Medicare Advantage PlansCategory:

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Medicare Advantage plans, or Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Parts A and B) and often include additional benefits such as prescription drug coverage and dental, vision, and hearing services.

We will delve into the specific circumstances in which a Medicare Advantage plan requires prior authorization and could potentially deny coverage, the appeals process for denied claims, and what steps you can take to ensure you receive the coverage you need. By understanding the ins and outs of Medicare Advantage plans, you can make an informed decision about your healthcare coverage. So, let’s unlock the truth together and navigate the world of Medicare Advantage plan prior authorization.

What is the Purpose of Prior Authorization?

Prior authorization (or Pre-Authorization) is a utilization management tool used to contain costs. It consists of a third party, usually employed by the insurance company, making determinations about a request for service. The third party, who may be a doctor, nurse, or non-medical staff, approves or denies a request based upon predetermined criteria.

• Is the service covered?

• Is it a duplicate?

• Does the request contain the proper codes and supporting documentation?

• Is the service “medically necessary” as defined by CMS’s standard of care?

The purpose of Medicare Advantage plans requiring prior authorization is to ensure that the medical procedures are necessary and that the payer (insurance company) and patient are not wasting money.

Health care involves a great deal of money. There are three primary interested parties: the patient, who wants to pay as little as possible, the doctor, who provides a service for a fee, and the insurance company, which protects the patient from overwhelming healthcare costs for a premium.

Each has different and conflicting interests. Each is making a cost-benefit analysis to determine if the activity is worth it.

The patient wants good care for minimal cost. The doctor wants to be paid as much as possible for skills and services rendered. The insurance company wants to provide protection at the lowest cost to itself to maximize profit. Each is attempting to protect its interests. The insurance company uses prior authorization to make sure the service is, in fact, medically necessary so it does not waste money on unnecessary services.

The tradeoff is that prior authorization creates a barrier that potentially delays care and adds to its cost. There is also the potential that needed healthcare is wrongly delayed or withheld.

Medicare Advantage Utilizes Prior Authorization

Like commercial health insurance your employer purchases for employees, Medicare Advantage requires prior authorization for a majority of procedures, tests, and treatments, especially the more costly treatments. If approval is not granted, the insurer does not pay. There is an appeal process; however, many do not utilize the appeal process.

Traditional Medicare does not employ utilization management tools like prior authorization except in a few instances. The lack of any supervision of the medical necessity of services and payments has resulted in some high-profile cases of fraud, waste, and abuse. The only mechanism to combat abuse is self-reporting, whistle blowers, and fraud hotlines.

Optimally, prior authorization deters patients from getting care that is not truly medically necessary, reducing costs for both insurers and enrollees. Prior authorization requirements, however, can also create hurdles and hassles for beneficiaries and their physicians and may limit access to both necessary as well as unnecessary care. It also adds the burden of expense to providers who pay staff to work with insurance companies through the prior authorization process.

Data suggests that Medicare Advantage members save an average of $1,965 per year in total health expenditures compared to fee-for-service Traditional Medicare. Medicare Advantage members have lower hospitalization rates and fewer readmissions than their Traditional Medicare counterparts.

Does Original Medicare Utilize Prior Authorization?

From its inception, Traditional Medicare (Original Medicare) has not used prior authorization. There was little, if any, oversight until the electric wheelchair scandal.

A Washington Post article published in August 2014 highlighted the massive fraud of Medicare’s resources. The article chronicled the sensational scams and trials of many Medicare swindlers. The outrageous theft of public funds and the massive fraud shamed CMS to amend its regulations to finally require pre-authorization for some “durable medical equipment,” i.e., electric wheelchairs.

Bureaucrats inside CMS admitted they knew how the wheelchair scheme worked as early as 1998. However, it was not until 15 years later that officials finally did enough to curb the practice significantly. Durable medical equipment—electric wheelchairs—is the only exception to the “reasonable and necessary” practice. They must be preapproved.

The Government Accountability Office (GAO) examined a prior authorization program that CMS ran in seven states in 20212. During the short duration of the program, Medicare saved $1.9 billion. The GAO recommended that CMS continue to study the subject and implement a prior authorization program for all of Original Medicare in its 2018 published study. CMS discontinued the program.

The Effect of Medicare Advantage Denials

The Effect of Medicare Advantage Denials

There may be severe consequences when a Medicare Advantage Organization (MAO) denies authorization for a procedure.

- Patient access to medical care is delayed or denied.

- Potentially, it results in the patient paying out of pocket for something Medicare should have covered.

- It causes an administrative burden for the patient and providers because they must devote resources to an appeal.

None of these have positive consequences and are a cause of frustration with Medicare Advantage for some.

How Common is Medicare Advantage Prior Authorization Denials?

The Kaiser Foundation examined CMS data from MAOs from 2021. They found that more than 35 million prior authorizations were submitted to Medicare Advantage insurers. Over 2 million prior authorization requests were fully or partially denied by the insurance companies.

The percentage of prior authorization requests and denials depends upon individual plans. They are not identical. Of the 2 million denials, some were partial denials, totaling 380,000.

Partial denials would be, for example, physical therapy sessions. The physician requests 10 sessions, but only 5 are granted. That leaves 1.6 million prior authorizations completely denied. The average for Medicare Advantage plans as a whole was less than 6 percent, with individual MAO falling slightly above or below that average.

How About Appeals of Prior Authorization Denials?

Each Medicare Advantage plan has an appeal process. Data from the same group revealed that only 11 percent (or 212,000) of appeals were made, including partially and fully denied requests. The insurance companies overturned 82 percent (or 173,000) of the appeals.

insurance companies overturned 82 percent (or 173,000) of the appeals.

The high number of repeals was cause for concern. Are Medicare beneficiaries being unjustly denied services? Are the insurance companies creating unfair obstacles to reduce costs?

The study’s data, however, do not describe in detail the causes of the denials. In general conversations with insurance carriers, the authors discovered that prior authorizations are denied for a number of common reasons.

- Incorrect coding and insufficient documentation

- Less intrusive or costly services were not first tried.

- The provider was not in the network

- Service is not covered

- Human error

All of these reasons may result in a denial of service, but the data does not identify the various causes, some of which are easily rectified upon review or appeal.

We have thousands of clients who call us when there are issues. I am amazed at how often the provider’s back office does not file the proper paperwork, use the correct codes, or include essential documentation such as X-rays or tests.

Then, when the pre-authorization is denied, the insurance company is blamed, and the subject is dropped. The back office is understaffed, doesn’t have the time, and doesn’t sufficiently understand the insurance company’s processes, so they cut their losses and move on to other cases. Sometimes, the provider moves on to the less costly treatment, knowing that it will be immediately approved.

How Many Are Denied Coverage Unnecessarily?

The Office of Inspector General (OIG) for the Department of Health & Human Services published a report in April 2022 regarding the denial of medically necessary services by some Medicare Advantage Organizations (MAO). The study discovered that MAOs denied services to Medicare beneficiaries on some MAO plans even though the prior authorization request did meet the standard for Medicare coverage rules.

The OIG study sample was taken from 15 of the largest MAOs during the week of June 1-7, 2019. The sample size was 500—250 prior authorizations and 250 denials of claims. Eventually, the number was reduced to 430 as the data was further sifted.

The OIG dug into the details of each of the 430 cases. In the course of the review of the cases, OIG found a conflict in the standards.

Conflict in Standards

CMS has its own guidance regarding the standard of care. The MAOs, however, have developed their own internal clinical criteria that go beyond Medicare coverage rules even though the case would pass CMS’s standards. In the past, CMS has left the MAOs to develop their own criteria where CMS is unclear. For example, a less intrusive or costly treatment may be required before a more expensive service is authorized by the MAO. Physical therapy may be more appropriate first before an MRI is prescribed.

Second, MAOs indicated that some prior authorization requests did not have enough documentation to support approval, yet OIG reviewers found that the existing beneficiary medical records were sufficient to support the medical necessity of the services.

On payment requests, the OIG found that the MAOs denied 18 percent of the cases that would have met the Medicare coverage and MAO billing rules. Most of these payment denials in the sample were caused by human error during manual claims processing reviews (e.g., overlooking a document) and system processing errors (e.g., the MAO’s system was not programmed or updated correctly).

In the end, OIG determined that 13 percent of the 250 prior authorization cases studied should not have been denied based upon CMS stands (or approximately 32 individuals).

How Many Denied Coverage Should Be Approved?

If we combine the two studies, Kaiser Foundation and Office of Inspector General for the Department of Health & Humana Services—we actually get an idea of who should have been approved.

The Kaiser Foundation consists of 35 million prior authorizations, with less than 2 million being denied, which is a 5 percent denial rate.

The OIG’s study discovered that only 13 percent of those denied should have been approved.

So, when we apply the average of 13% of wrongly denied prior authorization requests to the 2 million denials in the Kaiser study, that is approximately 260,000 individuals who should have been approved but were not out of 36 million prior authorization requests.

