Changes to MedicareCategory:

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Medicare is superb health insurance. The coverage is the most comprehensive of any health plan. The cost is incredibly low for the consumer. The medication portion, unfortunately, which has been relatively new since 2006, is not as good as most employer-provided drug coverage, at least for the Medicare demographic. Consequently, Medicare continually evolves, so the 2023 Medicare changes for drugs are significant.

Does Medicare Cover Insulin?

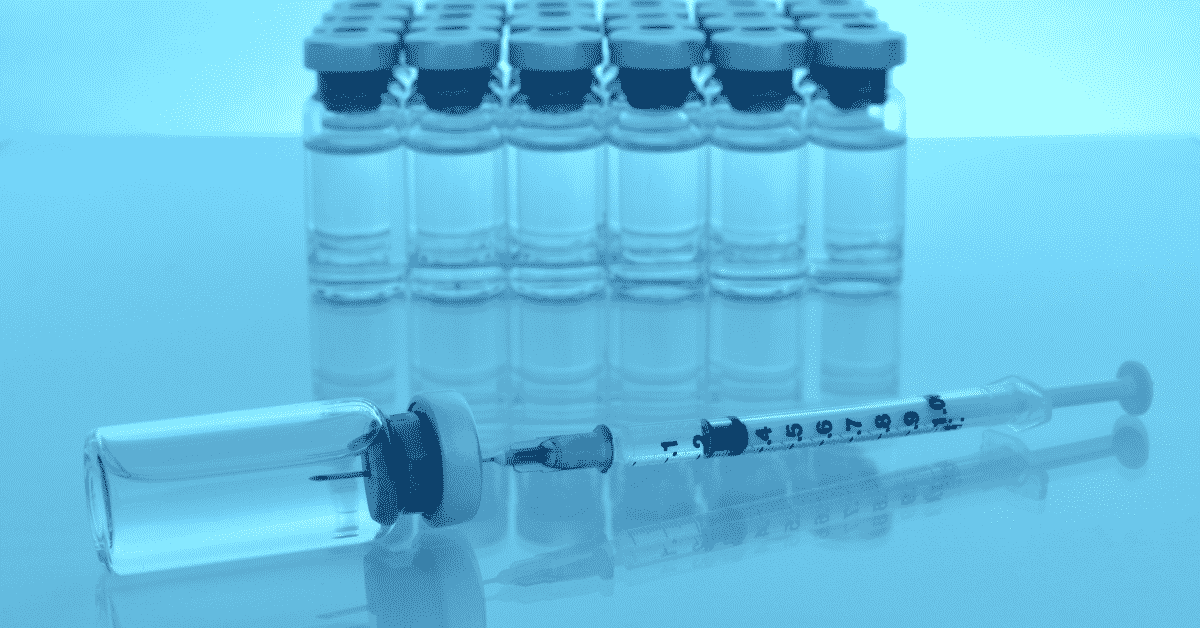

Medicare has covered insulin for a long time, but the cost to consumers has gone through the roof over the years. Under the Trump Administration, the Centers for Medicare & Medicaid Services (CMS) announced Medicare changes in 2021 that covered 1,750 Medicare Part D prescription drug plans and Medicare Advantage plans with prescription drug coverage. The plans would reduce insulin prices under the Senior Savings Model. Medicare beneficiaries would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

would have access to a broad range of insulins at a maximum copay of $35 per month. The program, however, was voluntary.

The Inflation Reduction Act (IRA) law the Biden administration sponsored significantly changed Medicare for 2023. The IRA law set a cap of $35 for insulin that Medicare Part D prescription drug plans offered. The insulin price reduction act went into effect in 2023.

Not all, but many insulin medications to combat diabetes are capped at $35 per month.

Medicare Changes Insulin Prices in 2023

The $35 insulin cap is for both Medicare Part B and Part D. Most people get their insulin medications through their Medicare Part D prescription drug plan. They pay the monthly plan premium and a copay when they pick up their insulin. In the past, the copays were significant. Now insulins on Medicare prescription drug plans in 2023 changed to $35 per month.

What Are 2023 Changes to Insulin Covered by Medicare Part B?

What Are 2023 Changes to Insulin Covered by Medicare Part B?

Many others use insulin delivered through an insulin pump that people wear. The pumps are considered durable medical equipment and are billed under Medicare Part B. Part B has a deductible and an unlimited 20 percent coinsurance. However, when paired with a Medicare supplement, like Plan G, the 20 percent coinsurance is wholly covered. After a small Part B deductible is met, the beneficiary pays nothing for the pump or insulin.

What About Disposable Insulin Patch Pumps?

Insulet Omnipods are very popular. It is a disposable insulin “patch” pump. The disposable pump is a small wireless, tubeless pump worn directly on the body. Beneficiaries get the refills for the Omnipod under the Part D prescription drug plan, not Part B.

The Medicare change for 2023 is insulin refills will be $35 or less.

The patch pump, however, is considered a durable medical device, which falls under Part B. The device will be covered like any other durable medical equipment with no price controls. What you pay is determined by your plan.

How Does Medicare Change Deductibles in 2023 For Insulin?

Most Medicare Part D prescription drug plans and many Medicare Advantage plans with prescription coverage have deductibles. The deductibles aren’t going anywhere; they still exist. However, the deductible no longer applies to covered $35 insulin medications. In other words, Medicare beneficiaries do not have first to meet the deductibles of $505 before they start paying $35 for insulin. This is significant.

Many times the large deductible is an insurmountable obstacle for some clients when they go to the pharmacy to pick up their medication for the first time. They choose not to get their essential medication because of the cost.

I always show clients the prices when we meet. I’m not sure what happens from the showing to when some actually pick up the medication at the pharmacy, but I have fielded many a phone call–“I can’t afford $$$$!”

Medicare changed the rule for $35 insulin on January 1, 2023, to no deductible.

Reimbursement When Overcharged for $35 Insulin

Reimbursement When Overcharged for $35 Insulin

Mistakes happen. If you are charged more than $35 per month for an insulin medication that is part of the program, the Part D plan must reimburse you within 30 days. The insurance company is responsible for the reimbursement. Contact the plan. The customer service 800-number is on the back of your Part D medical card.

Pharmacies Don’t Matter for $35 Insulin.

When I meet with clients, I always show how different pharmacies will affect drug copays. The effect of pharmacies on cost is essential to know if you wish to maximize your Part D plan and pay the least.

Drug plans sign contracts with different pharmacy chains and networks. As part of the deal, copays are lower if you go to one of the plan’s preferred pharmacies versus a non-preferred pharmacy.

Whether a preferred or non-preferred pharmacy, the insulin on the Medicare Part D plan will be $35. Many of my clients have a favorite pharmacy that may not be in the network—non-preferred. It is good to know, wherever you pick up your $35 insulin; it will be $35 insulin.

