Medicare has had an exciting history with prior authorization. Medicare prior authorization has become controversial over the years because of Medicare Advantage.

Have You Always Been Subject to Prior Authorization?

Health plans started using prior authorization in the 1960s. Hospital admittance grew after the creation of Medicare and Medicaid. At the same time, more employers began offering employees health insurance as part of their compensation package. Medical costs grew significantly, particularly hospital stays.

Insurance companies began implementing utilization reviews in the 1960s. Utilization reviews were a process to reduce the overutilization of resources and identify waste. Registered nurses initially performed utilization reviews in hospital settings. The skillset gained popularity within the health insurance industry as research grew around medical necessity, misuse, and overutilization of services.

Health plans reviewed claims for medical necessity and hospital length of stay. Health plans began to require physicians to certify the admission and subsequent days after admission to help contain costs. Prior authorization originated from the use of utilization reviews.

Fast-forward to the present day. You were subject to prior authorization when you entered the workforce and received employer-provided group health insurance as a benefit. The insurance company determines if it is “medically necessary” and covered by the policy your company purchased when you have any medical procedure. Then there is further discussion about the appropriate charges. Whether or not you were aware of it, prior authorization has always been part of your health insurance coverage.

Why Do Insurance Companies Use Prior Authorization?

Prior authorization is a medical management tool. Doctors and insurance companies work together to ensure that a specific treatment or service is the best option for the patient’s needs.

The purpose of prior authorization is to identify and discourage unnecessary and costly low-value services to reduce wasteful spending without impeding quality healthcare services.

Prior authorization, supervision, audits, and other compliance tools help identify and root out fraud, waste, and abuse in the healthcare system. The ultimate purpose is to reduce costs for the consumer and prevent unnecessary treatments.

The Department of Justice announced today (Feb 17, 2021) criminal charges against 138 defendants, including 42 doctors, nurses, and other licensed medical professionals, in 31 federal districts across the United States for their alleged participation in various healthcare fraud schemes that resulted in approximately $1.4 billion in alleged losses.

The charges target approximately $1.1 billion in fraud committed using telemedicine, $29 million in COVID-19 healthcare fraud, $133 million connected to substance abuse treatment facilities or “sober homes,” and $160 million connected to other healthcare fraud and illegal opioid distribution schemes across the country.

While most doctors, medical professionals, and medical facilities are honest and act with integrity, an element will always and continually seek illicit gain costing consumers and taxpayers untold amounts. This results in higher insurance premiums and medical costs. It is naive to believe all are good actors and that every recommended treatment and service is the best fit.

Why Does Original Medicare Not Use Prior Authorization?

In part, the Medicare prior authorization controversy is that “Original Medicare” does not require prior authorization for most procedures, and Medicare Advantage does. (Original Medicare is just Medicare Part A and Part B. The payment structure is called fee-for-service. Medicare Advantage (or Part C) is Medicare administered by a private insurance company contracted and approved by Medicare.)

At first glance, you probably ask, ‘Why does Original Medicare not require prior authorization’ because prior authorization is common practice in the health insurance world? No company will leave the decision to spend potentially tens of thousands of dollars, even millions, to one person without some oversight.

When Medicare was established, Congress included certain arrangements and excluded others. In Section 1862(a)(1)(A) of the Social Security Act:

“No payment may be made under Part A or Part B for any expenses incurred for items or service which . . .. are not reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed member . . ..”

The key phrase is “reasonable and necessary.” “Reasonable and necessary” has been interpreted over the years very broadly. If a submitted claim is in an allowed category and not excluded, the submission is “reasonable and necessary.”

The doctor authorizes an MRI of the shoulder because the patient complains of problems. MRIs are covered. This procedure is “reasonable and necessary” because it is not an uncommon practice, even if there may be less expensive diagnostic procedures or treatments.

As you can probably guess, this broad interpretation with no oversight or accountability will result in large amounts of fraud, waste, and abuse.

Why Is Medicare Advantage Prior Authorization So Controversial?

The short answer to why is that Original Medicare doesn’t require prior authorization. The controversy is some believe beneficiaries are being denied essential medical services and treatments. Beneficiaries and medical professionals do not even attempt to overturn denials because they believe the appeal process is so burdensome.

The facts, however, do not paint such a sad picture. The Office of the Inspector General reviewed a large number of Medicare Advantage Organizations (MAO), reviewing 448 million preauthorization requests in 2016. Of those, MAOs denied about 1 million preauthorization requests for a denial rate of 4 percent—4 percent is tiny.

The September 2018 Office of Inspector General report found that Medicare Advantage Organizations (MAO) overturned 75 percent of their own denials from 2014-2016, overturning approximately 216,000 yearly. During that same period, independent reviews discovered additional requests that had been inappropriately denied.

The most surprising finding, however, is that only one percent of beneficiaries and providers appealed their denial, which raised the question: how many were denied necessary treatment because the process is so arduous?

Unfortunately, the study does not give a coherent explanation of the denials. From my experience of doing Medicare planning for a decade with thousands of beneficiaries, doctors’ offices do not always submit requests with detailed documentation in support. When the request is denied, they blame the insurance company, and the effort stops unless the patient pushes the issue.

The other reason I find for denial is the doctor’s office uses the wrong billing code. Quite often, the insurance company does not give any explanation in those cases. The response is “denied.” The solution requires the doctor’s office to call and talk with the claims department about billing codes, documentation, and supporting tests. In the absence of these items, nothing happens.

Unfair Statistics and Sensational Journalism

The Department of Health and Human Services Office of Inspect General (OIG) conducted a study of Medicare Advantage Organizations’ (MAO) denial of prior authorizations during one week (June 1-7, 2019). In that week, there were 250 denials. The OIG discovered that 13 percent of these prior authorizations were incorrect. This amounted to 33 cases.

Later in the same report, they admitted the usual national average is 5 percent. No reason was given why the study was not expanded when the conclusions from their study did not coincide with other long-standing evidence, particularly when the study was so microscopic–one week and 250 cases.

In the same study, they did not review the cases where the prior authorization was approved when it should have actually been denied. There was also no control group to compare against. The OIG did not study fee-for-service Medicare billing for fraudulent or wasteful claims or denials on their part.

The New York Times piled on in an April 2022 article. They presented a very slanted view of the study, beginning the article with “Medicare Advantage plans often deny needed care, federal report finds.” Only toward the very end of the article did the author get into any of the facts of the report. The general impression during the first half of the article is Medicare Advantage denies its clients the necessary medical care they need.

Why Are Medicare Prior Authorization Denials Overturned?

Denials may be overturned for many reasons. First, there were errors on the part of the insurance company. The decision was incorrect.

Errors on the part of the doctor’s office or medical facility. They did not include sufficient documentation or incorrect information. The denial is reversed, then. The provider may add new information from additional tests in the appeal process that contributes to an overturn.

The overturn does not necessarily mean the MAO acted inappropriately, but the process and extra steps critics claim create friction in the system. Patients may wish to avoid going through the trouble of appeal. Doctors may not make recommendations because of a history of denials.

Did Medicare Ever Use Prior Authorization?

The Medicare practice of accepting bills from providers at face value without question as “reasonable and necessary” was an established and haloed practice from the beginning of Medicare. All parties who benefited the most—except U.S. taxpayers—were unmotivated to change until the wheelchair scandal.

In 1999 it was discovered that Medicare spent $8.2 billion to procure power wheelchairs and “scooters” for 2.7 million people. A large portion was paid to scammers because they discovered that Medicare not only did not require prior authorization for wheelchairs, but Medicare did not even review the authenticity of the claims.

A Washington Post article published in August 2014 highlighted the massive fraud of Medicare’s resources. The article chronicled the sensational scams and trials of many Medicare swindlers. The outrageous theft of public funds and the massive fraud shamed CMS to amend its regulations to finally require preauthorization for some “durable medical equipment,” i.e., electric wheelchairs.

Bureaucrats inside CMS admitted they knew how the wheelchair scheme worked as early as 1998. But it was not until 15 years later that officials finally did enough to curb the practice significantly. Durable medical equipment—electric wheelchairs—is the only exception to the “reasonable and necessary” practice. They must be preapproved.

