HospiceCategory:

Is Hospice Care Covered by Medicare?

Is Hospice Care Covered by Medicare?

When a loved one receives a terminal diagnosis, they’re typically given an average of six months to live. The next step is to find a place that can meet those special needs. While this is devastating news, the next logical step is to seek out options regarding hospice care to ensure a comfortable transition as their health continues to decline. Of course, figuring out how to pay for hospice care is part of that step. For those on Medicare, how much does Medicare cover for hospice care?

Understanding Medicare’s Hospice Care Coverage

Medicare, the federal health insurance program for individuals age 65 and over, offers coverage for hospice care under Part A. This coverage is available to eligible beneficiaries who have a terminal illness and have a life expectancy of six months or less. Medicare’s hospice care coverage includes a range of services, such as medical and nursing care, pain management, counseling, and medication.

To be eligible for Medicare hospice care, individuals must also be enrolled in Medicare Part A and have their doctor certify that they have a terminal illness with a life expectancy of six months or less. Additionally, individuals must sign a statement choosing hospice care instead of other Medicare-covered benefits for their terminal illness.

How Does Medicare Pay?

Medicare provides financial assistance for hospice care through its hospice benefit under Part A. Medicare Part A covers medications, medical equipment, nursing care, and counseling. The hospice provider is reimbursed directly by Medicare, and the provider must be Medicare-approved to receive reimbursements from Medicare. Beneficiaries are not responsible for any copays.

medical equipment, nursing care, and counseling. The hospice provider is reimbursed directly by Medicare, and the provider must be Medicare-approved to receive reimbursements from Medicare. Beneficiaries are not responsible for any copays.

Medicare’s payment structure for hospice care is based on a per diem (daily) rate. This means that Medicare pays a fixed amount to the hospice provider for each day that an individual is enrolled in hospice care. The per diem rate varies depending on the level of care provided. There may be higher rates for individuals receiving continuous home care or inpatient respite care.

However, it’s important to note that Medicare’s hospice benefit does not cover room and board in a hospice facility. If a beneficiary chooses to receive hospice care in a hospice facility, they may be responsible for paying the room and board costs out of pocket. Alternatively, if a beneficiary receives hospice care at home, Medicare will cover the cost of necessary medical equipment and supplies.

Medigap & Medicare Advantage with Hospice Care

Medigap & Medicare Advantage with Hospice Care

Medicare Part A covers everything hospice-related. Patient costs are copays for hospice-covered medications and respite care. The copay for hospice medications is no higher than $5. Medicare Part A covers 95% of respite care for persons who have taken responsibility for the dying patient. The patient would be responsible for 5% of the costs.

If an individual has a Medigap policy, the Medigap policy would cover the hospice medications and the coinsurance for respite care. Medicare Advantage would continue to cover everything as before, but it would not normally cover the hospice medication copay or respite coinsurance payment.

It is important to note that there are many other medical costs for hospice patients during their time–non-hospice doctors, hospital beds, emergency room visits, ambulances, oxygen, walkers & wheelchairs, and other non-hospice medications, etc. These expenses fall under Original Medicare and the Medigap policy or Medicare Advantage. Hospice care does not cover these other medical needs. It is important to understand this fact.

Once time the daughter of a client called me to let me know her mother was going into hospice. One of the hospice workers told her to save money by canceling her Medigap policy. I tried to explain there were other medical costs her mother would incur from doctors and other providers, but she was convinced it was an unnecessary expense. Unfortunately, they don’t find out about their mistaken decisions until after the fact and the bills roll in.

Eligibility Requirements for Medicare Covered Hospice Care

To be eligible for Medicare hospice care, individuals must meet certain requirements. First, they must be enrolled in Medicare Part A, which provides hospital insurance coverage. Second, they must have a terminal illness. Terminal is defined as a life expectancy of six months or less, as certified by their doctor. Finally, they must sign a statement choosing hospice care instead of other Medicare-covered benefits for their terminal illness.

A beneficiary can stop hospice care at any point. They are not obliged to remain in hospice once they sign the statement.

It’s important to note that individuals can still receive Medicare hospice care even if they are enrolled in a Medicare Advantage plan. Medicare Advantage plans are private health insurance plans that provide Medicare benefits. You don’t lose Part A when you enroll in a Medicare Advantage plan. It is Part A that pays for hospice, even when you are enrolled in a Medicare Advantage plan.