That means out of 36 million prior authorization requests, only 0.7 percent were wrongly denied coverage. In other words, 99.3 percent of prior authorizations are processed correctly.

I find that an incredibly high degree of accuracy.

Appeals and Reconsiderations for Denied Coverage

The appeals process for denied coverage with Medicare Advantage plans involves several levels, each with its own deadlines and requirements. Understanding these steps can help you navigate the process effectively and increase your chances of a successful appeal.

Redetermination

The first level of appeal is the “Redetermination” process. You must submit a written request to your Medicare Advantage plan within a specified timeframe, usually 60 days from the date of the denial letter. Include all relevant documentation and explain why you believe the service or procedure should be covered. The plan must review your appeal and provide a written decision within 30 days.

Reconsideration

If your appeal is denied at the redetermination level, you can proceed to the second level, known as a “Reconsideration.” This involves submitting a request to an independent review entity contracted by Medicare within 60 days of receiving the redetermination denial. The review entity will conduct a thorough review of your case, including any additional evidence you provide, and issue a written decision within 60 days.

Administrative Law Judge

If your appeal is still denied at the reconsideration level, you have the option to request a hearing before an administrative law judge (ALJ). This request must be made within 60 days of receiving the reconsideration denial. The ALJ will hold a hearing, either in person or by video conference, where you can present your case. The ALJ will issue a written decision within 90 days.

Medicare Appeals Council

If you are dissatisfied with the ALJ’s decision, you can further appeal to the Medicare Appeals Council. This request must be made within 60 days of receiving the ALJ’s decision. The council will review your case and issue a written decision.

Federal District Court

The final level of appeal is to seek judicial review in a federal district court. This step involves filing a lawsuit against the Medicare Advantage plan in a federal court. It’s important to consult with legal counsel if you reach this stage, as the process can be complex.

Bottom Line: Medicare Advantage Prior Authorization Is a Required Tool

No one writes a blank check. When money is being spent, there is oversight. When there is a lot of money from a lot of people, there will be a lot of accountability. The Medicare Advantage oversees that taxpayers’ and beneficiaries’ money is spent in accordance with the norms and procedures that CMS has laid down. Medicare Advantage requires prior authorization to protect resources and clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

Currently, no one has complete and adequate data to give an accurate idea of inappropriate Medicare Advantage denials, but the data and studies recently done show that the level of error is incredibly low.

Are you feeling lost and confused about Medicare Advantage prior authorization? You’re not alone. Navigating the healthcare system can be overwhelming, especially regarding insurance processes. But fear not—we are here to demystify it all for you.

Are you feeling lost and confused about Medicare Advantage prior authorization? You’re not alone. Navigating the healthcare system can be overwhelming, especially regarding insurance processes. But fear not—we are here to demystify it all for you.

This comprehensive guide will delve into everything you need to know about Medicare Advantage prior authorization. From understanding what it is, why it’s necessary to learn how it works, and the steps involved, we’ll break it down in simple terms. There will be no jargon, no confusing terms—just clear and concise information.

What is Prior Authorization?

Prior authorization is a process used by insurance companies to determine whether they will cover a specific medical procedure, treatment, or prescription drug. It is required for certain services to ensure that they are medically necessary and cost-effective.

Why is Prior Authorization Necessary?

Prior authorization prevents unnecessary medical procedures, reduces healthcare costs, and ensures patients receive appropriate care. Insurance companies can control expenses and ensure that resources are allocated efficiently by reviewing and approving or denying requests for certain healthcare services.

Problems With Medicare Advantage Prior Authorization

However, prior authorization can be complex and time-consuming. It requires healthcare providers to submit detailed information about the patient’s condition, medical history, and proposed treatment plan. The insurance company then reviews this information to determine whether the requested service meets its coverage criteria.

While prior authorization can be beneficial in some cases, it can also lead to delays in care and administrative burdens for both healthcare providers and patients. There are many elements, moving parts, and hands that touch a prior authorization request. Thus, the process is ripe for mistakes, misunderstandings, and delays. Understanding the process and requirements can help you navigate this system more effectively.

Prior Authorization Process for Medicare Advantage

Obtaining prior authorization for Medicare Advantage plans involves several steps. Here’s a breakdown of the process.

Consultation with Healthcare Provider

The first step is to consult with your healthcare provider. They will determine if the service or treatment you need requires prior authorization and initiate the process on your behalf.

Submission of Prior Authorization Request

Once your healthcare provider has determined that prior authorization is necessary, they will submit a request to your insurance company. This request includes all the necessary documentation, such as medical records, test results, and treatment plans. This is where I see problems arise. The doctor’s back office uses incorrect codes, forgets test results, and the doctor’s notes are missing essential language. Then, the request is denied.

Review by the Insurance Company

The insurance company will review the submitted request and evaluate the medical necessity of the service requested. It may also consider factors such as cost-effectiveness and alternative treatment options.

Approval or Denial

Approval or Denial

The insurance company will either approve or deny the prior authorization request based on their evaluation. If approved, you can proceed with the recommended treatment. If denied, you have the option to appeal the decision. The additional problem is the insurance company does not give a reason for the denial, so the provider is clueless about where to begin. The carrier is not required to give a reason, so the provider needs to commit more resources to find out what is needed or let it go.

Appeals Process

You can appeal the decision if your prior authorization request is denied. This involves providing additional documentation or evidence to support the medical necessity of the requested service. The insurance company will review your appeal and make a final determination.

necessity of the requested service. The insurance company will review your appeal and make a final determination.

It’s important to note that the prior authorization process may vary slightly depending on your specific Medicare Advantage plan and the services you need. For detailed information about the process, consult with your healthcare provider, insurance company, and Center for Medicare & Medicaid Services (CMS).

Standard Medicare Procedures & Services Requiring Prior Authorization

Prior authorization is typically required for certain medical procedures, treatments, and prescription drugs. While the specific requirements may vary depending on your Medicare Advantage plan, here are some standard procedures and services that often require prior authorization.

Prior authorization is typically required for certain medical procedures, treatments, and prescription drugs. While the specific requirements may vary depending on your Medicare Advantage plan, here are some standard procedures and services that often require prior authorization.

Specialized Surgeries

Complex surgical procedures, such as organ transplants or bariatric surgery, often require prior authorization. This ensures that the procedure is medically necessary and appropriate for the patient’s condition.

High-Cost Medications

Certain prescription drugs, especially those with high costs, may require prior authorization. This helps insurance companies manage expenses and ensure patients receive appropriate medications.

Imaging Tests

Advanced imaging tests like MRI or CT scans may require prior authorization. This ensures that these tests are necessary and will provide valuable information for diagnosis or treatment.

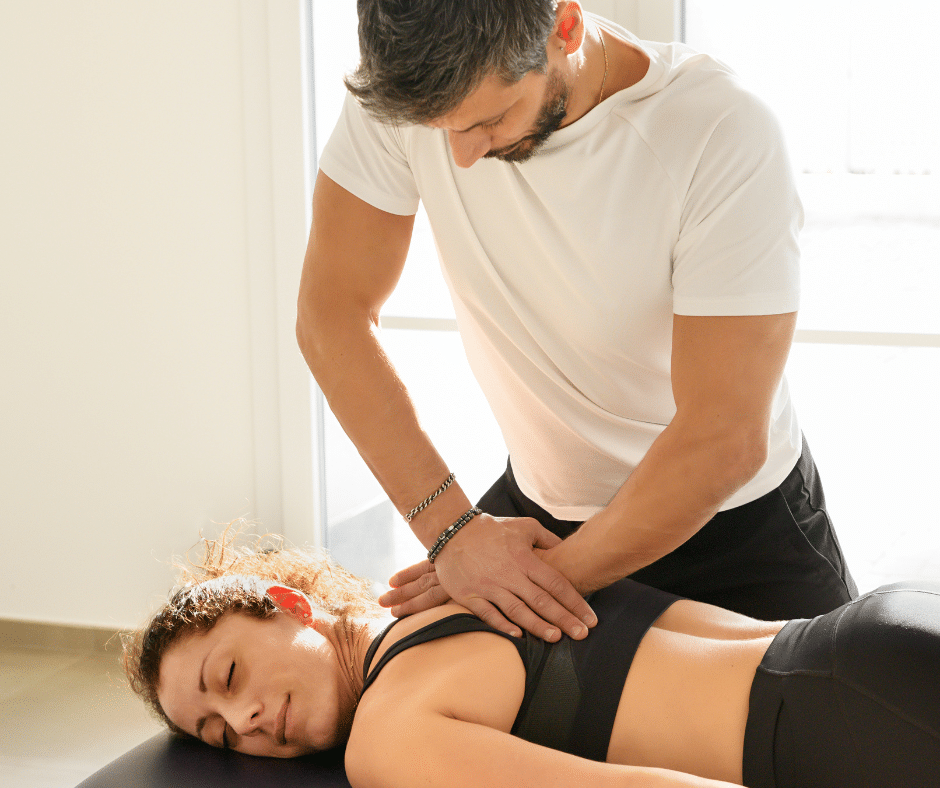

Physical Therapy or Rehabilitation Services

Medicare Advantage plans often require prior authorization for physical therapy, occupational therapy, or other rehabilitation services. This helps ensure that these services are appropriate and will contribute to the patient’s recovery.