Consequently, hundreds of millions of false and unnecessary claims were paid over many years in a massive Medicare fraud. Once the bureaucratic problem was fixed, and claims were more thoroughly reviewed, an enormous shift occurred. Medicare reimbursements for motorized wheelchairs fell from $32 million every month to $7 million—a 78 percent decrease.

The Medicare Claims System Is Designed for Fraud, Waste, & Abuse

By law, Medicare must pay most of its claims within 30 days. In that short window, it is supposed to filter out the fraud and uncover claims where the diagnosis or the prescription is bogus.

The system attempts to ameliorate the damage through a “pay and chase” policy. The bill is paid, then it is reviewed. Only a tiny fraction of claims — 3 percent or less — are reviewed by a live person before they are paid. The rest are reviewed only after the money is spent. If at all.

The whole Medicare claims process is set up as an honor system for the richest program managed by the U.S. government. It is a thief’s dream.

Medicare Prior Authorization Test Program

In March 2017, CMS (Center for Medicare & Medicaid Services) designed a test program for preauthorization for fee-for-service Original Medicare. In the month of March, the GAO (U.S. Government Accountability Office), in a Senate report, estimated a savings of $1.1 to $1.9 billion when preauthorization was used that month. The report estimated the federal government made an estimated $36.2 billion in improper payments for the Medicare fee-for-service program from July 2015 to June 2016.

The committee’s recommendation became the report’s title— “CMS Should Take Actions to Continue Prior Authorization Efforts to Reduce Spending.” The prior authorization programs created to monitor and measure improper payments were discontinued and never recommissioned.

Original Medicare Fee-For-Service vs. Medicare Advantage

The government created Medicare in 1965. It had been a long-time project of the Democratic Party. CMS (Center for Medicare & Medicaid Services), Department of Health & Human Services, and Social Security Administration are government agencies. Politicians of all political parties exercise control and funding over these agencies and programs. The agencies are staffed by thousands of bureaucrats and government union workers. A tremendous amount of various and conflicting self-interests, power, and money are all mixed together.

To save Medicare from ballooning budgets and to offer an alternative to citizens, the same politicians, programs, and agencies partnered with private insurance companies to control spending and improve patient care. What is now known as Medicare Advantage began back in the 90s.

The two ways of doing government healthcare for seniors are in competition. Politicians view the world through different ideologies and support policies and programs based upon their political views. Those who support the various political ideologies will support or attack these two platforms accordingly.

It is vital to find all the relevant facts, make your own comparisons and analysis, and determine where lies the truth and the better path.

When I meet with prospective clients, I begin with a brief explanation of Medicare. Then move on to the hundreds of plans. Drugs are next. This is hard. Clients must lay down their cards; some hold a straight flush of costly medications.

The Inflation Reduction Act of 2022 is a long-awaited solution to improve Medicare drug plans and make Part D affordable for those on costly medications.

Inflation Reduction Act of 2022 Deals with Medicare Drug Changes

When Medicare Part D was first established, Medicare contracted with private plan sponsors to provide the prescription drug benefit. The private insurance company created the Part D Prescription Drug Plans (PDP), sold the PDPs, and managed the PDPs. Each company negotiated separately with the pharmaceutical companies the price of the medications and which medications would be included on the plan formularies–the list of authorized drugs.

The insurance companies had the leverage of their brand and how many customers they would bring to the pharmaceutical companies. They were also competing with the other insurance companies to get more medications at the lowest cost. The pharmaceutical companies, of course, were trying to maximize their revenues and profits.

Ideally, it was hoped that the competition and freedom of the market would keep prices low. However, patent laws create a temporary monopoly for pharmaceutical companies that develop these very effective and popular new drugs. The patent, and the consequent monopoly, benefit the nation and the world with the newest and best medications. Unfortunately, it is a substantial financial burden for those who need the medication.

The Inflation Reduction Act Creates Leverage for Medicare

When Part D was created in 2004, a law was established known as “non-interference.” Non-interference means that the Secretary of Health and Human Services (HHS) cannot negotiate drug pricing with pharmaceutical companies, pharmacies, and insurance companies. Instead, the prices would be determined exclusively between the insurance companies, pharmaceutical companies, and pharmacies competing amongst one another.

With the Inflation Reduction Act of 2022, Medicare changes the law. The Secretary of HHS is granted a narrow exception to the non-interference clause. The HHS Secretary can negotiate on behalf of the 84 million Medicare and 76 million Medicaid beneficiaries for the lowest prices for a very limited number of costly prescriptions. The category of medications is single-source brand-name drugs or biologics without generic or biosimilar competitors.

Inflation Reduction Act of 2022 Effects Medicare Change in 2026

The Drug Price Negotiation Program begins in 2026 and is limited to 10 Part D drugs. Another 15 Part D drugs will be added in 2027, 15 Part D in 20228, and 20 Part in 2029. The HHS Secretary will select the drugs from among the 50 highest total cost Part D medications.

The timeline for the negotiation process will span roughly two years. For those companies that do not comply, there is an excise tax. The tax penalty starts at 65% of the product sales in the U.S. and increases by 10% every quarter to a maximum of 95%. The other option is that company can remove all its medications from the Medicare and Medicaid market.

Is the CBO Accurate, Reliable, & Trustworthy?

The Congressional Budget Office (CBO) claims HHS Secretaries’ ability to negotiate prices with Part D producers will significantly reduce what Medicare spends over the next ten years. The CBO also claims that reducing the revenue to pharmaceutical companies will have little effect upon developing new and better drugs. These are all projections and opinions to support the policy change. There is no evidence.

Drug Manufacturers Are Penalized for Inflation

The Inflation Reduction Act of 2002 adds another Medicare change. The Act requires drug manufacturers to pay a rebate to Medicare if prices for single-source drugs covered under Medicare Part B and nearly all covered frugs under part D increase faster than the rate of inflation reflected by the Consumer Price Index (CPI). The rebate dollars will be deposited in the Medicare Supplementary Medical Insurance (SMI) trust fund.

Cap Out-of-Pocket Part D Spending

Medicare Part D currently provides catastrophic coverage for high out-of-pocket drug costs. Still, there is no limit on the total amount beneficiaries pay out of pocket each year. Under the current design, Part D enrollees qualify for catastrophic coverage when the amount that they pay out of pocket plus the value of the manufacturer discount on the price of brand-name drugs in the coverage gap phase exceeds a certain threshold amount. Enrollees with drug costs high enough to exceed the catastrophic threshold must pay 5% of their total drug costs above the threshold until the end of the year. This can be huge.

The Inflation Reduction Act of 2022 amends Medicare’s design of Part D. For 2024, the law eliminates the 5% coinsurance requirement above the catastrophic coverage threshold, effectively capping out-of-pocket costs at approximately $3,250 that year.

The legislation adds a hard cap on out-of-pocket spending of $2,000 per person in 2025. How this will be funded, other than with savings, is still being determined.

Inflation Reduction Act of 2022 Puts Medicare Insulin at $35

Insulin is probably the most common high-dollar medication that burdens many Medicare beneficiaries. Most plans relieve several insulin products, beginning with the Trump Administration and now Biden.

Currently, Medicare beneficiaries can choose to enroll in a Part D plan participating in an Innovation Center model in which enhanced drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit.

Participating plans do not have to cover all insulin products at the $35 monthly copayment amount, just one of each dosage form and insulin type (rapid-acting, short-acting, intermediate-acting, and long-acting).

While Medicare is incredible health insurance, Part D prescription drug plans are the weakness because of the light coverage for higher-end medication. The Inflation Reduction Act of 2022 helps Medicare better service citizens with more reasonably priced medications.

We can ensure you have the plan that best covers your prescription drug needs at the lowest possible cost.

Call 402-614-3389 to speak with an experienced and licensed agent and insurance professional.

A Health Savings Account (HSA) is a powerful tax-advantaged devise. An HSA, however, can have devastating effect if you do not understand how an HSA works with Medicare.

What Is An HSA?

A Health Savings Account (HSA) is a type of personal savings account introduced in 2003. It is designed to work with employer health plans, especially high deductible plans. HSA are not part of Medicare, though HSA can work with Medicare.

