Medicare RegulationsCategory:

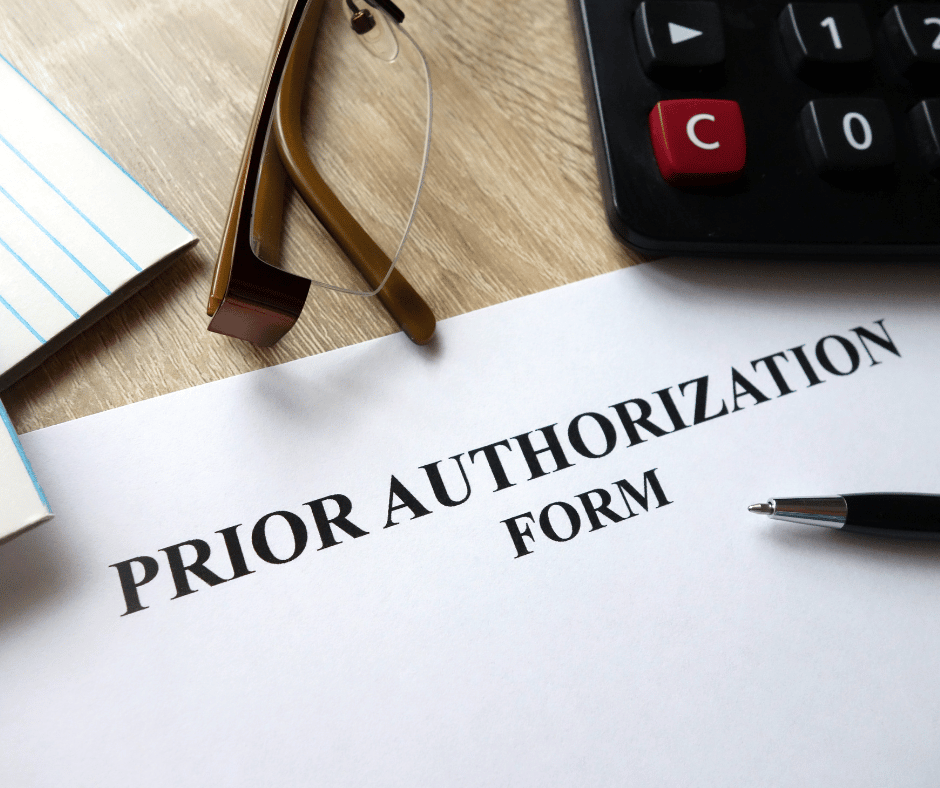

Prior authorization has arisen as an issue for Medicare Advantage Organizations (MAO)—insurance companies—and Medicaid–states. According to consumer claims, consumers are denied needed coverage unnecessarily. You can imagine the pain and hardship this causes. What if there was a Medicare prior authorization tool providers, insurance companies, and patients could use to communicate with one another?

Prior authorization has arisen as an issue for Medicare Advantage Organizations (MAO)—insurance companies—and Medicaid–states. According to consumer claims, consumers are denied needed coverage unnecessarily. You can imagine the pain and hardship this causes. What if there was a Medicare prior authorization tool providers, insurance companies, and patients could use to communicate with one another?

Congress recently conducted hearings on prior authorization denials, and the Department of Health & Human Services (DHHS), which is the ultimate supervising authority for Medicare (CMS) and Medicaid, issued a final rule that offers a partial solution to the problem.

DHHS initiated the creation of a Medicare prior authorization tool to speed up the process and reduce errors when it comes to prior authorizations for medically necessary treatments and procedures.

The DHHS Final Rule

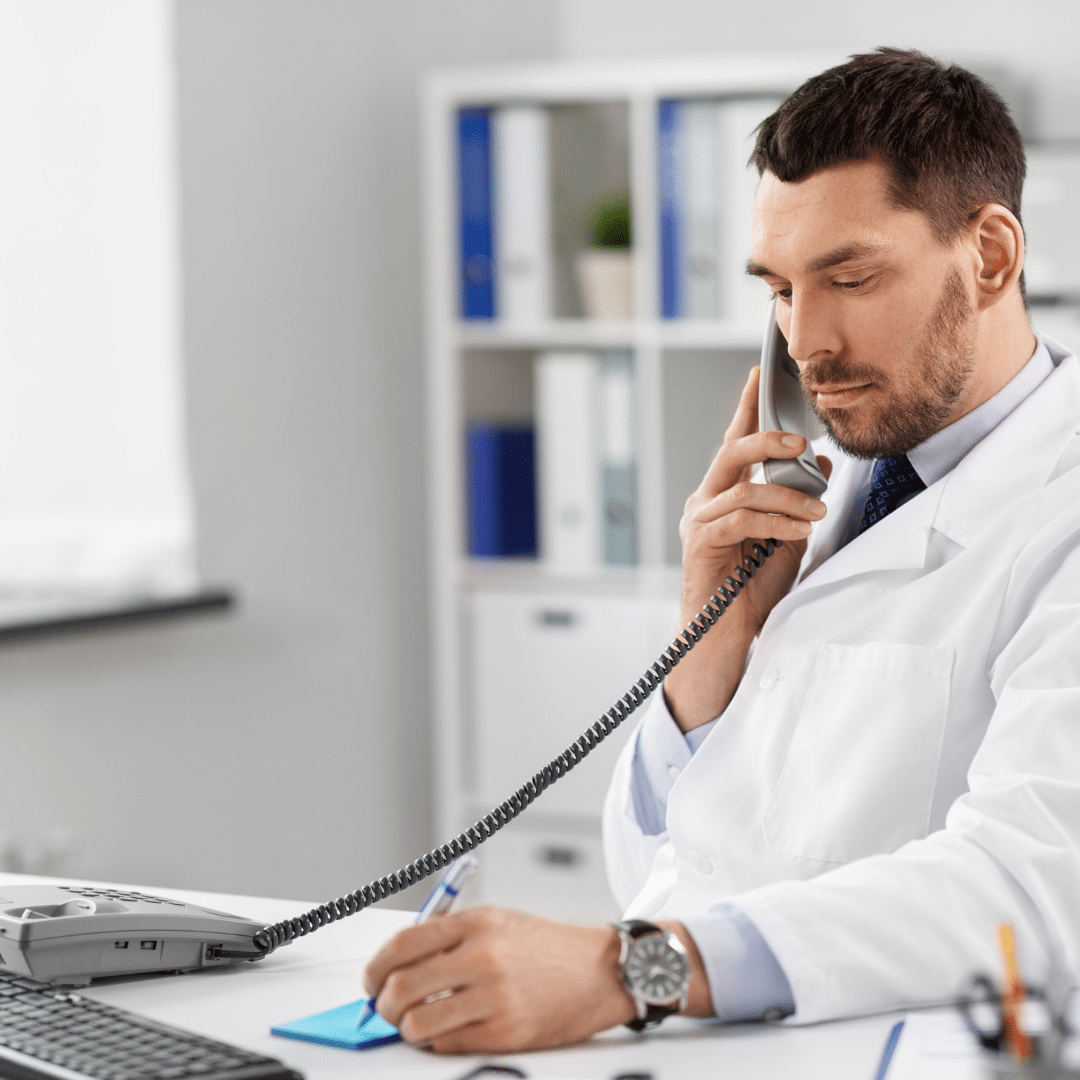

The DHHS mandated the establishment of a standardized electronic platform for exchanging medical and billing information between payers (insurers and states—for Medicaid), providers, and consumers. All three will be able to see prior authorizations while in process in real-time and interact with one another.

Doctors will see their prior authorization submission as the payer (insurance company) processes the prior authorization. They will see if codes are incorrect or documentation is missing; if denied, doctors will see the reasons.

Payers will see additional information added and corrections made to the prior authorization requests in real-time. They can track the prior authorization because there is a timeline they all can see.

Payers can see the medical history and even similar prior authorizations approved or denied for the patient from the past.

Payers can better coordinate with other payers when other insurance companies may be involved.

Consumers can see that the doctor’s office is actually submitting the prior authorization and where the request is in the process rather than calling the provider to check-in.

DHHS aims to create a more efficient, responsive, and transparent system than the current process for prior authorization. This electronic platform will be for

- Medicare

- Medicaid

- Affordable Care Act (ACA) Marketplace

- CHIP (Children’s Health Insurance Program)

The platform is called Application Programming Interfaces (API). While it will be for government-sponsored health plans and not private insurance, like employer health plans, these types of institutional changes usually trickle down to the private sector eventually.

What’s on the Application Programming Interfaces (APIs)?

What’s on the Application Programming Interfaces (APIs)?

Providers, payers, and consumers will be able to look up:

- Medical items and services that require prior authorization.

- Required documentation for the plan to make a prior authorization decision.

- Current status of a prior authorization decision.

The API (Application Programming Interface) will be the Medicare prior authorization tool that allows providers and payers to communicate quickly and easily and consumers to monitor the process.

