Does Medicare Cover Hospice?

Does Medicare Cover Hospice?

Many people are still not very familiar with Medicare and hospice. It is actually a fairly new idea. The “end of life movement” began in the ’70s. (The “end of life movement” is separate and distinct from the Euthanasia movement and organizations, like the Hemlock Society.) Medicare did not cover Hospice when Medicare started in 1965. Medicare and hospice were only put together in 1982 as part of the Tax, Equity, and Fiscal Responsibility Act under President Reagan in response to a growing awareness of end of life concerns. The legislation was an attempt to fill the gap in care. Awareness was growing in the country of the importance of what transpired at the end of life.

A Happy Death Is Not A New Idea

I remember when I was a teenager. My father was up before me in the mornings. He would take me to school on his way to work. I would see him praying when I came into the kitchen in the morning. One time I asked him what he was reading. It was a small devotional booklet. He was praying the novena to St. Joseph for a “Happy Death.” I was startled by the subject matter.

Teenagers don’t think much about death unless forced. I had a buddy, Herbert Woltz, killed in a motorcycle accident my senior year in high school. That was my abrupt intro to death.

I asked my father why pray for such a crazy thing as a “happy death”? The two subjects were oxymoronic to me. What’s happy about death? He reminded me that is how the Hail Mary ends. “Pray for us . . . now and at the hour of our death. Amen.”

After birth, he said, death is the most important event in your life. The difference, however, is you’re aware of what’s going on in the end, and you make the most important decisions of your life at “the hour of your death.” Praying for a “Happy Death” is about minimizing the pain and maximizing your moment of entrance into eternity. You’re asking for God and all the heavenly hosts to be at your side to handle the fear, pain, discouragement, and loneliness a person faces when approaching death and the moment of death.

I didn’t think much about what my father shared until many years had gone by and many friends and family members had passed away, including my dad. Medicare and hospice are something with which I have had extensive experience. Now I know why you would want to pay for a “happy death.”

End of Life Care Is Different

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

While I was there, I got to know the sisters. They were remarkable young ladies. The convent was inside the hospice facility. The nuns lived, prayed, and worked with their dying residents around them twenty-four hours a day. The Hawthorne Dominicans were some of the happiest people I ever met.

Their foundress, Rose Lanthrop-Hawthorne, was the youngest daughter of the famous author, Nathanial Hawthorne, and a convert to Catholicism. In her day, cancer patients were put on an island in New York harbor–Blackwell Island–because it was believed that cancer was contagious. Many people, especially the poor, died in incredible misery, isolation, and squalor.

Medicare and hospice were a century away. Rose, like Mother Teresa of our time, saw the face of Jesus in the poor, and she started a ministry to the dying among the poor immigrants of the New York slums. The Hawthorne Dominicans is a purely American woman’s religious order. Most woman’s religious orders in our country came from Europe originally.

End of Life Care Rediscovered With Hospice & Medicare

The end of life movement in our time found its origin during a 1967 lecture at Yale University by Cicely Saunders. She introduced the idea that the dying needed specialized care that served their unique situation. She later founded St. Christopher’s Hospice in London.

Dr. Elisabeth Kubler-Ross, MD research into death and dying identified five stages terminally ill patients go through. Her popular and groundbreaking book, On Death & Dying, fueled a movement to deal with issues of death and dying.

In 1972 she testified at the first national hearings on death with dignity conducted by the U.S. Senator Special Committee on Aging. Organizations, like The National Hospice and Palliative Care Organization (NHPCO), sprang up to study and promote awareness around the end of life issues. Finally, because of raised public interest and concerns, Medicare added hospice care to the list of services provides in 1982.

Medicare And Hospice Are Huge

In 2014 approximately 2.6 million people died in the US. Of those deaths, 80% were on Medicare. Medicare is the largest insurer for persons during the last year of life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

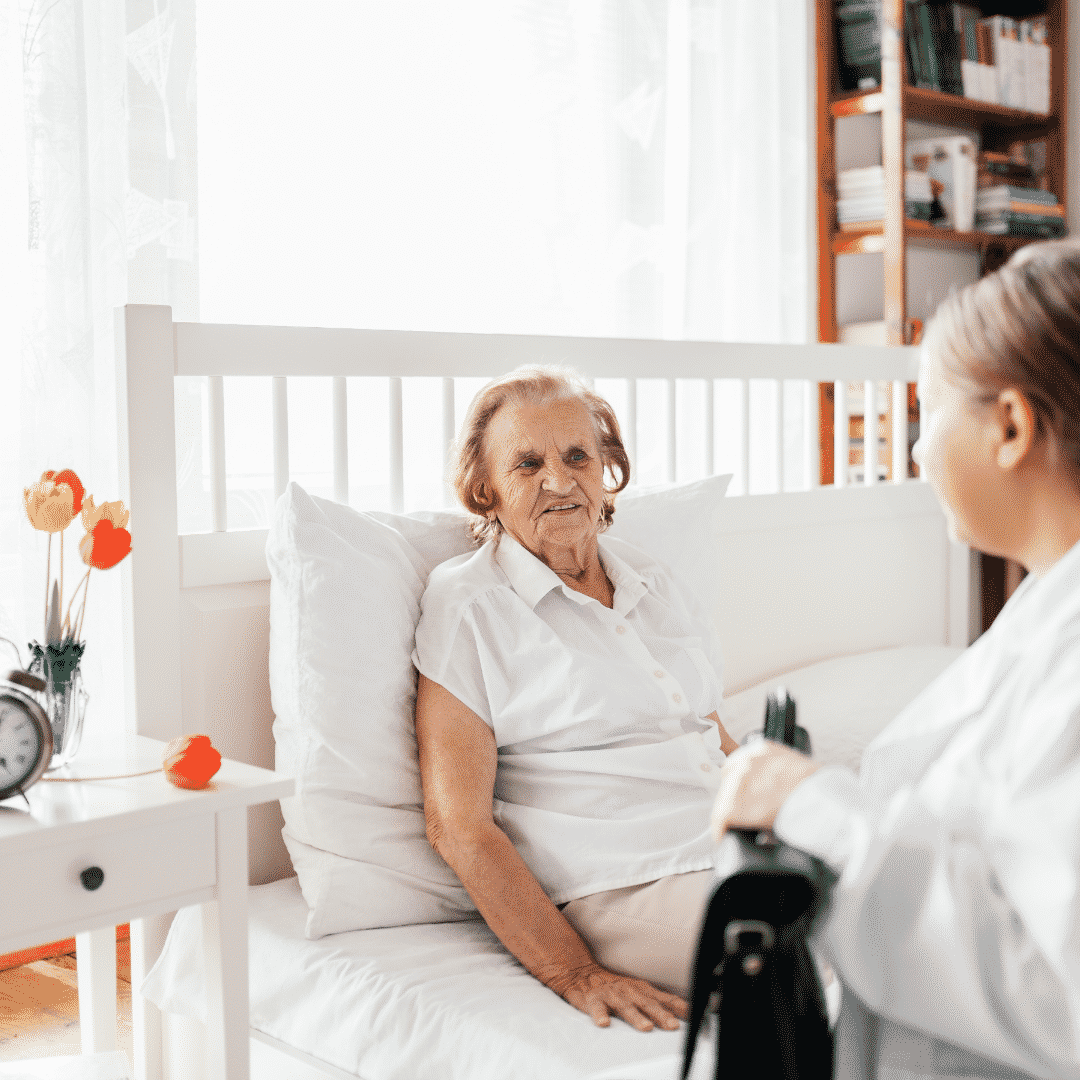

Today, hospice is an important benefit for terminally ill Medicare beneficiaries. Currently, nearly half of Medicare beneficiaries receive hospice benefits before their deaths. Medicare is the primary source of payment for hospice care in this country. Yet, hospice still remains somewhat of a mystery, and Medicare beneficiaries know very little about what Medicare does with hospice until they are forced into the situation.

