Medicare EnrollmentCategory:

If you have paid payroll taxes (FICA) for 40 quarters (or 10 years), you are eligible to apply for Medicare in Nebraska for 2022. You are eligible for Medicare Part A at zero premium and may purchase Part B at the current cost if your income is below the IRMAA (Income Related Monthly Adjustment Amounts) amounts.

The Easy Way To Apply For Medicare in Nebraska For 2022

If you are currently receiving Social Security benefits, you will be automatically enrolled in Medicare Part A for the hospital and Part B for doctor visits and outpatient services. You will then be given the option to cancel Part B if you wish.

You cancel Part B by signing the red, white, and blue Medicare card on the back and mailing it back to Medicare. Otherwise, Medicare Part A and B will start on the effective dates printed on the bottom right corner of the card. The Social Security Administration (SSA) will also start deducting the Medicare Part B premium from your monthly Social Security check.

Applying for Medicare in Nebraska in 2022 is easy that way. It is automatic. The other way is more challenging.

Online Application For Medicare in Nebraska for 2022

Applying for Medicare in Nebraska, Iowa, and throughout the country has become more difficult and complex with each subsequent month. The pandemic pushed the process almost entirely online. Social Security personnel were absent at Social Security Administration Offices throughout Nebraska, Iowa, and the whole country during that time. Offices were closed, and most employees were working remotely.

Identity theft, cyber security, and HIPPA regulations have pushed the Social Security Administration (SSA) to add more and more levels of security to the Medicare application.

I help my prospective clients apply for Medicare all the time. While eligibility for Medicare and Social Security benefits in Nebraska begins at 65, most people are not getting their Social Security benefit checks until much later. Instead, they are waiting until the full benefit age, which is around 66 and 8 months or older. So they need to apply for Medicare online.

I probably average helping five people a week apply for Medicare in Nebraska and Iowa. The level of difficulty each person experiences is amazing. I don’t know how other people do it on their own.

How Do You Apply For Medicare Benefits in Nebraska Online in 2022?

If you are eligible for Medicare in Nebraska, type ssa.gov into your address bar. Do NOT Google ssa.gov. You will end up at all kinds of websites trying to sell you Medicare plans. The Social Security Administration logo will be in the top left corner if you are successful.

Click on Menu in the top right section of the website. Go under Benefits and click Medicare. Then, scroll down the page until you see a bright blue button that says “Apply for Medicare Only.” Click on the button that will take you to a page with a gray button that says, “Start New Application.” Click it.

Follow the prompts. The most crucial part is your My Social Security login. This is the tricky part.

Hundreds of people swear they never set up an online Social Security account. Then, when we start the enrollment process, we discovered they have a My Social Security account, and SSA requires us to use it.

Logging in to your My Social Security account may become an insurmountable obstacle if you need to provide personal verification information, like the answers to the three security questions you had set up previously. At that point, you will be stopped out and need to call or go to the Omaha, Lincoln, or Council Bluffs Social Security Administration office to get access to continue applying for Medicare in Nebraska in 2022.

If you do not have an online My Social Security account, you create one. In creating the account, you will need immediate access to email and text. With that, you will be able to set up an online account.

Follow the prompts to set up the account.