How Long Does Medicare Pay for Hospice Care?

Once you are certified at the terminal with approximately six months or less of life expectancy, your doctor may recertify you. There are usually two 90-day periods and then every 60 days. You do not need to recommit to hospice. The doctor determines that you are still terminal with a six-month or less time period to live. You can remain in hospice almost indefinitely if you meet the criteria.

The Bottom Line: How Long Does Medicare Cover Palliative Care?

Christopher Grimmond

A quarter of the Medicare budget each year goes to cover the last year of Medicare beneficiaries’ lives. That is an incredible number. Hospice care is an essential part of Medicare.

The practice of hospice exists to provide comfort and optimal quality of life to individuals approaching the end. Medicare provides peace of mind that medical bills will be paid and that care will be provided uninterrupted. As long as a person continues to be certified for hospice, Medicare will continue to cover hospice care. You can be assured Medicare will be there for them the entire time.

Hospice is a difficult time. I have gone through this with both of my parents and with hundreds of clients. Contact us at Omaha Insurance Solutions to speak with a caring insurance professional about your Medicare needs. We are a call away at 402-614-3389.

Does Medicare Cover Hospice?

Does Medicare Cover Hospice?

Many people are still not very familiar with Medicare and hospice. It is actually a fairly new idea. The “end of life movement” began in the ’70s. (The “end of life movement” is separate and distinct from the Euthanasia movement and organizations, like the Hemlock Society.) Medicare did not cover Hospice when Medicare started in 1965. Medicare and hospice were only put together in 1982 as part of the Tax, Equity, and Fiscal Responsibility Act under President Reagan in response to a growing awareness of end of life concerns. The legislation was an attempt to fill the gap in care. Awareness was growing in the country of the importance of what transpired at the end of life.

A Happy Death Is Not A New Idea

I remember when I was a teenager. My father was up before me in the mornings. He would take me to school on his way to work. I would see him praying when I came into the kitchen in the morning. One time I asked him what he was reading. It was a small devotional booklet. He was praying the novena to St. Joseph for a “Happy Death.” I was startled by the subject matter.

Teenagers don’t think much about death unless forced. I had a buddy, Herbert Woltz, killed in a motorcycle accident my senior year in high school. That was my abrupt intro to death.

I asked my father why pray for such a crazy thing as a “happy death”? The two subjects were oxymoronic to me. What’s happy about death? He reminded me that is how the Hail Mary ends. “Pray for us . . . now and at the hour of our death. Amen.”

After birth, he said, death is the most important event in your life. The difference, however, is you’re aware of what’s going on in the end, and you make the most important decisions of your life at “the hour of your death.” Praying for a “Happy Death” is about minimizing the pain and maximizing your moment of entrance into eternity. You’re asking for God and all the heavenly hosts to be at your side to handle the fear, pain, discouragement, and loneliness a person faces when approaching death and the moment of death.

I didn’t think much about what my father shared until many years had gone by and many friends and family members had passed away, including my dad. Medicare and hospice are something with which I have had extensive experience. Now I know why you would want to pay for a “happy death.”

End of Life Care Is Different

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

While I was there, I got to know the sisters. They were remarkable young ladies. The convent was inside the hospice facility. The nuns lived, prayed, and worked with their dying residents around them twenty-four hours a day. The Hawthorne Dominicans were some of the happiest people I ever met.

Their foundress, Rose Lanthrop-Hawthorne, was the youngest daughter of the famous author, Nathanial Hawthorne, and a convert to Catholicism. In her day, cancer patients were put on an island in New York harbor–Blackwell Island–because it was believed that cancer was contagious. Many people, especially the poor, died in incredible misery, isolation, and squalor.

Medicare and hospice were a century away. Rose, like Mother Teresa of our time, saw the face of Jesus in the poor, and she started a ministry to the dying among the poor immigrants of the New York slums. The Hawthorne Dominicans is a purely American woman’s religious order. Most woman’s religious orders in our country came from Europe originally.

End of Life Care Rediscovered With Hospice & Medicare

The end of life movement in our time found its origin during a 1967 lecture at Yale University by Cicely Saunders. She introduced the idea that the dying needed specialized care that served their unique situation. She later founded St. Christopher’s Hospice in London.