How Does Medicare Cover Hospice?

Hospice is defined as a program of care and support for people who are terminally ill. Terminally ill means a life expectancy of six months or less. The primary goal of hospice in Medicare is to help terminally ill people live a comfortable life and manage their pain and discomfort. Hospice care is palliative care versus skilled nursing and home health care. That is, it is not designed to cure the patient, but rather to aid the person in the dying process. Because hospice care is so intimately involved and in such a big way with Medicare beneficiaries, understanding Medicare and hospice is essential.

Prayer to St. Joseph

O St. Joseph whose protection is so great, so strong, so prompt before the throne of God, I place in you all my interests and desires. O St. Joseph do assist me by your powerful intercession and obtain for me from your Divine Son all spiritual blessings through Jesus Christ, Our Lord; so that having engaged here below your heavenly power I may offer my thanksgiving and homage to the most loving of fathers. O St. Joseph, I never weary contemplating you and Jesus asleep in your arms. I dare not approach while He reposes near your heart. Press Him in my name and kiss His fine head for me, and ask Him to return the kiss when I draw my dying breath. St. Joseph, patron of departing souls, pray for us. Amen.

John Joseph Grimmond 1934-2013 R.I.P.

Medicare Advantage and Home Health Care

Medicare Advantage and Home Health Care

All Medicare Advantage (MA) plans must provide at least the same level of coverage for home health care as does Original Medicare, so Medicare Advantage pays for home health care. However, an MA plan may have different rules, costs, and restrictions on services. For example, depending on a person’s MA plan, it may require him to:

- Obtain care from a home health agency that has contracted with the plan.

- Receive prior authorization or a referral before receiving home health care.

- Pay a copayment for home health care.

Coverage of Non-Skilled Care and Other In-Home Support Services

Center for Medicare & Medicaid Services (CMS) recently announced that Medicare Advantage plan will be able to cover certain types of home health care related services that were not previously able to be offered, beginning in 2019. This will be possible because CMS has expanded the definitional scope of “supplemental benefits” that Medicare Advantage plans can offer. Starting in 2019, insurers can offer additional services to help improve enrollees’ health and quality of life.

Medicare Advantage Can Pay for Home Health Care Supplemental Benefits

Medicare Advantage plans may offer additions benefits not offered by Original Medicare. Previously, CMS did not allow any item or service to qualify as a supplemental benefit. Supplemental benefits were items of “daily maintenance.” In other words, MA plans could not offer items and services that were not directly for medical treatments. The agency has now reinterpreted the requirement for supplemental benefits to include a “primarily health-related” definition as follows:

an item or service that is used to diagnose, prevent, or treat an illness or injury, compensate for physical impairments, act to ameliorate the functional/psychological impact of injuries or health conditions, or reduce avoidable emergency and healthcare utilization

Some Medicare Advantage Supplemental Benefits

Accordingly, this reinterpretation of supplemental benefits will allow Medicare health plans to offer coverage or benefits for the following:

- Adult daycare services are services provided outside the home, such as assistance with activities of daily living (ADLs) and instrumental activities of daily living (IADLs)

- In-home support services are services a personal care attendant provides. She assists disabled or medically needy individuals with activities of daily living, such as eating, bathing, and transferring, and instrumental activities of daily living. These activities may include managing money, preparing meals, and cleaning a house. Services must be performed by individuals licensed to provide personal care services, or in a manner that is otherwise consistent with state requirements.

- Home-based palliative care services Medicare does not cover if life expectancy is more than six months. Palliative care (“comfort care”) is to diminish symptoms of a terminally ill patient.

- Transportation for nonemergency medical services is transportation to obtain Part A, Part B, Part D, and supplemental benefit items and services. The

transportation must be used to accommodate the enrollee’s health care needs: it cannot be used for nonmedical services, such as groceries or errands.

transportation must be used to accommodate the enrollee’s health care needs: it cannot be used for nonmedical services, such as groceries or errands. - Home safety devices and modifications are safety devices to prevent injuries in the home and/or bathroom. The modifications must be non-structural and non-Medicare covered. This benefit can include home and/or bathroom safety inspection to identify any need for safety devices or modifications.

A physician or licensed medical professional must recommend these home care services.

Medicare’s expansion of MA plan benefits, like adult days care, helps patients remain in their homes as they age rather than being institutionalized, which could also result in lower costs for Medicare and Medicaid.

The Advantage of Medicare Advantage for Home Health Care

The Advantage of Medicare Advantage for Home Health Care

Medicare Advantage plans may impose different rules, limitations, and costs than Original Medicare, but they must provide at least the same level of home health care benefits.

Starting in 2019, Medicare Advantage plans may offer supplemental benefits that help enrollees with daily maintenance, including transportation for medicare services, in-home support services, and home-based palliative care. Consult the individual MA plan for the details of coverage.

In the Omaha metro area, the MA plans offer some of these benefits. Currently, the plans that do offer a lot of these benefits are the “Dual” or “Special Needs” plans. Those plans are for a person on full Medicaid as well as Medicare or have some special needs because of chronic illness, such as COPD, Diabetes, etc.

In other areas with high population densities, many of the MA plans are much richer with benefits. As it stands in eastern Nebraska and western Iowa, principally Omaha, Lincoln, Bellevue, and Council Bluffs, the supplemental benefits seem to be growing in number and scope each year. A couple of insurance companies recently added transportation to their health plans. More insurance companies are developing Medicare Advantage plans and including this type of home health services.

Navigating the Complexities: What You Need to Know About Medicare and Home Healthcare Coverage

Navigating the Complexities: What You Need to Know About Medicare and Home Healthcare Coverage

Are you confused about Medicare and home health care coverage? If so, you’re not alone. Navigating the complexities of these topics can be overwhelming. It’s essential to understand your options and ensure you receive the care you need.

Does Medicare pay for home health care services?

This article will delve into the ins and outs of Medicare and home healthcare coverage, providing the information you need to make informed decisions. We’ll explore the different types of Medicare plans and how they relate to home healthcare services, eligibility requirements, coverage limitations, and common misconceptions.

Whether you’re a senior seeking assistance or a caregiver supporting a loved one, understanding how long Medicare pays for home health care is crucial. By the end of this article, you’ll clearly understand what options are available and how to navigate the complex healthcare landscape.

Stay tuned to discover everything you need about Medicare and home healthcare coverage. Don’t let the confusion hold you back from accessing the care you deserve.

Different Types of Medicare Coverage

Medicare is a federal health insurance program that covers people over 65 and those with specific disabilities or chronic conditions. There are several types of Medicare plans, each with benefits and limitations. Knowing how long each Medicare plan pays for health care is critical.

