Medicare Covered ServicesCategory:

Prior authorization has arisen as an issue for Medicare Advantage Organizations (MAO)—insurance companies—and Medicaid–states. According to consumer claims, consumers are denied needed coverage unnecessarily. You can imagine the pain and hardship this causes. What if there was a Medicare prior authorization tool providers, insurance companies, and patients could use to communicate with one another?

Prior authorization has arisen as an issue for Medicare Advantage Organizations (MAO)—insurance companies—and Medicaid–states. According to consumer claims, consumers are denied needed coverage unnecessarily. You can imagine the pain and hardship this causes. What if there was a Medicare prior authorization tool providers, insurance companies, and patients could use to communicate with one another?

Congress recently conducted hearings on prior authorization denials, and the Department of Health & Human Services (DHHS), which is the ultimate supervising authority for Medicare (CMS) and Medicaid, issued a final rule that offers a partial solution to the problem.

DHHS initiated the creation of a Medicare prior authorization tool to speed up the process and reduce errors when it comes to prior authorizations for medically necessary treatments and procedures.

The DHHS Final Rule

The DHHS mandated the establishment of a standardized electronic platform for exchanging medical and billing information between payers (insurers and states—for Medicaid), providers, and consumers. All three will be able to see prior authorizations while in process in real-time and interact with one another.

Doctors will see their prior authorization submission as the payer (insurance company) processes the prior authorization. They will see if codes are incorrect or documentation is missing; if denied, doctors will see the reasons.

Payers will see additional information added and corrections made to the prior authorization requests in real-time. They can track the prior authorization because there is a timeline they all can see.

Payers can see the medical history and even similar prior authorizations approved or denied for the patient from the past.

Payers can better coordinate with other payers when other insurance companies may be involved.

Consumers can see that the doctor’s office is actually submitting the prior authorization and where the request is in the process rather than calling the provider to check-in.

DHHS aims to create a more efficient, responsive, and transparent system than the current process for prior authorization. This electronic platform will be for

- Medicare

- Medicaid

- Affordable Care Act (ACA) Marketplace

- CHIP (Children’s Health Insurance Program)

The platform is called Application Programming Interfaces (API). While it will be for government-sponsored health plans and not private insurance, like employer health plans, these types of institutional changes usually trickle down to the private sector eventually.

What’s on the Application Programming Interfaces (APIs)?

What’s on the Application Programming Interfaces (APIs)?

Providers, payers, and consumers will be able to look up:

- Medical items and services that require prior authorization.

- Required documentation for the plan to make a prior authorization decision.

- Current status of a prior authorization decision.

The API (Application Programming Interface) will be the Medicare prior authorization tool that allows providers and payers to communicate quickly and easily and consumers to monitor the process.

The prior authorization details available through the APIs will include:

- Prior authorization status

- Date of approval or denial of a prior authorization request

- Date or circumstance when the prior authorization ends.

- What items or medical services were approved

- Reason for denial: if denied

- Administrative and clinical information submitted by a provider.

This could also include information about past prior authorization decisions beneficial for a patient who is required to obtain prior authorization again for the same service when switching health plans.

Medicare Prior Authorization Timeframes

Currently, Medicare Advantage Plans can take up to 14 calendar days for a standard decision. Expedited decisions must be completed within 72 hours of the request for medical treatment.

With the final rule, prior authorization timeframes were shorted to 7 calendar days, and the same 72-hour rule was used to expedite prior authorization decisions.

Reasons For Denial

Reasons For Denial

The plans must explain the denial to the provider and patient through the APIs. This was not always done, especially if the denial was for miscoding or lack of supporting documentation.

Now, the patient can see the denial. They do not need to rely upon the doctor’s office to explain what the insurance company did or didn’t do, particularly if the provider’s back office did not provide adequate documentation. Everyone can see what the other one is doing or not doing.

Everyone can also see what can be done to appeal or overturn the denial.

Public Reporting of Medicare Prior Authorization Because of the Tool

Insurance companies will be required to report their denial ratios on their website. Consumers will be able to see how often insurance carriers deny prior authorizations and thus determine which Medicare Advantage plan or other government-sponsored programs to choose.

The hope is that Medicare Advantage Organizations (MAO) will be motivated to improve the prior authorization processes through education, better technology, and more efficient and robust systems.

robust systems.

The data required to be listed on the payer (insurance company) website will be:

- List of all items and services that require prior authorization.

- Percentage of standard and expedited prior authorization requests approved & denied (aggregated for all items and services)

- Percentage of standard prior authorization requests that were approved after appeal.

- Percentage of standard and expedited claims where decision timeframes were extended, followed by a request approval.

- Average and median timeframes between a prior authorization request and a decision for standard and expedited prior authorization requests.

Implementation January 2027

As with any government legislation and systemic changes, time is required. The DHHS final rule set January 2027 as the effective date for the proposed regulations.

Building a system as large as the API takes time to provide an effective and robust tool for the Medicare prior authorization process.

Bottom Line: Medicare Prior Authorization Tool

I find this awesome. Too many times, consumers are in the dark. All they know is they can’t get their treatment. They do not know the truth.

Is this something Medicare covers? Did the doctor’s office submit the request correctly, and did they fight to approve it? Is the insurance company being unreasonable? Can I do anything?

It is hard to bluff when everyone can see everyone else’s cards. Light is the best disinfectant for an infection.

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Are you considering enrolling in a Medicare Advantage plan? Before making a decision, it’s crucial to understand the coverage options and potential limitations. One common concern is whether Medicare Advantage plans can deny coverage because they require prior authorization.

Medicare Advantage plans, or Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Parts A and B) and often include additional benefits such as prescription drug coverage and dental, vision, and hearing services.

We will delve into the specific circumstances in which a Medicare Advantage plan requires prior authorization and could potentially deny coverage, the appeals process for denied claims, and what steps you can take to ensure you receive the coverage you need. By understanding the ins and outs of Medicare Advantage plans, you can make an informed decision about your healthcare coverage. So, let’s unlock the truth together and navigate the world of Medicare Advantage plan prior authorization.

What is the Purpose of Prior Authorization?

Prior authorization (or Pre-Authorization) is a utilization management tool used to contain costs. It consists of a third party, usually employed by the insurance company, making determinations about a request for service. The third party, who may be a doctor, nurse, or non-medical staff, approves or denies a request based upon predetermined criteria.

• Is the service covered?

• Is it a duplicate?

• Does the request contain the proper codes and supporting documentation?

• Is the service “medically necessary” as defined by CMS’s standard of care?

The purpose of Medicare Advantage plans requiring prior authorization is to ensure that the medical procedures are necessary and that the payer (insurance company) and patient are not wasting money.

Health care involves a great deal of money. There are three primary interested parties: the patient, who wants to pay as little as possible, the doctor, who provides a service for a fee, and the insurance company, which protects the patient from overwhelming healthcare costs for a premium.

Each has different and conflicting interests. Each is making a cost-benefit analysis to determine if the activity is worth it.

The patient wants good care for minimal cost. The doctor wants to be paid as much as possible for skills and services rendered. The insurance company wants to provide protection at the lowest cost to itself to maximize profit. Each is attempting to protect its interests. The insurance company uses prior authorization to make sure the service is, in fact, medically necessary so it does not waste money on unnecessary services.

The tradeoff is that prior authorization creates a barrier that potentially delays care and adds to its cost. There is also the potential that needed healthcare is wrongly delayed or withheld.

Medicare Advantage Utilizes Prior Authorization

Like commercial health insurance your employer purchases for employees, Medicare Advantage requires prior authorization for a majority of procedures, tests, and treatments, especially the more costly treatments. If approval is not granted, the insurer does not pay. There is an appeal process; however, many do not utilize the appeal process.

Traditional Medicare does not employ utilization management tools like prior authorization except in a few instances. The lack of any supervision of the medical necessity of services and payments has resulted in some high-profile cases of fraud, waste, and abuse. The only mechanism to combat abuse is self-reporting, whistle blowers, and fraud hotlines.

