Prescription DrugsCategory:

Finding effective solutions to manage weight loss can sometimes feel like searching for a needle in a haystack. But what if there was a medication that could help you on your journey? Enter Ozempic, a breakthrough drug making waves in the weight loss community. Does Medicare cover Ozempic for weight loss?

Finding effective solutions to manage weight loss can sometimes feel like searching for a needle in a haystack. But what if there was a medication that could help you on your journey? Enter Ozempic, a breakthrough drug making waves in the weight loss community. Does Medicare cover Ozempic for weight loss?

In this article, we will explore how Medicare may give you access to Ozempic, giving you the insights you need to make informed health decisions. We’ll also explore the eligibility criteria, coverage options, and potential costs. Whether you’re already enrolled in Medicare or considering it in the future, this information is invaluable for those seeking weight management solutions.

What is Ozempic?

Ozempic is a medication used to treat type 2 diabetes in the class of drugs called GLP-1 receptor agonists. As a GLP-1 receptor agonist, semaglutide enhances the effects of the naturally occurring hormone GLP-1, which helps lower blood sugar levels. This medication is administered once weekly via injection, making it a convenient option for those managing diabetes. Ozempic is effective in reducing A1C levels and promoting weight loss in patients.

A 0.25 or 0.5-milligram dose of Ozempic currently retails on the Novo Nordisk website for $935.77 without insurance. However, those with private or commercial insurance who are eligible for a prescription may pay as little as $25. Medicare Part D and Part D copays for Ozempic can be significantly higher, especially if you fall into the Gap (or Donut Hole).

How Does Ozempic Work?

Ozempic works by mimicking the action of a naturally occurring hormone called glucagon-like peptide-1 (GLP-1) in the body. GLP-1 helps regulate blood sugar levels by stimulating insulin release, slowing down digestion, and reducing appetite. By activating GLP-1 receptors, Ozempic helps lower blood sugar levels, decrease appetite, and promote weight loss.

Who Can Benefit from Ozempic?

Ozempic is primarily prescribed to individuals with type 2 diabetes who have not achieved adequate glycemic control through lifestyle changes, such as diet and exercise, or oral diabetes medications alone. It is typically used as an adjunct to diet and exercise to improve blood sugar control.

GLP-1 also impacts weight via two key mechanisms:

- Affects the hunger centers in the brain (specifically, in the hypothalamus), reducing hunger, appetite, and cravings

- Slows the rate of stomach emptying, effectively prolonging fullness and satiety after meals

The net result is decreased hunger, prolonged fullness, and, ultimately, weight loss.

The Benefits of Ozempic for Weight Loss

Ozempic has gained significant attention in the weight loss community due to its potential benefits. Studies have shown that Ozempic can lead to significant weight loss when used with a healthy diet and exercise. In fact, clinical trials have demonstrated that individuals using Ozempic experienced an average weight loss of 5-10% of their body weight over a 26-52 week period. This is a remarkable achievement, considering many individuals’ challenges when trying to lose weight.

In one large clinical trial sponsored by Novo Nordisk, 1,961 adults with excess weight or obesity who did not have diabetes were given 2.4 milligrams of semaglutide or a placebo once a week for 68 weeks, along with lifestyle intervention. Those who took semaglutide lost 14.9% of their body weight compared with 2.4% for those who took the placebo.

Understanding Medicare Coverage

Before we dive into the specifics of Medicare coverage for Ozempic, it’s important to have a basic understanding of how Medicare works.

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, as well as certain younger individuals with disabilities. It consists of different parts, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

Medicare covers a wide range of medical services and treatments, including prescription medications. However, coverage for prescription drugs can vary depending on the specific plan you have. Some plans may cover a broader range of medications, while others may have more limited coverage. Understanding your specific Medicare plan is essential to determining the coverage options available for Ozempic.

How Medicare Covers Ozempic for Weight Loss

How Medicare Covers Ozempic for Weight Loss

To determine if Ozempic is covered by Medicare for weight loss, you need to check whether it is included in your Medicare Part D plan’s formulary. A formulary is a list of prescription drugs covered by a specific Medicare plan. You can typically find this information in the plan’s drug formulary document, which is usually available on the plan’s website or by contacting customer service.

All 21 Medicare Part D prescription drug plans and all 30 Medicare Advantage plans cover Ozempic in the Omaha, Lincoln, and Council Bluffs areas. Depending on the plan, you may or may not have a drug deductible and then copays. Ozempic is usually a tier 3 medication with a hefty copay. Depending on your total medications, you may or may not go into the Gap (or Donut Hole).

If Ozempic is included in the formulary, it means that it is covered by your Medicare Part D or Part C plan. However, coverage may still be subject to certain conditions. The medication must be medically necessary for the prescribed purpose. Other factors include prior authorization or step therapy.

Prior authorization requires your healthcare provider to obtain approval from the Part D prescription drug plan before prescribing Ozempic, while step therapy may require you to try other medications before Ozempic is covered.

Review the specific coverage requirements outlined in your Medicare Part D plan to ensure you meet all the necessary criteria for Ozempic coverage. It is important to understand Medicare covers Ozempic for diabetic and pre-diabetic treatment. Medicare does not cover Ozempic for weight loss exclusively.

Why Medicare Does Not Cover Ozempic for Weight Loss

Medicare Part D prescription drug plans were created under the Busch Administration. The Medicare Prescription Drug, Improvement, and Modernization Act (MMA) of 2003 determined that Part D prescriptions could not cover medications for cosmetic or weight loss reasons. Thus, Ozempic is only covered by Medicare for type 2 diabetes. Ozempic is not covered by Medicare for weight loss.

Wegovy: An Alternative?

Wegovy is a brand-name version of the drug semaglutide, which is the medication Ozempic in a different dosage. The FDA approves Wegovy as a chronic weight management medication, not for type 2 diabetes, like Ozempic.

Medicare, however, does not cover Wegovy because the drug is for weight loss. Medicare does not cover weight loss medications even though obesity is intimately tied to diabetes and a cause of poor health.

How to Navigate the Medicare Coverage Process for Ozempic

Here are some suggestions for you to navigate the Medicare coverage process for Ozempic.

Here are some suggestions for you to navigate the Medicare coverage process for Ozempic.

Check the Formulary

Look for Ozempic in your plan’s formulary to determine if it is covered. Note any additional coverage requirements, such as prior authorization or step therapy.

Consult Your Healthcare Provider

Diabetes and pre-diabetes are usually related to obesity. Discuss your diabetes or pre-diabetes in relation to your weight loss goals with your healthcare provider. See if Ozempic is a suitable option for you. They can help guide you through the coverage process and provide any necessary documentation.