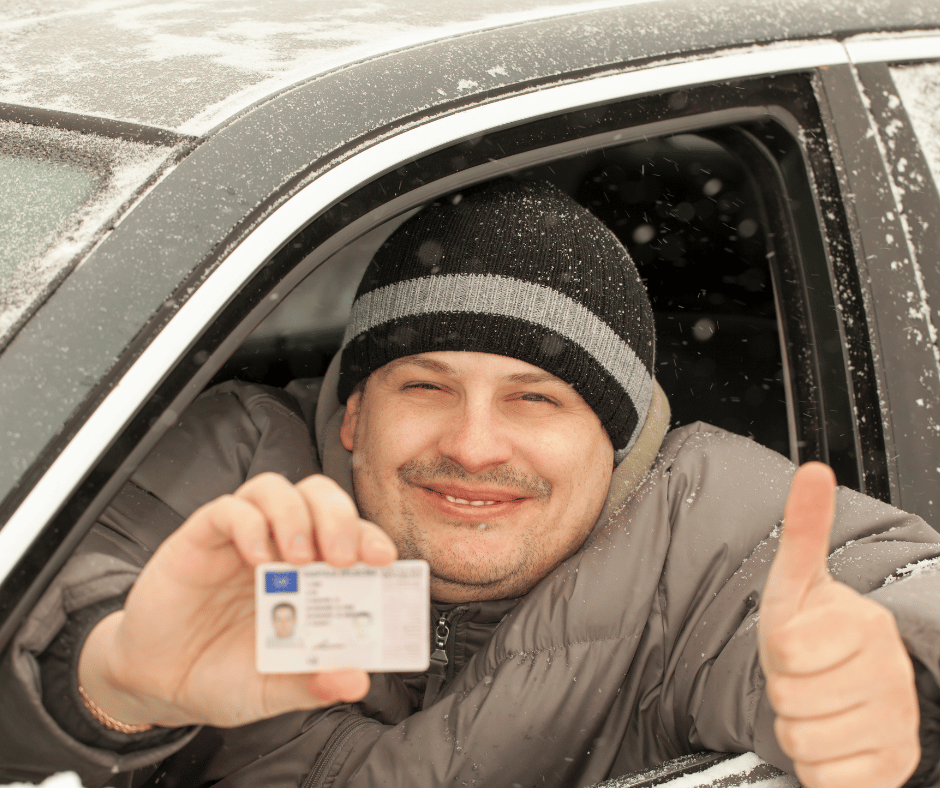

Second Form of Identification When Applying for Medicare in Nebraska for 2022

Giving SSA a second form of identification, such as your driver’s license, is vital. SSA will text a link to your phone. Then you take a photo of your driver’s license to verify who you are. Taking the photo so the system receives it can be problematic. This is the most difficult part of applying for Medicare.

Your phone’s camera software may not work well with SSA’s system, the cellular or internet connection may be weak, or the SSA system may be in a bad mood that day. Many factors can go into making the system unworkable. Be warned.

If you cannot set up a second means of verification, you will probably have to wait for a verification code to be mailed to your physical address. Then you go back in to complete the enrollment process.

More than half of the time, the system works. We get the text verification and complete the My Social Security online account setup.

When you enter your My Social Security online account through the Medicare prompts, the system pulls up the application for Medicare. Fill in the details and complete the application. The application process will assume you want Medicare Part A for the hospital since it is free. The system will ask if you want Medicare Part B for doctor visits and outpatient procedures. Medicare Part B costs something. You have the option to say yes or no.

Check On Your Online Medicare Application

When you have completed the application, you can go back in and check on your Medicare application status. A newly created box is in your My Social Security account for Medicare. There will be three grey horizontal bars going across the page. When you complete the application, one bar will be blue. When all three bars are blue, a comment underneath will say you are approved. Congrats!

Above will be a “Verification of Benefits Letter” link. Click on the link. A letter will open up. In the body of the letter will be your Medicare number (MBI), which is made up of eleven digits consisting of a combination of numbers and letters. The letter will also have the dates when your Part A and/or Part B will start.

Sometimes clients tell me they want to wait for the Medicare card to come in the mail. Bad decision. It may take over a month for your Medicare card to show up in the mail, significantly decreasing your time to select, enroll, and get your medical cards from the insurance company before your start date.

Online Medicare Application Problems

Check your account two weeks after you apply for Medicare online, and keep checking it until you have a Medicare number.

