Medicare ClaimsCategory:

Prior authorization has arisen as an issue for Medicare Advantage Organizations (MAO)—insurance companies—and Medicaid–states. According to consumer claims, consumers are denied needed coverage unnecessarily. You can imagine the pain and hardship this causes. What if there was a Medicare prior authorization tool providers, insurance companies, and patients could use to communicate with one another?

Prior authorization has arisen as an issue for Medicare Advantage Organizations (MAO)—insurance companies—and Medicaid–states. According to consumer claims, consumers are denied needed coverage unnecessarily. You can imagine the pain and hardship this causes. What if there was a Medicare prior authorization tool providers, insurance companies, and patients could use to communicate with one another?

Congress recently conducted hearings on prior authorization denials, and the Department of Health & Human Services (DHHS), which is the ultimate supervising authority for Medicare (CMS) and Medicaid, issued a final rule that offers a partial solution to the problem.

DHHS initiated the creation of a Medicare prior authorization tool to speed up the process and reduce errors when it comes to prior authorizations for medically necessary treatments and procedures.

The DHHS Final Rule

The DHHS mandated the establishment of a standardized electronic platform for exchanging medical and billing information between payers (insurers and states—for Medicaid), providers, and consumers. All three will be able to see prior authorizations while in process in real-time and interact with one another.

Doctors will see their prior authorization submission as the payer (insurance company) processes the prior authorization. They will see if codes are incorrect or documentation is missing; if denied, doctors will see the reasons.

Payers will see additional information added and corrections made to the prior authorization requests in real-time. They can track the prior authorization because there is a timeline they all can see.

Payers can see the medical history and even similar prior authorizations approved or denied for the patient from the past.

Payers can better coordinate with other payers when other insurance companies may be involved.

Consumers can see that the doctor’s office is actually submitting the prior authorization and where the request is in the process rather than calling the provider to check-in.

DHHS aims to create a more efficient, responsive, and transparent system than the current process for prior authorization. This electronic platform will be for

- Medicare

- Medicaid

- Affordable Care Act (ACA) Marketplace

- CHIP (Children’s Health Insurance Program)

The platform is called Application Programming Interfaces (API). While it will be for government-sponsored health plans and not private insurance, like employer health plans, these types of institutional changes usually trickle down to the private sector eventually.

What’s on the Application Programming Interfaces (APIs)?

What’s on the Application Programming Interfaces (APIs)?

Providers, payers, and consumers will be able to look up:

- Medical items and services that require prior authorization.

- Required documentation for the plan to make a prior authorization decision.

- Current status of a prior authorization decision.

The API (Application Programming Interface) will be the Medicare prior authorization tool that allows providers and payers to communicate quickly and easily and consumers to monitor the process.

The prior authorization details available through the APIs will include:

- Prior authorization status

- Date of approval or denial of a prior authorization request

- Date or circumstance when the prior authorization ends.

- What items or medical services were approved

- Reason for denial: if denied

- Administrative and clinical information submitted by a provider.

This could also include information about past prior authorization decisions beneficial for a patient who is required to obtain prior authorization again for the same service when switching health plans.

Medicare Prior Authorization Timeframes

Currently, Medicare Advantage Plans can take up to 14 calendar days for a standard decision. Expedited decisions must be completed within 72 hours of the request for medical treatment.

With the final rule, prior authorization timeframes were shorted to 7 calendar days, and the same 72-hour rule was used to expedite prior authorization decisions.

Reasons For Denial

Reasons For Denial

The plans must explain the denial to the provider and patient through the APIs. This was not always done, especially if the denial was for miscoding or lack of supporting documentation.

Now, the patient can see the denial. They do not need to rely upon the doctor’s office to explain what the insurance company did or didn’t do, particularly if the provider’s back office did not provide adequate documentation. Everyone can see what the other one is doing or not doing.

Everyone can also see what can be done to appeal or overturn the denial.

Public Reporting of Medicare Prior Authorization Because of the Tool

Insurance companies will be required to report their denial ratios on their website. Consumers will be able to see how often insurance carriers deny prior authorizations and thus determine which Medicare Advantage plan or other government-sponsored programs to choose.

The hope is that Medicare Advantage Organizations (MAO) will be motivated to improve the prior authorization processes through education, better technology, and more efficient and robust systems.

robust systems.

The data required to be listed on the payer (insurance company) website will be:

- List of all items and services that require prior authorization.

- Percentage of standard and expedited prior authorization requests approved & denied (aggregated for all items and services)

- Percentage of standard prior authorization requests that were approved after appeal.

- Percentage of standard and expedited claims where decision timeframes were extended, followed by a request approval.

- Average and median timeframes between a prior authorization request and a decision for standard and expedited prior authorization requests.

Implementation January 2027

As with any government legislation and systemic changes, time is required. The DHHS final rule set January 2027 as the effective date for the proposed regulations.

Building a system as large as the API takes time to provide an effective and robust tool for the Medicare prior authorization process.

Bottom Line: Medicare Prior Authorization Tool

I find this awesome. Too many times, consumers are in the dark. All they know is they can’t get their treatment. They do not know the truth.

Is this something Medicare covers? Did the doctor’s office submit the request correctly, and did they fight to approve it? Is the insurance company being unreasonable? Can I do anything?

It is hard to bluff when everyone can see everyone else’s cards. Light is the best disinfectant for an infection.

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Medicare Advantage plans, or Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Parts A and B) and often include additional benefits such as prescription drug coverage and dental, vision, and hearing services.

We will delve into the specific circumstances in which a Medicare Advantage plan requires prior authorization and could potentially deny coverage, the appeals process for denied claims, and what steps you can take to ensure you receive the coverage you need. By understanding the ins and outs of Medicare Advantage plans, you can make an informed decision about your healthcare coverage. So, let’s unlock the truth together and navigate the world of Medicare Advantage plan prior authorization.

What is the Purpose of Prior Authorization?

Prior authorization (or Pre-Authorization) is a utilization management tool used to contain costs. It consists of a third party, usually employed by the insurance company, making determinations about a request for service. The third party, who may be a doctor, nurse, or non-medical staff, approves or denies a request based upon predetermined criteria.

• Is the service covered?

• Is it a duplicate?

• Does the request contain the proper codes and supporting documentation?

• Is the service “medically necessary” as defined by CMS’s standard of care?

The purpose of Medicare Advantage plans requiring prior authorization is to ensure that the medical procedures are necessary and that the payer (insurance company) and patient are not wasting money.

Health care involves a great deal of money. There are three primary interested parties: the patient, who wants to pay as little as possible, the doctor, who provides a service for a fee, and the insurance company, which protects the patient from overwhelming healthcare costs for a premium.

Each has different and conflicting interests. Each is making a cost-benefit analysis to determine if the activity is worth it.

The patient wants good care for minimal cost. The doctor wants to be paid as much as possible for skills and services rendered. The insurance company wants to provide protection at the lowest cost to itself to maximize profit. Each is attempting to protect its interests. The insurance company uses prior authorization to make sure the service is, in fact, medically necessary so it does not waste money on unnecessary services.

The tradeoff is that prior authorization creates a barrier that potentially delays care and adds to its cost. There is also the potential that needed healthcare is wrongly delayed or withheld.