I have found that skilled nursing facility care is very difficult to get approved, especially if the stay exceeds the initial twenty days. The impasse is a combination of the skilled nursing facilities (SNF) refusing to submit for a patient with a Medicare Advantage plan. Many SNFs will not even consider submissions for stays beyond twenty days. Some seem to not know how to properly submit a reauthorization or claim. From the insurance company’s side, their restrictions seem overly prohibitive. This has been a huge source of complaints to CMS and Congress.

Durable Medical Equipment

Durable Medical Equipment

Equipment such as wheelchairs, oxygen tanks, or home healthcare supplies may require prior authorization. This ensures that the items are medically necessary and will improve the patient’s quality of life. CMS has a significant history of fraud, waste, and abuse regarding durable medical equipment.

It’s important to check with your specific Medicare Advantage plan to understand which procedures and services require prior authorization. Your healthcare provider can also provide guidance based on your individual needs.

Benefits of Medicare Advantage Prior Authorization

While the prior authorization process can be perceived as burdensome, it offers some benefits for patients and insurance companies. Here are a few advantages of Medicare Advantage prior authorization:

- Cost control: Prior authorization helps insurance companies control healthcare costs by ensuring that services are medically necessary and cost-effective. This helps keep premiums affordable for all members.

- Appropriate care: Prior authorization ensures that patients receive appropriate care by evaluating the medical necessity of requested services. This helps prevent unnecessary procedures or treatments that may not be beneficial.

- Improved outcomes: By reviewing and approving requests for certain healthcare services, insurance companies can help ensure that patients receive the most effective and evidence-based treatments. This can lead to improved health outcomes and better quality of life.

- Resource allocation: Prior authorization helps allocate healthcare resources efficiently by ensuring that they are used for the most appropriate and effective services. This helps prevent overutilization of healthcare services and ensures that resources are available for those who need them.

While there are benefits to prior authorization, it’s important to acknowledge the challenges and drawbacks of the process as well.

Challenges & Drawbacks of the Medicare Prior Authorization Process

While prior authorization serves a purpose in the healthcare system, it has its challenges and drawbacks. Here are some common challenges that patients and healthcare providers may encounter.

Prior Authorization Administrative Burden

The prior authorization process can be time-consuming and requires healthcare providers to gather and submit extensive documentation. This administrative burden can take away valuable time that could be spent on patient care.

Dr. Jesse M. Ehrenfeld, M.D., president of the AMA (American Medical Association), says,

The need to right-size prior authorization has never been greater—mountains of administrative busywork, hours of phone calls, other clerical tasks that are tied to this onerous review process. It not only robs physicians of face time with patients, but studies show that it contributes to physician dissatisfaction and burnout.

Delayed Care

Prior authorization can sometimes lead to delays in care, as the review process may take time. This can be frustrating for patients who need immediate treatment or services.

Starting in 2026, CMS is shortening the time frames for prior authorization decisions. Insurance payers must respond within 72 hours for an expedited or urgent request and seven calendar days (not business days) for a standard request.

Denial of Coverage

Denial of Coverage

There is always a risk of prior authorization requests being denied. This can be disappointing for patients hoping to receive a particular treatment or procedure.

Lack of Transparency

Insurance companies may have different criteria and guidelines for prior authorization, leading to confusion and lack of transparency. Patients and healthcare providers may struggle to understand the reasons for a denial or how to navigate the process effectively.

Dr. Jesse M. Ehrenfeld, M.D. describes the problem of the lack of transparency with the insurance companies.

When a request is denied, we often don’t know why. We don’t tell you the reasoning behind the denial. It can take hours and hours to appeal a decision. And then sometimes you wait weeks or even months for a peer-to-peer consult.

The CMS final rule will require insurers to provide specific, very specific denial reasons and public reporting of metrics. How often do they approve? How often do they deny things? How long does it take for a process to actually give a result for a request?

Insurers will also be required to share that information with patients, so that our patients can become informed decision makers when they buy health insurance on the exchanges and make planned decisions. That’s going to begin in 2026 and will go a long way in bringing much-needed transparency and accountability to the entire process.

Appeals Process

While the option to appeal a prior authorization denial exists, it can be a lengthy and complex process. Patients may need to provide additional documentation and evidence to support their case, which can be challenging and time-consuming.

In the efforts to improve the Medicare Advantage prior authorization process, CMS will require, according to Dr. Ehrenfeld,

Plans to support an electronic prior authorization process that’s embedded in the physician’s electronic health records, bringing much needed automation and efficiency to our current very manual and very time-consuming workflow. That change is going into effect in 2027—it’s going to be a game-changer for everybody.

So having direct integration of prior authorization into the EHR (electronic health record) is going to significantly reduce the burden on physicians. And this is where so much of that $10 to $15 billion in savings is going to come from.

Despite these challenges, some strategies and tips can help you navigate the prior authorization process more effectively.

Navigating the Prior Authorization Process Effectively

Navigating the Prior Authorization Process Effectively

Navigating the prior authorization process can be overwhelming, but with the right strategies, you can streamline the process and ensure a smoother experience. Here are some tips to help you navigate prior authorization effectively:

Understand your Medicare Advantage Plan

Familiarize yourself with your Medicare Advantage plan’s specific requirements and guidelines. This will help you understand which procedures and services require prior authorization and what documentation is needed. This is important because you may have to be the force behind the doctor’s office to pursue approval beyond the initial request.

Communicate with Your Healthcare Provider

It is crucial to communicate openly and clearly with your healthcare provider. They can guide you through the prior authorization process, provide necessary documentation, and advocate for your needs. The office needs to see that you want the procedure or test because they have limited resources to pursue further requests or appeals from the insurance company.

Gather All Necessary Documentation

Before submitting a prior authorization request, ensure you have all the necessary documentation. This may include medical records, test results, treatment plans, and any additional information requested by your insurance company. If you can assist in the process, then dig in. You may also have to be the supervising authority to make sure the office’s back office submits all relevant materials.

Be Proactive

Start the prior authorization process as early as possible to avoid delays in care. Submit your request well in advance of your scheduled procedure or treatment to allow ample time for review. Doctor’s offices are usually overworked and understaffed. To ensure you are taken care of in a timely way, contact the office yourself to see where your prior authorization is in the process. Ask for dates when you should expect tasks to be completed by the doctor’s office and insurance company.

Keep Copies of All Documents

Make copies of all documents related to the prior authorization process, including your request, supporting documentation, and any communication with your insurance company. This will help you stay organized and provide evidence if needed for an appeal. The documents are your records. You and the insurance company paid for the tests, and you have a right to your own copies.

Follow Up with Your Insurance Company

Stay proactive and follow up with your insurance company to ensure your prior authorization request is processed. This will help you stay informed and address any issues or concerns in a timely manner. Everyone is busy. Balls are dropped. People forget. You make sure none of that happens with your case because you are on it.

How to Appeal a Prior Authorization Denial

If your prior authorization request is denied, you have the option to appeal the decision. Here’s a step-by-step guide on how to appeal a prior authorization denial.

- Understand the denial: Carefully review your insurance company’s denial letter. Understand the reasons for the denial and the specific requirements for appealing the decision.

- Gather additional documentation: If you believe that the denial was made in error or that additional information could support your case, gather all the necessary documentation. This may include medical records, test results, or a letter of medical necessity from your healthcare provider. Your provider will need to perform most of this work.

- Submit an appeal letter: Write a formal appeal letter to your insurance company. Generally the doctor will need to draft and submit the letter. He will need to more clearly state the reasons for your request, provide supporting documentation, and explain why you believe the requested service is medically necessary.

- Follow up with your insurance company: This is where you can help the process. Stay in contact with your insurance company to ensure your appeal is processed. Follow up regularly. You will be able to follow up more readily than the provider’s office. Get any additional information or documentation requested.

Remember, the appeals process may take time, and no approval is guaranteed. However, following these steps and providing compelling evidence increases your chances of a favorable outcome.

Bottom Line: Understanding Medicare Advantage Prior Authorization May Determine Your Success

In conclusion, understanding and managing Medicare Advantage prior authorization is crucial for both patients and healthcare providers. While the process can be complex and time-consuming, it ensures that healthcare services are medically necessary and cost-effective.

By familiarizing yourself with the prior authorization process, understanding your Medicare Advantage plan requirements, and effectively communicating with

your healthcare provider and insurance company, you can navigate this system with confidence and ease.

