Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Maximizing Medicare: Understanding Coverage for Hospice in Skilled Nursing Facilities

Do you or a loved one need hospice care in a skilled nursing facility? Understanding Medicare coverage for this essential service is crucial for maximizing benefits and ensuring quality end-of-life care. This article will explore some of the ins and outs of hospice coverage I didn’t know when my mother was in hospice. We discuss the question of whether Medicare pays for hospice in a skilled nursing facility.

Navigating the complex world of healthcare can be overwhelming, especially when faced with a difficult situation like imminent death like I experienced with my mother. That’s why I’m here to break it down for you. I’ll explain what hospice care entails, how it differs from other types of care, and, most importantly, what Medicare covers. With this information, you can be confident in your ability to advocate for yourself or your loved one and ensure that all available resources are utilized.

At Omaha Insurance Solutions, information is power regarding healthcare decisions. We aim to make complex topics accessible, providing you with the tools you need to confidently navigate the healthcare system. So, let’s dive in and discover how Medicare can support you during a challenging time.

What is Hospice Care & Who is Eligible?

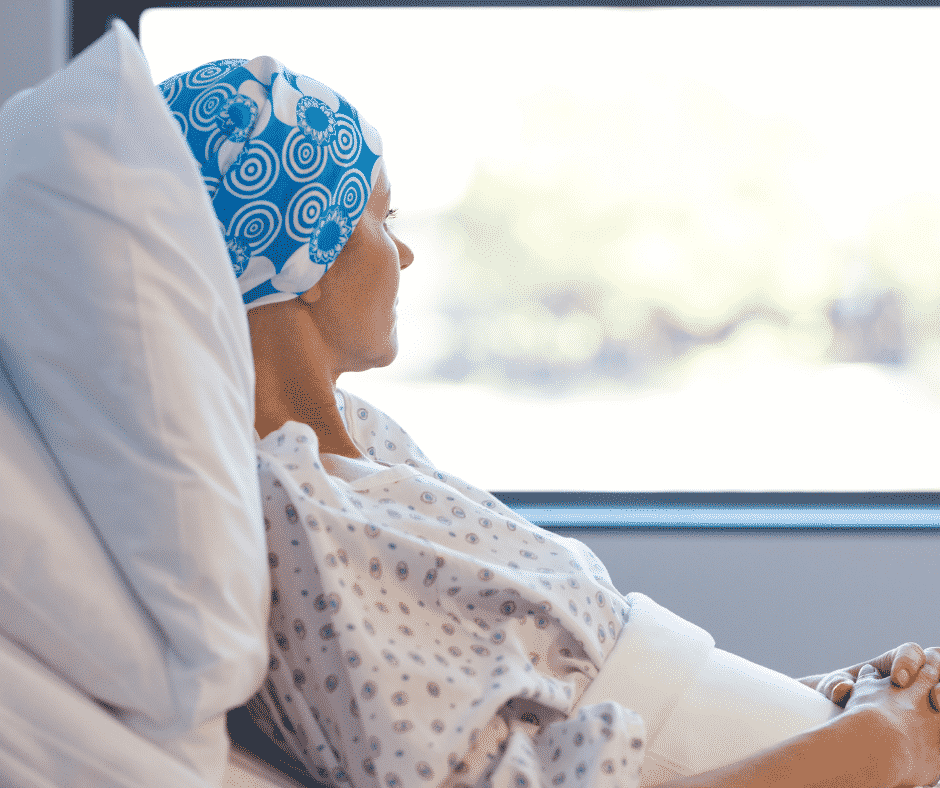

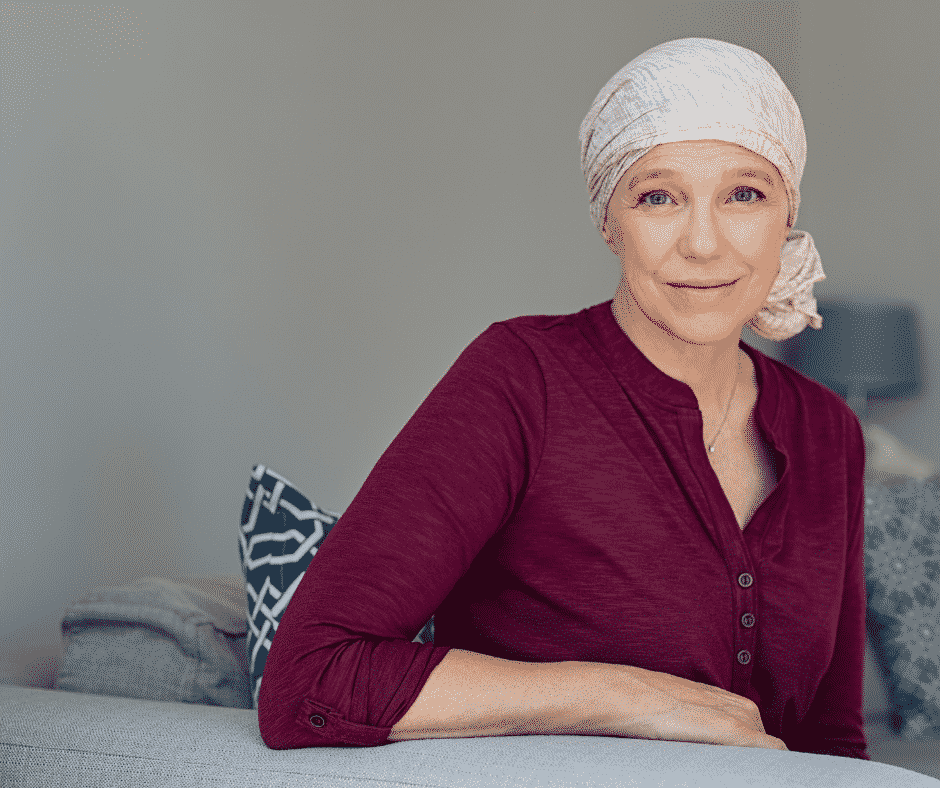

Hospice care focuses on providing comfort and support to individuals in the final stages of a terminal illness. The goal is to improve the quality of life for patients by managing pain and symptoms while offering emotional and spiritual support to both the patient and their loved ones. Hospice care can be provided in various settings, including skilled nursing facilities.

To be eligible for hospice care, a person must have a life expectancy of six months or less, as certified by a physician. This certification is required for Medicare coverage, which we will discuss further in the following sections. It’s important to note that choosing hospice care does not mean giving up on treatment altogether. It means shifting the focus to comfort and quality of life rather than curative measures.

Hospice care is a holistic approach that addresses individuals’ physical, emotional, and spiritual needs nearing the end of life. It provides a compassionate and supportive environment where patients receive specialized care tailored to their unique needs. Now that we have a basic understanding of hospice care, let’s explore how it relates to skilled nursing facilities and the coverage provided by Medicare.

Understanding Skilled Nursing Facility Care and Medicare Coverage

Skilled nursing facilities (SNFs) are residential facilities that provide round-the-clock nursing care for individuals requiring more intensive medical attention than they could receive at home. SNFs are equipped with trained healthcare professionals, including nurses and therapists, who can address the complex needs of patients. SNF care is often required when individuals have conditions that require ongoing medical monitoring, such as chronic illnesses or post-surgical recovery. Medicare covers certain SNF services, including skilled nursing care, rehabilitation therapy, and medications. However, it’s important to note that not all services provided in a SNF are covered by Medicare, and this includes hospice care.