Medicare Advantage Utilizes Prior Authorization

Like commercial health insurance your employer purchases for employees, Medicare Advantage requires prior authorization for a majority of procedures, tests, and treatments, especially the more costly treatments. If approval is not granted, the insurer does not pay. There is an appeal process; however, many do not utilize the appeal process.

Traditional Medicare does not employ utilization management tools like prior authorization except in a few instances. The lack of any supervision of the medical necessity of services and payments has resulted in some high-profile cases of fraud, waste, and abuse. The only mechanism to combat abuse is self-reporting, whistle blowers, and fraud hotlines.

Optimally, prior authorization deters patients from getting care that is not truly medically necessary, reducing costs for both insurers and enrollees. Prior authorization requirements, however, can also create hurdles and hassles for beneficiaries and their physicians and may limit access to both necessary as well as unnecessary care. It also adds the burden of expense to providers who pay staff to work with insurance companies through the prior authorization process.

Data suggests that Medicare Advantage members save an average of $1,965 per year in total health expenditures compared to fee-for-service Traditional Medicare. Medicare Advantage members have lower hospitalization rates and fewer readmissions than their Traditional Medicare counterparts.

Does Original Medicare Utilize Prior Authorization?

From its inception, Traditional Medicare (Original Medicare) has not used prior authorization. There was little, if any, oversight until the electric wheelchair scandal.

A Washington Post article published in August 2014 highlighted the massive fraud of Medicare’s resources. The article chronicled the sensational scams and trials of many Medicare swindlers. The outrageous theft of public funds and the massive fraud shamed CMS to amend its regulations to finally require pre-authorization for some “durable medical equipment,” i.e., electric wheelchairs.

Bureaucrats inside CMS admitted they knew how the wheelchair scheme worked as early as 1998. However, it was not until 15 years later that officials finally did enough to curb the practice significantly. Durable medical equipment—electric wheelchairs—is the only exception to the “reasonable and necessary” practice. They must be preapproved.

The Government Accountability Office (GAO) examined a prior authorization program that CMS ran in seven states in 20212. During the short duration of the program, Medicare saved $1.9 billion. The GAO recommended that CMS continue to study the subject and implement a prior authorization program for all of Original Medicare in its 2018 published study. CMS discontinued the program.

The Effect of Medicare Advantage Denials

The Effect of Medicare Advantage Denials

There may be severe consequences when a Medicare Advantage Organization (MAO) denies authorization for a procedure.

- Patient access to medical care is delayed or denied.

- Potentially, it results in the patient paying out of pocket for something Medicare should have covered.

- It causes an administrative burden for the patient and providers because they must devote resources to an appeal.

None of these have positive consequences and are a cause of frustration with Medicare Advantage for some.

How Common is Medicare Advantage Prior Authorization Denials?

The Kaiser Foundation examined CMS data from MAOs from 2021. They found that more than 35 million prior authorizations were submitted to Medicare Advantage insurers. Over 2 million prior authorization requests were fully or partially denied by the insurance companies.

The percentage of prior authorization requests and denials depends upon individual plans. They are not identical. Of the 2 million denials, some were partial denials, totaling 380,000.

Partial denials would be, for example, physical therapy sessions. The physician requests 10 sessions, but only 5 are granted. That leaves 1.6 million prior authorizations completely denied. The average for Medicare Advantage plans as a whole was less than 6 percent, with individual MAO falling slightly above or below that average.

How About Appeals of Prior Authorization Denials?

Each Medicare Advantage plan has an appeal process. Data from the same group revealed that only 11 percent (or 212,000) of appeals were made, including partially and fully denied requests. The insurance companies overturned 82 percent (or 173,000) of the appeals.

insurance companies overturned 82 percent (or 173,000) of the appeals.

The high number of repeals was cause for concern. Are Medicare beneficiaries being unjustly denied services? Are the insurance companies creating unfair obstacles to reduce costs?

The study’s data, however, do not describe in detail the causes of the denials. In general conversations with insurance carriers, the authors discovered that prior authorizations are denied for a number of common reasons.

- Incorrect coding and insufficient documentation

- Less intrusive or costly services were not first tried.

- The provider was not in the network

- Service is not covered

- Human error

All of these reasons may result in a denial of service, but the data does not identify the various causes, some of which are easily rectified upon review or appeal.

We have thousands of clients who call us when there are issues. I am amazed at how often the provider’s back office does not file the proper paperwork, use the correct codes, or include essential documentation such as X-rays or tests.

Then, when the pre-authorization is denied, the insurance company is blamed, and the subject is dropped. The back office is understaffed, doesn’t have the time, and doesn’t sufficiently understand the insurance company’s processes, so they cut their losses and move on to other cases. Sometimes, the provider moves on to the less costly treatment, knowing that it will be immediately approved.

How Many Are Denied Coverage Unnecessarily?

The Office of Inspector General (OIG) for the Department of Health & Human Services published a report in April 2022 regarding the denial of medically necessary services by some Medicare Advantage Organizations (MAO). The study discovered that MAOs denied services to Medicare beneficiaries on some MAO plans even though the prior authorization request did meet the standard for Medicare coverage rules.

The OIG study sample was taken from 15 of the largest MAOs during the week of June 1-7, 2019. The sample size was 500—250 prior authorizations and 250 denials of claims. Eventually, the number was reduced to 430 as the data was further sifted.

The OIG dug into the details of each of the 430 cases. In the course of the review of the cases, OIG found a conflict in the standards.

Conflict in Standards

CMS has its own guidance regarding the standard of care. The MAOs, however, have developed their own internal clinical criteria that go beyond Medicare coverage rules even though the case would pass CMS’s standards. In the past, CMS has left the MAOs to develop their own criteria where CMS is unclear. For example, a less intrusive or costly treatment may be required before a more expensive service is authorized by the MAO. Physical therapy may be more appropriate first before an MRI is prescribed.

Second, MAOs indicated that some prior authorization requests did not have enough documentation to support approval, yet OIG reviewers found that the existing beneficiary medical records were sufficient to support the medical necessity of the services.

On payment requests, the OIG found that the MAOs denied 18 percent of the cases that would have met the Medicare coverage and MAO billing rules. Most of these payment denials in the sample were caused by human error during manual claims processing reviews (e.g., overlooking a document) and system processing errors (e.g., the MAO’s system was not programmed or updated correctly).

In the end, OIG determined that 13 percent of the 250 prior authorization cases studied should not have been denied based upon CMS stands (or approximately 32 individuals).

How Many Denied Coverage Should Be Approved?

If we combine the two studies, Kaiser Foundation and Office of Inspector General for the Department of Health & Humana Services—we actually get an idea of who should have been approved.

The Kaiser Foundation consists of 35 million prior authorizations, with less than 2 million being denied, which is a 5 percent denial rate.

The OIG’s study discovered that only 13 percent of those denied should have been approved.

So, when we apply the average of 13% of wrongly denied prior authorization requests to the 2 million denials in the Kaiser study, that is approximately 260,000 individuals who should have been approved but were not out of 36 million prior authorization requests.

That means out of 36 million prior authorization requests, only 0.7 percent were wrongly denied coverage. In other words, 99.3 percent of prior authorizations are processed correctly.

I find that an incredibly high degree of accuracy.

Appeals and Reconsiderations for Denied Coverage

The appeals process for denied coverage with Medicare Advantage plans involves several levels, each with its own deadlines and requirements. Understanding these steps can help you navigate the process effectively and increase your chances of a successful appeal.