Not All Medicare Insulin Is $35

Medicare Part D prescription drug plans create formularies, a list of the medications the plan covers. The medications are put in tiers that determine copays and deductibles. Medicare requires the insurance companies to cover at least two medications in each category. Sometimes companies make choices, like covering Humalog insulin types but not Novolog insulin. The new law requires the plan to keep insulin at $35, but only insulins the plan carries. Not every brand or type. This is important in selecting a Part D plan. You need to know which brands and types of insulins are covered under a particular plan. And plans can change and often do change drugs on the formulary from year to year.

We always run clients’ medications when we meet to ensure they have the lowest cost plan for their specific list of medications. During Annual Election Period (AEP) Oct 15th–Dec 7th, we re-run clients’ medications to make sure they still have the best plan for them. If necessary, we change their plan.

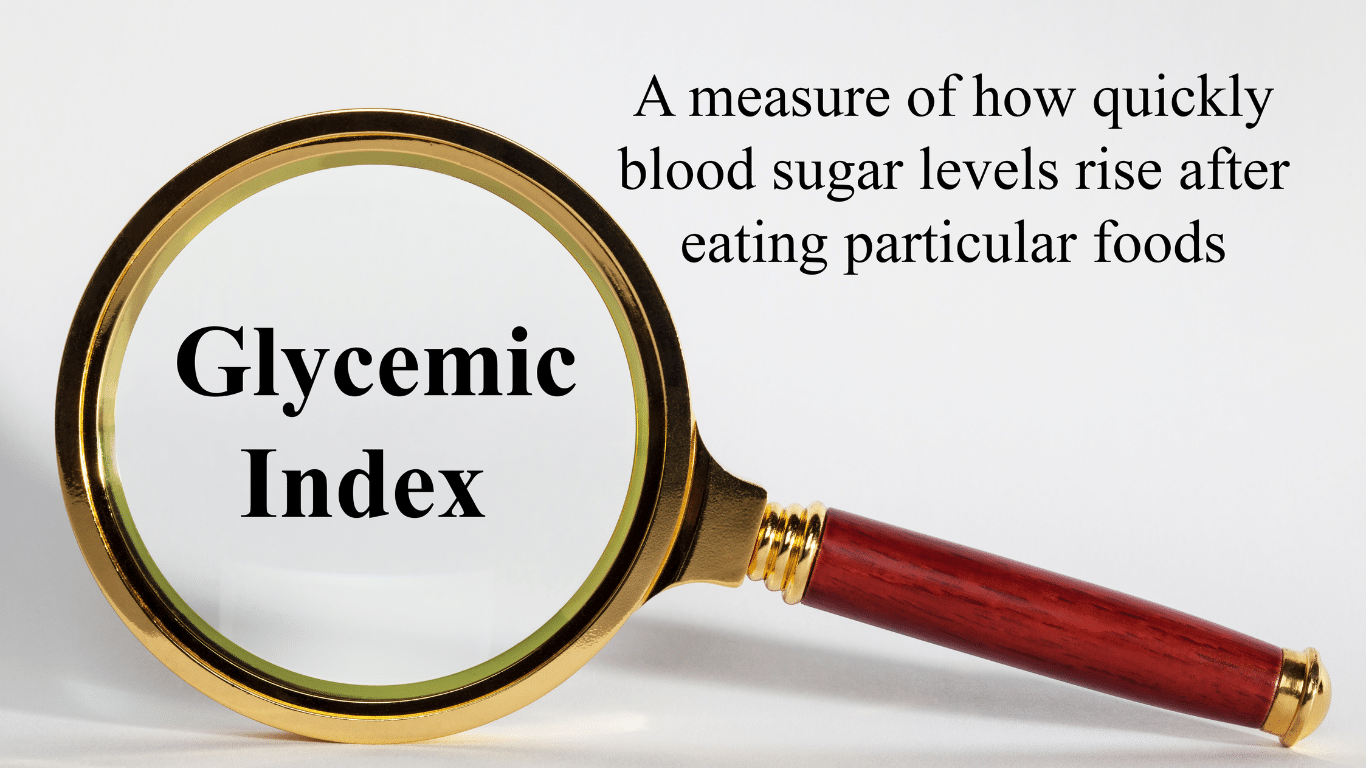

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

No Medicare Change in 2023 for Non-Insulin Anti-Diabetic Drugs

While Medicare’s $35 insulin is a tremendous financial relief for Medicare beneficiaries who are diabetic, other medications are equally important to improve and maintain glycemic control. Some popular non-insulin and anti-diabetic medications are Trulicity, Bydureon, Ozempic, and Victoza. Oral and injectable (non-insulin) pharmacological options are available for treating diabetes. Medicare, however, did not change the pricing for these medications for 2023. They are not part of the price reduction program currently.

Special Election Period Because of $35 Insulin

The $35 insulin for Medicare beneficiaries is a new regulation, so Medicare has allowed a special enrollment period for “Exceptional Circumstances.” The rule is only for those who are on insulin. You have a one-time opportunity to change your Medicare Part D prescription drug plan from December 8, 2022, until December 31, 2023. The reason is to take advantage of the favorable pricing for insulin medications.

Again, the ability to change Part D plans is only for those on insulin medications, a one-time opportunity during this period.

True Out-of-Pocket Costs Carry Over

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Each of the Medicare Part D prescription drug plans track the amount the beneficiaries pay and what the plan pays. These amounts determine where the beneficiaries are in the four stages. This calculation is called True Out-of-Pocket (TrOOP) costs.

Remember, there are four phases in pricing for Medicare Part D prescription drug plans: deductible, initial phase, the gap (or Donut Hole), and catastrophic phase. Switching Part D plans during the year does not mess this up. You do not start over again. The amounts, totals, and placement within Part D plan phases transfer to the new plan.

If you are in the gap phase in one plan, you will be in the same phase and place in the new plan. You did not lose your place or are forced to start over again.

Medicare Changes the Catastrophic Phase in 2023

The fourth phase in the four stages of tracking Part D prescription drug costs is called “Catastrophic.” When a beneficiary reaches the catastrophic phase, they and the plan have paid out approximately $7,400 in out-of-pocket costs between the beneficiary and the plan. The actual out-of-pocket for the beneficiary is $3,100. The prescription costs are usually minimal unless it is an expensive medication. The coinsurance in the catastrophic phase for expensive medications is an unlimited 5 percent, and 5 percent of a large amount is still significant for most pocketbooks.

The effect of the new legislation in 2024 is beneficiaries will no longer pay the unlimited 5 percent. The out-of-pocket cost will stop at a hard cap of $3,250 out-of-pocket max for beneficiaries. While still not a small amount, it is significantly less than what some beneficiaries paid who were on costly medications in previous years.