Remember to stay proactive, gather all necessary documentation, and be prepared to advocate for your needs. In the event of a denial, don’t hesitate to appeal and seek assistance if needed.

Empower yourself with knowledge and take control of your healthcare journey. With the right information and resources, you can successfully navigate Medicare Advantage prior authorization and receive the care you need.

Are you searching for a trustworthy Medicare Advantage plan insurance agent near you? Look no further! In this article, we will provide you with key tips and insights to help you find the right agent to meet your healthcare needs. Medicare Advantage plans offer additional benefits beyond the basic coverage of Original Medicare. Choosing the right plan can be overwhelming. So, who’s the trustworthy Medicare Advantage plan insurance agent near me?

Finding a trusted agent involves more than just a quick Google search. It requires careful consideration and research. We will guide you through the process, outlining important factors to consider when selecting an agent. From checking their credentials and experience to evaluating their customer satisfaction ratings, we will provide you with the tools you need to make an informed decision.

By the end of this article, you will clearly understand what to look for in a Medicare Advantage plan insurance agent near you. So, let’s dive in and find the perfect agent to help you navigate the complex world of Medicare Advantage plans.

Understanding Medicare Advantage Plans

Understanding Medicare Advantage Plans

Medicare Advantage plans, also known as Medicare Part C, are private health insurance plans that provide an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare. They combine the coverage of Medicare Parts A and B, and often include additional benefits such as prescription drug coverage, dental, vision, and hearing services, and wellness programs.

Medicare Advantage plans come in different types, including Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), and Special Needs Plans (SNPs). Each type has its own network of doctors, hospitals, and other healthcare providers. It’s important to understand the differences between these plan types and choose the one that best suits your needs.

The Importance of a Trustworthy Medicare Advantage Insurance Agent

Navigating the world of Medicare Advantage plans can be confusing. That is why working with a trustworthy insurance agent is crucial. A reliable agent can help you understand the complexities of different plan options, guide you through the enrollment process, and provide ongoing support for any questions or concerns you may have.

A trustworthy insurance agent is knowledgeable about Medicare rules and regulations, stays up to date with changes in the healthcare industry, and has a good understanding of the Medicare Advantage plans available in your area. They should be able to explain the pros and cons of each plan, and help you determine which plan aligns with your specific healthcare needs and budget.

Researching Medicare Advantage Insurance Agents Near Me

When searching for a Medicare Advantage plan insurance agent near you, it’s important to conduct thorough research to ensure you find a trustworthy professional. Here are some key steps to follow.

Checking for Licenses and Certifications

Checking for Licenses and Certifications

Start by checking if the agent is licensed to sell Medicare Advantage plans in your state. The agent should hold a valid insurance license and be authorized to sell Medicare products. You can verify their license status with your state’s insurance department or through the National Insurance Producer Registry (NIPR) website.

Local Department of Insurance Website

For Nebraska, you can go to the Nebraska Department of Insurance website. Once there, look at the tabs on the top of the page. Go to Policyholder. Under that tab, there is Agent/Company Search. Click Agent/Agency Search. Pick the state and choose the licensee. Type in the last name. You don’t need the agent number, but it helps, especially with common last names. There is your agent.

The importance of checking out an agent is you can quickly verify if he is licensed in your state. You can see how long he has held an insurance license. The date of the first activation will be there.

That may not be completely accurate, however. I noticed my activation date is 2012. I was first licensed in Nebraska in 2002, but I moved outside of Nebraska for a short time. My residence insurance license was not Nebraska, I was a non-residence licensed agent for Nebraska. Then, I returned in 2012 to Nebraska. So, the Nebraska Dept of Insurance site does not show the lifetime duration of a licensee.

Insurance Company Appointments

Toward the bottom of the page are the agent’s appointments. You must be licensed to sell insurance in a particular state. You must be licensed in each state you sell, and you must be appointed with each insurance company before you sell their products.

Medicare Certification

Insurance company appointments may require product training before you can be appointed. Sometimes you must pay a fee to be appointed. Insurance companies that offer Medicare Advantage plans require the agent to pass the AHIP exam. You only get three tries to pass the exam. If you fail the 3rd try, you cannot sell any Medicare Advantage plans or Part D prescription drug plans for any insurance company in any state.

After you pass the AHIP, you submit the certification to the insurance company. Then, you must pass the individual product training for each Medicare product you wish to sell. Again, there is a limited amount of time you can take the test to pass.

Then, the appointment paperwork is completed. Your appointment is listed on your state insurance department’s website. If not appointed, the agent cannot sell that company and/or product.

I recall meeting with a couple once whose financial advisor said he could get them any plan they wanted, including Medicare Advantage. I was suspicious because most financial advisors who offer financial advice as their primary business generally do not get deeply involved in Medicare. When I looked them up on the Nebraska Dept of Insurance, they were not appointed with any of the Medicare Advantage carriers in the area.

Reading Reviews & Testimonials

Online reviews and testimonials can provide valuable insights into the quality of service provided by the Medicare Advantage insurance agents near you.

I do not like to shop, so I use Amazon for a lot of my shopping. Once I know what I want, I look at star ratings and reviews. More and better reviews, the higher the chance I click on that product.

Look for reviews on reputable websites, such as Google, Facebook, or the Better Business Bureau. Pay attention to overall ratings, as well as specific feedback regarding the agent’s knowledge, responsiveness, and ability to help clients find suitable Medicare Advantage plans.

It’s important to note that while reviews can be helpful, they should be considered along with other factors. Negative reviews may not always reflect the agent’s true capabilities, as individual experiences can vary. Use reviews as a starting point for further investigation and gathering more information about the agent.

Referrals from Friends and Family

Reach out to friends, family members, or colleagues who have experience with Medicare Advantage plans. Ask them if they have worked with a trustworthy insurance agent and if they would recommend their services. Personal recommendations can be invaluable, as they come from people you trust who have first-hand experience with the agent’s professionalism and expertise.

Keep in mind that everyone’s healthcare needs are different, so while a certain agent may have been a great fit for someone you know, it doesn’t guarantee the same experience for you. Still, personal recommendations can help you narrow down your options and consider agents who have a proven track record of delivering excellent service.

Most of my new clients come from client referrals. The difference between referrals and prospects who come to us through other marketing avenues is usually night and day.

The trust level is already there because a trusted friend or family member referred them. The prospect starts learning about Medicare and the insurance products right from the start because they trust us. While we still work on building repertoire, there is enough trust present so they are listening attentively and learning what they need to know from the beginning. They can make much better decisions about their Medicare.

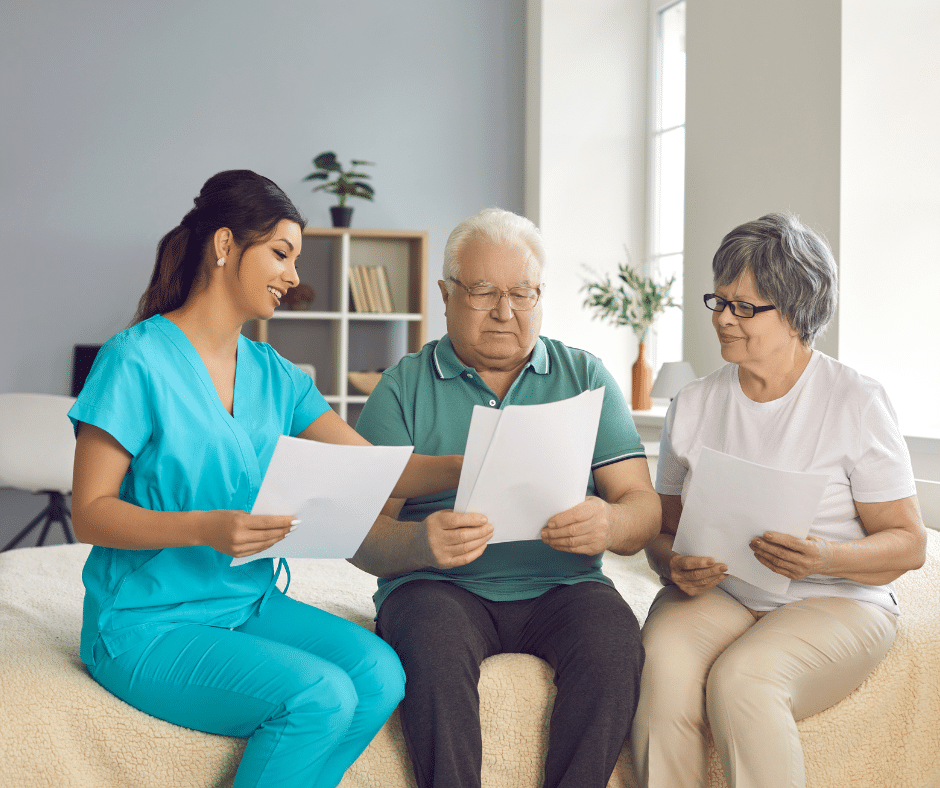

Meeting with a Medicare Advantage Insurance Agents Near Me

Meeting with a Medicare Advantage Insurance Agents Near Me

Once you have identified a few potential Medicare Advantage insurance agents near you, it’s time to schedule consultations to further assess their suitability. Meeting face-to-face or having a phone conversation allows you to gauge their expertise, ask important questions, and evaluate their communication skills. Trust is built not only upon believing the person has your best interest at heart. Trust is also built on competence. Does he know what he’s talking about?