The prior authorization details available through the APIs will include:

- Prior authorization status

- Date of approval or denial of a prior authorization request

- Date or circumstance when the prior authorization ends.

- What items or medical services were approved

- Reason for denial: if denied

- Administrative and clinical information submitted by a provider.

This could also include information about past prior authorization decisions beneficial for a patient who is required to obtain prior authorization again for the same service when switching health plans.

Medicare Prior Authorization Timeframes

Currently, Medicare Advantage Plans can take up to 14 calendar days for a standard decision. Expedited decisions must be completed within 72 hours of the request for medical treatment.

With the final rule, prior authorization timeframes were shorted to 7 calendar days, and the same 72-hour rule was used to expedite prior authorization decisions.

Reasons For Denial

Reasons For Denial

The plans must explain the denial to the provider and patient through the APIs. This was not always done, especially if the denial was for miscoding or lack of supporting documentation.

Now, the patient can see the denial. They do not need to rely upon the doctor’s office to explain what the insurance company did or didn’t do, particularly if the provider’s back office did not provide adequate documentation. Everyone can see what the other one is doing or not doing.

Everyone can also see what can be done to appeal or overturn the denial.

Public Reporting of Medicare Prior Authorization Because of the Tool

Insurance companies will be required to report their denial ratios on their website. Consumers will be able to see how often insurance carriers deny prior authorizations and thus determine which Medicare Advantage plan or other government-sponsored programs to choose.

The hope is that Medicare Advantage Organizations (MAO) will be motivated to improve the prior authorization processes through education, better technology, and more efficient and robust systems.

robust systems.

The data required to be listed on the payer (insurance company) website will be:

- List of all items and services that require prior authorization.

- Percentage of standard and expedited prior authorization requests approved & denied (aggregated for all items and services)

- Percentage of standard prior authorization requests that were approved after appeal.

- Percentage of standard and expedited claims where decision timeframes were extended, followed by a request approval.

- Average and median timeframes between a prior authorization request and a decision for standard and expedited prior authorization requests.

Implementation January 2027

As with any government legislation and systemic changes, time is required. The DHHS final rule set January 2027 as the effective date for the proposed regulations.

Building a system as large as the API takes time to provide an effective and robust tool for the Medicare prior authorization process.

Bottom Line: Medicare Prior Authorization Tool

I find this awesome. Too many times, consumers are in the dark. All they know is they can’t get their treatment. They do not know the truth.

Is this something Medicare covers? Did the doctor’s office submit the request correctly, and did they fight to approve it? Is the insurance company being unreasonable? Can I do anything?

It is hard to bluff when everyone can see everyone else’s cards. Light is the best disinfectant for an infection.

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Medicare Advantage plans, or Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Parts A and B) and often include additional benefits such as prescription drug coverage and dental, vision, and hearing services.

We will delve into the specific circumstances in which a Medicare Advantage plan requires prior authorization and could potentially deny coverage, the appeals process for denied claims, and what steps you can take to ensure you receive the coverage you need. By understanding the ins and outs of Medicare Advantage plans, you can make an informed decision about your healthcare coverage. So, let’s unlock the truth together and navigate the world of Medicare Advantage plan prior authorization.

What is the Purpose of Prior Authorization?

Prior authorization (or Pre-Authorization) is a utilization management tool used to contain costs. It consists of a third party, usually employed by the insurance company, making determinations about a request for service. The third party, who may be a doctor, nurse, or non-medical staff, approves or denies a request based upon predetermined criteria.

• Is the service covered?

• Is it a duplicate?

• Does the request contain the proper codes and supporting documentation?

• Is the service “medically necessary” as defined by CMS’s standard of care?

The purpose of Medicare Advantage plans requiring prior authorization is to ensure that the medical procedures are necessary and that the payer (insurance company) and patient are not wasting money.

Health care involves a great deal of money. There are three primary interested parties: the patient, who wants to pay as little as possible, the doctor, who provides a service for a fee, and the insurance company, which protects the patient from overwhelming healthcare costs for a premium.

Each has different and conflicting interests. Each is making a cost-benefit analysis to determine if the activity is worth it.

The patient wants good care for minimal cost. The doctor wants to be paid as much as possible for skills and services rendered. The insurance company wants to provide protection at the lowest cost to itself to maximize profit. Each is attempting to protect its interests. The insurance company uses prior authorization to make sure the service is, in fact, medically necessary so it does not waste money on unnecessary services.

The tradeoff is that prior authorization creates a barrier that potentially delays care and adds to its cost. There is also the potential that needed healthcare is wrongly delayed or withheld.

Medicare Advantage Utilizes Prior Authorization

Like commercial health insurance your employer purchases for employees, Medicare Advantage requires prior authorization for a majority of procedures, tests, and treatments, especially the more costly treatments. If approval is not granted, the insurer does not pay. There is an appeal process; however, many do not utilize the appeal process.

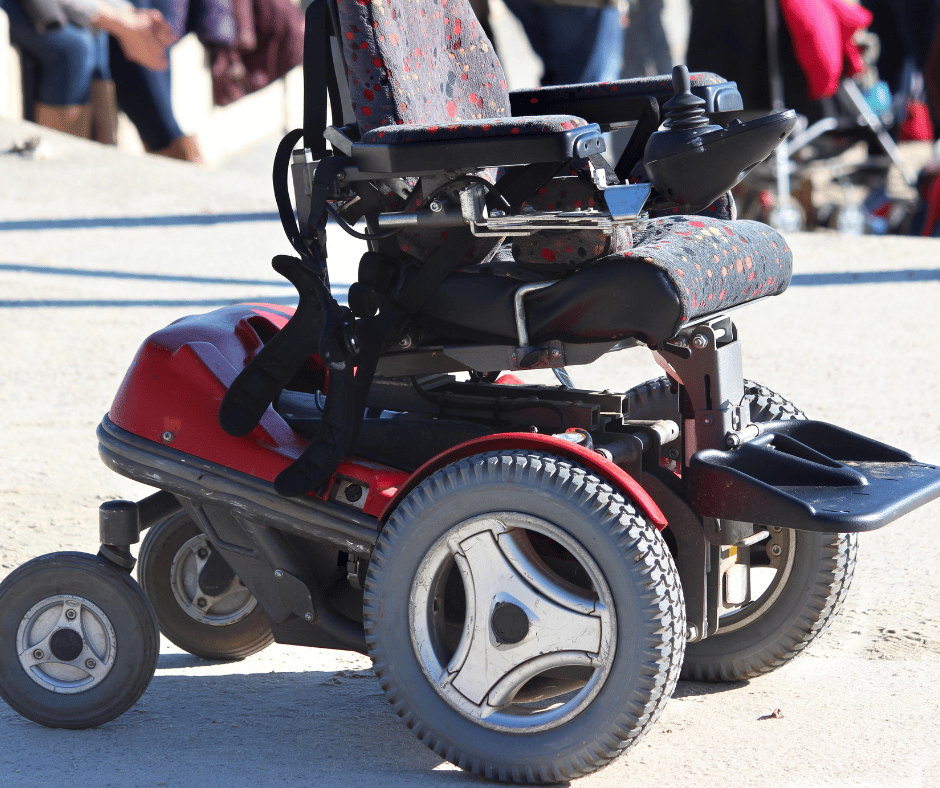

Traditional Medicare does not employ utilization management tools like prior authorization except in a few instances. The lack of any supervision of the medical necessity of services and payments has resulted in some high-profile cases of fraud, waste, and abuse. The only mechanism to combat abuse is self-reporting, whistle blowers, and fraud hotlines.

Optimally, prior authorization deters patients from getting care that is not truly medically necessary, reducing costs for both insurers and enrollees. Prior authorization requirements, however, can also create hurdles and hassles for beneficiaries and their physicians and may limit access to both necessary as well as unnecessary care. It also adds the burden of expense to providers who pay staff to work with insurance companies through the prior authorization process.

Data suggests that Medicare Advantage members save an average of $1,965 per year in total health expenditures compared to fee-for-service Traditional Medicare. Medicare Advantage members have lower hospitalization rates and fewer readmissions than their Traditional Medicare counterparts.

Does Original Medicare Utilize Prior Authorization?

From its inception, Traditional Medicare (Original Medicare) has not used prior authorization. There was little, if any, oversight until the electric wheelchair scandal.

A Washington Post article published in August 2014 highlighted the massive fraud of Medicare’s resources. The article chronicled the sensational scams and trials of many Medicare swindlers. The outrageous theft of public funds and the massive fraud shamed CMS to amend its regulations to finally require pre-authorization for some “durable medical equipment,” i.e., electric wheelchairs.

Bureaucrats inside CMS admitted they knew how the wheelchair scheme worked as early as 1998. However, it was not until 15 years later that officials finally did enough to curb the practice significantly. Durable medical equipment—electric wheelchairs—is the only exception to the “reasonable and necessary” practice. They must be preapproved.