You and your employer can put money into your HSA account. The money contributed is an above-the-line deduction on your income tax and is excluded from gross income. Many HSA accounts have various investment options for the money. Earning from the invested funds grow tax-free inside the HSA account. There is no tax consequence when you used to pay a qualified medical expense. Qualifed medical expenses are deductibles, copayments, coinsurance for a health insurance plan.

You can continue to hold the HSA even when you are no longer employed. You can use it for medical expenses while at a different job or even during retirement. HSAs can work with your Medicare, but there are specific rules.

HSAs Are Coupled with an HDHP

You are eligible to contribute to an HSA when specific high-deductible health plans cover you (HDHPs) with a deductible of at least $1,400 for yourself only or $2,800 for family coverage. With HDHPs, the monthly premium is usually significantly lower. You pay more health care costs upfront before your insurance company starts to pay its share.

You can only contribute to an HSA if your plan has a deductible that requires you to cover initial costs. The plan cannot have what is called “first dollar coverage.”

Many employers now offer HDHP plans paired with an HSA account. Non-employer HSA-eligible plans are available through the Health Insurance Marketplace®, Small Business Health Options Program (SHOP), or outside of the Marketplace. HSA-eligible plans are also available in most states that use HealthCare.gov.

Banks, insurance companies, and other financial institutions offer HSAs. The money you contribute to the account is not taxed as long as it is spent on qualified expenses.

Qualified Medical Expenses for an HSA?

Qualified medical expenses include but are not limited to:

- Acupuncture

- Alcoholism Treatment

- Ambulance Services

- Chiropractic Services

- Contact lens supplies

- Dental Treatments

- Diagnostic Services—MRIs, CT scans, EKGs, etc.

- Doctor’s fees

- Eye exams, glasses, & surgery

- Guide dogs

- Hearing aids & Batteries

- Insulin

- Lab Fees

- Long-Term Care Insurance premiums

- Prescription medications

- Nursing Services

- Surgery

- Psychiatric Care

- Telephone equipment for the visually or hearing impaired

- Therapy or counseling

- Wheelchairs

- X-Ray

Sometimes, you can spend your HSA money on similar medical costs for your spouse or dependents.

How Do HSAs Work?

The money in your HSA rolls over year-to-year if you don’t spend it. The money may also be put into an interest bearing bank and brokerage accounts. You can move the funds among the difference investments without triggering a taxable event.

Health Savings Account (HSA) contribution limits for 2023 are increasing significantly in response to the recent inflation surge. The IRS announced the change on April 29, giving employers that sponsor High-Deductible Health Plans (HDHPs) plenty of time to prepare for open enrollment season later this year.

The annual inflation-adjusted limit on HSA contributions for self-only coverage will be $3,850, up from $3,650 in 2022. The HSA contribution limit for family coverage will be $7,750, up from $7,300. The adjustments represent approximately a 5.5 percent increase over 2022 contribution limits. Last year’s limits rose only by about 1.4 percent between 2021 and 2022.

For 2023, the maximum out-of-pocket (MOOP) limit for self-only coverage is $7,500 or $15,000 for family coverage. According to the IRS, only deductibles and expenses for services within the health plan’s network should be used to determine if the plan meets or exceeds the MOOP limits.

HSA and Medicare Rules

Before the introduction of Health Savings Accounts (HSA), the standard practice was to at least enroll in Medicare Part A even if you continued to work past 65 and remained on employer health cover. It was a generally accepted best practice for any worker who was not already collecting Social Security at the age of 65 to go ahead and sign up for Medicare Part A, regardless of other coverage.

Part A did not interfere with employer health coverage and did not usually cost anything. Part A then reminded the person to enroll in Part B and D when he eventually lost employer health coverage.

This rule of thumb still applies, for the most part, The crucial exception arises for anyone who works past age 65 and wishes to continue contributing to an HSA while on Medicare.

The Number of HSAs Has Exploded

The number of High Deductible Health Plans (HDHP) with HSAs has significantly grown in the two decades since HSAs emerged.

Over the past ten years, especially, HSA growth exploded. Since 2011, the number of HSAs has grown from 6.8 million accounts to 30.2 million in 2020. That’s a growth rate of over 300 percent in a decade and a near-doubling in just five years from 16.7 million in 2015.

The HSA market should reach beyond 36 million by 2023, which is a 20 percent growth rate from 2020.

Many people who joined an HDHP with an HSA ten and twenty years ago are now turning 65. In the past, I rarely spoke about HSAs, even five years ago. The subject comes up much more frequently now. I am careful to ask everyone I talk with about HSAs. Many have old HSAs, many are currently in HDHPs with HSAs, and many plan to work past 65.

Among those working past 65, some are going on Medicare when eligible. Others are deferring Medicare until full Social Security retirement benefits. Some need to stay with their plan because of a spouse or child who needs health insurance. Regardless of the reasons, discussing their HSA, if they have one, and Medicare is critical.

HSA and Medicare Part A

It is important to note once you enroll in Medicare, even if you only enroll in Medicare Part A, you can no longer contribute to an employer’s Health Savings Account (HSA). If you or your employer contribute any amount to your HSA after you enroll in Medicare Part A and/or Part B, you will pay a sizeable tax penalty when you withdraw the money from your account, as well as the unpaid taxes.

Does Medicare Part A Disqualify HSA Contributions?

Do NOT enroll in either Medicare Part A or Part B IF you wish to continue contributing to an employer HSA.

You must also make sure you and your employer stop contributing to your HSA at least six months before your Medicare takes effect if you enroll in Medicare after age 65. Medicare Part A is always backdated six months or to your 65th month of birth, whichever is shorter.

If you turn 65 and enroll in Medicare during the year, you and your employer must stop contributions the month you turn 65. Any contributions you or your employer make before your 65th birthday must be pro-rated for the year only to include the months before you turn 65.

How Does Social Security Benefits Affect an HSA?

Suppose you are already collecting Social Security upon turning age 65. In that case, you will be automatically enrolled in Medicare. You can stop your Part B to avoid paying the monthly premium, but you do NOT have the option to cancel Part A if you continue to receive Social Security benefits. Consequently, you will be penalized if anyone contributes to your HSA past 65 in this circumstance.

The only way to opt-out of this would be to rescind your Social Security election within 12 months and pay back all benefits received.

Social Security will also automatically enroll you in Part A if you start your Social Security benefits when you reach full retirement age. Again, you can no longer make HSA contributions once Part A is activated without penalty.

Can You Use HSA Funds For Medicare-Related Expenses?

Funds already in your HSA account can still be used for qualified medical expenses upon enrollment in Medicare. You could pay your Part A premiums with HSA money if you or your spouse did not work long enough to be eligible for premium-free Part A coverage.

If your Part B premiums are paid directly from your Social Security check, you can withdraw money tax-free from your HSA to reimburse yourself for those expenses. Just remember to keep records of the costs.

Part D prescription drug costs and Medicare Advantage copays are also eligible expenses.

You cannot use HSA funds to cover Medicare supplemental insurance, also called Medigap.

HSAs and Long-Term Care

You can also withdraw money tax-free from an HSA to pay a portion of eligible long-term care insurance premiums based on your age.

You can withdraw up to $4,510 for long-term care premiums if you are age 61 to 70 and $5,640 if you’re older than 71. Your spouse can also withdraw up to that amount based on her age.

The eligible withdrawal limits for long-term care premiums are smaller at younger ages.

What Is the Penalty for HSA Contributions While on Medicare?

You will no longer have the HSA deduction during the period you were on Medicare and contributed to an HSA. You must add your pre-tax HSA contribution back into your income for the year you took the deduction. You will then be responsible for paying those past taxes with any interest due.

The IRS accesses an additional 6% as a penalty on the amount contributed.

HSA Testing Period & Penalty

HSAs also have what is described as a testing period. Contributors may make lump sum contributions, which are averaged out over the testing period. If the person’s Medicare is active at any time during the HSA testing period, an additional 10% IRS penalty is added along with the taxes.

Working Past 65 and Funding an HSA?

Note that a taxpayer must be enrolled in an employer-based group health plan to defer Medicare past age 65 without penalty. An HSA-eligible plan through the private Marketplace, COBRA, or a health care exchange does NOT qualify. In that case, you must cease contributions to the HSA upon reaching age 65 and enroll in Medicare to avoid lifetime late-enrollment penalties.