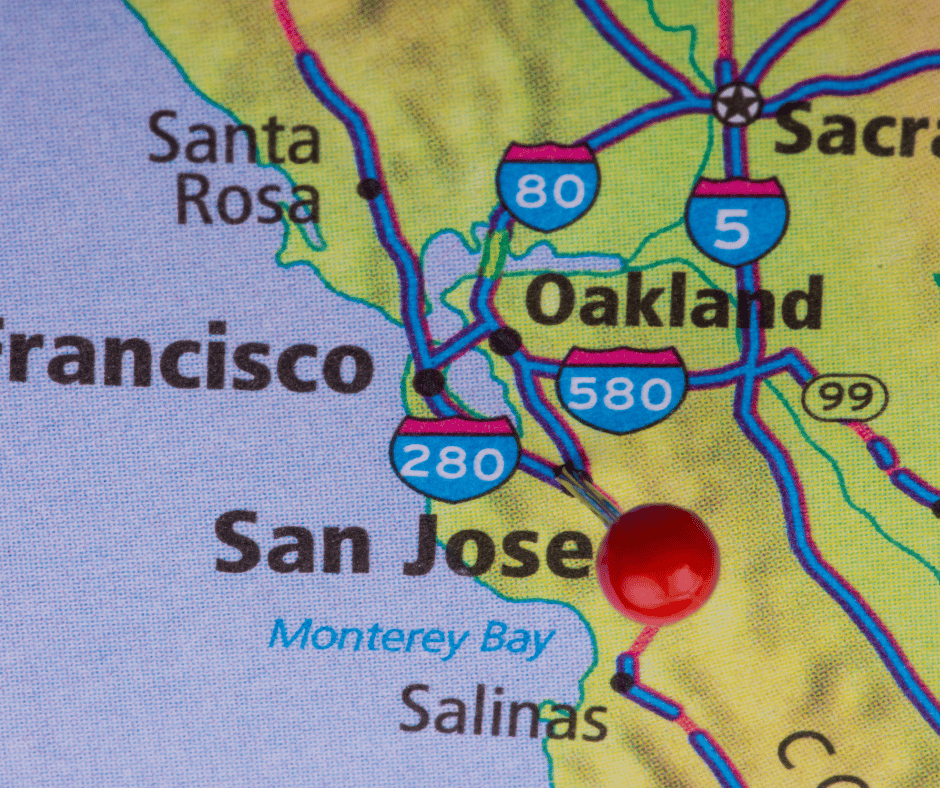

If your account says your case was sent to Salinas, CA, for processing, you need to call your local SSA office to find out why. Salinas, CA, is a black hole.

There is a problem with your application that needs to be solved sooner rather than later, and the folks in Salina, CA, are not very proactive or even active in solving your problem–whatever it may be.

All of this above-said information works if your personal information is in good order with SSA. There may be problems of which you are only aware once you enroll. For example, your name is misspelled with SSA, your birthday is wrong, your address is out-of-date, your maiden name was not changed to your married name or back after a divorce, and your naturalization date or number is incorrect. You could also be flagged as a terrorist, Russian mole, or affiliated with the opposing political party–just kidding.

I’ve experienced all of these with clients–except the terrorist one. Making corrections takes lots of time. I had a gentleman born at a Japanese civilian hospital instead of the U.S. military hospital on the base where his father served, which created a whole set of problems that plagued him throughout his life.

Getting the correct documentation takes time if it can be found. Then SSA takes time to verify the documentation and may ask for more. Then there is the processing time, which could result in you missing your intended start date. That is why you start applying for Medicare in Nebraska as early as possible in 2022.

Calling the SSA Office

You, of course, can call the SSA office or stop in to apply for Medicare in Nebraska for 2022. If you contact them too early, they will not talk with you. Too early is more than 3 months before you turn 65. Then, when they talk with you, SSA generally will set the appointment a month or two later, so you are right up against your birth month and start date. This will work if there are no problems and everything else works smoothly, but this situation usually causes anxiety for most people.

My Experience Helping Clients Apply for Medicare

I’m an insurance agent. I am not an employee of the SSA, but I feel like an unpaid auxiliary staff member. My clients need help, so I’ve learned to navigate the SSA Medicare enrollment system through trial and error. It is a system that is continually evolving.

I’m happy to help my clients. The process creates a tremendous amount of empathy for my clients for what they have to go through. Not only are they confused with all the information and choices that come with going on Medicare, but they have a government bureaucracy that is an unfriendly and confusing obstacle to overcome. I try my best to help and give encouragement when I can’t do specific tasks for them, like finding an original birth certificate with a raised seal.

As the bugs get worked out of the SSA/Medicare system, and Medicare beneficiaries become more tech-savvy, the process for applying for Medicare in Nebraska for 2022 will become more efficient–I hope.

Until then, use this guide to navigate and find your way to the end of the Medicare application maze.

What Does A Medicare Insurance Agent Do?

When you sign up for a Medicare plan or Medicare supplement, you use a licensed insurance agent. An agent is a person who acts on behalf of someone. That someone may be the client or he may be the insurance company. He is licensed which means that the state certifies he has passed some basic testing and has rudimentary knowledge about insurance that allows him to represent a company or person. Medicare insurance agents come in many different types. What type of Medicare insurance broker is near you?

What Is A Captive Medicare Insurance Agent?

What Is A Captive Medicare Insurance Agent?

A captive Medicare insurance agent is the opposite of an independent Medicare insurance broker. He has a contract to represent one insurance company. He is not an insurance broker. Depending on the level of captivity, he must sell a certain amount of the company’s insurance products to remain an agent and continue to receive renewal commissions. He may or may not be able to sell any other insurance company’s products.

The difficulty with dealing with a captive agent who offers Medicare insurance products is a lack of selection and objective evaluation. He will probably say his products are “the best!” However, you have no way to compare and evaluate based upon the product information he shares. He is a one-trick pony. Physician Mutual agents. Blue Cross Blue Shield of Nebraska Agents.