Medicare Coverage for Hospice in a Skilled Nursing Facility

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, or a skilled nursing facility. However, there are specific criteria that must be met in order for Medicare to pay for hospice care in a skilled nursing facility.

The criteria are the same as for hospice. Firstly, the individual must be eligible for Medicare Part A, which covers inpatient hospital stays, skilled nursing facility care, and hospice care. Secondly, the hospice care must be certified by a Medicare-approved hospice provider. Thirdly, the individual must have a life expectancy of six months or less, as certified by a physician. Lastly, individuals must agree to forgo curative treatments for their terminal illness and receive only palliative care.

The SNF is not primarily providing hospice care. A hospice team coordinates with the SNF to provide the service in the SNF. The location of the hospice care is secondary. The SNF is a location, like the home.

However, there must be a Medicare-covered reason or treatment to be granted admittance to a skilled nursing facility. The SNF is primarily a medical facility for patients to get better. It is not a hospice facility providing room and board, housekeeping, bathroom transfers, etc.

Medicare Hospice Benefits for My Mom

The doctors diagnosed my mother with ovarian cancer in 2012. I was living in Kansas at the time. I wasn’t able to go on doctor visits with her. My brother, Paul, was taking care of my mom. I would get information about her situation, but it was spotty.

My mother was an ‘I’m in charge’ type of person. Phyllis determined the flow of information, and it was sparse.

Talking with your mother about her health when her mortality is so tightly fixed to it is hard. Looking back now, I was a chicken. Who wants to talk about saying goodbye? I didn’t realize the seriousness of her health situation until much later. I assumed she didn’t speak about her own death, and I didn’t know how to initiate the conversation. We were all in different forms of denial.

At the end of 2012, the doctors said there was nothing more to be done. I don’t think I fully grasped what that meant at the time. I also did not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

not anticipate how quickly time would slip away from that moment onward. I’m sure my mother was scared, but she didn’t let on. I stupidly didn’t realize the magnitude of the moment and how she was probably feeling. My own feelings and denial fogged the situation.

My mother was admitted to hospice care (Medicare Hospice Benefits Booklet).

Mom’s Terminal Illness

Nature, in its less than glorious side, took its course rapidly. My mother’s health deteriorated in a few short weeks.

Cancer is a painful disease. The healthcare personnel gave her various painkillers, but even as they did so, we all insanely talked about not wishing to cause addiction. The pain had its own mind.

At various times, my mother’s suffering would be such that she needed to go to the hospital. There, the doctors administered intravenous medications that were faster acting and stabilized her pain level.

During the last visit, it became clear that we could not care for her at home. My father, John Grimmond–who would pass away six months later–was not physically able to care for our mother. I was in Kansas, my other brother, Tom, was in Sioux Falls, and Paul was in Omaha but busy with his career and family.

My mother needed around-the-clock care. We asked, ‘Does Medicare pay for hospice in a skilled nursing facility?’ The real question was whether Medicare would pay for a skilled nursing facility while my mother died. Strictly speaking, Medicare does not pay for custodial care. Custodial care is bathing, feeding, toileting, etc. Medicare doesn’t cover room and board if you get hospice care while in a nursing home or a hospice inpatient facility. That is out of your pocket.

Qualifying for Skilled Nursing Facility Care while on Hospice

The staff at the hospital initially told us that our mother needed to go to a skilled nursing facility (SNF) because they recognized she required more care than we could provide. They informed us that Medicare would provide and pay for hospice care in the Skilled Nursing Facility, but the cost of room and board and custodial nursing care would not be covered, and they were correct. Medicare coverage for skilled nursing when you are in hospice is tricky.

skilled nursing when you are in hospice is tricky.

The fortunate occurrence, however, was the intravenous nature of my mother’s painkillers. Other than a hospital, you can only receive intravenous medication treatment in a skilled nursing facility. The nature of my mom’s treatment triggered a reason Medicare would accept her being admitted to a skilled nursing facility and pay for it.

Medicare does cover skilled nursing care after a qualifying hospital stay of 3-days or more. Intravenous medication administration also requires a skilled nursing facility. A home health care nurse showing up several times at home would not be adequate. Also, my mother needed physical therapy to improve her strength after the reaction to the pain. From Medicare Part A and Part B, there were sufficient reasons for Medicare to pay for her stay in the skilled nursing facility (SNF) while she was in hospice.

Does Medicare Pay For Skilled Nursing Care During Hospice?

Strictly speaking, Medicare does not pay for skilled nursing care because someone is in hospice, but other triggering events often cause Medicare to cover skilled nursing care.

For example, someone who is in hospice falls and breaks a hip. That situation would justify skilled nursing care. A person develops an infection or pneumonia that results in hospitalization. Then, they qualify for a skilled nursing stay.

How to Navigate the Medicare Coverage Process for Hospice in a Skilled Nursing Facility

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

Navigating the Medicare coverage process for hospice care in a SNF can be complex, but it can be made easier with the correct information and guidance. Here are some steps to help you navigate the process:

1. The first step is to consult with the individual’s physician to determine if they meet the eligibility criteria for hospice care in a SNF. The physician can provide the necessary certification and guidance through the process. He knows the triggering circumstances that justify a skilled nursing facility stay.

2. It’s important to choose a Medicare-approved hospice provider with experience providing SNF care. They will be able to guide you through the necessary paperwork and ensure that all requirements are met. The health professionals are very familiar with Medicare’s billing codes and protocols for admittance to a SNF.

3. If the individual is already receiving care in a SNF, it’s important to coordinate with the facility to ensure a smooth transition to hospice care. The SNF staff can provide valuable information and support during this process.

4. Familiarize yourself with Medicare’s costs and coverage for hospice care in a SNF. This will help you plan and make informed decisions regarding the individual’s care.

The professionals you deal with know the Medicare rules and the subtleties of maximizing coverage in different circumstances. Listen attentively to their guidance.

Common Misconceptions about Medicare Coverage of SNF During Hospice

Several common misconceptions exist about Medicare coverage for hospice care in a SNF. Let’s address some of these misconceptions and provide clarity:

provide clarity:

1. Medicare only covers hospice care in certain settings: Medicare provides coverage for hospice care in various settings, including inpatient hospice facilities, the patient’s home, and skilled nursing facilities. As long as the eligibility criteria are met, Medicare will cover hospice care in a SNF.

2. Medicare covers room and board in a SNF. As a rule, Medicare does not cover room and board in a SNF because the individual is receiving hospice care, though room and board may be covered because the patient is in the SNF for reasons other than hospice.

3. Medicare coverage for hospice care is limited to specific conditions: Medicare coverage for hospice care is not limited to specific conditions or illnesses. As long as the eligibility criteria are met, Medicare will provide coverage for hospice care in a SNF for any terminal illness.

4. Medicare coverage for hospice care is limited to a certain time frame: Medicare does not limit the duration of hospice care coverage in a SNF. As long as the individual meets the eligibility criteria, Medicare will continue to cover the necessary services.

Bottomline: Ensuring Quality Care and Coverage for Hospice in a SNF through Medicare

Maximizing Medicare coverage for hospice care in a skilled nursing facility is essential for ensuring quality end-of-life care. By understanding the eligibility criteria, coverage details, and navigating the Medicare system, you can advocate for yourself or your loved one and ensure all available resources are utilized.