Optimally, prior authorization deters patients from getting care that is not truly medically necessary, reducing costs for both insurers and enrollees. Prior authorization requirements, however, can also create hurdles and hassles for beneficiaries and their physicians and may limit access to both necessary as well as unnecessary care. It also adds the burden of expense to providers who pay staff to work with insurance companies through the prior authorization process.

Data suggests that Medicare Advantage members save an average of $1,965 per year in total health expenditures compared to fee-for-service Traditional Medicare. Medicare Advantage members have lower hospitalization rates and fewer readmissions than their Traditional Medicare counterparts.

Does Original Medicare Utilize Prior Authorization?

From its inception, Traditional Medicare (Original Medicare) has not used prior authorization. There was little, if any, oversight until the electric wheelchair scandal.

A Washington Post article published in August 2014 highlighted the massive fraud of Medicare’s resources. The article chronicled the sensational scams and trials of many Medicare swindlers. The outrageous theft of public funds and the massive fraud shamed CMS to amend its regulations to finally require pre-authorization for some “durable medical equipment,” i.e., electric wheelchairs.

Bureaucrats inside CMS admitted they knew how the wheelchair scheme worked as early as 1998. However, it was not until 15 years later that officials finally did enough to curb the practice significantly. Durable medical equipment—electric wheelchairs—is the only exception to the “reasonable and necessary” practice. They must be preapproved.

The Government Accountability Office (GAO) examined a prior authorization program that CMS ran in seven states in 20212. During the short duration of the program, Medicare saved $1.9 billion. The GAO recommended that CMS continue to study the subject and implement a prior authorization program for all of Original Medicare in its 2018 published study. CMS discontinued the program.

The Effect of Medicare Advantage Denials

The Effect of Medicare Advantage Denials

There may be severe consequences when a Medicare Advantage Organization (MAO) denies authorization for a procedure.

- Patient access to medical care is delayed or denied.

- Potentially, it results in the patient paying out of pocket for something Medicare should have covered.

- It causes an administrative burden for the patient and providers because they must devote resources to an appeal.

None of these have positive consequences and are a cause of frustration with Medicare Advantage for some.

How Common is Medicare Advantage Prior Authorization Denials?

The Kaiser Foundation examined CMS data from MAOs from 2021. They found that more than 35 million prior authorizations were submitted to Medicare Advantage insurers. Over 2 million prior authorization requests were fully or partially denied by the insurance companies.

The percentage of prior authorization requests and denials depends upon individual plans. They are not identical. Of the 2 million denials, some were partial denials, totaling 380,000.

Partial denials would be, for example, physical therapy sessions. The physician requests 10 sessions, but only 5 are granted. That leaves 1.6 million prior authorizations completely denied. The average for Medicare Advantage plans as a whole was less than 6 percent, with individual MAO falling slightly above or below that average.

How About Appeals of Prior Authorization Denials?

Each Medicare Advantage plan has an appeal process. Data from the same group revealed that only 11 percent (or 212,000) of appeals were made, including partially and fully denied requests. The insurance companies overturned 82 percent (or 173,000) of the appeals.

insurance companies overturned 82 percent (or 173,000) of the appeals.

The high number of repeals was cause for concern. Are Medicare beneficiaries being unjustly denied services? Are the insurance companies creating unfair obstacles to reduce costs?

The study’s data, however, do not describe in detail the causes of the denials. In general conversations with insurance carriers, the authors discovered that prior authorizations are denied for a number of common reasons.

- Incorrect coding and insufficient documentation

- Less intrusive or costly services were not first tried.

- The provider was not in the network

- Service is not covered

- Human error

All of these reasons may result in a denial of service, but the data does not identify the various causes, some of which are easily rectified upon review or appeal.

We have thousands of clients who call us when there are issues. I am amazed at how often the provider’s back office does not file the proper paperwork, use the correct codes, or include essential documentation such as X-rays or tests.

Then, when the pre-authorization is denied, the insurance company is blamed, and the subject is dropped. The back office is understaffed, doesn’t have the time, and doesn’t sufficiently understand the insurance company’s processes, so they cut their losses and move on to other cases. Sometimes, the provider moves on to the less costly treatment, knowing that it will be immediately approved.

How Many Are Denied Coverage Unnecessarily?

The Office of Inspector General (OIG) for the Department of Health & Human Services published a report in April 2022 regarding the denial of medically necessary services by some Medicare Advantage Organizations (MAO). The study discovered that MAOs denied services to Medicare beneficiaries on some MAO plans even though the prior authorization request did meet the standard for Medicare coverage rules.

The OIG study sample was taken from 15 of the largest MAOs during the week of June 1-7, 2019. The sample size was 500—250 prior authorizations and 250 denials of claims. Eventually, the number was reduced to 430 as the data was further sifted.

The OIG dug into the details of each of the 430 cases. In the course of the review of the cases, OIG found a conflict in the standards.

Conflict in Standards

CMS has its own guidance regarding the standard of care. The MAOs, however, have developed their own internal clinical criteria that go beyond Medicare coverage rules even though the case would pass CMS’s standards. In the past, CMS has left the MAOs to develop their own criteria where CMS is unclear. For example, a less intrusive or costly treatment may be required before a more expensive service is authorized by the MAO. Physical therapy may be more appropriate first before an MRI is prescribed.

Second, MAOs indicated that some prior authorization requests did not have enough documentation to support approval, yet OIG reviewers found that the existing beneficiary medical records were sufficient to support the medical necessity of the services.

On payment requests, the OIG found that the MAOs denied 18 percent of the cases that would have met the Medicare coverage and MAO billing rules. Most of these payment denials in the sample were caused by human error during manual claims processing reviews (e.g., overlooking a document) and system processing errors (e.g., the MAO’s system was not programmed or updated correctly).

In the end, OIG determined that 13 percent of the 250 prior authorization cases studied should not have been denied based upon CMS stands (or approximately 32 individuals).

How Many Denied Coverage Should Be Approved?

If we combine the two studies, Kaiser Foundation and Office of Inspector General for the Department of Health & Humana Services—we actually get an idea of who should have been approved.

The Kaiser Foundation consists of 35 million prior authorizations, with less than 2 million being denied, which is a 5 percent denial rate.

The OIG’s study discovered that only 13 percent of those denied should have been approved.

So, when we apply the average of 13% of wrongly denied prior authorization requests to the 2 million denials in the Kaiser study, that is approximately 260,000 individuals who should have been approved but were not out of 36 million prior authorization requests.

That means out of 36 million prior authorization requests, only 0.7 percent were wrongly denied coverage. In other words, 99.3 percent of prior authorizations are processed correctly.

I find that an incredibly high degree of accuracy.

Appeals and Reconsiderations for Denied Coverage

The appeals process for denied coverage with Medicare Advantage plans involves several levels, each with its own deadlines and requirements. Understanding these steps can help you navigate the process effectively and increase your chances of a successful appeal.

Redetermination

The first level of appeal is the “Redetermination” process. You must submit a written request to your Medicare Advantage plan within a specified timeframe, usually 60 days from the date of the denial letter. Include all relevant documentation and explain why you believe the service or procedure should be covered. The plan must review your appeal and provide a written decision within 30 days.

Reconsideration

If your appeal is denied at the redetermination level, you can proceed to the second level, known as a “Reconsideration.” This involves submitting a request to an independent review entity contracted by Medicare within 60 days of receiving the redetermination denial. The review entity will conduct a thorough review of your case, including any additional evidence you provide, and issue a written decision within 60 days.

Administrative Law Judge

If your appeal is still denied at the reconsideration level, you have the option to request a hearing before an administrative law judge (ALJ). This request must be made within 60 days of receiving the reconsideration denial. The ALJ will hold a hearing, either in person or by video conference, where you can present your case. The ALJ will issue a written decision within 90 days.

Medicare Appeals Council

If you are dissatisfied with the ALJ’s decision, you can further appeal to the Medicare Appeals Council. This request must be made within 60 days of receiving the ALJ’s decision. The council will review your case and issue a written decision.