Redetermination

The first level of appeal is the “Redetermination” process. You must submit a written request to your Medicare Advantage plan within a specified timeframe, usually 60 days from the date of the denial letter. Include all relevant documentation and explain why you believe the service or procedure should be covered. The plan must review your appeal and provide a written decision within 30 days.

Reconsideration

If your appeal is denied at the redetermination level, you can proceed to the second level, known as a “Reconsideration.” This involves submitting a request to an independent review entity contracted by Medicare within 60 days of receiving the redetermination denial. The review entity will conduct a thorough review of your case, including any additional evidence you provide, and issue a written decision within 60 days.

Administrative Law Judge

If your appeal is still denied at the reconsideration level, you have the option to request a hearing before an administrative law judge (ALJ). This request must be made within 60 days of receiving the reconsideration denial. The ALJ will hold a hearing, either in person or by video conference, where you can present your case. The ALJ will issue a written decision within 90 days.

Medicare Appeals Council

If you are dissatisfied with the ALJ’s decision, you can further appeal to the Medicare Appeals Council. This request must be made within 60 days of receiving the ALJ’s decision. The council will review your case and issue a written decision.

Federal District Court

The final level of appeal is to seek judicial review in a federal district court. This step involves filing a lawsuit against the Medicare Advantage plan in a federal court. It’s important to consult with legal counsel if you reach this stage, as the process can be complex.

Bottom Line: Medicare Advantage Prior Authorization Is a Required Tool

No one writes a blank check. When money is being spent, there is oversight. When there is a lot of money from a lot of people, there will be a lot of accountability. The Medicare Advantage oversees that taxpayers’ and beneficiaries’ money is spent in accordance with the norms and procedures that CMS has laid down. Medicare Advantage requires prior authorization to protect resources and clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

Currently, no one has complete and adequate data to give an accurate idea of inappropriate Medicare Advantage denials, but the data and studies recently done show that the level of error is incredibly low.

Are you feeling lost and confused about Medicare Advantage prior authorization? You’re not alone. Navigating the healthcare system can be overwhelming, especially regarding insurance processes. But fear not—we are here to demystify it all for you.

Are you feeling lost and confused about Medicare Advantage prior authorization? You’re not alone. Navigating the healthcare system can be overwhelming, especially regarding insurance processes. But fear not—we are here to demystify it all for you.

This comprehensive guide will delve into everything you need to know about Medicare Advantage prior authorization. From understanding what it is, why it’s necessary to learn how it works, and the steps involved, we’ll break it down in simple terms. There will be no jargon, no confusing terms—just clear and concise information.

What is Prior Authorization?

Prior authorization is a process used by insurance companies to determine whether they will cover a specific medical procedure, treatment, or prescription drug. It is required for certain services to ensure that they are medically necessary and cost-effective.

Why is Prior Authorization Necessary?

Prior authorization prevents unnecessary medical procedures, reduces healthcare costs, and ensures patients receive appropriate care. Insurance companies can control expenses and ensure that resources are allocated efficiently by reviewing and approving or denying requests for certain healthcare services.

Problems With Medicare Advantage Prior Authorization

However, prior authorization can be complex and time-consuming. It requires healthcare providers to submit detailed information about the patient’s condition, medical history, and proposed treatment plan. The insurance company then reviews this information to determine whether the requested service meets its coverage criteria.

While prior authorization can be beneficial in some cases, it can also lead to delays in care and administrative burdens for both healthcare providers and patients. There are many elements, moving parts, and hands that touch a prior authorization request. Thus, the process is ripe for mistakes, misunderstandings, and delays. Understanding the process and requirements can help you navigate this system more effectively.

Prior Authorization Process for Medicare Advantage

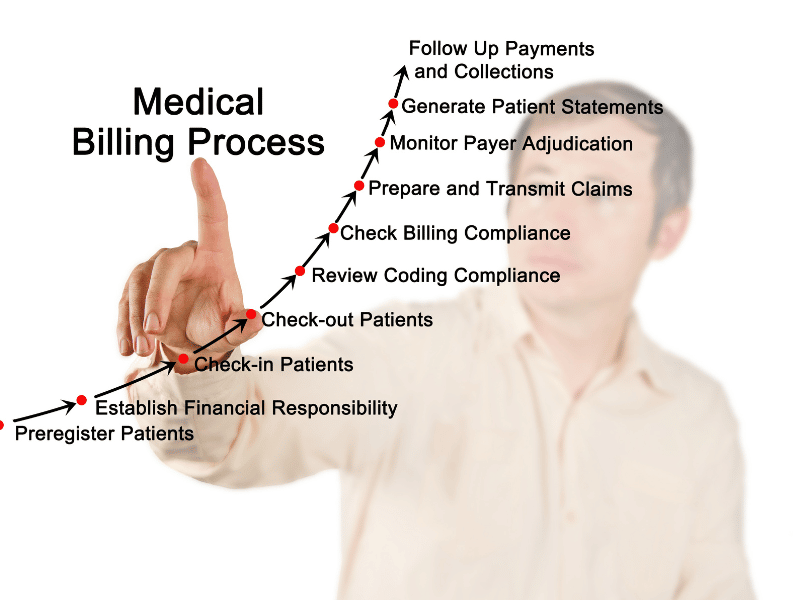

Obtaining prior authorization for Medicare Advantage plans involves several steps. Here’s a breakdown of the process.

Consultation with Healthcare Provider

The first step is to consult with your healthcare provider. They will determine if the service or treatment you need requires prior authorization and initiate the process on your behalf.

Submission of Prior Authorization Request

Once your healthcare provider has determined that prior authorization is necessary, they will submit a request to your insurance company. This request includes all the necessary documentation, such as medical records, test results, and treatment plans. This is where I see problems arise. The doctor’s back office uses incorrect codes, forgets test results, and the doctor’s notes are missing essential language. Then, the request is denied.

Review by the Insurance Company

The insurance company will review the submitted request and evaluate the medical necessity of the service requested. It may also consider factors such as cost-effectiveness and alternative treatment options.

Approval or Denial

Approval or Denial

The insurance company will either approve or deny the prior authorization request based on their evaluation. If approved, you can proceed with the recommended treatment. If denied, you have the option to appeal the decision. The additional problem is the insurance company does not give a reason for the denial, so the provider is clueless about where to begin. The carrier is not required to give a reason, so the provider needs to commit more resources to find out what is needed or let it go.

Appeals Process

You can appeal the decision if your prior authorization request is denied. This involves providing additional documentation or evidence to support the medical necessity of the requested service. The insurance company will review your appeal and make a final determination.

necessity of the requested service. The insurance company will review your appeal and make a final determination.

It’s important to note that the prior authorization process may vary slightly depending on your specific Medicare Advantage plan and the services you need. For detailed information about the process, consult with your healthcare provider, insurance company, and Center for Medicare & Medicaid Services (CMS).

Standard Medicare Procedures & Services Requiring Prior Authorization

Prior authorization is typically required for certain medical procedures, treatments, and prescription drugs. While the specific requirements may vary depending on your Medicare Advantage plan, here are some standard procedures and services that often require prior authorization.

Prior authorization is typically required for certain medical procedures, treatments, and prescription drugs. While the specific requirements may vary depending on your Medicare Advantage plan, here are some standard procedures and services that often require prior authorization.