Remember, hospice care is a compassionate and holistic approach that focuses on providing comfort and support during the final stages of a terminal illness. Medicare provides coverage for hospice care in a SNF, including room and board, medications, and necessary medical equipment. By staying informed and proactive, you can maximize Medicare coverage and ensure that the individual receives the care they need.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Burying a mother is one of those milestone events in our lives. While dealing with all the emotional, spiritual, and financial challenges that accompanied that moment, health care cost was not a burden to my family and me. Medicare and my mother’s Medicare plan took excellent care of her and us. I am grateful for the wonderful program and the insurance that worked with Medicare.

Phyllis Grimmond 1935-2013 R.I.P.

The Bottomline: Benefit Knowledge Makes for Maximum Benefits

At Omaha Insurance Solutions, we understand the importance of access to accurate and reliable information regarding healthcare

Christopher J. Grimmond

decisions. We aim to empower you with the knowledge and resources to navigate the complex world of Medicare coverage. It is important to know that Medicare pays for hospice care in a skilled nursing facility.

By maximizing benefits and ensuring quality care, we can make a difference in the lives of individuals and their loved ones during this challenging time. Call us at 402-614-3389 to ensure you have a Medicare plan protecting you and your loved ones. Speak with an experienced licensed insurance agent profession.

What Are Skilled Nursing Facilities?

All of us have strong memories of visiting the “old folks’ home.” Whether grandparents, relatives, or friends, we recall the smells, linoleum, long hallways, and institutional dormitory rooms. “Old folks’ homes” or nursing homes fall under the category of Skilled Nursing Facilities (SNF). Medicare covers skilled nursing facilities within limits.

Patients go to the SNF after surgeries to recover, from illnesses to heal, and from injuries to recover and strengthen. Skilled Nursing Facilities are for temporary treatment, not long term residential care or custodial care, like memory care. Other facilities, like senior living communities, assisted living, or senior care centers describe other types of facilities that assist seniors.

A skilled nursing facility provides highly skilled professionals, such as occupational therapists, physical therapists, registered nurses, speech therapists. The advantage of an SNF is these professions are available 24 hours a day for the patients. The level of care is very high but short term.

Post-Acute & Skill Rehab Services

Skilled Nursing Facilities are institutions that provide post-acute skilled nursing care and rehabilitation services. People sometimes confuse skilled nursing care with nursing home care because most of the time skill nursing usually takes place in a nursing home location. Medicare, however, doesn’t pay for “nursing home care”.

Skilled Nursing Facilities are institutions that provide post-acute skilled nursing care and rehabilitation services. People sometimes confuse skilled nursing care with nursing home care because most of the time skill nursing usually takes place in a nursing home location. Medicare, however, doesn’t pay for “nursing home care”.

Medicare covers skilled nursing facilities within specific parameters. Nursing home care is for individuals who have reached a point in life when they can no longer perform activities of daily living. This is referred to as custodial care. In other words, they cannot bath, feed, and dress themselves. Medicare will not pay for those services to be provided exclusively.

Skilled Nursing is for after surgery or acute illness, for example, hip surgery for a fractured hip or a stroke. A skilled nursing facility admits patients for a short period of time after being in the hospital to aid in their healing and/or rehabilitation. Hospitals are incredibly expensive, and a skilled nursing facility can provide the necessary treatment at a lower cost.

Medicare Criteria For Skilled Nursing Facilities

The tricky part about skilled nursing facilities is admittance. A skilled nursing facility requires patients to meet certain essential criteria for admittance and for Medicare to pay. This is the complex checklist:

- The patient must be admitted to a hospital as an “inpatient” for at least three consecutive days, not including the day of dismissal. She can’t be in the

hospital for “observation” for it to count for Medicare to pay.

hospital for “observation” for it to count for Medicare to pay. - Medicare mandates patient admittance to the skilled nursing facility within 30 days of discharge from the hospital. If problems arise later—past 30 days—the patient cannot go to the skilled nursing facility and have Medicare pay for it.

- Only a skilled nursing facility can provide the type of care necessary for the patient’s recovery. A skilled nursing facility would provide intense physical therapy for a hip injury or occupational therapy after a stroke. Going to the physical therapist’s office a couple of times a week would not be sufficient in those cases.

- A doctor, or appropriate medical professional, must certify that skilled nursing care is required for recovery.

- The patient must be treated for the same condition for which she was in the hospital.

There are nuances and exceptions to some of these rules. The list gives you a good idea about how skilled nursing fits into your Medicare health insurance. The Omaha, NE area has many quality Medicare certified facilities, and You can find them on the Medicare.gov website.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

People constantly ask me, ‘What should I do about Medicare?’ They are overwhelmed with all the brochures from insurance companies. They look through the 162 pages of the Official Medicare Handbook and are further confused. Some go to the Medicare.gov website, and are confounded in attempts to navigate through the endless ocean of information. They simply ask in bewilderment, “What does everyone else do?’ A huge number of people choose a Medicare supplement, or Medigap plan, as the solution, but more of an answer is needed than just ‘everyone is doing it.’ Some thoughtful consideration is required.

Part A Deductible

Medicare is a generous health plan. It covers a majority of the hospital and doctor costs, but there is some important exposure to be aware of. Medicare Part A covers the hospital, but only after you pay the deductible of $1,288. That deductible is not an annual deductible. It is per event within a 60 day period. While you would have to be very unlucky, very sick, or both, you could pay that deductible an endless number of times. That is your exposure.

Part B Co-Insurance

Medicare Part B covers 80% of the doctor and outpatient procedures. While that is quite generous, 20% of a big number is still a big number. Heart attacks, strokes, cancer treatment can run into the hundreds of thousands of dollars. Twenty percent of a $200,000 bill is $40,000. Most people would find that beyond the family budget.

MOOP

And with Part A & B, there is NO maximum-out-of-pocket (MOOP). In other words, you continue to pay as the bills roll in. You do not stop paying on deductibles and co-insurance if all you have is Original Medicare without anything else.

So comes the questions from clients: ‘What should I do about Medicare?’ Medicare supplements or Medigap plans fill in those gaps in Medicare. They cover the hospital deductibles and 20% co-insurance for doctor and outpatient use. Depending on how much you wish to cover, the Medigap plan can cover everything 100%, most of everything, or a potion. You choose. There are ten plans available.

12,200,000 Satisfied Medigap Clients

The fact that 22% of people on Medicare choose a supplement and stay on a supplement for 20-30 years tells you the level of satisfaction. There are currently 55,200,000 Medicare beneficiaries. Of that number 12,200,000 chose a supplement. That number grows each year: 9.7 million in 2010 to 12.2 million in 2015. The key number is that 9 out of 10 Medigap beneficiaries say that they are satisfied with their coverage and keep their coverage. Med Sup Conference Stats

While Medicare is a wonderful health insurance program for seniors, it doesn’t cover everything. You still have exposure to significant financial loss if you only have Medicare alone.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

One of the things that holds people back from purchasing a Medicare supplement is that they don’t know. That is, they don’t investigate what Medigap plans are, what the costs are, how much or little they cover. It is simple as making a phone call 402-614-3389. A quote will not cost you anything, but you will have some real, solid information for your decision making process. Take a couple minutes, answer a few questions, and you will be surprised how easily you can find out what you should do about your Medicare @ OmahaInsuranceSolutions.com.