Dr. Elisabeth Kubler-Ross, MD research into death and dying identified five stages terminally ill patients go through. Her popular and groundbreaking book, On Death & Dying, fueled a movement to deal with issues of death and dying.

In 1972 she testified at the first national hearings on death with dignity conducted by the U.S. Senator Special Committee on Aging. Organizations, like The National Hospice and Palliative Care Organization (NHPCO), sprang up to study and promote awareness around the end of life issues. Finally, because of raised public interest and concerns, Medicare added hospice care to the list of services provides in 1982.

Medicare And Hospice Are Huge

In 2014 approximately 2.6 million people died in the US. Of those deaths, 80% were on Medicare. Medicare is the largest insurer for persons during the last year of life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

Today, hospice is an important benefit for terminally ill Medicare beneficiaries. Currently, nearly half of Medicare beneficiaries receive hospice benefits before their deaths. Medicare is the primary source of payment for hospice care in this country. Yet, hospice still remains somewhat of a mystery, and Medicare beneficiaries know very little about what Medicare does with hospice until they are forced into the situation.

How Does Medicare Cover Hospice?

Hospice is defined as a program of care and support for people who are terminally ill. Terminally ill means a life expectancy of six months or less. The primary goal of hospice in Medicare is to help terminally ill people live a comfortable life and manage their pain and discomfort. Hospice care is palliative care versus skilled nursing and home health care. That is, it is not designed to cure the patient, but rather to aid the person in the dying process. Because hospice care is so intimately involved and in such a big way with Medicare beneficiaries, understanding Medicare and hospice is essential.

Prayer to St. Joseph

O St. Joseph whose protection is so great, so strong, so prompt before the throne of God, I place in you all my interests and desires. O St. Joseph do assist me by your powerful intercession and obtain for me from your Divine Son all spiritual blessings through Jesus Christ, Our Lord; so that having engaged here below your heavenly power I may offer my thanksgiving and homage to the most loving of fathers. O St. Joseph, I never weary contemplating you and Jesus asleep in your arms. I dare not approach while He reposes near your heart. Press Him in my name and kiss His fine head for me, and ask Him to return the kiss when I draw my dying breath. St. Joseph, patron of departing souls, pray for us. Amen.

John Joseph Grimmond 1934-2013 R.I.P.

What Is Medicare Hospice?

Medicare pays for hospice, but what is hospice exactly?

Medicare defines hospice as a program of care and support for people who are terminally ill. Terminal illness, as Medicare definites it, is a life expectancy of six months or less. The primary goal of hospice in Medicare is to help terminally ill people live a comfortable life and manage their pain and discomfort. Hospice care is palliative care versus skilled nursing and home health care. Hospice does not cure the patient but rather aids the person in the dying process.

Death & dying is an area most people do not wish to ponder, so there are many misconceptions about Medicare-covered hospice care.

What Medicare Hospice Is Not?

Hospice is not a place. When my mother was terminally ill with ovarian cancer, I was thinking of taking her to a place.

When I was in college in the 80s, I had volunteered in a hospice facility run by the Hawthorne Dominican sisters. The hospice facility was an actual place people went to die. The nuns took care of everything: medical, personal care, food & lodging; and patients stayed there until the end.

That is what I had in mind when the doctors spoke to my family about hospice for our mother. That is not, however, how Medicare thinks of hospice.

Medicare does not pay for a hospice facility that provides room & board unless the care is tied to something like a skilled nursing facility. Medicare does, however, pay for hospice personnel and the medications they administer during hospice.

Where Do You Go For Hospice?

Hospice can be given virtually anywhere. A Medicare beneficiary can receive hospice at a hospital, hospice in a skilled nursing facility, hospice in an assisted living residence, and hospice at home. Medicare will pay for hospice care in assisted living, nursing homes, and other facilities if it is a Medicare-approved facility.

The end of life movement that started in the ’70s sees passing at home as the ideal. Most Medicare patients, when surveyed, prefer hospice in the home. That is where people feel most comfortable, but because of the level of care required, hospice care may have to move to a hospital in the last few days or another location.

Hospice can be given virtually anywhere.