Specialized Surgeries

Complex surgical procedures, such as organ transplants or bariatric surgery, often require prior authorization. This ensures that the procedure is medically necessary and appropriate for the patient’s condition.

High-Cost Medications

Certain prescription drugs, especially those with high costs, may require prior authorization. This helps insurance companies manage expenses and ensure patients receive appropriate medications.

Imaging Tests

Advanced imaging tests like MRI or CT scans may require prior authorization. This ensures that these tests are necessary and will provide valuable information for diagnosis or treatment.

Physical Therapy or Rehabilitation Services

Medicare Advantage plans often require prior authorization for physical therapy, occupational therapy, or other rehabilitation services. This helps ensure that these services are appropriate and will contribute to the patient’s recovery.

I have found that skilled nursing facility care is very difficult to get approved, especially if the stay exceeds the initial twenty days. The impasse is a combination of the skilled nursing facilities (SNF) refusing to submit for a patient with a Medicare Advantage plan. Many SNFs will not even consider submissions for stays beyond twenty days. Some seem to not know how to properly submit a reauthorization or claim. From the insurance company’s side, their restrictions seem overly prohibitive. This has been a huge source of complaints to CMS and Congress.

Durable Medical Equipment

Durable Medical Equipment

Equipment such as wheelchairs, oxygen tanks, or home healthcare supplies may require prior authorization. This ensures that the items are medically necessary and will improve the patient’s quality of life. CMS has a significant history of fraud, waste, and abuse regarding durable medical equipment.

It’s important to check with your specific Medicare Advantage plan to understand which procedures and services require prior authorization. Your healthcare provider can also provide guidance based on your individual needs.

Benefits of Medicare Advantage Prior Authorization

While the prior authorization process can be perceived as burdensome, it offers some benefits for patients and insurance companies. Here are a few advantages of Medicare Advantage prior authorization:

- Cost control: Prior authorization helps insurance companies control healthcare costs by ensuring that services are medically necessary and cost-effective. This helps keep premiums affordable for all members.

- Appropriate care: Prior authorization ensures that patients receive appropriate care by evaluating the medical necessity of requested services. This helps prevent unnecessary procedures or treatments that may not be beneficial.

- Improved outcomes: By reviewing and approving requests for certain healthcare services, insurance companies can help ensure that patients receive the most effective and evidence-based treatments. This can lead to improved health outcomes and better quality of life.

- Resource allocation: Prior authorization helps allocate healthcare resources efficiently by ensuring that they are used for the most appropriate and effective services. This helps prevent overutilization of healthcare services and ensures that resources are available for those who need them.

While there are benefits to prior authorization, it’s important to acknowledge the challenges and drawbacks of the process as well.

Challenges & Drawbacks of the Medicare Prior Authorization Process

While prior authorization serves a purpose in the healthcare system, it has its challenges and drawbacks. Here are some common challenges that patients and healthcare providers may encounter.

Prior Authorization Administrative Burden

The prior authorization process can be time-consuming and requires healthcare providers to gather and submit extensive documentation. This administrative burden can take away valuable time that could be spent on patient care.

Dr. Jesse M. Ehrenfeld, M.D., president of the AMA (American Medical Association), says,

The need to right-size prior authorization has never been greater—mountains of administrative busywork, hours of phone calls, other clerical tasks that are tied to this onerous review process. It not only robs physicians of face time with patients, but studies show that it contributes to physician dissatisfaction and burnout.

Delayed Care

Prior authorization can sometimes lead to delays in care, as the review process may take time. This can be frustrating for patients who need immediate treatment or services.

Starting in 2026, CMS is shortening the time frames for prior authorization decisions. Insurance payers must respond within 72 hours for an expedited or urgent request and seven calendar days (not business days) for a standard request.

Denial of Coverage

Denial of Coverage

There is always a risk of prior authorization requests being denied. This can be disappointing for patients hoping to receive a particular treatment or procedure.

Lack of Transparency

Insurance companies may have different criteria and guidelines for prior authorization, leading to confusion and lack of transparency. Patients and healthcare providers may struggle to understand the reasons for a denial or how to navigate the process effectively.

Dr. Jesse M. Ehrenfeld, M.D. describes the problem of the lack of transparency with the insurance companies.

When a request is denied, we often don’t know why. We don’t tell you the reasoning behind the denial. It can take hours and hours to appeal a decision. And then sometimes you wait weeks or even months for a peer-to-peer consult.

The CMS final rule will require insurers to provide specific, very specific denial reasons and public reporting of metrics. How often do they approve? How often do they deny things? How long does it take for a process to actually give a result for a request?

Insurers will also be required to share that information with patients, so that our patients can become informed decision makers when they buy health insurance on the exchanges and make planned decisions. That’s going to begin in 2026 and will go a long way in bringing much-needed transparency and accountability to the entire process.

Appeals Process

While the option to appeal a prior authorization denial exists, it can be a lengthy and complex process. Patients may need to provide additional documentation and evidence to support their case, which can be challenging and time-consuming.

In the efforts to improve the Medicare Advantage prior authorization process, CMS will require, according to Dr. Ehrenfeld,

Plans to support an electronic prior authorization process that’s embedded in the physician’s electronic health records, bringing much needed automation and efficiency to our current very manual and very time-consuming workflow. That change is going into effect in 2027—it’s going to be a game-changer for everybody.

So having direct integration of prior authorization into the EHR (electronic health record) is going to significantly reduce the burden on physicians. And this is where so much of that $10 to $15 billion in savings is going to come from.

Despite these challenges, some strategies and tips can help you navigate the prior authorization process more effectively.

Navigating the Prior Authorization Process Effectively

Navigating the Prior Authorization Process Effectively

Navigating the prior authorization process can be overwhelming, but with the right strategies, you can streamline the process and ensure a smoother experience. Here are some tips to help you navigate prior authorization effectively:

Understand your Medicare Advantage Plan

Familiarize yourself with your Medicare Advantage plan’s specific requirements and guidelines. This will help you understand which procedures and services require prior authorization and what documentation is needed. This is important because you may have to be the force behind the doctor’s office to pursue approval beyond the initial request.

Communicate with Your Healthcare Provider

It is crucial to communicate openly and clearly with your healthcare provider. They can guide you through the prior authorization process, provide necessary documentation, and advocate for your needs. The office needs to see that you want the procedure or test because they have limited resources to pursue further requests or appeals from the insurance company.

Gather All Necessary Documentation

Before submitting a prior authorization request, ensure you have all the necessary documentation. This may include medical records, test results, treatment plans, and any additional information requested by your insurance company. If you can assist in the process, then dig in. You may also have to be the supervising authority to make sure the office’s back office submits all relevant materials.

Be Proactive

Start the prior authorization process as early as possible to avoid delays in care. Submit your request well in advance of your scheduled procedure or treatment to allow ample time for review. Doctor’s offices are usually overworked and understaffed. To ensure you are taken care of in a timely way, contact the office yourself to see where your prior authorization is in the process. Ask for dates when you should expect tasks to be completed by the doctor’s office and insurance company.

Keep Copies of All Documents

Make copies of all documents related to the prior authorization process, including your request, supporting documentation, and any communication with your insurance company. This will help you stay organized and provide evidence if needed for an appeal. The documents are your records. You and the insurance company paid for the tests, and you have a right to your own copies.