Prior Authorization or Step Therapy

If your plan requires prior authorization or step therapy for Ozempic, work with your healthcare provider to complete the necessary paperwork and submit it to Medicare for approval.

Those who are type 2 diabetic or pre-diabetic AND overweight may be able to get access to Ozempic for their healthcare needs, which secondarily includes weight loss.

Dangers of Ozempic

Ozempic, however, isn’t safe for everyone. According to the company, people with the following conditions should avoid using Ozempic:

- Pancreatitis

- Type 1 diabetes

- Under 18 years of age

- Pregnant or breastfeeding

- Diabetic retinopathy

- Problems with the pancreas or kidneys

- Family history of medullary thyroid carcinoma (MTC)

- Multiple Endocrine Neoplasia syndrome type 2 (MEN 2), an endocrine system condition

As with any prescription medication, you must consult your doctor or other qualified healthcare provider on whether this medication is safe for you and what dosage is appropriate.

Ozempic Side Effects and Health Risks

There are many side effects of taking Ozempic as a weight loss medication, including

- Gastrointestinal issues like nausea, vomiting, and diarrhea

- Constipation

- Stomach pain

- Headache

- Excessive burping

- Heartburn

- Fatigue

- Flatulence

- Gastroesophageal reflux disease

These most common side effects of Ozempic don’t tend to be dangerous and may dissipate as you grow used to the medication. However, there is potential for more serious adverse effects, such as:

- Vision problems

- Swelling in extremities

- Dizziness or fainting

- Reduced urination

- Rash

- Rapid heart rate

- Swelling of throat, tongue, mouth, face, or eyes

- Problems swallowing or breathing

- Fever

- Yellow eyes or skin

- Chronic upper stomach pain

Wegovy, another brand name for semaglutide, may also cause damage to the retina, suicidal ideation, gallstones, pancreatitis, and acute kidney damage.

Moreover, taking semaglutide can increase the chance of developing thyroid tumors, including medullary thyroid carcinoma. Speak with your doctor if you are experiencing any of the side effects listed above.

“Ozempic Face”

You may have heard about “Ozempic face” as a side effect of GLP-1 drugs, though the term is misleading because this can be a side effect of any GLP-1 drug or any other cause of rapid weight loss.

The rapid loss of fat in the face can cause:

- a hollowed look to the face

- changes in the size of the lips, cheeks, and chin

- wrinkles on the face

- sunken eyes

- sagging jowls around the jaw and neck.

If weight is lost more gradually, these changes may not be as noticeable. However, the faster pace of weight loss that occurs with GLP-1 drugs can make facial changes more obvious.

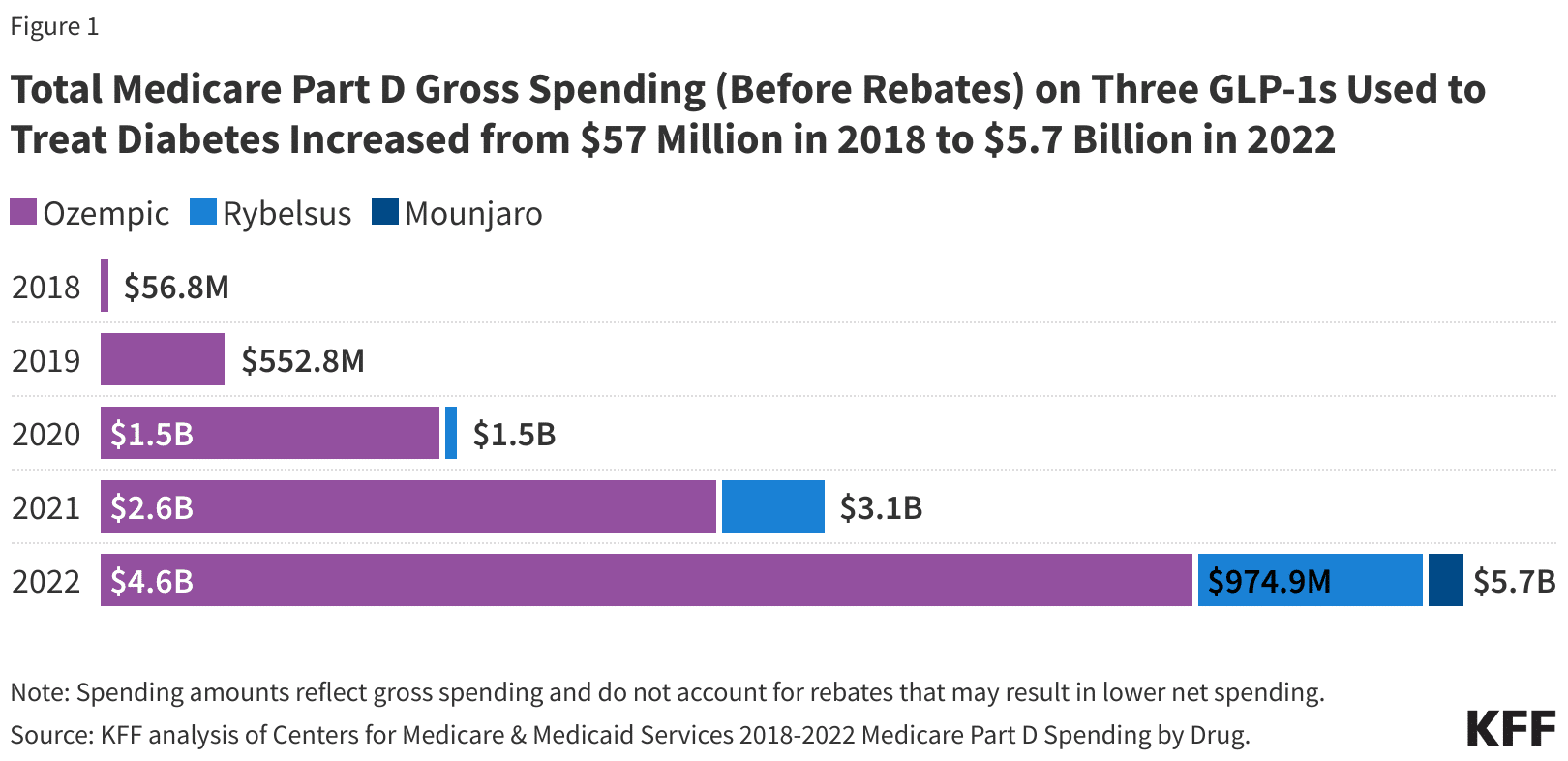

Spending for the three GLP-1 medications, Ozempic, Rybelsus, and Mounjaro, has skyrocketed in the past year on Medicare. While more Medicare beneficiaries are becoming diabetic and using these medications, the number far exceed that type of increase. A significant portion of people on Medicare are now using GLP-1 medications for weight loss.