Medicare.gov

What Kind of Illness Makes You Hospice Eligible?

When we think of hospice, we usually think of cancer, but there are other illnesses that result in hospice.

Grandpa Joe was 98. Grandpa had beaten cancer 4 times, lockjaw, and the Second World War. Dying didn’t seem possible. He had always been there, and we grandkids assumed he would always be there. Terminal illness and Grandpa Joe didn’t fit.

When Grandma Hilda announced to the family, Grandpa had congestive heart failure and was going into hospice, it didn’t quite register with us grandkids.

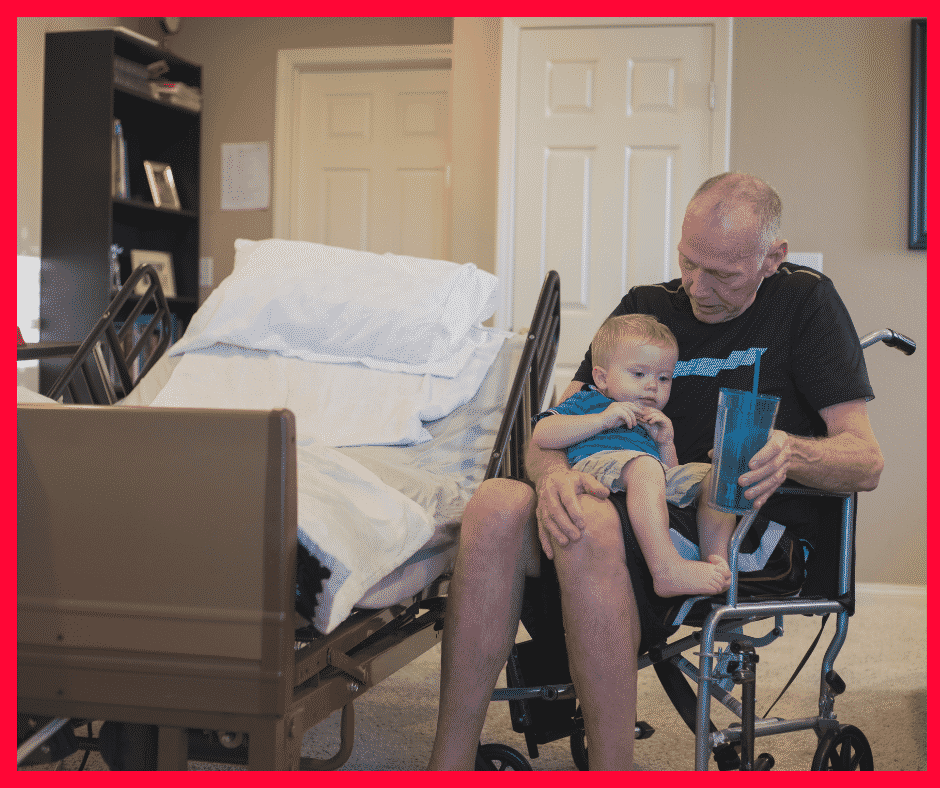

Grandpa Joe seemed the same old Grandpa Joe. When I was home from college, we chatted about the Cornhuskers, baseball, and politics. Nothing seemed to have changed, but there was a procession of nurses and therapists who came in and out of their home.

When Grandma Hilda finally called to tell us Grandpa had passed in his sleep, his death hit me like a sledgehammer.

Grandpa’s passing was hard on everyone, but Medicare providing and paying for hospice lightened the burden, especially for my parents and grandparents.

Who Can Go Into Hospice?

Hospice is also not exclusively for the old. I have a number of clients who are in their twenties and thirties. Not everyone on Medicare is sixty-five and older, though the majority are.

Accidents or illnesses permanently disabled some, and some are terminal. Hospice is for them too.

How Much Is Hospice?

Hospice care is not expensive for those on Medicare. Medicare pays for the vast majority of the hospice costs under Medicare Part A with very little out-of-pocket costs. Medications, some equipment, and nurses are covered.

Like I said earlier, hospice does not usually include custodial care or housekeeping. That can be very costly if the family cannot provide that type of care themselves.

How Do You Get Medicare To Pay For Hospice?

A Medicare beneficiary is eligible for Medicare’s hospice care benefit if she is entitled to Medicare Part A and meets the following conditions.