The Government Accountability Office (GAO) examined a prior authorization program that CMS ran in seven states in 20212. During the short duration of the program, Medicare saved $1.9 billion. The GAO recommended that CMS continue to study the subject and implement a prior authorization program for all of Original Medicare in its 2018 published study. CMS discontinued the program.

The Effect of Medicare Advantage Denials

The Effect of Medicare Advantage Denials

There may be severe consequences when a Medicare Advantage Organization (MAO) denies authorization for a procedure.

- Patient access to medical care is delayed or denied.

- Potentially, it results in the patient paying out of pocket for something Medicare should have covered.

- It causes an administrative burden for the patient and providers because they must devote resources to an appeal.

None of these have positive consequences and are a cause of frustration with Medicare Advantage for some.

How Common is Medicare Advantage Prior Authorization Denials?

The Kaiser Foundation examined CMS data from MAOs from 2021. They found that more than 35 million prior authorizations were submitted to Medicare Advantage insurers. Over 2 million prior authorization requests were fully or partially denied by the insurance companies.

The percentage of prior authorization requests and denials depends upon individual plans. They are not identical. Of the 2 million denials, some were partial denials, totaling 380,000.

Partial denials would be, for example, physical therapy sessions. The physician requests 10 sessions, but only 5 are granted. That leaves 1.6 million prior authorizations completely denied. The average for Medicare Advantage plans as a whole was less than 6 percent, with individual MAO falling slightly above or below that average.

How About Appeals of Prior Authorization Denials?

Each Medicare Advantage plan has an appeal process. Data from the same group revealed that only 11 percent (or 212,000) of appeals were made, including partially and fully denied requests. The insurance companies overturned 82 percent (or 173,000) of the appeals.

insurance companies overturned 82 percent (or 173,000) of the appeals.

The high number of repeals was cause for concern. Are Medicare beneficiaries being unjustly denied services? Are the insurance companies creating unfair obstacles to reduce costs?

The study’s data, however, do not describe in detail the causes of the denials. In general conversations with insurance carriers, the authors discovered that prior authorizations are denied for a number of common reasons.

- Incorrect coding and insufficient documentation

- Less intrusive or costly services were not first tried.

- The provider was not in the network

- Service is not covered

- Human error

All of these reasons may result in a denial of service, but the data does not identify the various causes, some of which are easily rectified upon review or appeal.

We have thousands of clients who call us when there are issues. I am amazed at how often the provider’s back office does not file the proper paperwork, use the correct codes, or include essential documentation such as X-rays or tests.

Then, when the pre-authorization is denied, the insurance company is blamed, and the subject is dropped. The back office is understaffed, doesn’t have the time, and doesn’t sufficiently understand the insurance company’s processes, so they cut their losses and move on to other cases. Sometimes, the provider moves on to the less costly treatment, knowing that it will be immediately approved.

How Many Are Denied Coverage Unnecessarily?

The Office of Inspector General (OIG) for the Department of Health & Human Services published a report in April 2022 regarding the denial of medically necessary services by some Medicare Advantage Organizations (MAO). The study discovered that MAOs denied services to Medicare beneficiaries on some MAO plans even though the prior authorization request did meet the standard for Medicare coverage rules.

The OIG study sample was taken from 15 of the largest MAOs during the week of June 1-7, 2019. The sample size was 500—250 prior authorizations and 250 denials of claims. Eventually, the number was reduced to 430 as the data was further sifted.

The OIG dug into the details of each of the 430 cases. In the course of the review of the cases, OIG found a conflict in the standards.

Conflict in Standards

CMS has its own guidance regarding the standard of care. The MAOs, however, have developed their own internal clinical criteria that go beyond Medicare coverage rules even though the case would pass CMS’s standards. In the past, CMS has left the MAOs to develop their own criteria where CMS is unclear. For example, a less intrusive or costly treatment may be required before a more expensive service is authorized by the MAO. Physical therapy may be more appropriate first before an MRI is prescribed.

Second, MAOs indicated that some prior authorization requests did not have enough documentation to support approval, yet OIG reviewers found that the existing beneficiary medical records were sufficient to support the medical necessity of the services.

On payment requests, the OIG found that the MAOs denied 18 percent of the cases that would have met the Medicare coverage and MAO billing rules. Most of these payment denials in the sample were caused by human error during manual claims processing reviews (e.g., overlooking a document) and system processing errors (e.g., the MAO’s system was not programmed or updated correctly).

In the end, OIG determined that 13 percent of the 250 prior authorization cases studied should not have been denied based upon CMS stands (or approximately 32 individuals).

How Many Denied Coverage Should Be Approved?

If we combine the two studies, Kaiser Foundation and Office of Inspector General for the Department of Health & Humana Services—we actually get an idea of who should have been approved.

The Kaiser Foundation consists of 35 million prior authorizations, with less than 2 million being denied, which is a 5 percent denial rate.

The OIG’s study discovered that only 13 percent of those denied should have been approved.

So, when we apply the average of 13% of wrongly denied prior authorization requests to the 2 million denials in the Kaiser study, that is approximately 260,000 individuals who should have been approved but were not out of 36 million prior authorization requests.

That means out of 36 million prior authorization requests, only 0.7 percent were wrongly denied coverage. In other words, 99.3 percent of prior authorizations are processed correctly.

I find that an incredibly high degree of accuracy.

Appeals and Reconsiderations for Denied Coverage

The appeals process for denied coverage with Medicare Advantage plans involves several levels, each with its own deadlines and requirements. Understanding these steps can help you navigate the process effectively and increase your chances of a successful appeal.

Redetermination

The first level of appeal is the “Redetermination” process. You must submit a written request to your Medicare Advantage plan within a specified timeframe, usually 60 days from the date of the denial letter. Include all relevant documentation and explain why you believe the service or procedure should be covered. The plan must review your appeal and provide a written decision within 30 days.

Reconsideration

If your appeal is denied at the redetermination level, you can proceed to the second level, known as a “Reconsideration.” This involves submitting a request to an independent review entity contracted by Medicare within 60 days of receiving the redetermination denial. The review entity will conduct a thorough review of your case, including any additional evidence you provide, and issue a written decision within 60 days.

Administrative Law Judge

If your appeal is still denied at the reconsideration level, you have the option to request a hearing before an administrative law judge (ALJ). This request must be made within 60 days of receiving the reconsideration denial. The ALJ will hold a hearing, either in person or by video conference, where you can present your case. The ALJ will issue a written decision within 90 days.

Medicare Appeals Council

If you are dissatisfied with the ALJ’s decision, you can further appeal to the Medicare Appeals Council. This request must be made within 60 days of receiving the ALJ’s decision. The council will review your case and issue a written decision.

Federal District Court

The final level of appeal is to seek judicial review in a federal district court. This step involves filing a lawsuit against the Medicare Advantage plan in a federal court. It’s important to consult with legal counsel if you reach this stage, as the process can be complex.

Bottom Line: Medicare Advantage Prior Authorization Is a Required Tool

No one writes a blank check. When money is being spent, there is oversight. When there is a lot of money from a lot of people, there will be a lot of accountability. The Medicare Advantage oversees that taxpayers’ and beneficiaries’ money is spent in accordance with the norms and procedures that CMS has laid down. Medicare Advantage requires prior authorization to protect resources and clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

Currently, no one has complete and adequate data to give an accurate idea of inappropriate Medicare Advantage denials, but the data and studies recently done show that the level of error is incredibly low.

Are you feeling lost and confused about Medicare Advantage prior authorization? You’re not alone. Navigating the healthcare system can be overwhelming, especially regarding insurance processes. But fear not—we are here to demystify it all for you.

Are you feeling lost and confused about Medicare Advantage prior authorization? You’re not alone. Navigating the healthcare system can be overwhelming, especially regarding insurance processes. But fear not—we are here to demystify it all for you.

This comprehensive guide will delve into everything you need to know about Medicare Advantage prior authorization. From understanding what it is, why it’s necessary to learn how it works, and the steps involved, we’ll break it down in simple terms. There will be no jargon, no confusing terms—just clear and concise information.

What is Prior Authorization?

Prior authorization is a process used by insurance companies to determine whether they will cover a specific medical procedure, treatment, or prescription drug. It is required for certain services to ensure that they are medically necessary and cost-effective.

Why is Prior Authorization Necessary?

Prior authorization prevents unnecessary medical procedures, reduces healthcare costs, and ensures patients receive appropriate care. Insurance companies can control expenses and ensure that resources are allocated efficiently by reviewing and approving or denying requests for certain healthcare services.

Problems With Medicare Advantage Prior Authorization

However, prior authorization can be complex and time-consuming. It requires healthcare providers to submit detailed information about the patient’s condition, medical history, and proposed treatment plan. The insurance company then reviews this information to determine whether the requested service meets its coverage criteria.