Sheep get sheared. They follow the other sheep into the pen, down the shoot, then in to the hands of the shearer and are fleeced. The ram is a alert. He doesn’t go with the flow he leads the way and butts heads when he is force to go where he doesn’t want to go.

How do people pick their Medicare supplement plan and company? They talk with their buddy on the left and their buddy on the right. ‘They both can’t be wrong.’ Everyone says Plan F is “the best.” “I never have to pay anything”—no co-pays. That’s great! Sign me up. That is the thought process of the sheep. Insurance companies love it. Insurance agents love it. Plan F is the most expensive plan in all kinds of way.

There are ten possible Medicare supplement plan types that an insurance may offer–A–N. In reality, they usually only offer 4 or 5. Plan F is the most popular as well as the most expensive. Insurance companies and agents like that because it brings in the most money and pays the highest commission. But is it the best for a client?

Plan F does cover all the deductibles and co-insurance that Medicare doesn’t cover. That is nice, but you pay a price for that convenience. It raises the question whether Plan F is the best.

Is there an alternative? How about Plan G? Plan G is very close to Plan F. The difference is that you pay the Part B deductible of $147. It is a one-time annual deductible. Once you pay your Part B deductible of $147, for let’s say a doctor’s visit, you are done for the year. Everything else will be covered 100% which is similar to a Plan F. So why plan G? Because the premium is lower—quite a bit.

Let’s do some simple math. Let’s say that a plan F is $150 per month for a 65 year old male and a plan G is $110 for the same person. The difference is $40 per month and $480 per year less for the Plan G. Subtract the $147 Part B deductible, and you are still ahead $333. Putting it another way, you are paying $333 for the convenience of having the insurance company pay your Part B deductible so that you don’t have to write a check IF you go to the doctor or have some other procedure. Multiply that times 10 years and you are at $3,330.

The second and more important consideration about Plan G is that the rate increases are smaller and less frequent. Yes premiums go up because medical costs go up, but the unusual reality about Plan G policy holders is that they generally do not go to the doctor or emergency room as frequently as Plan F policy holders. There is something about the $147 deductible that causes people to pause and think. ‘Is this really medically necessary?’ The result is that, because Plan G policy holders do not over use medical benefits to the extent Plan F policy holders do, the claims and cost are not has high. Consequently the rate increases for Plan G’s are fewer and smaller than Plan F. Plan F is the best?

Don’t be a sheep. Don’t follow the herd. Stop and look at the different plans. Ask yourself the hard question in light of the facts whether Plan F is the best. Do some analysis, and you will save money in the short, long, and longer run.

402-614-3389; [email protected]

402-614-3389; [email protected]

Does Medicare Cover Cancer Treatment After Age 76

Does Medicare Cover Cancer Treatment After Age 76

My mother had her routine physical in Nov of 2011. There were many tests. One test came back positive for cancer. We were stunned. She had no symptoms. Everything was fine, we thought.

As the doctors performed more tests, they determined my mother had stage four ovarian cancer. The next week, she was in chemotherapy.

I learned a lot about Medicare and cancer after that. Yes, cancer treatment is covered by Medicare.

Medicare covered her cancer treatments, radiation treatment for cancer, and chemotherapy. She had a Medicare Supplement Plan F. Medically, everything was covered. My mother was 76. Medicare covers cancer treatment after age 76. There is no age at which Medicare will not cover radiation treatment for cancer or chemotherapy.

Cancer Is Scary, And So Are Medical Bills

The C-word is a scary word. I don’t know your relationship to the C-word. You may have had a family member or friend contract cancer? Did she die, recover, or is still struggling? Or maybe it was you?

Cancer is a dirty word that ignites intense feelings because you are fighting for your life.

You also realize there is a price tag, and you immediately begin to ask, ‘Is cancer treatment covered by Medicare?‘ ‘What will I have to pay?’

I suggest you ask yourself several serious questions about your Medicare health coverage.

- How much would you be willing to pay out of your pocket in a year–$2,000, $5,000, $7,550?

- How much would you be willing to pay to avoid paying hefty bills?

The cost of cancer is high, both emotionally in terms of pain and financially. I remember seeing some of my mother’s EOBs (Explanation of Benefits). There were no small bills.

Does Medicare Part A Cover Cancer Treatment?

Does Medicare Part A Cover Cancer Treatment?

Medicare Part A covers the hospital, and Part B takes care of doctors and outpatient services. You will not be in the hospital as an inpatient with cancer most of the time. The oncological treatments are done as an outpatient, but there may be instances when you need hospitalization.

My mother was admitted to the hospital during the year because the pain was too intense. The doctors needed to use intervenience medications to beat back the pain that was overwhelming mom. In those instances, Medicare Part A picked up the tab.

Medicare Part A also includes skilled nursing, home health care, and hospice, not just inpatient hospital.

After a 3-day stay in the hospital, a person may be admitted to skilled nursing for a number of reasons. The person can continue cancer treatment while in the skilled nursing facility, and Medicare Part A will pay. My mother did that toward the end.

Does Medicare Part B Cover Cancer Treatment?

Medicare Part B is where most patients will experience Medicare for cancer treatments. The doctors administer chemotherapy drugs through your veins in an outpatient clinic or doctor’s office. Some oral chemotherapy is administered in the doctor’s office, though more are moving toward self-administration. The doctors also give radiation treatments in an outpatient setting. Medicare Part B covers cancer treatment when administered in this way.

administer chemotherapy drugs through your veins in an outpatient clinic or doctor’s office. Some oral chemotherapy is administered in the doctor’s office, though more are moving toward self-administration. The doctors also give radiation treatments in an outpatient setting. Medicare Part B covers cancer treatment when administered in this way.

The doctors need to check on the progress of treatments, so Medicare Part B covers cancer treatment for diagnostic tests like X-rays and CT scans.

Cancer treatment is incredibly taxing for the person, so durable medical equipment is often needed. Medicare covers wheelchairs, walkers, and feeding pumps for cancer treatment.

When appropriate, surgeons will operate to stop or curtail cancer. You see this most often with skin cancer. Outpatient surgeries are likewise covered.

The strain is not only physical for the patient but mental. Counseling and other mental health support may be appropriate and would be covered by Medicare.

What Does Medigap Do to Cancer Costs?

What Does Medigap Do to Cancer Costs?

Beneficiaries on Original Medicare would be responsible for the Part A deductible and the Part B coinsurance unless they have a Medigap policy. Depending on the type of Medigap policy, it will come in and pay most or all of the remaining amounts. Regarding cancer treatments, Medigap policies, such as Plan G and Plan N, are very powerful in the amount of coverage, filling in the 20% Part coinsurance gap after the Part B deductible.

What Are Cancer Policies?

Medicare does not cover some benefits that may be helpful for people going through cancer treatment, like room and board in assisted living facilities, adult day care, long-term nursing home care, and services of daily living–bathing and feeding. Neither Medicare nor the Medigap policy will cover those expenses. Another type of insurance could be helpful in these instances–indemnity plans.

You should ask us about cancer policies.

Does Medicare Advantage Cover Cancer Treatment?

Each Medicare Part C (or Medicare Advantage) plan is unique. Looking at the Medicare Advantage plans in the Omaha Metro area, most cover cancer treatment at 80%. Beneficiaries will need to pay the 20% for chemo and radiological treatments for cancer. Your coinsurance payments will go against the maximum out-of-pocket for the particular plan, and because of the high cost of cancer treatment, it would not be unusual for you to reach the maximum out-of-pocket (MOOP). Each plan has a designated MOOP amount, for example, $4,900, $5,500, or even $6,700. Once the Medicare beneficiary reaches the MOOP, you pay no more. The Medicare Advantage plan covers everything at 100%. The MOOP, however, is a large expense for most people in a given year.