Original Medicare, also known as Medicare Part A and Part B, provides coverage for hospital stays, doctor visits, home healthcare, and some medical equipment. Medicare Part C, also known as Medicare Advantage, is a private insurance option combining Parts A and B, often including additional benefits such as prescription drug coverage and dental care. Both provide home healthcare coverage, but in specific ways unique to the plans.

Medicare Part D provides coverage for prescription drugs, while Medicare Supplement plans, also known as Medigap, help cover the costs of out-of-pocket expenses not covered by Original Medicare.

Understanding the differences between these plans is essential because they approach home health care differently.

Understanding Home Healthcare Services

Understanding Home Healthcare Services

As the name suggests, home healthcare services provide medical care and support to individuals in their homes. This can include services such as nursing care, physical therapy, and speech-language therapy. Home health care is often a more convenient and cost-effective option than hospital or skilled nursing facility (SNF) care and can provide a higher level of comfort and independence for patients. It is skilled nursing care but provided in the home for those who would not have access to medical care otherwise.

The purpose of home health care is short-term treatment for an illness or injury, such as a stroke or broken hip. It is about getting back your health and independence again.

For the chronically ill and disabled, the goal of home health care is to maintain the highest level of ability and health.

Home healthcare services can be provided by a variety of healthcare professionals, including registered nurses, licensed practical nurses, physical therapists, occupational therapists, and speech-language pathologists. A physician typically orders services, and they are covered by Medicare and/or private insurance.

Home health care is not home care. Home care would be custodial services like housekeeping, bathing, feeding, etc. Medicare does not usually provide those types of personal services, strictly speaking. There are exceptions, however. On occasion, Medicare allows for a temporary home health aide to assist in the healing process.

Some injuries and illnesses may last for a long time. While home health care is a necessary service, the bigger question is: how long does Medicare pay for home healthcare?

Medicare Eligibility for Home Healthcare Coverage

Individuals must meet specific requirements to be eligible for Medicare home healthcare coverage. First, they must be enrolled in Medicare Part A and/or Part B. Both Medicare Part A and Part B provide home healthcare coverage.

Under Part B, a person is eligible for home health care if she is homebound, requires skilled care, and is certified as needing care by a physician. The added benefit is Part B does not require a qualifying hospital stay.

The essential requirements of eligibility and access to Medicare home healthcare services are: homebound, physician certification, and Medicare-certified agency care.

Homebout, in Medicare terms, means that leaving the home requires a considerable and taxing effort. A physician is the gatekeeper of Medicare home healthcare. The physician certifies and/or recertifies a patient for access to home healthcare. Finally, a Medicare-certified agency must provide home healthcare services, not any healthcare provider.

Medicare Part A Coverage

In contrast, Medicare Part A provides home health care coverage in some situations. A hospital or skilled nursing facility stay triggers Part A. If a person has a three-day inpatient stay at a hospital or has a Medicare-covered Skilled Nursing Facility (SNF) stay, Part A will cover up to 100 days of home health care.

Note that a person must still meet the other eligibility requirements to receive home health care, such as needing skilled care, being homebound, and having a doctor certify that such care is necessary.

A person also must receive home health services within 14 days of being discharged from a hospital or SNF. If a person doesn’t meet all of the requirements for Part A coverage but is otherwise eligible for home health care benefits, her care will be financed under Part B.

Medicare Coverage For Home Healthcare Services Amounts

Regardless of whether Part A or Part B covers a person’s care, Medicare will pay:

- The entire approved cost of all covered home health services.

- Eighty percent of the Medicare-approved amount is for durable medical equipment.

Medicare covers a wide range of home health care visits, including skilled nursing care, physical therapy, occupational therapy, speech-language pathology, and medical social services. These services are typically provided part-time or intermittently, depending on the individual’s needs.

Medicare also covers specific durable medical equipment and supplies, such as wheelchairs, hospital beds, and oxygen equipment.

However, coverage limitations and restrictions may apply, and it’s essential to understand what services are covered and how much you may be responsible for paying out of pocket. The agencies providing the equipment and supplies can give details of costs.

Limitations and restrictions of Medicare coverage for home health care

Limitations and restrictions of Medicare coverage for home health care

While Medicare provides coverage for many home healthcare services, there are limitations and restrictions to be aware of. For example, Medicare typically only covers part-time or intermittent care and may not cover 24-hour or long-term care.

In addition, Medicare may not cover certain services considered custodial care, such as help with bathing, dressing, and eating. Finally, there may be coverage limitations based on the individual’s medical condition. Some coverage is subject to annual or lifetime caps.

Certified Home Health Agency Disclosure of Covered Costs

Before home health care starts, the certified home health agency must tell the person how much Medicare will pay. The agency must also disclose if Medicare does not cover needed items or services. Then tell how much the person will have to pay for them.

For example, charges to a person may be:

- Medical services and supplies that Original Medicare doesn’t cover, such as prescription drugs or routine foot care

- 20 percent of the approved amount for Medicare-covered durable medical equipment such as wheelchairs, walkers, and oxygen equipment

Tips for Navigating Medicare and Home Healthcare Coverage

Navigating the complexities of Medicare and home healthcare coverage can be challenging, but several tips help make the process easier. First, it’s important to understand your needs and choose the Medicare plan that best fits them.

Second, work with your healthcare provider to ensure that a Medicare-certified agency orders and provides home healthcare services.

Finally, read the fine print and understand any coverage limitations or restrictions that may apply. The Medicare-certified agency is well versed in the cover limitations and costs. Be sure to consult with them ahead of time.

Alternative options for home health care coverage

While Medicare provides coverage for many home health care services, alternative options may be available to better meet your needs. For example, private insurance plans may offer more comprehensive coverage for certain services. Medicaid is another route for low-income individuals.

Private Home Health Care Insurance Policies

Home health care insurance is typically a private insurance policy purchased ahead of time to assist Medicare in caring for someone receiving home health care. The policy covers activities of daily living in the home, such as bathing, feeding, transportation, and housekeeping. Like any insurance, these alternative options must be purchased before the health issues arise. Many insurance carriers offer a variety of these types of policies.

In addition, a variety of community-based programs and organizations offer support and assistance to seniors and individuals with disabilities. These programs may include meal delivery, transportation services, and assistance with daily living activities.

Home Health Agency Advance Beneficiary Notice of Noncoverage

Home Health Agency Advance Beneficiary Notice of Noncoverage

When a certified home health agency believes that Medicare may not pay for some or all of a person’s home health care, it must give the person a written notice called an Advance Beneficiary Notice of Noncoverage (ABN). The ABN might occur, for example, if the home health agency thinks that Medicare will not pay for items or services because:

- The care is not considered medically reasonable and necessary.

- The care is only unskilled, a home health care aide, like help with bathing or dressing.

- The person is not homebound.

- The person does not need skilled care on an intermittent basis.

The ABN must describe the service and/or items that may not be covered and explain why Medicare probably won’t pay. The notice must also include an estimate of the costs for the items and services so that the beneficiary can decide whether to receive the services, understanding that she may have to pay out-of-pocket for such care.

The ABN also gives directions for getting an official decision from Medicare about payment for home health services and supplies and for filing an appeal if Medicare won’t pay.

How Long Does Medicare Pay for Home Health Care?