While prior authorization can be beneficial in some cases, it can also lead to delays in care and administrative burdens for both healthcare providers and patients. There are many elements, moving parts, and hands that touch a prior authorization request. Thus, the process is ripe for mistakes, misunderstandings, and delays. Understanding the process and requirements can help you navigate this system more effectively.

Prior Authorization Process for Medicare Advantage

Obtaining prior authorization for Medicare Advantage plans involves several steps. Here’s a breakdown of the process.

Consultation with Healthcare Provider

The first step is to consult with your healthcare provider. They will determine if the service or treatment you need requires prior authorization and initiate the process on your behalf.

Submission of Prior Authorization Request

Once your healthcare provider has determined that prior authorization is necessary, they will submit a request to your insurance company. This request includes all the necessary documentation, such as medical records, test results, and treatment plans. This is where I see problems arise. The doctor’s back office uses incorrect codes, forgets test results, and the doctor’s notes are missing essential language. Then, the request is denied.

Review by the Insurance Company

The insurance company will review the submitted request and evaluate the medical necessity of the service requested. It may also consider factors such as cost-effectiveness and alternative treatment options.

Approval or Denial

Approval or Denial

The insurance company will either approve or deny the prior authorization request based on their evaluation. If approved, you can proceed with the recommended treatment. If denied, you have the option to appeal the decision. The additional problem is the insurance company does not give a reason for the denial, so the provider is clueless about where to begin. The carrier is not required to give a reason, so the provider needs to commit more resources to find out what is needed or let it go.

Appeals Process

You can appeal the decision if your prior authorization request is denied. This involves providing additional documentation or evidence to support the medical necessity of the requested service. The insurance company will review your appeal and make a final determination.

necessity of the requested service. The insurance company will review your appeal and make a final determination.

It’s important to note that the prior authorization process may vary slightly depending on your specific Medicare Advantage plan and the services you need. For detailed information about the process, consult with your healthcare provider, insurance company, and Center for Medicare & Medicaid Services (CMS).

Standard Medicare Procedures & Services Requiring Prior Authorization

Prior authorization is typically required for certain medical procedures, treatments, and prescription drugs. While the specific requirements may vary depending on your Medicare Advantage plan, here are some standard procedures and services that often require prior authorization.

Prior authorization is typically required for certain medical procedures, treatments, and prescription drugs. While the specific requirements may vary depending on your Medicare Advantage plan, here are some standard procedures and services that often require prior authorization.

Specialized Surgeries

Complex surgical procedures, such as organ transplants or bariatric surgery, often require prior authorization. This ensures that the procedure is medically necessary and appropriate for the patient’s condition.

High-Cost Medications

Certain prescription drugs, especially those with high costs, may require prior authorization. This helps insurance companies manage expenses and ensure patients receive appropriate medications.

Imaging Tests

Advanced imaging tests like MRI or CT scans may require prior authorization. This ensures that these tests are necessary and will provide valuable information for diagnosis or treatment.

Physical Therapy or Rehabilitation Services

Medicare Advantage plans often require prior authorization for physical therapy, occupational therapy, or other rehabilitation services. This helps ensure that these services are appropriate and will contribute to the patient’s recovery.

I have found that skilled nursing facility care is very difficult to get approved, especially if the stay exceeds the initial twenty days. The impasse is a combination of the skilled nursing facilities (SNF) refusing to submit for a patient with a Medicare Advantage plan. Many SNFs will not even consider submissions for stays beyond twenty days. Some seem to not know how to properly submit a reauthorization or claim. From the insurance company’s side, their restrictions seem overly prohibitive. This has been a huge source of complaints to CMS and Congress.

Durable Medical Equipment

Durable Medical Equipment

Equipment such as wheelchairs, oxygen tanks, or home healthcare supplies may require prior authorization. This ensures that the items are medically necessary and will improve the patient’s quality of life. CMS has a significant history of fraud, waste, and abuse regarding durable medical equipment.

It’s important to check with your specific Medicare Advantage plan to understand which procedures and services require prior authorization. Your healthcare provider can also provide guidance based on your individual needs.

Benefits of Medicare Advantage Prior Authorization

While the prior authorization process can be perceived as burdensome, it offers some benefits for patients and insurance companies. Here are a few advantages of Medicare Advantage prior authorization:

- Cost control: Prior authorization helps insurance companies control healthcare costs by ensuring that services are medically necessary and cost-effective. This helps keep premiums affordable for all members.

- Appropriate care: Prior authorization ensures that patients receive appropriate care by evaluating the medical necessity of requested services. This helps prevent unnecessary procedures or treatments that may not be beneficial.

- Improved outcomes: By reviewing and approving requests for certain healthcare services, insurance companies can help ensure that patients receive the most effective and evidence-based treatments. This can lead to improved health outcomes and better quality of life.

- Resource allocation: Prior authorization helps allocate healthcare resources efficiently by ensuring that they are used for the most appropriate and effective services. This helps prevent overutilization of healthcare services and ensures that resources are available for those who need them.

While there are benefits to prior authorization, it’s important to acknowledge the challenges and drawbacks of the process as well.

Challenges & Drawbacks of the Medicare Prior Authorization Process

While prior authorization serves a purpose in the healthcare system, it has its challenges and drawbacks. Here are some common challenges that patients and healthcare providers may encounter.

Prior Authorization Administrative Burden

The prior authorization process can be time-consuming and requires healthcare providers to gather and submit extensive documentation. This administrative burden can take away valuable time that could be spent on patient care.

Dr. Jesse M. Ehrenfeld, M.D., president of the AMA (American Medical Association), says,

The need to right-size prior authorization has never been greater—mountains of administrative busywork, hours of phone calls, other clerical tasks that are tied to this onerous review process. It not only robs physicians of face time with patients, but studies show that it contributes to physician dissatisfaction and burnout.

Delayed Care

Prior authorization can sometimes lead to delays in care, as the review process may take time. This can be frustrating for patients who need immediate treatment or services.

Starting in 2026, CMS is shortening the time frames for prior authorization decisions. Insurance payers must respond within 72 hours for an expedited or urgent request and seven calendar days (not business days) for a standard request.

Denial of Coverage

Denial of Coverage

There is always a risk of prior authorization requests being denied. This can be disappointing for patients hoping to receive a particular treatment or procedure.

Lack of Transparency

Insurance companies may have different criteria and guidelines for prior authorization, leading to confusion and lack of transparency. Patients and healthcare providers may struggle to understand the reasons for a denial or how to navigate the process effectively.

Dr. Jesse M. Ehrenfeld, M.D. describes the problem of the lack of transparency with the insurance companies.

When a request is denied, we often don’t know why. We don’t tell you the reasoning behind the denial. It can take hours and hours to appeal a decision. And then sometimes you wait weeks or even months for a peer-to-peer consult.

The CMS final rule will require insurers to provide specific, very specific denial reasons and public reporting of metrics. How often do they approve? How often do they deny things? How long does it take for a process to actually give a result for a request?

Insurers will also be required to share that information with patients, so that our patients can become informed decision makers when they buy health insurance on the exchanges and make planned decisions. That’s going to begin in 2026 and will go a long way in bringing much-needed transparency and accountability to the entire process.

Appeals Process

While the option to appeal a prior authorization denial exists, it can be a lengthy and complex process. Patients may need to provide additional documentation and evidence to support their case, which can be challenging and time-consuming.

In the efforts to improve the Medicare Advantage prior authorization process, CMS will require, according to Dr. Ehrenfeld,

Plans to support an electronic prior authorization process that’s embedded in the physician’s electronic health records, bringing much needed automation and efficiency to our current very manual and very time-consuming workflow. That change is going into effect in 2027—it’s going to be a game-changer for everybody.

So having direct integration of prior authorization into the EHR (electronic health record) is going to significantly reduce the burden on physicians. And this is where so much of that $10 to $15 billion in savings is going to come from.

Despite these challenges, some strategies and tips can help you navigate the prior authorization process more effectively.

Navigating the Prior Authorization Process Effectively

Navigating the Prior Authorization Process Effectively

Navigating the prior authorization process can be overwhelming, but with the right strategies, you can streamline the process and ensure a smoother experience. Here are some tips to help you navigate prior authorization effectively:

Understand your Medicare Advantage Plan

Familiarize yourself with your Medicare Advantage plan’s specific requirements and guidelines. This will help you understand which procedures and services require prior authorization and what documentation is needed. This is important because you may have to be the force behind the doctor’s office to pursue approval beyond the initial request.

Communicate with Your Healthcare Provider

It is crucial to communicate openly and clearly with your healthcare provider. They can guide you through the prior authorization process, provide necessary documentation, and advocate for your needs. The office needs to see that you want the procedure or test because they have limited resources to pursue further requests or appeals from the insurance company.

Gather All Necessary Documentation

Before submitting a prior authorization request, ensure you have all the necessary documentation. This may include medical records, test results, treatment plans, and any additional information requested by your insurance company. If you can assist in the process, then dig in. You may also have to be the supervising authority to make sure the office’s back office submits all relevant materials.