Medicare Part D Annual Limit In 2025

The Inflation Reduction Act (IRA) mandates that the annual limit of the Medicare Part D prescription drug will be $2,000 starting in 2025 and indexed for inflation yearly after that. Part D expenses are not currently capped. This Medicare change starting in 2023 is enormous.

I think of my clients on various insulins, anti-diabetic medications, Eliquis for the heart, Humira & Enbrel for rheumatoid arthritis. Their costs have been thousands of dollars for years. That will stop.

The Medicare Part D $2,000 cap is for all tiers of drugs. The limit is for all medications on the plan’s formulary, and the $2,000 limit is for all Medicare beneficiaries regardless of past or current income. IRMAA does not apply.

Inflation Cap on Part D Premiums

The law also includes a 6 percent limit on Part D premium increases. With current inflation around 6 percent now and medical costs usually at a higher rate of inflation growth than regular inflation, how the system will really work is yet to be seen.

Smoothing Part D Out-of-Pocket Costs

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

Another challenge with Medicare Part D prescription drug expense is the ups and downs of the costs.

One month the cost may be $1,000, and the next month is $100. Most consumers’ incomes are consistently the same each month, and large spikes in expenses create extreme hardship.

The IRA law offers an option for “smoothing” the payments evenly over the year.

In 2025 when the medication copays are set at a total out-of-pocket of $2,000 per year, “smoothing” would look like a $167 monthly payment for those on medications that reach the cost cap.

The smoothing idea aims to reduce prescription abandonment, dosage reductions, and delays in treatment because of high-cost specialty drugs. I had gotten phone calls too many times from the pharmacy when a client went to pick up a medication during the deductible phase. “I can’t afford $500 for this #%&* drug!” I explained their cost would not be $500 every month. They are in the deductible phase. Clients tell me they can’t afford the drug, so they leave it at the pharmacy. Not good.

The Bottom Line For 2023 Medicare Changes

The Medicare Part D prescription drug program has evolved since its inception in 2006. The Inflation Reduction Act (IRA) introduces significant changes to Medicare from 2023 to 2025. The law addresses the growing senior population dependent upon insulin and its rising cost. The IRA law reduces costs for those on limited incomes to afford critical life-sustaining medications.

It is essential to be aware of these new rules to benefit from them and get the proper medications to enhance your life’s quality.

When I meet with prospective clients, I begin with a brief explanation of Medicare. Then move on to the hundreds of plans. Drugs are next. This is hard. Clients must lay down their cards; some hold a straight flush of costly medications.

The Inflation Reduction Act of 2022 is a long-awaited solution to improve Medicare drug plans and make Part D affordable for those on costly medications.

Inflation Reduction Act of 2022 Deals with Medicare Drug Changes

When Medicare Part D was first established, Medicare contracted with private plan sponsors to provide the prescription drug benefit. The private insurance company created the Part D Prescription Drug Plans (PDP), sold the PDPs, and managed the PDPs. Each company negotiated separately with the pharmaceutical companies the price of the medications and which medications would be included on the plan formularies–the list of authorized drugs.

The insurance companies had the leverage of their brand and how many customers they would bring to the pharmaceutical companies. They were also competing with the other insurance companies to get more medications at the lowest cost. The pharmaceutical companies, of course, were trying to maximize their revenues and profits.

Ideally, it was hoped that the competition and freedom of the market would keep prices low. However, patent laws create a temporary monopoly for pharmaceutical companies that develop these very effective and popular new drugs. The patent, and the consequent monopoly, benefit the nation and the world with the newest and best medications. Unfortunately, it is a substantial financial burden for those who need the medication.

The Inflation Reduction Act Creates Leverage for Medicare

When Part D was created in 2004, a law was established known as “non-interference.” Non-interference means that the Secretary of Health and Human Services (HHS) cannot negotiate drug pricing with pharmaceutical companies, pharmacies, and insurance companies. Instead, the prices would be determined exclusively between the insurance companies, pharmaceutical companies, and pharmacies competing amongst one another.

With the Inflation Reduction Act of 2022, Medicare changes the law. The Secretary of HHS is granted a narrow exception to the non-interference clause. The HHS Secretary can negotiate on behalf of the 84 million Medicare and 76 million Medicaid beneficiaries for the lowest prices for a very limited number of costly prescriptions. The category of medications is single-source brand-name drugs or biologics without generic or biosimilar competitors.

Inflation Reduction Act of 2022 Effects Medicare Change in 2026

The Drug Price Negotiation Program begins in 2026 and is limited to 10 Part D drugs. Another 15 Part D drugs will be added in 2027, 15 Part D in 20228, and 20 Part in 2029. The HHS Secretary will select the drugs from among the 50 highest total cost Part D medications.

The timeline for the negotiation process will span roughly two years. For those companies that do not comply, there is an excise tax. The tax penalty starts at 65% of the product sales in the U.S. and increases by 10% every quarter to a maximum of 95%. The other option is that company can remove all its medications from the Medicare and Medicaid market.

Is the CBO Accurate, Reliable, & Trustworthy?

The Congressional Budget Office (CBO) claims HHS Secretaries’ ability to negotiate prices with Part D producers will significantly reduce what Medicare spends over the next ten years. The CBO also claims that reducing the revenue to pharmaceutical companies will have little effect upon developing new and better drugs. These are all projections and opinions to support the policy change. There is no evidence.

Drug Manufacturers Are Penalized for Inflation

The Inflation Reduction Act of 2002 adds another Medicare change. The Act requires drug manufacturers to pay a rebate to Medicare if prices for single-source drugs covered under Medicare Part B and nearly all covered frugs under part D increase faster than the rate of inflation reflected by the Consumer Price Index (CPI). The rebate dollars will be deposited in the Medicare Supplementary Medical Insurance (SMI) trust fund.

Cap Out-of-Pocket Part D Spending

Medicare Part D currently provides catastrophic coverage for high out-of-pocket drug costs. Still, there is no limit on the total amount beneficiaries pay out of pocket each year. Under the current design, Part D enrollees qualify for catastrophic coverage when the amount that they pay out of pocket plus the value of the manufacturer discount on the price of brand-name drugs in the coverage gap phase exceeds a certain threshold amount. Enrollees with drug costs high enough to exceed the catastrophic threshold must pay 5% of their total drug costs above the threshold until the end of the year. This can be huge.

The Inflation Reduction Act of 2022 amends Medicare’s design of Part D. For 2024, the law eliminates the 5% coinsurance requirement above the catastrophic coverage threshold, effectively capping out-of-pocket costs at approximately $3,250 that year.