Follow Up with Your Insurance Company

Stay proactive and follow up with your insurance company to ensure your prior authorization request is processed. This will help you stay informed and address any issues or concerns in a timely manner. Everyone is busy. Balls are dropped. People forget. You make sure none of that happens with your case because you are on it.

How to Appeal a Prior Authorization Denial

If your prior authorization request is denied, you have the option to appeal the decision. Here’s a step-by-step guide on how to appeal a prior authorization denial.

- Understand the denial: Carefully review your insurance company’s denial letter. Understand the reasons for the denial and the specific requirements for appealing the decision.

- Gather additional documentation: If you believe that the denial was made in error or that additional information could support your case, gather all the necessary documentation. This may include medical records, test results, or a letter of medical necessity from your healthcare provider. Your provider will need to perform most of this work.

- Submit an appeal letter: Write a formal appeal letter to your insurance company. Generally the doctor will need to draft and submit the letter. He will need to more clearly state the reasons for your request, provide supporting documentation, and explain why you believe the requested service is medically necessary.

- Follow up with your insurance company: This is where you can help the process. Stay in contact with your insurance company to ensure your appeal is processed. Follow up regularly. You will be able to follow up more readily than the provider’s office. Get any additional information or documentation requested.

Remember, the appeals process may take time, and no approval is guaranteed. However, following these steps and providing compelling evidence increases your chances of a favorable outcome.

Bottom Line: Understanding Medicare Advantage Prior Authorization May Determine Your Success

In conclusion, understanding and managing Medicare Advantage prior authorization is crucial for both patients and healthcare providers. While the process can be complex and time-consuming, it ensures that healthcare services are medically necessary and cost-effective.

By familiarizing yourself with the prior authorization process, understanding your Medicare Advantage plan requirements, and effectively communicating with

your healthcare provider and insurance company, you can navigate this system with confidence and ease.

Remember to stay proactive, gather all necessary documentation, and be prepared to advocate for your needs. In the event of a denial, don’t hesitate to appeal and seek assistance if needed.

Empower yourself with knowledge and take control of your healthcare journey. With the right information and resources, you can successfully navigate Medicare Advantage prior authorization and receive the care you need.

Finding a Medicare approved chiropractor can be a daunting task, especially if you’re dealing with chronic pain or a specific condition requiring specialized care. Knowing where to turn for effective treatment is crucial. That’s where our comprehensive guide comes in, dedicated to helping you navigate the world of Medicare approved chiropractors near you with ease.

Finding a Medicare approved chiropractor can be a daunting task, especially if you’re dealing with chronic pain or a specific condition requiring specialized care. Knowing where to turn for effective treatment is crucial. That’s where our comprehensive guide comes in, dedicated to helping you navigate the world of Medicare approved chiropractors near you with ease.

In this article, we’ll walk you through the process of finding local chiropractors near you who are covered by Medicare. You’ll learn about the specific criteria that chiropractors need to meet to be Medicare approved, ensuring you receive the best chiropractic care near you.

We’ll also provide tips on finding chiropractors in your area who accept Medicare, saving you valuable time and energy. From understanding Medicare coverage for chiropractic services to reviewing online directories and seeking referrals, we’ll cover it all.

Whether you’re new to Medicare or simply need a chiropractor who accepts this insurance, our guide will equip you with the knowledge and resources necessary to make informed decisions about your chiropractic care. Stay tuned for valuable insights and expert advice in the pages ahead.

Understanding Medicare Coverage for Chiropractic Services

Medicare coverage for chiropractic services can be complex, and it’s essential to understand what is and isn’t covered before seeking treatment. Chiropractic care falls under Medicare Part B, which covers medically necessary services and preventive care.

To be eligible for Medicare coverage, chiropractic services must meet specific criteria. Firstly, the treatment must be considered medically necessary, meaning it is aimed at diagnosing or treating a specific health condition. Additionally, the chiropractor must be a Medicare approved provider, and they must accept assignment. This means they agree to accept the Medicare approved amount as full payment for their services.

The process with Medicare Advantage plans is similar to Original Medicare. Each plan must approve the chiropractor to be in the network. There is a credentialing process providers go through to be accepted into the plan’s network. As part of the acceptance, they agree to the plan’s payment amounts.

It’s worth noting that Medicare only covers manual manipulation of the spine to correct a subluxation. Other services, such as acupuncture or massage therapy, are not covered under Original Medicare. Some Medicare Advantage plans may cover additional benefits, like acupuncture. Understanding these limitations will help you make informed decisions about your chiropractic care and plan.

The Importance of Choosing a Medicare Approved Chiropractor

The Importance of Choosing a Medicare Approved Chiropractor

Choosing a Medicare approved chiropractor is crucial for several reasons. Firstly, it ensures that the chiropractor meets the necessary standards and qualifications Medicare sets. This gives you peace of mind, knowing you’re receiving care from a professional vetted by a trusted authority. That is for those who are on Original Medicare, which is Medicare Part A and Part B.

professional vetted by a trusted authority. That is for those who are on Original Medicare, which is Medicare Part A and Part B.

Medicare Advantage plans are managed care plans. The insurance company that runs the Medicare plans contracts with networks of doctors, health networks, hospitals, other healthcare facilities, and health professionals, like chiropractors. Each company and Medicare plan has its own vetting process called credentialing.

Secondly, choosing a Medicare approved chiropractor or in-network provider ensures that your services will be covered by Medicare or the particular Medicare Advantage plan in your area. This is particularly important if you’re relying on Medicare or Advantage plans to help with the cost of your chiropractic care. By selecting an approved provider, you can avoid unexpected out-of-pocket expenses.

Lastly, Medicare approved chiropractors have experience working with Medicare patients and navigating the complexities of billing and reimbursement. This means they are well-equipped to handle the administrative aspects of your care, allowing you to focus on your health and well-being.

How to Find Medicare Approved Chiropractors Near You

Finding Medicare-approved chiropractors in your local area is easier than you might think. Here are a few tips to help you get started:

Use the Medicare.gov Physician Compare tool. This online directory allows you to search for chiropractors in your area who accept Original Medicare. Simply enter your location and select “chiropractor” as the specialty to find a list of Medicare approved chiropractors near you.

Use the Medicare.gov Physician Compare tool. This online directory allows you to search for chiropractors in your area who accept Original Medicare. Simply enter your location and select “chiropractor” as the specialty to find a list of Medicare approved chiropractors near you.

If you are on a Medicare Advantage plan, you can do the same with any of the insurance companies that sponsor a Medicare Advantage plan. The three largest plans in the Omaha, Lincoln, and Council Bluffs metro areas are United Healthcare, Aetna, and Humana. Go to their provider search tools on the plan website or downloadable their app on your phone. You can find all the chiropractors near you who accept the plan in order of distance from you.

you.

Check with your primary care physician. Your primary care physician may be able to recommend chiropractors who accept Medicare. They can provide valuable insights based on their knowledge of your medical history and specific needs.

Ask for referrals. Reach out to friends, family, or colleagues who have received chiropractic care with Medicare coverage. They can provide recommendations and share their experiences, helping you make an informed decision. Then check the chiropractor on one of the provider search tools.

Factors to consider when selecting a chiropractor

Factors to consider when selecting a chiropractor

When selecting a chiropractor, there are several important factors to consider. These include:

1. Qualifications and credentials: Ensure that the chiropractor is licensed and has the necessary qualifications to provide chiropractic care. This includes checking their educational background, certifications, and any additional training they may have undergone.