Medicare Spending on Ozempic Explodes

Impact on Diabetes Patients

The popularity of Ozempic’s off-label use for weight loss is driving a global shortage of diabetes drugs. Pharmacies in the U.S., Canada, and Europe have been reporting shortages. My clients have reported to me their experience of not finding Ozempic at their local pharmacy.

If the shortages persist, people who’ve relied on Ozempic to treat their diabetes may face difficulty adjusting to alternatives. The shortage of Ozempic, driven by its off-label use for weight loss, can have significant consequences for patients with diabetes who genuinely need the medication.

Bottom Line: Medicare Does Not Cover Ozempic for Weight Loss

Ozempic is a dilemma. Most diabetics are overweight, but not all overweight persons are diabetic or pre-diabetic. Medicare does not cover Ozempic for weight loss, but it does cover it for diabetes or pre-diabetes. Weight loss is usually an important element in minimizing the negative effects of diabetes.

While Medicare does not cover Ozempic for weight loss, strictly speaking, Medicare does cover Ozempic for a very large population that also needs and will benefit from Ozempic and losing weight. People aren’t stupid.

It’s actually not a bad solution for an imperfect and overweight world.

Are you wondering if your Medicare Part D plan covers Xarelto? Well, you’re in the right place! This article will unlock the benefits and examine whether Medicare Part D pays for Xarelto.

Xarelto is a widely prescribed anticoagulant medication used to prevent blood clots. It is commonly prescribed for conditions such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism. Xarelto is also a very expensive medication. Even with Medicare insurance, the copays are high, especially in the Gap phase of Part D.

Navigating the intricacies of Medicare coverage can add an additional level of complexity and confusion around prescription drugs.

Medicare Part D is a prescription drug plan offered by private insurance companies approved by Medicare. The program aims to provide affordable access to various medications, but not all drugs are covered. That’s why it’s crucial to understand whether Xarelto is included in the formulary of your specific Part D plan.

I have hundreds of Medicare clients on Xarelto. We run our clients’ medications through our proprietary software to determine the lowest-cost drug plans. We want the plans to have at least a 3-star or higher Medicare rating. Xarelto is one of many high-dollar medications we have had to deal with for over a decade. This article will delve into Medicare Part D coverage details and explain how we find plans that cover our clients’ Xarelto and other costly medications. So, let’s start unlocking the benefits of Medicare Part D and discovering if Xarelto is covered under your plan.

Understanding Xarelto and Its Importance

Understanding Xarelto and Its Importance

Xarelto, also known by its generic name rivaroxaban, is an oral anticoagulant medication that plays a crucial role in preventing blood clots. Blood clots can lead to serious health complications such as stroke, heart attack, or even death. Xarelto works by inhibiting the clotting factors in the blood, reducing the risk of clot formation.

The use of Xarelto is particularly prevalent among individuals with conditions such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism. Atrial fibrillation is an irregular heart rhythm that can increase the risk of blood clots forming in the heart. Deep vein thrombosis occurs when blood clots form in the deep veins of the legs, while pulmonary embolism is a life-threatening condition where a blood clot travels to the lungs.

Given the importance of Xarelto in managing these conditions, individuals must have access to affordable medication. This is where Medicare Part D comes into play, offering coverage for prescription drugs to Medicare beneficiaries. Let’s explore the coverage options under Medicare Part D and how they relate to Xarelto.

Coverage Options Under Medicare Part D

Medicare Part D provides coverage for prescription drugs through private insurance companies that contract with Medicare. There are 21 Medicare Part D plans in the Omaha, Lincoln, and Council metro areas. These plans are designed to offer affordable access to a wide range of medications, including Xarelto. As of the writing of this article (January 2024), all 21 Medicare Part D plans pay for Xarelto. However, it’s important to note that not all Part D plans cover every prescription drug.

These plans are designed to offer affordable access to a wide range of medications, including Xarelto. As of the writing of this article (January 2024), all 21 Medicare Part D plans pay for Xarelto. However, it’s important to note that not all Part D plans cover every prescription drug.

Each Medicare Part D plan has a formulary, which is a list of covered drugs. The formulary is divided into different tiers, each with a different cost-sharing structure. Xarelto may be included in the formulary, but its placement within the tiers can affect how much you must pay out of your pocket.

Typically, Part D plans place drugs in different tiers based on their cost and how they compare to other medications in terms of safety and effectiveness. The lower the tier, the lower your out-of-pocket costs will be. It’s worth noting that the formulary and tier structure can vary between different Part D plans, so reviewing your plan’s specific details is essential to determine if Xarelto is covered and at what cost.

How to Determine if Xarelto is Covered Under Your Medicare Part D Plan

How to Determine if Xarelto is Covered Under Your Medicare Part D Plan

You have a few options to determine if Xarelto is covered under your specific Medicare Part D plan. The first step is to review the plan’s formulary. You can usually find this information on the plan’s website or request a copy of the formulary from the insurance company.

When reviewing the formulary, look for Xarelto or its generic equivalent, rivaroxaban. Note the tier in which it is placed and the associated cost-sharing requirements. Remember that formularies can change from year to year, so reviewing the most up-to-date information is essential.

Another helpful resource is the Medicare Plan Finder tool the Centers for Medicare & Medicaid Services (CMS) provides. This online tool allows you to enter your zip code, current medications, and dosage information to compare different Part D plans in your area. The tool will provide a list of plans and estimated costs. You will learn whether Xarelto is covered and the monthly costs.

If you prefer a more personalized approach, contact the insurance company directly and speak with a representative. They can provide detailed information about your plan’s coverage for Xarelto, including any prior authorization requirements or restrictions.

We Can Help Unlock Your Part B Benefits

Like Medicare, Omaha Insurance Solutions uses a plan finder tool that reviews all the Part D plans, formularies, and prices. The tool shows the various plans, the drug tiers, the medication cost before the Gap (Donut Hole) and in the Gap (Donut Hole), and the total overall cost combining copays and premiums together. You will have a total annual cost for each plan, so you can compare. We also point out the plan’s Medicare star rating.

We can filter the Part D information in many ways so you can look at the data as it applies to you. Our service is free when you are a client. We do this every year during the Annual Election Period for our clients to ensure they are on the best plan for their medication needs and budget.