Federal District Court

The final level of appeal is to seek judicial review in a federal district court. This step involves filing a lawsuit against the Medicare Advantage plan in a federal court. It’s important to consult with legal counsel if you reach this stage, as the process can be complex.

Bottom Line: Medicare Advantage Prior Authorization Is a Required Tool

No one writes a blank check. When money is being spent, there is oversight. When there is a lot of money from a lot of people, there will be a lot of accountability. The Medicare Advantage oversees that taxpayers’ and beneficiaries’ money is spent in accordance with the norms and procedures that CMS has laid down. Medicare Advantage requires prior authorization to protect resources and clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

clients, but like any institution that is carrying out millions of actions among thousands of people, there are errors. The appeals process is supposed to remedy those errors, but in an imperfect world, not always.

Currently, no one has complete and adequate data to give an accurate idea of inappropriate Medicare Advantage denials, but the data and studies recently done show that the level of error is incredibly low.

With the rising prevalence of cancer diagnoses, obtaining affordable and accessible cancer drug coverage with Medicare is critical for patients. Medicare, the government health insurance program primarily for individuals age 65 and older, is vital in ensuring that cancer treatments are financially attainable. Many of my clients will call me when they receive a diagnosis of cancer. As you can imagine, the experience is overwhelming and frightening. Their first question is what they should do about their insurance to ensure maximum coverage.

With the rising prevalence of cancer diagnoses, obtaining affordable and accessible cancer drug coverage with Medicare is critical for patients. Medicare, the government health insurance program primarily for individuals age 65 and older, is vital in ensuring that cancer treatments are financially attainable. Many of my clients will call me when they receive a diagnosis of cancer. As you can imagine, the experience is overwhelming and frightening. Their first question is what they should do about their insurance to ensure maximum coverage.

This article will explore the implications of Medicare’s cancer drug coverage on affordability and access. We will consider the various components of Medicare, including Part B and Part D, and how they differ in covering cancer drugs. Additionally, we will examine the potential out-of-pocket costs that Medicare beneficiaries may face and discuss strategies to navigate these expenses.

Aspects such as drug tiers, formularies, and specific cancer treatments covered by Medicare will also be explored. By the end of this article, you will understand the implications of Medicare’s cancer drug coverage on affordability and access. You will be empowered to make informed decisions regarding your healthcare needs.

Understanding the Implications of Medicare Coverage for Cancer Drugs

Medicare provides crucial coverage for cancer drugs, ensuring beneficiaries can access potentially life-saving treatments. However, it’s important to understand the implications and costs of this coverage to make informed decisions and navigate the system effectively.

Part B Or Part D

One key aspect to consider is the difference between Medicare Part B and Part D coverage for cancer drugs. Medicare Part B covers drugs administered in a medical setting, such as chemotherapy drugs. These drugs are typically covered at 80% of the Medicare-approved amount, with the remaining 20% being the beneficiary’s responsibility. Part B coverage is often more comprehensive for cancer treatments, including essential drugs like intravenous chemotherapy and supportive medications.

When clients tell me their medication falls under Part B, I am relieved. Treatments, like chemotherapy drugs, insulin pumps, and Prolia injections in the doctor’s office, are completely covered when you have Original Medicare and a Medicare Supplement. On Medicare Advantage, there is a maximum out-of-pocket that puts at least a cap on costs.

Part D Formularies

On the other hand, some oral cancer medications and medications used for supportive care, such as anti-nausea drugs, are placed under Part D prescription drug plans. Private insurance companies approved by Medicare offer Part D plans, and coverage may vary depending on the specific plan. Medicare Part D prescription drug plans are not as robust in their coverage compared to Part B.

prescription drug plans. Private insurance companies approved by Medicare offer Part D plans, and coverage may vary depending on the specific plan. Medicare Part D prescription drug plans are not as robust in their coverage compared to Part B.

It’s important to carefully review Part D formularies, which are lists of covered drugs, to ensure that the necessary cancer medications are included. Expensive medications, including expensive cancer drugs, are very expensive on a Medicare Part D plan. While there are limitations, and in 2025 there will be a $2,000 cap, generally, the medications are still very expensive if they are covered.

Understanding the differences between Part B and Part D coverage is crucial for effectively navigating Medicare’s cancer drug coverage. You may not have much choice when it comes to cancer drug treatment and where it falls in terms of Medicare insurance. But, by knowing which drugs fall under each part, beneficiaries can determine the most appropriate coverage for their specific needs and minimize out-of-pocket costs.

Accessing Affordable Cancer Drug Coverage Under Medicare

Accessing Affordable Cancer Drug Coverage Under Medicare

While Medicare plays a significant role in providing cancer drug coverage, beneficiaries may face challenges and barriers when trying to access affordable medications. These issues can impact both the affordability and availability of cancer drugs, making it difficult for patients to receive the treatments they need.

High Cost

One common challenge is the high cost of cancer drugs. Many cancer medications come with a hefty price tag, and even with Medicare coverage, beneficiaries may still face substantial out-of-pocket costs. This can create financial burdens, especially for those with fixed incomes or limited financial resources. Additionally, certain cancer drugs may not be covered by Medicare, leaving beneficiaries to shoulder the entire cost themselves.

Confusing System

Another barrier to affordable cancer drug access is the complex nature of Medicare’s coverage policies. Understanding the intricacies of drug tiers, formularies, and coverage restrictions can be overwhelming, leading to confusion and potential errors in selecting the most suitable coverage option. The lack of clarity and transparency regarding coverage details can further complicate the process of accessing affordable cancer drugs under Medicare.

Medicare Part D and its Impact on Cancer Drug Coverage

Medicare Part D plays a significant role in providing coverage for cancer drugs obtained from a pharmacy. This component of Medicare offers beneficiaries the opportunity to access prescription medications, including oral cancer drugs and supportive care medications.

Private insurance companies approved by Medicare offer Part D plans, which vary in terms of premiums, deductibles, and copayments. Beneficiaries must carefully review and compare different Part D plans to ensure they choose the most suitable coverage.

Formulary

One key consideration when exploring Part D coverage is the formulary. Formularies are lists of drugs covered by each Part D plan. These lists can vary from plan to plan, so it’s essential to review them to ensure that the necessary cancer drugs are included. Some medications may be placed in higher tiers, resulting in higher out-of-pocket costs for beneficiaries. Understanding the formulary and the associated costs can help beneficiaries make informed decisions and minimize their expenses.

Medicare Gap or Donut Hole

Medicare Gap or Donut Hole

Another important aspect of Part D coverage is the coverage gap, commonly known as the “donut hole.” The coverage gap occurs when beneficiaries reach a certain spending threshold, and their out-of-pocket costs increase until they reach catastrophic coverage.

However, it’s important to note that the coverage gap is gradually being phased out due to the Affordable Care Act. By 2020, beneficiaries are responsible for only 25% of the cost of their medications while in the coverage gap. The Inflation Reduction Act of 2022 put a cap of $2,000 on Part D drug costs in 2025.

Run the Numbers

When we run clients’ medications, we can show them the cost of the medication in the initial phase of drug cover and the gap phase. The software also performs calculations showing approximately when you will fall into the gap phase of the Part D prescription drug coverage. So you can at least see what you will be paying each month and make the appropriate adjustments.

Exploring the intricacies of Medicare Part D coverage is crucial for beneficiaries seeking affordable and accessible cancer drug coverage. By understanding the formulary, costs, and potential coverage gaps, individuals can select the most suitable Part D plan and ensure that their necessary cancer medications are covered.

Medicare Cancer Drug Coverage Appeals Process

Medicare Cancer Drug Coverage Appeals Process

Medicare beneficiaries may encounter situations where their cancer drug coverage is denied or not approved as expected. I find this rare, except with experimental procedures.