Once you are 65 or older and no longer have coverage through an employer-based group health plan, you have eight months to enroll in Medicare Part B to avoid a penalty. If you miss that deadline, there is a risk of a lifetime penalty for late enrollment.

Conclusion

The bottom line is that you must be clear on all rules and ramifications when working past age 65 and continuing to fund an HSA when Medicare eligible. You want to avoid penalties for excess HSA contributions or late-enrollment penalties for Medicare Part B and Part D.

Many people have heard of the Medicare Donut Hole, but even those on Medicare are not familiar with what the donut hole really means unless they fall into it.

When you are in the Medicare Donut Hole, you know it and quickly learn what it means.

Clients call me monthly asking, “What’s going on? My medication jumped from $45 to $145!” I say, “Oh, you’re probably in the Medicare Gap, or the more popular name is the ‘donut hole.”’ They ask, “What’s that?”

Even clients I have warned ahead of time usually still call with distressed and perplexed voices. People don’t really begin to grasp what’s happening until it happens.

Medicare Donut Hole Explained

How to explain the Medicare Donut Hole? There is nothing logical about the Medicare Donut Hole (or Medicare Gap). The government actuaries devised this idea to deal with many Medicare beneficiaries who are on many extremely expensive medications.

Think about it this way: We all pay for auto insurance. Most of us do not get into accidents or kill anyone, thankfully. Over a long driving career, there may be some fender benders, but nothing major.

So we complain a little, but we pay the insurance premiums. It’s the price of doing business. We understand that more people need to pay in than people take out for accidents and injuries for insurance to work. Medicare Part D prescription drug insurance is similar. We need more people paying in than taking out.

The Problem Of Expensive Prescriptions

When we were working, our employers and we paid a lot of health insurance premiums, including medication copays. The age group for employer plans is 18-64. Not many people were on Eliquis, Toujeo, Xarelto, Jardiance, Ventolin Inhalers, etc. However, when it comes to Medicare, you have people ages 65-100, and the percentage of persons on expensive medications is enormous.

If the cost and risk were evenly distributed among all participants without distinction, Medicare Part D prescription drug plans would be significantly more expensive — so expensive that those who aren’t on medications or very few medications would never buy a Medicare Part D plan.

Remember, you need more people paying into the insurance plan than taking out. The magical actuaries at Medicare came up with an idea. Voila, the Medicare Donut Hole!

4 Phases To the Medicare Part D Plans

The Medicare Part D prescription drug program is broken down into four phases. The first phase is the deductible. The deductible for 2023 will be $505. The purpose of any deductible is to ensure that people do not charge recurring and minor costs to the insurance plan. The consumer needs to foot the bill for those low-cost expenditures. All insurance policies have some deductible built into the policy. Otherwise, premiums would be astronomical.

Phase 1: Deductible

In the case of Part D plans, the deductible is usually only for the more expensive Tier 3 medications. The plan entirely or mostly covers minor and inexpensive medications.

Phase 2: Initial Stage

The second phase is the initial stage. The Medicare initial stage is how insurance generally feels to the consumer. There is a claim, and the insurance pays most of the claim. The insured pays a fourth or a fifth of the actual cost.

Most people on Medicare never get out of the Medicare initial phase. They may even be on many medications, but their cost is insufficient to drive them into the Gap.

Phase 3: The Gap / Medicare Donut Hole

The third phase is the Medicare Gap (or Medicare Donut Hole). You cross this threshold when you and the plan have paid at least $4,660 in the insurance company’s cost of the medications.

You’ve paid about a fourth of the cost out of your pocket. The insurance companies paid the rest. You have now thoroughly and completely crossed over into the Medicare Gap (or Medicare Donut Hole).

In the Gap, pharmaceutical companies discount the medication cost by 75%. You pay 25% of the actual cost. The reasoning is that now the persons who most benefit directly from the medications should bear the burden of the cost. Again, if it were evenly split among participants, those with no or few medications would opt out of Part D plans and significantly reduce the premium paid into the pool.

Phase 4: Catastrophic

The final phase is catastrophic. Like it sounds, the costs are catastrophic for most people by this point. You have paid $7,400 out of your pocket in actual or discounted costs. This amount is based on the actual costs of the medications. You need to pay the $7,400 out of your pocket to descend to the next level.

This phase is probably called catastrophic because you have paid out a catastrophic amount of money for medications, which is catastrophic for your budget.

In this stage, instead of paying the actual cost of the medications, the insurance company and Medicare step back in. Medicare significantly subsidizes the cost. Beneficiaries pay copays of $4.15, $10.35, or 5%, whichever is higher. The cost and tier determine the copay.

Then, the whole process starts over again on Jan. 1 each year.

Changes to the Medicare Donut Hole In 2024

Because of recent legislation in Congress, this entire system may be significantly altered starting in 2024. Hopefully, for the good, but as it stands, this is what and how the Medicare “Donut Hole” works.

The amount of the Medicare Part A Hospital deductible for 2023 is vital because other numbers are based upon it. The Part Hospital A deductible in 2023 is more than just a dollar amount. The Part A deductible for Medicare drives the other copays, coinsurance, and deductibles.

Part A not only covers inpatient hospital stays. Medicare Part A and the deductible for 2023 include Skill Nursing Facilities, Home Healthcare, and even Hospice. These services have their own particular copays.

Payroll Taxes Pay For Medicare Part A

Payroll taxes support Medicare Part A. Each pay period, the taxes deducted from your check go into a special trust fund to cover Part A expenses. The payroll tax (or FICA) is currently 1.45% of your gross wages. There is no limit to the 1.45% tax. In other words, your entire income, even if it is $400,000, is subject to the 1.45% tax.

While the revenue from payroll taxes to the federal government is enormous as an absolute number, it is finite and limited in relation to the costs that Medicare Part A must support. Consequently, deductibles, coinsurance, and copays for the hospital, skilled nursing, home health care, and hospice are designed to offset any shortfall in rising expenses and insufficient tax revenue.

Medicare Part A Increases In 2023 Increase Supplements

Part A claims generally are more considerable than Part B claims. When the Center for Medicare & Medicaid Services (CMS) increases the deductibles and copays for Part A, the insurance companies need to cover more with the Medigap and Medicare Advantage policies. Their costs and risk go up in relation to Medicare’s higher deductibles and copays. They pass those costs on to the consumer through increased premiums and larger copays.

How Much Is Medicare Part A Deductible?

The Medicare Part A deductible for 2022 was $1,556 per benefit period. The new Medicare Part A deductible for 2023 is $1,600 per benefit period, which is a 3% increase.

The key to Medicare Part A deductible is the benefit period. The benefit period restarts after 60 days without inpatient care. There is no limit to the number of benefit periods a patient may experience in a year. Consequently, the insurance company that covers this risk has almost unlimited liability.

After the Part A deductible is met during the benefit period, the patient has 60 days at no cost in the hospital. If the patient remains as an inpatient on day 61, his copay is $400 daily from day 61 to 90 for 2023. As you can imagine, the 60-day stay is more than sufficient for most people.

Lifetime Reserve Days

However, for those who need even more inpatient hospital care, there is a one-time amount of 60 lifetime reserve days. The patient may draw upon this pool of days when he has exceeded the initial 90 days. The accompanying copay for these 60 lifetime reserve days is $800 per day. Once these days are exhausted, then you are responsible for all costs on day 150 and beyond that year.

These numbers are strictly Medicare Part A deductible, and copays for 2023 without a Medicare Supplement or Medicare Advantage plan included.

Medicare Part A Include Skilled Nursing Facilities

Medicare Part A for 2023 includes skilled nursing facilities. Skilled nursing is required when the level of care is more than can be provided by home health care visits or a patient going to a facility several times a week. Skilled nursing is for intense rehabilitation requiring several hours of care per day.

The Medicare Part A deductible for 2023 is zero for the first twenty days in the skilled nursing facility, but from day 21 to day 100, the copay increased from $194.50 to $200 daily in 2023.

Medicare Supplements fill in the gap for skilled nursing facility care. Medicare Advantage plans provide smaller daily copays, but the cost of a supplement or advantage plan increases when more of the burden is passed on to the plan.