Researching and understanding your plan’s coverage for all your medications, including Xarelto, can help you make informed decisions about your healthcare and potentially save you money. But what should you do if your Part D plan does not cover Xarelto? Let’s explore the steps you can take in such a situation.

Steps to take if your plan does not cover Xarelto

If your Medicare Part D plan does not cover Xarelto, don’t panic. You can take several steps to explore alternative options and potentially lower your out-of-pocket costs.

1. Speak with your healthcare provider: Your healthcare provider can help you explore alternative medications covered by your plan or suggest other strategies to manage your condition effectively.

2. Request a formulary exception: Sometimes, your healthcare provider can submit a request to the insurance company for a formulary exception. This request outlines why Xarelto is medically necessary for you and provides supporting documentation. If the exception is approved, the insurance company may cover Xarelto, even if it’s not on the formulary.

3. Consider therapeutic alternatives: Your Part D plan may cover alternative medications within the same class as Xarelto. These medications work similarly to Xarelto and may be suitable for your condition. Your healthcare provider can guide you in exploring these alternatives.

4. Explore patient assistance programs: Pharmaceutical companies often offer patient assistance programs that provide financial assistance or free medication to individuals who meet specific eligibility criteria. Due to its high cost, these programs can be a valuable resource if you need help to afford Xarelto.

5. Review other Part D plans: If Xarelto is essential for your health and well-being, consider switching to a different one during the annual enrollment period, typically from October 15th to December 7th each year. By reviewing other plans, you may find one that covers Xarelto or offers more favorable coverage for your specific needs.

Remember, it’s crucial to consult with your healthcare provider and insurance company before changing your medication regimen or coverage. They can provide personalized guidance based on your specific health condition and insurance coverage.

Alternative options for accessing Xarelto at a lower cost

If Xarelto is not covered by your Medicare Part D plan or the out-of-pocket costs are prohibitively high, alternative options are available to access Xarelto at a lower cost.

If Xarelto is not covered by your Medicare Part D plan or the out-of-pocket costs are prohibitively high, alternative options are available to access Xarelto at a lower cost.

1. Generic alternatives: Generic versions of Xarelto, known as rivaroxaban, may be cheaper. Generic drugs contain the same active ingredients as their brand-name counterparts and are approved by the FDA as safe and effective. Speak with your healthcare provider and pharmacist to explore whether a generic alternative suits you.

2. Manufacturer discounts and coupons: The pharmaceutical manufacturer may offer discounts or coupons that can help reduce the cost of the medication. These savings programs are often available for eligible individuals who meet specific criteria. Check the manufacturer’s website or discuss these programs with your healthcare provider.

3. Medication assistance programs: Non-profit organizations and foundations may offer medication assistance programs that provide financial support or free medication to individuals in need. These programs often have specific eligibility criteria, so it’s important to research and understand the requirements before applying.

4. Pharmacy discount programs: Some pharmacies, including Xarelto, offer discount programs or savings cards to help lower prescription medication costs. These programs may provide discounts for individuals paying out-of-pocket or even those with insurance coverage.

It’s worth noting that while these alternative options can help reduce the cost of Xarelto, it’s important to discuss them with your healthcare provider and consider their recommendations. They can provide valuable insights based on your specific health condition and medication needs.

Tips for Maximizing your Medicare Part D coverage for Xarelto

To maximize your Medicare Part D coverage for Xarelto, consider the following tips:

1. Review your plan annually: Medicare Part D plans can change their formularies and coverage yearly. Take the time to review your plan’s coverage during the annual enrollment period with your agent to ensure Xarelto is still covered and assess any potential changes in cost-sharing requirements. From October 15th to December 7th, we work around the clock to ensure our clients’ medications are covered in their Part D or Medicare Advantage plan within their budget.

ensure Xarelto is still covered and assess any potential changes in cost-sharing requirements. From October 15th to December 7th, we work around the clock to ensure our clients’ medications are covered in their Part D or Medicare Advantage plan within their budget.

2. Consider the total cost: When evaluating different Part D plans, Don’t solely focus on the monthly premium- this is a very common mistake. Consider the deductible, copayments, and coinsurance, as these factors can significantly impact your out-of-pocket costs for Xarelto.

Total Annual Cost! Not just copays, or t just monthly premiums. Not just the cost outside the donut hole. It is the total annual cost you pay.

3. Utilize preferred pharmacies: Some Part D plans have preferred pharmacy networks to access medications at lower copayments. Check if your plan has a preferred pharmacy network, and consider utilizing these pharmacies to reduce your medication costs. I have had clients save hundreds and

4. Explore mail-order options: Mail-order pharmacies often offer discounted prices for prescription medications, including Xarelto. If your plan allows for mail-order prescriptions, it may be worth considering this option to save on your medication costs.

By staying proactive and informed, you can maximize your Medicare Part D coverage and ensure affordable access to Xarelto.

Common Misconceptions about Medicare Part D Coverage for Xarelto

There are several common misconceptions about Medicare Part D coverage for Xarelto that are important to address:

There are several common misconceptions about Medicare Part D coverage for Xarelto that are important to address:

1. All Part D plans cover Xarelto: Not all Part D plans cover Xarelto, and its coverage can vary depending on the plan. Review your specific plan’s formulary to determine if Xarelto is covered and at what cost is essential.

2. Coverage is the same across all Part D plans: Xarelto’s coverage and cost-sharing requirements can vary between different Part D plans. It’s crucial to compare the formularies and associated costs of various plans to find one that suits your needs.

3. Once covered, Xarelto will always be covered: Formularies can change annually, and a medication covered in the past may not be covered in the future. Reviewing your plan’s formulary annually during the annual enrollment period is vital to ensure Xarelto is still covered.

This Medicare mistake is the bane of my existence. Some clients do not take the annual review period seriously. They do not send us an updated list of medications. They do not talk with us, and when January comes—and it is too late—they call because a particular medication is not covered or the cost is significantly higher than the previous year.

4. Generic alternatives are always covered: While generic alternatives are often less expensive, they may not be covered by all Part D plans. Reviewing your plan’s formulary is crucial to determine if the generic version of Xarelto is covered.

By dispelling these misconceptions, you can approach your Medicare Part D coverage for Xarelto with a clear understanding of what to expect and how to navigate the system’s complexities.

Resources and Assistance Programs for Xarelto Users

If you need assistance accessing Xarelto or managing the cost of the medication, several resources and assistance programs can provide support:

1. Extra Help/Low-Income Subsidy: The Extra Help program is a federal program that helps individuals with limited income and resources pay for their Medicare prescription drug costs. Eligible individuals can receive assistance with premiums, deductibles, and copayments. To determine if you qualify for Extra Help, contact the Social Security Administration or visit their website.