2. Experience: Look for a chiropractor with experience treating your specific condition or dealing with similar cases. This can help ensure they have the expertise necessary to provide effective care.

3. Communication and bedside manner: A good chiropractor should communicate effectively, listen to your concerns, and make you feel comfortable throughout the treatment process. Pay attention to their communication style and how well they address your questions and concerns.

4. Treatment approach: Chiropractors may use different treatment approaches, so finding one whose approach aligns with your preferences and needs is important. Some chiropractors may focus on manual adjustments, while others may incorporate additional therapies or techniques.

By considering these factors, you can select a chiropractor who not only meets the Medicare-approved criteria but also aligns with your specific needs and preferences.

Medicare Billing & Reimbursement for Chiropractic Services

Understanding Medicare billing and reimbursement for chiropractic services can be complex. Medicare typically covers 80% of the Medicare approved amount for chiropractic services after you have met your annual deductible. This means you will be responsible for the remaining 20% as well as any applicable copayments or coinsurance. Medicare Supplements will fill in the gaps with Original Medicare. Medicare Advantage plans will probably have specific copays.

To ensure proper billing and reimbursement, it’s crucial to choose a chiropractor who accepts assignment. This means they agree to accept the Medicare-approved amount as full payment for their services. If the chiropractor does not accept assignment, you may be responsible for paying the difference between the Medicare-approved amount and their actual charges.

If on a Medicare Advantage plan, make sure he accepts that particular plan. Again consult the provider search tool the plan provides and/or ask the provider.

It’s also important to keep in mind that Medicare has specific documentation requirements for chiropractic services. The chiropractor must provide documentation that supports the medical necessity of the services provided. This documentation is crucial for proper billing and reimbursement. When clients call me complaining a service was denied, mistakes, lack of documentation, or incorrect billing codes are the usual reason. The medical office needs to correct any errors to receive approval and payment.

Common Misconceptions about Medicare Coverage for Chiropractic Care

There are several common misconceptions about Medicare coverage for chiropractic care. It’s important to debunk these misconceptions to ensure you clearly understand what is and isn’t covered. Here are a few common misconceptions:

1. Chiropractic care is covered without restrictions: While Original Medicare and Medicare Advantage plans do cover chiropractic care, it is subject to specific criteria. The treatment must be medically necessary and aimed at correcting a subluxation of the spine.

2. All chiropractors accept Medicare, and all insurance companies offer Medicare Advantage. Not all chiropractors accept Medicare or every Medicare Advantage plan in the area. Verifying that the chiropractor you choose is a Medicare-approved provider and in the network is vital.

3. Medicare covers all chiropractic services: Medicare only covers manual manipulation of the spine to correct a subluxation. Additional services, such as acupuncture or massage therapy, are not covered by Original Medicare.

3. Medicare covers all chiropractic services: Medicare only covers manual manipulation of the spine to correct a subluxation. Additional services, such as acupuncture or massage therapy, are not covered by Original Medicare.

By understanding these misconceptions, you can make informed decisions about your chiropractic care and avoid unexpected expenses.

The Bottomline: Take Control of Your Healthcare with Medicare Approved Chiropractors

Navigating the world of Medicare-approved chiropractors doesn’t have to be overwhelming. With the information and resources provided in this guide, confidently search for chiropractic care that meets your needs and is covered by Medicare near you.

Remember to understand the specific criteria for Medicare coverage, choose a Medicare approved chiropractor, and ask the right questions during consultations. By staying informed and utilizing available resources, you can take control of your healthcare and receive the quality chiropractic care you deserve. We can help you sort through the confusion at Omaha Insurance Solutions. Give us a call at 402-614-3389 to speak with an experienced and licensed insurance agent professional.

Christopher J. Grimmond

Whether seeking relief from chronic pain or improving your overall well-being, Medicare approved chiropractors near you are here to help. Take the first step towards better health by exploring your options and finding a chiropractor who meets your needs. Your journey to wellness starts now.

Medicare has had an exciting history with prior authorization. Medicare prior authorization has become controversial over the years because of Medicare Advantage.

Have You Always Been Subject to Prior Authorization?

Health plans started using prior authorization in the 1960s. Hospital admittance grew after the creation of Medicare and Medicaid. At the same time, more employers began offering employees health insurance as part of their compensation package. Medical costs grew significantly, particularly hospital stays.

Insurance companies began implementing utilization reviews in the 1960s. Utilization reviews were a process to reduce the overutilization of resources and identify waste. Registered nurses initially performed utilization reviews in hospital settings. The skillset gained popularity within the health insurance industry as research grew around medical necessity, misuse, and overutilization of services.

Health plans reviewed claims for medical necessity and hospital length of stay. Health plans began to require physicians to certify the admission and subsequent days after admission to help contain costs. Prior authorization originated from the use of utilization reviews.

Fast-forward to the present day. You were subject to prior authorization when you entered the workforce and received employer-provided group health insurance as a benefit. The insurance company determines if it is “medically necessary” and covered by the policy your company purchased when you have any medical procedure. Then there is further discussion about the appropriate charges. Whether or not you were aware of it, prior authorization has always been part of your health insurance coverage.

Why Do Insurance Companies Use Prior Authorization?

Prior authorization is a medical management tool. Doctors and insurance companies work together to ensure that a specific treatment or service is the best option for the patient’s needs.

The purpose of prior authorization is to identify and discourage unnecessary and costly low-value services to reduce wasteful spending without impeding quality healthcare services.

Prior authorization, supervision, audits, and other compliance tools help identify and root out fraud, waste, and abuse in the healthcare system. The ultimate purpose is to reduce costs for the consumer and prevent unnecessary treatments.

The Department of Justice announced today (Feb 17, 2021) criminal charges against 138 defendants, including 42 doctors, nurses, and other licensed medical professionals, in 31 federal districts across the United States for their alleged participation in various healthcare fraud schemes that resulted in approximately $1.4 billion in alleged losses.

The charges target approximately $1.1 billion in fraud committed using telemedicine, $29 million in COVID-19 healthcare fraud, $133 million connected to substance abuse treatment facilities or “sober homes,” and $160 million connected to other healthcare fraud and illegal opioid distribution schemes across the country.

While most doctors, medical professionals, and medical facilities are honest and act with integrity, an element will always and continually seek illicit gain costing consumers and taxpayers untold amounts. This results in higher insurance premiums and medical costs. It is naive to believe all are good actors and that every recommended treatment and service is the best fit.

Why Does Original Medicare Not Use Prior Authorization?

In part, the Medicare prior authorization controversy is that “Original Medicare” does not require prior authorization for most procedures, and Medicare Advantage does. (Original Medicare is just Medicare Part A and Part B. The payment structure is called fee-for-service. Medicare Advantage (or Part C) is Medicare administered by a private insurance company contracted and approved by Medicare.)

At first glance, you probably ask, ‘Why does Original Medicare not require prior authorization’ because prior authorization is common practice in the health insurance world? No company will leave the decision to spend potentially tens of thousands of dollars, even millions, to one person without some oversight.

When Medicare was established, Congress included certain arrangements and excluded others. In Section 1862(a)(1)(A) of the Social Security Act:

“No payment may be made under Part A or Part B for any expenses incurred for items or service which . . .. are not reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed member . . ..”