The legislation adds a hard cap on out-of-pocket spending of $2,000 per person in 2025. How this will be funded, other than with savings, is still being determined.

Inflation Reduction Act of 2022 Puts Medicare Insulin at $35

Insulin is probably the most common high-dollar medication that burdens many Medicare beneficiaries. Most plans relieve several insulin products, beginning with the Trump Administration and now Biden.

Currently, Medicare beneficiaries can choose to enroll in a Part D plan participating in an Innovation Center model in which enhanced drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit.

Participating plans do not have to cover all insulin products at the $35 monthly copayment amount, just one of each dosage form and insulin type (rapid-acting, short-acting, intermediate-acting, and long-acting).

While Medicare is incredible health insurance, Part D prescription drug plans are the weakness because of the light coverage for higher-end medication. The Inflation Reduction Act of 2022 helps Medicare better service citizens with more reasonably priced medications.

We can ensure you have the plan that best covers your prescription drug needs at the lowest possible cost.

Call 402-614-3389 to speak with an experienced and licensed agent and insurance professional.

January begins a new calendar year for Medicare. What does that mean for your Medicare drug deductibles in 2023?

For most Medicare members with a Medicare Part D prescription drug plan, you have a deductible. The Medicare drug deductible for 2023 is currently $505. The Part D drug deductible for 2022 was $480, which means a 5% increase. The deductible is the amount you initially pay out of your pocket before the insurance plan begins paying for the prescriptions. Deductibles are vital because they keep the overall cost of medications low. Deductibles also prevent members from overusing Part D drug plans for trivial or unnecessary purposes.

2023 Medicare Drug Deductible Shock!

I mention the Medicare drug deductible for 2023 because I get distressed phone calls at the beginning of the year. Clients go to the pharmacy in January, February, and March and are shocked. They have a huge unexpected bill. I hear cries of ‘I can’t afford $500 every month for their medications!’

I remind clients that they are in the deductible phase of their Medicare drug plan. Once they meet their drug deductible, the medication cost will decrease significantly to around $45 per month per medication.

Since it is an entire year from the last time clients paid their drug deductible, it is understandable they forget.

For those paying the deductible all at once in January and for the first time, the deductible experience will be a new and eye-opening surprise.

Plan For the Unexpected

I don’t know about you, but $505 is a lot of money to pay out all of a sudden, especially if you were not planning on it. I’m usually all tapped out by January. My trophy wife, high-maintenance step-children, and grandchildren require a lot of maintenance around Christmas time.

Once you have met your Medicare Part D deductible for the year, your Tier 3, 4, & 5 medications will be the amount listed in your handbook during the initial phase before the Gap. Please, consult my other blogs about the GAP / Donut Hole.

Most people, however, will not fall into the Gap and will simply pay minimal copays for the remainder of the year. It is the deductible that is the big obstacle.

Clients ask, ‘Are there other Part D plans without a deductible?’ There are a few, but the monthly premiums are much higher, like $100 per month, and the copays are generally higher too.

Lowest Total Annual Medicare Drug Cost

When I run clients’ drugs through the Medicare Part D medication calculator, I look primarily at the total annual cost. The winning drug plan is the plan with the lowest total annual cost and with at least a 3 Star Medicare rating.

The calculator combines the monthly premium, deductibles, copays, and gap–if applicable–and spits out a total number for the year. That is the plan you want to use.

Look For Stars

As for the Medicare star rating, you want to have at least three stars. More stars are better. There is no point in having the cheapest Medicare drug plan if you never get your medications or the insurance company is so painful to deal with you need additional drugs to handle them.

Most Have A Medicare Drug Deductible

January to March is when Part D plans remind most people they have a deductible. Don’t be upset. There is nothing wrong. You must meet the Medicare drug deductible to get to the lower cost for your medications for the remainder of 2023.

Needed Changes to the Medicare Enrollment Process 2022

Needed Changes to the Medicare Enrollment Process 2022

I have been a licensed insurance agent since 2003. I’ve seen a lot of changes to Medicare over that time. One of the problems that always baffled me was how difficult it was to enroll in Medicare. Let me put you in the front seat of the upcoming changes to Medicare for 2022 and 2023.

Non-Stop Complaints About Medicare

More than 11,000 persons turn 65 each day and become Medicare eligible. That is a lot of people enrolling in Medicare. The problem that Congress created a number of years ago was moving the full Social Security retirement age from 65 to 66 and so many months.

People are also living longer. Retirement is being pushed off because people don’t have enough saved. Consequently, many continue to work past 66 to just survive, so they remain on their employer’s group health plans. But, when they turn 65, they need to do something about Medicare enrollment.

How to Enroll with Upcoming Changes to Medicare in 2022 & 2023?

When you start your Social Security, Social Security enrolls you automatically into Medicare Part A and Part B when you turn 65. You have the option then to decline Part B. Many do if they are still working and have adequate health insurance from their employer.

Many people are not taking Social Security at 65, so Social Security does not automatically enroll them in Medicare. That number is even smaller than a few years ago.

So, people must actually choose to enroll in Part A at 65. If they are going on Medicare entirely and delaying Social Security, they must actively choose to enroll in Part A and Part B. A lot of people call Medicare complaining because of how hard it is to enroll in Medicare. Upcoming changes to Medicare in 2022 and 2023 will make the enrollment process simpler.

Enrolling in Medicare at The Social Security Administration Office

Enrolling in Medicare at The Social Security Administration Office

Enrolling in Medicare is a challenge, to put it kindly. I do this for a living. I like to think I have above-average intelligence and some good computer skills. However, I still find the Medicare enrollment process unnecessarily difficult and complicated.

Before the pandemic, you could go to your local Social Security office to enroll in Medicare. Depending on the office’s busyness and the staff’s competency, it was more or less complicated and very time-consuming. The primary issue was the time involved—driving to the office, waiting in line, being at the office during regular business hours when you are still working. Those were the usual challenges. As of the writing of this, the local Social Security offices are closed to visitors because of COVID. The only option now is to enroll online.

Apply For Medicare Online Only

The other option for enrollment, which has become pretty much the only option now, is enrolling online. Enrolling online is not easy, even if everything goes smoothly.

In the past two years, the online process has evolved. A few months ago you took a photo of your state driver’s license. Social Security scanned your license into their system through your smartphone. The purpose was to identify you if you did not already have an active MySocialSecurity account. It was not a bad improvement over the old way, which was answering credit questions. That was an amazing bureaucratic mess in itself. I’m glad the credit questions are gone, but the technology for taking the photo of the driver’s license was faulty.

The latest method is a combination of email and text confirmation codes. This method works if there are no issues with your personal information.

The major challenge with this newest method is some of my clients do not have email or do not get emails and texts on their phones.