There is no limit to the length of time that a person can receive home health care services. Once the initial qualifying criteria are met, Medicare will cover home health care as long as it is medically necessary. However, care is limited. There are a maximum number of visits per week and a certain amount of hours per day of care.

When a person first begins receiving home health care, the plan of care will allow for up to 60 days. At the end of this period, the physician must decide whether to recertify the patient for another 60 days. The patient must be recertified at least every 60 days if home health care is to continue.

Medicare does not limit the number of times a physician may recertify a patient. Provided all eligibility requirements continue, he can recertify an unlimited number.

What Happens When Medicare Stops Paying for Home Health Care?

A home health agency must give a beneficiary a written Home Health Change of Care Notice (HHCCN) when the patient’s plan of care changes because the home health agency decides to reduce or stop providing some or all of the home health services or supplies. Or, the patient’s doctor has changed the orders, which may reduce or stop certain home healthcare services or supplies that Medicare covers.

doctor has changed the orders, which may reduce or stop certain home healthcare services or supplies that Medicare covers.

For example, the doctor changes the care plan from five to three days a week. The agency issues an HHCCN. The beneficiary receives a notification in writing of the change.

The HHCCN lists the services or supplies that will be changed and gives the beneficiary instructions on what to do if she disagrees. The home health agency is not required to give a person an HHCCN when a Notice of Medicare Noncoverage is issued.

Notice of Medicare Noncoverage

When a person’s Medicare-covered services end, the home health agency must give the beneficiary a Notice of Medicare Noncoverage (NOMNC). This notice states when services will end as well as how to appeal the decision. The NOMNC also provides information on contacting the Beneficiary and Family-Centered Care Quality Improvement Organization (BFCC-QIO) to request an expedited appeal.

Once a person decides to appeal and has reached the BFCC-QIO, the home health agency must give the patient a detailed notice explaining why it believes Medicare-covered care should end. The agency should tell the applicable coverage rules and other information about the person’s situation.

A physician must submit a statement of appeal to the BFCC-QIO. It says the patient’s health will be jeopardized if care is discontinued. These factors determine how long Medicare pays for home health care. Knowledge of these rules is vital to maximize benefits and avoid costly mistakes.

Importance of understanding Medicare and home health care coverage

Understanding Medicare and home health care coverage is crucial for seniors and individuals with chronic conditions or disabilities. These programs provide access to essential medical care. They support individuals to maintain their independence and quality of life.

By understanding the different types of Medicare plans, eligibility requirements, coverage limitations, and alternative options, individuals can make informed decisions about their healthcare and ensure they receive the care they need.

Bottomline: Taking Advantage of Medicare and Home Healthcare Benefits

In conclusion, navigating the complexities of Medicare and home healthcare coverage can be challenging, but it’s essential for seniors and individuals with chronic conditions or disabilities. By understanding the different types of Medicare plans, eligibility requirements, coverage

Christopher J. Grimmond

limitations, and alternative options, individuals can make informed decisions about their healthcare and ensure they receive the care they need.

Whether you’re seeking home healthcare services for yourself or a loved one, working with your healthcare provider and understanding the coverage options available is essential. By taking advantage of Medicare and other home healthcare benefits, you can maintain your independence, improve your quality of life, and ensure you receive the care you deserve.

At Omaha Insurance Solutions, we help you understand the many Medicare rules. We navigate you through the forms and get the care you need. Call us at 402-614-3389 to speak with an experienced, licensed insurance agent professional.

Medicare covers Home Health Care, but the Medicare beneficiary must meet particular criteria, maintain a status of medical need, and follow Medicare regulations and processes to enjoy the benefits.

Medicare covers Home Health Care, but the Medicare beneficiary must meet particular criteria, maintain a status of medical need, and follow Medicare regulations and processes to enjoy the benefits.

Eligibility For Medicare Home Health Care Benefits

- A physician must certify that skilled care is needed and must prescribe the plan of care.

- A participating Medicare-approved home health care organization must provide the care.

- The patient must need at least one of the services: intermittent skilled nursing care, physical therapy, speech-language pathology, and continued occupational therapy.

- The patient must be confined to the home.

Plan of Care

A physician must meet face-to-face with the patient 90 days before the start of home health care or within 30 days after the start of home health care. She must sign and date a certification that the patient needs skilled care and meets all the Medicare eligibility criteria for home health care. As part of the certification, she must determine from the in-person meeting a plan of care.

- A plan of care describes the type of services and care a person will receive for their health concerns. The program will list:

- the variety of services, supplies, and equipment needed.

- the health care professional who will deliver these services

- how often services will be needed

- the beneficiary’s function limitations

- nutritional requirements]

- the results that the physician expects from the treatment

The home health agency is responsible for providing all of the care listed in a person’s plan of care. The agency may do this through its staff or an arrangement with another agency.

The doctor certifies the person as eligible for an initial 60-day benefit period. At the end of the period or before, the doctor may recertify the person, or if the person’s condition has changed, determine the care is no longer needed. Only the doctor can certify the patient or make changes to the plan of care, not the home health agency.

Medicare-Certified Home Health Care Agency

Medicare-Certified Home Health Care Agency

Medicare will pay for home health care only if a Medicare-certified home health care agency provides it. Medicare approves agencies that meet specific federal health and safety requirements as well as Medicare standards necessary for reimbursement. To ensure that these standards met, Medicare regularly inspects home health agencies. However, Medicare certification does not guarantee a legal warrant of the individuals performing the services.

A Medicare-certified home health agency agrees to:

- be paid by Medicare

- accept only the amount that Medicare approves for its services.

The patient has the right to choose any agency to provide the services as long as they are Medicare certified. The agency is not required to accept the person if it cannot meet that person’s medical needs.

Skilled Care Required But Intermittent

To qualify for Medicare provided home health care, the person needs specialized care. Skilled care means services, such as skilled nursing care, physical therapy, speech therapy, and/or continuing occupational therapy.

The key to determining home health care versus skilled nursing care in a facility is the quantity of care. Home health care must be intermittent. That is, the care must be part-time, meaning less than eight hours each day for up to 21 days–although coverage may be extended in particular circumstances when the need for additional skilled nursing is finite and predictable.

Required Homebound

The homebound criterium does not mean the person is a prisoner in her home. It means leaving is an undue burden. She has trouble leaving home without help because she must use a cane, wheelchair, walker, crutches, or specialized transportation.

It does not mean that person does not leave home on occasion because of important family events, specific medical tests, funerals, or weddings. Even attending adult daycare would not be a violation of being homebound.

Home Health Care May Cover A Health Aide

Home health aide services get a great deal of play. Medicare will cover a health aide for short periods. The aide service must be coupled with home health care  services. Medicare does not cover it exclusively.

services. Medicare does not cover it exclusively.

The home health aide is in support of the healing process with the other skilled nursing professionals. The home health aid does not have a nursing license. For example, a home health aide might help a person with personal care, such as bathing, using the toilet, or dressing–in other words, services that do not require the skills of a licensed nurse.

Other services are help with medications that are self-administered, assistance with activities that are directly supportive of skilled therapy. The aide may help with routine exercises and/or practicing functional communication skills. Where appliable, she may help with regular care of prosthetic and orthotic devices. Medicare will not cover the home health aide if the patient is not receiving skilled care.