The key phrase is “reasonable and necessary.” “Reasonable and necessary” has been interpreted over the years very broadly. If a submitted claim is in an allowed category and not excluded, the submission is “reasonable and necessary.”

The doctor authorizes an MRI of the shoulder because the patient complains of problems. MRIs are covered. This procedure is “reasonable and necessary” because it is not an uncommon practice, even if there may be less expensive diagnostic procedures or treatments.

As you can probably guess, this broad interpretation with no oversight or accountability will result in large amounts of fraud, waste, and abuse.

Why Is Medicare Advantage Prior Authorization So Controversial?

The short answer to why is that Original Medicare doesn’t require prior authorization. The controversy is some believe beneficiaries are being denied essential medical services and treatments. Beneficiaries and medical professionals do not even attempt to overturn denials because they believe the appeal process is so burdensome.

The facts, however, do not paint such a sad picture. The Office of the Inspector General reviewed a large number of Medicare Advantage Organizations (MAO), reviewing 448 million preauthorization requests in 2016. Of those, MAOs denied about 1 million preauthorization requests for a denial rate of 4 percent—4 percent is tiny.

The September 2018 Office of Inspector General report found that Medicare Advantage Organizations (MAO) overturned 75 percent of their own denials from 2014-2016, overturning approximately 216,000 yearly. During that same period, independent reviews discovered additional requests that had been inappropriately denied.

The most surprising finding, however, is that only one percent of beneficiaries and providers appealed their denial, which raised the question: how many were denied necessary treatment because the process is so arduous?

Unfortunately, the study does not give a coherent explanation of the denials. From my experience of doing Medicare planning for a decade with thousands of beneficiaries, doctors’ offices do not always submit requests with detailed documentation in support. When the request is denied, they blame the insurance company, and the effort stops unless the patient pushes the issue.

The other reason I find for denial is the doctor’s office uses the wrong billing code. Quite often, the insurance company does not give any explanation in those cases. The response is “denied.” The solution requires the doctor’s office to call and talk with the claims department about billing codes, documentation, and supporting tests. In the absence of these items, nothing happens.

Unfair Statistics and Sensational Journalism

The Department of Health and Human Services Office of Inspect General (OIG) conducted a study of Medicare Advantage Organizations’ (MAO) denial of prior authorizations during one week (June 1-7, 2019). In that week, there were 250 denials. The OIG discovered that 13 percent of these prior authorizations were incorrect. This amounted to 33 cases.

Later in the same report, they admitted the usual national average is 5 percent. No reason was given why the study was not expanded when the conclusions from their study did not coincide with other long-standing evidence, particularly when the study was so microscopic–one week and 250 cases.

In the same study, they did not review the cases where the prior authorization was approved when it should have actually been denied. There was also no control group to compare against. The OIG did not study fee-for-service Medicare billing for fraudulent or wasteful claims or denials on their part.

The New York Times piled on in an April 2022 article. They presented a very slanted view of the study, beginning the article with “Medicare Advantage plans often deny needed care, federal report finds.” Only toward the very end of the article did the author get into any of the facts of the report. The general impression during the first half of the article is Medicare Advantage denies its clients the necessary medical care they need.

Why Are Medicare Prior Authorization Denials Overturned?

Denials may be overturned for many reasons. First, there were errors on the part of the insurance company. The decision was incorrect.

Errors on the part of the doctor’s office or medical facility. They did not include sufficient documentation or incorrect information. The denial is reversed, then. The provider may add new information from additional tests in the appeal process that contributes to an overturn.

The overturn does not necessarily mean the MAO acted inappropriately, but the process and extra steps critics claim create friction in the system. Patients may wish to avoid going through the trouble of appeal. Doctors may not make recommendations because of a history of denials.

Did Medicare Ever Use Prior Authorization?

The Medicare practice of accepting bills from providers at face value without question as “reasonable and necessary” was an established and haloed practice from the beginning of Medicare. All parties who benefited the most—except U.S. taxpayers—were unmotivated to change until the wheelchair scandal.

In 1999 it was discovered that Medicare spent $8.2 billion to procure power wheelchairs and “scooters” for 2.7 million people. A large portion was paid to scammers because they discovered that Medicare not only did not require prior authorization for wheelchairs, but Medicare did not even review the authenticity of the claims.

A Washington Post article published in August 2014 highlighted the massive fraud of Medicare’s resources. The article chronicled the sensational scams and trials of many Medicare swindlers. The outrageous theft of public funds and the massive fraud shamed CMS to amend its regulations to finally require preauthorization for some “durable medical equipment,” i.e., electric wheelchairs.

Bureaucrats inside CMS admitted they knew how the wheelchair scheme worked as early as 1998. But it was not until 15 years later that officials finally did enough to curb the practice significantly. Durable medical equipment—electric wheelchairs—is the only exception to the “reasonable and necessary” practice. They must be preapproved.

Consequently, hundreds of millions of false and unnecessary claims were paid over many years in a massive Medicare fraud. Once the bureaucratic problem was fixed, and claims were more thoroughly reviewed, an enormous shift occurred. Medicare reimbursements for motorized wheelchairs fell from $32 million every month to $7 million—a 78 percent decrease.

The Medicare Claims System Is Designed for Fraud, Waste, & Abuse

By law, Medicare must pay most of its claims within 30 days. In that short window, it is supposed to filter out the fraud and uncover claims where the diagnosis or the prescription is bogus.

The system attempts to ameliorate the damage through a “pay and chase” policy. The bill is paid, then it is reviewed. Only a tiny fraction of claims — 3 percent or less — are reviewed by a live person before they are paid. The rest are reviewed only after the money is spent. If at all.

The whole Medicare claims process is set up as an honor system for the richest program managed by the U.S. government. It is a thief’s dream.

Medicare Prior Authorization Test Program

In March 2017, CMS (Center for Medicare & Medicaid Services) designed a test program for preauthorization for fee-for-service Original Medicare. In the month of March, the GAO (U.S. Government Accountability Office), in a Senate report, estimated a savings of $1.1 to $1.9 billion when preauthorization was used that month. The report estimated the federal government made an estimated $36.2 billion in improper payments for the Medicare fee-for-service program from July 2015 to June 2016.

The committee’s recommendation became the report’s title— “CMS Should Take Actions to Continue Prior Authorization Efforts to Reduce Spending.” The prior authorization programs created to monitor and measure improper payments were discontinued and never recommissioned.

Original Medicare Fee-For-Service vs. Medicare Advantage

The government created Medicare in 1965. It had been a long-time project of the Democratic Party. CMS (Center for Medicare & Medicaid Services), Department of Health & Human Services, and Social Security Administration are government agencies. Politicians of all political parties exercise control and funding over these agencies and programs. The agencies are staffed by thousands of bureaucrats and government union workers. A tremendous amount of various and conflicting self-interests, power, and money are all mixed together.

To save Medicare from ballooning budgets and to offer an alternative to citizens, the same politicians, programs, and agencies partnered with private insurance companies to control spending and improve patient care. What is now known as Medicare Advantage began back in the 90s.

The two ways of doing government healthcare for seniors are in competition. Politicians view the world through different ideologies and support policies and programs based upon their political views. Those who support the various political ideologies will support or attack these two platforms accordingly.

It is vital to find all the relevant facts, make your own comparisons and analysis, and determine where lies the truth and the better path.

I changed how I do my meetings with new clients. I set up their My Medicare login before they leave my office because . . . .