- The hospice doctor and the person’s regular physician certify that the person is terminally ill with a life expectancy of six months or less if the illness runs its

expected course.

expected course. - The person accepts palliative care for comfort instead of care to cure her illness.

- The person must sign a statement choosing hospice care instead of other Medicare-covered treatments for her terminal illness and related conditions.

- The care is provided by a Medicare-certified hospice agency.

When these 4 critical are met, Medicare pays for hospice. At any time, a person may choose to exit hospice.

Is Hospice Euthanasia?

Hospice does not accelerate the dying process.

I have had people describe hospice to me as akin to euthanasia where someone actively terminates a life. Hospice is not euthanasia or assisted suicide. You do not intentionally cut short a person’s life. Hospice is about allowing the dying process to take its natural and inevitable course without assistance. Hospice care is about alleviating the suffering and providing comfort while the person dies.

An uncle of mine was a retired Omaha police captain. Uncle Bill had a severe stroke with many complications. He was put on a ventilator.

Uncle Bill was a strong and courageous individual. A vegetative existence was not for him not to mention impoverishing his wife with medical bills. He ordered the ventilator turned off.

Without the ventilator, he would quickly stop breathing. He knew it. The doctors made him as comfortable as possible with heavy sedation. His body fought hard against the loss of breath.

We gathered around his hospital bed. Over the course of a day, he passed peacefully from this life to next surrounded by his loving wife and children.

Hospice Is Up To You

I’ve known many individuals over the years who have gone on hospice for a time. Instead of dying, their health improved, or they resumed a normal life and quit hospice because the decline stopped. You are free to remove yourself from hospice at any time.

Hospice Is Also For The Living

Hospice is the option when all other alternatives have been exhausted. It is the option to bring the highest possible quality of life to a person’s remaining time. The hope is family members will look back on their time and know that everything was done to preserve, prolong, and then peacefully say goodbye.

While you may struggle with the challenge of terminal illness, the end of your life and hospice is as much about your loved ones as it is about you. Watching you suffer and your family’s grief afterward will be their burden. Dying is equally about them. Understanding that there is something for them as well as you in a scary time can give you all hope that the last great challenge in life will be a little less daunting.

While hospice ends with a patient’s death, family grief counseling can continue for up to a year. Medicare pays for that hospice care too.

One’s mortality is difficult to face, but the chance you will go on Medicare hospice at the end of your life is more than 50%. That is an extraordinary number, so having confidence Medicare will pay for hospice is critical.

Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Do you or a loved one need hospice care in a skilled nursing facility? Understanding Medicare coverage for this essential service is crucial for maximizing benefits and ensuring quality end-of-life care. This article will explore some of the ins and outs of hospice coverage I didn’t know when my mother was in hospice. We discuss the question of whether Medicare pays for hospice in a skilled nursing facility.

Navigating the complex world of healthcare can be overwhelming, especially when faced with a difficult situation like imminent death like I experienced with my mother. That’s why I’m here to break it down for you. I’ll explain what hospice care entails, how it differs from other types of care, and, most importantly, what Medicare covers. With this information, you can be confident in your ability to advocate for yourself or your loved one and ensure that all available resources are utilized.

At Omaha Insurance Solutions, information is power regarding healthcare decisions. We aim to make complex topics accessible, providing you with the tools you need to confidently navigate the healthcare system. So, let’s dive in and discover how Medicare can support you during a challenging time.

What is Hospice Care & Who is Eligible?

Hospice care focuses on providing comfort and support to individuals in the final stages of a terminal illness. The goal is to improve the quality of life for patients by managing pain and symptoms while offering emotional and spiritual support to both the patient and their loved ones. Hospice care can be provided in various settings, including skilled nursing facilities.

To be eligible for hospice care, a person must have a life expectancy of six months or less, as certified by a physician. This certification is required for Medicare coverage, which we will discuss further in the following sections. It’s important to note that choosing hospice care does not mean giving up on treatment altogether. It means shifting the focus to comfort and quality of life rather than curative measures.

Hospice care is a holistic approach that addresses individuals’ physical, emotional, and spiritual needs nearing the end of life. It provides a compassionate and supportive environment where patients receive specialized care tailored to their unique needs. Now that we have a basic understanding of hospice care, let’s explore how it relates to skilled nursing facilities and the coverage provided by Medicare.