2. Patient Assistance Programs (PAPs): Pharmaceutical manufacturers often offer patient assistance programs that provide free or low-cost medications to individuals who meet specific eligibility criteria. These programs can be a valuable resource for individuals who cannot afford their medications, including Xarelto. Check the manufacturer’s website or discuss these programs with your healthcare provider.

3. State Pharmaceutical Assistance Programs (SPAPs): Some states have their own pharmaceutical assistance programs that provide financial assistance or low-cost medications to eligible individuals. These programs may have specific eligibility criteria and income limits, so it’s important to research the programs available in your state. Nebraska and Iowa do not have these types of programs.

4. Non-profit organizations and foundations: Various non-profit organizations and foundations provide financial assistance or free medication programs for individuals in need. These programs often have specific eligibility criteria and may focus on particular medical conditions. Research and reach out to relevant organizations to explore potential assistance options.

By leveraging these resources and programs, you can access the support you need to afford Xarelto and manage your health effectively.

Conclusion: Making Informed Decisions about Medicare Part D Coverage for Xarelto

Understanding the complexities of Medicare Part D coverage for Xarelto is essential for individuals who rely on this medication to manage their health conditions effectively. By delving into the details of coverage

Christopher J. Grimmond

options, determining if Xarelto is covered by your specific plan, exploring alternative options, and maximizing your Part D coverage, you can make informed decisions about your healthcare.

Remember to consult with your healthcare provider and insurance agent professional throughout the process to ensure you make decisions that align with your specific health needs. By staying proactive and informed, you can unlock the benefits of Medicare Part D and access the necessary medications, such as Xarelto, at an affordable cost. Give us a call at Omaha Insurance Solutions at 402-614-3389, and we will help unlock the benefits of Medicare Part D for you.

The Power of Negotiation Enables Medicare to Lower Drug Prices

In today’s healthcare landscape, the soaring cost of prescription drugs has become a critical concern for millions of Americans. As Medicare beneficiaries struggle with skyrocketing medication prices, the power to negotiate Medicare drug prices emerges as a potential solution.

In today’s healthcare landscape, the soaring cost of prescription drugs has become a critical concern for millions of Americans. As Medicare beneficiaries struggle with skyrocketing medication prices, the power to negotiate Medicare drug prices emerges as a potential solution.

With over 65 million enrollees, Medicare has significant purchasing power. However, unlike private insurers, Medicare is legally prohibited from directly negotiating drug prices with pharmaceutical companies. This restriction has prevented the program from achieving lower prices for its beneficiaries.

But what if Medicare could negotiate directly? What impact would it have on drug costs?

Empowering Medicare to negotiate drug prices may unlock savings all around, ensuring seniors receive affordable access to the medications they need. Or it may not. Let’s explore the government’s attempt to make Medicare drug prices more affordable through negotiations.

The Inflation Reduction Act of 2022

Medicare, the federal health insurance program for individuals aged 65 and older, is crucial in providing affordable healthcare to millions of Americans. With over 65 million enrollees, Medicare has substantial purchasing power. However, when negotiating drug prices, Medicare cannot negotiate directly with pharmaceutical companies.

healthcare to millions of Americans. With over 65 million enrollees, Medicare has substantial purchasing power. However, when negotiating drug prices, Medicare cannot negotiate directly with pharmaceutical companies.

Medicare is divided into parts, including Part A, which covers hospital insurance, and Part B, which covers medical insurance. Part D, prescription drug coverage, is the focus of this discussion. Medicare Part D provides beneficiaries access to a wide range of prescription medications, but the prices for some of these drugs are often exorbitant. The inability to negotiate directly with pharmaceutical companies has limited Medicare’s ability to control drug costs.

President Biden signed the Inflation Reduction Act of 2022 into law on August 16, 2022. One of the provisions of the law was to lower prescription drug costs for those on Medicare. The law gives the federal government limited power to negotiate drug prices for the costliest Medicare medications.

Non-Interference Clause Changed To Interference

The power to negotiate drug prices for Medicare Part D is a significant policy change. When the Medicare Part D program was created in 2004, the Health & Human Services Secretary was prohibited from interfering with negotiations between drug manufacturers, pharmacies, and prescription drug plan sponsors. This was the agreement at the time of Part D’s creation. It was referred to as the “Part D non-interference clause.”

A provision in the Inflation Reduction Act grants an exception to the non-interference clause. The law permits the HHS Secretary to directly negotiate with pharmaceutical companies on behalf of Medicare and the sponsored plans for a limited number of drugs with only single-source and non-generic brands starting in 2026 for Part D and 2028 for Part B medications.

The schedule for the negotiations is set, but the implementation of the changes is not scheduled to take effect until 2026. That is when the first set of selected drugs with newly negotiated prices covered under Part D will be available.

Price Controls & Punishing Penalties for Pharmaceutical Companies

Another policy change is that drug companies will be penalized for raising prices higher than the current inflation rate. They will be required to pay Medicare rebates for drug prices exceeding the consumer price index (CPI-U). The penalties will be for those most expensive drugs that HHS identifies. This is an entirely new power for the HHS Secretary. The Part D inflation rebate provision takes effect in 2022, so prices and inflation will be measured from that point. The rebate penalty will start in 2023.

$35 Insulin on Medicare

Diabetes is a growing problem in the U.S., including among Medicare beneficiaries. Insulin costs among this population have been staggering. In 2023, as part of the Inflation Reduction Act, insulin offered under Part D is set at $35 during the deductible, the initial phase, and even during the Medicare gap (donut hole). A prescription plan is not required to offer all insulins, but the ones they do must not exceed $35, and some are even $11.

$2,000 Out-of-Pocket Cap on Part D Prescriptions

The Medicare provision of the Inflation Reduction Act caps out-of-pocket spending for Medicare Part D beneficiaries at $2,000 in 2025 for each individual, excluding premiums. The 2024 provision of the law eliminates the 5% catastrophic Part D phase, effectively capping medication costs at $3,250 for 2024.

August 29, 2023: The HHS secretary announced the first list of ten medications for Medicare drug price negotiations.