Drugs Are An Essential Part

Drugs Are An Essential Part

Medications are also an essential part of cancer treatment. Beneficiaries may purchase a stand-alone Medicare Part D prescription drug plan. Most Medicare Part C/Medicare Advantage plans have a Medicare Part D prescription drug plan included in the plan.

Part D covers some oral chemotherapy drugs not covered under Part B. Anti-nausea drugs and other prescriptions used in cancer treatment, like pain medications, will come under Part D.

Questions To Ask Yourself About Medicare & Cancer Treatment

There are two important questions I would ask myself about Medicare and cancer treatment in the Omaha metro area.

- How likely do you think you will contract cancer?

- How easily will you cover the costs out of your pocket?

The A merican Cancer Society says that the elderly are ten times more likely than younger people to get cancer. Medicare beneficiaries over age 65 account for 54% of all new cancer cases. Cancer is the leading cause of death among the elderly.

merican Cancer Society says that the elderly are ten times more likely than younger people to get cancer. Medicare beneficiaries over age 65 account for 54% of all new cancer cases. Cancer is the leading cause of death among the elderly.

While those are generalizations, you can further add your own analysis to the formula if you have had cancer. Cancer among family members raises your chance of you contracting cancer.

The reality is that there is a probability that you may develop cancer during your time on Medicare. What is your estimate of that probability?

The second question to consider is cost. There is no one number for the cost of cancer. It depends on the type of cancer, the number of treatments, the type of treatments, etc. But there are ranges.

A study by Avalere Health gives prices as low as $25,000 to as high as $45,000 for chemotherapy. What do you think of that cost?

Avalere Health gives prices as low as $25,000 to as high as $45,000 for chemotherapy. What do you think of that cost?

With Medicare, you will only pay 20% of the expense. Most of it will probably be covered if you have a Medigap policy. The relevant cost for a Medigap policy will be the ever-growing monthly premium.

A Medicare Advantage plan will guarantee you pay no more than the maximum out-of-pocket (MOOP). In 2022, the largest possible MOOP nationally is currently $7,550. The MOOP in the Omaha Metro area is about $4,500 on average.

Is that something you can afford?

Is that something you can afford?

Does Medicare Cover Breast Cancer, Prostate Cancer, and Lung Cancer Treatment?

Medicare does not make any distinction between the types of cancer. All cancer is covered by the customary treatments doctors and hospitals use to combat cancer.

The Wheel of Fortune Or Misfortune?

James Bond was so cool when I was growing up. When he would sit down at the Roulette table in the casino across from the pretty girl, I was rooting for him to win. But would you want to leave the cost of your health care to the spin of the wheel?

There are 37 slots in a roulette wheel–0-36. The numbers divide into the colors red and black. Predicting the color is much easier than choosing a winning number. The house takes it most of the time, but people keep playing! It is incredible.

There are 37 slots in a roulette wheel–0-36. The numbers divide into the colors red and black. Predicting the color is much easier than choosing a winning number. The house takes it most of the time, but people keep playing! It is incredible.

Most people will not get cancer, though a certain percentage will. Do you want to spin the wheel and take your chances that you won’t end up with back-breaking bills, or do you want to offload the problem?

You could purchase a Medicare Supplement for a reasonable monthly premium. The Medigap policy will cover the 20% that Medicare does not. You then can go to any of the excellent medical systems we have in the Omaha, Lincoln, and Council Bluffs metro area or anywhere in the country without concern about costs.

You could choose a Medicare Advantage plan that limits your maximum out-of-pocket to a manageable number, and you will pay very little or nothing beyond your Part B premium.

The choice is yours. Choose wisely.

My mother died on February 4, 2013. We worried a lot about her during the illness. There was fear, pain, and grief. I think about her daily and all she did for me to make me the man that I am. I pray for the repose of her soul. But during the trial that was her treatment and ultimately her death, there was no concern about medical bills. She had prepared.

pain, and grief. I think about her daily and all she did for me to make me the man that I am. I pray for the repose of her soul. But during the trial that was her treatment and ultimately her death, there was no concern about medical bills. She had prepared.

I talk to lots of people about Medicare. One gentleman told me about his $1,258.80 mistake. He signed up for Social Security and Medicare at sixty-five because he thought he had to. Started receiving Social Security. Got his Medicare Part A and Part B card. Started paying his $104.90 for Part B. At the end of the year, Jim sat down with him HR person to go over his health benefits. Jim planned to work until 68 because his wife didn’t work and was on his health insurance. He saw that he was paying a small amount for his family’s health insurance compared to most group health plans and getting excellent coverage. He asked his HR person what he needed Medicare for, especially since it was an additional expense of $1,258.80 per year. She informed him that he probably didn’t since his employer plan covered everything and he is not required to have Medicare Part B, if he has other creditable coverage. Jim was not happy, but the mistake he made is very common.

Medicare Part B, or not Part B. That is the question. People assume that they need to enroll in Medicare Part B because they are required to enroll in Medicare Part A at 65. Many people don’t understand the differences, the reasons, and the rules. Medicare Part A is for the hospital and don’t cost anything because it was paid for during your working years. Part B is for doctor and outpatient procedures. That does cost something—currently $104.90 per month. You still have a 20% co-insurance with that, but if you have other coverage that Medicare would deem creditable, you can delay enrolling in Medicare Part B. There will be no penalty. You may delay to avoid paying the premium and because the coverage that you currently have through an employer group plan is the same or better than what Medicare would offer. Or, you have a spouse that needs the employer group health coverage because that person is not eligible for Medicare yet.

Medicare Part B, or not Part B. That is the question. People assume that they need to enroll in Medicare Part B because they are required to enroll in Medicare Part A at 65. Many people don’t understand the differences, the reasons, and the rules. Medicare Part A is for the hospital and don’t cost anything because it was paid for during your working years. Part B is for doctor and outpatient procedures. That does cost something—currently $104.90 per month. You still have a 20% co-insurance with that, but if you have other coverage that Medicare would deem creditable, you can delay enrolling in Medicare Part B. There will be no penalty. You may delay to avoid paying the premium and because the coverage that you currently have through an employer group plan is the same or better than what Medicare would offer. Or, you have a spouse that needs the employer group health coverage because that person is not eligible for Medicare yet.

The question is: what should you do? Make a comparison. Get the details of your employer group health plan: premium, deductible, co-pays, co-insurance, and maximum-out-of-pocket. Once you have those numbers, then you will be able to make a side-by-side, apples-to-apples comparison between your group plan and your Medicare options. It may make more sense to go in the direction of Medicare and a supplement or Medicare Advantage than staying on your employer plan, or not. It all depends on a number of variables. I help people determine the direction that best fits their needs easily and quickly.

The question is: what should you do? Make a comparison. Get the details of your employer group health plan: premium, deductible, co-pays, co-insurance, and maximum-out-of-pocket. Once you have those numbers, then you will be able to make a side-by-side, apples-to-apples comparison between your group plan and your Medicare options. It may make more sense to go in the direction of Medicare and a supplement or Medicare Advantage than staying on your employer plan, or not. It all depends on a number of variables. I help people determine the direction that best fits their needs easily and quickly.