Understanding Skilled Nursing Facility Care and Medicare Coverage

Skilled nursing facilities (SNFs) are residential facilities that provide round-the-clock nursing care for individuals requiring more intensive medical attention than they could receive at home. SNFs are equipped with trained healthcare professionals, including nurses and therapists, who can address the complex needs of patients. SNF care is often required when individuals have conditions that require ongoing medical monitoring, such as chronic illnesses or post-surgical recovery. Medicare covers certain SNF services, including skilled nursing care, rehabilitation therapy, and medications. However, it’s important to note that not all services provided in a SNF are covered by Medicare, and this includes hospice care.

Medicare Coverage for Hospice in a Skilled Nursing Facility

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

The criteria are the same as for hospice. Firstly, the individual must be eligible for Medicare Part A, which covers inpatient hospital stays, skilled nursing facility care, and hospice care. Secondly, the hospice care must be certified by a Medicare-approved hospice provider. Thirdly, the individual must have a life expectancy of six months or less, as certified by a physician. Lastly, individuals must agree to forgo curative treatments for their terminal illness and receive only palliative care.

The SNF is not primarily providing hospice care. A hospice team coordinates with the SNF to provide the service in the SNF. The location of the hospice care is secondary. The SNF is a location, like the home.

However, there must be a Medicare-covered reason or treatment to be granted admittance to a skilled nursing facility. The SNF is primarily a medical facility for patients to get better. It is not a hospice facility providing room and board, housekeeping, bathroom transfers, etc.

Medicare Hospice Benefits for My Mom

The doctors diagnosed my mother with ovarian cancer in 2012. I was living in Kansas at the time. I wasn’t able to go on doctor visits with her. My brother, Paul, was taking care of my mom. I would get information about her situation, but it was spotty.

My mother was an ‘I’m in charge’ type of person. Phyllis determined the flow of information, and it was sparse.

Talking with your mother about her health when her mortality is so tightly fixed to it is hard. Looking back now, I was a chicken. Who wants to talk about saying goodbye? I didn’t realize the seriousness of her health situation until much later. I assumed she didn’t speak about her own death, and I didn’t know how to initiate the conversation. We were all in different forms of denial.

At the end of 2012, the doctors said there was nothing more to be done. I don’t think I fully grasped what that meant at the time. I also did not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

My mother was admitted to hospice care (Medicare Hospice Benefits Booklet).

Mom’s Terminal Illness

Nature, in its less than glorious side, took its course rapidly. My mother’s health deteriorated in a few short weeks.

Cancer is a painful disease. The healthcare personnel gave her various painkillers, but even as they did so, we all insanely talked about not wishing to cause addiction. The pain had its own mind.

At various times, my mother’s suffering would be such that she needed to go to the hospital. There, the doctors administered intravenous medications that were faster acting and stabilized her pain level.

During the last visit, it became clear that we could not care for her at home. My father, John Grimmond–who would pass away six months later–was not physically able to care for our mother. I was in Kansas, my other brother, Tom, was in Sioux Falls, and Paul was in Omaha but busy with his career and family.

My mother needed around-the-clock care. We asked, ‘Does Medicare pay for hospice in a skilled nursing facility?’ The real question was whether Medicare would pay for a skilled nursing facility while my mother died. Strictly speaking, Medicare does not pay for custodial care. Custodial care is bathing, feeding, toileting, etc. Medicare doesn’t cover room and board if you get hospice care while in a nursing home or a hospice inpatient facility. That is out of your pocket.

Qualifying for Skilled Nursing Facility Care while on Hospice

The staff at the hospital initially told us that our mother needed to go to a skilled nursing facility (SNF) because they recognized she required more care than we could provide. They informed us that Medicare would provide and pay for hospice care in the Skilled Nursing Facility, but the cost of room and board and custodial nursing care would not be covered, and they were correct. Medicare coverage for skilled nursing when you are in hospice is tricky.

skilled nursing when you are in hospice is tricky.

The fortunate occurrence, however, was the intravenous nature of my mother’s painkillers. Other than a hospital, you can only receive intravenous medication treatment in a skilled nursing facility. The nature of my mom’s treatment triggered a reason Medicare would accept her being admitted to a skilled nursing facility and pay for it.