Home Health Care Can Cover Social Services

Many injuries and illnesses come with an emotional cost. A patient of my wife recently was hospitalized because his son assaulted him while under the influence of illegal drugs. He was defending his wife, who was likewise being assaulted. The father was hospitalized with broken bones. He is also currently going through chemotherapy treatment and is eighty-six years old.

As you can imagine, the emotional trauma to this couple was extensive and may require counseling and other intervention when the gentleman returns home. Home health care provides these types of services as well.

Durable Medical Equipment

Durable Medical Equipment

Home health agencies will also help with durable medical equipment. A patient may need a hospital bed, walker, wheelchair, or oxygen. Medicare also covers Medicare supplies, like wound dressings or catheters that are ordered as part of a patient’s care.

If a home health agency doesn’t supply durable medical equipment directly, its staff will typically arrange for a home equipment supplier to bring the items need to the person’s home.

Does Medicare Exclude Some Home Health Care Services?

Medicare does not pay for the following:

- 24-hour-per-day care at home

- meals delivered to the home

- homemaker services like shopping, cleaning, and laundry

- personal care given by home health aides (like bathing, using the toilet, or help in getting dressed)when this is the only care needed.

Does Medicare cover home health care? It certainly does when the patient meets the established criteria. Home health care is a rich source of benefits to beneficiaries that are delivered in a variety of ways and circumstances as needed.

We know what hospitals are. We all have been to a doctor’s office. Many have experienced a relative in a nursing home, but what is home health care?

Home health care is like it sounds. It is the care that takes place in the home. It consists of a wide range of services, like physical therapy, occupational therapy, speech therapy, and nursing care.

The purpose of home health care is short term treatment for an illness or injury, such as a stroke or broken hip. It is about getting the person healthy and independent again. Or, it is for the chronically ill and disabled. The goal is to maintain the highest level of ability and health.

Home health care is not home care. Home care would be services, like housekeeping, bathing, feeding, etc. Medicare does not usually provide those types of personal services, strictly speaking, though there are exceptions at times that allow for a temporary home health aide. It is skilled nursing care provided in the home for those who would not have access otherwise.

Does Medicare Cover It?

Four criteria must be met for Medicare to pay for home health care.

- A physician must certify home health care is necessary.

- The home health care provider must be a Medicare-approved organization.

- The patient must need at least one of the following: skilled nursing care, physical therapy, occupational therapy, or speech therapy.

- The patient must be homebound.

Doctor Certifies Patient For Home Health Care

The doctor must certify a patient needs home health care during an in-person meeting. He signs a certificate certifying that the person meets the Medicare qualification. The doctor lays out a plan of care that care professions implement, and the certification is for 60 days. At the end of the 60 days, or before, he can recertify that patient for an additional 60 days.

The doctor can continue to recertify the patient indefinitely as long as the person qualifies for the medically necessary treatment, and Medicare will continue to cover them.

Home Health Agency Medicare Certified

The home health agency providing the care must be certified by Medicare for the service to be Medicare-covered. In my office building as you come in, a care agency is in the lobby. On the office door, the home health agency lists the various services, and in even bigger letters, it states, “Medicare Certified.”

Medicare certification of a home health agency is an extensive process. Because accreditation is arduous and a source of considerable revenue, home health agencies are very careful about maintaining their certification and advertising their Medicare certification as well. The Omaha metro area has some excellent home health care agencies.

Intermittent Care

Home health care must also be intermittent care. That is, it consists of fewer than seven days a week, or daily care for less than 8 hours each day for up to 21 days. Otherwise, a skilled nursing facility would most likely be recommended for a more intense regimen of care.

Homebound

The patient must be homebound, which means she cannot leave her home without great difficulty and requires help, such as a wheelchair, walker, crutches, or specialized transportation. It doesn’t mean she can never leave her home for important things, like family events, hairdressing appointments, some doctors’ appointments, but getting regular health services outside the house would be an undue burden.

The patient must be homebound, which means she cannot leave her home without great difficulty and requires help, such as a wheelchair, walker, crutches, or specialized transportation. It doesn’t mean she can never leave her home for important things, like family events, hairdressing appointments, some doctors’ appointments, but getting regular health services outside the house would be an undue burden.

People are living longer. Tremendous advances in technology have enabled seniors to stay out of expensive skilled nursing care. Nowadays, patients may receive very sophisticated treatment at home and do not need to be institutionalized, keeping the cost of treatment lower. It is an important and essential service that Medicare covers.

Medicare Coverage For Skilled Nursing Facilities

Skilled Nursing Facilities—or better known in the jargon of Medicare as SNF—is the cause of much consternation among people on Medicare. The reason for the  distress and stress is because Medicare beneficiaries are sometimes denied coverage. This both confuses and angers Medicare beneficiaries because there doesn’t seem to be any rhyme or reason to the denials. People ask: does Medicare cover Skilled Nursing Facility?

distress and stress is because Medicare beneficiaries are sometimes denied coverage. This both confuses and angers Medicare beneficiaries because there doesn’t seem to be any rhyme or reason to the denials. People ask: does Medicare cover Skilled Nursing Facility?

Medicare Billing Guidelines For Skilled Nursing Facility

From my observation over the years, doctors’ offices sometimes don’t follow the Medicare billing guidelines for Skilled Nursing Facility. I understand everyone is busy and people are certainly well-intentioned, but Medicare is insurance. Insurance has rules, protocols, and forms. A lack of adequate explanation to Medicare is many times the cause of Medicare denials, I’ve seen over the years. Other times the situation does not meet the Medicare criteria for Skilled Nursing Facility stays.

What are the Medicare Skilled Nursing Facility Requirements?

When skilled nursing is prescribed, five Medicare Skilled Nursing Facility requirements must be met. The first is a qualifying hospital stay.

When skilled nursing is prescribed, five Medicare Skilled Nursing Facility requirements must be met. The first is a qualifying hospital stay.

The Medicare beneficiary must stay as an inpatient for three consecutive days in the hospital. Each of these is an essential ingredient. The beneficiary must be admitted to the hospital. If the patient is only admitted for “observation,” she will not qualify. She must be an “inpatient.” Next, the stay must be consecutive. It can’t be a day or two within a short period of time. It must be at least 3 consecutive days. And finally, it must be at least 3 days, not counting the day of dismissal.

Many times, people assume the day of dismissal counts, but that is definitely not the case. Three days of inpatient care at least with a fourth day for the dismissal. Sometimes people will complain that the patient doesn’t need a third day, but if you want the person to qualify, she must stay at least three consecutive days.

Medicare Skilled Nursing Facility Benefit Period

The second ingredient for Medicare to cover a skilled nursing facility stay is the admittance must occur with 30 days of dismissal from the qualifying hospital stay.

My mother-in-law had open heart surgery a while back. Her cardiologist prescribed that she stay in a skilled nursing facility for cardiac rehab. She was not a very cooperative patient. She refused. My wife was insistent and explained that if she didn’t go then, she would lose the opportunity for skilled nursing rehab. My mother-in-law’s response was she would do it later if she needed it.

My mother-in-law had open heart surgery a while back. Her cardiologist prescribed that she stay in a skilled nursing facility for cardiac rehab. She was not a very cooperative patient. She refused. My wife was insistent and explained that if she didn’t go then, she would lose the opportunity for skilled nursing rehab. My mother-in-law’s response was she would do it later if she needed it.