Home Healthcare & Hospice Go With Part A

Home health care is also part of Medicare Part A. It remains the same with zero copays, and durable medical equipment remains at 20% coinsurance.

While these numbers remain the same, inflation affects the amount the insurance company must make up to cover the 20% of durable medical equipment like walkers, wheelchairs, hospital beds, CPAP machines, oxygen tanks, and other medical equipment. More liability means higher premiums in the long run for Medicare Supplements.

Medicare Part A includes hospice. The Medicare Part A for hospice in 2023 is the same as well. Medicare almost completely covers hospice. There are some minimal copays for medications.

At the end of each year, the Center for Medicare & Medicaid Services (CMS) releases the new numbers for Medicare Part A and Part B. The insurance companies follow suit with their adjustments over the course of the year. Understanding the changes and how all the numbers work together gives you a better appreciation for how Medicare works and enables you to anticipate increases and plan your healthcare budget. You can adjust your strategy for your Medicare Supplement, Medicare Advantage plan, or Medicare Part D prescription drug plan when you know how it works. The first number to learn is the Medicare Part A deductible for 2023.

January begins a new calendar year for Medicare. What does that mean for your Medicare drug deductibles in 2023?

For most Medicare members with a Medicare Part D prescription drug plan, you have a deductible. The Medicare drug deductible for 2023 is currently $505. The Part D drug deductible for 2022 was $480, which means a 5% increase. The deductible is the amount you initially pay out of your pocket before the insurance plan begins paying for the prescriptions. Deductibles are vital because they keep the overall cost of medications low. Deductibles also prevent members from overusing Part D drug plans for trivial or unnecessary purposes.

2023 Medicare Drug Deductible Shock!

I mention the Medicare drug deductible for 2023 because I get distressed phone calls at the beginning of the year. Clients go to the pharmacy in January, February, and March and are shocked. They have a huge unexpected bill. I hear cries of ‘I can’t afford $500 every month for their medications!’

I remind clients that they are in the deductible phase of their Medicare drug plan. Once they meet their drug deductible, the medication cost will decrease significantly to around $45 per month per medication.

Since it is an entire year from the last time clients paid their drug deductible, it is understandable they forget.

For those paying the deductible all at once in January and for the first time, the deductible experience will be a new and eye-opening surprise.

Plan For the Unexpected

I don’t know about you, but $505 is a lot of money to pay out all of a sudden, especially if you were not planning on it. I’m usually all tapped out by January. My trophy wife, high-maintenance step-children, and grandchildren require a lot of maintenance around Christmas time.

Once you have met your Medicare Part D deductible for the year, your Tier 3, 4, & 5 medications will be the amount listed in your handbook during the initial phase before the Gap. Please, consult my other blogs about the GAP / Donut Hole.

Most people, however, will not fall into the Gap and will simply pay minimal copays for the remainder of the year. It is the deductible that is the big obstacle.

Clients ask, ‘Are there other Part D plans without a deductible?’ There are a few, but the monthly premiums are much higher, like $100 per month, and the copays are generally higher too.

Lowest Total Annual Medicare Drug Cost

When I run clients’ drugs through the Medicare Part D medication calculator, I look primarily at the total annual cost. The winning drug plan is the plan with the lowest total annual cost and with at least a 3 Star Medicare rating.

The calculator combines the monthly premium, deductibles, copays, and gap–if applicable–and spits out a total number for the year. That is the plan you want to use.

Look For Stars

As for the Medicare star rating, you want to have at least three stars. More stars are better. There is no point in having the cheapest Medicare drug plan if you never get your medications or the insurance company is so painful to deal with you need additional drugs to handle them.

Most Have A Medicare Drug Deductible

January to March is when Part D plans remind most people they have a deductible. Don’t be upset. There is nothing wrong. You must meet the Medicare drug deductible to get to the lower cost for your medications for the remainder of 2023.

I changed how I do my meetings with new clients. I set up their My Medicare login before they leave my office because . . . .

Client Problem

A client called me because he had an unpaid bill. He claimed the insurance company with his Medicare Supplement policy would not pay his hospital bills.

I tend not to react anymore until I have the whole story from all the sources. I said, “Ok, let’s call the insurance company.”

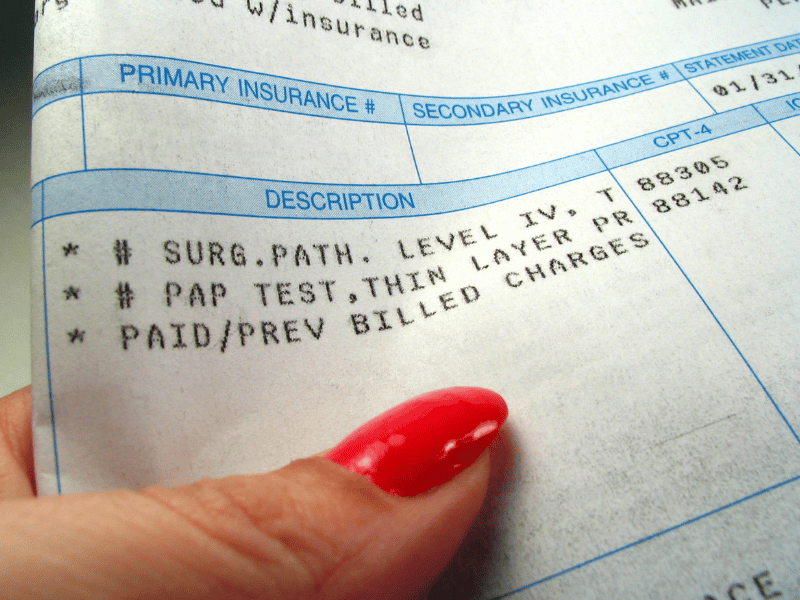

We got a customer service representative on a three-way phone call. The rep said they had received bills from the hospital, but the bills didn’t have Medicare approval and coding. The insurance company requested the hospital send the proper codes, but the hospital didn’t reply.

Medicare Determines What Is Paid

The customer service rep said the insurance company was not refusing to pay; instead, they couldn’t pay until Medicare sent the approval with the proper codes. Then the insurance company would happily pay its portion.

After we got off the phone with the insurance rep, I translated what happened to my client.

How Medicare Billing Works

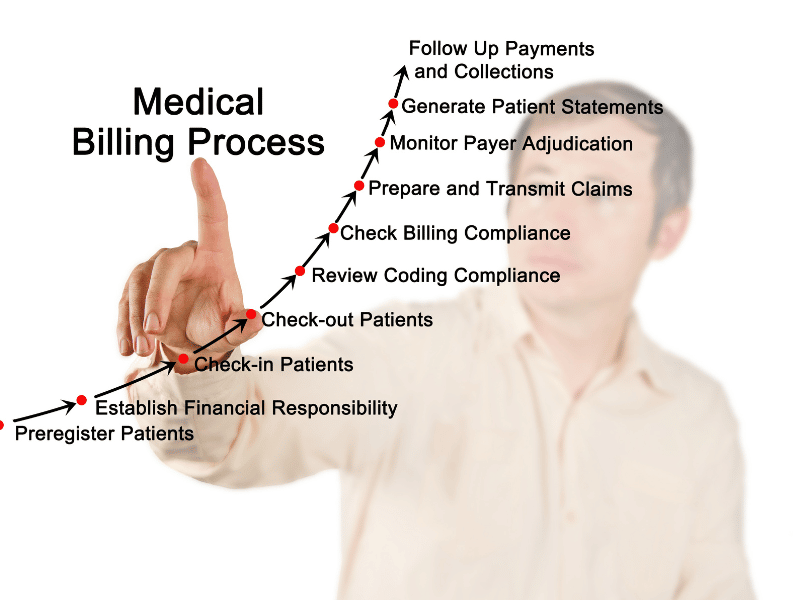

The hospital is supposed to send the claims to Medicare first, not the insurance company. Medicare determines everything. Medicare already has a schedule of payments for specific procedures. Medicare determines whether the procedure is “medically necessary.” If it is medically necessary, Medicare pays the predetermined fee, which also has a procedural code. You can view the claims through your My Medicare Login.