Be Proactive

Start the prior authorization process as early as possible to avoid delays in care. Submit your request well in advance of your scheduled procedure or treatment to allow ample time for review. Doctor’s offices are usually overworked and understaffed. To ensure you are taken care of in a timely way, contact the office yourself to see where your prior authorization is in the process. Ask for dates when you should expect tasks to be completed by the doctor’s office and insurance company.

Keep Copies of All Documents

Make copies of all documents related to the prior authorization process, including your request, supporting documentation, and any communication with your insurance company. This will help you stay organized and provide evidence if needed for an appeal. The documents are your records. You and the insurance company paid for the tests, and you have a right to your own copies.

Follow Up with Your Insurance Company

Stay proactive and follow up with your insurance company to ensure your prior authorization request is processed. This will help you stay informed and address any issues or concerns in a timely manner. Everyone is busy. Balls are dropped. People forget. You make sure none of that happens with your case because you are on it.

How to Appeal a Prior Authorization Denial

If your prior authorization request is denied, you have the option to appeal the decision. Here’s a step-by-step guide on how to appeal a prior authorization denial.

- Understand the denial: Carefully review your insurance company’s denial letter. Understand the reasons for the denial and the specific requirements for appealing the decision.

- Gather additional documentation: If you believe that the denial was made in error or that additional information could support your case, gather all the necessary documentation. This may include medical records, test results, or a letter of medical necessity from your healthcare provider. Your provider will need to perform most of this work.

- Submit an appeal letter: Write a formal appeal letter to your insurance company. Generally the doctor will need to draft and submit the letter. He will need to more clearly state the reasons for your request, provide supporting documentation, and explain why you believe the requested service is medically necessary.

- Follow up with your insurance company: This is where you can help the process. Stay in contact with your insurance company to ensure your appeal is processed. Follow up regularly. You will be able to follow up more readily than the provider’s office. Get any additional information or documentation requested.

Remember, the appeals process may take time, and no approval is guaranteed. However, following these steps and providing compelling evidence increases your chances of a favorable outcome.

Bottom Line: Understanding Medicare Advantage Prior Authorization May Determine Your Success

In conclusion, understanding and managing Medicare Advantage prior authorization is crucial for both patients and healthcare providers. While the process can be complex and time-consuming, it ensures that healthcare services are medically necessary and cost-effective.

By familiarizing yourself with the prior authorization process, understanding your Medicare Advantage plan requirements, and effectively communicating with

your healthcare provider and insurance company, you can navigate this system with confidence and ease.

Remember to stay proactive, gather all necessary documentation, and be prepared to advocate for your needs. In the event of a denial, don’t hesitate to appeal and seek assistance if needed.

Empower yourself with knowledge and take control of your healthcare journey. With the right information and resources, you can successfully navigate Medicare Advantage prior authorization and receive the care you need.

Are you in the lucky top 4% of earners? You will pay more for your Medicare benefits. The more is IRMAA (Income-Related Monthly Adjustment Amount). The amount you pay for your Medicare health and prescription drug coverage depends on your level of income. There is a ladder.

Are you in the lucky top 4% of earners? You will pay more for your Medicare benefits. The more is IRMAA (Income-Related Monthly Adjustment Amount). The amount you pay for your Medicare health and prescription drug coverage depends on your level of income. There is a ladder.

Would you like to avoid paying that tax or possibly pay a smaller portion of it? We will guide you through the key IRS exceptions for Medicare IRMAA (Income-Related Monthly Adjustment Amount). By understanding and leveraging these exceptions, you can potentially lower your Medicare expenses and put more money back in your pocket.

Medicare IRMAA is an additional premium that high-income Medicare beneficiaries are required to pay. However, there are exceptions that may enable you to reduce or even eliminate this extra cost. Knowing the ins and outs of these exceptions can make a significant difference in your healthcare expenses.

In our comprehensive guide, we will break down each exception and provide you with the information you need to take advantage of them. From ‘Life-Changing Events’ to ‘Reconsideration Requests,’ we will explore all the options available to you.

Understanding the IRS Exceptions for IRMAA

The Income-Related Monthly Adjustment Amount, or IRMAA, is an additional premium that high-income Medicare beneficiaries have to pay. However, the IRS provides exceptions that may allow you to reduce or eliminate this extra cost. Let’s explore these exceptions in detail.

Life-Changing Event

Life-Changing Event

One of the exceptions to IRMAA is a life-changing event. This includes events like marriage, divorce, death of a spouse, or work stoppage. If you experience any of these events, you may be eligible for a reduction in your Medicare costs.

To qualify for this exception, you will need to provide documentation of the life-changing event and submit it to the IRS. Documentation is key. The IRS will not take your word for it. You need to prove your income decreased.

Examples of documentation may include a marriage license or divorce decree, death certificate, or proof of work stoppage. By leveraging this exception, you can potentially save a significant amount of money on your monthly Medicare premium.

Medicare IRMAA Exception 1: Marriage or Divorce

Getting married or divorced can have a significant impact on your income and, consequently, your Medicare costs.

If you are recently divorced and you are a lower income earner, you may drop below the IRMAA threshold or at least step down the ladder, which would reduce your tax.

For some individuals, marriage may reduce their income because alimony is lost. The threshold is increased because it is for two persons. The initial threshold for a single individual is $103,000. For married filing jointly, it is $206,000. Either of these lifestyle changes may affect your income in that year and, consequently, your IRMAA tax, even if your income was higher in the previous year.

To take advantage of this exception, you must provide documentation of the marriage or divorce and proof of the change in income. By doing so, you can potentially save a significant amount on your Medicare expenses.

Medicare IRMAA Exception 2: Work Stoppage or Reduction

If you experience a work stoppage or a significant reduction in your work hours, you may be eligible for an exception to IRMAA. This can happen if you retire, get laid off, or experience a reduction in your income due to other circumstances. This is probably the most common reason high-income earners should apply for the exception. Their income was significantly higher the previous year because of work, but the year they retire and must pay the Medicare premium, their income is drastically smaller. That is what the exception is for.

To qualify for this exception, you will need to provide documentation of the work stoppage or reduction in work hours, along with proof of the decrease in income. By doing so, you can potentially reduce or eliminate the additional premium you have to pay.

Medicare IRMAA Exception 3: Loss of Income-Producing Property

If you experienced a loss of income-producing property, such as rental properties or investments, you may be eligible for an exception to IRMAA. This can happen if your rental property becomes unprofitable or if you experience significant losses in your investments.

I had a high-net-worth client who lost significant rental income because of flooding in Missouri. His properties produced nothing for several years as he settled with insurance companies and repaired buildings.

I had a high-net-worth client who lost significant rental income because of flooding in Missouri. His properties produced nothing for several years as he settled with insurance companies and repaired buildings.

To qualify for this exception, you will need to provide documentation of the loss of income-producing property, along with proof of the decrease in income. By leveraging this exception, you can potentially lower your Medicare costs and save money.

Medicare IRMAA Exception 5: Loss of Pension Income

Pension plans go bankrupt. Some pensions are for a particular duration. The cessation of a pension may impact your income significantly enough to affect the IRMAA tax.

To qualify for this exception, you will need to provide documentation of the change in income, along with proof of the decrease in income. By taking advantage of this exception, you can potentially reduce or eliminate the additional premium you have to pay.

Medicare IRMAA Exception 6: Employer Settlement Payment

Employers pay out settlements to employees for many reasons. These settlements may increase income in a given year or for several. The settlement may have its own legal stipulations.

To qualify for this exception, you will need to provide documentation of the change in income, along with proof of the decrease in income. Some legal settlements may be placed legally outside of your modified adjusted gross income. By taking advantage of this exception, you can potentially reduce or eliminate the additional premium you have to pay.

Medicare IRMAA Exception 7: Correcting An Erroneous Determination

Sometimes, the IRS may make an erroneous determination regarding your Medicare costs. If you believe that the IRS made a mistake in calculating your IRMAA, you can submit a reconsideration request and provide additional documentation to correct the error.

To qualify for this exception, you will need to provide evidence that the IRS made an error in its determination. This can include documentation of your income, tax returns, or any other relevant information that supports your case. Correcting an erroneous determination can potentially save you a significant amount on your Medicare expenses.

Applying for a IRMAA exception

To apply for an exception to IRMAA and reduce your Medicare costs, you will need to follow a few steps.

First, gather all the necessary documentation to support your case. This includes marriage or divorce certificates, death certificates, proof of work stoppage or reduction, documentation of the loss of income-producing property, proof of a change in tax-exempt income, or evidence of an erroneous determination.

Next, complete the appropriate forms provided by the IRS SSA-44 (12-2023). These forms may vary depending on the exception you are applying for. Make sure to fill them out accurately and include all the required information.

Once you have completed the forms, submit them to the IRS along with the supporting documentation. It is crucial to keep copies of all the documents and forms for your records.