To B or not to B, that is the question. It requires a little homework and comparison so that you can make an informed decision that will get you the best coverage at the most reasonable cost.

Most people show up at the steps of Medicare without any idea about how to buy Medigap insurance. If they have health insurance company A at their work, they call up health insurance company A and buy their Medigap insurance from company A. They don’t shop, and most pay more without getting more.

Most people show up at the steps of Medicare without any idea about how to buy Medigap insurance. If they have health insurance company A at their work, they call up health insurance company A and buy their Medigap insurance from company A. They don’t shop, and most pay more without getting more.

Amateur Or Professional?

A few years ago, a friend of mine told me that he was going to finish off his basement himself. His wife wanted it done because she was going to host her large family for Thanksgiving that year. Tom thought he could save some money by doing it himself.

himself.

He figured out a design, went to the hardware store, and bought some lumber. It sat there for several months because he got busy with coaching the kids, work, and other projects. His wife got on him because there was a deadline. He started the project, but because he wasn’t an experienced carpenter, he made a few mistakes. The mistakes started adding up.

Mistakes are expensive. The deadline was looming. Finally, he called in a professional. The basement was done in six weeks, just in time for Thanksgiving. He also realized that the basement was much nicer than what he could have done.

What does this have to do with how to buy Medigap Insurance?

How Do You Find The Lowest Price?

A true insurance professional will show you how to buy Medigap insurance at the lowest cost for the coverage you want. He will have the knowledge and experience to better serve you than doing Medigap insurance yourself, visiting with a friend of a friend who does Medigap insurance part-time, or talking to someone in a call center thousands of miles away.

The benefits of working with an experienced and independent local Medigap insurance professional are that he or she understands the laws and regulations around Medicare in that state and county. The Medicare Handbook is over 150 pages. It takes a while to absorb all the regulations, and that is just from Medicare. Each insurance company has its underwriting guidelines, policies, and procedures. In other words, buying Medigap insurance is complicated.

And all of these organizations are run by humans, and humans make mistakes—lots of mistakes. Have you ever had an insurance company make a mistake that affected you? I’ve seen a few, and an experienced Medigap insurance agent can quickly and easily help you resolve snags that inevitably will arise when you’re trying to figure out how to buy Medigap insurance.

How Do You Buy Medigap Insurance With So Many Choices?

Showing you how to buy Medigap insurance means shopping for Medicare supplements and plans for you. In Nebraska or Iowa, there are over 30+ insurance companies offering hundreds of supplements, 20 Medicare Part C Advantage plans, and 28 Medicare Part D prescription drug plans, which all interact with Medigap insurance.

That is a tremendous amount of information, and prices and information are not easily available to persons not licensed and appointed with Medigap insurance companies. A truly independent agent will be able to show you all the plans and pricing, not just one company with a few plans or a handful of cherry-picked companies. Using sophisticated software, he or she can line up the Medigap insurance plans in your area down to the zip code, showing you how to buy Medigap insurance.

A Plan G is a Plan G

A dirty little secret that most people do not know is all the Medigap insurance plans are the same. By law and regulation, the plans are exactly the same.

“It’s important to compare Medigap policies since the costs can vary between insurance companies for exactly the same coverage . . . .” The Official U.S. Medicare Handbook: Medicare & You

A Plan G is a Plan G is a Plan G. The only difference is the price. An independent Medicare insurance broker should be able to line up all the Plan G’s and Plan N’s in a row from the least expensive to the most for you to see. How to buy Medigap insurance should be straightforward.

Lowest Price vs. Biggest Brand

While brands are not unimportant, saving money is more important. Some companies trade on their name. You pay more, but the Medigap insurance you buy does not cover anymore, pay any faster, or do anything extra.

There are other things to consider when you think about how to buy Medigap insurance. You will hopefully be using Medicare for twenty or thirty years. Picking a Medicare plan is not like getting a tattoo. It is not a one-and-done thing. Each year Medicare makes changes in rules. Medigap insurance policies go up in price because of age or rate increases. The insurance companies are constantly adjusting plans based upon Medicare, markets, inflation, pharmaceutical companies, etc.

Medigap Age & Rate Increases

How to buy Medigap insurance should also consider the history of age increases to the policy and rate increases. For an insurance company to stay alive, not to mention be profitable, it must be able to adjust its prices. The two ways an insurance company adjusts are through age and rate increases. An independent Medicare insurance broker should be able to show you the age increases. In other words, what will your Medigap insurance policy be at 66, 67, 68, etc.

An independent Medicare insurance agent should also have access to the history of rate increases. Some companies will increase their rates each year a little bit. Other companies will wait a couple of years. Those increases can be quite large. Either way, the price will go up. While past performance does not guarantee the future, you still get an idea of how any insurance company handles prices and inflation. With inflation over 4% this quarter, prices will definitely be going up.

How To Buy Medigap Insurance?

An experienced and independent agent lives in this world and can guide you through the changes to supplements and plans that are most beneficial to you. She can shop Medicare supplements each year and show you how to buy Medigap insurance at the lowest price.

New people are constantly recruited to sell Medigap insurance. Some last a few days, a few months, or a few years. Most do not last at all. The Medicare rules are confusing and unforgiving. Insurance companies follow strict underwriting guidelines and are constantly changing prices. Do you really want to do it yourself or entrust yourself to an amateur?

A Professional Will Show You How to Buy Medigap Insurance

The insurance companies will not give you a discount for going direct. When you do that—and the insurance companies love that—your agent is now whoever answers the 800-number you call. You will speak to a different person each time. That person may be in the insurance industry for two days, two months, or two years. You’ll never know. Or would you rather have an experienced and independent local insurance professional who will be your advocate for the next twenty or thirty years, to help you learn how to buy Medigap insurance? He can show you how to buy Medigap insurance at the best price for you.

for two days, two months, or two years. You’ll never know. Or would you rather have an experienced and independent local insurance professional who will be your advocate for the next twenty or thirty years, to help you learn how to buy Medigap insurance? He can show you how to buy Medigap insurance at the best price for you.

What Does Medicare Cover For Diabetics?

What Does Medicare Cover For Diabetics?

Diabetes is one of the fastest-growing medical conditions in America and can be one of the most costly conditions to treat. Diabetes costs for Medicare are important for Medicare beneficiaries to know.

According to the Center for Disease Control, there are currently 21.0 million Americans who have been diagnosed with at least one type of diabetes and millions more who have yet to be diagnosed. An additional 79 million people over age 20 living in the United States have blood sugar levels higher than usual but not high enough to be classified as pre-diabetic. With such dramatic numbers, it is no wonder that direct medical costs for diabetes treatment total over $176 billion each year. Nebraska and Iowa have their statistics. What Medicare covers for diabetics is critical for their sustained health and improvement.

What Does Diabetes Cost For Medicare?

Prevention and screening are high priorities for Medicare diabetes coverage. Medicare covers prevention programs and screening to detect pre-diabetic persons and high-risk individuals. Medicare can then more proactively treat and advise Medicare beneficiaries on how to avoid developing diabetes.

pre-diabetic persons and high-risk individuals. Medicare can then more proactively treat and advise Medicare beneficiaries on how to avoid developing diabetes.

For those with diabetes, Medicare covers insulin, anti-diabetic drugs, diabetes supplies, diabetes self-management training, nutritional therapy services, foot exams, blood testing mentors, and glaucoma exams.