The major challenge with this newest method is some of my clients do not have email or do not get emails and texts on their phones.

Challenges, however, go beyond just the mechanics of getting enrolled with Medicare. The problems are with when you can enroll, penalties when you don’t follow the rules, confusion about the rules, and penalties that are imposed as a result. Frustration has built over time as more and more baby boomers run into the wall called Medicare enrollment.

Someone must have heard that consumers were not happy because Congress made some significant changes to the Medicare enrollment process for 2022 and 2023.

What Are the Upcoming Changes to Medicare for 2022?

In December 2020, Congress passed the Beneficiary Enrollment Notification and Eligibility Simplification (BENES) Act of 2020. Parts of this legislation will be effective beginning in January 2023.

The changes are in five areas:

- GEP (General Election Period)

- Part B Enrollment Exceptions

- IEP (Initial Enrollment Period)

- Advanced education for Medicare enrollment

- Expanded Kidney transplant patient coverage

What Are Medicare General Enrollment Period Changes For 2022 & 2023?

Sometimes people miss their Initial Enrollment Period (IEP), which occurs when they turn 65. If you do not have health insurance from 65 onward, you cannot enroll in Medicare until the General Election Period (GEP), January 1st—March 31st. The delay is part of the punishment for missing your IEP. You may also incur the 10% permanent late enrollment penalty.

The problem with the rules around GEP is that Medicare Part A and/or Part B does not start until July 1st after you enrolled sometime from January 1st–March 31st. Consequently, a person cannot get a Medicare Supplement or Part D plan until then. Medicare Part C/Medicare Advantage plans are delayed even further until Annual Election Period (AEP) in October. You are without comprehensive health coverage for many months after an already delayed enrollment.

The BENES Act changes GEP (General Election Period). Congress moved GEP from the first three months of the year to the last three months of the year—October 15th—December 31st—to coincide with the Medicare Annual Election Period (AEP), which is October 15th–December 7th. The hope was to reduce confusion and enable a newly enrolled beneficiary to get maximum coverage right away. For example, if you enrolled in November during the GEP, your Medicare would start on Dec 1st.

Medicare Changes in 2022 Allow For More Exceptions

Medicare Changes in 2022 Allow For More Exceptions

Medicare enrollment periods are very restrictive and precise. The handbook that agents must learn runs to many pages for Medicare election periods when someone can enroll in Medicare or make changes to a Medicare plan. Often I cannot enroll someone in a plan or change their plan, even when the situation is terrible, because of the restrictive enrollment election criteria.

The new law allows the Secretary of Health and Human Service to initiate a particular enrollment period for Part B when exceptional circumstances arise. Of course, we all can think of the pandemic as the perfect example.

The Last 3 Months of The Initial Enrollment Period

Many people know that your Initial Enrollment Period (IEP) is three months before the month of your birthday, the month of your birthday, and the three months afterward. What people do not realize about this rule is there are additional rules for the last three months. This provision has been the bane of my existence—as well as a few clients—for years.

Staggered Medicare Start Dates Change in 2023

Sometimes people will delay enrolling in Medicare when they turn 65 to coincide with a spouse turning 65, a retirement date, the end of a school year, etc. The problem with enrolling after you turn 65 is the start dates are staggered.

For example, you are turning 65 in July, but your spouse is turning 65 in October and needs you to remain on the employer health plan so she can have health insurance. You want to enroll in Medicare for an October 1st start date so it coincides with your spouse, but you can’t.

If you enroll in August, your Medicare will start in September. If you enroll in September, your Medicare will start two months in November under the current rules. You will need to enroll in Medicare in August, so your Medicare starts in September. Your spouse will enroll during the three months before, so it starts on October 1st. You will need to double pay for insurance for one month because of the unusual Medicare rules.

The upcoming changes to Medicare in 2022 and 2023 do away with the silliness. Joe can enroll in September for October and not have to pay double for health insurance. I can’t tell you how many times this has been an unnecessary burden for my clients going on Medicare.

This change will allow people retiring at the end of their IEP (Initial Enrollment Period) to have a smoother transition from employer coverage to Medicare without a lapse in coverage or double paying.

Medicare Part B after 65

I find that Medicare does not explain very well how Medicare works when you work past 65 or beyond and have an employer health plan. I hear the standard response from Medicare and Social Security bureaucrats. They encourage people to enroll only in Part A and stay on their employer’s health plan as long as they are working.

In the past, that standard answer may have worked, but when more and more people are working past 65 and full Social Security retirement is 66+, reality changed.

Also, employer plans have steadily declined in quality during the past fifteen years. Health plan costs have increased and coverage has decreased significantly. I find the vast majority of employer health plans are inferior to Medicare Advantage or Original Medicare and a supplement.

Medicare Enrollment Deadline & Penalty

The most common issue around Medicare is initial enrollment, which is when people turn 65. Some people claim they didn’t know about their Medicare enrollment. I’m not sure how that is possible because most people’s mailbox is jammed full of mail announcing they are turning 65 and need to get signed up for Medicare.

The real issue around 65 is should I enroll in Medicare, and how do I quickly do that? I find a lot of legitimacy around that question.

The upcoming changes to Medicare in 2022 & 2023 through the BENES Act will include notifying people of Medicare eligibility. The notifications will start at ages 60 to 64. Medicare will send information to explain rules such as Medicare eligibility, timeframes for enrollment, Medicare penalties, delaying Medicare without penalty, Part B coordination of benefits, and other online resources will be included on the notice. The purpose is to alert beneficiaries, so no one misses their opportunity.

If your mailbox was not full enough when you turned 65, it will be stuffed to overflowing now.

Medicare For Kidney Transplant Patients

End-Stage Renal Disease (ESRD) is one of the ways you qualify for Medicare before age 65.

End-Stage Renal Disease (ESRD) is one of the ways you qualify for Medicare before age 65.

If you are under 65 and diagnosed with ESRD, you can enroll in Medicare for a specific number of months. For example, now if you qualify for Medicare based on ESRD and have a kidney transplant, your Medicare coverage will end 36 months after the month of your transplant.

The BENES Act of 2020 change will allow kidney transplant beneficiaries to continue their Medicare Part B coverage past 36 months if they have no other health insurance source. The purpose of this is so these beneficiaries will continue to have coverage for immunosuppressive drugs.

According to the Social Security Administration (SSA), Part B’s premium under these circumstances would be less than the base premium and not subject to late penalties.

When Does the BENES Act Take Effect?

The BENES Act will take effect on January 1, 2023, but like many laws, different aspects will be implemented over time to give all the institutions and organizations time to comply.

The two changes I think most important are General Election Period (GEP) and Initial Enrollment Period (IEP). Those will be implemented on the start date–January 1, 2023. The outreach program and kidney transplant patients will take about two years to enact the changes fully.