After submitting your application, the IRS will review your case and make a determination. If your exception is approved, you will receive a notification informing you of the reduction or elimination of your IRMAA.

By applying for an exception and reducing your Medicare costs, you can put more money back in your pocket and have a significant impact on your overall healthcare expenses.

Bottom Line: Don’t Ignore the IRMAA Exceptions

Leveraging the key IRS exceptions for IRMAA can reduce your Medicare costs. Whether you have experienced a life-changing event, a change in income, or an erroneous determination, understanding these

Christopher J. Grimmond

exceptions can significantly reduce your healthcare expenses.

Don’t let high-income Medicare premiums burden your finances. Take the necessary steps to apply for an exception and potentially reduce or eliminate your IRMAA. By doing so, you can save money and have more control over your healthcare expenses.

Many years ago, I was still new to the Medicare insurance business. I had a few hundred clients but no high-income earners. I knew what Medicare IRMAA was, but I had never met someone subject to the IRMAA tax before Doug. He was an improbable candidate. After many years and thousands of clients later, I am very familiar with IRMAA, and I can tell you what the Medicare IRMAA 2024 schedule is all about.

Don’t Judge A Book by Its Cover

Doug drove up to my office on a loud Harley Davidson hog, his long hair waving in the wind. He was a big dude, and his leathers made him even bigger. I was a little nervous, but we sat down and took care of Medicare business.

Medicare business.

A few months later, when Doug’s Medicare started, I got a distressed phone call. “You said my Medicare premium was going to be this amount. It’s three times that!”

I was befuddled. I got my calculator out but couldn’t figure out why it was so high. Finally, I said, “Your income would have to be unusually high to be charged that much.”

Doug got quiet. “How high?” he asked. The first IRMAA bracket was $85,000 for a single person at the time. Doug guffawed and said, “Hell, my income is way more than that.”

Turns out Doug was not only a retired municipal employee with a pension and Social Security. He was also retired from the military with 20 years of service and a pension. On top of that, he had built up a stock portfolio that kicked out around $30,000 in dividend income a year.

I should have taken the adage, ‘Don’t judge a book by its cover’ more seriously.

Since then, I have always brought up income in my introductory meetings and how income affects Medicare Part B premiums. Zip code or fashion choices are no guarantee of what someone’s income may be.

What Is Medicare IRMAA?

IRMAA stands for income-related monthly adjustment amount. The government loves acronyms. Medicare IRMAA is a surcharge that high-earners pay for their Medicare Part B monthly premium.

IRMAA stands for income-related monthly adjustment amount. The government loves acronyms. Medicare IRMAA is a surcharge that high-earners pay for their Medicare Part B monthly premium.

Everyone pays a tax for Medicare during their working years. The Medicare tax is included in the FICA (Federal Insurance Contribution Act) you pay and is recorded on your pay stubs. Your Medicare tax is currently 1.45%. It is graduated up for higher earners.

In 1966 when the Medicare program began, the cost to workers was $3 per person per month, which is approximately $30 in today’s dollars. The baby boomers are leaving the workforce in huge numbers currently, so fewer workers are paying the Medicare tax. Medicare tax revenue is dropping like a stone in relation to the number of people collecting.

As Baby Boomers leave the workforce, they enter Medicare. The number of workers paying into Medicare is contracting, and the number taking out of the program is ballooning. Medical expenses are climbing. The current demographics are crushing Medicare’s ability to provide the same level of service as in the past because expenses are outpacing tax revenue.

Medicare Prescription Drug Improvement & Modernization Act

In 2003 Congress passed the Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA). In the legislation, Congress addressed the coming shortfall in Medicare revenue. Congress’s answer was to raise taxes. The top 7 percent of earners were required to pay more into the program. There are currently 65 million Medicare beneficiaries. The IRMAA tax will affect approximately 4.6 million people out of the 65 million. If you are a politician, it is better to keep 60.4 million voters happy, even at the expense of making 4.6 million unhappy.

Congress’s answer was to raise taxes. The top 7 percent of earners were required to pay more into the program. There are currently 65 million Medicare beneficiaries. The IRMAA tax will affect approximately 4.6 million people out of the 65 million. If you are a politician, it is better to keep 60.4 million voters happy, even at the expense of making 4.6 million unhappy.

A little-known fact is Medicare beneficiaries pay less than 25 percent of the actual Medicare cost. The current Part B premium is only $174.70. That premium covers about a fifth of the actual cost. In the MMA, Congress increased the Part B premium based upon your income. The IRMAA increases the percentage that upper-income Medicare beneficiaries actually pay for their Medicare. Instead of paying only 25 percent of the Medicare cost, IRMAA payors pay for 35, 50, 65, 80, or 85 percent of the actual Medicare cost. The additional revenue the IRMAA tax brings in is allocated to offset Medicare’s budget shortfall.

How Does the Medicare IRMAA 2024 Schedule Work?

How Does the Medicare IRMAA 2024 Schedule Work?

Medicare IRMAA is a different calculation from the progress income tax rates the IRS uses for federal income tax brackets.

You do not pay a federal income tax rate on everything you make. The federal government divides your taxable income into chunks — also known as tax brackets — and each chunk gets taxed at a progressively higher rate. The beauty of this is that no matter which bracket you’re in, you won’t pay the highest tax rate on your entire income! Only the “chunk” in that bracket. For example, you pay 10% on the first $40,000 of income, 25% on the next $20,000 of income (total of $60,000), and 35% on the next $15,000 of income (total of $75,000).

Me dicare IRMAA 2024 schedule utilizes a “cliff” style of assessment instead. That means if you are just $1 over the cut-off for the next tier of IRMAA, you will pay the higher amount. There are no brackets for each chuck of income like federal income tax and no graduation or progression in the amount you pay. The Medicare 2024 Part B IRMAA premium brackets change when you earn one dollar more above the line.

dicare IRMAA 2024 schedule utilizes a “cliff” style of assessment instead. That means if you are just $1 over the cut-off for the next tier of IRMAA, you will pay the higher amount. There are no brackets for each chuck of income like federal income tax and no graduation or progression in the amount you pay. The Medicare 2024 Part B IRMAA premium brackets change when you earn one dollar more above the line.

What Is Medicare IRMAA Based Upon in 2024?

The IRS and Social Security work with Medicare. Medicare determines your income based on your most recent tax filing. So, for example, you are going on Medicare in 2023. The most recent tax filing was in 2022 for 2021. Usually, IRMAA is based on a two-year lag in your income.

How Is Medicare IRMAA Calculated?

Your adjusted gross income (AGI) determines where you fall in the Medicare IRMAA 2024 schedule. The AGI, however, differs from the MAGI (Modified Adjusted Gross Income) you usually think of when doing your taxes. AGI for IRMAA is a Medicare-specific form of MAGI. It is your AGI with tax-exempt bonds–-both earned and accrued interest–-added back into your income. Interest from U.S. Savings bonds used for higher education is added back. Earned income from working abroad that was not added to gross income is included. MAGI (Modified Adjusted Gross Income) for Medicare differs from what MAGI usually means for non-healthcare-related purposes.

You will be sent your Medicare IRMAA Initial Determination Notice soon after you enroll in Medicare Part B. Confirm the income amounts the IRS uses are correct–they make mistakes, too.

Medicare Financial Planning

Medicare Financial Planning

Examine the Medicare IRMAA 2024 schedule to see if you are close to any of the limits.

What are your plans for the future? Will you withdraw from retirement savings this year or in future years? A home sale can spike your income when your intention is only to downsize and move to a one-story home. Capital gains from a stock and property sale or other appreciated assets may come back to visit you as an unexpected IRMAA tax.

Any of these actions may increase your income substantially enough to move you into and/or up the IRMAA brackets, requiring you to pay more. Knowing and planning for these events, you can move assets in smaller amounts over time to avoid large spikes in income and, consequently, increases in your income tax and IRMAA Part B premium.

How Do I Reduce Medicare IRMAA?

Charitable donations of cash, appreciated assets, and appreciated stock can reduce your taxable and IRMAA surcharge, as well as contributions to 401ks, IRAs, and other qualified programs. Some minor adjustments may drop you down a bracket and save you some money.

What Is the Medicare IRMAA 2024 Schedule?

Since 2007, some Medicare beneficiaries’ Part B monthly premiums included a surcharge based on income. The Medicare IRMAA for 2024 is in the table below.

|

Individual |

Couple | IRMAA Tax |

Part B Total Monthly Premium |

|

Less than $103,000 |

Less than $206,000 | $0.00 |

$174.70 |

|

$103,000 < $129,000 |

$206,000 < $258,000 | $69.90 |

$244.60 |

|

$129,000 < $161,000 |

$258,000 < $322,000 | $174.70 |

$349.40 |

|

$161,000 < $193,000 |

$322,000 < $386,000 | $279.50 |

$454.20 |

|

$193,000 < $500,000 |

$386,000 < $750,000 | $384.30 |

$559.00 |

|

$500,000 < Greater |

$750,000 < Greater | $419.30 |

$594.00 |

Since 2011, higher-income Medicare beneficiaries have paid a surcharge on top of their Medicare Part D premium. The Medicare IRMAA for 2023 prescription drug plans is in the table below. This does not include premiums for specific Medicare Part D plans, Medicare supplements, or Medicare Part C/Medicare Advantage plans. The totals only reflect Part B premiums and Medicare IRMAA 2023 surcharges.