From what clients have reported to me, many captive agents do not honestly represent themselves as exclusively with one company. They lead prospective to believe they can represent many companies when that is not the case. Some captive agents do not disclose they are in fact captive.

What Is A Medicare Supplement Insurance Agent?

Some agents sell almost exclusively Medicare supplements or Medigap policies. For those who sell over the phone, Medicare Supplements are the only Medicare products they can sell because of very strict regulations around Medicare Advantage and Medicare Part D. Medicare rules and regulations prohibit unsolicited calls to consumers about Medicare Advantage.

and regulations prohibit unsolicited calls to consumers about Medicare Advantage.

Consequently, these agents sell against Medicare Advantage constantly. They point out weaknesses in the product–whether real, exaggerated or imagined. Medicare Supplements are the best, of course, because they cannot offer an alternative.

Consequently, these agents sell against Medicare Advantage constantly. They point out weaknesses in the product–whether real, exaggerated or imagined. Medicare Supplements are the best, of course, because they cannot offer an alternative.

With auto-dialers, Med Sup agents dial 10 to 15 prospects simultaneously. Call centers in Florida, South Carolina, and California carpet bomb the U.S. with millions of phone calls each day. During Annual Election Period (Oct. 15th–Dec 7th), the Med Sup call centers recruit a bunch of agents for the season. You will probably never talk with the agent again after he signs you up.

Other agents who sell Medicare Supplements exclusively face-to-face are controlled by agencies, managers, or marketing groups. If they sell a lot of one or two companies, their commission is higher. They can win sales trips abroad and bonuses. That is the motive behind their exclusivity. They are not truly Medicare insurance brokers.

What Is A Medicare Advantage Insurance Agent?

Some agents sell just Medicare Advantage plans. They are likewise semi-captive to an insurance company that feeds them leads. The insurance company may have a large market presence. Lots of consumers call in because they are familiar with the brand name and trust it. They enroll in the Medicare Advantage plan over the phone or online with an insurance agent at the company.

Some people, however, want to talk with a live person. The insurance company will send an agent out to the person’s home to explain the product in greater depth and enroll them in person. The agent, however, is obliged to just offer that company’s products in the most favorable light and not the competition. That is why the insurance company supplies the leads to the agents. These are not Medicare insurance brokers.

Independent Medicare Insurance Brokers Near Me

Independent Medicare brokers represent both sides of Medicare–Medigap policies and Medicare Advantage. Independent Medicare insurance brokers represent multiple companies, not just a hand full. He should be showing quotes and brochures from many different insurance companies.

Insurance companies that offer Medicare Advantage pay the agent the same amount, so there should be no preference based upon commission. An independent agent should receive the same percentage on the supplement side as well.

Medicare insurance brokers are only paid when you are a client. To keep you a client, you need to remain a happy client. A conscientious independent insurance agent should keep in touch and make sure his clients are happy with their current Medicare plans and change them when not.

Local Broker Vs. Call Center Agent

When you turn 65, that is when you first become Medicare eligible. You will be inundated with mail, phone calls, and even door knockers trying to sell you some Medicare insurance product. I hear complaints from my clients all the time about the oodles of phone calls and the blizzard of junk mail. They need to go into witness protection to avoid the solicitors.

all the time about the oodles of phone calls and the blizzard of junk mail. They need to go into witness protection to avoid the solicitors.

Most solicitations will come from persons you will never meet. You do not know them. They are strangers calling from far away states. They may have been insurance licensed for only a year, a month, or just a week. The average insurance agent doesn’t last in the business even a year.

Do you want to share your personal information over the phone with a complete stranger? Someone you will never meet in person.

There is something reassuring about dealing with someone who is established in the local community. Proven. They will not disappear in a month. Connected to people and institutions you know. At least a Cornhusker!

How to Find Medicare Brokers In My Area?

You can use Google to find Medicare insurance brokers. Google seems to know everything. It is not a bad start.

An agent’s website gives you a feel for the agent and agency. Blogs and videos demonstrate his knowledge and expertise–or the lack.

Google reviews from clients–hopefully not family and friends–give some proof of professionalism and quality of service. Google is a 3rd party, so the reviews are not cherry-picked.

Referrals are another way. Most of my clients now come from my existing clients. So ask a friend, but check the person out. Go to the Better Business Burea and check the rating. Again, visit the website.

One new client told me she was at a work function. She’s employed in the healthcare field. Three other ladies–fellow nurses–were chatting around a table. She mentioned she was turning 65 and going on Medicare. She complained how the endless phone calls and junk mail made the whole process a headache. Immediately the three nurses volunteered “their Medicare guy” to her to help solve the dilemma. All four were surprised when they realized I was the Medicare agent for each of them.