In such cases, it’s important to understand the Medicare appeals process to challenge these denials and ensure access to necessary medications. That being said, before beginning the formal appeal process, check to make sure the provider’s back office correctly processed the preapproval. I’ve found that some doctors’ office do not go through the insurance company’s required protecals. As a consequence, the authorization is denied because an incorrect code was used, the wrong form was submitted, or inadequate documentation accompanied the request. Once it is clear the preapproval was correctly done and denied, move on to the formal appeals process.

The appeals process consists of several stages. Each is designed to allow beneficiaries to present their case and request a reconsideration of the initial decision. Following the proper steps and providing the necessary documentation to support the appeal is crucial.

Step 1

The first step in the appeals process is the redetermination stage. This involves submitting a written request to the Medicare Administrative Contractor (MAC) that made the initial decision. The MAC will review the case and decide. If the redetermination does not favor the beneficiary, they can proceed to the next stage.

Step 2

The second stage is the reconsideration stage. This involves requesting reconsideration by a Qualified Independent Contractor (QIC) who was not involved in the initial decision. The QIC will review the case and decide. If the reconsideration is not in favor of the beneficiary, they can proceed to the further stages of the appeals process.

Step 3, 4, & 5

The subsequent stages include a hearing by an Administrative Law Judge (ALJ), a review by the Medicare Appeals Council, and, finally, a judicial review by a federal district court. These stages provide additional opportunities for beneficiaries to present their case and challenge the denial of cancer drug coverage.

Navigating the Medicare appeals process can be complex and time-consuming. However, it is an essential avenue for beneficiaries to pursue if they believe their cancer drug coverage has been unfairly denied.

Seeking assistance from healthcare advocates or legal professionals specializing in Medicare appeals can be beneficial in guiding individuals through this process and increasing their chances of a favorable outcome.

Maximizing Medicare Coverage for Cancer Drugs

Here are some tips to help make the most of their Medicare coverage.

Review your Medicare Plan Annually

Medicare plans can change yearly, including drug formularies and costs. It’s important to review your plan during the Annual Election Period, Oct 15th–Dec 7th. Ensure that your current medications are covered and affordable under the plan.

I send out emails and letters to my clients every year during Annual Election Period to remind them. The client will tell me that their medications have not changed, but I emphatically remind them that it doesn’t matter. The drug plans change, and in some cases, the change can be drastic. Premiums go up, deductibles go up, tiers change, and drugs are dropped and added to plans. For the little time it requires, the review can save hundreds if not thousands of dollars.

Utilize Prior Authorization

Some cancer drugs may require prior authorization from Medicare before they are covered. Work closely with your healthcare provider to ensure that the necessary documentation is submitted. Over the years, I have had clients denied because the doctor’s office did not properly submit the request. Sometime I got the client to encourage second try with the correct codes and documentation, and it worked.

Explore Patient Assistance Programs (PAP)

Many pharmaceutical companies offer assistance programs that provide eligible individuals with financial assistance or free medications. Research and inquire about these programs to determine whether you qualify for assistance. I have a number of clients who come to me who are on these programs before they even get on Medicare. Some programs will even continue once you are on Medicare.

These programs provide free or discounted medications to individuals who meet specific eligibility criteria. Each program has its requirements, so it’s important to research and apply for programs that may apply to your situation. Pharmaceutical companies are always testing their medications. You may qualify, depending on your health issues, for free medications as part of a study.

Nonprofit Organizations

nonprofit organizations and foundations may offer financial assistance or grants specifically for cancer patients. These organizations aim to alleviate the financial burden associated with cancer treatment and provide support to individuals in need. Research and reach out to these organizations to explore potential assistance options.

It’s important to note that these alternative options may have their own eligibility criteria and limitations. However, for individuals who do not qualify for Medicare or need additional assistance, exploring these alternatives can be instrumental in accessing affordable cancer drugs.

Cancer Organizations

Cancer-specific organizations like the American Cancer Society may also offer resources and support services for cancer patients on Medicare. These organizations can provide information on financial assistance programs, educational materials, and support groups to help individuals navigate their cancer journey.

Utilizing these resources and assistance programs can help Medicare beneficiaries access the support they need in terms of understanding their coverage and obtaining affordable cancer drugs. By taking advantage of these resources, individuals can enhance their overall healthcare experience and improve their quality of life during cancer treatment.

Bottom Line: Research your Medicare Cancer Drug Coverage

Bottom Line: Research your Medicare Cancer Drug Coverage

You can not control whether you get cancer or not. You may not have much control over the treatment, but you can see the costs and what insurance covers. Understanding the implications of Medicare’s cancer drug coverage, including the differences between Part B and Part D, the challenges and barriers faced, and the various strategies and resources available, empowers beneficiaries to make informed decisions and navigate the system effectively.

By reviewing Medicare plans annually, utilizing prior authorization, and exploring patient assistance programs, beneficiaries can maximize their coverage and minimize out-of-pocket costs. Additionally, alternative options such as Medicaid and Patient Assistance Programs can provide additional support for individuals who may not qualify for Medicare or need extra assistance.

As people age, the value of good health becomes more important than ever. When you had a bad fall in your 40s, it would take a few weeks to recover. Now, a bad fall may result in a hip injury that takes months of recovery, doctor visits, physical therapy, or even surgery. Some must go to skilled nursing facilities to recover. The contrast is stark. Seniors’ health issues increase in frequency and complexity as they age. According to the National Council on Aging, nearly 95% of older adults have at least one chronic condition, and 3 million adults aged 65 or older are treated in emergency rooms due to fall-related injuries every year. So Medicare beneficiaries ask: How long Will Medicare Pay for nursing home care and home health care?

Navigating the Complexities of Care: Medicare’s Coverage of Long-Term Care, Skilled Nursing Facilities, and Home Health Care

While preventative care is essential–annual physicals, screenings, and regular tests–and “fall-proofing” your home is critical, you must be prepared financially for the costs associated with extensive medical care if and when that occurs. If a health event puts you in a situation requiring special care or costly in-facility admittance, your first question will probably be, “How am I going to pay for this?”

If you are a Medicare recipient, navigating care in a long-term care facility can be complex and confusing. There are so many different types of care – long-term care (LTC), skilled nursing facility (SNF), and home healthcare (HH) – that it’s hard to know how it all works and how much Medicare is willing to pay for each.

My job is to make that journey a whole lot easier. I’ll break down each of these care types and dive into what Medicare will and won’t cover so that you know your options if you’re faced with a health challenge that requires ongoing care.

The Differences: LTC vs. SNF vs. HH

Understanding the different types of care offerings can feel like a full-time job for aging adults. Terms like assisted living facilities, senior living providers, and skilled nursing facilities are often used interchangeably, but the truth is, there are subtle differences in care and what and how much Medicare pays for the different types of “nursing home care.”

The three essential categories of care for seniors are long-term care (LTC), skilled nursing facilities (SNF), and home healthcare (HH). Understanding what each one does and its purpose can be beneficial when it comes time to finding care for your specific situation.

Long Term Care (LTC)

Long-Term Care facilities are the places we think of as “nursing homes.” A person may go to a long-term care facility for several reasons and lengths of stay. Permanent residents generally go to LTC facilities primarily because they can no longer perform the activities of daily living.

The 5 activities of daily living are:

- Feeding

- Dressing

- Personal Hygiene (bathing, brushing teeth, clipping nails, etc.)

- Continence (control of bladder and bowels)

- Toileting

If you struggle with any of the above, a Long-Term Care facility may be the right choice for you.

Staffed with caregivers, such as certified nurse assistants, registered nurses, various types of therapists, and doctors–these facilities focus more on providing meals, custodial care like dressing and feeding, and offering social environments for their patients. While also providing health care, the primary focus is custodial care because residents can no longer perform those functions for themselves, their families cannot care for them, and they cannot afford to provide those services in their own homes economically.