These IRMAA surcharges for Part D have nothing to do with the Part D Gap (or Donut Hole).

|

Individual |

Couple | IRMAA Tax Part D |

Total Monthly Part B & Part D |

|

Less than $103,000 |

Less than $206,000 | $00.00 |

$174.70 |

|

$103,000 < $129,000 |

$206,000 < $258,000 | $12.90 |

$257.50 |

|

$129,000 < $161,000 |

$258,000 < $322,000 | $33.30 |

$382.70 |

|

$161,000 < $193,000 |

$322,000 < $386,000 | $53.80 |

$580.00 |

|

$193,000 < $500,000 |

$386,000 < $750,000 | $74.20 |

$633.20 |

|

$500,000 < Greater |

$750,000 < Greater | $81.00 |

$675.00 |

The Bottom Line For Medicare IRMAA in 2024

Medicare has rules. Lots of rules, including how much you pay if you are successful in our country. We are about helping you navigate the rules, and in the case of Medicare IRMAA for 2024, make sure you do not

Christopher Grimmond

pay one penny more than is required.

If you fall into one of the Medicare IRMAA brackets, talk with your financial planner and tax consultant about minimizing the damage. Get started positioning assets well before 65 and have a plan to move yourself down the Medicare IRMAA 2024 schedule.

We are licensed and experienced insurance professionals. This may be your first Medicare IRMAA rodeo in 2024. It is not ours at Omaha Insurance Solutions. Give us a call and speak with an experienced & licensed insurance agent professional at 402-614-3389.

You don’t get Medicare because you want it. You must be eligible for Medicare. Medicare eligibility doesn’t mean you can enroll in Medicare whenever you wish. You can only enroll in Medicare during specific periods under particular circumstances.

These special times are called election periods, each governed by criteria and circumstances. You must meet specific criteria to be eligible for Medicare and can enroll in Medicare during a specific time period or circumstance.

These special times are called election periods, each governed by criteria and circumstances. You must meet specific criteria to be eligible for Medicare and can enroll in Medicare during a specific time period or circumstance.

Congress passed the Consolidated Appropriations Act of 2021 (CAA), which expanded, streamlined, and made Medicare eligibility and enrollment easier.

Two areas of change are very relevant to newbies going on Medicare in 2023.

The Last 3 Months of Medicare Initial Enrollment

You have probably heard you have seven months to enroll in Medicare—3 months before your 65th birthday, the month of your 65th birthday, and 3 months after your 65th birthday. This is referred to as your Initial Enrollment Period. The problem for years was a bizarre rule when you enroll during the last 3 months of this period that affected your Medicare eligibility.

The old rule was if you enrolled during the 3 months before your 65th birthday, Medicare started the month you turned 65. That remains the same. For example, your 65th birthday is in July. Your Medicare will start in July if you enroll in April, May, or June.

If you enrolled during the 3 months after your 65th birthday, Medicare did not start until 2 months later for month 5, 3 months later for month 6, and 3 months later for month 7. For example, if you enroll in August, Medicare starts in October. You enroll in October, Medicare starts in January. Crazy.

Now when you enroll during the last 3 months, Medicare starts immediately the following month. For example, if your 65th birthday is in July and you enroll in Medicare in August, Medicare starts September 1st instead of October 1st.

Or if your 65th birthday is in July and you enroll in Medicare in September, Medicare starts October 1st instead of December 1st.

This makes way more sense. It shortens the waiting time and prevents lapses in coverage from employer health plans ending on an immovable date. Not sure why this Medicare eligibility wasn’t fixed years ago.

Medicare General Enrollment Period Eligibility

Over the years, a few people came to me who missed enrolling in Medicare when they were first eligible. Consequently, they were assessed the famous Medicare 10% penalty compounded for each year without Medicare, but more importantly, their Medicare eligibility was affected. They could not start their Medicare health coverage until months later.

Over the years, a few people came to me who missed enrolling in Medicare when they were first eligible. Consequently, they were assessed the famous Medicare 10% penalty compounded for each year without Medicare, but more importantly, their Medicare eligibility was affected. They could not start their Medicare health coverage until months later.

Quite often, they have no health coverage for months. They are entirely on their own, paying for any medical services out of their own pocket.

Imagine you are 67 and decide it’s time to get on Medicare. You retired a few years back but never signed up for Medicare or had any other health insurance. You cannot just show up at the Social Security office, sign up for Medicare and have it start the next month. You must wait until the General Enrollment Period from January 1st—March 31st. This is just for enrollment. Medicare then did not start until July 1st, and you could only purchase a Part D drug plan and/or Medicare Supplement. No Medicare Part C/Medicare Advantage until January 1st. Not sure about the confused thinking behind such a bad rule.

In 2023, when a Medicare beneficiary signs up for Medicare during the General Enrollment Period, Medicare coverage starts on the 1st of the following month. For example, if you sign up in February, Medicare starts March 1st. You don’t need to wait anymore until July 1st for Medicare to start.

People constantly complain about how confusing Medicare is. Medicare rules, however—believe it or not—remain very constant over time. These two rule changes from the Consolidated Appropriations Act of 2021 (CAA) are unusual because Medicare does not change much. These new rules about Medicare eligibility and enrollment periods are a welcome adjustment to how Medicare operates.

The Bottom Line On Medicare Eligibility & Enrollment

When you do not deal with Medicare rules daily, they feel overwhelming. I understand and sympathize. Also, understand Medicare eligibility and the ability to enroll in Medicare is critical. There is no room for mistakes.

You want to know how Medicare works, the rules, and the intricacies so that you have the best possible Medicare health coverage.

You can also just call us rather than trying to remember the Medicare eligibility and enrollment rules. We listen to your situation and provide the most up-to-date and relevant Medicare information.

Christopher Grimmond

Call 402-614-3389 to speak with an experienced insurance professional and licensed agent.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Does Medicare Cover Insulin?

Medicare has covered insulin for a long time, but the cost to consumers has gone through the roof over the years. Under the Trump Administration, the Centers for Medicare & Medicaid Services (CMS) announced Medicare changes in 2021 that covered 1,750 Medicare Part D prescription drug plans and Medicare Advantage plans with prescription drug coverage. The plans would reduce insulin prices under the Senior Savings Model. Medicare beneficiaries would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

The Inflation Reduction Act (IRA) law the Biden administration sponsored significantly changed Medicare for 2023. The IRA law set a cap of $35 for insulin that Medicare Part D prescription drug plans offered. The insulin price reduction act went into effect in 2023.

Not all, but many insulin medications to combat diabetes are capped at $35 per month.

Medicare Changes Insulin Prices in 2023

The $35 insulin cap is for both Medicare Part B and Part D. Most people get their insulin medications through their Medicare Part D prescription drug plan. They pay the monthly plan premium and a copay when they pick up their insulin. In the past, the copays were significant. Now insulins on Medicare prescription drug plans in 2023 changed to $35 per month.

What Are 2023 Changes to Insulin Covered by Medicare Part B?

What Are 2023 Changes to Insulin Covered by Medicare Part B?

Many others use insulin delivered through an insulin pump that people wear. The pumps are considered durable medical equipment and are billed under Medicare Part B. Part B has a deductible and an unlimited 20 percent coinsurance. However, when paired with a Medicare supplement, like Plan G, the 20 percent coinsurance is wholly covered. After a small Part B deductible is met, the beneficiary pays nothing for the pump or insulin.

What About Disposable Insulin Patch Pumps?

Insulet Omnipods are very popular. It is a disposable insulin “patch” pump. The disposable pump is a small wireless, tubeless pump worn directly on the body. Beneficiaries get the refills for the Omnipod under the Part D prescription drug plan, not Part B.

The Medicare change for 2023 is insulin refills will be $35 or less.

The patch pump, however, is considered a durable medical device, which falls under Part B. The device will be covered like any other durable medical equipment with no price controls. What you pay is determined by your plan.

How Does Medicare Change Deductibles in 2023 For Insulin?

Most Medicare Part D prescription drug plans and many Medicare Advantage plans with prescription coverage have deductibles. The deductibles aren’t going anywhere; they still exist. However, the deductible no longer applies to covered $35 insulin medications. In other words, Medicare beneficiaries do not have first to meet the deductibles of $505 before they start paying $35 for insulin. This is significant.