Medicare Summary Notice (MSN)

Medicare will also send a Medicare Summary Notice (MSN) to you with what was covered, paid, or not paid. You can appeal any claims Medicare refuses to pay at this time. You can also file your own Medicare claims through this portal.

Then Medicare forwards the claims to the insurance company with the necessary coding. The insurance company receives the claim and knows precisely what to pay based on the code. The insurance company sends the money to the provider within 48 hours of receiving the claim from Medicare.

The system is beautifully flawless—usually.

Instead, it sounded like someone at the hospital must have been new, poorly trained, or mistakenly sent the bill to the wrong place.

When the hospital did not receive payment, they did the easy thing and blamed the insurance company and sent the bill to the patient rather than looking at what they did wrong.

Unfortunately, I had to send my client back to the hospital to have them forward the seven-month-old bills to Medicare.

My Medicare Login Is the Solution

Something I am doing now when I meet with clients for the last time is setting up their My Medicare login. Everyone on Medicare has a My Medicare login and an online account with Medicare.

MyMedicare.gov is especially important for clients on Original Medicare (Part A & B only) and a Medicare Supplement/Medigap policy because your bills are sent directly to Medicare, and you can view the transactions on your MyMedicare.gov online account. There is a section called Medicare Summary Notices (MSN). The claims are all there, and how they were handled.

For those on Medicare Advantage (Part C) plans, you can see your bills on your online account with your specific insurance company.

How to Pay Medicare Premium?

On MyMedicare.gov, you can see the claims sent to Medicare, print out your Medicare card, and pay your Medicare Part B premium online if you are NOT getting a Social Security check. It is an excellent tool for everyone on Medicare.

Click on the icon for Pay Part B Premium. You can put in your banking information to pay your premium monthly if you are not receiving Social Security benefits.

Login to Medicare Bills

Everyone should login to their My Medicare account. For the client who thought his Medicare Supplement company was not paying, if he had logged into his My Medicare online account, he could have quickly seen the bills were never sent to Medicare.

Please call us at 402-614-3389 if you need help setting up your My Medicare login for your online account. I want my clients to have the best Medicare insurance experience possible.

If you have paid payroll taxes (FICA) for 40 quarters (or 10 years), you are eligible to apply for Medicare in Nebraska for 2022. You are eligible for Medicare Part A at zero premium and may purchase Part B at the current cost if your income is below the IRMAA (Income Related Monthly Adjustment Amounts) amounts.

The Easy Way To Apply For Medicare in Nebraska For 2022

If you are currently receiving Social Security benefits, you will be automatically enrolled in Medicare Part A for the hospital and Part B for doctor visits and outpatient services. You will then be given the option to cancel Part B if you wish.

You cancel Part B by signing the red, white, and blue Medicare card on the back and mailing it back to Medicare. Otherwise, Medicare Part A and B will start on the effective dates printed on the bottom right corner of the card. The Social Security Administration (SSA) will also start deducting the Medicare Part B premium from your monthly Social Security check.

Applying for Medicare in Nebraska in 2022 is easy that way. It is automatic. The other way is more challenging.

Online Application For Medicare in Nebraska for 2022

Applying for Medicare in Nebraska, Iowa, and throughout the country has become more difficult and complex with each subsequent month. The pandemic pushed the process almost entirely online. Social Security personnel were absent at Social Security Administration Offices throughout Nebraska, Iowa, and the whole country during that time. Offices were closed, and most employees were working remotely.

Identity theft, cyber security, and HIPPA regulations have pushed the Social Security Administration (SSA) to add more and more levels of security to the Medicare application.

I help my prospective clients apply for Medicare all the time. While eligibility for Medicare and Social Security benefits in Nebraska begins at 65, most people are not getting their Social Security benefit checks until much later. Instead, they are waiting until the full benefit age, which is around 66 and 8 months or older. So they need to apply for Medicare online.

I probably average helping five people a week apply for Medicare in Nebraska and Iowa. The level of difficulty each person experiences is amazing. I don’t know how other people do it on their own.

How Do You Apply For Medicare Benefits in Nebraska Online in 2022?

If you are eligible for Medicare in Nebraska, type ssa.gov into your address bar. Do NOT Google ssa.gov. You will end up at all kinds of websites trying to sell you Medicare plans. The Social Security Administration logo will be in the top left corner if you are successful.

Click on Menu in the top right section of the website. Go under Benefits and click Medicare. Then, scroll down the page until you see a bright blue button that says “Apply for Medicare Only.” Click on the button that will take you to a page with a gray button that says, “Start New Application.” Click it.

Follow the prompts. The most crucial part is your My Social Security login. This is the tricky part.

Hundreds of people swear they never set up an online Social Security account. Then, when we start the enrollment process, we discovered they have a My Social Security account, and SSA requires us to use it.

Logging in to your My Social Security account may become an insurmountable obstacle if you need to provide personal verification information, like the answers to the three security questions you had set up previously. At that point, you will be stopped out and need to call or go to the Omaha, Lincoln, or Council Bluffs Social Security Administration office to get access to continue applying for Medicare in Nebraska in 2022.

If you do not have an online My Social Security account, you create one. In creating the account, you will need immediate access to email and text. With that, you will be able to set up an online account.

Follow the prompts to set up the account.

Second Form of Identification When Applying for Medicare in Nebraska for 2022

Giving SSA a second form of identification, such as your driver’s license, is vital. SSA will text a link to your phone. Then you take a photo of your driver’s license to verify who you are. Taking the photo so the system receives it can be problematic. This is the most difficult part of applying for Medicare.

Your phone’s camera software may not work well with SSA’s system, the cellular or internet connection may be weak, or the SSA system may be in a bad mood that day. Many factors can go into making the system unworkable. Be warned.

If you cannot set up a second means of verification, you will probably have to wait for a verification code to be mailed to your physical address. Then you go back in to complete the enrollment process.

More than half of the time, the system works. We get the text verification and complete the My Social Security online account setup.

When you enter your My Social Security online account through the Medicare prompts, the system pulls up the application for Medicare. Fill in the details and complete the application. The application process will assume you want Medicare Part A for the hospital since it is free. The system will ask if you want Medicare Part B for doctor visits and outpatient procedures. Medicare Part B costs something. You have the option to say yes or no.

Check On Your Online Medicare Application

When you have completed the application, you can go back in and check on your Medicare application status. A newly created box is in your My Social Security account for Medicare. There will be three grey horizontal bars going across the page. When you complete the application, one bar will be blue. When all three bars are blue, a comment underneath will say you are approved. Congrats!

Above will be a “Verification of Benefits Letter” link. Click on the link. A letter will open up. In the body of the letter will be your Medicare number (MBI), which is made up of eleven digits consisting of a combination of numbers and letters. The letter will also have the dates when your Part A and/or Part B will start.

Sometimes clients tell me they want to wait for the Medicare card to come in the mail. Bad decision. It may take over a month for your Medicare card to show up in the mail, significantly decreasing your time to select, enroll, and get your medical cards from the insurance company before your start date.

Online Medicare Application Problems

Check your account two weeks after you apply for Medicare online, and keep checking it until you have a Medicare number.

If your account says your case was sent to Salinas, CA, for processing, you need to call your local SSA office to find out why. Salinas, CA, is a black hole.

There is a problem with your application that needs to be solved sooner rather than later, and the folks in Salina, CA, are not very proactive or even active in solving your problem–whatever it may be.

All of this above-said information works if your personal information is in good order with SSA. There may be problems of which you are only aware once you enroll. For example, your name is misspelled with SSA, your birthday is wrong, your address is out-of-date, your maiden name was not changed to your married name or back after a divorce, and your naturalization date or number is incorrect. You could also be flagged as a terrorist, Russian mole, or affiliated with the opposing political party–just kidding.

I’ve experienced all of these with clients–except the terrorist one. Making corrections takes lots of time. I had a gentleman born at a Japanese civilian hospital instead of the U.S. military hospital on the base where his father served, which created a whole set of problems that plagued him throughout his life.

Getting the correct documentation takes time if it can be found. Then SSA takes time to verify the documentation and may ask for more. Then there is the processing time, which could result in you missing your intended start date. That is why you start applying for Medicare in Nebraska as early as possible in 2022.