Client Problem

A client called me because he had an unpaid bill. He claimed the insurance company with his Medicare Supplement policy would not pay his hospital bills.

I tend not to react anymore until I have the whole story from all the sources. I said, “Ok, let’s call the insurance company.”

We got a customer service representative on a three-way phone call. The rep said they had received bills from the hospital, but the bills didn’t have Medicare approval and coding. The insurance company requested the hospital send the proper codes, but the hospital didn’t reply.

Medicare Determines What Is Paid

The customer service rep said the insurance company was not refusing to pay; instead, they couldn’t pay until Medicare sent the approval with the proper codes. Then the insurance company would happily pay its portion.

After we got off the phone with the insurance rep, I translated what happened to my client.

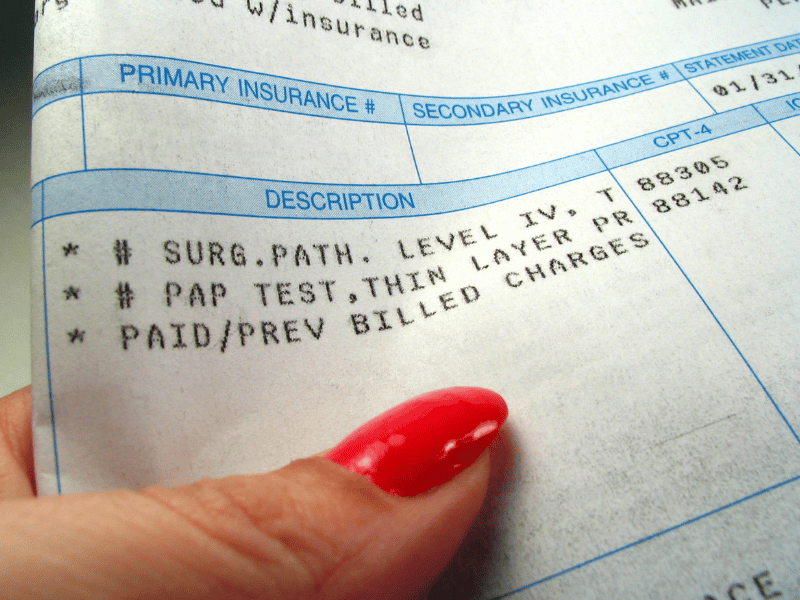

How Medicare Billing Works

The hospital is supposed to send the claims to Medicare first, not the insurance company. Medicare determines everything. Medicare already has a schedule of payments for specific procedures. Medicare determines whether the procedure is “medically necessary.” If it is medically necessary, Medicare pays the predetermined fee, which also has a procedural code. You can view the claims through your My Medicare Login.

Medicare Summary Notice (MSN)

Medicare will also send a Medicare Summary Notice (MSN) to you with what was covered, paid, or not paid. You can appeal any claims Medicare refuses to pay at this time. You can also file your own Medicare claims through this portal.

Then Medicare forwards the claims to the insurance company with the necessary coding. The insurance company receives the claim and knows precisely what to pay based on the code. The insurance company sends the money to the provider within 48 hours of receiving the claim from Medicare.

The system is beautifully flawless—usually.

Instead, it sounded like someone at the hospital must have been new, poorly trained, or mistakenly sent the bill to the wrong place.

When the hospital did not receive payment, they did the easy thing and blamed the insurance company and sent the bill to the patient rather than looking at what they did wrong.

Unfortunately, I had to send my client back to the hospital to have them forward the seven-month-old bills to Medicare.

My Medicare Login Is the Solution

Something I am doing now when I meet with clients for the last time is setting up their My Medicare login. Everyone on Medicare has a My Medicare login and an online account with Medicare.

MyMedicare.gov is especially important for clients on Original Medicare (Part A & B only) and a Medicare Supplement/Medigap policy because your bills are sent directly to Medicare, and you can view the transactions on your MyMedicare.gov online account. There is a section called Medicare Summary Notices (MSN). The claims are all there, and how they were handled.

For those on Medicare Advantage (Part C) plans, you can see your bills on your online account with your specific insurance company.

How to Pay Medicare Premium?

On MyMedicare.gov, you can see the claims sent to Medicare, print out your Medicare card, and pay your Medicare Part B premium online if you are NOT getting a Social Security check. It is an excellent tool for everyone on Medicare.

Click on the icon for Pay Part B Premium. You can put in your banking information to pay your premium monthly if you are not receiving Social Security benefits.

Login to Medicare Bills

Everyone should login to their My Medicare account. For the client who thought his Medicare Supplement company was not paying, if he had logged into his My Medicare online account, he could have quickly seen the bills were never sent to Medicare.

Please call us at 402-614-3389 if you need help setting up your My Medicare login for your online account. I want my clients to have the best Medicare insurance experience possible.

Beneficiary Assignment For Medicare Claims

Beneficiary Assignment For Medicare Claims

The provider or institution will file a Medicare claim most of the time. They must file the claim within twelve months of service, but there may be some instances when it doesn’t happen. Your healthcare provider cannot file the claim, or they won’t. Some providers and suppliers do not take assignment for Medicare or are not enrolled with Medicare. Some choose not to certify with Medicare. It would be best if you then did the filing.

I would also ask your Medicare insurance agent for help.

Can I Submit a Claim Directly To Medicare?

Here is how to file Medicare claims, so you don’t get stuck with the bill.

Check your Medicare Summary Notice (MSN) each month. Sometimes providers and suppliers forget to file or are slow. Others do not enroll with Medicare or take Medicare assignment because they want more than what Medicare reimburses.

Rare circumstances may require you to file, like a shipboard medical incident, travel between the lower 48 states through Canada to Alaska, and events across the border in Mexico.

It will be your responsibility to remind the provider to bill Medicare. You will need to file the Medicare claim yourself if the provider refuses.

How To File Your Own Medicare Claim

The Medicare form to complete is Patient’s Request for Medical Payment (CMS-1490S), which you can find on the Medicare and CMS websites.

A successful reimbursement would be helped if you listed the reasons for the medical care. You must identify the cause of the ailment. For example, the injury was work-related, auto accident, dialysis, kidney transplant, etc. Instruction on how to fill out a Medicare claim form is attached to the form.

How To File A Medicare Claim As A Patient with Other Insurance

You must document any other health insurance, such as an employer’s health plan, including a spouse’s health plan. Any Medigap policy or Medicaid must be listed. Veterans Administration (VA) is another example during the process of filing a Medicare claim.

You must document any other health insurance, such as an employer’s health plan, including a spouse’s health plan. Any Medigap policy or Medicaid must be listed. Veterans Administration (VA) is another example during the process of filing a Medicare claim.

HIPPA For Medicare

The form should include supporting documentation, such as the itemized bill. The bill will probably contain the necessary details. Still, if not, you will need to provide the date of service, doctor’s contact information, etc. You may also wish to include the HIPPA form, so there is no communication difficulty between the entities, including your spouse. All of this is necessary to file a Medicare claim.

Local Social Security Office

Local Social Security Office

Christopher Grimmond

You submit the paperwork to the local Social Security office that handles these claims. You cannot do this online. The Medicare website has the contact information for your local office. It is included in the Patients Request for Medicare Payment (CMS-1490S). Beneficiaries are required to file claims within twelve months of the occurrence. Otherwise, it will be rejected.