- Eliquis-Bristol-Myers Squibb-a blood thinner to prevent blood clotting to reduce the risk of stroke

- Xarelto—Johnson & Johnson–a blood thinner to prevent blood clotting to reduce the risk of stroke

- Januvia—Merck–a diabetes drug to lower blood sugar for Type 2 diabetes

- Jardiance—Boehringer Ingelheim–a diabetes drug to lower blood sugar for Type 2 diabetes

- Enbrel—Amgen–a rheumatoid arthritis drug

- Imbruvica—Abbie–a drug for blood cancers

- Farxiga—AstraZeneca–a drug for Type 2diabetes, heart failure, and chronic kidney disease

- Entresto—Novartis–a heart failure drug

- Stelara—Janssen–a drug for psoriasis & Crohn’s disease

- Fiasp & NovoLog—Novo Nordisk—insulins for diabetes

According to CMS (Center for Medicare & Medicaid Services), these ten drugs were selected because they account for $50.5 billion, or 20% of Medicare Part D spending from June 1, 2022 to May 31st. They are very commonly used medications by the Medicare population.

My Experience As An Insurance Professional

I can attest to this fact after the Annual Election Period for 2023. We ran hundreds of Part D prescription drug plans for clients. These medications come up over and over again, and they are the cause of incredibly high copay totals for clients.

For those on Medicare, nearly 1 in 10 have heart conditions that put them at risk of blood clots. I see Eliquis and Xarelto were on many clients’ medication lists this year. Diabetes affects 28%, so Januvia, Jardiance, and NovoLog appear repeatedly. Some of my clients should be on Enbrel for rheumatoid arthritis, but even with Medicare insurance, the cost is beyond their reach.

Medicare Drug Price Negotiations May Be an Empty Jester

The law is not without its challengers. Several pharmaceutical companies are suing the federal government for its overreach into their business. The government is attacking their right to free speech but also threatening industry and individual businesses with extinction if they do not comply with the “negotiated” terms of the “agreement.”

The law is not without its challengers. Several pharmaceutical companies are suing the federal government for its overreach into their business. The government is attacking their right to free speech but also threatening industry and individual businesses with extinction if they do not comply with the “negotiated” terms of the “agreement.”

The U.S. Chamber of Commerce sought an injunction to halt preliminary negotiations on Oct 1, 2023, the day the drug companies were required to sign an agreement to participate in the negotiations. A federal judge, U.S. District Judge Michael Newman, in Dayton, Ohio, ruled on Sept 29, 2023, that negotiation could go forward.

Johnson & Johnson owns the drugmaker Janssen. In a lawsuit filed July 2023 in U.S. District Court in Trenton, N.J., Johnson & Johnson claimed Medicare drug price negotiations are unconstitutional. The situation leaves its company, Janssen, with no choice if it refuses to negotiate on Stelar because it must withdraw all drugs from Medicare and Medicaid, which is 40% of the U.S. healthcare market. “It is akin to the government taking your car on terms that you would never voluntarily accept and threatening to take your house if you do not ‘agree’ that the taking was ‘fair,’” the company said.

The myriad legal challenges could significantly delay or completely overturn the law’s implementation.

Innovation & Markets May Render the Law Meaningless

All of this activity may end up being an exercise in political theater. Politicians appear to care about the average citizen on Medicare, and the insurance companies keep making money from high-priced medications.

All of this activity may end up being an exercise in political theater. Politicians appear to care about the average citizen on Medicare, and the insurance companies keep making money from high-priced medications.

The pharmaceutical behemoth, Merck, will likely lose its exclusivity in 2026 on its medication, Januvia, one of the first ten drugs up for negotiation. If that happens, most of the business will go to cheaper generic versions when the patent expires.

The same can be said for AstraZeneca’s Farxiga for Type 2 diabetics. AstraZeneca will lose its exclusive patent in 2026. Johnson & Johnson’s Xarelto, Novartis, and Entresto will lose exclusivity in 2027. Many of these drugs on the first list may come down significantly in price naturally through market forces, especially if the current schedule of drug negotiations is delayed through litigation. The desired effect will take place. Lower drug costs. The cause may not be government coercion but rather the effects of innovations and competition. The politicians, however, will take the bows if it works.

Eliquis, taken for blood thinning, will no longer be protected by its patent in 2028. Bristol-Myers Squibb and Pfizer’s revenue will decline, whether by government legislation or patents ending.

Competition is also eroding prices. AstraZeneca has Calquence, and Beigene has Brukinsa. Both are for blood cancer, which now competes directly against AbbVie’s Imbruvica.

Ultimately, the consumer may still benefit, but it may not be by the hands of the politicians who claim credit.

Help Is on the Way

Whether from government intervention or efficient capital markets and technological advances, medication prices, like microchips, computers, and flat-screen televisions, will go down. I remember when Celebrex was a high-dollar medication. Celecoxib, the generic, is now $5 or even zero on some plans. Then, there will be new medications that are better than the ones we use now, but if we want to use those newer, better medications, we will have to pay new, higher prices.

Every year during the Annual Election Period, we run the medications for our clients to ensure they have a reliable plan with the lowest possible overall costs, regardless of Medicare drug price negotiations. We look at all the moving parts: premium, deductible, gap.

Christopher J. Grimmond, MA, CFP

Call us at Omaha Insurance Solutions at 402-614-3389 to speak with a licensed insurance agent professional to make sure you have the plan that meets your needs and budget.

When I meet with prospective clients, I begin with a brief explanation of Medicare. Then move on to the hundreds of plans. Drugs are next. This is hard. Clients must lay down their cards; some hold a straight flush of costly medications.

The Inflation Reduction Act of 2022 is a long-awaited solution to improve Medicare drug plans and make Part D affordable for those on costly medications.

Inflation Reduction Act of 2022 Deals with Medicare Drug Changes

When Medicare Part D was first established, Medicare contracted with private plan sponsors to provide the prescription drug benefit. The private insurance company created the Part D Prescription Drug Plans (PDP), sold the PDPs, and managed the PDPs. Each company negotiated separately with the pharmaceutical companies the price of the medications and which medications would be included on the plan formularies–the list of authorized drugs.

The insurance companies had the leverage of their brand and how many customers they would bring to the pharmaceutical companies. They were also competing with the other insurance companies to get more medications at the lowest cost. The pharmaceutical companies, of course, were trying to maximize their revenues and profits.

Ideally, it was hoped that the competition and freedom of the market would keep prices low. However, patent laws create a temporary monopoly for pharmaceutical companies that develop these very effective and popular new drugs. The patent, and the consequent monopoly, benefit the nation and the world with the newest and best medications. Unfortunately, it is a substantial financial burden for those who need the medication.

The Inflation Reduction Act Creates Leverage for Medicare

When Part D was created in 2004, a law was established known as “non-interference.” Non-interference means that the Secretary of Health and Human Services (HHS) cannot negotiate drug pricing with pharmaceutical companies, pharmacies, and insurance companies. Instead, the prices would be determined exclusively between the insurance companies, pharmaceutical companies, and pharmacies competing amongst one another.