Calling the SSA Office

You, of course, can call the SSA office or stop in to apply for Medicare in Nebraska for 2022. If you contact them too early, they will not talk with you. Too early is more than 3 months before you turn 65. Then, when they talk with you, SSA generally will set the appointment a month or two later, so you are right up against your birth month and start date. This will work if there are no problems and everything else works smoothly, but this situation usually causes anxiety for most people.

My Experience Helping Clients Apply for Medicare

I’m an insurance agent. I am not an employee of the SSA, but I feel like an unpaid auxiliary staff member. My clients need help, so I’ve learned to navigate the SSA Medicare enrollment system through trial and error. It is a system that is continually evolving.

I’m happy to help my clients. The process creates a tremendous amount of empathy for my clients for what they have to go through. Not only are they confused with all the information and choices that come with going on Medicare, but they have a government bureaucracy that is an unfriendly and confusing obstacle to overcome. I try my best to help and give encouragement when I can’t do specific tasks for them, like finding an original birth certificate with a raised seal.

As the bugs get worked out of the SSA/Medicare system, and Medicare beneficiaries become more tech-savvy, the process for applying for Medicare in Nebraska for 2022 will become more efficient–I hope.

Until then, use this guide to navigate and find your way to the end of the Medicare application maze.

Which Is A Better Deal for You? Medicare Or Employer Health Insurance

Congress created a problem in the 1980s when it increased the age for full Social Security benefits. Eligibility was age 65 for both Social Security AND Medicare. Medicare eligibility is still age 65, but full Social Security benefit now is 66 and six months or 67 for those born in 1960 or later.

Many people delay retirement now until they reach the age of full Social Security benefits at 66 and six months. The issue for those who continue to work is whether they should go on Medicare at age 65 or stay on their employer plan. The quandary is, which is a better deal: Medicare or your employer-provided health insurance? People are stumped. Which way to go?

Many of my clients who come to us after retiring at 66 or older complain they should have gone on Medicare instead of staying on their employer’s health insurance plan. Medicare would have been a far better deal. Medicare typically costs less and typically provides better coverage than their employer plan, but they didn’t know any better. They didn’t understand Medicare, the rules, and the costs. Medicare was a mystery. Consequently, they made misinformed decisions.

Find out what they didn’t know.

What Is Medicare?

First of all, what is Medicare?

Medicare is a federal health insurance program that Congress created in 1965. The program was designed to provide health insurance for those who work in the U.S. and are 65 or older. At the time, there was little access to reliable, low-cost health insurance once you retired and lost employer-provided health insurance.

How Do You Qualify for Medicare?

You must have worked at least 40 quarters (10 years). To qualify for Medicare, you must have paid FICA (Federal Insurance Contribution Act) payroll taxes.

Once you turn 65 or are certified as disabled by the Social Security Administration (SSA) after 24 months, you can enroll in Medicare.

- Those with End-Stage Renal Disease (ESRD) (permanent kidney failure requiring dialysis and/or transplant) are immediately covered by Medicare.

- Those with ALS (Amyotrophic Lateral Sclerosis, also called Lou Gehrig’s Disease) will likewise qualify for Medicare immediately.

I have clients in every category, but most of my Medicare beneficiaries are 65 and older.

What Is Part A?

Medicare is divided into two parts–Part A and Part B. Medicare Part A is hospital insurance. Part A covers

- Inpatient Hospital

- Skilled Nursing Facilities

- Home Health Care

- Hospice

How Much Does Medicare Part A Cost Compare to Employer Health Insurance?

You would pay nothing for Part A coverage if you or your spouse paid FICA for at least ten years. Of course, the zero premium for Medicare beats the premium employees pay for their employer-provided health insurance.

If you are not eligible for free Part A, consult the article on paying for Part A.

Part A Penalty and Medicare Fake News

If you are eligible for free Medicare Part A, there is no penalty for not enrolling in Part A when first eligible.

People call me up in a panic because they are worried about “the penalty.” They fear if they do not enroll in Medicare Part A, there will be a lifetime penalty. There is no penalty for not enrolling in Part A. Medicare Part B, however, is a different story.

Why Should You Enroll in Medicare Part A?

That being said, I encourage people to enroll in Medicare Part A when they are eligible. You will establish your identity with the Social Security Administration (SSA) and CMS (Center for Medicare & Medicaid Services).

Sometimes my clients go to enroll in Medicare, and they discover they cannot. There are errors with their personal information in the government’s database that results in problems and delays.

Delayed enrollment in Medicare is especially critical when there is a strict timeline. Sometimes clients have hard retirement dates when they will lose their employer-provided health insurance, and Medicare has not approved them. Over the years–especially during COVID–I had several clients run-up to the deadline, and even a few went over it. Not a good situation to be in. That is why I recommend you enroll in Medicare as soon as you are eligible, even if it is only Part A.

Medicare Enrollment Problems

For example, I have had clients who were scheduled to lose their health insurance in a few weeks. They needed a Medicare number to enroll in a Medicare plan, Medicare drug plan, or Medicare Supplement. We cannot process any application without their Medicare number. We are dead in the water without the number.

Clients had begun the process as early as Social Security allowed–3 months–but they still did not have Medicare insurance. SSA or CMS was backed up, there was a mistake in personal data, and/or documents were lost and needed to be resent.

Starting Medicare and Medicare insurance on time is critical because essential prescriptions may need to be filled. Hard to get doctor’s appointments, and vital surgeries are sometimes on the calendar. The dates are inflexible. These plans blow up when Medicare delays someone’s enrollment past their expected start date.

While these incidents were a small percentage of my clients, I guarantee, you are stressed to the max when it happens to you. Most of the time, I coach them across the finish line. Everything starts on the desired date, but being in that time crunch is not comfortable.

At Least Enroll in Part A When You Turn 65

Enrolling in Medicare Part A even when you are on an employer health plan is the smart thing to do. There is no critical timeline because you have insurance. It gives you plenty of time and space to fix any problems that may arise without the rush and pressure.

Then the process is much easier and quicker when you go to activate your Medicare Part B later. Your identity is already established, you have a Medicare (MBI) number, and you are an active Medicare beneficiary. Activating Part B is the simple matter of submitting a couple of forms.

Medicare Beneficiary Identifiers (MBI) Is the Ticket to the Dance

The old Medicare number was the Health Insurance Claim Number (HICN). It served as your personal Medicare beneficiary identification number. The HICN was used for paying claims and for determining eligibility for services across multiple entities (e.g., Social Security Administration (SSA), Railroad Retirement Board (RRB), States, Medicare providers, health plans, etc.)

The MBI (Medicare Beneficiary Identifiers) is the new number. SSA generates the number for you when you enroll in at least Medicare Part A. The MBI is necessary when enrolling in any Medicare Advantage Plan, Part D Prescription Drug Plan, or Medicare Supplement.

Your Medicare card (a.k.a. Red, White, & Blue Card) has your MBI printed on the front. The card also shows your coverage. CMS prints Part A in the bottom right corner for hospital coverage and Part B for doctor’s visits and outpatient services if you also have Part B.

How the MBI Affects Picking A Medicare Supplement

In the past, some insurance agents would enroll people in Medicare Supplements as early as six months before their 65th birthday. They aimed to lock down the business so another insurance agent could not get in there. Then, people’s Medicare number (HICN) was their Social Security number with a letter on the end. It was easy to figure out their Medicare number. But since April 2019, the only number CMS (Center for Medicare & Medicare Services) will process is the new MBI. The MBI is a series of random numbers and letters.

Some unscrupulous insurance agents will still fill out applications with your signature six months before you turn 65. Again the purpose is to lock down the business. The agent does not date the application at the time he takes it. Eventually, when you get your Medicare (MBI) number to him, he completes the application. He dates it since you have already signed the application and submits it to the insurance company. Major violation of the rules!

What Is Part B?

Medicare Part B is for medical insurance, which means doctor visits and outpatient procedures. Part B covers medically necessary services in these areas as well as preventative care.

How Do You Pay For Part B?

Your Medicare Part B health insurance has a monthly premium. You pay your Part B premium out of your Social Security check if you receive benefits.