Diabetes-related expenses can be a significant burden, especially for older Americans who rely on Medicare and government-funded healthcare systems. Unfortunately, Original Medicare (Medicare Part A and Part B only) will not cover diabetes costs 100% unless you have a Medicare supplement that may cover the remaining costs.

Not all Medicare Advantage Plans will completely cover testing or medications that help patients manage their diabetes, and even when coverage is extended, patients still face out-of-pocket expenses. Therefore, it is essential to read the Evidence of Coverage for your particular Medicare Advantage plan so that you understand Medicare diabetes prevention program billing and other services.

It is typical for Medicare Part B to cover blood glucose tests for diabetes screening, and two diabetes screenings each year for beneficiaries at high risk for diabetes, but drugs are not covered. As a result, patients are still often responsible for co-payments, office visit fees, and other expenses.

Part D Is the Achilles Heel of Medicare

On the other hand, Medicare Part D will generally help some patients cover the supplies needed to control diabetes by helping patients pay for insulin and blood sugar monitoring equipment. However, in nearly all situations, diabetes costs for Medicare do not cover the full cost of these expenses unless the individual has a supplement or is on Medicaid. Insulin and anti-diabetic prescriptions are costly and can quickly drive patients into the Part D gap (donut hole).

On the other hand, Medicare Part D will generally help some patients cover the supplies needed to control diabetes by helping patients pay for insulin and blood sugar monitoring equipment. However, in nearly all situations, diabetes costs for Medicare do not cover the full cost of these expenses unless the individual has a supplement or is on Medicaid. Insulin and anti-diabetic prescriptions are costly and can quickly drive patients into the Part D gap (donut hole).

When prospective clients come to my office, my heart drops slightly when they say they are on insulin or the well-known expensive anti-diabetic prescriptions. I know how expensive these medications can be, especially on a limited and fixed income.

What Kind of Diabetic Costs for Medicare Are Included?

Diabetes wears the body down, and there are lots of side effects. Diabetes may cause nerve damage to your feet. Part B covers a foot exam every six months by a podiatrist. Medicare might cover even more visits if you had a non-traumatic amputation of all or part of your foot.

Your doctor may order Hemoglobin A1c tests to determine your blood sugar levels over the past three months. Medicare will cover diabetic services such as that when prescribed by your doctor.

Glaucoma is another adverse side effect of diabetes. Medicare Part B pays for eye exams for glaucoma once a year, especially if you have retinopathy or a family history of glaucoma.

These are all efforts to curb the negative effects of diabetes and maintain the highest possible quality of life.

What Are the Medicare Diabetes Prevention Programs?

“An ounce of prevention is worth a pound of cure,” we’ve always heard.

The Medicare diabetes prevention programs begin with screenings. Diabetes screenings help detect early-stage or pre-diabetes in patients. Doctors can help their patients attack the causes when they can identify at-risk individuals. Medicare Part B covers diabetes screening tests when your physician prescribes a screening. Medicare may pay for as many as two diabetes screening tests in a 12-month period.

Symptoms like high blood pressure, a history of abnormal cholesterol and triglyceride levels, obesity, and impaired glucose tolerance, may indicate a higher likelihood of developing diabetes. Once identified, medical professionals can address the issue directly.

For those at risk, Medicare diabetes prevention programs may be in order. A once-per-lifetime behavior change program to help you prevent type 2 diabetes is covered by Part B. Medicare Advantage, which is Medicare delivered by a private insurance company, is highly motivated to keep its patients’ healthy. Diabetes is a costly disease, so Medicare Advantage plans are very generous with prevention services, especially diabetes. Read the Evidence of Coverage for your particular Medicare Advantage plan so that you understand Medicare diabetes prevention program billing and other services.

Prevention Program Criteria

Medicare establishes specific criteria your doctor must follow before prescribing a Medicare diabetes prevention program. You must have:

Medicare establishes specific criteria your doctor must follow before prescribing a Medicare diabetes prevention program. You must have:

- Part B (or a Medicare Advantage Plan).

- A fasting plasma glucose of 110-125mg/dL, 2-hour plasma glucose of 140-199

mg/dL (oral glucose tolerance test), or a hemoglobin A1c test result between

5.7 and 6.4% within 12 months before attending the first core session. - A body mass index (BMI) of 25 or more (BMI of 23 or more if you’re Asian). No history of type 1 or type 2 diabetes.

- No End-Stage Renal Disease (ESRD).

- Never participated in the Medicare Diabetes Prevention Program.

To be eligible for the program. You may pay nothing if you are eligible.

The program consists of a weekly core session over a 6-month period with a peer group. The topics covered are changing behavior around diet and exercise, weight control, motivation, group support.

After completing the initial core session, you will have a six-month follow-up program with monthly sessions to help you maintain the healthy habits you established in the core program. After the 6 month follow-up, you may qualify for an additional 12 month ongoing maintenance program if you have met personal weight loss outcomes.

How Does Medicare Help You Self-Manage Your Diabetes?

Once someone has diabetes, their situation can be managed and even improved. Medicare offers self-management training to help you learn how to control your diabetes successfully. Diabetes self-management training requires a doctor’s prescription. Diabetes self-management training falls under Part B, which is Original Medicare.

Like any program, you need to meet the prerequisites.

- You were diagnosed with diabetes.

- You changed from taking no diabetes medication to taking diabetes

medication, or from oral diabetes medication to insulin. - You have been diagnosed with diabetes and are at risk for complications.

Further, your primary care physician considers you at increased risk because of one or more of these conditions:

- Problems controlling blood sugar, have been treated in an

emergency room, or have stayed overnight in a hospital because of your

diabetes. - Diagnosed with eye disease related to diabetes.

- Lack of feeling in your feet or some other foot problems, like ulcers,

deformities, or have had an amputation. - Diagnosed with kidney disease related to diabetes.

Like most Medicare-covered services, the training program must be Medicare-certified and accredited by the American Diabetes Association or the American Association of Diabetes Educators.

Special Individual Training

The program is taught by specially trained healthcare professionals with a thorough knowledge of diabetes. Medicare covers up to 10 hours of initial training and 2 hours of follow-up training if necessary. They must complete the program within 12 months once it has begun.

The diabetes self-management training will cover:

- General information about diabetes, the benefits of blood sugar control, and poor blood sugar control risks.

- Nutrition and how to manage your diet.

- Options to manage and improve blood sugar control.

- Exercise and why it’s vital to your health

- Taking medications properly

- Blood sugar testing

- Foot, skin, and dental care.

Does Medicare pay for Diabetic Supplies?

Medicare Part B covers “durable medical equipment.” This category covers everything from CPAP machines to electric scooters. Diabetic supplies, like monitors, test strips, and lancets, fall under durable medicare equipment. Durable medical equipment even includes disposable items. Medicare covers diabetic supplies.

supplies, like monitors, test strips, and lancets, fall under durable medicare equipment. Durable medical equipment even includes disposable items. Medicare covers diabetic supplies.

With advances in diabetic technology, Medicare coverage of diabetes supplies includes new devices, like therapeutic continuous glucose monitors. The doctor, however, needs to make a case for you that a newer, more expensive device is medically necessary. In many cases, approval hinges on the doctor’s office making a case for the prescription. The prescription notes need to explain to Medicare or the insurer why the treatment would be beneficial to the health of the patient. In diabetes, especially, the insurance company and Medicare are trying to avoid more costly treatments that may result from further deterioration due to the illness. Even applying after a denial would be good. Sometimes it just takes a little more effort to get the best result.

