vary in the extent of their coverage. I’m always surprised how quickly people pass over the skilled nursing facility section of the benefit highlights in the Medicare Advantage plan’s outline of coverage. I think the assumption is they will never be in a nursing home.

One Medicare Advantage plan in our area covers the first 20 days at zero copays. Days 21-40 (or 19 days) are $196 per day. On day 41, the copay returns to zero on that plan until day 100. Another Medicare Advantage plan in our area covers the first 20 days at zero, but day 21-100 is $196 for the entire period. The second plan has some other very enticing benefits, but that is a huge hole in coverage.

Differences like that are certainly worth considering more than other benefits like dental and vision, even if those benefits are richer. A skilled nursing facility stay can significantly dent one’s pocketbook.

What Is Home Healthcare?

What Is Home Healthcare?

In addition to coverage for skilled nursing facility care, Medicare Advantage plans also offer home health care services. Home healthcare is the alternative to skilled nursing facility care or the logical progression from skilled nursing.

Home healthcare is, as it says, care in the home. Physical and occupational therapists come to the home. Speech pathologists perform therapy in the home. Wound nurses come to the home to change dressings.

Home healthcare is less intense. For example, in home healthcare, a patient would get by seeing a therapist thrice a week for an hour versus three hours daily in a skilled nursing facility. The person’s illness does not require custodial care, like bathing, dressing, and feeding, during the treatment process. She is independent enough to carry out these activities on her own or with the assistance of a family member.

Home healthcare is also less expensive, so it may be chosen over skilled nursing care in a facility. The high cost of SNF is why the flow is to get the patient home and out of the skilled nursing facility as soon as adequate progress is made.

Qualifying Criteria for Nursing Homes in Medicare Advantage

Individuals generally need to meet specific criteria to qualify for nursing home coverage in a Medicare Advantage plan, as well as Original Medicare. This includes a qualifying hospital stay, where they are admitted for at least three consecutive days as an inpatient before being transferred to a skilled nursing facility. In addition, individuals must require skilled nursing care or therapy services daily. It is important to understand the purpose of a skilled nursing facility is not nursing home care. The SNF is not a place of convalescence after surgery or a traumatic event. SNF is for intense therapy; the term ends when the therapy ends or can be continued as an outpatient.

Limitations & Restrictions on Nursing Homes in Medicare Advantage

Limitations & Restrictions on Nursing Homes in Medicare Advantage

While Medicare Advantage plans may offer coverage for nursing home care, it’s important to be aware of any applicable limitations or restrictions. For example, the plan may require prior authorization to continue treatment beyond twenty days. Patients and/or family members often want the nursing home stay prolonged. The plan, however, will not approve any more days because the person has completed the treatment or has reached a plateau in her recovery.

This can cause distress because the person is not ready to be alone at home. Their home is not adequately equipped with ramps or lifts. No one can attend to the patient without significant expense or inconvenience during her continued recovery.

Medicare Advantage plans are managed care plans. They carefully monitor treatment following Medicare’s criteria. The point is to protect from waste or abuse of the limited resources from the Medicare trust fund while also providing the proper care.

Medicare Advantage Is Bad Insurance

In my experience, this situation is exasperated when SNF billing personnel complain to patients and their families that Original Medicare is not as strict as the Medicare Advantage plans in monitoring and restricting treatment. I probably get this phone call once a year. “You sold me the wrong Medicare plan!”

restricting treatment. I probably get this phone call once a year. “You sold me the wrong Medicare plan!”

Patients and families are already in extreme distress because of the medical situation of their loved ones. I find it cruel and unprofessional to burden the family with medical billing challenges, mainly because nothing can be done to change the immediate circumstances of their insurance.

Skilled Nursing Facilities are also far from impartial and unbiased. Their monetary gain is significant if they can keep patients for the full 100 days and bill for therapy versus only 20 or even 30 days.

The reality is therapy has come to an end. The patient can be cared for at home, and treatment may continue with home healthcare. Medicare is health insurance and is not designed for caretaking, food preparation, maid service, and companion care.

People, however, observe that nursing homes are full of people who are cared for in this manner. Those individuals pay for that custodial service out of their own pocket or have long-term care (LTC) insurance. Or they are indigent and on state Medicaid. The citizens then of the county where they reside are paying the monthly rate.

Tips for Choosing the Right Medicare Advantage Plan for Nursing Home Coverage

If you choose to go the direction of Medicare Advantage instead of Original Medicare with a Medicare Supplement, understanding the place of nursing home coverage in a Medicare Advantage plan is important.

If you choose to go the direction of Medicare Advantage instead of Original Medicare with a Medicare Supplement, understanding the place of nursing home coverage in a Medicare Advantage plan is important.

Here are some tips to help you navigate the process:

1. Consider the specific nursing home coverage options offered by each plan. What are the copays for which days?

2. Review the costs associated with nursing home care in each plan. We have 22 Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas. Put them side-by-side.

3. Research the network of skilled nursing facilities covered by each plan. Have the agent look up the skilled nursing facilities you would be most interested in. Make sure they are in the network.

4. Consider the reputation and customer satisfaction ratings of the insurance companies offering Medicare Advantage plans. Medicare has a star rating system: 5-star is best; 1-star is worst.

5. Look at ancillary insurance products that may fill in the gaps that Original Medicare or Medicare Advantage do not cover, like Long-Term Care; Home Care; Cancer, Heart Attack, and Stroke policies.

6. Consult with an independent and impartial insurance agent who can act as a broker for both Medicare Advantage plans in your area as well as Medicare Supplements.

The Bottom Line: Making informed decisions about nursing home coverage in Medicare Advantage plans

All insurance, even Medicare, has rules, limitations, and restrictions. Healthcare, especially when it comes to critical illness, is expensive. When caring for our loved ones, understanding the nursing home coverage options in Medicare Advantage plans is essential. By exploring the different types of nursing home services covered, eligibility requirements, and potential limitations or restrictions, you can make informed decisions to ensure your loved one receives the care they need.

Christopher J. Grimmond

Omaha Insurance Solutions offers Medicare Supplements and Medicare Advantage plans from all major insurance companies. We can explain the plans, the differences, the pros & cons, so you can determine what is the best fit for you. Your health needs change over time, so we review your plan annually to ensure you have the best Medicare plan that meets your unique needs. Call us at 402-614-3389 to speak with an experienced and licensed insurance agent profession.