Skilled Nursing Facility (SNF)

Skilled Nursing Facility (SNF)

Skilled nursing facilities are often in the same physical location as long-term care facilities. The difference comes down to the reason behind your stay. If you need care because of a medical condition – such as a broken hip from a fall, car accident, stroke, or heart attack – then an SNF can provide the medical care you need–intense nursing care, physical therapy, speech pathology. Custodial care, such as feeding or toileting, comes with a stay in the skilled nursing facility, but it is secondary to the primary reason for the stay–intense and daily treatment.

Seniors needing intense physical therapy, speech therapy, occupational therapy, or continuous medical support should reside in Skilled Nursing Facilities until they are recovered, reach a certain level, or plateau. Then you return home, where home healthcare takes over. The nurses, physical & occupational therapists, and speech pathologists come to your home. Eventually, when you have progressed in your recovery and do not need treatment as often, home healthcare stops, and you go to providers’ offices for an appointment.

Home Healthcare (HH)

Home Healthcare providers allow their clients to continue living in the comfort of their homes while providing care. The person still cannot get out and go to appointments easily, so the skilled providers come to you in your home two or three times a week or less, depending upon need. Ideally, in the recovery process, you eventually leave your home and go to their offices to receive treatment until you fully recover. Again, home healthcare does not provide custodial care in the home, except on rare occasions for short periods of time.

Understanding that Medicare is health insurance. It covers and pays for doctors, nurses, tests, hospitals–all the things you associate with medical treatment and recovery. Medicare does not provide custodial care, housekeeping, meal & laundry service, or taxis.

Will Medicare Cover Long-Term Care?

When someone says “long-term care” or “nursing home,” they generally mean the person is residing permanently in a facility because she cannot take care of herself–she cannot perform the 5 activities of daily living. Medicare does not pay for nursing home care. Even when medical necessity requires admittance to a nursing home (skilled nursing facility), the length of stay is capped at 100 days. There are rules around stopping and starting this coverage, coming from a hospital stay, and restarting a stay, but essentially, Medicare will only pay for 100 days per year in a nursing home. And Medicare approval for a stay of that length is rare. Again, Medicare pays for “nursing home” care for purposes of intense but temporary medical treatment.

Will Medicare Cover Skilled Nursing Facilities?

Medicare provides “Skilled Nursing Facilities” coverage, but patients must qualify based on stringent requirements. Medicare will only cover SNF care if all of the following are true:

- You are a recipient of Medicare Part A and have days of coverage remaining in your benefit period.

- A qualifying hospital stay preceded the need for SNF. An inpatient stay of at least 3 consecutive days in the hospital followed by admission into an SNF within 30 days of leaving the hospital is required for coverage.

- A doctor must have ordered inpatient SNF care based on medical necessity.

- Your condition requires skilled care daily.

- You need skilled services for an ongoing condition that was treated during your 3-day hospital stay OR a new condition that started while you were already receiving SNF care for an ongoing condition.

- The services must be reasonable and necessary for the treatment of your condition.

- You obtain care through a Medicare-certified SNF.

Even if you qualify, your stay will not last indefinitely.

How Many Days Will Medicare Pay for Skilled Nursing Care?

After qualifying for SNF care, your progress will be closely monitored for the length of your stay, the care you are receiving, and the above requirements to ensure Medicare will continue providing coverage. At a high level, Medicare will cover up to 100 days of SNF coverage within a single benefit period. Again, approval for that length of stay is rare. Medicare wishes to move you to less costly home healthcare as soon as medically possible.

In those 100 days, Medicare will cover the cost of the following:

- A semi-private room

- Meals

- Skilled nursing care

- Medical social services

- Medications

- Medical supplies and equipment usage

- Ambulance transport when required

- Dietary counseling

- Physical therapy, occupational therapy, and speech-language pathology when required to meet your health goal

It’s important to note that while Medicare will provide coverage for 100 days, you will have to supplement the coverage starting on day 21.

- Days 1 – 20: Medicare will pay the total cost; you pay nothing.

- Days 21 – 100: You pay the daily coinsurance, which can be up to $204 per day in 2024.

- Days 101+: Medicare pays nothing; you incur the total cost of care if you remain.

A detailed breakdown of coverage details can be found in Medicare’s SNF handbook. Medicare does not pay for nursing home care unless it is tied to a treatment program while you are in residence.

Will Medicare Cover Home Health Care?

Home healthcare falls under both Medicare Part A and Part B. Home healthcare is defined as part-time or intermittent skilled care when you are “homebound.” Homebound means you cannot leave your home without assistance. Assistance could be using a walker, wheelchair, crutches, or even a cane. You may need special transportation because of your condition. Your doctor may advise you not to leave your home because of your medical condition. These all constitute reasons Medicare will accept for home healthcare.

The usual services home healthcare provides on a part-time basis are:

- physical therapy

- occupation therapy

- speech-language pathology services

- Injectable osteoporosis drugs

- durable medical equipment

A doctor must certify you need home health care through a face-to-face meeting. You need part-time or intermittent care, which may be up to 8 hours per day but with a maximum of 28 hours per week.

Home Healthcare does not include:

- 24-hour adult day care at home

- Meals delivered to the home

- Homemaker services

- Custodial (or personal) care help.

If you do attend adult day care in a facility, you can still qualify for home healthcare.

Getting the Most from Your Medicare: Which Direction?

There are two ways for you to receive Medicare: Original Medicare or Medicare Advantage.

There are two ways for you to receive Medicare: Original Medicare or Medicare Advantage.

Original Medicare

Original Medicare is Part A for inpatient hospital stays and Part B for outpatient services and doctor visits. There are no networks for Original Medicare. It is fee-for-service (FFS), which means if the doctor or facility accepts Medicare–accept assignment for Medicare is the proper terminology–then Medicare will reimburse the provider for medically necessary services rendered.

Original Medicare does not include Part D for prescriptions, and Orignal Medicare has big gaps in coverage. A quarter of people purchase some sort of supplemental insurance policy, such as Medigap, to fill in the gaps in coverage.

Medicare Advantage/Part C

The other direction is Medicare Advantage (or Part C). These plans are provided by a private insurance company that is Medicare-approved to provide health coverage that is equal to or better than Original Medicare.

The gaps in coverage are structured differently than Original Medicare. Medicare Advantage plans have a maximum out-of-pocket. Original Medicare does not. For example, the most popular Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs have a maximum out-of-pocket of less than $4,000. Original Medicare, on the other hand, does not have a maximum. The sky is the limit for your out-of-pocket costs.

Medicare Advantage is also built on provider networks. The Omaha, Lincoln, Council Bluffs metro area has four healthcare networks: CHI (Catholic Health Initiative), Nebraska Medicine, Methodist Health Systems, and Bryan Hospital. All these networks work with the Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs. Access to providers is a non-issue for us. In other places and with other Medicare Advantage plans, there can be issues and problems, but not here.

Home healthcare is zero for both Original Medicare and most Medicare Advantage plans.

Skilled nursing is zero for the first 20 days for both. On the 21st day, Original Medicare has a copay of $204 during the potential 100 days of coverage–again with no cap on expenses for Part B. Medicare Advantage plans have copays of various sizes, but the key is a limit to what you could pay– a maximum out-of-pocket.

For those who pay the additional premium for the Medigap plan, the skilled nursing facility copay will usually be covered entirely.

Medicare Part D

Medicare Part D prescription drug plans are another premium. Most Medicare Advantage plans in Omaha, Lincoln, and Council Bluffs include the prescription drug plan and are mostly at zero cost.

Neither Original Medicare with a Medigap plan nor Medicare Advantage provides long-term care, custodial care, housekeeping, or adult day care. They may cover some of these services as incidental to providing skilled nursing care in a facility or home but for short periods.

Alternative Ways to Pay for the Care You Need

In 2021, the average cost of long-term care services ranged from $20,280 to $108,405 annually. These prices are exorbitant, and they’re only going up. As you age, the best thing you can do for your health and your wallet is to ensure you have the coverage you can rely on if you need long-term care. Since Medicare doesn’t pay for many long-term care scenarios–“nursing home care”–knowing your other options for coverage is crucial.