How to Choose An Independent Medicare Broker Near Me?

How to Choose An Independent Medicare Broker Near Me?

The most important criterion I believe is experience. Being in the insurance industry, I have seen hundreds of agents come and go since I became an agent back in 2003. Like anything–stock trading, medicine, law–you need practice. While it may be very nice to help out a friend or nephew who is getting started in the business, your health insurance is a serious matter. You want a professional handling your money, your body, and your assets to have time in harness.

Let the market pick your Medicare broker. If the agent makes lots of people happy with his work, he is successful and stays in the business. Time in service with lots of clients is the first key.

While my doctor is younger than me for the first time, she didn’t just get out of medical school. I know she had a lot of practice before I showed up. I think Medicare insurance brokers near you need to have lots of years in the business and lots of clients. That way they are not practicing on you, and they will be there for you for years to come.

Again, visit their website, read their materials, list to their presentation. It is like listening to good or not so good music. After a while, you can tell whether it rings true.

As much information as there is about Medicare, I’m surprised people still do not remember important Medicare dates. The surplus of commercials, mailers, emails, and advertisements probably do more to obscure and confuse people about Medicare enrollment dates. The first Medicare enrollment date to remember is the most important one.

As much information as there is about Medicare, I’m surprised people still do not remember important Medicare dates. The surplus of commercials, mailers, emails, and advertisements probably do more to obscure and confuse people about Medicare enrollment dates. The first Medicare enrollment date to remember is the most important one.

Medicare Initial Enrollment Period

You are first eligible for Medicare at age 65. You can enroll in Medicare three months before your 65th birthday, the month of your birthday, and three months after your birthday. If you do not enroll, a penalty is permanently added to your Medicare Part B premium if you do not enroll.

The penalty is 10% of your current Part B premium added to your Part B premium for the rest of your life. Yes, it never stops. The 10% penalty is for not being enrolled in Medicare each full year when you were eligible. I have client who cannot verify he had employer health coverage for 4 year. Yes, he has a permanent 40% penalty tacked on to his Medicare Part B premium.

There is also a separate permanent penalty for not having a Medicare Part D plan as well.

The exception is if you have an employer health plan that is as good as Medicare. If you do, then you may defer going on Medicare indefinitely without penalty as long as you remain on a qualifying employer health plan. This is the part that many salespeople leave off in the rush to sell you a supplement or Medicare plan.

The Big Medicare Enrollment Date Is Annual Election Period (AEP)

Once you are on Medicare, you have an opportunity to change your Medicare Part D or Medicare Part C/Medicare Advantage plan during Annual Election Period (AEP). AEP that is from October 15th–December 7th each year.

You need this period because Medicare plans change, and your health needs change. You can switch to a plan that better serves your needs during this time. AEP is particularly important for a person on expensive medications.

Part D and Part C plans can drop prescription drugs, move them to higher tiers, or increase their copays significantly. The Annual Election Period allows people to switch to a plan that covers their medications at a lower cost.

Those on Part C/Medicare Advantage plans may be interested in other Medicare Advantage plans that have lower copays and better benefits. The Annual Election Period (AEP) is an opportunity to shift to a better plan.

For those who want to move to a Medicare Supplement from an Advantage plan or go from an Advantage plan to a Medicare Supplement, this is the time for that switch.

Medicare Advantage Open Enrollment Period (OEP)

A couple of years ago, CMS (Center for Medicare & Medicaid Services) decided to create Medicare Advantage Open Enrollment Period (OEP). OEP is from January 1 — March 31 each year; if you’re enrolled in a Medicare Advantage Plan, you can switch to a different Medicare Advantage Plan or switch to Original Medicare (and join a Medicare Part D prescription drug plan) once during this time.

CMS observed that Medicare beneficiaries change Medicare Advantage plans during Annual Election Period AEP (Oct 15th–Dec 7th), but mistakes happen. The biggest mistake is the plan they switched to did not have their doctors in the network.

Other mistakes happened as well. OEP was an opportunity to rectify the situation. It was a free get-out-of-jail pass. You can make one change to another Part C/Medicare Advantage plan.

Or you could ultimately get out of your Medicare Advantage plan and go back to Original Medicare (Part A & Part B) and purchase a Part D plan.