During the meeting, pay attention to the agent’s ability to explain complex concepts clearly and understandably. They should be patient, attentive, and willing to address your concerns. Consider their level of professionalism, as well as their ability to listen and tailor their recommendations to your unique needs.

Do they show you the universe of Medicare Supplements, Medicare Advantage plans, and Medicare Part D Prescription Drug plans in your area? Or do they go immediately to only one or two companies? Or do they only do Medicare Advantage or only offer Medicare Supplements?

You want an independent agent or broker who represents most companies and plans in your areas and can objectively and impartially present all your Medicare options. Then, he can take you through the process of matching the various plans and their benefits to your unique needs and concerns. One size does not fit all.

Questions to Ask a Medicare Advantage Insurance Agent

To ensure you make an informed decision, it’s essential to ask the right questions during your meetings with potential insurance agents. Here are some basic questions to consider:

- Can you explain the different types of Medicare Advantage plans available in my area?

- How do these plans differ in terms of cost, coverage, and network of providers?

- What additional benefits can I expect from the Medicare Advantage plans you recommend?

- How do I know if my preferred doctors and hospitals are included in the plan’s network?

- What prescription drug coverage options are available?

- Can you provide an estimate of the monthly premiums, deductibles, and out-of-pocket costs for the plans you recommend?

- How do I qualify for extra help with Medicare costs, such as the Low-Income Subsidy?

Asking these questions will help you gain a better understanding of the agent’s knowledge, expertise, and ability to find a plan that meets your healthcare and financial needs.

Comparing Quotes and Plans

After meeting with several insurance agents and gathering information, it’s time to compare the quotes and coverage options they have provided. Keep in mind that the lowest premium may not always be the best option, as it’s important to consider factors such as deductibles, copayments, and the network of providers.

After meeting with several insurance agents and gathering information, it’s time to compare the quotes and coverage options they have provided. Keep in mind that the lowest premium may not always be the best option, as it’s important to consider factors such as deductibles, copayments, and the network of providers.

Evaluate the coverage options based on your specific healthcare needs. Consider factors such as prescription drug coverage, access to specialists, and the availability of preferred hospitals or healthcare facilities. Consider the estimated out-of-pocket costs for each plan, including copayments, coinsurance, and deductibles.

Enrolling in a Medicare Advantage Plan with Your Local Agent

Once you have thoroughly researched and compared the different Medicare Advantage plans and insurance agents, you should have at least a couple of names to answer the questions: who’s the trustworthy Medicare Advantage plan insurance agent near me?

Contact the chosen agent and inform them of your decision. They will guide you through the enrollment process, ensuring that you understand the terms and conditions of the plan you have selected.

Remember to review all the relevant documents, including the Summary of Benefits and the plan’s provider directory. If you have any doubts or questions, don’t hesitate to reach out to your agent for clarification.

At Omaha Insurance Solutions, we have taken thousands of clients over the years through the process of understanding and selecting the Medicare plan that best fits their needs, and each year, we review that

Christopher Grimmond

plan to make sure it still meets their needs.

Give us a call at 402-614-3389 for a free, no-obligation consultation to find out your Medicare options.

Are you ready to unlock the potential benefits of Medicare Advantage in your area? Look no further. This informative article will explore the advantages of Medicare Advantage plans and how they can enhance your healthcare coverage.

Are you ready to unlock the potential benefits of Medicare Advantage in your area? Look no further. This informative article will explore the advantages of Medicare Advantage plans and how they can enhance your healthcare coverage.

Medicare Advantage, also known as Medicare Part C, goes beyond what Original Medicare provides. With a Medicare Advantage plan, you can enjoy additional benefits like prescription drug coverage, dental care, and vision services in one convenient package. But that’s not all – some plans even offer fitness memberships, transportation services, and telehealth options.

By delving into the specifics of Medicare Advantage, we’ll help you understand how these plans work, what they cover, and whether they align with your unique healthcare needs. We’ll also examine how you can find the right plan for you in your local area.

Don’t settle for one-size-fits-all healthcare coverage. Discover the customized benefits and added features that Medicare Advantage plans can offer. Read on to learn more about the advantages waiting for you right around the corner.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of health insurance plan offered by private insurance companies that contract with Medicare. These plans provide an alternative way to receive your Medicare benefits, combining the coverage of Parts A (hospital insurance) and B (medical insurance) and often including additional benefits not covered by Original Medicare.

One key characteristic of Medicare Advantage plans is that they are required to provide at least the same level of coverage as Original Medicare. However, many plans go above and beyond. They put a cap on spending. Original Medicare is unlimited. There are small copays for services. Original Medicare Part B is an unlimited 20%. Part D prescription drug plans are usually included. With Original Medicare, you must purchase a separate Part D plan. Many Medicare Advantage plans have no deductible for the prescription side of the plan in the Omaha, Lincoln, & Council Bluffs areas. Most of the Part D plans have a large deductible. The most common deductible for 2024 is $545. Medicare Advantage offers additional benefits such as dental care, vision services, and hearing aids. That would be a separate policy and monthly premium on Original Medicare.

In summary, Medicare Advantage plans offer a comprehensive and convenient way to receive your Medicare benefits, often with added benefits not available through Original Medicare alone.

Medicare Advantage Enrollment & Eligibility

Now that we’ve explored the benefits of Medicare Advantage let’s discuss how you can enroll in a plan and determine your eligibility.

To be eligible for Medicare Advantage, you must meet the following criteria:

- You must be enrolled in both Medicare Part A and Part B. You still must continue to pay your Medicare Part B premium.

- You must live in the service area of the Medicare Advantage plan you wish to enroll in. If you leave that area, you will be disenrolled. You will then need to enroll in another plan in your new area in a timely manner.

Once you meet these eligibility requirements, you can enroll in a Medicare Advantage plan during specific enrollment periods.

- Initial Enrollment Period (IEP) occurs when you first become eligible for Medicare, typically three months before your 65th birthday, the month of your 65th birthday, and three months afterward.

- Annual Enrollment Period (AEP) takes place from October 15th to December 7th each year, during which you can switch or enroll in a Medicare Advantage plan.

- Special Election Periods (SEP) occur for special circumstances. For example, you move out of the service area. Another common SEP is when you lose employer health coverage. There are many others.

It’s important to note that Medicare Advantage plans may have different networks of doctors and healthcare providers, so it’s essential to confirm that your preferred healthcare providers are included in the plan’s network before enrolling. Each area has its unique circumstances.

Medicare Advantage in the Omaha, Lincoln, & Council Bluffs areas is exceptionally good when it comes to networks. There are four provider networks: CHI (Catholic Health Initiative), Methodist Health Systems, Nebraska Medicine (UNMC), and Bryan Health. All of these networks work with the six insurance companies with Medicare Advantage contacts in the area.

Original Medicare vs. Medicare Advantage

Original Medicare vs. Medicare Advantage

Original Medicare is only Part A for hospital and Part B for doctor visits and outpatient services. Part A currently has a deductible of $1,632 for an event in 60 days. Part B is a 20% coinsurance that is unlimited.

Medicare Advantage covers the same as Part A & Part B, but there is a maximum out-of-pocket (MOOP). The MOOP is potentially $8,850 in-network and $13,300 out-of-network. These amounts are the maximum cap a plan can have. All Medicare Advantage plans MOOPs in Omaha, Lincoln, and Council Bluffs are much lower. The most popular plan MOOP is $3,800.

Medicare Advantage plans have small copays for various services. For example, doctor visits maybe 0-$10, emergency rooms $120-$135, and outpatient surgeries $250-$350. All of the copays go against the maximum out-of-pocket (MOOP).

How to choose the Right Medicare Advantage Plan for You

With numerous Medicare Advantage plans available, choosing the right one that meets your healthcare needs is crucial. Here are some factors to consider when selecting a Medicare Advantage plan:

Medications Covered

Run your medications through the various software available, including the Plan Finder on the Medicare.gov website. Make sure your medications are on the formulary. Look for the plans with the lowest total copays for your medications.

Provider Network

Medicare Advantage is managed care, so there are networks, versus Original Medicare, which is fee-for-service (FFS). Check to make sure your doctors and hospitals are in the plan network.