Private Pay

Private Pay

Although challenging, some people will pay for their nursing home care from their savings and assets. By dipping into retirement accounts, tapping into assets such as property or investments, or simply saving up over their lifetimes, some seniors pay out-of-pocket for all the care they receive. This is rare.

One major benefit to this approach is that LTC facilities often prioritize private pay clients when space is limited. With the looming senior care crisis, this will get even more important in the years to come.

Long-Term Care Insurance

A separate long-term care insurance policy can pay the cost of residing in a long-term care facility. In most scenarios, these policies require that you need help with two or more of the activities of daily living (feeding, dressing, hygiene, continence, and toileting) before they take effect. There are usually elimination periods of 30, 60, 90, and 120 days before a policy will pay. The premiums for these insurance plans are not cheap. As you age, like life insurance, the price goes up and can be beyond the budget of many people. You also need to pass underwriting when you apply for the policy, though it will be guaranteed renewal for the rest of your life, no matter your health, as long as you continue to pay the monthly premium.

Veteran Benefits

If you served in the military, you may qualify for some sort of long-term care benefits from the Department of Veterans Affairs. Eligibility will depend upon length of service, type of service, military-related disabilities, and even income. Then, there may be limited or no facility access in your area. Where there is a facility, availability may be limited in terms of beds. Contact the Department of Veteran Affairs to determine for what you qualify. Access is very limited in Nebraska.

Veterans Affairs. Eligibility will depend upon length of service, type of service, military-related disabilities, and even income. Then, there may be limited or no facility access in your area. Where there is a facility, availability may be limited in terms of beds. Contact the Department of Veteran Affairs to determine for what you qualify. Access is very limited in Nebraska.

Medicaid

Often confused with Medicare, Medicaid is an entirely different health program. It’s partially funded by the federal government but funded and managed by the state.

Medicaid provides low-income seniors with financial help for long-term care. Each state has its own eligibility guidelines, but you’ll need to demonstrate financial need to qualify.

Many times people will tell me that so-in-so is in a “nursing home,” and they pay nothing. That is because all their assets have been depleted, and they are on county assistance. Medicaid is paying the bill, and all their assets are gone or will be upon death. The state takes homes and any other assets to offset the loss to the taxpayer who covers the expense.

Medicare Does Not Pay for Nursing Home Care: Your Health is in Your Hands

Medicare Does Not Pay for Nursing Home Care: Your Health is in Your Hands

LTC, SNF, and HH are a jungle of terms, regulations, insurance, and costs. It is even confusing for experts. Like figuring out your income tax or finances, consulting an insurance professional will be helpful. You need someone who knows Medicare, Medicare insurance, the CMS rules and regulations, and possesses years of experience dealing with Medicare. He can guide you through the maze of Medicare and help you take your health care into your own hands and plan for the best outcome.

You’re in the right place if you’re unsure where to start. Every week, I spend time helping those on Medicare just like you find the right coverage for their needs. At Omaha Insurance Solutions, we can help you figureout the best direction for you, enroll you in Medicare, choose a plan, and get all the T’s cross and I’s dotted on forms and applications. Each year, we will review your needs and the plans available to maximize your Medicare benefits.

Christopher Grimmond

Get in touch with us today at 402-614-3389 for a free, no-obligation consultation about your Medicare options.

Is Hospice Care Covered by Medicare?

Is Hospice Care Covered by Medicare?

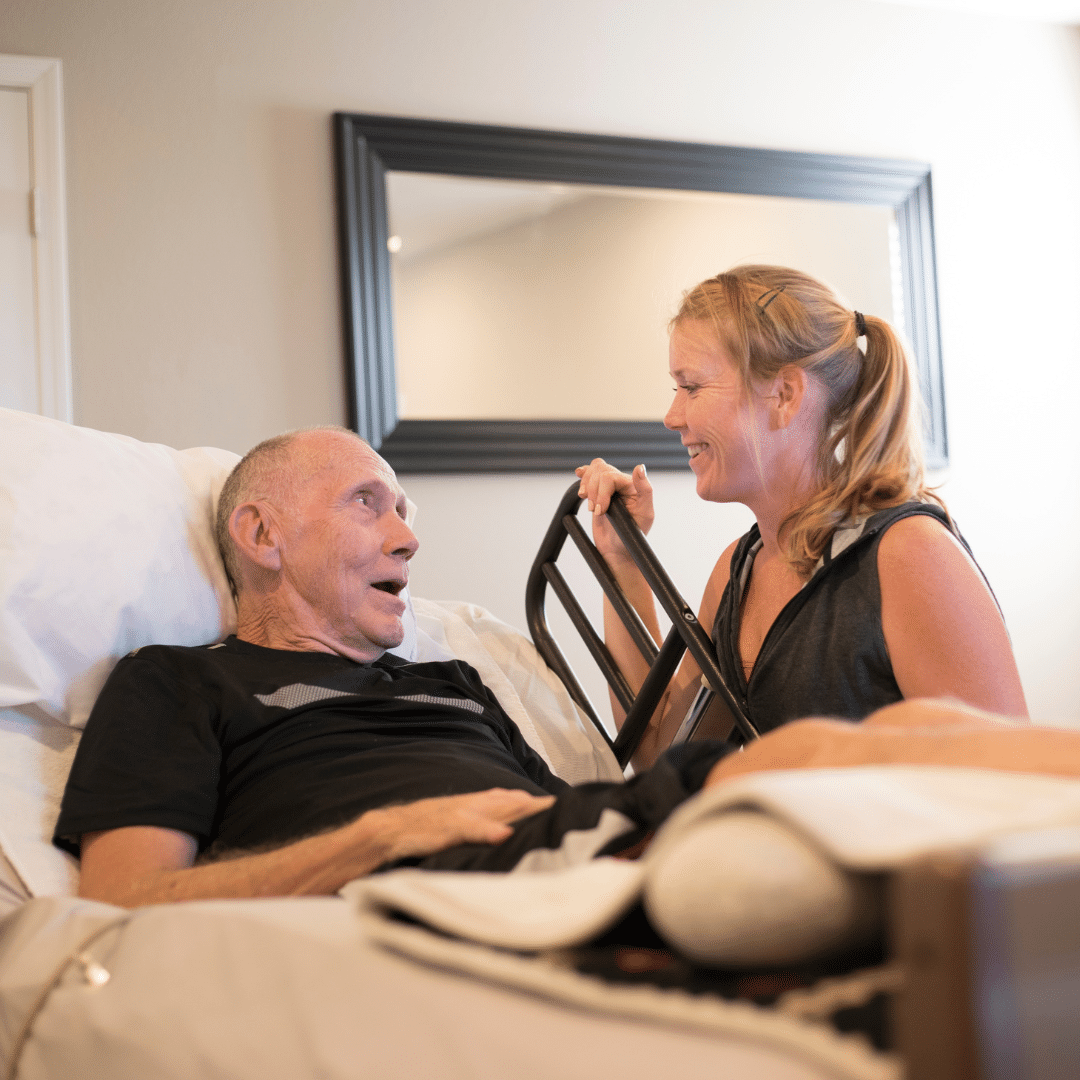

When a loved one receives a terminal diagnosis, they’re typically given an average of six months to live. The next step is to find a place that can meet those special needs. While this is devastating news, the next logical step is to seek out options regarding hospice care to ensure a comfortable transition as their health continues to decline. Of course, figuring out how to pay for hospice care is part of that step. For those on Medicare, how much does Medicare cover for hospice care?

Understanding Medicare’s Hospice Care Coverage

Medicare, the federal health insurance program for individuals age 65 and over, offers coverage for hospice care under Part A. This coverage is available to eligible beneficiaries who have a terminal illness and have a life expectancy of six months or less. Medicare’s hospice care coverage includes a range of services, such as medical and nursing care, pain management, counseling, and medication.

To be eligible for Medicare hospice care, individuals must also be enrolled in Medicare Part A and have their doctor certify that they have a terminal illness with a life expectancy of six months or less. Additionally, individuals must sign a statement choosing hospice care instead of other Medicare-covered benefits for their terminal illness.