The number of people enrolling in Medicare is monster. I think all the Baby Boomers enrolling in Medicare have forced politicians and bureaucrats to streamline the Medicare system. Upcoming changes to Medicare enrollment in 2022 and 2023 are going to make life easier. Late enrollment penalties and complaints should decline significantly with the more efficient and user-friendly rules. The most vulnerable, like kidney transplant patients, will have better options.

Christopher Grimmond

Medicare and Medicare insurance, however, is still complicated. When you need help understanding the new BENES rules and all the others, give us a call at 402-614-3389 and speak with a licensed and experienced insurance professional.

55648_051622_MK

Medicare Open Enrollment Is Also Known As Medicare Annual Election Period

Medicare Open Enrollment Is Also Known As Medicare Annual Election Period

Medicare Open Enrollment is when people may make changes to their Medicare plan. Medicare Open Enrollment is also called Annual Election Period or AEP. That is the new official name Medicare Open Enrollment. Annual Election Period (AEP) is when you can change your Medicare Part D prescription drug plan or your Medicare Part C Medicare Advantage plan. AEP is from October 15th–December 7th. A lot of people blow this opportunity. They don’t check to see if they have the best plan for their needs and situation for the coming year. BIG MISTAKE. For some people with serious health issues and medication needs, HUGE MISTAKE!

There are a thousand complaints the day after Medicare Open Enrollment (Annual Election Period), December 8th. People offer a myriad of excuses–It’s the agent’s fault,’ ‘I was too busy to deal with it,’ ‘The dog ate my Medicare card.’ The number of phone calls I get on December 8th is amazing–mostly non-clients. They are hoping to find a Medicare-fairy-godmother to save them from their negligence. Sorry, there is no Medicare-fairy-godmother!

When January 1st arrives and the new plan year begins, people may find out their plan does not cover one or more medications, or the price of one of their drugs went through the roof. Now they have a deductible on their plan they didn’t have before, a medication moved to a higher tier, or their doctor is no longer in-network. Their Medicare situation is a disaster because they didn’t double-check during the Medicare Open Enrollment / Annual Election Period (AEP).

What are the most significant problems created by not reviewing your Medicare plan during Medicare Open Enrollment / Annual Election Period (AEP)?

Formulary Check During Medicare Open Enrollment

Formulary Check During Medicare Open Enrollment

During Medicare Open Enrollment /Annual Election Period (AEP), insurance companies determine the medications on their approved list of drugs in the formularies that service their Medicare Part D prescription drug plans and the Part C Medicare Advantage plans.

Some years, they drop certain medications altogether. In other years, they might shift the medications from a lower to a higher tier.

The result is you may end up paying more for your prescription drugs. In some cases, a lot more. Checking the formulary and comparing it to the other plans in the area is a straightforward but essential process.

During Medicare Open Enrollment / Annual Election Period (AEP), reviewing medications is a big part of what we do. I sometimes have to arm-twist clients to send me their current list of medications. Some will tell me that they don’t need to do anything because their medications have not changed, but I try to remind them it doesn’t matter. The insurance companies change their formularies.

medications. Some will tell me that they don’t need to do anything because their medications have not changed, but I try to remind them it doesn’t matter. The insurance companies change their formularies.

Over the years, I have had clients neglect their reviews and end up with substantial prescription drug bills as a consequence. Your agent should thoroughly check your medications with dosages each AEP.

Double Check Physician Directories

Double Check Physician Directories

The Medicare Advantage plan manages your care. That means that an insurance company under the supervision of Medicare is making determinations about your care. As part of that program, they have doctors contracted with the plan. Some doctors and hospitals are not contracted. Doctors may change their credentialing.

may change their credentialing.

It is important to double-check to ensure your doctor is still in-network during Medicare Annual Election Period (AEP) / Medicare Open Enrollment.

We have three medical networks in the Omaha, Lincoln, and Council Bluffs area. The vast majority of medical professionals are part of one or more of these networks. The networks work with the local Medicare Advantage plans. Doctor access is not an issue.

I have clients, however, throughout the U.S., and the other plans are not as generous in the number of in-network medical professionals. Checking the directory to make sure your physicians are still in-network every year is critical during Annual Election Period (AEP) / Medicare Open Enrolment.

Review CoPays

Review CoPays

With Medicare Advantage plans, copays may change from year to year. This AEP saw very little change among the plans around here. I suspect that was because the plans determined prices in the Spring of the preceding year.

The inflation we are experiencing right now was not a factor in the 2022 planning. I think 2023 will be a different ball game.

Copays can change each year, so you need to review those changes. For example, the cost of MRIs may jump on your plan to the extent you want to change to another plan. Sometimes plans will drop benefits that Medicare does not require, like dental.

I’ve seen plans in the past drop benefits like dental. Beneficiaries don’t imagine their plan could ever change. The lack of coverage and the price tag associated with that shocks clients.

Re-Explain The Donut Hole

The dreaded Donut Hole or Gap! The Donut Hole is still there. I’ve seen the burden of drug costs lighten for some of my clients, but it is still expensive when people fall into the Donut Hole.

The dreaded Donut Hole or Gap! The Donut Hole is still there. I’ve seen the burden of drug costs lighten for some of my clients, but it is still expensive when people fall into the Donut Hole.

If you are on expensive medications that drive you into the Gap, checking your medications for the level of Gap coverage is essential. While no plan eliminates the cost, some plans are structured, so you pay less than other plans. Some plans delay going into the Gap longer, or other plans even out the cost because of a zero deductible.

If drug costs are an issue for you, look at the various Part D, and Part C plans side-by-side to determine which payment schedule would benefit your wallet during Medicare Open Enrollment.

Have A Conversation About Your Travel Plans

Many clients on Medicare like to travel. Their grandkids are scattered throughout the country. Friends moved to warmer clients, or getting out of town is just great. Other clients have semi-permanent homes in Arizona, Florida, and Texas. Medicare is a federal program. It exists from sea to shining sea in the U.S. The Medigap policies that company them work anywhere in the U.S. too. (Medicare. however, does not leave the borders of the U.S.)

Many clients on Medicare like to travel. Their grandkids are scattered throughout the country. Friends moved to warmer clients, or getting out of town is just great. Other clients have semi-permanent homes in Arizona, Florida, and Texas. Medicare is a federal program. It exists from sea to shining sea in the U.S. The Medigap policies that company them work anywhere in the U.S. too. (Medicare. however, does not leave the borders of the U.S.)