Medicare Advantage is managed care, so there are networks, versus Original Medicare, which is fee-for-service (FFS). Check to make sure your doctors and hospitals are in the plan network.

We are fortunate to have strong network affiliations with the Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs. There are four networks: CHI, Nebraska Medicine, Methodist Health Systems, and Bryan Hospital. All six Medicare Advantage companies in our area work with these networks. However, we still check to confirm providers are in the network.

Maximum Out-of-Pocket in Budget

The maximum out-of-pocket is the most you must pay in a calendar year. Does that amount work in your budget? A Medicare Supplement coupled with Original will cost approximately $2,000-$3,000 per year, depending upon your age and location. You will pay the monthly Medicare Supplement premium regardless of any medical expenses. With an Advantage plan, you only pay copays if you see a doctor or have something done medically.

HMO vs. PPO

Medicare Advantage plans that are Health Maintenance Organizations (HMO) will only pay for services provided in the plan’s network. That is the limitation. When traveling, you are covered anywhere for an emergency.

Medicare Advantage plans that are Preferred Provider Organizations (PPO) cover services in and out of the network. Out-of-network care providers who accept Medicare but are not in the local service area network are covered. Those providers may charge more, and the maximum out-of-pocket expenses are usually larger.

PPO plans are best for people living in multiple locations or with limited local network coverage. Again, a PPO Medicare Advantage Plan has no real advantage in the Omaha, Lincoln, and Council Bluffs areas because all providers are in the four local networks.

Many insurance companies with Medicare Advantage contracts also have national networks. That means you can access doctors and hospitals in other parts of the country far from home, still be in the network, and pay in-network copays. It is always important to confirm a provider’s status before seeking treatment. I have had a number of clients leave the Omaha area and go to facilities in other states while on their HMO Medicare Advantage plan and pay in-network copays.

Copays

Copays

To explore the Medicare Advantage plans available in your area, you can use the Medicare Plan Finder tool on the official Medicare website (medicare.gov). This tool allows you to enter your zip code and compare the different plans offered in your local area.

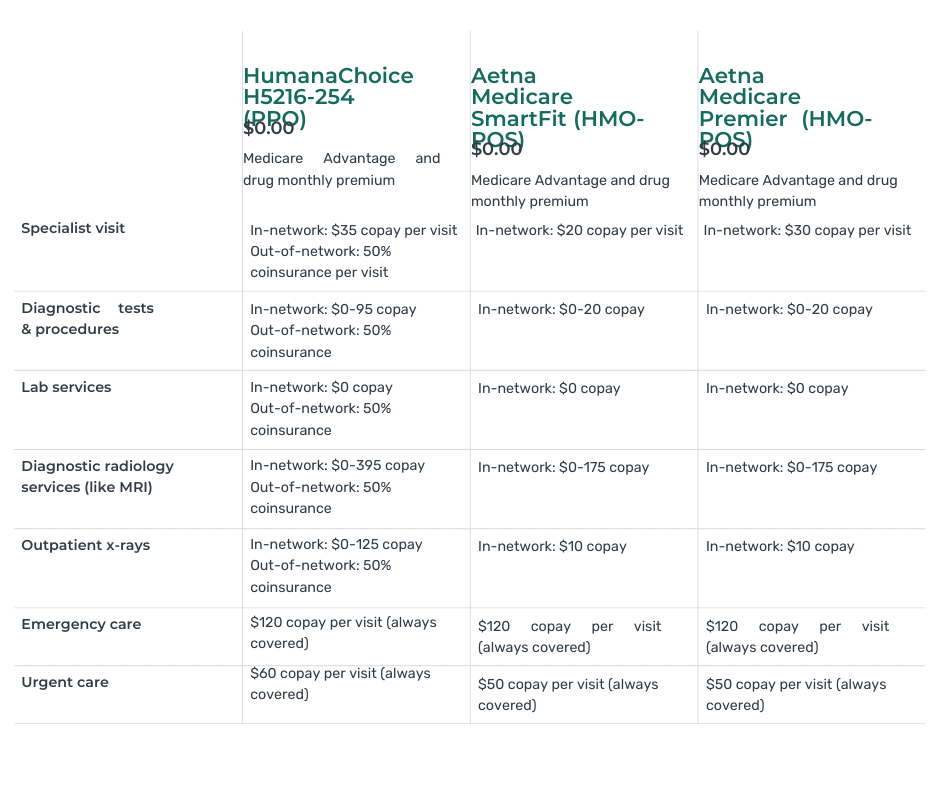

The Medicare Advantage comparison tool is helpful when looking at copays. There are many plans, and copays differ from plan to plan and service to service. If you are looking through company sales brochures, you will become cross-eyed. A comparison tool, either at Medicare.gov or through an insurance agent you are working with, will make the review process much more manageable.

Over the years, I have listened to many clients voice their opinions on which copays are more important than others. I try to make clients aware of essential copays and the differences between the plans. They come to their own conclusions and rankings for the plans based on what they see.

Additional Benefits

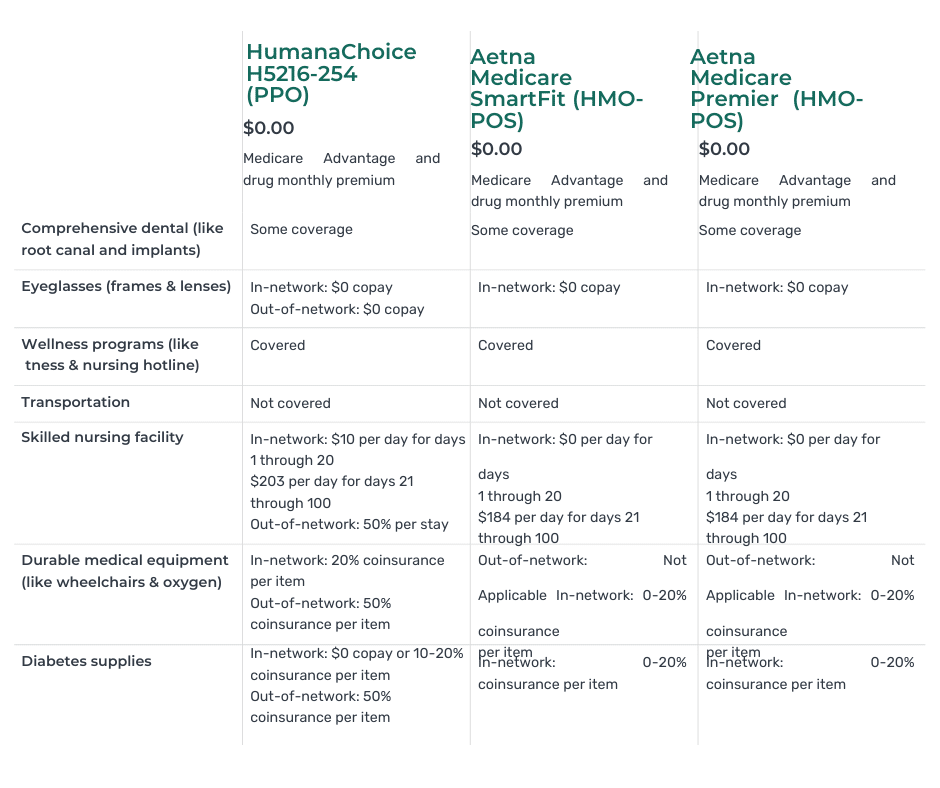

The big attraction of Medicare Advantage is the additional benefits. It is interesting to listen to clients’ comments and compare the additional benefits between plans. Those who don’t wear glasses pass over that benefit, and those who have issues with their teeth will laser focus on the size of the dental benefit and the network.

Over-the-counter (OTC) benefits are getting a second glance this year because some companies reduced their amount, and another company kept it comparatively large. When the plans are very similar in terms of all other benefits, one benefit, like OTC, can make the deciding difference.

Once you have covered these essential aspects of the plans in your area, you should have a feeling about which plan (or plans) best address your needs. Going through this checklist will narrow your selection to a plan or couple of plans that will serve you best.

Exploring Medicare Advantage Plans in Your Area

Some large metro areas have many, many plans. In the Omaha area, we have six insurance companies that offer 27 Medicare Advantage plans in the Nebraska counties of Douglas, Sarpy, Washington, Cass, Saunders, and Lancaster, and five insurance companies offer 26 plans in Pottawatomie County in Iowa.

Some large metro areas have many, many plans. In the Omaha area, we have six insurance companies that offer 27 Medicare Advantage plans in the Nebraska counties of Douglas, Sarpy, Washington, Cass, Saunders, and Lancaster, and five insurance companies offer 26 plans in Pottawatomie County in Iowa.

So there is an excellent variety. The complaint I hear quite often is that there are too many choices. The large number of plans and the different copay amounts and benefits are overwhelming and make the selection process confusing for many of my clients.