With the Inflation Reduction Act of 2022, Medicare changes the law. The Secretary of HHS is granted a narrow exception to the non-interference clause. The HHS Secretary can negotiate on behalf of the 84 million Medicare and 76 million Medicaid beneficiaries for the lowest prices for a very limited number of costly prescriptions. The category of medications is single-source brand-name drugs or biologics without generic or biosimilar competitors.

Inflation Reduction Act of 2022 Effects Medicare Change in 2026

The Drug Price Negotiation Program begins in 2026 and is limited to 10 Part D drugs. Another 15 Part D drugs will be added in 2027, 15 Part D in 20228, and 20 Part in 2029. The HHS Secretary will select the drugs from among the 50 highest total cost Part D medications.

The timeline for the negotiation process will span roughly two years. For those companies that do not comply, there is an excise tax. The tax penalty starts at 65% of the product sales in the U.S. and increases by 10% every quarter to a maximum of 95%. The other option is that company can remove all its medications from the Medicare and Medicaid market.

Is the CBO Accurate, Reliable, & Trustworthy?

The Congressional Budget Office (CBO) claims HHS Secretaries’ ability to negotiate prices with Part D producers will significantly reduce what Medicare spends over the next ten years. The CBO also claims that reducing the revenue to pharmaceutical companies will have little effect upon developing new and better drugs. These are all projections and opinions to support the policy change. There is no evidence.

Drug Manufacturers Are Penalized for Inflation

The Inflation Reduction Act of 2002 adds another Medicare change. The Act requires drug manufacturers to pay a rebate to Medicare if prices for single-source drugs covered under Medicare Part B and nearly all covered frugs under part D increase faster than the rate of inflation reflected by the Consumer Price Index (CPI). The rebate dollars will be deposited in the Medicare Supplementary Medical Insurance (SMI) trust fund.

Cap Out-of-Pocket Part D Spending

Medicare Part D currently provides catastrophic coverage for high out-of-pocket drug costs. Still, there is no limit on the total amount beneficiaries pay out of pocket each year. Under the current design, Part D enrollees qualify for catastrophic coverage when the amount that they pay out of pocket plus the value of the manufacturer discount on the price of brand-name drugs in the coverage gap phase exceeds a certain threshold amount. Enrollees with drug costs high enough to exceed the catastrophic threshold must pay 5% of their total drug costs above the threshold until the end of the year. This can be huge.

The Inflation Reduction Act of 2022 amends Medicare’s design of Part D. For 2024, the law eliminates the 5% coinsurance requirement above the catastrophic coverage threshold, effectively capping out-of-pocket costs at approximately $3,250 that year.

The legislation adds a hard cap on out-of-pocket spending of $2,000 per person in 2025. How this will be funded, other than with savings, is still being determined.

Inflation Reduction Act of 2022 Puts Medicare Insulin at $35

Insulin is probably the most common high-dollar medication that burdens many Medicare beneficiaries. Most plans relieve several insulin products, beginning with the Trump Administration and now Biden.

Currently, Medicare beneficiaries can choose to enroll in a Part D plan participating in an Innovation Center model in which enhanced drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit.

Participating plans do not have to cover all insulin products at the $35 monthly copayment amount, just one of each dosage form and insulin type (rapid-acting, short-acting, intermediate-acting, and long-acting).

While Medicare is incredible health insurance, Part D prescription drug plans are the weakness because of the light coverage for higher-end medication. The Inflation Reduction Act of 2022 helps Medicare better service citizens with more reasonably priced medications.

We can ensure you have the plan that best covers your prescription drug needs at the lowest possible cost.

Call 402-614-3389 to speak with an experienced and licensed agent and insurance professional.

Many people have heard of the Medicare Donut Hole, but even those on Medicare are not familiar with what the donut hole really means unless they fall into it.

When you are in the Medicare Donut Hole, you know it and quickly learn what it means.

Clients call me monthly asking, “What’s going on? My medication jumped from $45 to $145!” I say, “Oh, you’re probably in the Medicare Gap, or the more popular name is the ‘donut hole.”’ They ask, “What’s that?”

Even clients I have warned ahead of time usually still call with distressed and perplexed voices. People don’t really begin to grasp what’s happening until it happens.

Medicare Donut Hole Explained

How to explain the Medicare Donut Hole? There is nothing logical about the Medicare Donut Hole (or Medicare Gap). The government actuaries devised this idea to deal with many Medicare beneficiaries who are on many extremely expensive medications.

Think about it this way: We all pay for auto insurance. Most of us do not get into accidents or kill anyone, thankfully. Over a long driving career, there may be some fender benders, but nothing major.

So we complain a little, but we pay the insurance premiums. It’s the price of doing business. We understand that more people need to pay in than people take out for accidents and injuries for insurance to work. Medicare Part D prescription drug insurance is similar. We need more people paying in than taking out.

The Problem Of Expensive Prescriptions

When we were working, our employers and we paid a lot of health insurance premiums, including medication copays. The age group for employer plans is 18-64. Not many people were on Eliquis, Toujeo, Xarelto, Jardiance, Ventolin Inhalers, etc. However, when it comes to Medicare, you have people ages 65-100, and the percentage of persons on expensive medications is enormous.

If the cost and risk were evenly distributed among all participants without distinction, Medicare Part D prescription drug plans would be significantly more expensive — so expensive that those who aren’t on medications or very few medications would never buy a Medicare Part D plan.

Remember, you need more people paying into the insurance plan than taking out. The magical actuaries at Medicare came up with an idea. Voila, the Medicare Donut Hole!

4 Phases To the Medicare Part D Plans

The Medicare Part D prescription drug program is broken down into four phases. The first phase is the deductible. The deductible for 2023 will be $505. The purpose of any deductible is to ensure that people do not charge recurring and minor costs to the insurance plan. The consumer needs to foot the bill for those low-cost expenditures. All insurance policies have some deductible built into the policy. Otherwise, premiums would be astronomical.

Phase 1: Deductible

In the case of Part D plans, the deductible is usually only for the more expensive Tier 3 medications. The plan entirely or mostly covers minor and inexpensive medications.

Phase 2: Initial Stage

The second phase is the initial stage. The Medicare initial stage is how insurance generally feels to the consumer. There is a claim, and the insurance pays most of the claim. The insured pays a fourth or a fifth of the actual cost.

Most people on Medicare never get out of the Medicare initial phase. They may even be on many medications, but their cost is insufficient to drive them into the Gap.

Phase 3: The Gap / Medicare Donut Hole

The third phase is the Medicare Gap (or Medicare Donut Hole). You cross this threshold when you and the plan have paid at least $4,660 in the insurance company’s cost of the medications.