Suppose you are not receiving a monthly Social Security check. In that case, you can set up an ETF automatic monthly draft from your bank account. Medicare Easy Pay is the program through which you pay monthly. A detailed explanation of how to pay is on the Medicare.gov website. If you do not set up an ETF, the Social Security Administration will bill you quarterly. Those are the three options.

Who Pays For Part B?

The actual Part B cost is more than four times your monthly premium. Taxpayers pay the remaining cost of Medicare through the federal budget.

The Medicare Part B premium can change as medical expenses and Medicare administrative costs increase. The current 2023 premium is $164.90. The 2022 premium was $170.10, 2021-$148.50, 2020-$144.60, 2019-$135.50, and 2018-$134. You can see the increasing trend. With current inflationary pressures, your Part B premium increasing cost will probably accelerate.

If you are in the top 4% of income earners, your Medicare Part B and Part D premiums will be higher depending upon your level of income. Please, consult Blog: IRMAA Tax.

Lifetime Medicare Late Enrollment Penalty

If you do not enroll in Medicare Part B when first eligible, you will pay a late enrollment penalty for the rest of your life.

You will also be required to wait until General Enrollment Period (from January 1—March 31) to enroll in Part B. When you enroll during General Enrollment, Medicare coverage will not start until July 1 of that year. (FYI: these rules will change in 2023. Please, consult Blog: 2023 Medicare Changes.)

UNLESS: If you are an active participant in an employer health insurance plan as good as Medicare, or other qualifying health plans, you may delay enrolling in Medicare Part B (or Part A and Part B) indefinitely without penalty.

You will also have an open enrollment period if you wish to enroll in Medicare Part B (or Part A and Part B) at any time after 65 when you are actively covered by employer health insurance.

Many people are completely unaware of this exception to the rule. As a matter of fact, insurance agents will take advantage of this rule and omit the exception to induce people to meet with them.

When Can I Sign Up for Medicare?

If you are eligible for Medicare when you turn 65, you can sign up

- 3 months before the month of your 65th birthday,

- The month of your 65th birthday

- The 3 months following your 65th birthday.

Enrolling when you are first eligible for Medicare is vital in case of delays. The Social Security Administration (SSA) and CMS (Center for Medicare & Medicaid Services) are very slow.

Also, there may be errors in your personal data that will require time to correct. The corrections will require supporting documentation, like a birth certificate or naturalization papers. The SSA bureaucratic process does not function with the same instantaneous efficiency to which you may be accustomed.

Making corrections, processing documents, and verifying your identity must be completed before your Medicare enrollment process begins. So begin your enrollment process as early as possible.

Over the years, many of my clients had their Medicare postponed beyond their intended start time. Errors in their personal information delayed the process. The back and forth with SSA to make corrections dragged on.

Part A Post-Dated Six Months Back

After your Initial Enrollment Period (IEP), you may enroll in Medicare Part A at any time. However, your Part A will be post-dated six months back from the date you apply for Medicare part A, but no earlier than the first month you were eligible for Medicare or turned 65. This rule applies only to Part A.

The six-month backdating is important to be aware of if you contribute to an HSA (Health Savings Account). An HSA is attached to an employer’s high deductible health insurance plan. Medicare has rules and penalties around HSAs as well.

Birthday on the First of the Month with Medicare

If your birthday is on the first day of the month, your coverage will start on the first day of the prior month.

For example, Mr. O’Shea’s 65th birthday is May 1, 2022. His Medicare will start on April 1 if he enrolls in January, February, or March.

Enroll in Medicare After 65 During Initial Enrollment Period

For many years, if you enrolled in Medicare after the month of your 65th birthday, your start date for Medicare was set for two to three months later. The Consolidate Appropriate Act of 2021 (CAA) changed the rule so in 2023, those who enroll in Medicare in the last three months of their initial enrollment period will begin Medicare the following month.

The old rule was confusing and created unexpected hardships for people who may have delayed initial enrollment by only a couple of months. Over the years, I had some clients who were forced to go without health coverage for a month or two because they were unaware of the law or delayed enrollment because of unforeseen circumstances.

Medicare Special Enrollment with Employer Health Insurance

Once your Initial Enrollment Period ends, you have another chance to sign up for Part B. This new election period is called a Special Enrollment Period. You need to meet specific requirements.

Suppose you are covered under an employer health insurance plan that is as good as Medicare. Then you have a Special Enrollment Period to sign up for Part A and/or Part B as long as you (or your spouse) are working and covered by an employer health insurance plan Medicare recognizes. Medicare will allow you to enroll at any time.

You may decide to retire, or you change jobs. The new employer’s health plan is not as good as your previous employer’s or as good as Medicare. So you decide to go completely on Medicare.

No matter the reason–retirement or job change–you will not pay a Medicare Part B late enrollment penalty or Part D late enrollment penalty because you were covered by an employer health plan.

COBRA & Retiree Employer Insurance and Medicare

COBRA and retiree health plans are not considered coverage based on current employment. You are not eligible for a Special Enrollment Period when that coverage ends.

General Enrollment Period

Suppose you don’t sign up for Part A and/or Part B when you are first eligible and do not qualify for a Special Enrollment Period. In that case, you may have to wait until the Medicare General Enrollment Period (from January 1st-March 31st) to enroll in Medicare.

Coverage will not start until the following July 1st of that year.

What Is the Medicare Late Enrollment Penalty?

In most cases, you will have to pay a late enrollment penalty for the rest of your life if you sign up during the General Enrollment. You did not have Medicare Part B and had no employer health insurance plan when you were eligible.

The penalty is 10% of the current Part B premium for each full 12-month period you did not have coverage when you should have.

Yes, if you did not have Part B for five years when you should have and had no employer health insurance either, your late enrollment penalty would result in a 50% surcharge permanently added to your Medicare Part B premium. Not good.

When Are You Automatically Enrolled in Part A and Part B?

If you are getting your Social Security (or Railroad Retirement Board) benefits, you will automatically be enrolled in Medicare Part A and Part B starting the first day of the month you turn 65. If your birthday is on the first day of the month, Part A and Part B will start on the first day of the prior month. You should receive your Medicare card three months before the month of your birthday.

If you want to keep Part B, you do not need to do anything.

If you do not want Part B, you can cancel Part B by signing the back of the card and returning it to CMS. A new Medicare card will be reissued to you with only Part A for hospital coverage. You always have the option to activate your Part B at a later date.

You have the option to purchase a Medicare Part D prescription drug plan with Part A only.

However, if you want to purchase a Medicare Supplement or enroll in a Medicare Part C (Medicare Advantage Plan), you will need both Part A and Part B active.

What if I Am Under 65 and Disabled?

Suppose you are eligible for Medicare because of a disability. You will automatically get Part A and Part B after receiving disability benefits from Social Security (or RRB) for 24 months.

Signing Up for Part A and Part B

If you are not currently receiving Social Security (or Railroad Retirement Board (RRB)) benefits, you will need to sign up for Medicare Part A and/or Part B to activate them. You will not receive Medicare automatically like those already receiving Social Security Benefits.

Enrolling in Medicare Online

Social Security is the gatekeeper for Medicare. Signing up for Medicare has been an evolving adventure because of the pandemic. Enrolling online is the preferred way to initiate your Medicare since the pandemic. The Medicare online enrollment iterations have been myriad. Enrolling online has grown progressively more complex and difficult over time.

I help my clients enroll in Medicare online weekly. I am relieved when the process goes smoothly, but that is not as often as I would like. There frequently seems to be some sort of glitch. I highly encourage people to enroll as soon as they are eligible. You do not know how the system may or may not work when you try to enroll. Also, it is possible the government does not have your correct personal information.

What Could Delay Medicare Enrollment?

For example, I had a client named Gregory, but the Social Security Administration had his name as Greg. That stopped his enrollment process cold. He needed to produce an original birth certificate. After several time-consuming meetings at the local Social Security Administration Office, SSA approved Greg for Medicare.

I had another client who had divorced and moved to a different residence. However, SSA still had his old address, where he had not resided for three years. SSA blocked his enrollment until he made the corrections.

Many a time, I have had a client’s enrollment delayed because a birthday was off by a single digit. One client moved one house down from their previous residence. SSA did not have the current address, which was one digit different from the old one. That person went two months past her start date because of processing delays. Fortunately, for her, she could carry her employer coverage until Medicare kicked in.