How Does Medicare Pay?

Medicare provides financial assistance for hospice care through its hospice benefit under Part A. Medicare Part A covers medications, medical equipment, nursing care, and counseling. The hospice provider is reimbursed directly by Medicare, and the provider must be Medicare-approved to receive reimbursements from Medicare. Beneficiaries are not responsible for any copays.

medical equipment, nursing care, and counseling. The hospice provider is reimbursed directly by Medicare, and the provider must be Medicare-approved to receive reimbursements from Medicare. Beneficiaries are not responsible for any copays.

Medicare’s payment structure for hospice care is based on a per diem (daily) rate. This means that Medicare pays a fixed amount to the hospice provider for each day that an individual is enrolled in hospice care. The per diem rate varies depending on the level of care provided. There may be higher rates for individuals receiving continuous home care or inpatient respite care.

However, it’s important to note that Medicare’s hospice benefit does not cover room and board in a hospice facility. If a beneficiary chooses to receive hospice care in a hospice facility, they may be responsible for paying the room and board costs out of pocket. Alternatively, if a beneficiary receives hospice care at home, Medicare will cover the cost of necessary medical equipment and supplies.

Medigap & Medicare Advantage with Hospice Care

Medigap & Medicare Advantage with Hospice Care

Medicare Part A covers everything hospice-related. Patient costs are copays for hospice-covered medications and respite care. The copay for hospice medications is no higher than $5. Medicare Part A covers 95% of respite care for persons who have taken responsibility for the dying patient. The patient would be responsible for 5% of the costs.

If an individual has a Medigap policy, the Medigap policy would cover the hospice medications and the coinsurance for respite care. Medicare Advantage would continue to cover everything as before, but it would not normally cover the hospice medication copay or respite coinsurance payment.

It is important to note that there are many other medical costs for hospice patients during their time–non-hospice doctors, hospital beds, emergency room visits, ambulances, oxygen, walkers & wheelchairs, and other non-hospice medications, etc. These expenses fall under Original Medicare and the Medigap policy or Medicare Advantage. Hospice care does not cover these other medical needs. It is important to understand this fact.

Once time the daughter of a client called me to let me know her mother was going into hospice. One of the hospice workers told her to save money by canceling her Medigap policy. I tried to explain there were other medical costs her mother would incur from doctors and other providers, but she was convinced it was an unnecessary expense. Unfortunately, they don’t find out about their mistaken decisions until after the fact and the bills roll in.

Eligibility Requirements for Medicare Covered Hospice Care

To be eligible for Medicare hospice care, individuals must meet certain requirements. First, they must be enrolled in Medicare Part A, which provides hospital insurance coverage. Second, they must have a terminal illness. Terminal is defined as a life expectancy of six months or less, as certified by their doctor. Finally, they must sign a statement choosing hospice care instead of other Medicare-covered benefits for their terminal illness.

A beneficiary can stop hospice care at any point. They are not obliged to remain in hospice once they sign the statement.

It’s important to note that individuals can still receive Medicare hospice care even if they are enrolled in a Medicare Advantage plan. Medicare Advantage plans are private health insurance plans that provide Medicare benefits. You don’t lose Part A when you enroll in a Medicare Advantage plan. It is Part A that pays for hospice, even when you are enrolled in a Medicare Advantage plan.

How Long Does Medicare Pay for Hospice Care?

Once you are certified at the terminal with approximately six months or less of life expectancy, your doctor may recertify you. There are usually two 90-day periods and then every 60 days. You do not need to recommit to hospice. The doctor determines that you are still terminal with a six-month or less time period to live. You can remain in hospice almost indefinitely if you meet the criteria.

The Bottom Line: How Long Does Medicare Cover Palliative Care?

Christopher Grimmond

A quarter of the Medicare budget each year goes to cover the last year of Medicare beneficiaries’ lives. That is an incredible number. Hospice care is an essential part of Medicare.

The practice of hospice exists to provide comfort and optimal quality of life to individuals approaching the end. Medicare provides peace of mind that medical bills will be paid and that care will be provided uninterrupted. As long as a person continues to be certified for hospice, Medicare will continue to cover hospice care. You can be assured Medicare will be there for them the entire time.

Hospice is a difficult time. I have gone through this with both of my parents and with hundreds of clients. Contact us at Omaha Insurance Solutions to speak with a caring insurance professional about your Medicare needs. We are a call away at 402-614-3389.

Does Medicare Cover Hospice?

Does Medicare Cover Hospice?

Many people are still not very familiar with Medicare and hospice. It is actually a fairly new idea. The “end of life movement” began in the ’70s. (The “end of life movement” is separate and distinct from the Euthanasia movement and organizations, like the Hemlock Society.) Medicare did not cover Hospice when Medicare started in 1965. Medicare and hospice were only put together in 1982 as part of the Tax, Equity, and Fiscal Responsibility Act under President Reagan in response to a growing awareness of end of life concerns. The legislation was an attempt to fill the gap in care. Awareness was growing in the country of the importance of what transpired at the end of life.

A Happy Death Is Not A New Idea

I remember when I was a teenager. My father was up before me in the mornings. He would take me to school on his way to work. I would see him praying when I came into the kitchen in the morning. One time I asked him what he was reading. It was a small devotional booklet. He was praying the novena to St. Joseph for a “Happy Death.” I was startled by the subject matter.

Teenagers don’t think much about death unless forced. I had a buddy, Herbert Woltz, killed in a motorcycle accident my senior year in high school. That was my abrupt intro to death.

I asked my father why pray for such a crazy thing as a “happy death”? The two subjects were oxymoronic to me. What’s happy about death? He reminded me that is how the Hail Mary ends. “Pray for us . . . now and at the hour of our death. Amen.”

After birth, he said, death is the most important event in your life. The difference, however, is you’re aware of what’s going on in the end, and you make the most important decisions of your life at “the hour of your death.” Praying for a “Happy Death” is about minimizing the pain and maximizing your moment of entrance into eternity. You’re asking for God and all the heavenly hosts to be at your side to handle the fear, pain, discouragement, and loneliness a person faces when approaching death and the moment of death.

I didn’t think much about what my father shared until many years had gone by and many friends and family members had passed away, including my dad. Medicare and hospice are something with which I have had extensive experience. Now I know why you would want to pay for a “happy death.”

End of Life Care Is Different

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

As a seminary student in St. Paul, Minnesota in the early 80’s, I was looking for a part-time ministry when I wasn’t at school studying. I found the Hawthorne Dominicans. The Hawthorne Dominicans is a Catholic women’s religious order devoted to the terminally ill. They had a hospice facility near my college, so I would walk down to it and help out on weekends. Most of the patients were cancer patients. My work was minor cleaning, but mainly it was visiting with the patients. Keeping up their spirits. Show them someone cared as they were coming to the end of their lives, and I would join the sisters in prayer and mass for the residents.

While I was there, I got to know the sisters. They were remarkable young ladies. The convent was inside the hospice facility. The nuns lived, prayed, and worked with their dying residents around them twenty-four hours a day. The Hawthorne Dominicans were some of the happiest people I ever met.

Their foundress, Rose Lanthrop-Hawthorne, was the youngest daughter of the famous author, Nathanial Hawthorne, and a convert to Catholicism. In her day, cancer patients were put on an island in New York harbor–Blackwell Island–because it was believed that cancer was contagious. Many people, especially the poor, died in incredible misery, isolation, and squalor.

Medicare and hospice were a century away. Rose, like Mother Teresa of our time, saw the face of Jesus in the poor, and she started a ministry to the dying among the poor immigrants of the New York slums. The Hawthorne Dominicans is a purely American woman’s religious order. Most woman’s religious orders in our country came from Europe originally.

End of Life Care Rediscovered With Hospice & Medicare

The end of life movement in our time found its origin during a 1967 lecture at Yale University by Cicely Saunders. She introduced the idea that the dying needed specialized care that served their unique situation. She later founded St. Christopher’s Hospice in London.