Medicare does cover skilled nursing care after a qualifying hospital stay of 3-days or more. Intravenous medication administration also requires a skilled nursing facility. A home health care nurse showing up several times at home would not be adequate. Also, my mother needed physical therapy to improve her strength after the reaction to the pain. From Medicare Part A and Part B, there were sufficient reasons for Medicare to pay for her stay in the skilled nursing facility (SNF) while she was in hospice.

Does Medicare Pay For Skilled Nursing Care During Hospice?

Strictly speaking, Medicare does not pay for skilled nursing care because someone is in hospice, but other triggering events often cause Medicare to cover skilled nursing care.

For example, someone who is in hospice falls and breaks a hip. That situation would justify skilled nursing care. A person develops an infection or pneumonia that results in hospitalization. Then, they qualify for a skilled nursing stay.

How to Navigate the Medicare Coverage Process for Hospice in a Skilled Nursing Facility

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

1. The first step is to consult with the individual’s physician to determine if they meet the eligibility criteria for hospice care in a SNF. The physician can provide the necessary certification and guidance through the process. He knows the triggering circumstances that justify a skilled nursing facility stay.

2. It’s important to choose a Medicare-approved hospice provider with experience providing SNF care. They will be able to guide you through the necessary paperwork and ensure that all requirements are met. The health professionals are very familiar with Medicare’s billing codes and protocols for admittance to a SNF.

3. If the individual is already receiving care in a SNF, it’s important to coordinate with the facility to ensure a smooth transition to hospice care. The SNF staff can provide valuable information and support during this process.

4. Familiarize yourself with Medicare’s costs and coverage for hospice care in a SNF. This will help you plan and make informed decisions regarding the individual’s care.

The professionals you deal with know the Medicare rules and the subtleties of maximizing coverage in different circumstances. Listen attentively to their guidance.

Common Misconceptions about Medicare Coverage of SNF During Hospice

Several common misconceptions exist about Medicare coverage for hospice care in a SNF. Let’s address some of these misconceptions and provide clarity:

provide clarity:

1. Medicare only covers hospice care in certain settings: Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, and skilled nursing facilities. As long as the eligibility criteria are met, Medicare will cover hospice care in a SNF.

2. Medicare covers room and board in a SNF. As a rule, Medicare does not cover room and board in a SNF because the individual is receiving hospice care, though room and board may be covered because the patient is in the SNF for reasons other than hospice.

3. Medicare coverage for hospice care is limited to specific conditions: Medicare coverage for hospice care is not limited to specific conditions or illnesses. As long as the eligibility criteria are met, Medicare will provide coverage for hospice care in a SNF for any terminal illness.

4. Medicare coverage for hospice care is limited to a certain time frame: Medicare does not limit the duration of hospice care coverage in a SNF. As long as the individual meets the eligibility criteria, Medicare will continue to cover the necessary services.

Bottomline: Ensuring Quality Care and Coverage for Hospice in a SNF through Medicare

Maximizing Medicare coverage for hospice care in a skilled nursing facility is essential for ensuring quality end-of-life care. By understanding the eligibility criteria, coverage details, and navigating the Medicare system, you can advocate for yourself or your loved one and ensure all available resources are utilized.

Remember, hospice care is a compassionate and holistic approach that focuses on providing comfort and support during the final stages of a terminal illness. Medicare provides coverage for hospice care in a SNF, including room and board, medications, and necessary medical equipment. By staying informed and proactive, you can maximize Medicare coverage and ensure that the individual receives the care they need.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Phyllis Grimmond 1935-2013 R.I.P.

The Bottomline: Benefit Knowledge Makes for Maximum Benefits

At Omaha Insurance Solutions, we understand the importance of access to accurate and reliable information regarding healthcare

Christopher J. Grimmond

decisions. We aim to empower you with the knowledge and resources to navigate the complex world of Medicare coverage. It is important to know that Medicare pays for hospice care in a skilled nursing facility.

By maximizing benefits and ensuring quality care, we can make a difference in the lives of individuals and their loved ones during this challenging time. Call us at 402-614-3389 to ensure you have a Medicare plan protecting you and your loved ones. Speak with an experienced licensed insurance agent profession.