Many times the large deductible is an insurmountable obstacle for some clients when they go to the pharmacy to pick up their medication for the first time. They choose not to get their essential medication because of the cost.

I always show clients the prices when we meet. I’m not sure what happens from the showing to when some actually pick up the medication at the pharmacy, but I have fielded many a phone call–“I can’t afford $$$$!”

Medicare changed the rule for $35 insulin on January 1, 2023, to no deductible.

Reimbursement When Overcharged for $35 Insulin

Reimbursement When Overcharged for $35 Insulin

Mistakes happen. If you are charged more than $35 per month for an insulin medication that is part of the program, the Part D plan must reimburse you within 30 days. The insurance company is responsible for the reimbursement. Contact the plan. The customer service 800-number is on the back of your Part D medical card.

Pharmacies Don’t Matter for $35 Insulin.

When I meet with clients, I always show how different pharmacies will affect drug copays. The effect of pharmacies on cost is essential to know if you wish to maximize your Part D plan and pay the least.

Drug plans sign contracts with different pharmacy chains and networks. As part of the deal, copays are lower if you go to one of the plan’s preferred pharmacies versus a non-preferred pharmacy.

Whether a preferred or non-preferred pharmacy, the insulin on the Medicare Part D plan will be $35. Many of my clients have a favorite pharmacy that may not be in the network—non-preferred. It is good to know, wherever you pick up your $35 insulin; it will be $35 insulin.

Not All Medicare Insulin Is $35

Medicare Part D prescription drug plans create formularies, a list of the medications the plan covers. The medications are put in tiers that determine copays and deductibles. Medicare requires the insurance companies to cover at least two medications in each category. Sometimes companies make choices, like covering Humalog insulin types but not Novolog insulin. The new law requires the plan to keep insulin at $35, but only insulins the plan carries. Not every brand or type. This is important in selecting a Part D plan. You need to know which brands and types of insulins are covered under a particular plan. And plans can change and often do change drugs on the formulary from year to year.

We always run clients’ medications when we meet to ensure they have the lowest cost plan for their specific list of medications. During Annual Election Period (AEP) Oct 15th–Dec 7th, we re-run clients’ medications to make sure they still have the best plan for them. If necessary, we change their plan.

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

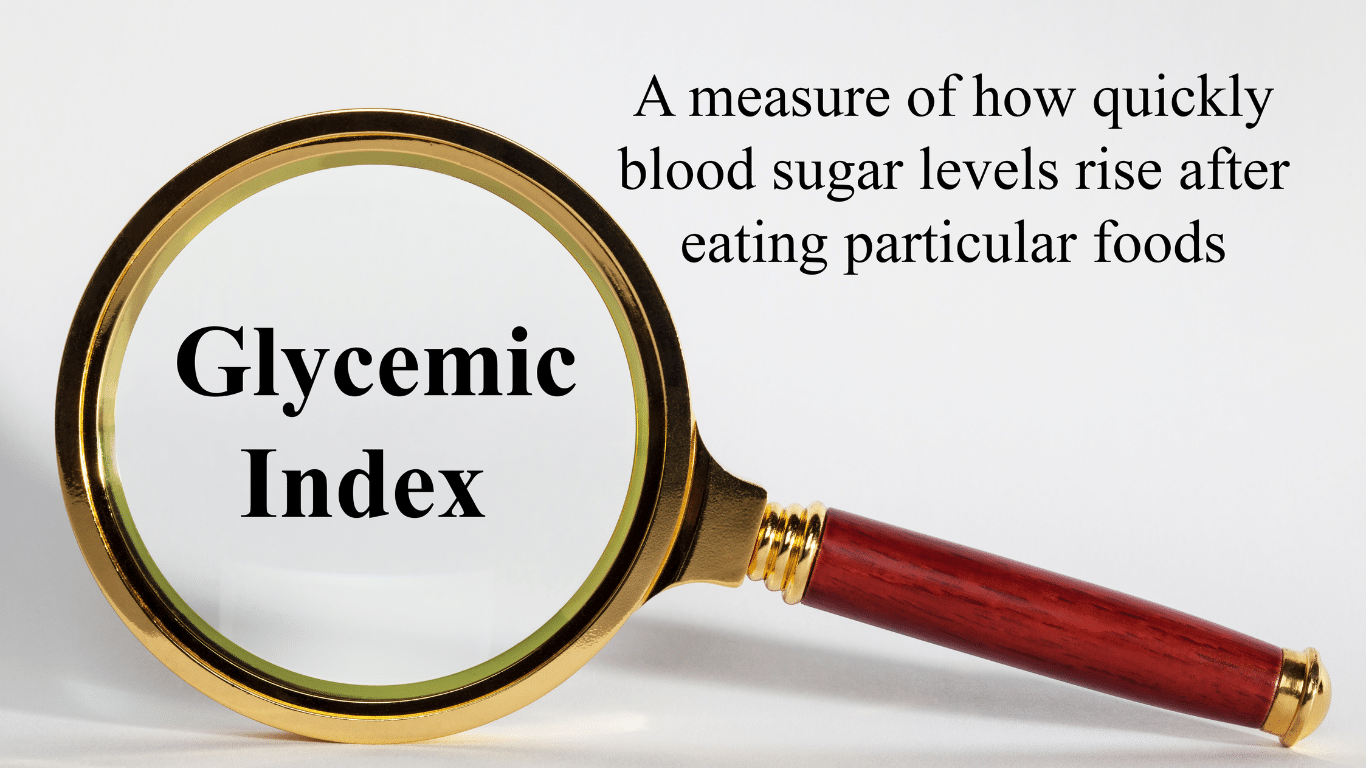

While Medicare’s $35 insulin is a tremendous financial relief for Medicare beneficiaries who are diabetic, other medications are equally important to improve and maintain glycemic control. Some popular non-insulin and anti-diabetic medications are Trulicity, Bydureon, Ozempic, and Victoza. Oral and injectable (non-insulin) pharmacological options are available for treating diabetes. Medicare, however, did not change the pricing for these medications for 2023. They are not part of the price reduction program currently.

Special Election Period Because of $35 Insulin

The $35 insulin for Medicare beneficiaries is a new regulation, so Medicare has allowed a special enrollment period for “Exceptional Circumstances.” The rule is only for those who are on insulin. You have a one-time opportunity to change your Medicare Part D prescription drug plan from December 8, 2022, until December 31, 2023. The reason is to take advantage of the favorable pricing for insulin medications.

Again, the ability to change Part D plans is only for those on insulin medications, a one-time opportunity during this period.

True Out-of-Pocket Costs Carry Over

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Remember, there are four phases in pricing for Medicare Part D prescription drug plans: deductible, initial phase, the gap (or Donut Hole), and catastrophic phase. Switching Part D plans during the year does not mess this up. You do not start over again. The amounts, totals, and placement within Part D plan phases transfer to the new plan.

If you are in the gap phase in one plan, you will be in the same phase and place in the new plan. You did not lose your place or are forced to start over again.

Medicare Changes the Catastrophic Phase in 2023

The fourth phase in the four stages of tracking Part D prescription drug costs is called “Catastrophic.” When a beneficiary reaches the catastrophic phase, they and the plan have paid out approximately $7,400 in out-of-pocket costs between the beneficiary and the plan. The actual out-of-pocket for the beneficiary is $3,100. The prescription costs are usually minimal unless it is an expensive medication. The coinsurance in the catastrophic phase for expensive medications is an unlimited 5 percent, and 5 percent of a large amount is still significant for most pocketbooks.

The effect of the new legislation in 2024 is beneficiaries will no longer pay the unlimited 5 percent. The out-of-pocket cost will stop at a hard cap of $3,250 out-of-pocket max for beneficiaries. While still not a small amount, it is significantly less than what some beneficiaries paid who were on costly medications in previous years.

Medicare Part D Annual Limit In 2025

The Inflation Reduction Act (IRA) mandates that the annual limit of the Medicare Part D prescription drug will be $2,000 starting in 2025 and indexed for inflation yearly after that. Part D expenses are not currently capped. This Medicare change starting in 2023 is enormous.

I think of my clients on various insulins, anti-diabetic medications, Eliquis for the heart, Humira & Enbrel for rheumatoid arthritis. Their costs have been thousands of dollars for years. That will stop.

The Medicare Part D $2,000 cap is for all tiers of drugs. The limit is for all medications on the plan’s formulary, and the $2,000 limit is for all Medicare beneficiaries regardless of past or current income. IRMAA does not apply.

Inflation Cap on Part D Premiums

The law also includes a 6 percent limit on Part D premium increases. With current inflation around 6 percent now and medical costs usually at a higher rate of inflation growth than regular inflation, how the system will really work is yet to be seen.

Smoothing Part D Out-of-Pocket Costs

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

One month the cost may be $1,000, and the next month is $100. Most consumers’ incomes are consistently the same each month, and large spikes in expenses create extreme hardship.

The IRA law offers an option for “smoothing” the payments evenly over the year.