So what diabetic testing supplies are over by Medicare?

Diabetes Test Strips Are Expensive!

I have learned a lot about diabetes over the years from my clients. They tell me in unambiguous and sometimes loud terms the cost of things like test strips. Syringes, insulin pens, needles, alcohol swabs, gauze, inhaled insulin devices, test strips are all covered. The issue is not usually coverage but cost. Depending on your supplement or Medicare Advantage plan, your supplies may be nothing to very little. That is why it is critical to know how your Medicare plan affects those particular areas and costs for your health.

I have learned a lot about diabetes over the years from my clients. They tell me in unambiguous and sometimes loud terms the cost of things like test strips. Syringes, insulin pens, needles, alcohol swabs, gauze, inhaled insulin devices, test strips are all covered. The issue is not usually coverage but cost. Depending on your supplement or Medicare Advantage plan, your supplies may be nothing to very little. That is why it is critical to know how your Medicare plan affects those particular areas and costs for your health.

Does Medicare Cover An Insulin Pump?

I am always delighted when someone tells me they use an insulin pump. I am happy for them because the insulin that goes with the insulin pump does not come under Medicare Part D. The insulin for the pump comes under Part B. Those clients with Original Medicare and a Medicare Supplement (Medigap) policy will pay little or nothing for their insulin. Insulin can be incredibly expensive.

Part B covers insulin pumps worn outside the body (external), including the insulin used with the pump. Insulin pumps are considered durable medical equipment. With a Medigap plan, the patient will pay little or nothing for the pump and insulin. Medicare covers insulin pumps and supplies. The insulin that goes with the pump is considered supplies. This is all contained in the Medicare insulin pump guidelines.

Medicare Covered Therapeutic Shoes Or Inserts for Diabetics

Medicare Covered Therapeutic Shoes Or Inserts for Diabetics

If you have Part B, have diabetes, and meet certain conditions, Medicare will cover therapeutic shoes if you need them.

The types of shoes Part B covers each year include one of these:

• One pair of depth-inlay shoes and 3 pairs of inserts

• One pair of custom-molded shoes (including inserts) if you can’t wear depth-inlay shoes because of a foot deformity, and 2 additional pairs of inserts

Doctor Certification for Therapeutic Shoes

For Medicare to pay for your therapeutic shoes, the doctor treating your diabetes

must certify that you meet these 3 conditions:

1. You have diabetes.

2. You have at least one of these conditions in one or both feet:

• Partial or complete foot amputation

• Past foot ulcers

• Calluses that could lead to foot ulcers

• Nerve damage because of diabetes with signs of problems with calluses

• Poor circulation

• A deformed foot

3. You’re being treated under a comprehensive diabetes care plan and need

therapeutic shoes and/or inserts because of diabetes.

Medicare also requires:

• A podiatrist or other qualified health care provider prescribes the shoes.

• A doctor or other qualified individuals like a podiatrist, orthopedist, or prosthetist fit and provide the shoes.

Are Medicare Diabetes Mail Order Suppliers Covered?

You can receive your diabetic supplies and medications through the mail. It is essential that the Medicare diabetes mail-order supplier be Medicare-certified and/or contracted with the Medicare Advantage plan. Insulin and anti-diabetic medications will usually come under Part D. The prescription drugs can be delivered by a stand-alone Part D plan or a Part C Medicare Advantage plan that includes prescription drug coverage. Prescription drug costs will be substantially different than those costs that fall under Part B. Check and confirm that company’s status before ordering, but mail-order is definitely an option.

Do Medicare Supplements Cover Diabetes?

The above discussion of Medicare coverage for diabetes has been reserved mostly to just Original Medicare (Part A and Part B). Medicare Supplements and Medicare Advantage add additional coverage but also another wrinkle to what is covered.

Medicare Supplements (Medigap) policies are simple because they are universal–the same everywhere. Plan G and Plan N are the most popular Medigap policies. Medigap covers whatever Medicare covers. They fill in the gaps in Original Medicare coverage. Under Part B, they take care of the insulin pump, and insulin for the pump, and durable medical equipment. Minus the Part B deductible, the Medigap policy almost completely covers any cost.

What Does Medicare Part C – Medicare Advantage Do For Diabetes?

Medicare Advantage plans all differ. Coverage varies from plan to plan and region to region. Reading the Evidence of Coverage that each plan has for the details of the plan is essential to find out how much is covered or not covered for things like orthopedic shoes, insulin pumps, diabetic supplies. I could describe the plans in the Omaha Metro area, but that may not apply to other areas.

What Does Medicare Drug Coverage Pay for Diabetic Prescriptions?

What Does Medicare Drug Coverage Pay for Diabetic Prescriptions?

Medicare drug coverage is very similar between stand-alone Part D and Medicare Part C plans that include drug coverage. Insulin and anti-diabetic medications are mostly very expensive unless you have EXTRA HELP. Depending on the amount and type of medication, the patient can easily be driven into the coverage gap (donut hole) and even to the catastrophic stage because of the cost. It hurts my heart when I am adding up all the medications knowing that the picture is not going to be pretty when meeting with a diabetic client. I’ve witnessed a lot of tears and fear because of the sometimes staggering drug costs.

You Need To Know Your Prices

Medicare coverage of diabetes and diabetics is comprehensive. The real question is the shared costs that beneficiaries pay out of pocket. Medicare supplies are limited. Prevention costs are very small if non-existent. The real challenge, even now after the Trump administration initiatives, is the cost of insulin and anti-diabetic medications.

For my clients who are on any expensive medications, I highly, highly encourage them to be in contact with me during the Annual Election Period (AEP) October 15th–December 7th when they can change their Part D prescription drug plan or Medicare Part C plan. Even if your medications do not change, the plan can change. You could go from paying very little for a medication to not being covered at all. An annual review is critical for those with high-end medications.

Talking with a licensed, knowledgeable, experienced insurance professional you trust is critical to get the correction information and prices to make informed decisions about your Medicare health coverage.

The Affordable Care Act (ACA) has left many Americans with questions, especially lately with many of the regulations going into effect for 2015. The ACA provides a Health Insurance Marketplace, designed to assist people who don’t otherwise have health coverage through their employer or otherwise. How does this all affect Omaha Medicare Recipients? The short answer is; nothing changes. If you currently receive Medicare, your choices and benefits remain the same. How so?

You can get more, for less. That’s right; if you are a Medicare recipient, you’ll be able to receive many types of preventive care at no additional cost, including services such as mammograms or colonoscopies. In addition, you’ll be able to receive one free wellness exam per year.

You’ll save money on prescription drugs. The “donut hole” that is part of the Medicare Part D program is a gap in your drug coverage that gives recipients 55% off of Part D-covered brand-name prescription drugs. This donut hole is steadily shrinking, and is expected to be closed by 2020, meaning recipients will only pay for 25% of their covered brand-name and generic prescription drugs.

Your Doctor will receive more support. The ACA has created new initiatives that support care coordination, ensuring that patients get the right care at the right time. As a result, your doctors will likely receive additional resources to ensure that your treatments are consistent.

Whether you receive Medicare through Original Medicare or an Omaha Medicare Advantage Plan, you will have the same benefits and security that you do now as a Medicare Recipient. Interested in learning more? Please contact Omaha Insurance Solutions at (855) 367-3631 to speak to a licensed insurance agent today.