The Lesser-Known Medicare Enrollment Date Is General Election Period

The Lesser-Known Medicare Enrollment Date Is General Election Period

Another Medicare enrollment date to remember is January 1-March 31 each year for those who missed their initial enrollment period. This is called the General Enrollment Period. Your coverage, however, does not start until the following July 1. You might pay a monthly late enrollment penalty if you don’t qualify for a Special Enrollment Period.

At this time, you may have an open enrollment period for a Medicare Supplement starting in July. You may also enroll in a Part D plan, but you will need to wait until Annual Election Period in October to enroll in a Medicare Advantage plan.

Special Enrollment Periods

Special Enrollment Periods

There is a myriad of Special Enrollment Periods. One of the most common is when someone is past 65 and 4 months and losses their employer’s health plan. At this time, CMS will allow you to enroll in Medicare Part A and Part B without delay or penalty if you can verify employer health coverage.

Some additional forms need to be completed and submitted to the Social Security Administration. Still, you will be enrolled on the date of your choosing and not need to wait for General Election Period.

Rules & Penalties

Medicare has lots of rules, regulations, norms, and penalties. Some of them are pretty obscure, but there is little to no forgiveness for mistakes or ignorance of the law. If you have questions about Medicare, please call us at 402-614-3389 or check out our blogs and videos on OmahaInsuranceSolutions.com. You can also call Medicare at 800-633-4227 or look on Medicare.gov for information about Medicare enrollment dates to remember.

Medicare Open Enrollment Is Also Known As Medicare Annual Election Period

Medicare Open Enrollment Is Also Known As Medicare Annual Election Period

Medicare Open Enrollment is when people may make changes to their Medicare plan. Medicare Open Enrollment is also called Annual Election Period or AEP. That is the new official name Medicare Open Enrollment. Annual Election Period (AEP) is when you can change your Medicare Part D prescription drug plan or your Medicare Part C Medicare Advantage plan. AEP is from October 15th–December 7th. A lot of people blow this opportunity. They don’t check to see if they have the best plan for their needs and situation for the coming year. BIG MISTAKE. For some people with serious health issues and medication needs, HUGE MISTAKE!

There are a thousand complaints the day after Medicare Open Enrollment (Annual Election Period), December 8th. People offer a myriad of excuses–It’s the agent’s fault,’ ‘I was too busy to deal with it,’ ‘The dog ate my Medicare card.’ The number of phone calls I get on December 8th is amazing–mostly non-clients. They are hoping to find a Medicare-fairy-godmother to save them from their negligence. Sorry, there is no Medicare-fairy-godmother!

When January 1st arrives and the new plan year begins, people may find out their plan does not cover one or more medications, or the price of one of their drugs went through the roof. Now they have a deductible on their plan they didn’t have before, a medication moved to a higher tier, or their doctor is no longer in-network. Their Medicare situation is a disaster because they didn’t double-check during the Medicare Open Enrollment / Annual Election Period (AEP).

What are the most significant problems created by not reviewing your Medicare plan during Medicare Open Enrollment / Annual Election Period (AEP)?

Formulary Check During Medicare Open Enrollment

Formulary Check During Medicare Open Enrollment

During Medicare Open Enrollment /Annual Election Period (AEP), insurance companies determine the medications on their approved list of drugs in the formularies that service their Medicare Part D prescription drug plans and the Part C Medicare Advantage plans.

Some years, they drop certain medications altogether. In other years, they might shift the medications from a lower to a higher tier.

The result is you may end up paying more for your prescription drugs. In some cases, a lot more. Checking the formulary and comparing it to the other plans in the area is a straightforward but essential process.

During Medicare Open Enrollment / Annual Election Period (AEP), reviewing medications is a big part of what we do. I sometimes have to arm-twist clients to send me their current list of medications. Some will tell me that they don’t need to do anything because their medications have not changed, but I try to remind them it doesn’t matter. The insurance companies change their formularies.

medications. Some will tell me that they don’t need to do anything because their medications have not changed, but I try to remind them it doesn’t matter. The insurance companies change their formularies.

Over the years, I have had clients neglect their reviews and end up with substantial prescription drug bills as a consequence. Your agent should thoroughly check your medications with dosages each AEP.

Double Check Physician Directories

Double Check Physician Directories

The Medicare Advantage plan manages your care. That means that an insurance company under the supervision of Medicare is making determinations about your care. As part of that program, they have doctors contracted with the plan. Some doctors and hospitals are not contracted. Doctors may change their credentialing.

may change their credentialing.

It is important to double-check to ensure your doctor is still in-network during Medicare Annual Election Period (AEP) / Medicare Open Enrollment.