Many people mistakenly think they can go to a nursing home for rehab if they simply want to. It must be within the 30-day window after dismissal from an inpatient stay. Otherwise, Medicare will not pay. Now you may think it is not fair, or right, or make sense. I am simply stating the rules and facts.

Medicare Guidelines for Skilled Nursing Facility

The third requirement for admittance to a skilled nursing facility (SNF) is the treatment can only be provided by a skilled nursing facility.

The third requirement for admittance to a skilled nursing facility (SNF) is the treatment can only be provided by a skilled nursing facility.

What this usually means is “full time” or five day a week care. In other words, the same level of treatment cannot be provided by going to a treatment center by appointment a few times a week. Only an inpatient skilled nursing facility can provide the level of intense treatment needed for adequate recovery. This can be a tricky call and where judgments can and are questioned.

Medicare Denial Skilled Nursing Facility

I had a client who had a knee replacement. Usually a knee replacement, even with  complications, does not require admittance to a skilled nursing facility (SNF) because physical therapy is something that can be completed by going to the physical therapist’s office and/or doing exercises on your own. This situation was different.

complications, does not require admittance to a skilled nursing facility (SNF) because physical therapy is something that can be completed by going to the physical therapist’s office and/or doing exercises on your own. This situation was different.

She was living in a small apartment with lots of furniture. There was a pet. The husband was feeble. While she was not very old, her knee was not recovering at the usual pace. The doctor recommended skilled nursing care, but Medicare denied the prescription.

The family came to me with questions. I suggested they explain the situation to the doctor in greater detail and with more urgency. She was a serious “fall risk” because of her living situation.

Once the idea was emphasized sufficiently in the doctor’s notes to Medicare, Medicare understood that the work that had been done would be undone if she fell at home because of a pet, furniture, and/or feeble husband, etc. The request was approved.

Skilled nursing is very expensive. Medicare needs to understand the “medical necessity” of a prescription. Once the idea is communicated effectively, things can happen.

List of Medicare Approved Skilled Nursing Facilities

The fourth ingredient is that a doctor, or another appropriate medical professional, certifies that the patient needs the type of daily therapy that can only be performed in a skilled nursing facility. The skilled nursing facility must also be a Medicare-certified skilled nursing facility. You can go to Medicare.gov to find certified sites and Medicare the star ratings for Skilled Nursing Facilities.

The fifth and final requirement can be confusing. The skilled nursing care must be for the reason the patient was in the hospital for the three days.

Imagine John goes to the hospital because of a broken hip. While John was in the hospital, he has a stroke. The doctor certifie s John for treatment at a skilled nursing facility for the stroke, not the hip issue. The skilled nursing recommendation does not have to be based on the reason the person was admitted to the hospital, but it does need to be because of something he was treated for during the 3-day hospital stay.

s John for treatment at a skilled nursing facility for the stroke, not the hip issue. The skilled nursing recommendation does not have to be based on the reason the person was admitted to the hospital, but it does need to be because of something he was treated for during the 3-day hospital stay.

As you can see, Medicare coverage for skilled nursing facilities can be complex. It’s important to have some understanding so that you know what to expect, or not to expect, when it comes to Medicare coverage of skilled nursing facility care, and how to navigate the processes to your benefit and the benefit of loved ones. Medicare Part A covers the Skilled Nursing Facility, but the rule must be followed for Skilled Nursing Facility Medicare reimbursement to happen.

The chances are you or someone in your family will require skilled nursing care because of a serious injury, stroke, or surgery.  Twenty-five percent of skilled nursing stays are less than three months. Many, however, are longer. Nursing home care costs vary from state to state and location to location. The questions my clients ask are: how long does Medicare pay for skilled nursing care?

Twenty-five percent of skilled nursing stays are less than three months. Many, however, are longer. Nursing home care costs vary from state to state and location to location. The questions my clients ask are: how long does Medicare pay for skilled nursing care?

Skilled Nursing Care Costs Are High

Depending upon the state in which you reside, the daily costs associated with nursing home care vary widely between $140 and $771 per day for a semi-private room in 2017. The average cost was $235 per day for a semi-private room. Multiplying that out the monthly cost associated with skilled nursing care ran anywhere between $4,258 and $23,451 per month for a semi-private room, with the average being closer to $7,148 each month for a semi-private room. For most people, those are prohibitive costs!

Depending upon the state in which you reside, the daily costs associated with nursing home care vary widely between $140 and $771 per day for a semi-private room in 2017. The average cost was $235 per day for a semi-private room. Multiplying that out the monthly cost associated with skilled nursing care ran anywhere between $4,258 and $23,451 per month for a semi-private room, with the average being closer to $7,148 each month for a semi-private room. For most people, those are prohibitive costs!

How Much Skilled Nursing Does Medicare Pay For?

Many of my clients will call when faced with the possibility of going into a skilled nursing facility. Illness is scary enough. You don’t want to worry about overwhelming medical bills. My people want to know they’re covered. They want to know how much skilled nursing does Medicare pay for. Do Medicare Advantage plans cover skilled nursing facilities? Do Medicare Supplements cover skilled nursing facilities? So, the big question is: who pays?

Medicare Skill Nursing Benefit Period Is 100-Days

So, how many days does Medicare cover skilled nursing facility care? The Medicare Skilled Nursing Facility (SNF) benefit period, or “Spell of care,” is 100 days. The benefit period ends when the patient leaves the SNF for 3o days, and a new 100 day benefit period is available after 60 days.

Skilled Nursing Facility’s Legal Obligations

When a patient leaves a hospital and moves to a nursing home that provides Medicare coverage, the nursing home must give the patient written notice of whether the  nursing home believes that the patient requires a skilled level of care and thus merits Medicare coverage. Even in cases where the SNF initially treats the patient as a Medicare recipient, after two or more weeks, often, the SNF will determine that the patient no longer needs a skilled level of care and will issue a “Notice of Non-Coverage” terminating the Medicare coverage.

nursing home believes that the patient requires a skilled level of care and thus merits Medicare coverage. Even in cases where the SNF initially treats the patient as a Medicare recipient, after two or more weeks, often, the SNF will determine that the patient no longer needs a skilled level of care and will issue a “Notice of Non-Coverage” terminating the Medicare coverage.

Whether the non-coverage determination is made on entering the SNF or after a period of treatment, the patient can submit or not to Medicare. The patient (or his or her representative) should always ask for the bill to be submitted. This requires the nursing home to submit the patient’s medical records for review to the fiscal intermediary, an insurance company hired by Medicare, which reviews the facility’s determination. The review costs the patient nothing and may result in more Medicare coverage. While the review is being conducted, the patient is not obligated to pay the nursing home. However, if the appeal is denied, the patient will owe the facility retroactively for the period under review.

If the fiscal intermediary agrees with the nursing home that the patient no longer requires a skilled level of care, the next level of appeal is to an Administrative Law Judge. This appeal can take a year and involves hiring a lawyer. It should be pursued only if, after reviewing the patient’s medical records, the lawyer believes that the patient was receiving a skilled level of care that should have been covered by Medicare. If you are turned down at this appeal level, there are subsequent appeals to the Appeals Council in Washington, and then to federal court.