Medicare Advantage plans, however, are set up for a particular area or region. The HMO (Health Maintenance Organization) plans only include doctors and hospitals in that area. Emergencies are a different matter. Emergency visits are covered anywhere in the country. Some insurance companies with HMO plans also have national networks, so you can still get in-network services and prices outside of your geographic region for ordinary services.

include doctors and hospitals in that area. Emergencies are a different matter. Emergency visits are covered anywhere in the country. Some insurance companies with HMO plans also have national networks, so you can still get in-network services and prices outside of your geographic region for ordinary services.

For those who travel a lot and especially those who stay for long periods away from home, I highly recommend the PPO (Preferred Provider Organization) plans. You may go to doctors and hospitals outside the network as long as they take Medicare. Out-of-network copays may be more, but you have the convenience and security of going anywhere that accepts Medicare.

You can change your Medicare Advantage plan during Medicare Open Enrollment even if you are out of the area. There is email, U.S. mail, text, and even voice signatures.

Changing Circumstances Makes Medicare Open Enrollment Critical

Over the years, I have had client reevaluate their situation during Medicare Open Enrollment or AEP. Those paying enormous amounts in monthly Medigap premium look to switch to a Medicare Advantage plan.

The amount of money they pay in premium very quickly covers any copays. Others anticipate more medical costs as they age, switching to Medigap plans. Medicare Open Enrollment or AEP is the time to review your ever-changing circumstances and adjust accordingly.

Save Money On Medigap Quote Anytime, Not Just During Medicare Open Enrollment

While Medicare supplements are not geared toward Medicare Open Enrollment or AEP exclusively, it is still an excellent time to look at your pricing. Running Medigap quotes only takes a few moments. I can tell you in a minute if you have the lowest price for Plan G or Plan N in your area. We can then make adjustments accordingly.

Christopher Grimmond

Medicare planning is not a one-and-done deal. As you change, Medicare changes and the Medicare plans change. You need to make the adjustments that best fit your needs and circumstances at that time.

Ignore Medicare Annual Election Period (AEP) October 5th–December 7th at your peril or not.

Every year there are changes to Medicare. The changes are usually not as drastic as the television commercials would lead you to believe. The purpose of the advertisements is to stimulate fear, uncertainty, and greed. They hit it hard to motivate you to call the 800-number. They will claim to offer a free objective evaluation. I find their objective evaluation inevitably ends with you changing to their plan. Know about Medicare 2021 changes before they flip you.

Every year there are changes to Medicare. The changes are usually not as drastic as the television commercials would lead you to believe. The purpose of the advertisements is to stimulate fear, uncertainty, and greed. They hit it hard to motivate you to call the 800-number. They will claim to offer a free objective evaluation. I find their objective evaluation inevitably ends with you changing to their plan. Know about Medicare 2021 changes before they flip you.

Unique One-Time Medicare 2021 Changes

My grandmother used to say, ‘live long enough, and you will see everything.’ The changes this year are unique because of the pandemic. COVID tests will have no co-pays. The vaccine is free. The federal government wants to overcome the virus, so Medicare is reflecting that public health policy.

Many Medicare plans had already offering telehealth options. With the pandemic, insurance companies now hardwire their plans with these options–most with zero co-pays.

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) changes began in 2015. CMS implemented the changes slowly over the years so Medicare, the insurance companies, and beneficiaries could more easily adjust. Starting in 2020, those turning 65 did not have the opportunity to purchase the Medigap F or C plan. Medicare fazed out those plans with plan G being the principal plan with the most comprehensive coverage. They grandfathered in those 65 and over before 2020. They can still own and purchase plan Fs and C’s.

Medicare Part B Premium in 2021

The most significant Medicare change to know about in 2021 for most people is the Part B premium. This year it will increase from $145.60 to $148.50 per month per person, which is a $2.90 increase. Each year the premium amount is a hard-fought debate in Congress. Usually, Congress threatens to raise it much more. Constituents call in, and advocacy groups lobby, so the price usually goes down.

Part B Deductible in 2021

Medicare Part B consists of many different services. It has its own deductible, which is separate and distinct from the Part A deductible. The deductible increased from $198 in 2020 to $203 in 2021, only $5. The deductible is a flat amount. The consumer pays the deductible before the 20% coinsurance starts. For plan G, the Part B deductible is the only payment, aside from the monthly premium. The Medigap policy fills the remaining gaps in Part A and Part B coverage.

COLA 2021

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 1.3 percent in 2021. The 1.3 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2021. The Social Security COLA increase should not be less than the Medicare Part B premium increase. There are exceptions around this. If you are receiving Social Security benefits, you will be held harmless on the increase, but those who do not take Social Security benefits will pay the increase.

Medicare 2021 Changes for Part A

Medicare Part A covers inpatient hospitals, skilled nursing facilities, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,484 in 2021, increasing $76 from $1,408 in 2020.

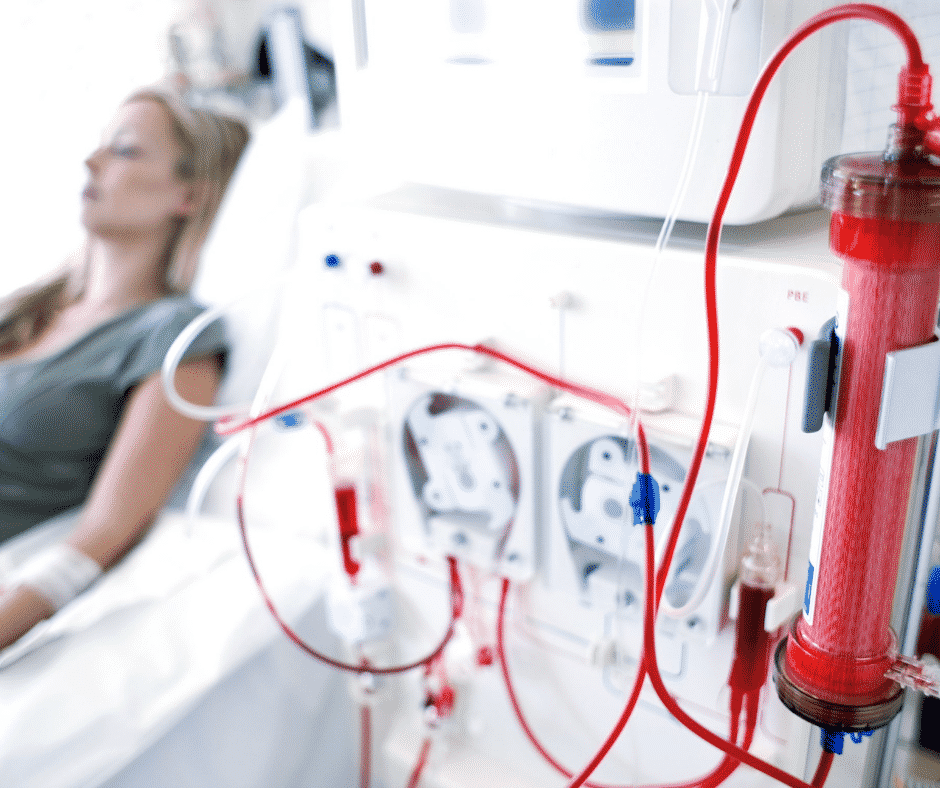

Part D Changes in 2021 (Senior Savings Model)

The Senior Savings Model is an experiment in modeling that tests the impact of offering beneficiaries an increased choice of enhanced alternative Part D plan options that offer lower out-of-pocket costs for insulin. One in every three Medicare beneficiaries has diabetes, and over 3.3 million Medicare beneficiaries use one or more of the common forms of insulin. For some of these beneficiaries, access to insulin can be a critical component of their medical management, with gaps in access increasing the risk of serious complications, ranging from vision loss to kidney failure to foot ulcers (potentially requiring amputation) to heart attacks.