We have three medical networks in the Omaha, Lincoln, and Council Bluffs area. The vast majority of medical professionals are part of one or more of these networks. The networks work with the local Medicare Advantage plans. Doctor access is not an issue.

I have clients, however, throughout the U.S., and the other plans are not as generous in the number of in-network medical professionals. Checking the directory to make sure your physicians are still in-network every year is critical during Annual Election Period (AEP) / Medicare Open Enrolment.

Review CoPays

Review CoPays

With Medicare Advantage plans, copays may change from year to year. This AEP saw very little change among the plans around here. I suspect that was because the plans determined prices in the Spring of the preceding year.

The inflation we are experiencing right now was not a factor in the 2022 planning. I think 2023 will be a different ball game.

Copays can change each year, so you need to review those changes. For example, the cost of MRIs may jump on your plan to the extent you want to change to another plan. Sometimes plans will drop benefits that Medicare does not require, like dental.

I’ve seen plans in the past drop benefits like dental. Beneficiaries don’t imagine their plan could ever change. The lack of coverage and the price tag associated with that shocks clients.

Re-Explain The Donut Hole

The dreaded Donut Hole or Gap! The Donut Hole is still there. I’ve seen the burden of drug costs lighten for some of my clients, but it is still expensive when people fall into the Donut Hole.

The dreaded Donut Hole or Gap! The Donut Hole is still there. I’ve seen the burden of drug costs lighten for some of my clients, but it is still expensive when people fall into the Donut Hole.

If you are on expensive medications that drive you into the Gap, checking your medications for the level of Gap coverage is essential. While no plan eliminates the cost, some plans are structured, so you pay less than other plans. Some plans delay going into the Gap longer, or other plans even out the cost because of a zero deductible.

If drug costs are an issue for you, look at the various Part D, and Part C plans side-by-side to determine which payment schedule would benefit your wallet during Medicare Open Enrollment.

Have A Conversation About Your Travel Plans

Many clients on Medicare like to travel. Their grandkids are scattered throughout the country. Friends moved to warmer clients, or getting out of town is just great. Other clients have semi-permanent homes in Arizona, Florida, and Texas. Medicare is a federal program. It exists from sea to shining sea in the U.S. The Medigap policies that company them work anywhere in the U.S. too. (Medicare. however, does not leave the borders of the U.S.)

Many clients on Medicare like to travel. Their grandkids are scattered throughout the country. Friends moved to warmer clients, or getting out of town is just great. Other clients have semi-permanent homes in Arizona, Florida, and Texas. Medicare is a federal program. It exists from sea to shining sea in the U.S. The Medigap policies that company them work anywhere in the U.S. too. (Medicare. however, does not leave the borders of the U.S.)

Medicare Advantage plans, however, are set up for a particular area or region. The HMO (Health Maintenance Organization) plans only include doctors and hospitals in that area. Emergencies are a different matter. Emergency visits are covered anywhere in the country. Some insurance companies with HMO plans also have national networks, so you can still get in-network services and prices outside of your geographic region for ordinary services.

include doctors and hospitals in that area. Emergencies are a different matter. Emergency visits are covered anywhere in the country. Some insurance companies with HMO plans also have national networks, so you can still get in-network services and prices outside of your geographic region for ordinary services.

For those who travel a lot and especially those who stay for long periods away from home, I highly recommend the PPO (Preferred Provider Organization) plans. You may go to doctors and hospitals outside the network as long as they take Medicare. Out-of-network copays may be more, but you have the convenience and security of going anywhere that accepts Medicare.

You can change your Medicare Advantage plan during Medicare Open Enrollment even if you are out of the area. There is email, U.S. mail, text, and even voice signatures.

Changing Circumstances Makes Medicare Open Enrollment Critical

Over the years, I have had client reevaluate their situation during Medicare Open Enrollment or AEP. Those paying enormous amounts in monthly Medigap premium look to switch to a Medicare Advantage plan.

The amount of money they pay in premium very quickly covers any copays. Others anticipate more medical costs as they age, switching to Medigap plans. Medicare Open Enrollment or AEP is the time to review your ever-changing circumstances and adjust accordingly.

Save Money On Medigap Quote Anytime, Not Just During Medicare Open Enrollment

While Medicare supplements are not geared toward Medicare Open Enrollment or AEP exclusively, it is still an excellent time to look at your pricing. Running Medigap quotes only takes a few moments. I can tell you in a minute if you have the lowest price for Plan G or Plan N in your area. We can then make adjustments accordingly.