Dr. Elisabeth Kubler-Ross, MD research into death and dying identified five stages terminally ill patients go through. Her popular and groundbreaking book, On Death & Dying, fueled a movement to deal with issues of death and dying.

In 1972 she testified at the first national hearings on death with dignity conducted by the U.S. Senator Special Committee on Aging. Organizations, like The National Hospice and Palliative Care Organization (NHPCO), sprang up to study and promote awareness around the end of life issues. Finally, because of raised public interest and concerns, Medicare added hospice care to the list of services provides in 1982.

Medicare And Hospice Are Huge

In 2014 approximately 2.6 million people died in the US. Of those deaths, 80% were on Medicare. Medicare is the largest insurer for persons during the last year of life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

life. A quarter of the Medicare budget is just for those who are in the last year of life. That number has been consistent for decades. The high cost of health care at the end of life is not surprising considering the number and complexity of health issues, so CMS (Center for Medicare & Medicaid Services) is acutely aware of end of life issues.

Today, hospice is an important benefit for terminally ill Medicare beneficiaries. Currently, nearly half of Medicare beneficiaries receive hospice benefits before their deaths. Medicare is the primary source of payment for hospice care in this country. Yet, hospice still remains somewhat of a mystery, and Medicare beneficiaries know very little about what Medicare does with hospice until they are forced into the situation.

How Does Medicare Cover Hospice?

Hospice is defined as a program of care and support for people who are terminally ill. Terminally ill means a life expectancy of six months or less. The primary goal of hospice in Medicare is to help terminally ill people live a comfortable life and manage their pain and discomfort. Hospice care is palliative care versus skilled nursing and home health care. That is, it is not designed to cure the patient, but rather to aid the person in the dying process. Because hospice care is so intimately involved and in such a big way with Medicare beneficiaries, understanding Medicare and hospice is essential.

Prayer to St. Joseph

O St. Joseph whose protection is so great, so strong, so prompt before the throne of God, I place in you all my interests and desires. O St. Joseph do assist me by your powerful intercession and obtain for me from your Divine Son all spiritual blessings through Jesus Christ, Our Lord; so that having engaged here below your heavenly power I may offer my thanksgiving and homage to the most loving of fathers. O St. Joseph, I never weary contemplating you and Jesus asleep in your arms. I dare not approach while He reposes near your heart. Press Him in my name and kiss His fine head for me, and ask Him to return the kiss when I draw my dying breath. St. Joseph, patron of departing souls, pray for us. Amen.

John Joseph Grimmond 1934-2013 R.I.P.

What Is Medicare Hospice?

Medicare pays for hospice, but what is hospice exactly?

Medicare defines hospice as a program of care and support for people who are terminally ill. Terminal illness, as Medicare definites it, is a life expectancy of six months or less. The primary goal of hospice in Medicare is to help terminally ill people live a comfortable life and manage their pain and discomfort. Hospice care is palliative care versus skilled nursing and home health care. Hospice does not cure the patient but rather aids the person in the dying process.

Death & dying is an area most people do not wish to ponder, so there are many misconceptions about Medicare-covered hospice care.

What Medicare Hospice Is Not?

Hospice is not a place. When my mother was terminally ill with ovarian cancer, I was thinking of taking her to a place.

When I was in college in the 80s, I had volunteered in a hospice facility run by the Hawthorne Dominican sisters. The hospice facility was an actual place people went to die. The nuns took care of everything: medical, personal care, food & lodging; and patients stayed there until the end.

That is what I had in mind when the doctors spoke to my family about hospice for our mother. That is not, however, how Medicare thinks of hospice.

Medicare does not pay for a hospice facility that provides room & board unless the care is tied to something like a skilled nursing facility. Medicare does, however, pay for hospice personnel and the medications they administer during hospice.

Where Do You Go For Hospice?

Hospice can be given virtually anywhere. A Medicare beneficiary can receive hospice at a hospital, hospice in a skilled nursing facility, hospice in an assisted living residence, and hospice at home. Medicare will pay for hospice care in assisted living, nursing homes, and other facilities if it is a Medicare-approved facility.

The end of life movement that started in the ’70s sees passing at home as the ideal. Most Medicare patients, when surveyed, prefer hospice in the home. That is where people feel most comfortable, but because of the level of care required, hospice care may have to move to a hospital in the last few days or another location.

Hospice can be given virtually anywhere.

Medicare.gov

What Kind of Illness Makes You Hospice Eligible?

When we think of hospice, we usually think of cancer, but there are other illnesses that result in hospice.

Grandpa Joe was 98. Grandpa had beaten cancer 4 times, lockjaw, and the Second World War. Dying didn’t seem possible. He had always been there, and we grandkids assumed he would always be there. Terminal illness and Grandpa Joe didn’t fit.

When Grandma Hilda announced to the family, Grandpa had congestive heart failure and was going into hospice, it didn’t quite register with us grandkids.

Grandpa Joe seemed the same old Grandpa Joe. When I was home from college, we chatted about the Cornhuskers, baseball, and politics. Nothing seemed to have changed, but there was a procession of nurses and therapists who came in and out of their home.

When Grandma Hilda finally called to tell us Grandpa had passed in his sleep, his death hit me like a sledgehammer.

Grandpa’s passing was hard on everyone, but Medicare providing and paying for hospice lightened the burden, especially for my parents and grandparents.

Who Can Go Into Hospice?

Hospice is also not exclusively for the old. I have a number of clients who are in their twenties and thirties. Not everyone on Medicare is sixty-five and older, though the majority are.

Accidents or illnesses permanently disabled some, and some are terminal. Hospice is for them too.

How Much Is Hospice?

Hospice care is not expensive for those on Medicare. Medicare pays for the vast majority of the hospice costs under Medicare Part A with very little out-of-pocket costs. Medications, some equipment, and nurses are covered.

Like I said earlier, hospice does not usually include custodial care or housekeeping. That can be very costly if the family cannot provide that type of care themselves.

How Do You Get Medicare To Pay For Hospice?

A Medicare beneficiary is eligible for Medicare’s hospice care benefit if she is entitled to Medicare Part A and meets the following conditions.

- The hospice doctor and the person’s regular physician certify that the person is terminally ill with a life expectancy of six months or less if the illness runs its

expected course.

expected course. - The person accepts palliative care for comfort instead of care to cure her illness.

- The person must sign a statement choosing hospice care instead of other Medicare-covered treatments for her terminal illness and related conditions.

- The care is provided by a Medicare-certified hospice agency.

When these 4 critical are met, Medicare pays for hospice. At any time, a person may choose to exit hospice.

Is Hospice Euthanasia?

Hospice does not accelerate the dying process.

I have had people describe hospice to me as akin to euthanasia where someone actively terminates a life. Hospice is not euthanasia or assisted suicide. You do not intentionally cut short a person’s life. Hospice is about allowing the dying process to take its natural and inevitable course without assistance. Hospice care is about alleviating the suffering and providing comfort while the person dies.

An uncle of mine was a retired Omaha police captain. Uncle Bill had a severe stroke with many complications. He was put on a ventilator.

Uncle Bill was a strong and courageous individual. A vegetative existence was not for him not to mention impoverishing his wife with medical bills. He ordered the ventilator turned off.

Without the ventilator, he would quickly stop breathing. He knew it. The doctors made him as comfortable as possible with heavy sedation. His body fought hard against the loss of breath.

We gathered around his hospital bed. Over the course of a day, he passed peacefully from this life to next surrounded by his loving wife and children.

Hospice Is Up To You

I’ve known many individuals over the years who have gone on hospice for a time. Instead of dying, their health improved, or they resumed a normal life and quit hospice because the decline stopped. You are free to remove yourself from hospice at any time.

Hospice Is Also For The Living

Hospice is the option when all other alternatives have been exhausted. It is the option to bring the highest possible quality of life to a person’s remaining time. The hope is family members will look back on their time and know that everything was done to preserve, prolong, and then peacefully say goodbye.