Unfortunately, sometimes the cost of insulin can be a barrier to appropriate medical management of diabetes. CMS’s designed Senior Savings Model for Part D plans to address President Trump’s promise to lower prescription drug costs. The model provides Medicare patients with new choices of Part D plans that offer insulin at an affordable and predictable cost. A one-month supply of a broad set of plan-formulary insulins costs will be no more than $35 each.

Medicare changes to know in 2021 are your drugs listed in the formulary. Part D premiums for 2021 will probably rise an average of 9%. The average stand-alone Part D premium is $41 in 2021. The premiums range from $7 a month for the SilverScript SmartRx plan to a high of $89 for the AARP MedicareRx Preferred plan.

Part D Deductible 2021

The Part D drug deductible went up from $435 to $445 on most plans. That is the max deductible CMS allows insurance companies to set the deductible. They can set it lower, though few plans did this year, and for those plans with zero deductible or a lower deductible, the cost is offset by either higher monthly premiums or co-pays or both.

Most of the time, that deductible is only applicable to tiers 3, 4 & 5 medications.

The first of the year is the time when I get the distressed phone calls because people must meet their deductibles. Many forget the deductible starts over again in January, and they are shocked when they show up at the pharmacy counter. I have to remind clients they need to meet the deductible first to get to the lower copay.

Medicare Advantage Changes in 2021

In the nine years, I have offered Medicare Advantage plans, I have seen the number and especially the quality of the plans increase significantly. Nationally more Medicare Advantage plans are offered now than ever before. In Nebraska and Iowa, I have seen the number of counties offering quality plans explode.

There are now over 4,800 Medicare Advantage plans, an increase of 76% over 2017. The average person will choose from 33 plans offered by eight different insurance companies, with some areas having as many as 60 different plans.

Besides, the number of Special Needs Plans (SNP) also increased to nearly 1,000 in 2021, a sizable jump. The increase in SNP means more people have access to low-cost plans with extra benefits to manage chronic conditions and diseases.

Medicare Advantage Premiums in 2021

Average Medicare Advantage premiums dropped for the fourth consecutive year to $21 in 2021, down from $25 in 2020. Nearly 90% of all Medicare Advantage plans include Part D prescription drug coverage.

Of note, the Medicare Advantage out-of-pocket maximum will increase to $7,550 in 2021, up significantly from $6,700 in 2020. However, the vast majority of insurance companies set their out-of-pocket max well below the government limit. In 2020, the average Medicare Advantage out-of-pocket maximum was $4,900.

Medicare Advantage and ESRD

Medicare Advantage and ESRD

The most heartening plan change for Medicare Advantage is ESRD (End-Stage Renal Disease). When I first started, the only pre-existing condition that excluded me from enrolling someone in a Medicare Advantage plan was ESRD. While I didn’t have that situation very often, it was sad when I couldn’t offer Part C to clients.

ESRD is one of the health issues that almost always automatically makes you Medicare eligible. Still, if you are younger than 65 in Nebraska and Iowa, you are not eligible for a Medicare supplement. The dialysis falls under the unlimited 20% coinsurance of Part B. The cost can be incredible. Even for those on Medicare Advantage, beneficiaries can easily hit the maximum out of pocket.

At least now those with ESRD can get on a Medicare Advantage plan and limit their out-of-pocket costs.

There’s good news for people with ESRD in 2021. In the past, those with ESRD could not join Medicare Advantage unless there was an ESRD Special Needs Plan available. However, new rules grant guaranteed issue rights to people with ESRD for any Medicare Advantage plan offered in their service area.

Access to Medicare Advantage when you have ESRD is massive. Long-standing rules allowed Medigap companies to deny coverage to people with ESRD outside their Medigap Open Enrollment Period. Even many states that enacted laws forcing insurers to offer Medigap to people under age 65 failed to extend that protection to people with ESRD.

What this means is that, for the first time, people with ESRD have low-cost options to control their health care expenses with a Medicare Advantage plan. If that applies to you, you could have used the 2020 Annual Election Period to shop for a new Medicare Advantage plan.

Provider Compensation

Congress made significant changes to the billing process behind Medicare in the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). MACRA changes how Medicare rewards providers for qualify over volume inpatient care. It streamlines provider reimbursements through the Merit-Based Incentive Payments System (MIPS) and even grants bonuses for participation in alternative payment models (APMs). Still, the change that gets the most attention is the eliminating of Plan F and C in the Medigap lineup. The plans completely covered the Part A deductibles and Part B co-insurance, so beneficiaries did not have to pay anything aside from their monthly premiums. Congress found the lack of co-pays and deductibles was an incentive for waste and abuse of the Medicare system. Starting in 2021, you could no longer purchase Plan F or C when you turned 65. Those who turned 65 before that period were grandfathered into Plan F and C.

through the Merit-Based Incentive Payments System (MIPS) and even grants bonuses for participation in alternative payment models (APMs). Still, the change that gets the most attention is the eliminating of Plan F and C in the Medigap lineup. The plans completely covered the Part A deductibles and Part B co-insurance, so beneficiaries did not have to pay anything aside from their monthly premiums. Congress found the lack of co-pays and deductibles was an incentive for waste and abuse of the Medicare system. Starting in 2021, you could no longer purchase Plan F or C when you turned 65. Those who turned 65 before that period were grandfathered into Plan F and C.

The other most obvious change was the Medicare number is no longer your Social Security number, but a unique eleven-digit number combining letters and numbers. Everyone’s card should have been replaced by the end of 2019, though I still have some clients who have their old numbers and card. It is a simple matter of calling Medicare for a replacement card.

Medicare makes slight changes over time. Many times the Medicare changes to know about in 2021 do not apply to you, but you, or your agent, still need to be aware of what is going on to always maximize your benefits and avoid disadvantaging yourself temporarily or permanently.