Christopher Grimmond

Medicare planning is not a one-and-done deal. As you change, Medicare changes and the Medicare plans change. You need to make the adjustments that best fit your needs and circumstances at that time.

Ignore Medicare Annual Election Period (AEP) October 5th–December 7th at your peril or not.

What is Medicare? A basic question. Or rather, why should anyone care about Medicare? The reason people should care is that most bankruptcies are medical bankruptcies. In other words, if you wish to protect your retirement nest egg from bill collectors, Medicare is important to know about. There are few things that are more disturbing than a pile of medical bills sitting on the kitchen table. The golden years could be tarnished with worrying about actual or potential medical expenses. Medicare–if implemented proper–will protect you from a potential catastrophe. It is critical for people entering into retirement to understand what is Medicare.

What is Medicare?

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare is a Federal health insurance program for people who are 65 and older (or on Social Security disability). It began in 1965 when President Johnson signed it into law. It was designed to provide medical covered to the elderly at a reasonable price. In 1965, few people had health coverage once they stopped working. As a result, many seniors fell into poverty because of burdensome medical expenses. Medicare was a solution to a national problem.

Medicare Part A

Medicare is divided into two parts: Medicare Part A and Medicare Part B. Medicare Part A has everything to do with the hospital. It doesn’t cost anything because you paid for it during your working years. It was one of the deductions in your payroll taxes. Medicare Part A covers a 100% of the medical expenses incurred in the hospital, but there is deductible that many people are not aware of. The Medicare Part A deductible is currently $1,288. This is NOT an annual deductible. It is a deductible per benefit period, and a benefit period is 60 days. So each event has a deductible, and the time for the event is 60 days. In other words, you could have multiple events and pay multiple deductibles because the event is not limited to just a 60 day period. Each new event, even if it overlaps with another event, has its own 60 day timeline. While rare, it could happen, and probably more importantly, you could pay the Part A $1,288 deductible more than once in any given year.

Medicare Part B

Medicare Part B, however, does cost something. For most people going on Medicare and Social Security in 2016, the Medicare Part B premium is $121.80 per month. It is generally taken out of your Social Security check. Medicare Part B covers doctors’ visits and outpatient procedures, such as X-rays, blood work, emergency room visits, etc. Medicare Part B covers 80% of the cost. Your portion is 20%. The 20% coinsurance, however, is unusual. There is no cap. There is no maximum out-of-pocket. Most group plans you were ever on probably had a maximum out-of-pocket. It may have been $1,000, $2,000, even $10,000, but at some point, you stopped paying and the insurance company covered everything. Medicare Part B does not have that, so 20% of a big number will be a big number. You keep paying your 20% coinsurance as long as the bills come in.

These are the basic building blocks to what is Medicare. You must understand Medicare, Medicare Part A, and Medicare Part B to understand the rest that follows. In the next blogs and videos, we will cover how to get Medicare, how to cover the Part A deductible, and how to fill the unlimited 20% gap in Part B coverage.

Delay Medicare Enrollment

Many people work past 65. They continue on with them employer group coverage. They delay Medicare enrollment. At 66+, they wonder what to do about Medicare.

How to Enroll after 65

Here is what to do. Go to Medicare.gov. Click on “Forms, Help, Resources” on the top right. Then click on “Medicare Forms” on the left middle. You will see the enrollment forms in the middle of the page in PDF form. There are two forms: one to enroll in Medicare Part B and a second for your employer to sign off on your coverage. You fill out the enrollment in Part B. Give the second form to your employer. Your employer will verify that you have had health coverage as good as Medicare since you turned 65. They will sign the form. It is important for you to write in the date that you wish your Medicare Part B to start. Give yourself enough time to find a Medicare plan and prescription drug plan. (There are much shorter and restrictive time limits when you have delayed Medicare Part B enrollment.) Drop the forms in the mail or hand deliver them to the local Social Security office.

Medicare Employer Enrollment Forms

Why do you want to involve your employer with your enrollment in Medicare Part B? If you do not have your employer verify that you had health coverage from the time you could have enrolled in Medicare until the time you did take Part B, Medicare will assume you did not have creditable coverage and will asset a penalty. The penalty is a 10% increase in Part B premium for every year you did not have coverage. That can be significant over time and completely unnecessary. Delay Medicare enrollment at your own risk. Get the form. Your employer is required to verify. The human resource department will know exactly what to do. It is a very simple matter.

At Omaha Insurance Solutions, we help clients who delay Medicare enrollment all the time. We can get this done quickly and easily. Give us a call 402-614-3389. We can email you the forms, walk you through filling them out, and explain what to do.