If an independent agent lives and works in the area, he should be able to compare and explain most plans. One of the problems I have with agents out of call centers in Florida, California, or the Philippines is that they do not know the local area and the plans because they don’t live here. They are unaware of the subtle differences between the companies and plans. The telesale agent has no lived experience or history with the Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs.

Their primary concern is to switch you into the plan they are selling so they get paid. If there are problems later, they will not be there to answer your calls. They may not even be in the business after Open Enrollment.

Bottom Line: Is Medicare Advantage Right for You?

Medicare Advantage plans offer a wealth of benefits and added features that can enhance your healthcare coverage. From additional benefits like prescription drug coverage and dental care to added perks like fitness memberships and telehealth options, Medicare Advantage plans provide a comprehensive and convenient way to receive your Medicare benefits.

When considering Medicare Advantage, it’s important to carefully compare the plans available, review their coverage and benefits, and consider your specific healthcare needs. Doing so lets you choose the right Medicare Advantage plan that aligns with your preferences and provides the coverage you require.

Unlock the potential benefits of Medicare Advantage in your area. With over two decades of experience at Omaha Insurance Solutions, we know the Medicare Advantage plans well in Nebraska & Iowa. We can guide you through the selection process.

With the right plan, you can enjoy comprehensive benefits, cost savings, and a more convenient healthcare experience. Take control of your healthcare today and call us at 402-614-3389 to speak with an insurance agent professional to explore the possibilities of Medicare Advantage.

With the right plan, you can enjoy comprehensive benefits, cost savings, and a more convenient healthcare experience. Take control of your healthcare today and call us at 402-614-3389 to speak with an insurance agent professional to explore the possibilities of Medicare Advantage.

Are you looking to maximize your healthcare coverage? In this article, we will explain the benefits of Medicare Advantage Part C, helping you make informed decisions about your healthcare options. Medicare Advantage Part C offers an alternative to traditional Medicare coverage, providing additional benefits and services to enhance your overall healthcare experience.

Are you looking to maximize your healthcare coverage? In this article, we will explain the benefits of Medicare Advantage Part C, helping you make informed decisions about your healthcare options. Medicare Advantage Part C offers an alternative to traditional Medicare coverage, providing additional benefits and services to enhance your overall healthcare experience.

With Medicare Advantage Part C, you can enjoy prescription drug coverage, vision and dental care, and even fitness programs. These additional services can save you money and provide comprehensive coverage tailored to your specific needs.

But how do you know if Medicare Advantage Part C is correct for you? We’ll explore the eligibility criteria and factors to consider when weighing your options. Understanding the ins and outs of Medicare Advantage Part C will empower you to make the best choice for your healthcare needs.

So, if you’re ready to take control of your healthcare coverage and get the most out of your benefits, keep reading. Let’s dive into the Medicare Advantage Part C world and discover the possibilities it holds for you.

Understanding the Basics of Medicare Advantage Part C Benefits

Medicare Advantage Part C, also known as Medicare Advantage Plans, is a comprehensive healthcare option offered by private insurance companies approved by Medicare. It combines the benefits of Medicare Parts A & B, and usually Part D, as well as additional services and coverage options. Medicare Advantage Part C is managed care, which means it is a network system. Doctors, hospitals, and clinics contract with the insurance company.

One of the key advantages of Medicare Advantage Part C is that it often includes prescription drug coverage, known as Medicare Part D, which is not included in Original Medicare. This means you can cover all your healthcare needs, including medications, under a single plan. Additionally, many Medicare Advantage plans offer extra benefits such as vision and dental care, hearing aids, and even fitness programs to help you stay healthy and active.

But how do you know if Medicare Advantage Part C is right for you? Let’s explore the eligibility criteria and factors when weighing your options.

The Benefits of Medicare Advantage Part C

Medicare Advantage Part C offers a wide range of benefits that can significantly enhance your healthcare coverage. These benefits can include:

include:

- Comprehensive coverage: Medicare Advantage Part C combines the benefits of Medicare Parts A and B, providing hospital insurance (Part A) and medical insurance (Part B) in one plan. This means you have coverage for hospital stays, doctor visits, preventive care, and more.

- Prescription drug coverage: Many Medicare Advantage plans include prescription drug coverage, allowing you to obtain your medications conveniently through the same plan. This can save you money and reduce the hassle of managing multiple insurance providers.

- Additional services: Medicare Advantage Part C plans often offer additional services not covered by Original Medicare, such as vision and dental care, hearing aids, and wellness programs. These services can help you maintain your overall health and well-being.

- Out-of-pocket cost protection: Medicare Advantage plans have a cap on out-of-pocket expenses, providing financial protection in case of unexpected medical costs. This can bring peace of mind and help you plan your healthcare budget more effectively.

How to Qualify for Part C

To be eligible for Medicare Advantage Part C, you must meet the following requirements:

To be eligible for Medicare Advantage Part C, you must meet the following requirements:

- Enrollment in Medicare Parts A and B: You must be enrolled in both Medicare Part A (hospital insurance) and Part B (medical insurance) to be eligible for Medicare Advantage Part C.

- Residency: You must reside in the service area of the Medicare Advantage plan you wish to join. Residency is important to remember. I have had clients move without telling me or the plan. They are then surprised when their coverage doesn’t work or is even canceled.

It’s important to note that eligibility requirements may vary depending on the specific Medicare Advantage plan and insurance provider. There are special needs plans for those on state Medicaid or with chronic health conditions like diabetes, COPD, or heart disease. These plans have additional requirements.

Review the requirements and seek guidance from a qualified insurance agent to ensure you meet the eligibility criteria. These plans have even richer benefits for those who qualify.

Differences Between Original Medicare Vs. Medicare Advantage

While Original Medicare and Medicare Advantage Part C both provide healthcare coverage, there are some key differences between the two:

- Coverage options: Original Medicare consists of Part A (hospital insurance) and Part B (medical insurance), while Medicare Advantage Part C combines both Parts A and B into a single plan. Medicare Advantage plans also often include additional benefits, such as prescription drug coverage and extra services.

- Network restrictions: Original Medicare allows you to go to any doctor or hospital that accepts Medicare, while Medicare Advantage plans typically have a network of providers you must use to receive full coverage. However, some Medicare Advantage plans offer out-of-network coverage for higher out-of-pocket costs.

- Cost structure: Original Medicare deductibles and coinsurance have no cap or maximum out-of-pocket. Many purchase

additional coverage—a Medigap plan—to cover the significant gaps in coverage. This additional insurance comes at an additional cost. Medicare Advantage has minimal copays with a maximum out-of-pocket as well as additional benefits. Most of the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs area have zero monthly premium. You simply continue to pay your Medicare Part B premium, which you are paying anyway.

additional coverage—a Medigap plan—to cover the significant gaps in coverage. This additional insurance comes at an additional cost. Medicare Advantage has minimal copays with a maximum out-of-pocket as well as additional benefits. Most of the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs area have zero monthly premium. You simply continue to pay your Medicare Part B premium, which you are paying anyway. - Flexibility: Original Medicare allows you to see any specialist or visit any healthcare provider without a referral. While some Medicare Advantage HMO plans in other parts of the country require referrals to see specialists, the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas are open access. Open Access means you can see any specialist in the network without a referral.

Considering these differences can help you determine which type of coverage aligns best with your healthcare needs and preferences.

Choosing the Right Medicare Advantage Part C Plan

Choosing the right Medicare Advantage Part C plan requires careful consideration of your healthcare needs and personal preferences. Here are some factors to consider when selecting a plan:

Choosing the right Medicare Advantage Part C plan requires careful consideration of your healthcare needs and personal preferences. Here are some factors to consider when selecting a plan:

- Coverage and benefits: Review the coverage options and benefits offered by different Medicare Advantage plans. Consider your specific healthcare needs, such as prescription drugs, vision, and dental care, or fitness programs, and choose a comprehensive plan for your requirements.

- Provider network: Check whether the plan’s network includes your preferred doctors, hospitals, and specialists. Ensure the plan’s network is convenient and accessible for your healthcare needs. All four networks work with the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas. If the provider is part of CHI, Nebraska Medicine, Methodist Health Systems, or Bryan Health, they will be in the network.

- Costs: Compare the costs associated with different Medicare Advantage plans, including monthly premiums, deductibles, copayments, and coinsurance. Consider your budget and evaluate which plan offers the most cost-effective coverage for your needs.

I recommend starting with the maximum out-of-pocket (MOOP) amount and the star rating. Maximum out-of-pocket is what you have at risk. The star rating can help you narrow down the plans that have been around for a while and have a good service record.

Researching and comparing different Medicare Advantage plans can help you select the best plan that aligns with your healthcare needs and budget. At Omaha Insurance Solutions, we help clients evaluate the universe of Medicare plans quickly & easily using our sophisticated but user-friendly software, and with over a decade of experience, we know the local Medicare plans intimately.