Day 101 You Pay

If you need more than 100 days of SNF care in a benefit period, how many days will Medicare pay for skilled nursing care? Nothing. SNF is meant to be short term. You will need to pay out of pocket if your care ends because you are run out of days. The SNF is not required to provide written notice. It is important that you or a caregiver keep track of how many days you spend in a SNF to avoid unexpected costs after Medicare coverage ends.

If you need more than 100 days of SNF care in a benefit period, how many days will Medicare pay for skilled nursing care? Nothing. SNF is meant to be short term. You will need to pay out of pocket if your care ends because you are run out of days. The SNF is not required to provide written notice. It is important that you or a caregiver keep track of how many days you spend in a SNF to avoid unexpected costs after Medicare coverage ends.

How Else to Pay For Skilled Nursing Care

If you are receiving medically necessary physical, occupational, or speech therapy, Medicare may continue to cover those skilled therapy services even when you have used up your SNF days in a benefit period, but Medicare will not pay for your room and board, meaning you may face high costs.

used up your SNF days in a benefit period, but Medicare will not pay for your room and board, meaning you may face high costs.

Medicare does not cover long term care or custodial care. You may wish to move to a home health care situation at that point. Medicare pays for home health care, and the costs are much less. If you have long-term care insurance, it may cover your SNF stay after your Medicare coverage ends. If your income is low enough, you may be eligible for Medicaid to cover the cost of your stay.

Unlimited Skilled Nursing Benefit Periods

Once you are out of skilled nursing for 60 days, your SNF benefit period ends, but you may become eligible again for another SNF benefit period after a qualifying hospital stay of 3-days. There is no limit on the number of benefit periods available to a Medicare beneficiary as long as the Medicare requirements are met.

In other words, a person could potentially keep going into Medicare covered skilled nursing care every 100 days after a 60-day break as long as it is preceded by a qualifying hospital stay of 3-days. While repeat 100 day stays in a skilled nursing facility are not likely, that does give an idea of the level of incredible care available to a Medicare beneficiary.

NO Insurance: $176 Per Day

Medicare Supplements and Medicare Advantage plans pick up large portions of the 100-benefit period. The amount covered depends on the type of Medicare Supplement plan and Advantage plan. If the patients has neither, just Original Medicare, she is responsible for 21-100 days. The per day cost is currently $176 (2020).

30 Or 60 Days

An important note on the number of days out of a Skilled Nursing Facility approved stay. If a patient has left the SNF for 30-days or less, she may return without a 3-day inpatient hospital stay to initial the stay, but the 100-day count continues from where it left off. If the patient has been out of the SNF for 60-days for less, but more than 30-days, she will need another 3-day hospital stay for Medicare to pay for the time in the Skilled Nursing Facility. And the 100-day count continues from where it left off. After 60 consecutive days without SNF care, a new benefit may begin. There is no limit to the number of benefit periods.

An important note on the number of days out of a Skilled Nursing Facility approved stay. If a patient has left the SNF for 30-days or less, she may return without a 3-day inpatient hospital stay to initial the stay, but the 100-day count continues from where it left off. If the patient has been out of the SNF for 60-days for less, but more than 30-days, she will need another 3-day hospital stay for Medicare to pay for the time in the Skilled Nursing Facility. And the 100-day count continues from where it left off. After 60 consecutive days without SNF care, a new benefit may begin. There is no limit to the number of benefit periods.

Dave’s Scenario

Let’s layout some common scenarios. You might need your calculator or at least your fingers and toes to keep track.

Imagine David is in the hospital for 4 days because of a stroke. He is then admitted to a skilled nursing facility for 20 days. Dave leaves the skilled nursing facility for 28 days, but he has a complication. Dave falls going to the bathroom. The doctor readmitted him into the nursing home. He is within the 30-day window. No problem. Medicare will pay for that.

If, however, David was out of the nursing home 31 days, and he fell, he would need another 3-day stay in the hospital to be readmitted to the skilled nursing facility so Medicare would pay. Dave’s doctor may or may not be able to get him re-admitted to the hospital based upon his medical condition.

Summary

Skilled Nursing Facilities (SNF) are incredibly expensive. How long does Medicare pay for Skilled Nursing Care? Medicare does cover a 100-day benefit period. Medicare Supplements and Medicare Advantage plans cover large portions of the stay, depending on the plan. The cost, however, starting day 21 is $176 per day to patients without any additional coverage. The 100-day benefit period has very strict rules when it begins and ends. There are rules to which you need to be attentive to avoid unexpected and large bills, and it is worth talking with your insurance agent to make sure you have the maximum amount of coverage you can afford.

What Are Skilled Nursing Facilities?

All of us have strong memories of visiting the “old folks’ home.” Whether grandparents, relatives, or friends, we recall the smells, linoleum, long hallways, and institutional dormitory rooms. “Old folks’ homes” or nursing homes fall under the category of Skilled Nursing Facilities (SNF). Medicare covers skilled nursing facilities within limits.

Patients go to the SNF after surgeries to recover, from illnesses to heal, and from injuries to recover and strengthen. Skilled Nursing Facilities are for temporary treatment, not long term residential care or custodial care, like memory care. Other facilities, like senior living communities, assisted living, or senior care centers describe other types of facilities that assist seniors.

A skilled nursing facility provides highly skilled professionals, such as occupational therapists, physical therapists, registered nurses, speech therapists. The advantage of an SNF is these professions are available 24 hours a day for the patients. The level of care is very high but short term.

Post-Acute & Skill Rehab Services

Skilled Nursing Facilities are institutions that provide post-acute skilled nursing care and rehabilitation services. People sometimes confuse skilled nursing care with nursing home care because most of the time skill nursing usually takes place in a nursing home location. Medicare, however, doesn’t pay for “nursing home care”.

Skilled Nursing Facilities are institutions that provide post-acute skilled nursing care and rehabilitation services. People sometimes confuse skilled nursing care with nursing home care because most of the time skill nursing usually takes place in a nursing home location. Medicare, however, doesn’t pay for “nursing home care”.

Medicare covers skilled nursing facilities within specific parameters. Nursing home care is for individuals who have reached a point in life when they can no longer perform activities of daily living. This is referred to as custodial care. In other words, they cannot bath, feed, and dress themselves. Medicare will not pay for those services to be provided exclusively.

Skilled Nursing is for after surgery or acute illness, for example, hip surgery for a fractured hip or a stroke. A skilled nursing facility admits patients for a short period of time after being in the hospital to aid in their healing and/or rehabilitation. Hospitals are incredibly expensive, and a skilled nursing facility can provide the necessary treatment at a lower cost.

Medicare Criteria For Skilled Nursing Facilities

The tricky part about skilled nursing facilities is admittance. A skilled nursing facility requires patients to meet certain essential criteria for admittance and for Medicare to pay. This is the complex checklist:

- The patient must be admitted to a hospital as an “inpatient” for at least three consecutive days, not including the day of dismissal. She can’t be in the

hospital for “observation” for it to count for Medicare to pay.

hospital for “observation” for it to count for Medicare to pay. - Medicare mandates patient admittance to the skilled nursing facility within 30 days of discharge from the hospital. If problems arise later—past 30 days—the patient cannot go to the skilled nursing facility and have Medicare pay for it.