You’ve paid about a fourth of the cost out of your pocket. The insurance companies paid the rest. You have now thoroughly and completely crossed over into the Medicare Gap (or Medicare Donut Hole).

In the Gap, pharmaceutical companies discount the medication cost by 75%. You pay 25% of the actual cost. The reasoning is that now the persons who most benefit directly from the medications should bear the burden of the cost. Again, if it were evenly split among participants, those with no or few medications would opt out of Part D plans and significantly reduce the premium paid into the pool.

Phase 4: Catastrophic

The final phase is catastrophic. Like it sounds, the costs are catastrophic for most people by this point. You have paid $7,400 out of your pocket in actual or discounted costs. This amount is based on the actual costs of the medications. You need to pay the $7,400 out of your pocket to descend to the next level.

This phase is probably called catastrophic because you have paid out a catastrophic amount of money for medications, which is catastrophic for your budget.

In this stage, instead of paying the actual cost of the medications, the insurance company and Medicare step back in. Medicare significantly subsidizes the cost. Beneficiaries pay copays of $4.15, $10.35, or 5%, whichever is higher. The cost and tier determine the copay.

Then, the whole process starts over again on Jan. 1 each year.

Changes to the Medicare Donut Hole In 2024

Because of recent legislation in Congress, this entire system may be significantly altered starting in 2024. Hopefully, for the good, but as it stands, this is what and how the Medicare “Donut Hole” works.

January begins a new calendar year for Medicare. What does that mean for your Medicare drug deductibles in 2023?

For most Medicare members with a Medicare Part D prescription drug plan, you have a deductible. The Medicare drug deductible for 2023 is currently $505. The Part D drug deductible for 2022 was $480, which means a 5% increase. The deductible is the amount you initially pay out of your pocket before the insurance plan begins paying for the prescriptions. Deductibles are vital because they keep the overall cost of medications low. Deductibles also prevent members from overusing Part D drug plans for trivial or unnecessary purposes.

2023 Medicare Drug Deductible Shock!

I mention the Medicare drug deductible for 2023 because I get distressed phone calls at the beginning of the year. Clients go to the pharmacy in January, February, and March and are shocked. They have a huge unexpected bill. I hear cries of ‘I can’t afford $500 every month for their medications!’

I remind clients that they are in the deductible phase of their Medicare drug plan. Once they meet their drug deductible, the medication cost will decrease significantly to around $45 per month per medication.

Since it is an entire year from the last time clients paid their drug deductible, it is understandable they forget.

For those paying the deductible all at once in January and for the first time, the deductible experience will be a new and eye-opening surprise.

Plan For the Unexpected

I don’t know about you, but $505 is a lot of money to pay out all of a sudden, especially if you were not planning on it. I’m usually all tapped out by January. My trophy wife, high-maintenance step-children, and grandchildren require a lot of maintenance around Christmas time.

Once you have met your Medicare Part D deductible for the year, your Tier 3, 4, & 5 medications will be the amount listed in your handbook during the initial phase before the Gap. Please, consult my other blogs about the GAP / Donut Hole.

Most people, however, will not fall into the Gap and will simply pay minimal copays for the remainder of the year. It is the deductible that is the big obstacle.

Clients ask, ‘Are there other Part D plans without a deductible?’ There are a few, but the monthly premiums are much higher, like $100 per month, and the copays are generally higher too.

Lowest Total Annual Medicare Drug Cost

When I run clients’ drugs through the Medicare Part D medication calculator, I look primarily at the total annual cost. The winning drug plan is the plan with the lowest total annual cost and with at least a 3 Star Medicare rating.

The calculator combines the monthly premium, deductibles, copays, and gap–if applicable–and spits out a total number for the year. That is the plan you want to use.

Look For Stars

As for the Medicare star rating, you want to have at least three stars. More stars are better. There is no point in having the cheapest Medicare drug plan if you never get your medications or the insurance company is so painful to deal with you need additional drugs to handle them.

Most Have A Medicare Drug Deductible

January to March is when Part D plans remind most people they have a deductible. Don’t be upset. There is nothing wrong. You must meet the Medicare drug deductible to get to the lower cost for your medications for the remainder of 2023.

Medicare usually makes some changes every year. Medicare changes Part D without exception. Medicare and the insurance companies make adjustments based upon drug costs and contracts with pharmaceutical companies. Medicare is also gradually eliminating the dreaded gap in Part D coverage, better known as the “Donut Hole.”

Medicare Changes Part D Deductible

Medicare Changes Part D Deductible

The change that gets the most recognition this year is the Medicare Part D changes deductible. Medicare changes Part D deductible from $350 in 2016 to $400 in 2017. That is a 14% increase to the deductible alone, which is a constant reminder to review your Medicare Part D plan each year with your agent.

Part D Shell Game

A $400 deductible is sizeable. Most of the Part D plans have the deductible, but some do not. The way those plans are able to eliminate the deductible is by spreading the deductible out  through the various co-pays on your medications. The other way is to apply the deductible only to higher Tier, more expensive drugs, e.g., Tier 3-5 medication. The Part D plans are a bit of a shell game shifting costs from this drug to another. It is important to not be distracted by the various co-pays. Medicare.gov has a wonderful medication calculator that will compared all of the Part D plans in your area side-by-side. You want to use that tool and focus on the total number that you will spend. Too often, Medicare beneficiaries will focus on one co-pay or an initial deductible. The bottom line is the total amount coming out of your pocket.

through the various co-pays on your medications. The other way is to apply the deductible only to higher Tier, more expensive drugs, e.g., Tier 3-5 medication. The Part D plans are a bit of a shell game shifting costs from this drug to another. It is important to not be distracted by the various co-pays. Medicare.gov has a wonderful medication calculator that will compared all of the Part D plans in your area side-by-side. You want to use that tool and focus on the total number that you will spend. Too often, Medicare beneficiaries will focus on one co-pay or an initial deductible. The bottom line is the total amount coming out of your pocket.

Medicare.gov Medication Calculator

Medicare.gov Medication Calculator

That being said, we all have limited budgets. A big deductible may be too big for your wallet. It may make sense to use a Part D plan without a deductible to even out your costs over the year. If you are going on a Part D plan more than half way through the year because you just turned 65, it may make sense to pick a plan with no deductible. Why pay the big deductible and turn around and pay it again in January? That is why it is important that your agent go through your list of medications, talk about the costs, and figure out the best plan for you. An experienced agent should be able to effectively use the Medicare prescription drug calculator to show you how your medication costs will play out in the coming year. Also remember to check whether you qualify for the EXTRA HELP Program.