Exploring Additional Benefits

Medicare Advantage Part C plans often provide additional benefits that go beyond what Original Medicare offers. These benefits can vary depending on the specific plan and insurance provider, but commonly include:

- Vision and dental care: Many Medicare Advantage plans cover routine vision and dental services, including exams,

cleanings, and eyeglasses.

cleanings, and eyeglasses. - Hearing aids: Some plans offer coverage for hearing aids and related services, helping you maintain your hearing health.

- Fitness programs: Medicare Advantage plans may provide access to fitness programs, gym memberships, or wellness classes to help you stay active and improve your overall health. I belong to the Genesis Health Clubs in Omaha. My membership is almost $600 a year. I would be very happy to have my health insurance plan pay that fee. I’m looking forward to Medicare. In the Silver Sneakers and Renew Active Programs, you can actually join multiple gyms. You are not limited to one chain or a single club.

- Transportation services: Certain plans offer transportation services to and from medical appointments, ensuring you can get the care you need even if you don’t have reliable transportation.

These additional benefits can significantly enhance your healthcare experience and provide you with comprehensive coverage tailored to your specific needs. Original Medicare does not provide these benefits. If you want additional benefits, you must purchase them at additional costs.

Common Misconceptions about Medicare Advantage Part C

Common Misconceptions about Medicare Advantage Part C

There are several misconceptions surrounding Medicare Advantage Part C. Let’s address some of the most common ones:

- Limited provider choice: While provider networks are not an issue with the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas, it certainly may be a concern in other places. There are typically, however, many options to choose from within most networks. Additionally, some plans offer out-of-network coverage for higher out-of-pocket costs.

- Lack of coverage for pre-existing conditions: Medicare Advantage plans cannot deny coverage based on pre-existing conditions. They must cover all services covered by Original Medicare, even if you have a pre-existing condition.

- Difficulty changing plans: Medicare beneficiaries have the opportunity to change their Medicare Advantage plans during the Annual Enrollment Period, which typically occurs from October 15th to December 7th each year. They also have a second opportunity during the Open Enrollment Period, which occurs from January 1st to March 31st, to make a one-time change to a Medicare Advantage plan.

- Higher costs: While Medicare Advantage plans have copays and coinsurance, these copays are generally small and have a cap. Medigap plans have a monthly cost that increases with age and usually exceeds annual copays on Medicare Advantage plans most of the time in most years.

Understanding these misconceptions can help you make informed decisions about Medicare Advantage Part C and ensure you have accurate information when considering your healthcare options.

Tips for Maximizing Your Medicare Advantage Part C Benefits

To make the most of your Medicare Advantage Part C benefits, consider the following tips:

- Review your plan annually: Medicare Advantage plans can change their coverage and benefits each year. Take the time to review your plan’s Annual Notice of Change (ANOC) to ensure it still meets your healthcare needs. Check the cost of medications for the coming year. We offer an annual review to our clients. However, some clients ignore our letters, emails, and phone calls to meet. We get distressed calls in the new year when plan changes catch up with some folks.

- Stay within your plan’s network: To receive full coverage and avoid higher out-of-pocket costs, use healthcare providers within your plan’s network. If you need to see a specialist or receive services outside the network, consult your plan’s guidelines for appropriate referrals or prior authorization. As I said earlier, this is generally not an issue in our area with doctors and hospitals; problems can arise with dentists and optimists who are not within the network. Double-check with the network because providers do change who they work with.

- Take advantage of additional benefits: Explore the extra benefits offered by your Medicare Advantage plan, such as vision and dental care or fitness programs. Utilizing these services can help you stay healthy and maximize the value of your plan. These Medicare Advantage Part C benefits save you money. I’m surprised when clients don’t utilize the over-the-counter benefit. In some cases, that is hundreds of dollars not coming out of your pocket.

- Understand your costs: Familiarize yourself with your plan’s copayments, deductibles, and coinsurance to avoid unexpected expenses. Knowing your costs upfront can help you budget for healthcare expenses more effectively. I always recommend clients talk with the doctor’s back office before any procedure is performed. Make sure the office received any prior approvals and find out the approximate cost to you beforehand so there are no surprises.

Following these tips can optimize your healthcare coverage and ensure you get the most out of your Medicare Advantage Part C plan.

Bottom Line: Making the Most of your Medicare Advantage Part C Benefits

Medicare Advantage Part C offers a comprehensive and flexible alternative to traditional Medicare coverage. With additional benefits such as prescription drug coverage, vision and dental care, and fitness

Christopher J. Grimmond, MA, CFP

programs, Medicare Advantage plans can provide you with comprehensive coverage tailored to your specific needs. Understanding the basics of Medicare Advantage Part C, eligibility criteria, and differences from Original Medicare is crucial in making informed decisions about your healthcare options.

By choosing the right Medicare Advantage Part C plan, exploring additional benefits, and maximizing your coverage, you can take control of your healthcare and enjoy comprehensive and cost-effective coverage.

If you’re ready to maximize your healthcare coverage and get the most out of your benefits, consider exploring the possibilities of Medicare Advantage Part C. Take charge of your healthcare journey today. Give us a call at Omaha Insurance Solutions at 402-614-3389 to view the Medicare Advantage Part C plans you are eligible for in your area to ensure a healthier and more secure future.

Is it overwhelming to choose the best Medicare plan for your needs? With so many options available, it’s understandable. But worry not because we have your ultimate solution – the Medicare Plan Comparisons Chart.

Is it overwhelming to choose the best Medicare plan for your needs? With so many options available, it’s understandable. But worry not because we have your ultimate solution – the Medicare Plan Comparisons Chart.

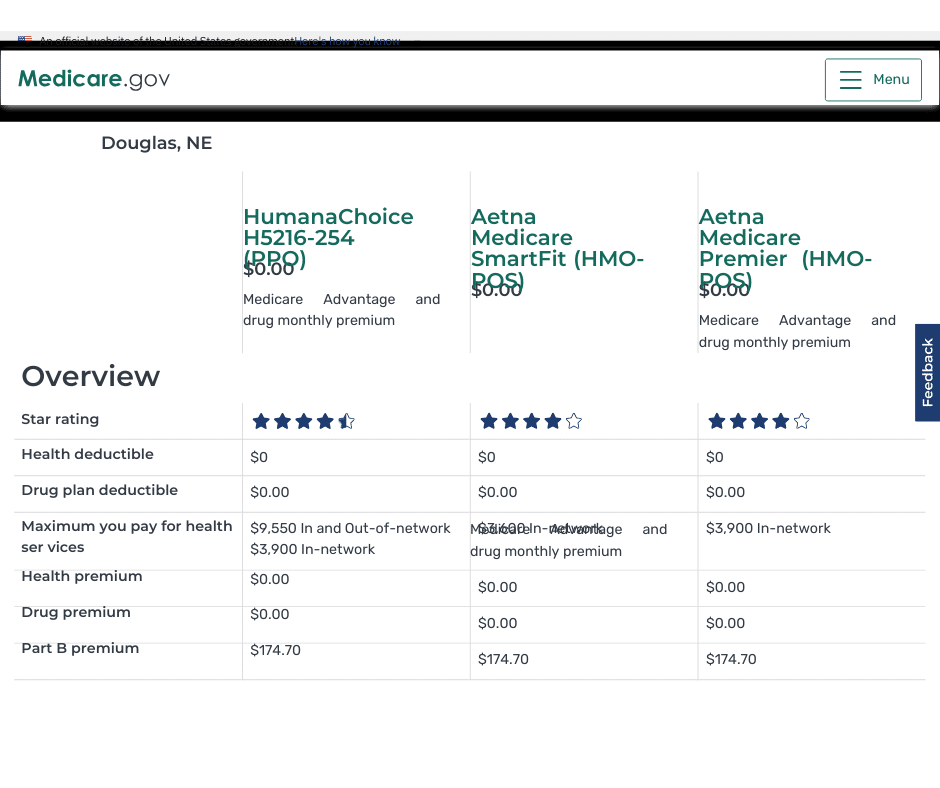

The best way to compare is side-by-side. We can see each relevant benefit or cost in chart form and compare apples to apples. There is still a lot of information to comb through and remember, but a chart helps to reduce some of the confusion and the mental work of remembering what each Medicare plan offers.

Whether you’re looking for a plan that covers prescription drugs, outpatient surgeries, or dental more favorably, you can look at your options in the Medicare plan comparison chart.

By utilizing this user-friendly chart, you can easily compare different plans side by side, evaluate their features and benefits, and make an informed decision based on your unique healthcare needs.

Choosing the right Medicare plan is crucial because it directly impacts your overall health and pocketbook. At Omaha Insurance Solutions, we aim to simplify your Medicare selection process by providing all the necessary information in one place. With a Medicare Plan Comparisons Chart, you can confidently select the plan that meets your specific requirements and enjoy peace of mind knowing that you have made the best choice for your healthcare coverage.

Understanding Medicare Plans