- Only a skilled nursing facility can provide the type of care necessary for the patient’s recovery. A skilled nursing facility would provide intense physical therapy for a hip injury or occupational therapy after a stroke. Going to the physical therapist’s office a couple of times a week would not be sufficient in those cases.

- A doctor, or appropriate medical professional, must certify that skilled nursing care is required for recovery.

- The patient must be treated for the same condition for which she was in the hospital.

There are nuances and exceptions to some of these rules. The list gives you a good idea about how skilled nursing fits into your Medicare health insurance. The Omaha, NE area has many quality Medicare certified facilities, and You can find them on the Medicare.gov website.

Know What Medicare A Covers

Know What Medicare A Covers

I have known veterans who only took Medicare A because it was free, and they opted out of Medicare Part B for doctor and outpatient services because it cost something. They thought Medicare A was enough because they could rely on the VA hospital. The VA, however, changes what it will cover or reimburse, depending upon Congress’s budget and who is in the White House. I had another gentleman in my office recently who thought Part B was unnecessary waste of money because he had been healthy all of his life. While Medicare A is good insurance and covers some things, it is very limited if you understand how Part A works. You should never guess about health insurance. You need to know what Medicare A covers and doesn’t cover.

Medicare A was the first Medicare plan in 1965. It covers hospital services. Hospital stays are the most devastating and costly part of health care. Medicare A covers five areas: inpatient hospital stays, blood, skilled nursing facilities, home healthcare, and hospice. It does not cover these services completely. There are deductibles, copayments, coinsurance, and limitations on days of service.

Medicare A Covers 60 Days In the Hospital

Chris Grimmond explained Medicare to me. Showed me the Medicare plans, and helped me find the one for me.

Ruby C.

The deductible for Medicare A is currently $1,484 for 2021. It has increased with a definite consistency over the years. After the deductible is met, the patient is covered 100% for the next 60 days. After a continuous 60 days as an inpatient in the hospital, the copay is $371 per day for Medicare A coverage. The copay runs from days 61-90. (This cost is assuming you have no other coverage, like a Medicare supplement.)

Lifetime Reserve Days for Medicare

Each Medicare beneficiary has 60 lifetime reserve days for Medicare A coverage. This means the patient may dip into this limited number of days when they go past the 90-day mark. If they use up those 60 days, they are not replaceable. “Lifetime” means lifetime. Even then, the 60 lifetime reserve days for Medicare have a copay of $742 for each day. After the 150 consecutive days, the patient assumes ALL costs. Of course, this is a rare event.

Hospital Stay Coverage Depends on the Day

Staying as an inpatient in a hospital for 60, 90, or 150 days is a very rare event. The more likely occurrence is being admitted to the hospital, discharged, then readmitted for the same thing. That is a number game in itself. Once you are discharged, you need to be out of the hospital for 60 consecutive days. If you are, then the clock starts over again when you are admitted, even if it is for the same reason.

The count starts back up where you left off if you return to the hospital within those initial 60 days. If you left day 15 and are readmitted 30 days later, your second period in the hospital starts with day 16. This is assuming the readmittance is for essentially the same reason. Hospital stay coverage depends on where you fall in the sequence of days.

Does Medicare Cover Blood Transfusions?

Medicare A covers blood and Medicare B covers blood, but in two different circumstances. Medicare does not cover the first three pints of blood. They wait until the fourth pint before they kick in.

If the hospital gets the blood for the transfusion from a blood bank then you may not pay, other than donating blood afterward. Someone else may also donate blood in your name. If the hospital purchases blood, you will either pay or give you the option to donate.

Medicare A Covers Hospice Care

Medicare A Covers Hospice Care

Hospice is for the terminally ill. Terminally ill means the medical prognosis is an expectation of six months or less of life, assuming the illness runs its usual course. Only a Medicare-certified hospice program may take a patient, and the program director, together with the attending physician, determines admittance to the hospice program. Medicare A covers the care totally except for some minor copays for medications.

What hospice provides is PAIN RELIEF. Everything—drugs, medical equipment, nursing, homemaker services—are all designed to reduce pain and maintain some reasonable level of comfort for the dying person. Hospice is generally administered at home.

Some people believe hospice will cover room and board and other housekeeping items in a hospice or nursing home facility. The individual and/or family will bear those costs, not Medicare.

Does Medicare Cover Skilled Nursing Facilities?

Skilled nursing is not nursing home insurance. I get this question almost every week. ‘What happens to me if I have to go to a nursing home?’ If it is not tied to a medically necessary reason for full-time rehabilitation, the nursing home will be on your dime unless you have long-term care insurance.

Skilled nursing care is not custodial care, which means bathing, transporting, feeding, etc. That is what most people imagine when they think of a nursing home. Skilled nursing is something else.

There are five criteria a person must meet to be admitted to the skilled nursing facility that Medicare A covers. The first criteria is a minimum 3-day inpatient hospital stay for a related illness. Then the doctor discharges you to a facility because you cannot continue your treatment on your own. For example, if you need injections or physical therapy.

Second, you must enter the facility within 30 days of dismissal. Third, you can only receive the medically necessary treatment in a skilled nursing facility. You cannot receive the same or similar treatment through home health care or office visits.

Fourth, the skilled nursing facility must be a Medicare-approved facility. Finally, the reason for the stay must be the same reason the patient was in the hospital.

Medicare A covers skilled nursing at zero cost for the first twenty days. However, on days 21-100, the patient pays $185.50 per day unless they have a Medicare supplement or other insurance. Like the hospital stay, there is a formula for starting and stopping the days and how they are counted.

Medicare A Covers Home Health Care

Medicare A Covers Home Health Care

Medicare A covers home health care in much the same way as it covers skilled nursing facilities. There is a list of criteria the patient must meet.

Home health care is like skilled nursing in that it provides skilled care–not custodial. The patient must be certified to receive it. They must be homebound. In other words, they cannot easily go to an office to receive treatment. Medicare will cover home health care completely under Part A for as long as medically necessary and can be verified as necessary. It will be at no cost to the beneficiary.

What Does Medicare Part A Not Cover?

Medicare A does not include Medicare B. Part B is doctor and outpatient procedures, which is the bulk of what most people need. Those are also doctor visits in the hospital.

Medicare Part B does cost something. The Part B premium is currently $148.50 per month per person unless your income is in the top 6%.

Some people who do not take Part B. Maybe they have VA benefits or some other coverage. That can be a mistake.

Medicare A does not cover prescription drugs. Part D covers medications. Part A does not cover dental, vision, hearing, transportation. Those are all medically important services covered in other places and ways.

Medicare Part A Doesn’t Cover All Medical Costs

You paid for Medicare A coverage during your working years. Your payroll taxes included a 1.45% tax for Medicare Part A. It was and is strong protection for seniors against the devastating cost of hospital stays.

Skilled nursing is an important service, and Medicare A comes in to cover it. Home health care is vital for a person’s recovery and getting back to self-sufficiency, and hospice is a tremendously humane ministry Medicare A provides. But alone, Medicare Part A does not cover the medical care that most people need.

I recommend you seriously consider whether you need additional protection. Know your costs and coverage limitations.

Call 402-614-3389 and email us at info@omahainsurancesolutions.com for a free consultation and quote. We will confirm whether you’re covered and if additional protection is right for you.